Microspeaker Market Report

Published Date: 31 January 2026 | Report Code: microspeaker

Microspeaker Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Microspeaker market, including insights into market size, growth trends, regional performances, and future forecasts for the period 2023 - 2033.

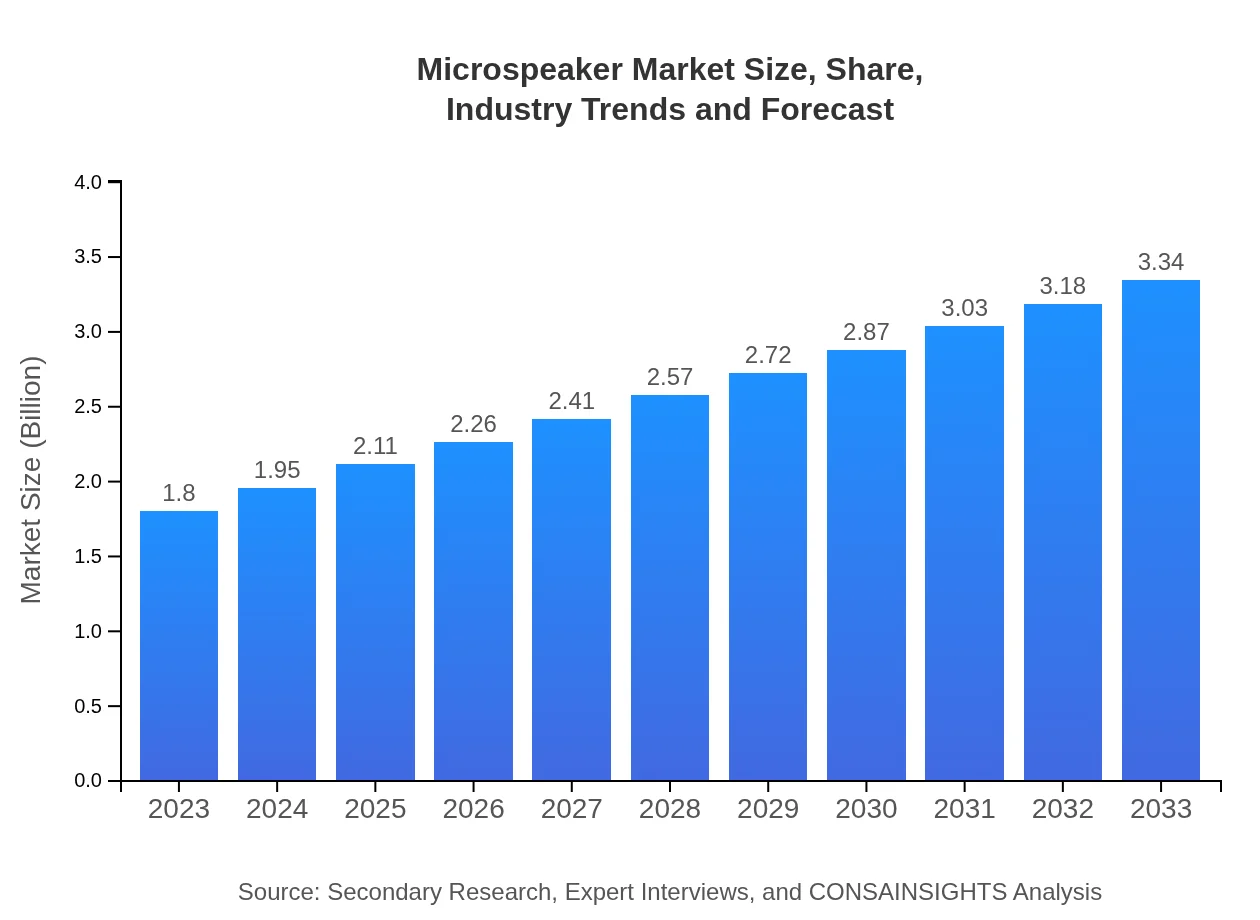

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Knowles Corporation, Bose Corporation, Harman International, Sony Corporation |

| Last Modified Date | 31 January 2026 |

Microspeaker Market Overview

Customize Microspeaker Market Report market research report

- ✔ Get in-depth analysis of Microspeaker market size, growth, and forecasts.

