Microwave Power Meters Market Report

Published Date: 22 January 2026 | Report Code: microwave-power-meters

Microwave Power Meters Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Microwave Power Meters market from 2023 to 2033. It covers market trends, size, segmentation, regional analyses, industry forecasts, and competitive landscape to aid stakeholders in strategic decision-making.

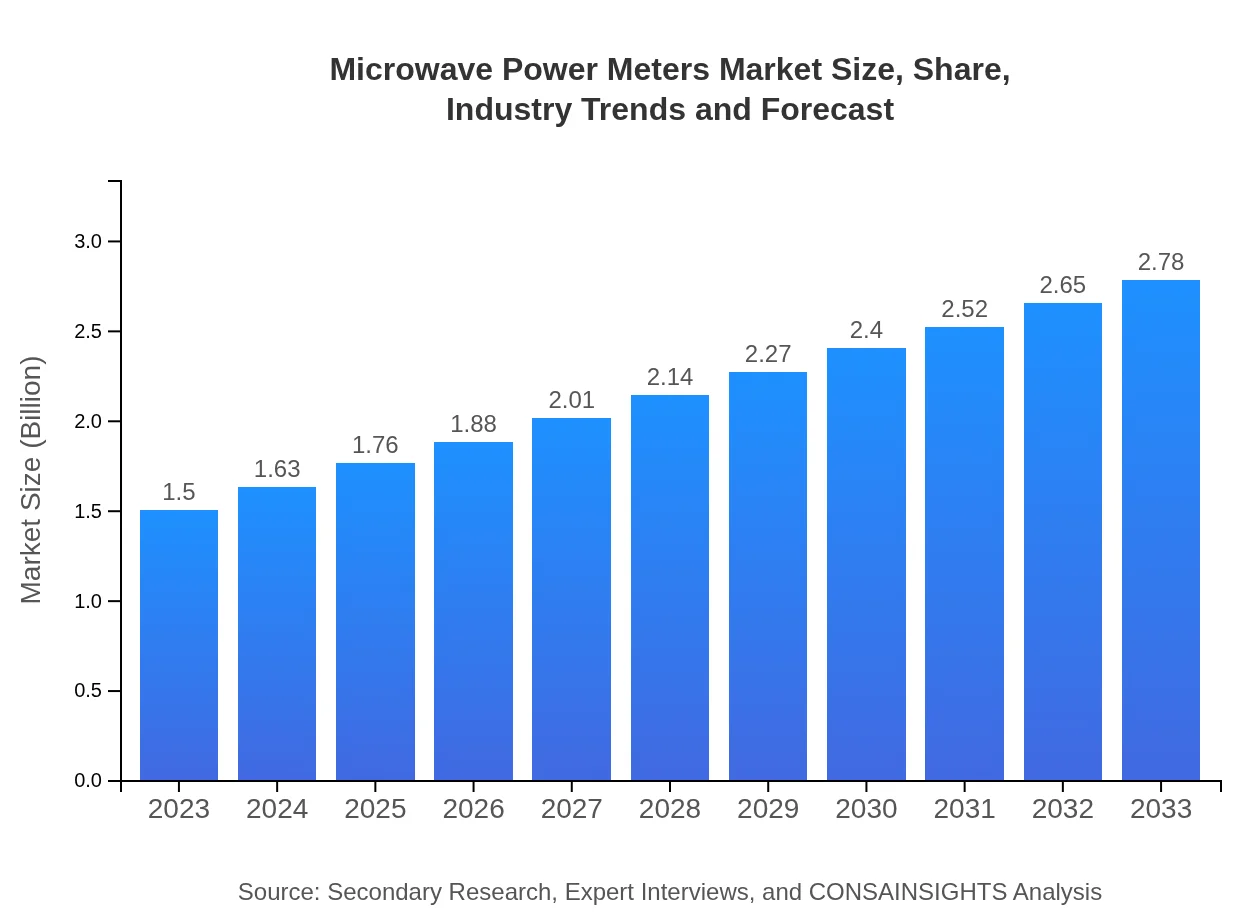

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Keysight Technologies, Rohde & Schwarz, Fluke Corporation, Anritsu Corporation |

| Last Modified Date | 22 January 2026 |

Microwave Power Meters Market Overview

Customize Microwave Power Meters Market Report market research report

- ✔ Get in-depth analysis of Microwave Power Meters market size, growth, and forecasts.

