Military-3d And-4d Printing Market Report

Published Date: 03 February 2026 | Report Code: military-3d-and-4d-printing

Military-3d And-4d Printing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Military-3D and 4D Printing market from 2023 to 2033, focusing on market size, growth potential, industry trends, and regional dynamics.

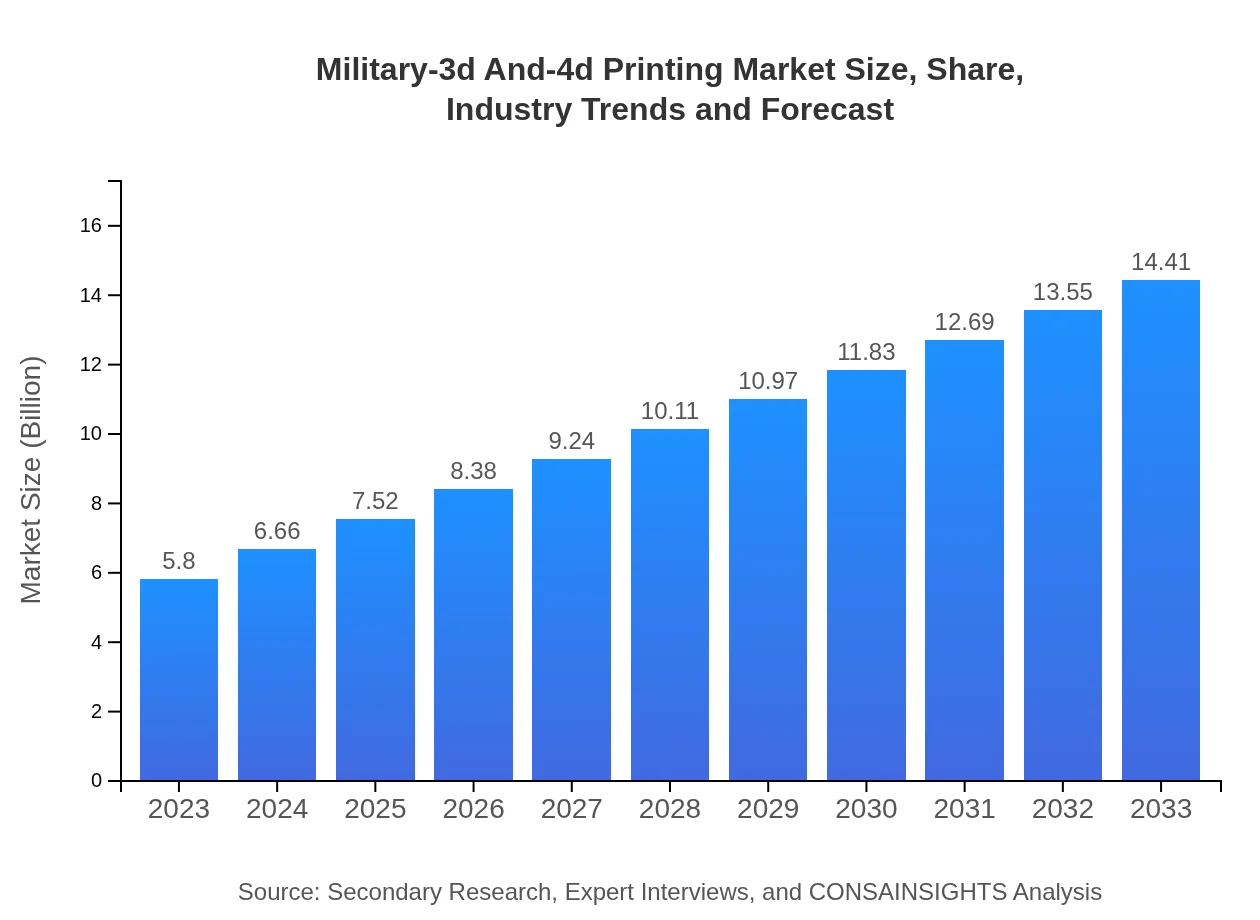

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $14.41 Billion |

| Top Companies | Boeing , Lockheed Martin, Stratasys, General Electric (GE), 3D Systems |

| Last Modified Date | 03 February 2026 |

Military-3d And-4d Printing Market Overview

Customize Military-3d And-4d Printing Market Report market research report

- ✔ Get in-depth analysis of Military-3d And-4d Printing market size, growth, and forecasts.