- ✔ Understand Microspeaker's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microspeaker

What is the Market Size & CAGR of Microspeaker market in 2023 and 2033?

Microspeaker Industry Analysis

Microspeaker Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microspeaker Market Analysis Report by Region

Europe Microspeaker Market Report:

The European market for Microspeakers is forecasted to grow from 0.61 billion USD in 2023 to 1.13 billion USD by 2033, driven by advancements in automotive technology and an increasing number of smart devices.Asia Pacific Microspeaker Market Report:

The Asia Pacific is projected to witness substantial growth in the Microspeaker market, with sales expected to rise from 0.30 billion USD in 2023 to 0.56 billion USD by 2033. The region benefits from a strong manufacturing base, a growing middle class, and increasing disposable incomes, driving demand for audio equipment.North America Microspeaker Market Report:

North America will continue to be a key market, with growth from 0.64 billion USD in 2023 to 1.18 billion USD in 2033. The region’s demand for innovative audio solutions in smart technologies and consumer electronics contributes significantly to overall market expansion.South America Microspeaker Market Report:

In South America, the Microspeaker market is expected to grow from 0.10 billion USD in 2023 to 0.18 billion USD by 2033. The growth is fueled by rising interest in consumer electronics and increased penetration of audio devices in homes and automobiles.Middle East & Africa Microspeaker Market Report:

In the Middle East and Africa, the market for Microspeakers is estimated to rise from 0.15 billion USD in 2023 to 0.28 billion USD by 2033, supported by increasing urbanization and smart home trends.Tell us your focus area and get a customized research report.