- ✔ Understand Microwave Power Meters's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microwave Power Meters

What is the Market Size & CAGR of Microwave Power Meters market in 2023?

Microwave Power Meters Industry Analysis

Microwave Power Meters Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microwave Power Meters Market Analysis Report by Region

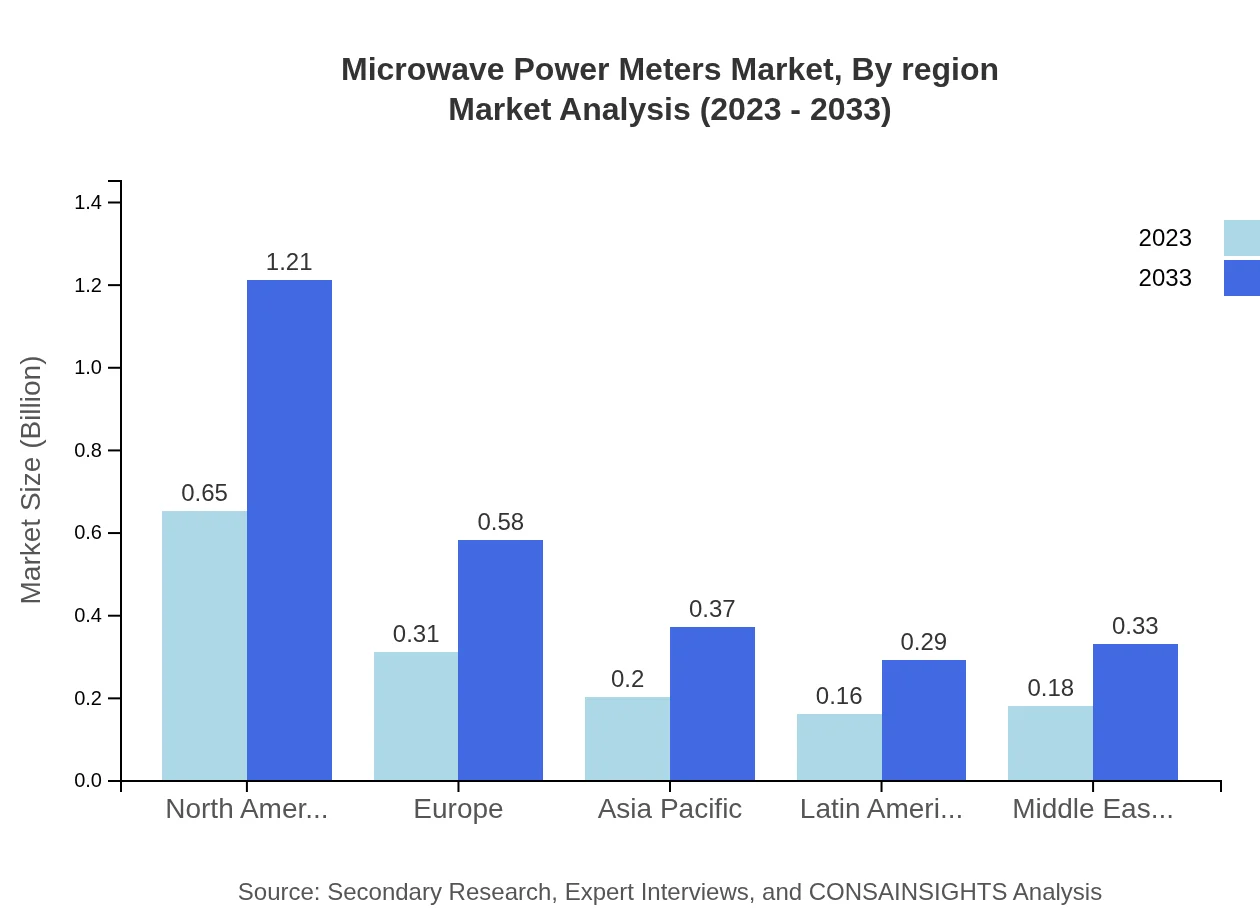

Europe Microwave Power Meters Market Report:

In Europe, the market size is anticipated to rise from $0.37 billion in 2023 to $0.68 billion by 2033. The increasing focus on renewable energy and smart technology integration in various sectors is a major growth catalyst in the region.Asia Pacific Microwave Power Meters Market Report:

Asia Pacific's Microwave Power Meters market is projected to grow from $0.32 billion in 2023 to $0.59 billion by 2033, driven by rising manufacturing capabilities and increasing technological investments in the telecommunications sector.North America Microwave Power Meters Market Report:

North America dominates the market, with a projected increase from $0.58 billion in 2023 to $1.07 billion by 2033. This growth is driven by advanced technological adoption and a strong focus on R&D in industries like healthcare and aerospace.South America Microwave Power Meters Market Report:

The South American market is expected to expand from $0.14 billion in 2023 to $0.25 billion by 2033 as telecommunications infrastructure development continues to gain momentum, improving demand for accurate power measurement solutions.Middle East & Africa Microwave Power Meters Market Report:

The Middle East and Africa market is forecasted to grow from $0.10 billion in 2023 to $0.19 billion by 2033, with emerging applications in defense and communication sectors contributing significantly.Tell us your focus area and get a customized research report.

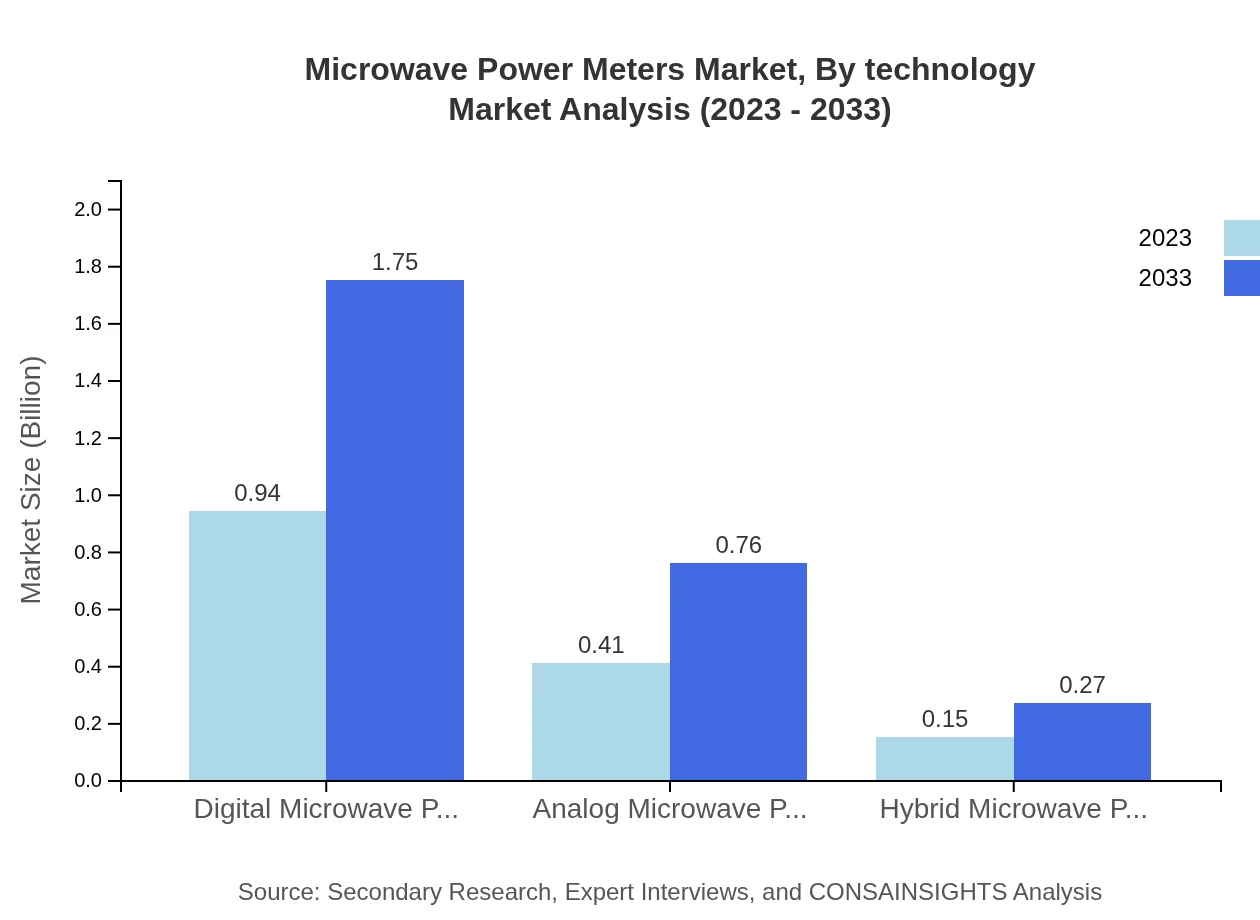

Microwave Power Meters Market Analysis By Technology

In 2023, Digital Microwave Power Meters accounted for 62.99% of the market share and are projected to continue leading due to their advanced features and accuracy. Analog Microwave Power Meters hold a 27.3% share, while Hybrid types contribute 9.71%. By 2033, Digital types will remain dominant, showcasing significant growth in demand.