- ✔ Understand Military-3d And-4d Printing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military-3d And-4d Printing

What is the Market Size & CAGR of Military-3d And-4d Printing market in 2023?

Military-3d And-4d Printing Industry Analysis

Military-3d And-4d Printing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military-3d And-4d Printing Market Analysis Report by Region

Europe Military-3d And-4d Printing Market Report:

The European market is anticipated to increase from USD 1.98 billion in 2023 to USD 4.92 billion by 2033, as NATO countries focus on enhancing their technological edge.Asia Pacific Military-3d And-4d Printing Market Report:

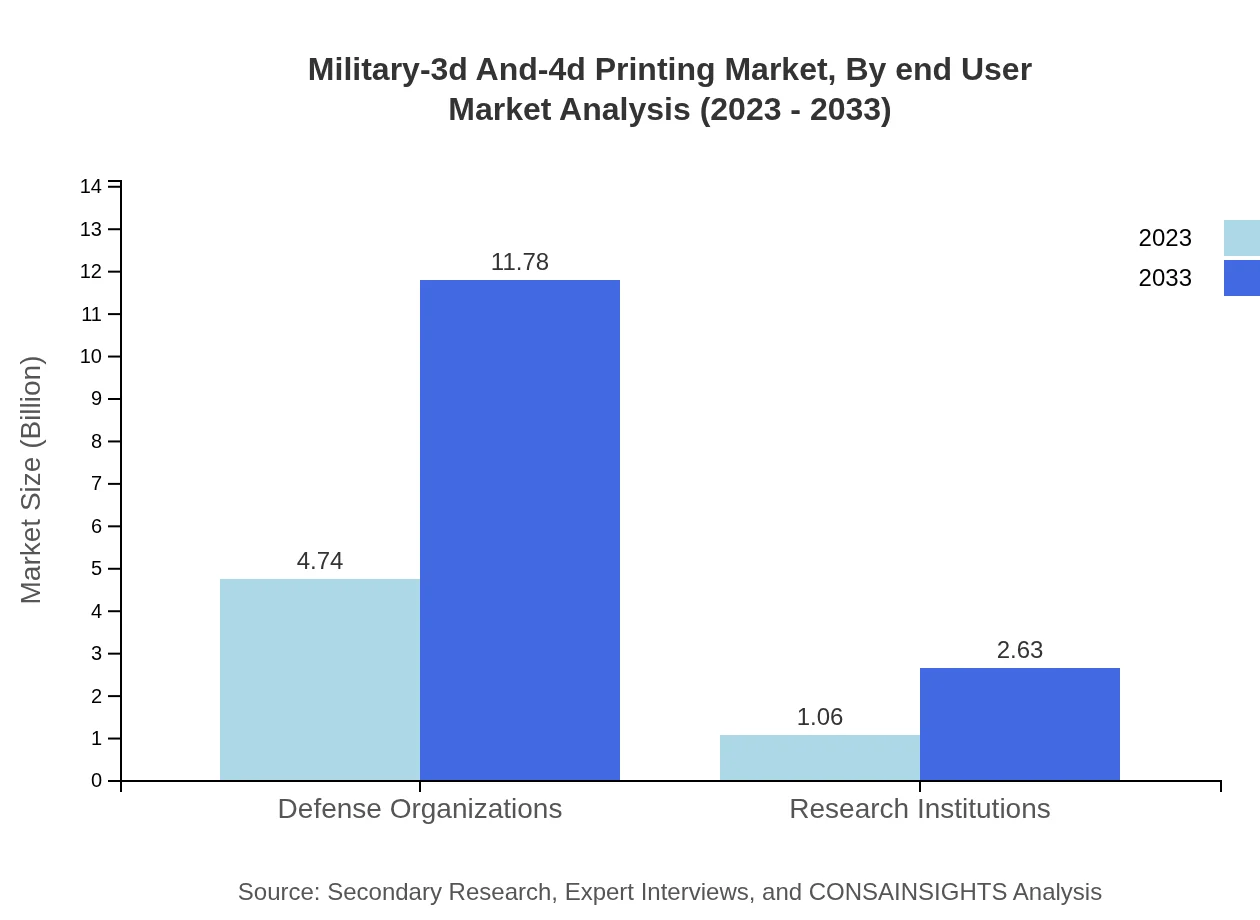

In the Asia Pacific region, the market is projected to grow from USD 1.06 billion in 2023 to USD 2.63 billion by 2033, supported by increased defense budgets and regional military modernization efforts.North America Military-3d And-4d Printing Market Report:

North America leads the market with an estimated size of USD 2.04 billion in 2023, projected to expand to USD 5.06 billion by 2033, with significant contributions from the U.S. military's investments in advanced technologies.South America Military-3d And-4d Printing Market Report:

The South American market is smaller, expected to rise from USD 0.22 billion in 2023 to USD 0.54 billion by 2033, largely driven by emerging economies increasing their military capabilities.Middle East & Africa Military-3d And-4d Printing Market Report:

The Middle East and Africa market, valued at USD 0.51 billion in 2023, is set to grow to USD 1.26 billion by 2033, fueled by ongoing regional conflicts and defense upgrades.Tell us your focus area and get a customized research report.

