Mid And High Level Precision Gps Market Report

Published Date: 31 January 2026 | Report Code: mid-and-high-level-precision-gps

Mid And High Level Precision Gps Market Size, Share, Industry Trends and Forecast to 2033

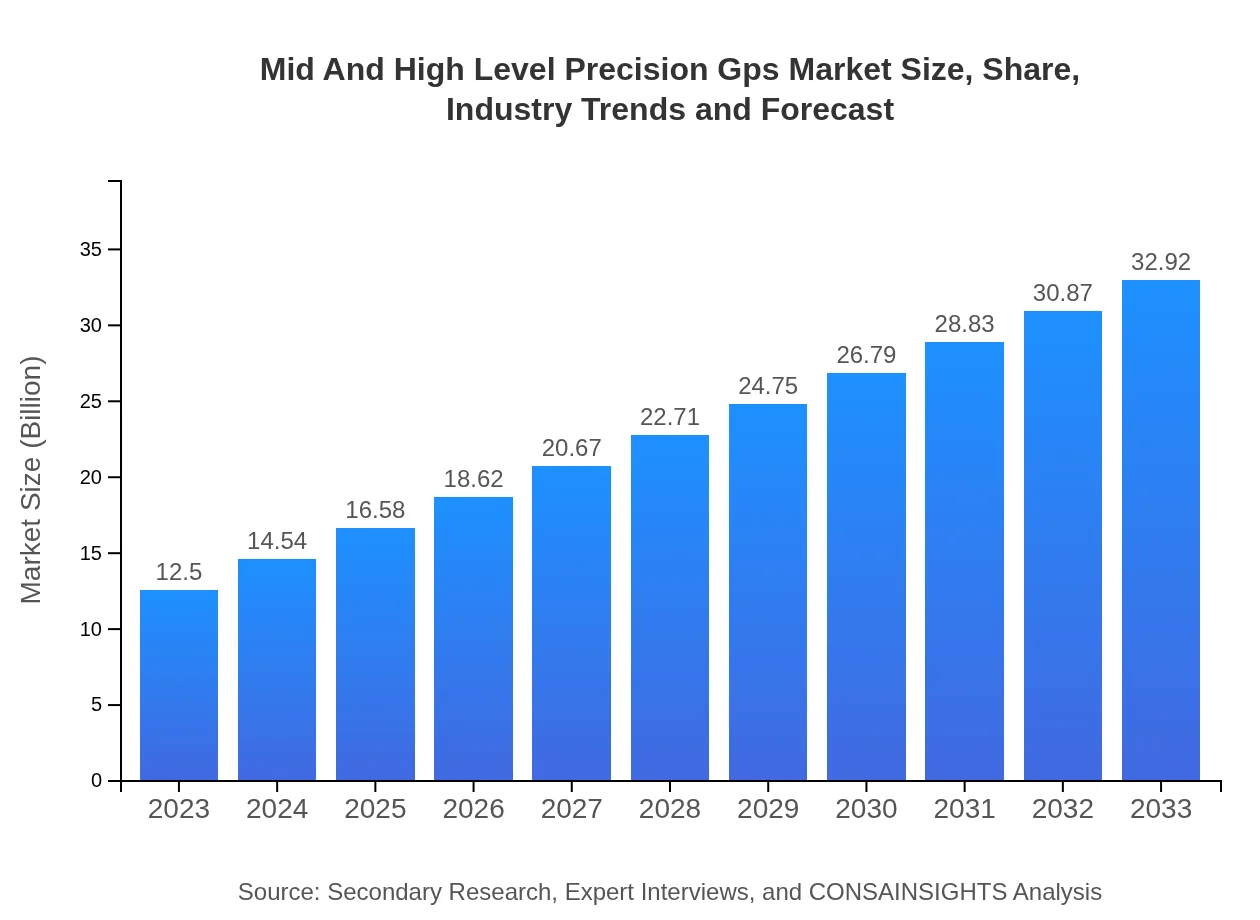

This market report examines the Mid and High-Level Precision GPS industry, providing insights on market size, trends, and growth forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | Trimble Inc., Garmin Ltd., Topcon Positioning Systems, Inc. |

| Last Modified Date | 31 January 2026 |

Mid And High Level Precision Gps Market Overview

Customize Mid And High Level Precision Gps Market Report market research report

- ✔ Get in-depth analysis of Mid And High Level Precision Gps market size, growth, and forecasts.