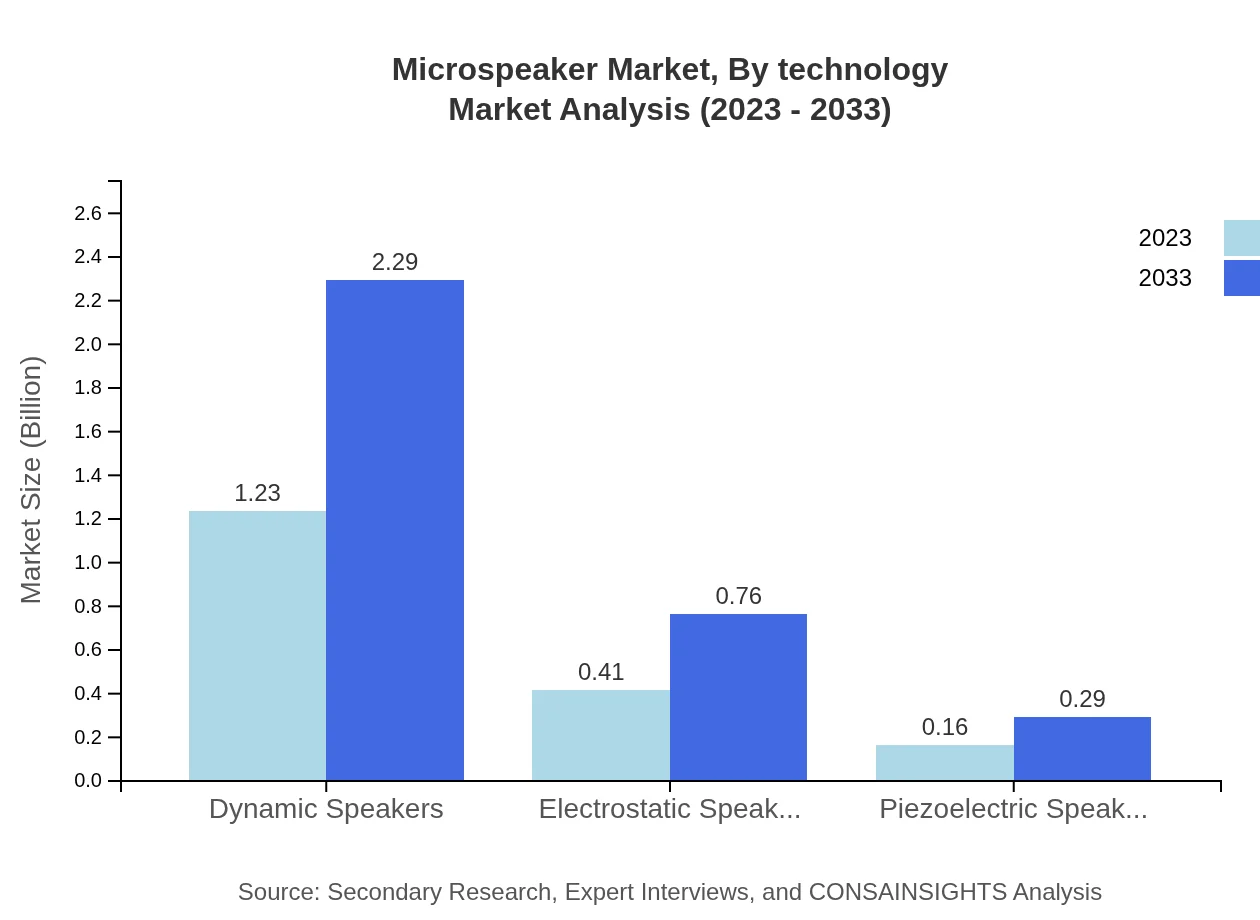

Microspeaker Market Analysis By Technology

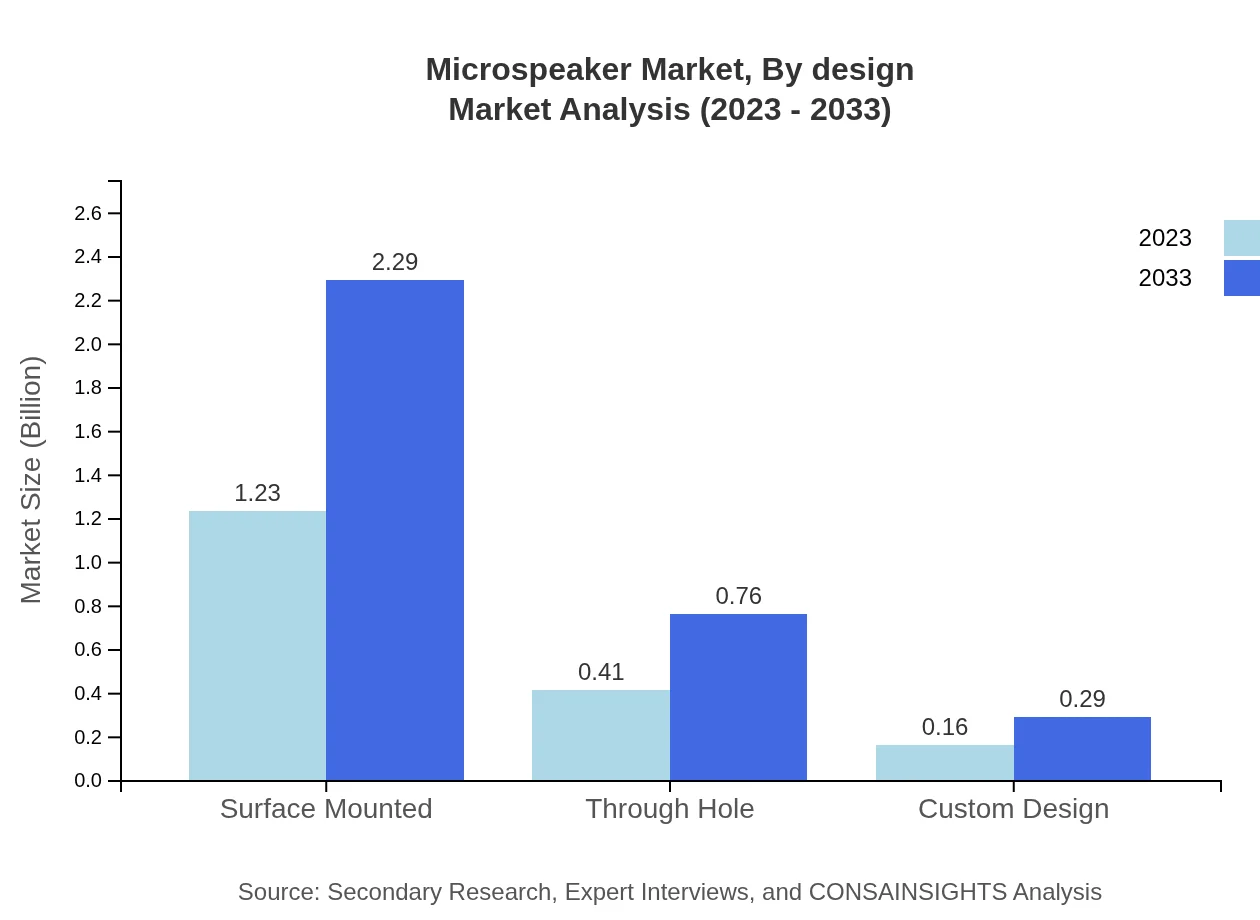

In terms of technology, the Surface Mounted segment leads the market, with a size of 1.23 billion USD in 2023, expected to reach 2.29 billion USD by 2033. The Through Hole segment is also significant, starting at 0.41 billion USD in 2023 and projected to grow to 0.76 billion USD. Custom Design speakers occupy a smaller market share but are seeing growth as customization becomes a consumer priority.