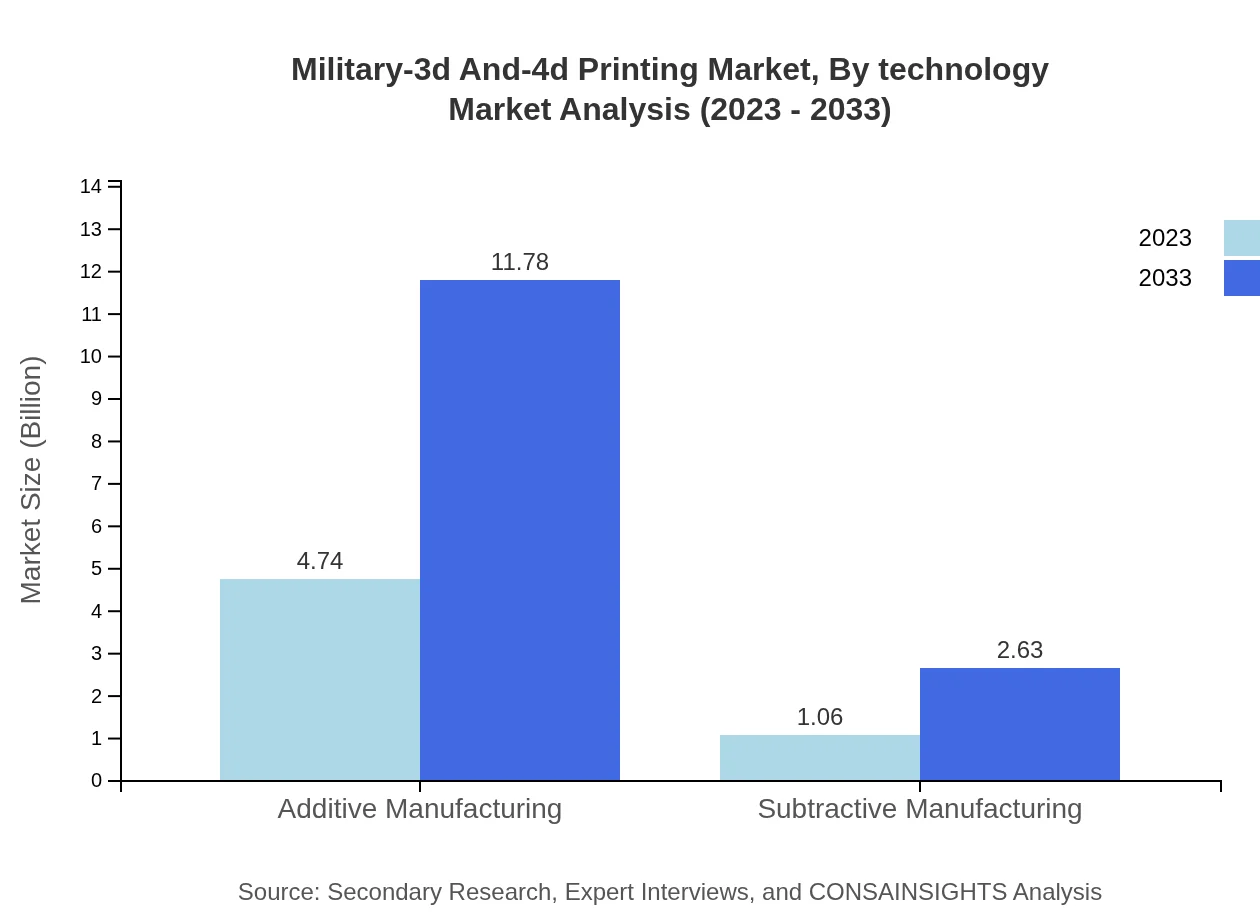

Military-3d And-4d Printing Market Analysis By Technology

The technology segment includes both additive manufacturing and subtractive manufacturing processes. Additive manufacturing techniques dominate the market, accounting for 81.73% share in 2023, reflecting their efficiency and customization capabilities.