- ✔ Understand Mid And High Level Precision Gps's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mid And High Level Precision Gps

What is the Market Size & CAGR of Mid And High Level Precision Gps market in 2023?

Mid And High Level Precision Gps Industry Analysis

Mid And High Level Precision Gps Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mid And High Level Precision Gps Market Analysis Report by Region

Europe Mid And High Level Precision Gps Market Report:

Europe's market is anticipated to grow from $3.17 billion in 2023 to $8.36 billion by 2033, influenced by stringent regulations mandating precision in various sectors while also promoting advancements in autonomous vehicles.Asia Pacific Mid And High Level Precision Gps Market Report:

In the Asia Pacific region, the Mid and High-Level Precision GPS market is projected to grow from $2.57 billion in 2023 to $6.77 billion by 2033. This growth is driven by rapid urbanization, increased investments in infrastructure, and robust demand from sectors such as construction and agriculture.North America Mid And High Level Precision Gps Market Report:

North America shows a significant market size increase from $4.42 billion in 2023, projected to reach $11.65 billion by 2033. The region benefits from advanced technological adoption, high commercial and governmental GPS usage, and ongoing R&D investments in precision positioning solutions.South America Mid And High Level Precision Gps Market Report:

For South America, the market is expected to expand from $0.62 billion in 2023 to $1.64 billion by 2033. Factors contributing to this growth include rising automotive applications and governmental efforts to enhance geographical data collection.Middle East & Africa Mid And High Level Precision Gps Market Report:

The Middle East and Africa region expects a rise from $1.71 billion in 2023 to $4.49 billion by 2033. Developments in smart city projects and the oil and gas sector are major contributors to this growth.Tell us your focus area and get a customized research report.

