Military Aircraft Avionics Market Report

Published Date: 03 February 2026 | Report Code: military-aircraft-avionics

Military Aircraft Avionics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Military Aircraft Avionics market, including market size, growth trends, segmentation, regional insights, key technology advancements, and competitive landscape. The forecast period covered is from 2023 to 2033.

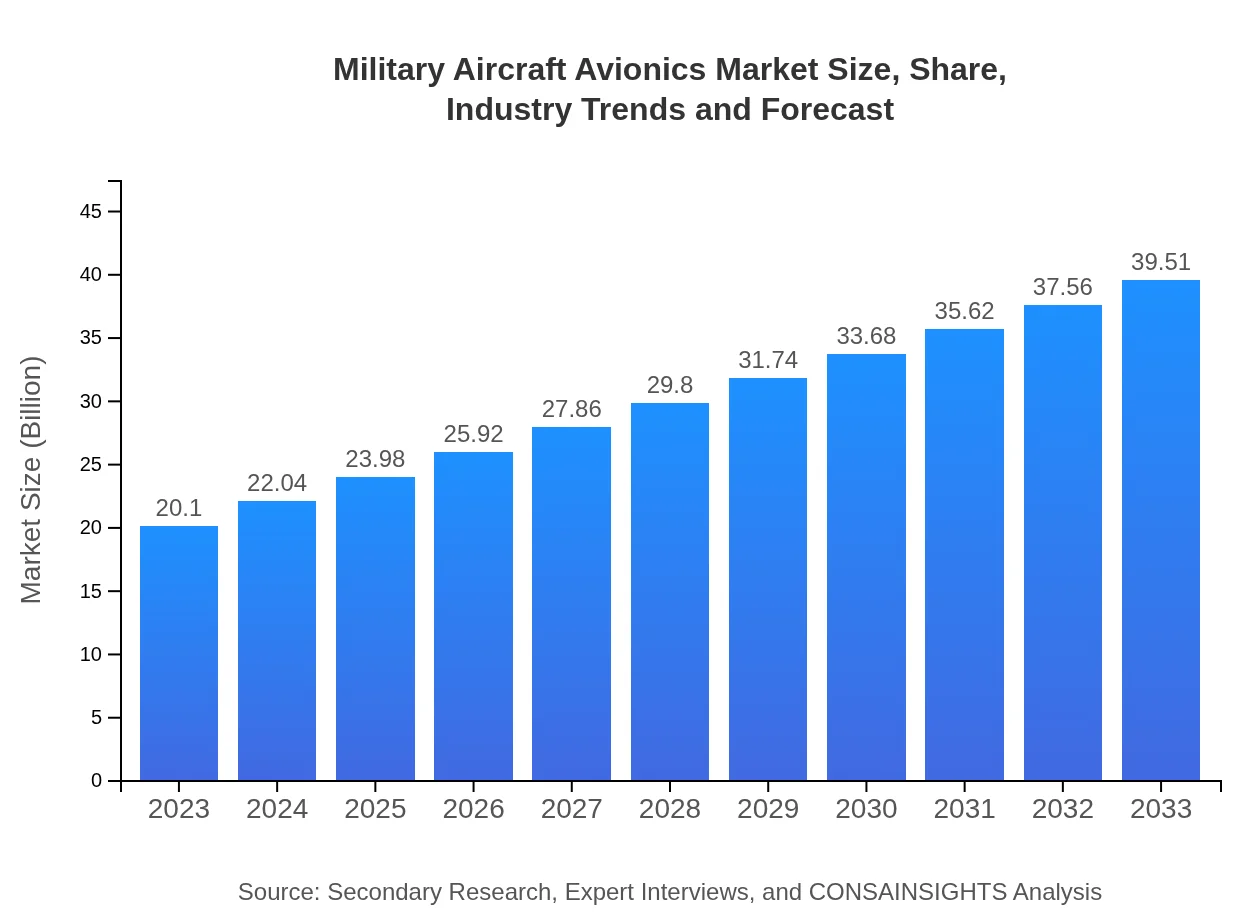

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.10 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $39.51 Billion |

| Top Companies | Lockheed Martin Corporation, Northrop Grumman, Raytheon Technologies, Honeywell International Inc., Thales Group |

| Last Modified Date | 03 February 2026 |

Military Aircraft Avionics Market Overview

Customize Military Aircraft Avionics Market Report market research report

- ✔ Get in-depth analysis of Military Aircraft Avionics market size, growth, and forecasts.