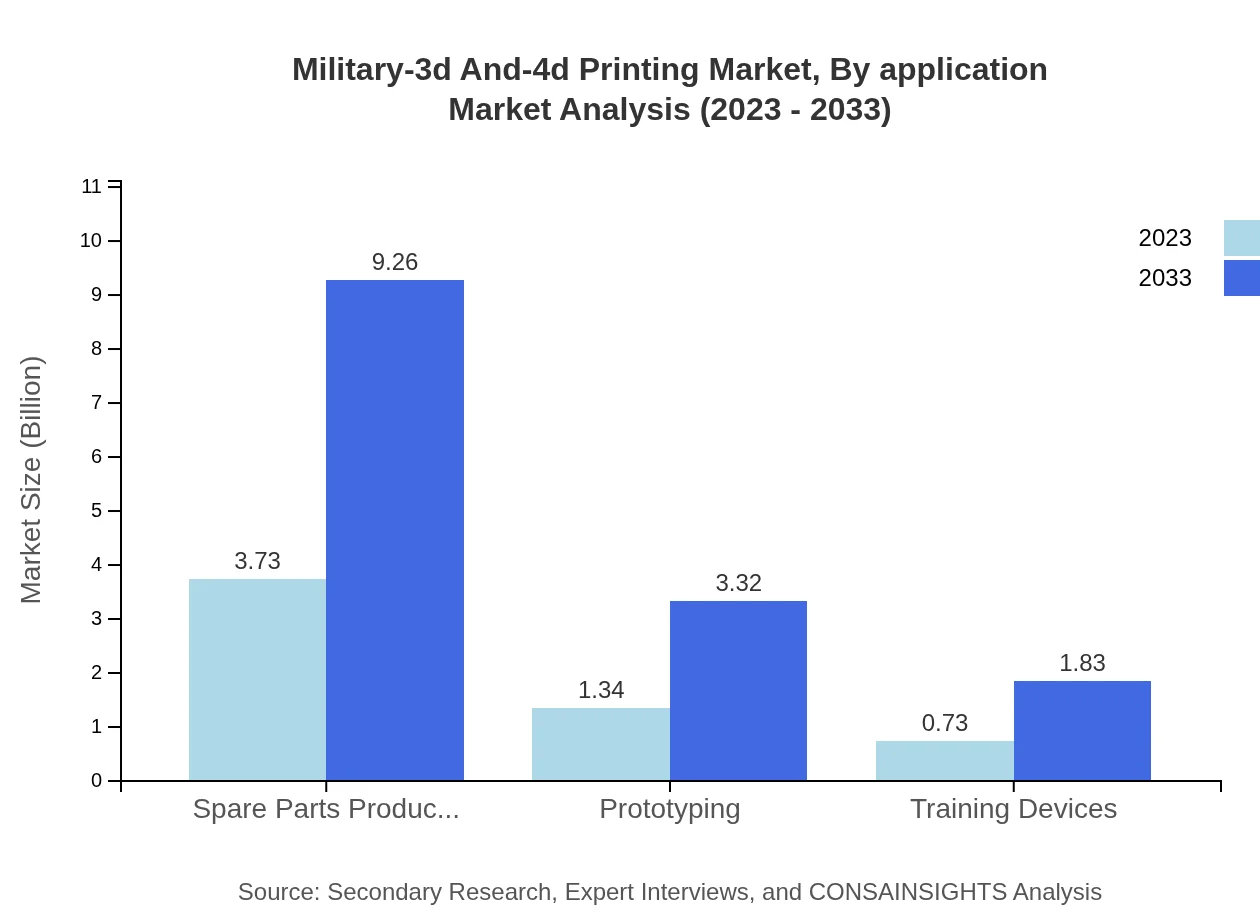

Military-3d And-4d Printing Market Analysis By Application

Applications encompass training devices, prototyping, and spare parts production, with training devices representing 12.67% of market shares in 2023, as they play critical roles in soldier education and skill enhancement.