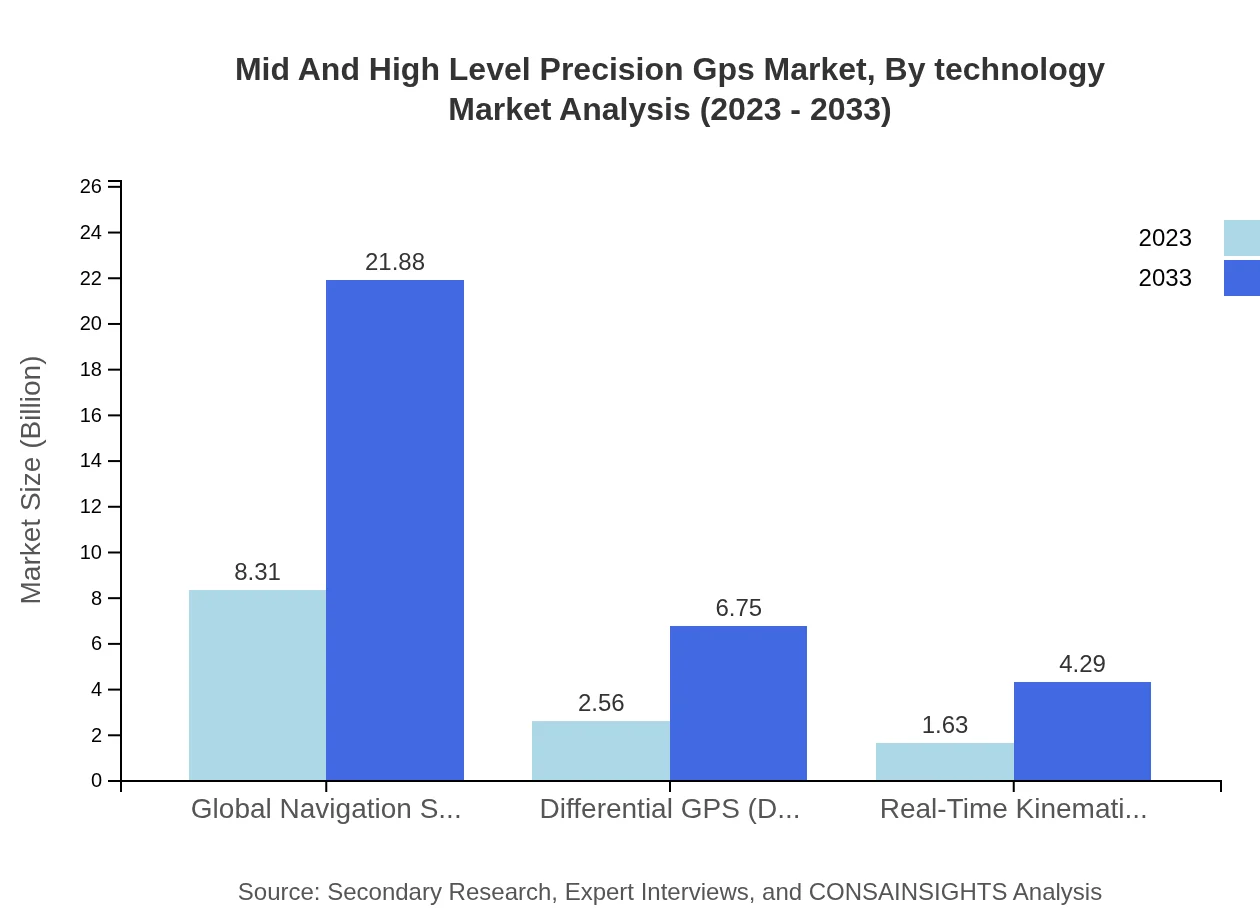

Mid And High Level Precision Gps Market Analysis By Technology

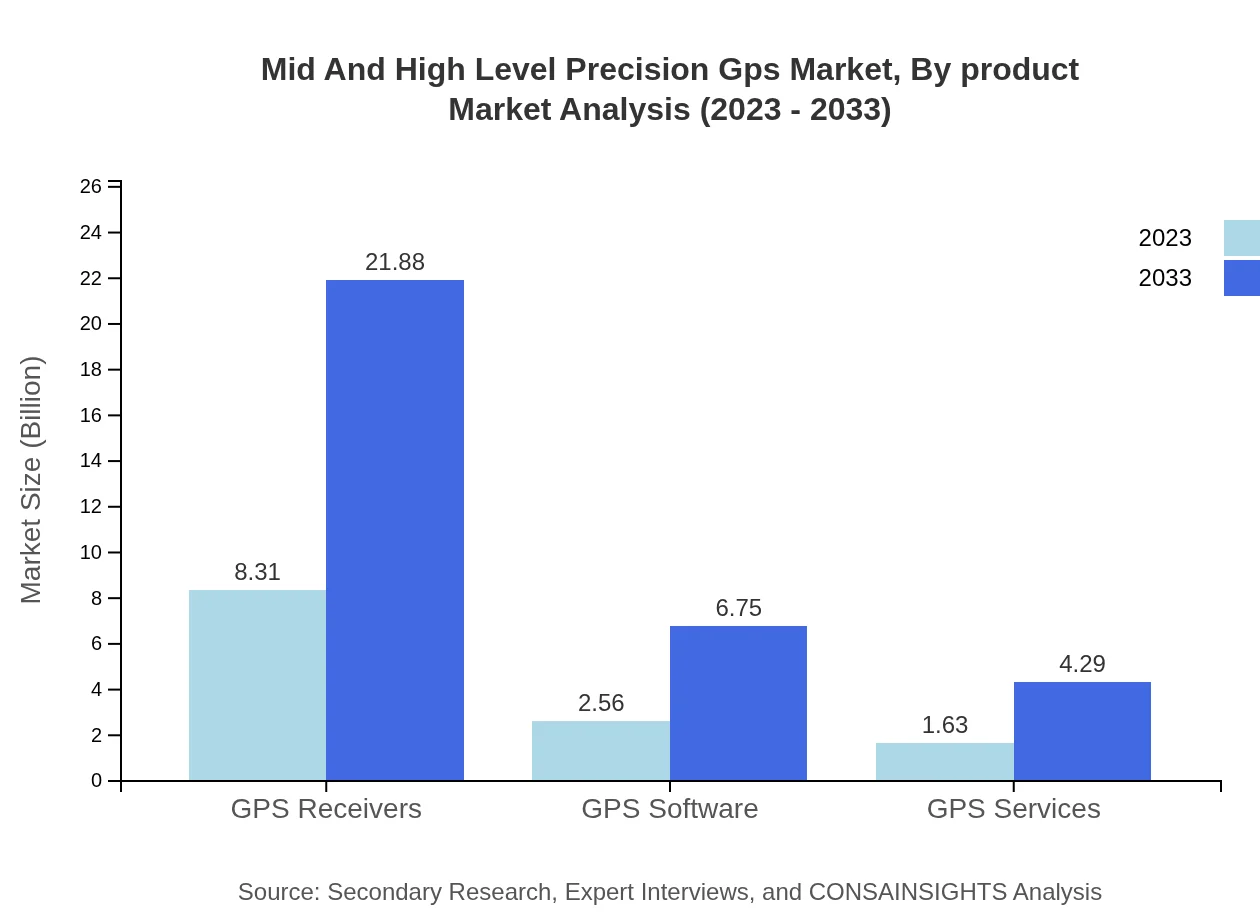

The technology segment comprises GPS Receivers, GPS Software, and GPS Services. In 2023, GPS Receivers hold a significant market share of 66.47% representing $8.31 billion, growing to $21.88 billion by 2033. GPS Software and Services contribute $2.56 billion and $1.63 billion respectively, indicating substantial growth potential in emerging applications and value-added services.