- ✔ Understand Military Aircraft Avionics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Aircraft Avionics

What is the Market Size & CAGR of Military Aircraft Avionics market in 2023?

Military Aircraft Avionics Industry Analysis

Military Aircraft Avionics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Aircraft Avionics Market Analysis Report by Region

Europe Military Aircraft Avionics Market Report:

In Europe, the market size is expected to grow from USD 6.23 billion in 2023 to USD 12.24 billion in 2033. The increasing defense collaborations and joint procurement initiatives among NATO member states significantly contribute to the market expansion.Asia Pacific Military Aircraft Avionics Market Report:

In the Asia Pacific region, the Military Aircraft Avionics market is projected to grow from USD 3.51 billion in 2023 to USD 6.89 billion in 2033, driven by increased defense budgets and modernization initiatives undertaken by countries such as India, Japan, and China. The growing focus on indigenous defense production is further enhancing the market landscape.North America Military Aircraft Avionics Market Report:

North America dominates the Military Aircraft Avionics market, valued at USD 7.52 billion in 2023, projected to reach USD 14.77 billion by 2033. The U.S. military's substantial budget allocation for advanced avionics systems and the presence of established manufacturers contributes to this growth.South America Military Aircraft Avionics Market Report:

The South American market for Military Aircraft Avionics, though relatively smaller, is anticipated to witness growth from USD 1.43 billion in 2023 to USD 2.80 billion by 2033. Brazil is the key player in this region, leveraging its defense spending for upgrading their aircraft avionics capabilities.Middle East & Africa Military Aircraft Avionics Market Report:

The Middle East and Africa market is set to increase from USD 1.43 billion in 2023 to USD 2.80 billion by 2033. Middle Eastern countries are investing heavily in military modernization, further driving the demand for advanced avionics systems.Tell us your focus area and get a customized research report.