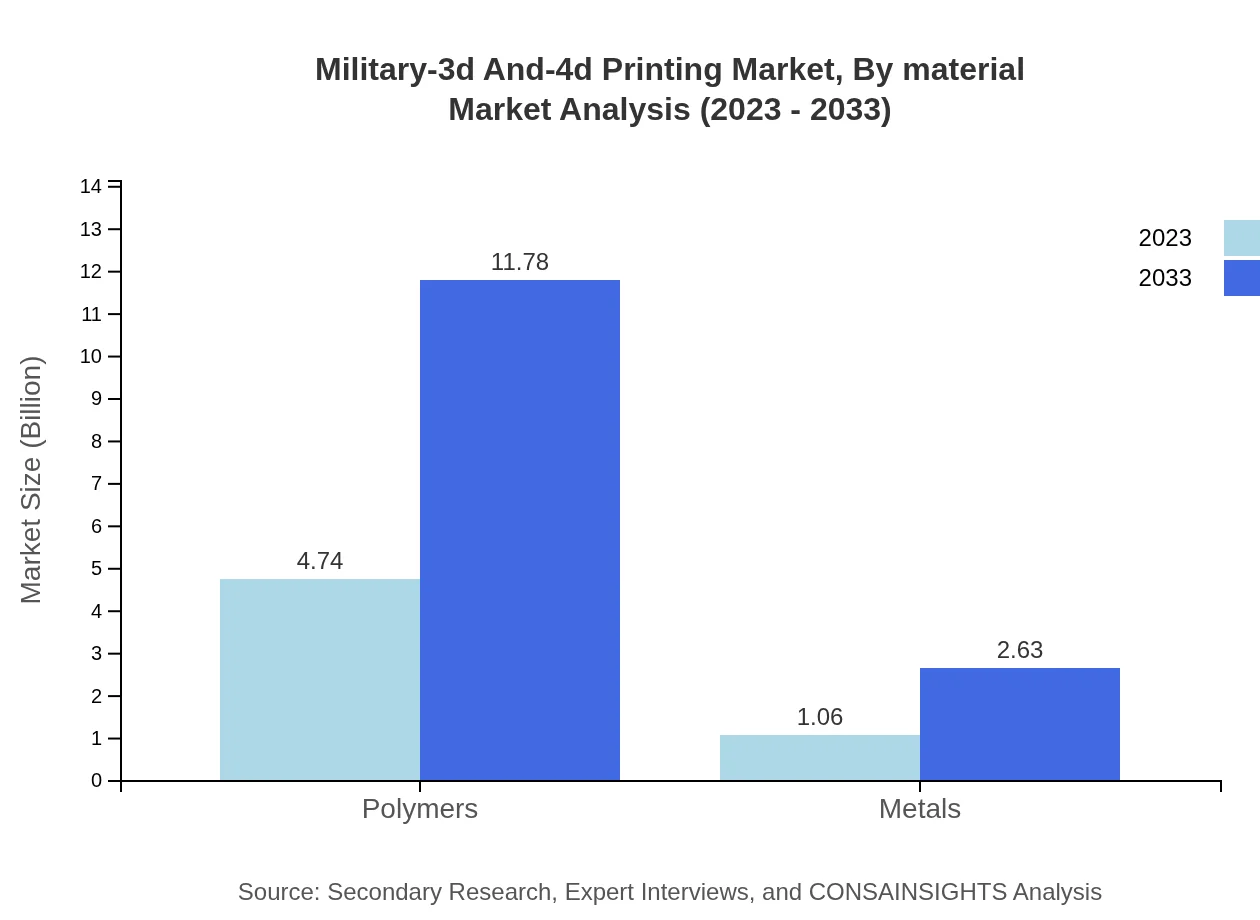

Military-3d And-4d Printing Market Analysis By Material

Material segmentation includes polymers and metals, with polymers taking a significant lead at 81.73% market share due to their versatility and lightweight properties, essential for military applications.

Military-3d And-4d Printing Market Analysis By End User

End-users predominantly consist of defense organizations and research institutions. Defense organizations lead the market, boasting an 81.73% share in 2023, highlighting the critical need for advanced manufacturing techniques in military operations.