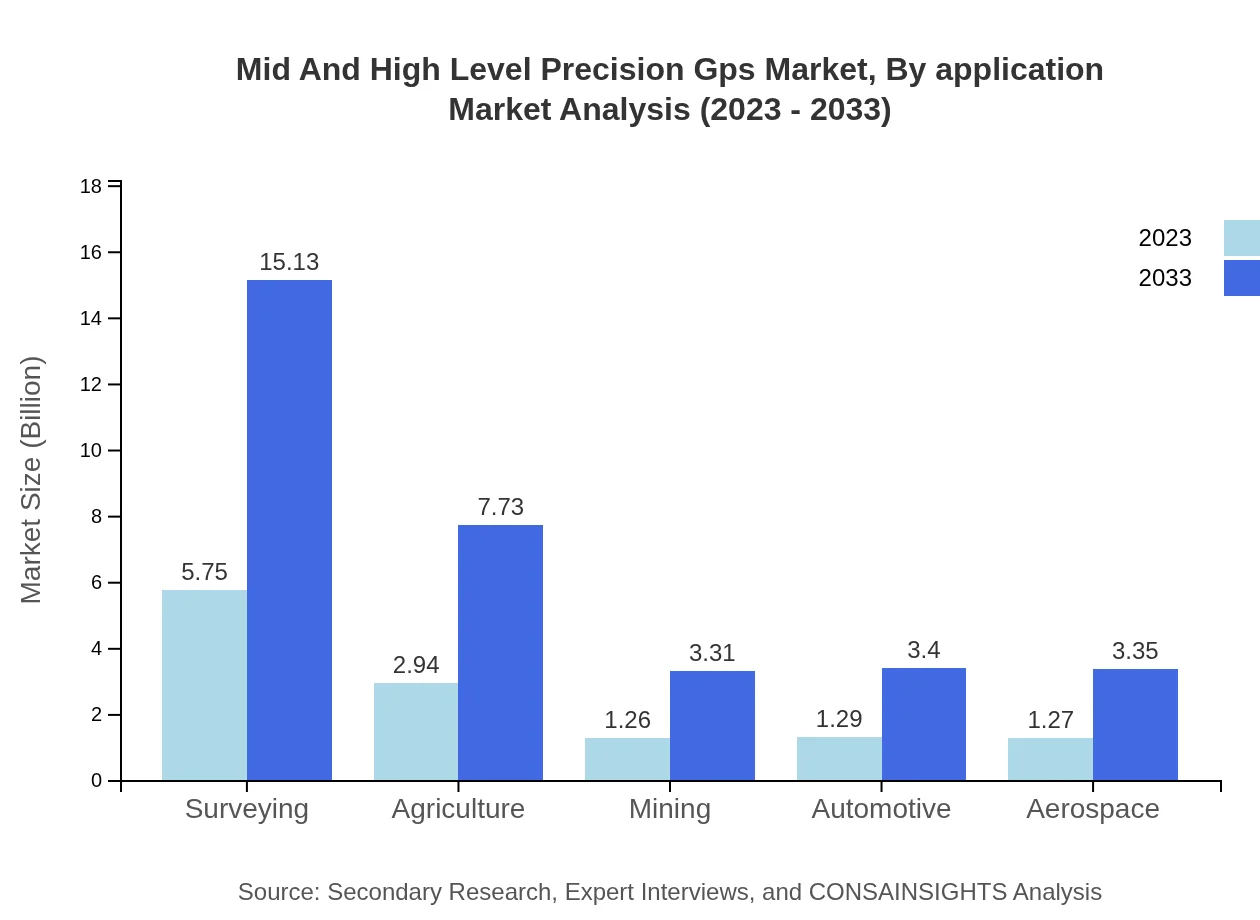

Mid And High Level Precision Gps Market Analysis By Application

Applications of precision GPS span various sectors, with surveying and agriculture leading in market share. Surveying accounts for 45.97% of the market in 2023, worth $5.75 billion, while agriculture commands 23.49%, reflecting important roles in construction and resource management.