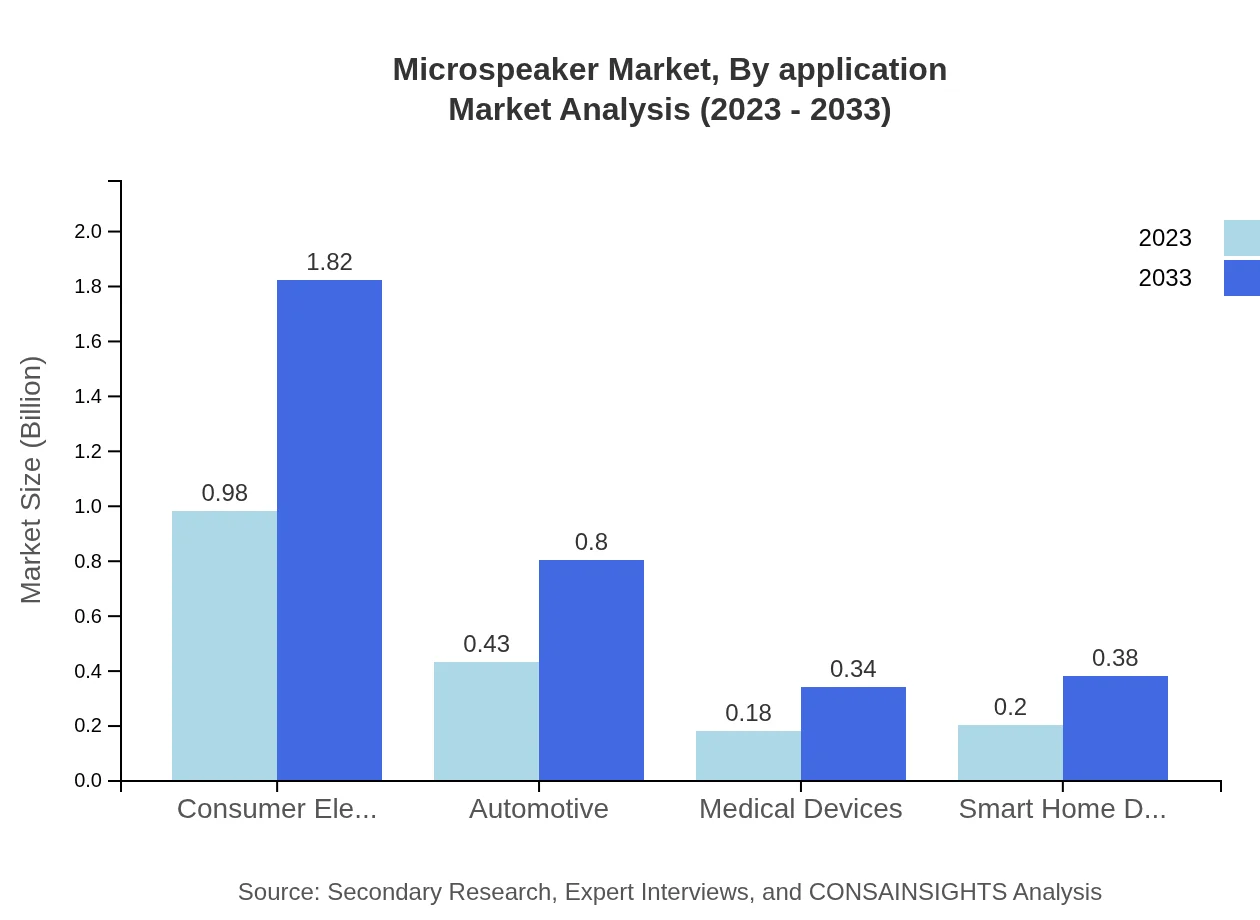

Microspeaker Market Analysis By Application

The consumer electronics sector dominates the application segment of the Microspeaker market. It generated 0.98 billion USD in 2023 and is expected to reach 1.82 billion USD by 2033. Automotive applications are also significant, starting at 0.43 billion USD and projected to grow steadily.

Microspeaker Market Analysis By Design

Surface-mounted designs are the primary focus due to their efficiency in manufacturing and integration into compact devices. This segment holds a dominant market share with expected growth, reflecting ongoing trends in technological innovation and design efficiency.