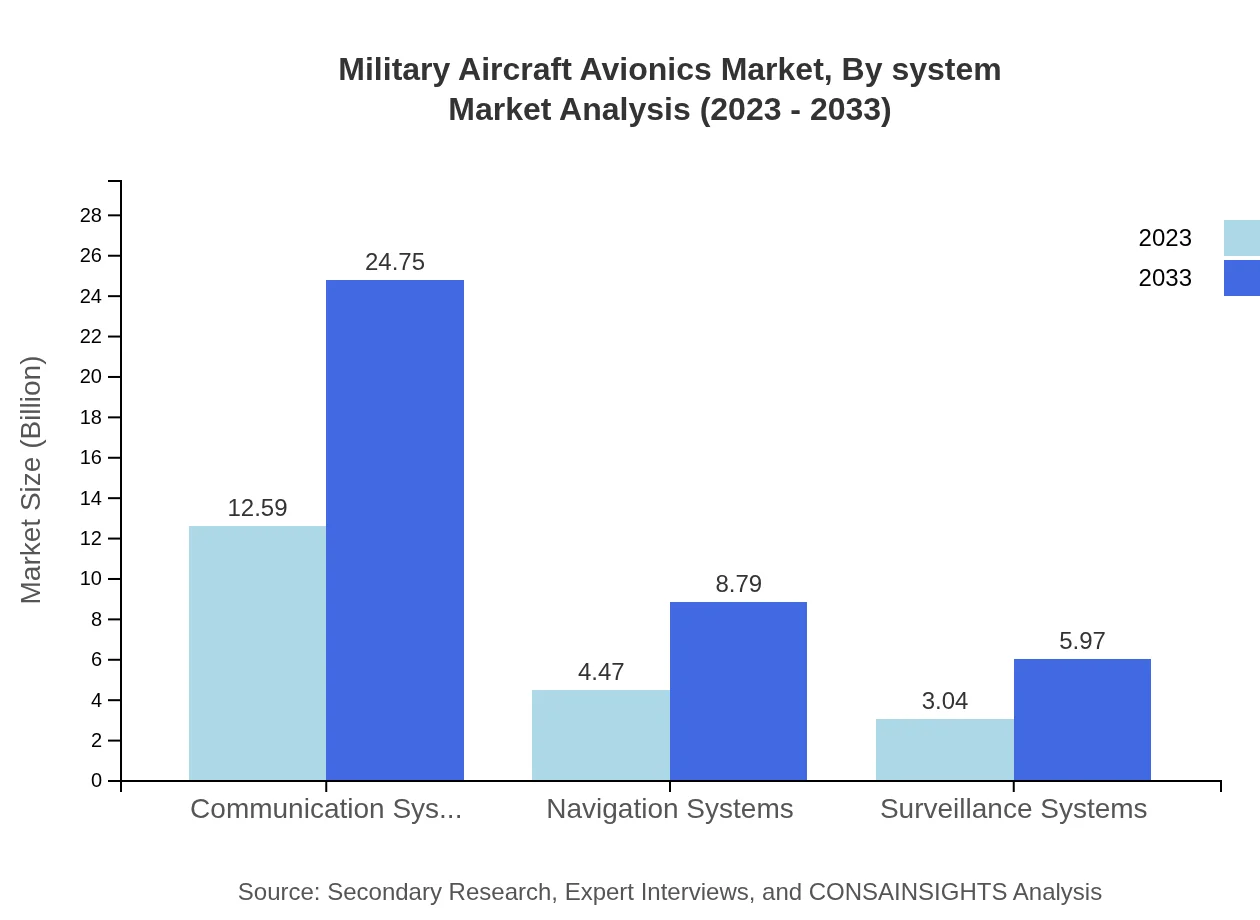

Military Aircraft Avionics Market Analysis By System

The Military Aircraft Avionics market is heavily reliant on systems such as Communication Systems (USD 12.59 billion in 2023, reaching USD 24.75 billion by 2033), Navigation Systems (projected growth from USD 4.47 billion to USD 8.79 billion), and Surveillance Systems (expected increase from USD 3.04 billion to USD 5.97 billion). These systems contribute significantly to aircraft operational efficiency and situational awareness.