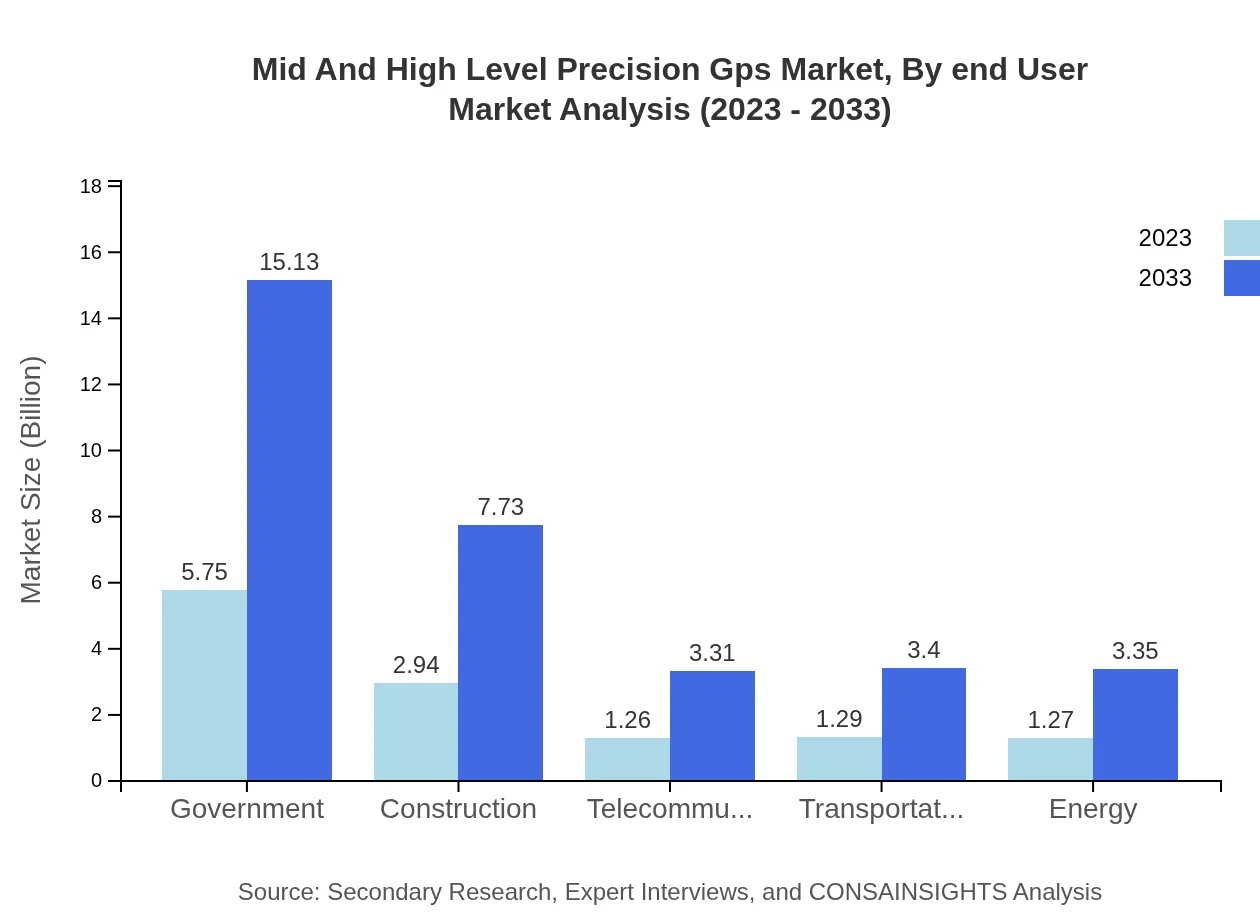

Mid And High Level Precision Gps Market Analysis By End User

End-user segmentation reveals that government applications dominate, holding a 45.97% market share worth $5.75 billion in 2023. Other notable sectors include construction, telecommunications, and transportation, each showcasing unique needs for positioning accuracy.

Mid And High Level Precision Gps Market Analysis By Product

The product segment highlights GPS Receivers and Software, where GPS Receivers dominate with a substantial share, essential for various consumer and commercial applications, reflecting the core of the precision GPS market.