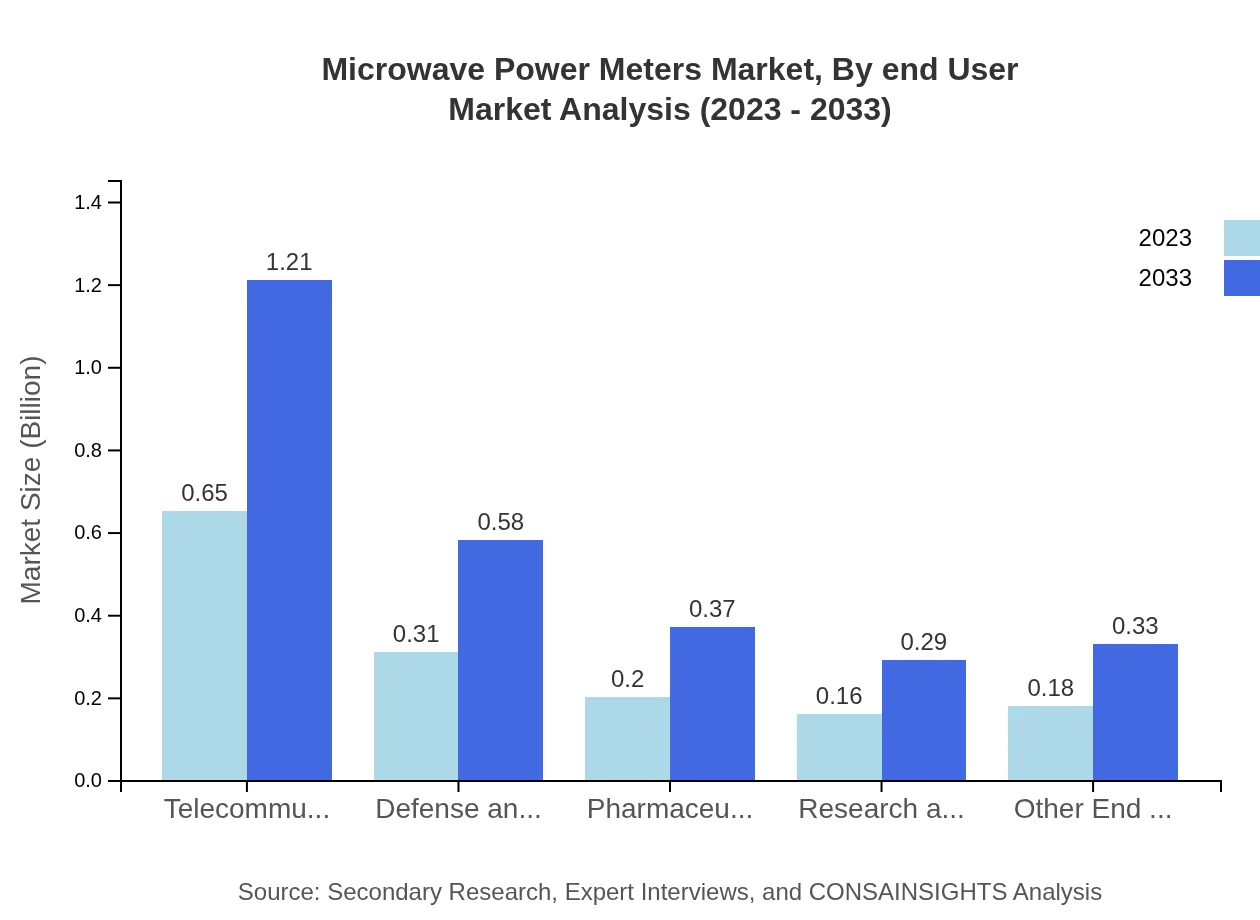

Microwave Power Meters Market Analysis By End User

The Telecommunications sector represented 43.59% of market share in 2023, primarily driven by the need for precise power measurements in signal transmission. The Defense and Aerospace sector followed closely with a 20.91% share. Expected growth continues in each segment, fueled by ongoing technological advancements.