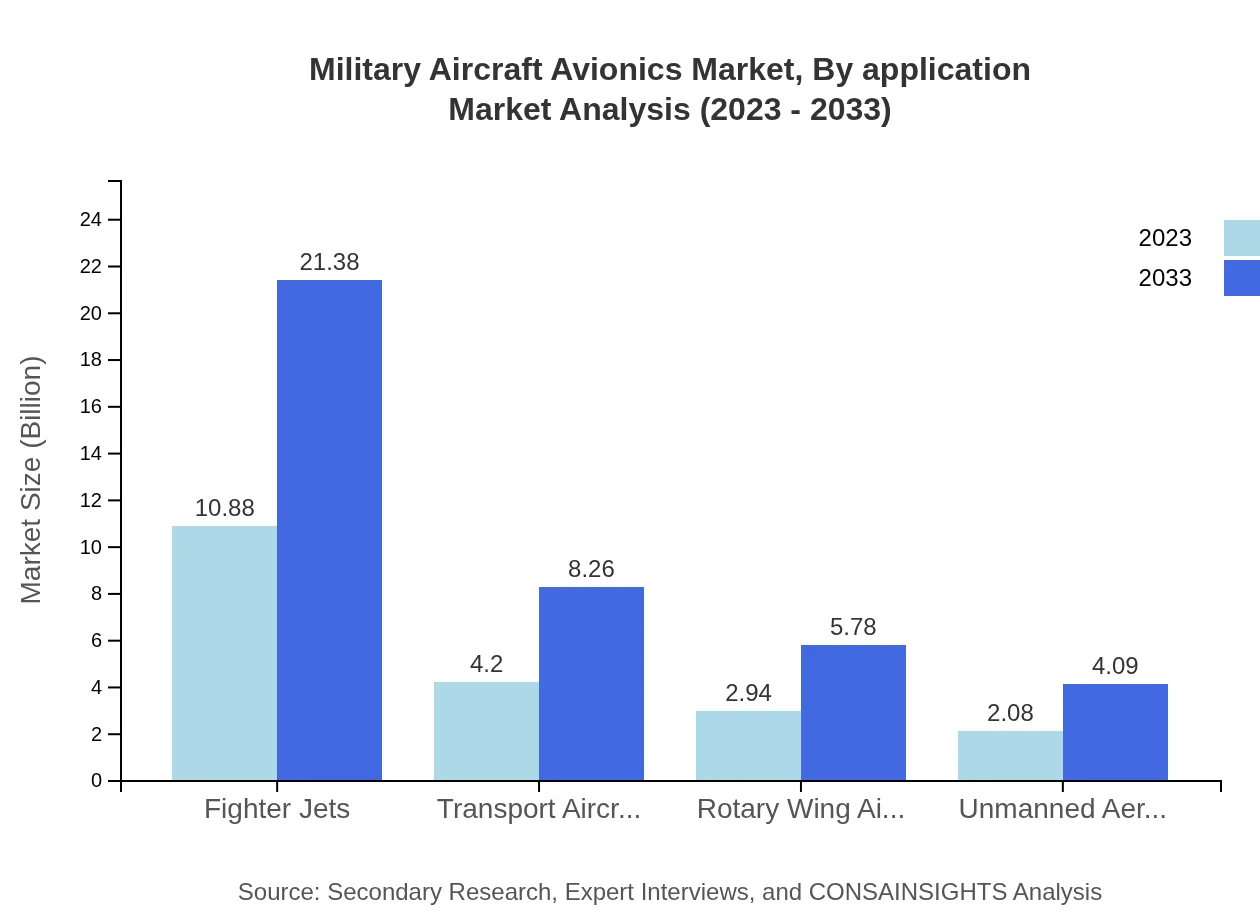

Military Aircraft Avionics Market Analysis By Application

The application segments comprise Military uses, which command an impressive size of USD 12.59 billion in 2023 projected to reach USD 24.75 billion by 2033, followed by Government uses growing from USD 4.47 billion to USD 8.79 billion. The increasing reliance on technologically advanced systems is enhancing operational capabilities in various military applications.