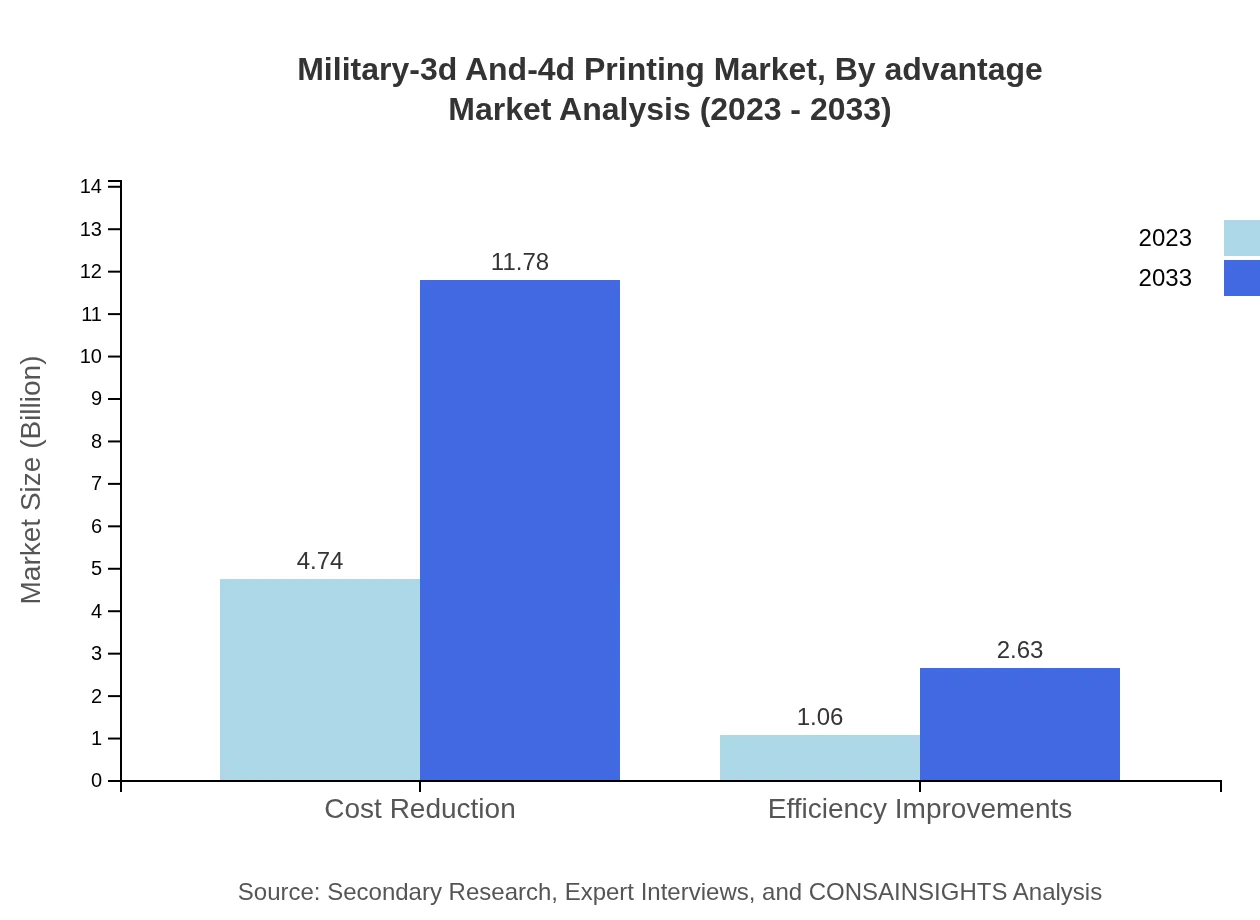

Military-3d And-4d Printing Market Analysis By Advantage

The advantages include cost reduction and efficiency improvements. Cost reduction benefits dominate with 81.73% market share, as militaries seek to optimize budgets and increase operational readiness.

Military-3d And-4d Printing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military-3d And-4d Printing Industry

Boeing :

Boeing has integrated 3D printing technologies to manufacture parts and components for military aircraft, significantly reducing production times.Lockheed Martin:

Lockheed Martin utilizes 3D printing for various defense applications, emphasizing innovation in weapon systems and aerospace technologies.Stratasys:

Stratasys provides advanced 3D printing solutions tailored to military use, focusing on rapid prototyping and manufacturing of complex components.General Electric (GE):

GE employs 3D printing in the production of jet engine parts, optimizing performance and minimizing waste in manufacturing processes.3D Systems:

3D Systems offers a range of additive manufacturing solutions for the defense sector, with innovations that align closely with military requirements.We're grateful to work with incredible clients.

FAQs

What is the market size of military-3d And-4d Printing?

The military 3D and 4D printing market is currently valued at approximately $5.8 billion, with a projected CAGR of 9.2%, indicating substantial growth potential over the next decade, reaching new heights in innovation and application.

What are the key market players or companies in this military-3d And-4d Printing industry?