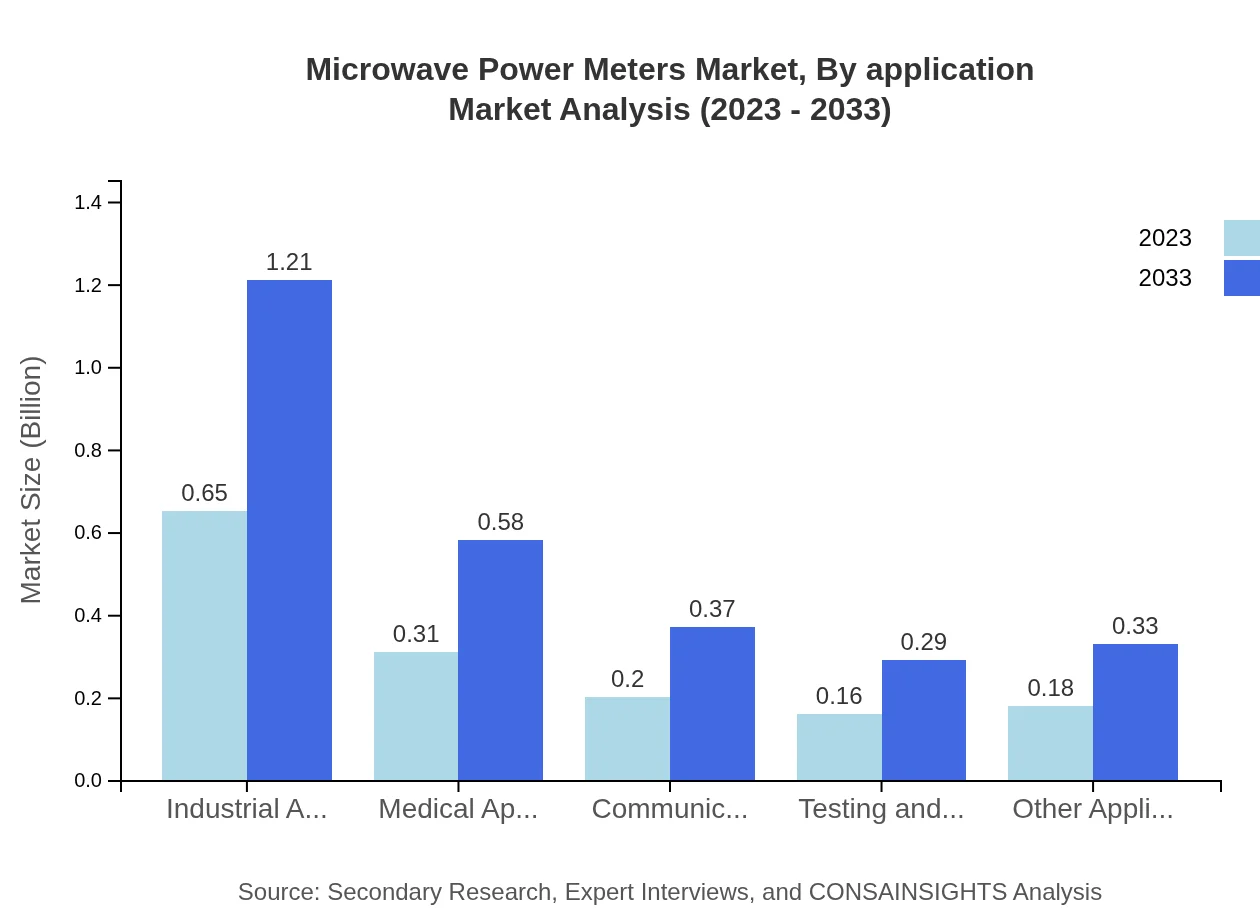

Microwave Power Meters Market Analysis By Application

Industrial applications lead with a market share of 43.59%, reflecting the increasing automation and monitoring needs across sectors. Medical applications hold 20.91%, while communication applications account for 13.14%. The forecast indicates continued growth across these categories, emphasizing the importance of microwave power measurement.