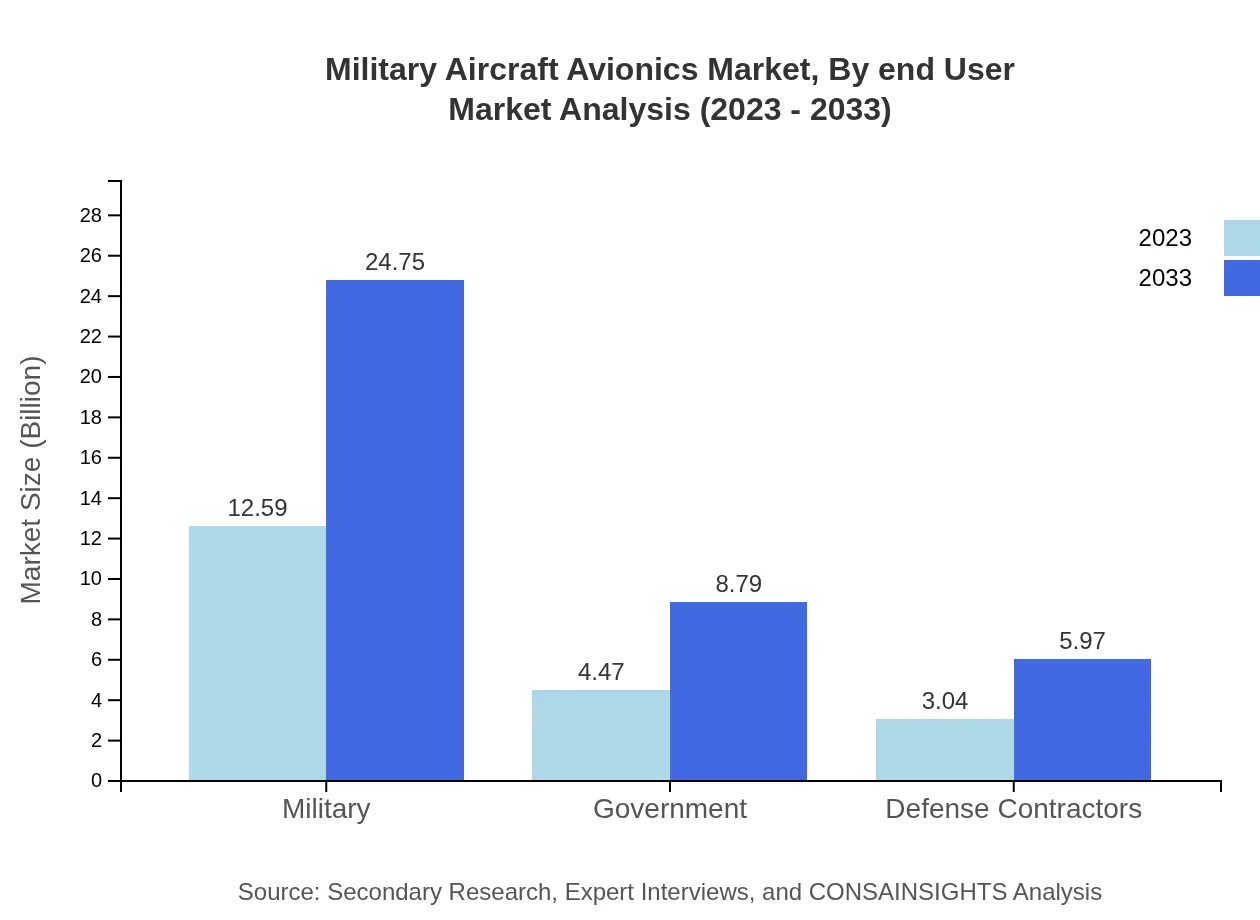

Military Aircraft Avionics Market Analysis By End User

Key end-users include Defense Contractors (size shifting from USD 3.04 billion to USD 5.97 billion) and government research entities. The demand is shaped by the need for innovative solutions that enhance national security and defense operations.