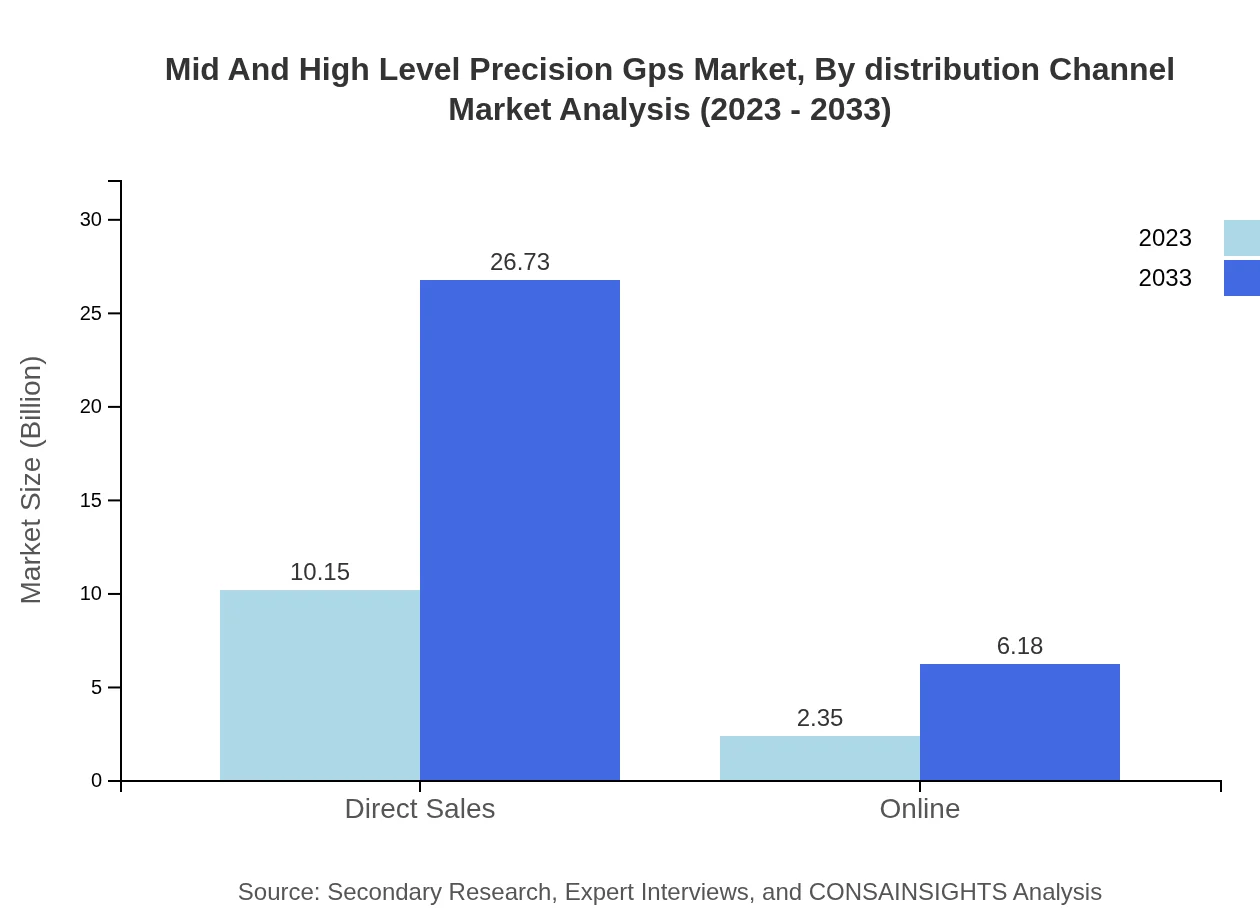

Mid And High Level Precision Gps Market Analysis By Distribution Channel

Distribution channels split between direct sales and online platforms illustrate the evolving purchasing behavior, with direct sales leading at 81.22% in 2023, hinting at strong customer relationships maintained by manufacturers and resellers.

Mid And High Level Precision Gps Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mid And High Level Precision Gps Industry

Trimble Inc.:

A leading provider of advanced positioning solutions, Trimble designs and delivers GPS technology for agriculture, construction, and transportation, focused on enhancing operational efficiency.Garmin Ltd.:

Garmin specializes in GPS technology, with a vast range of products for various industries such as automotive and aviation, ensuring high-accuracy user experiences.Topcon Positioning Systems, Inc.:

Topcon is renowned for its precision measurement systems and solutions and has a significant presence in construction and surveying, driving improvements in work efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of mid And High Level Precision-GPS?

The market size of mid-and-high-level-precision GPS is projected to reach $12.5 billion by 2033, with a compound annual growth rate (CAGR) of 9.8% from 2023 to 2033.

What are the key market players or companies in this mid And High Level Precision-GPS industry?

Key market players include major companies involved in GPS technology, such as Trimble Navigation, Leica Geosystems, and Garmin, who are instrumental in driving innovation and market growth.

What are the primary factors driving the growth in the mid And High Level Precision-GPS industry?

Growth factors include increasing demand for accurate positioning technology in sectors like construction, surveying, and agriculture, as well as advancements in GPS technology and applications.

Which region is the fastest Growing in the mid And High Level Precision-GPS?

The fastest-growing region is Europe, expected to grow from $3.17 billion in 2023 to $8.36 billion by 2033, reflecting strong investment in GPS technology across the continent.

Does ConsaInsights provide customized market report data for the mid And High Level Precision-GPS industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the mid-and-high-level-precision GPS industry.

What deliverables can I expect from this mid And High Level Precision-GPS market research project?

Deliverables include detailed market analysis reports, segmentation breakdowns, competitive landscapes, and tailored insights into regional and global trends.

What are the market trends of mid And High Level Precision-GPS?

Current market trends include increased adoption of GPS in autonomous vehicles, integration with IoT devices, and a shift towards real-time data processing capabilities.