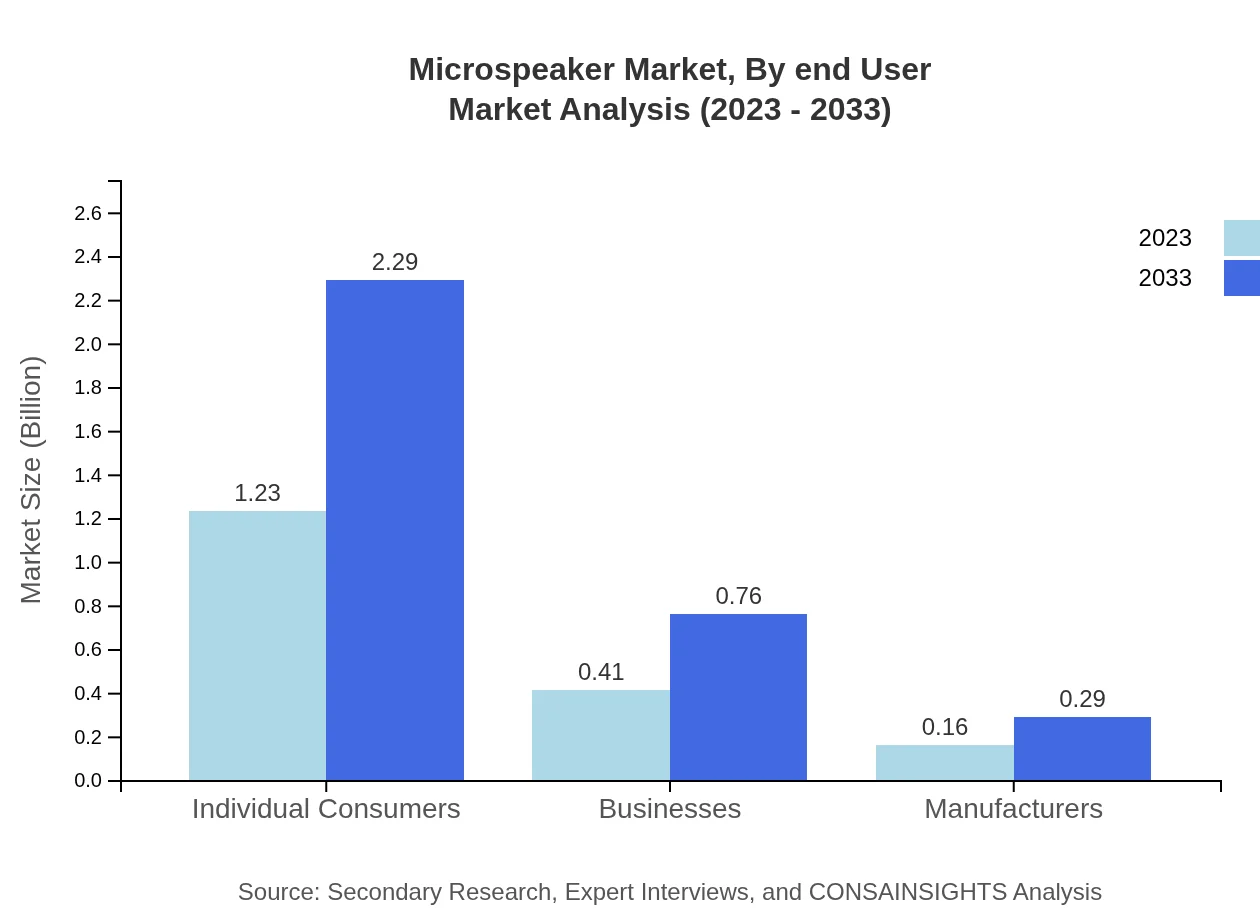

Microspeaker Market Analysis By End User

Individual consumers are the largest end-user segment, with market size recorded at 1.23 billion USD in 2023, growing to 2.29 billion USD by 2033. Businesses also represent a significant portion, particularly in niche audio solutions and custom installations.