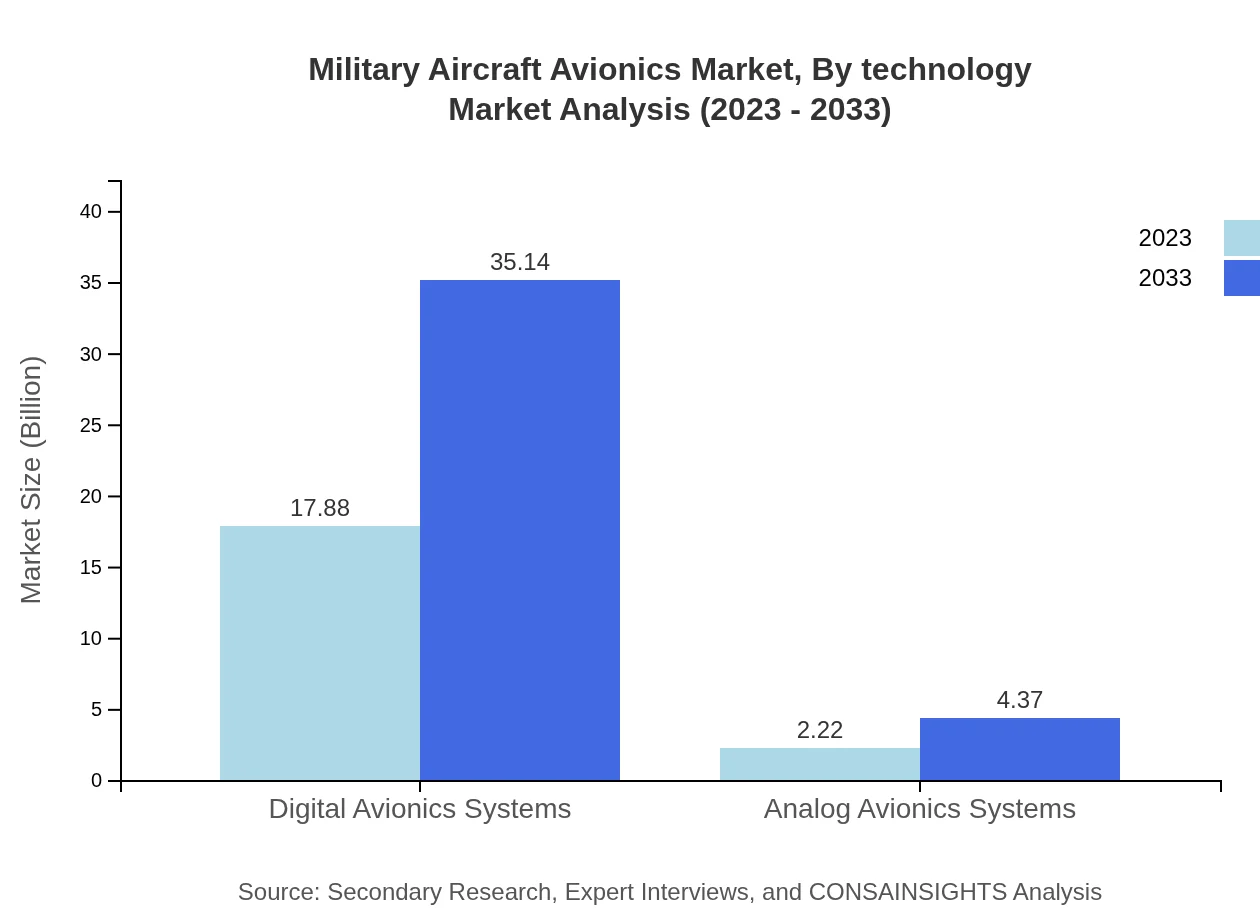

Military Aircraft Avionics Market Analysis By Technology

The distinction between Digital Avionics Systems (dominant share of 88.94% and projected increase from USD 17.88 billion to USD 35.14 billion) and Analog systems (projecting from USD 2.22 billion to USD 4.37 billion) illustrates the significant market movement towards digitalization and enhanced functionalities in avionics.