Key players in the military 3D and 4D printing industry include major defense contractors, aerospace firms, and various technology companies specializing in additive manufacturing solutions tailored to military specifications and capabilities.

What are the primary factors driving the growth in the military 3D and 4D printing industry?

Growth is primarily driven by the demand for rapid prototyping, cost-effective production, customized parts, and efficient supply chain solutions, enhancing operational capabilities and reducing military logistical burdens.

Which region is the fastest Growing in the military 3D and 4D printing?

The fastest-growing region for military 3D and 4D printing is Europe, projected to grow from $1.98 billion in 2023 to $4.92 billion by 2033, driven by enhanced defense budgets and technological advancements.

Does ConsaInsights provide customized market report data for the military 3D and 4D printing industry?

Yes, ConsaInsights offers tailored market report data specifically catering to client needs in the military 3D and 4D printing sector, ensuring actionable insights for strategic decision-making.

What deliverables can I expect from this military 3D and 4D printing market research project?

Deliverables include comprehensive market analysis, trend reports, competitive landscape assessments, segmentation analysis, and actionable recommendations for entry and growth strategies.

What are the market trends of military-3d And-4d Printing?

Current trends include a shift towards additive manufacturing, increased usage of polymers and metals for defense applications, and advancements in digital fabrication technologies that enhance systems efficiency and reduce costs.