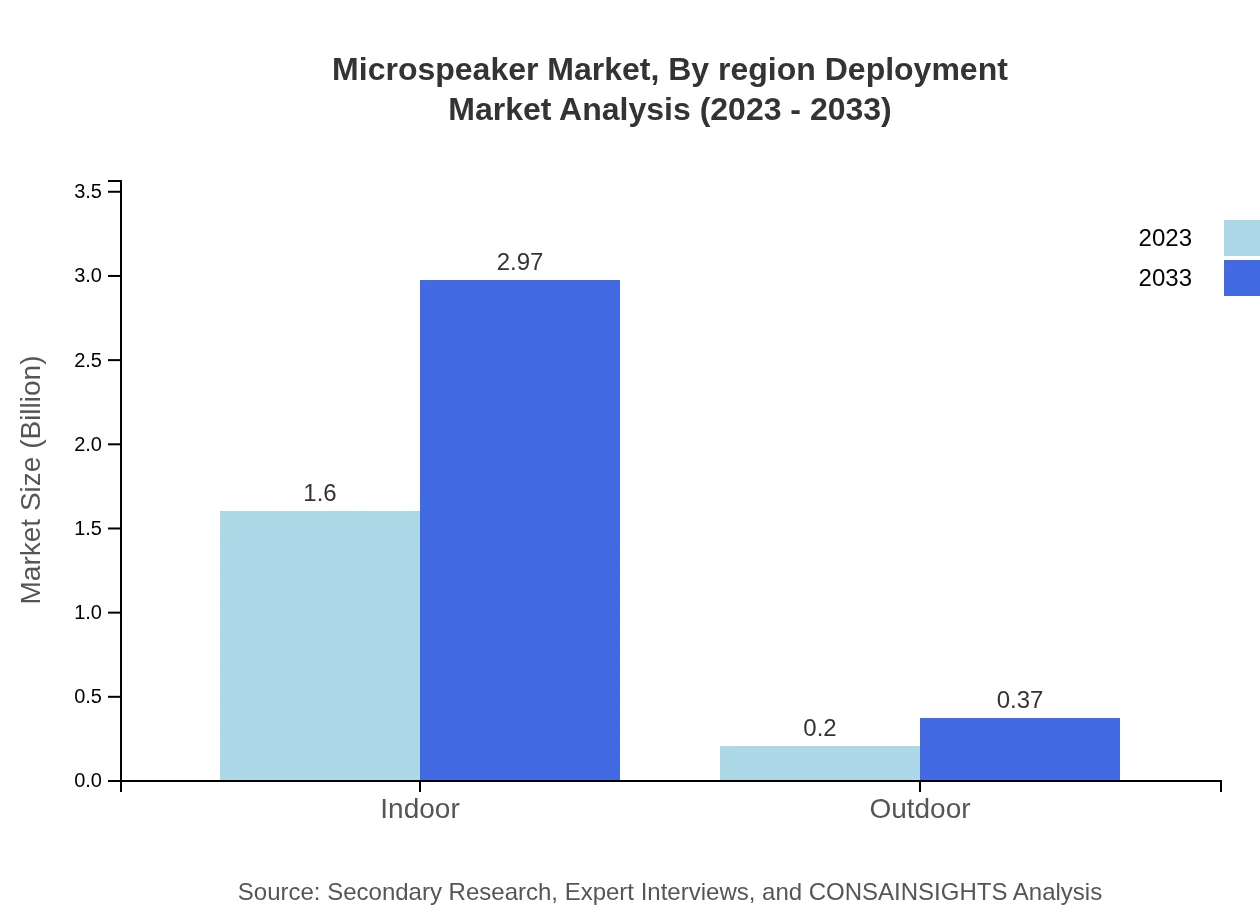

Microspeaker Market Analysis By Region Deployment

Market deployment by region shows a promising trend, indicating that regions like North America and Europe will continue to lead in terms of innovation and investment in Microspeaker technology, while Asia Pacific shows rapid growth in production and consumption.

Microspeaker Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microspeaker Industry

Knowles Corporation:

A leading provider in the audio solutions market, Knowles specializes in microspeakers and microphones for various applications, including consumer electronics and automotive.Bose Corporation:

Bose is renowned for its superior sound quality and innovative speaker designs tailored for compact audio solutions, heavily involved in the Microspeaker market.Harman International:

Harman, a subsidiary of Samsung, provides advanced audio systems and Microspeaker solutions across consumer electronics and automotive sectors.Sony Corporation:

Sony is a global leader in electronics, producing high-quality Microspeakers for premium audio experiences in mobile devices and home audio systems.We're grateful to work with incredible clients.

FAQs

What is the market size of microspeaker?

The microspeaker market is valued at approximately $1.8 billion with a projected CAGR of 6.2% from 2023 to 2033. This growth reflects the increasing adoption of advanced audio technology across various consumer electronics.

What are the key market players or companies in this microspeaker industry?

Key players in the microspeaker industry include major audio equipment manufacturers such as Bose, Sony, and Harman International. These companies are at the forefront, pioneering innovations in microspeaker technology and enhancing audio quality.

What are the primary factors driving the growth in the microspeaker industry?

The growth of the microspeaker industry is driven by the surging demand for portable audio devices, increased consumer interest in smart home technologies, and advancements in audio engineering that enhance sound quality while minimizing size.

Which region is the fastest Growing in the microspeaker?

Asia Pacific is the fastest-growing region in the microspeaker market, projected to grow from $0.30 billion in 2023 to $0.56 billion by 2033. This growth is fueled by rising disposable incomes and increasing consumer electronics sales in the region.

Does ConsaInsights provide customized market report data for the microspeaker industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the microspeaker industry. Clients can request detailed insights pertaining to market trends, forecasts, and competitive analysis.

What deliverables can I expect from this microspeaker market research project?

Deliverables from the microspeaker market research project include comprehensive market analysis reports, segment breakdowns, competitive landscape assessments, and strategic recommendations to guide business decisions and investments.

What are the market trends of microspeaker?

Current trends in the microspeaker market include the growing integration of AI in sound amplification, a shift towards wireless formats, and an emphasis on miniaturization for enhanced portability without compromising audio quality.