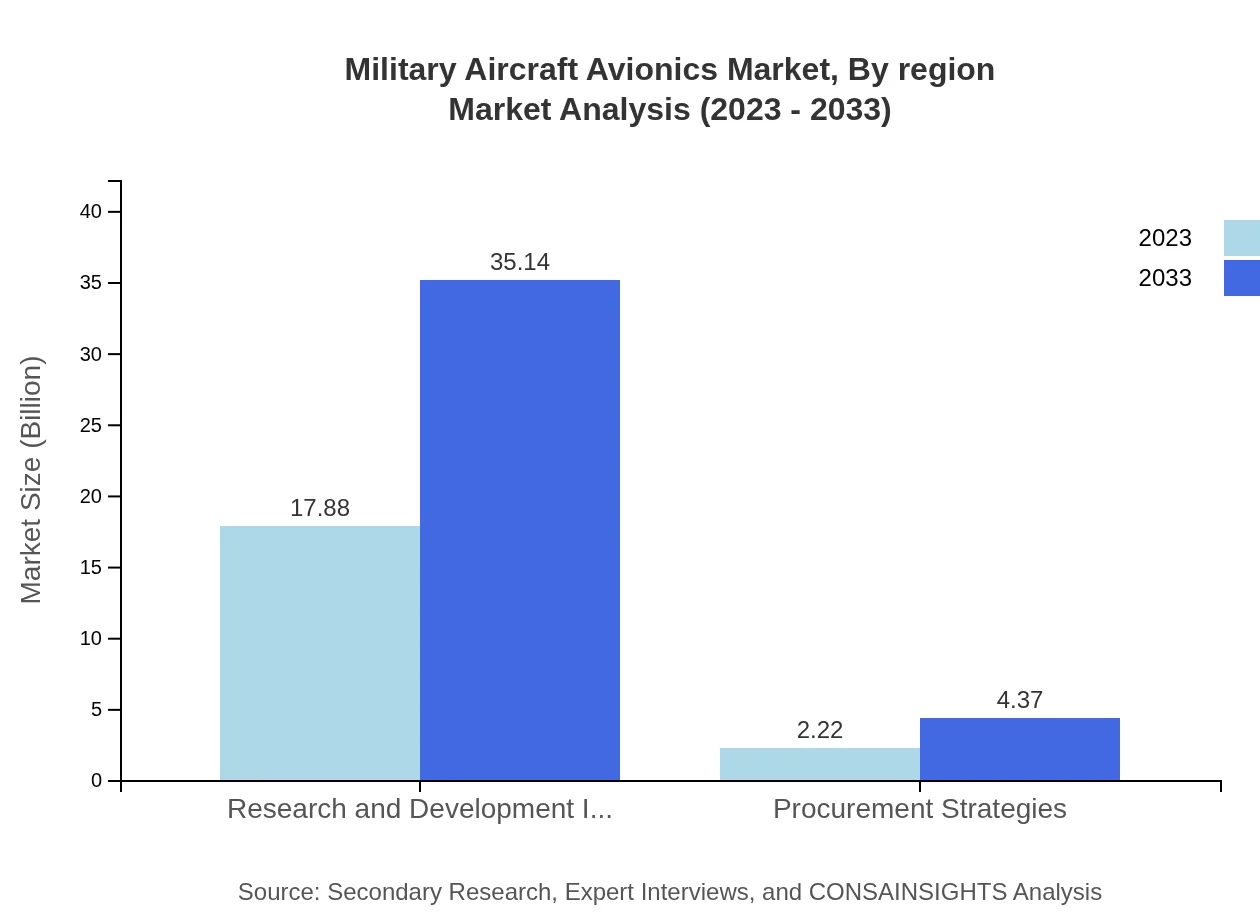

Military Aircraft Avionics Market Analysis By Region

Investment analysis showcases the rising focus on R&D in the avionics sector with investments expected to grow from USD 17.88 billion in 2023 to USD 35.14 billion by 2033, reflecting the industry's commitment to technological advancements and modernization.

Military Aircraft Avionics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Aircraft Avionics Industry

Lockheed Martin Corporation:

A global aerospace company, Lockheed Martin is a leader in military avionics technology, renowned for its advanced fighter jets and integrated avionics systems.Northrop Grumman:

Known for aerospace and defense technologies, Northrop Grumman develops sophisticated avionics and surveillance systems for various military applications.Raytheon Technologies:

Raytheon Technologies plays a key role in the avionics market, providing innovative defense solutions and electronic systems that enhance operational capabilities.Honeywell International Inc.:

Honeywell is a leading manufacturer of military avionics systems, focusing on communication, navigation, and safety systems for defense aircraft.Thales Group:

Thales Group specializes in advanced avionics systems and solutions that ensure superior operational performance and mission success.We're grateful to work with incredible clients.

FAQs

What is the market size of military Aircraft Avionics?

The military aircraft avionics market is projected to reach a size of approximately $20.1 billion by 2033, growing at a CAGR of 6.8% from a baseline market size in 2023.

What are the key market players or companies in the military Aircraft Avionics industry?

Key players in the military aircraft avionics industry include major defense contractors, technology firms specializing in aerospace solutions, and multinational corporations with divisions dedicated to military aerospace technology development and support.

What are the primary factors driving the growth in the military Aircraft Avionics industry?

The growth of the military aircraft avionics industry is driven by advancements in technology, increased defense budgets globally, modernization of existing fleets, and the rising demand for advanced communication and navigation systems in military operations.

Which region is the fastest Growing in the military Aircraft Avionics market?

The North American region is currently the fastest-growing area in the military aircraft avionics market, expected to grow from $7.52 billion in 2023 to $14.77 billion by 2033, reflecting strong defense investments.

Does Consainsights provide customized market report data for the military Aircraft Avionics industry?

Yes, Consainsights offers customized market reports that can be tailored to specific requirements in the military aircraft avionics sector, providing detailed insights that are relevant to individual clients' needs.

What deliverables can I expect from this military Aircraft Avionics market research project?

Deliverables from the military aircraft avionics market research project typically include market size analyses, competitive landscape assessments, trend forecasts, segment analyses, and detailed profiles of key industry players.

What are the market trends of military Aircraft Avionics?

Current trends in the military aircraft avionics market include increased digitization of systems, emphasis on cybersecurity, integration of AI, and growing investments in modernization programs for legacy aircraft.