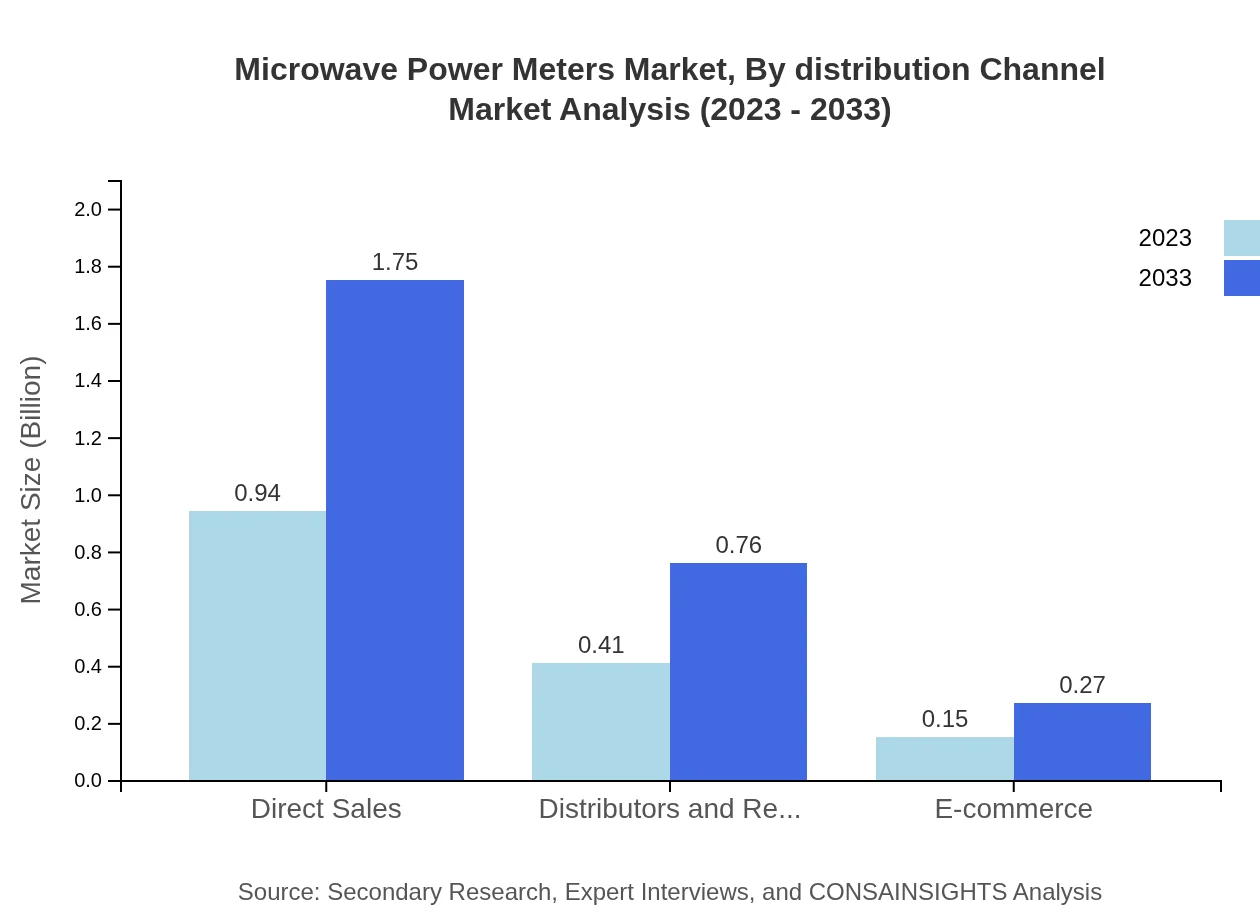

Microwave Power Meters Market Analysis By Distribution Channel

Direct Sales account for the largest share at 62.99%, indicating a strong preference for direct engagement and custom solutions. Distributors and Resellers hold 27.3%, while E-commerce contributes 9.71%. This distribution landscape reveals the significance of tailored sales strategies to meet customer needs.

Microwave Power Meters Market Analysis By Region

North America remains the foremost region regarding market size and share, with ongoing technological advancements and considerable investments fostering growth. Europe and Asia Pacific are also attractive markets, with increasing demand for precise measurement tools across several industries.

Microwave Power Meters Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microwave Power Meters Industry

Keysight Technologies:

A leader in electronic measurement technologies, offering a wide range of microwave power meters known for their precision and reliability.Rohde & Schwarz:

Specializes in advanced measurement solutions, providing comprehensive microwave power meters catering to various applications, particularly in telecommunications.Fluke Corporation:

Known for high-quality electronic testing tools, Fluke's microwave power meters emphasize ease of use and robust performance suitable for industrial applications.Anritsu Corporation:

Anritsu offers innovative microwave power measurement solutions that are essential in RF and microwave applications across numerous sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of microwave Power Meters?

The microwave power meters market is currently valued at approximately $1.5 billion, with a projected CAGR of 6.2% from 2023 to 2033. This indicates robust growth opportunities in the industry over the next decade.

What are the key market players or companies in the microwave Power Meters industry?

Key players in the microwave power meters industry include major manufacturers and technology providers focused on telecommunications, aerospace, and industrial applications, leveraging innovative technologies to enhance measurement precision and product efficiency.

What are the primary factors driving the growth in the microwave Power Meters industry?

Growth in the microwave power meters industry is driven by increasing demand in telecommunications, advancements in technology, and the expansion of industrial applications, alongside heightened focus on precision measurements in defense and aerospace sectors.

Which region is the fastest Growing in the microwave Power Meters?

The North American region is the fastest-growing for microwave power meters, projected to reach $1.07 billion by 2033, with significant contributions from telecommunications and industrial applications amplifying market demand.

Does ConsaInsights provide customized market report data for the microwave Power Meters industry?

Yes, ConsaInsights offers customized market report data tailored for the microwave power meters industry, catering to specific client needs and providing in-depth analysis and insights.

What deliverables can I expect from this microwave Power Meters market research project?

From the microwave power meters market research project, you can expect detailed market analysis, growth forecasts, competitive landscape reviews, and insights on regional and segment trends that inform strategic decision-making.

What are the market trends of microwave Power Meters?

Current trends in the microwave power meters market include increased adoption of digital models, growth in industrial and medical applications, and a shift towards more integrated measurement solutions across various sectors.