Military Aircraft Collision Avoidance Systems Market Report

Published Date: 03 February 2026 | Report Code: military-aircraft-collision-avoidance-systems

Military Aircraft Collision Avoidance Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Military Aircraft Collision Avoidance Systems market, including insights on market size, growth rates, and technological advancements from 2023 to 2033.

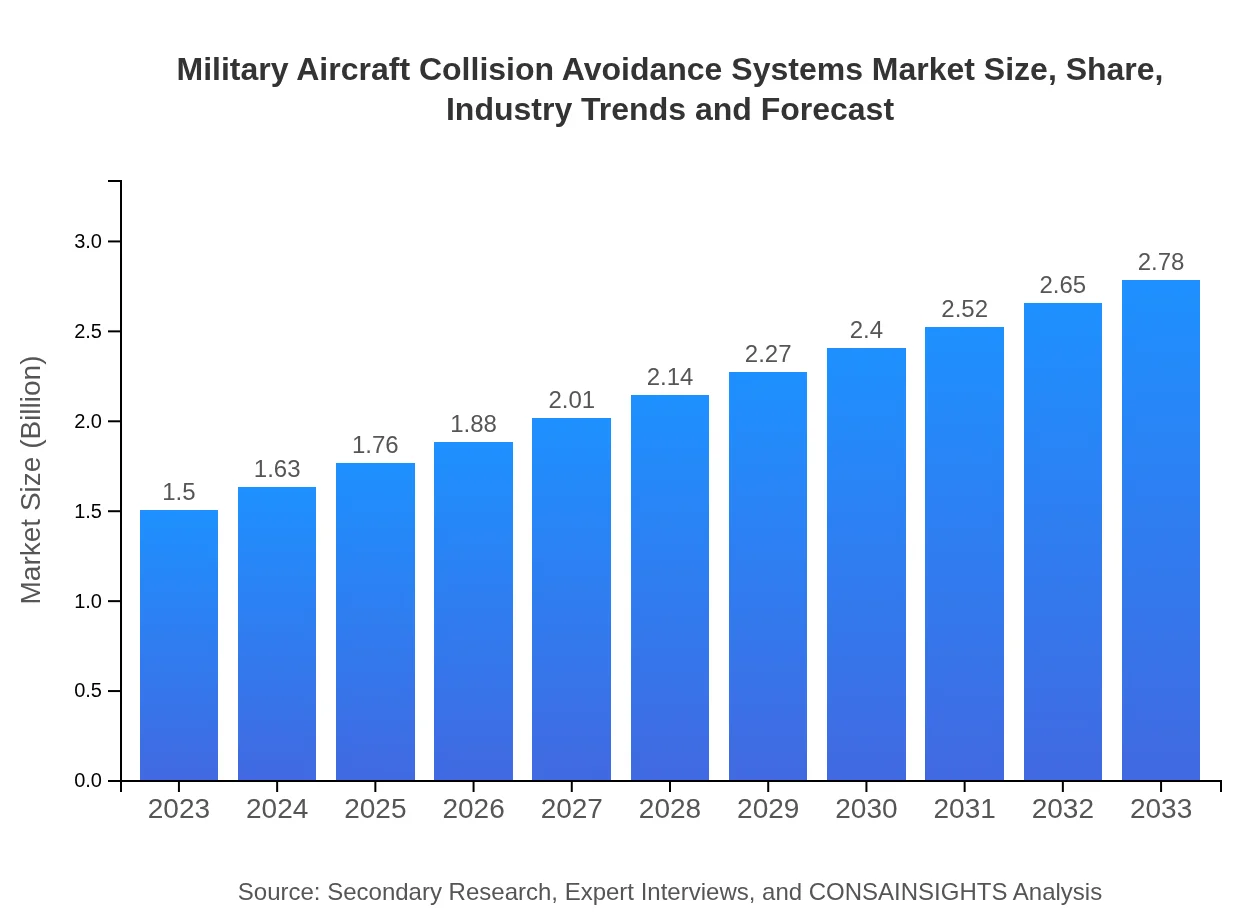

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Northrop Grumman Corporation, Raytheon Technologies, Honeywell International Inc., General Dynamics |

| Last Modified Date | 03 February 2026 |

Military Aircraft Collision Avoidance Systems Market Overview

Customize Military Aircraft Collision Avoidance Systems Market Report market research report

- ✔ Get in-depth analysis of Military Aircraft Collision Avoidance Systems market size, growth, and forecasts.

- ✔ Understand Military Aircraft Collision Avoidance Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Aircraft Collision Avoidance Systems

What is the Market Size & CAGR of Military Aircraft Collision Avoidance Systems market in 2023-2033?

Military Aircraft Collision Avoidance Systems Industry Analysis

Military Aircraft Collision Avoidance Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Aircraft Collision Avoidance Systems Market Analysis Report by Region

Europe Military Aircraft Collision Avoidance Systems Market Report:

In Europe, the market is estimated at $0.40 billion in 2023, rising to approximately $0.74 billion by 2033. The demand is largely driven by stringent safety regulations and increased focus on military readiness amidst evolving geopolitical challenges.Asia Pacific Military Aircraft Collision Avoidance Systems Market Report:

In the Asia Pacific region, the market is currently valued at $0.30 billion in 2023 and is expected to reach $0.56 billion by 2033. The rapid modernization of military forces and rising defense expenditures in countries like India and China contribute to this growth, along with increased focus on integrating advanced technologies in aerial operations.North America Military Aircraft Collision Avoidance Systems Market Report:

North America holds a leading position in the Military Aircraft Collision Avoidance Systems market, with a valuation of $0.52 billion in 2023, expected to soar to $0.97 billion by 2033. Significant investments in defense technology and a robust military infrastructure, especially from the United States, are key factors fueling market growth.South America Military Aircraft Collision Avoidance Systems Market Report:

The South American market for Military Aircraft Collision Avoidance Systems is valued at $0.14 billion in 2023, projected to grow to $0.25 billion by 2033. Factors driving this growth include the modernization of military fleets and increased collaboration with international defense contractors to upgrade existing systems.Middle East & Africa Military Aircraft Collision Avoidance Systems Market Report:

The Middle East and Africa market stands at $0.14 billion in 2023, anticipated to grow to $0.26 billion by 2033. Ongoing regional conflicts and the pursuit of advanced military capabilities by countries in the region are driving investments in collision avoidance technology.Tell us your focus area and get a customized research report.

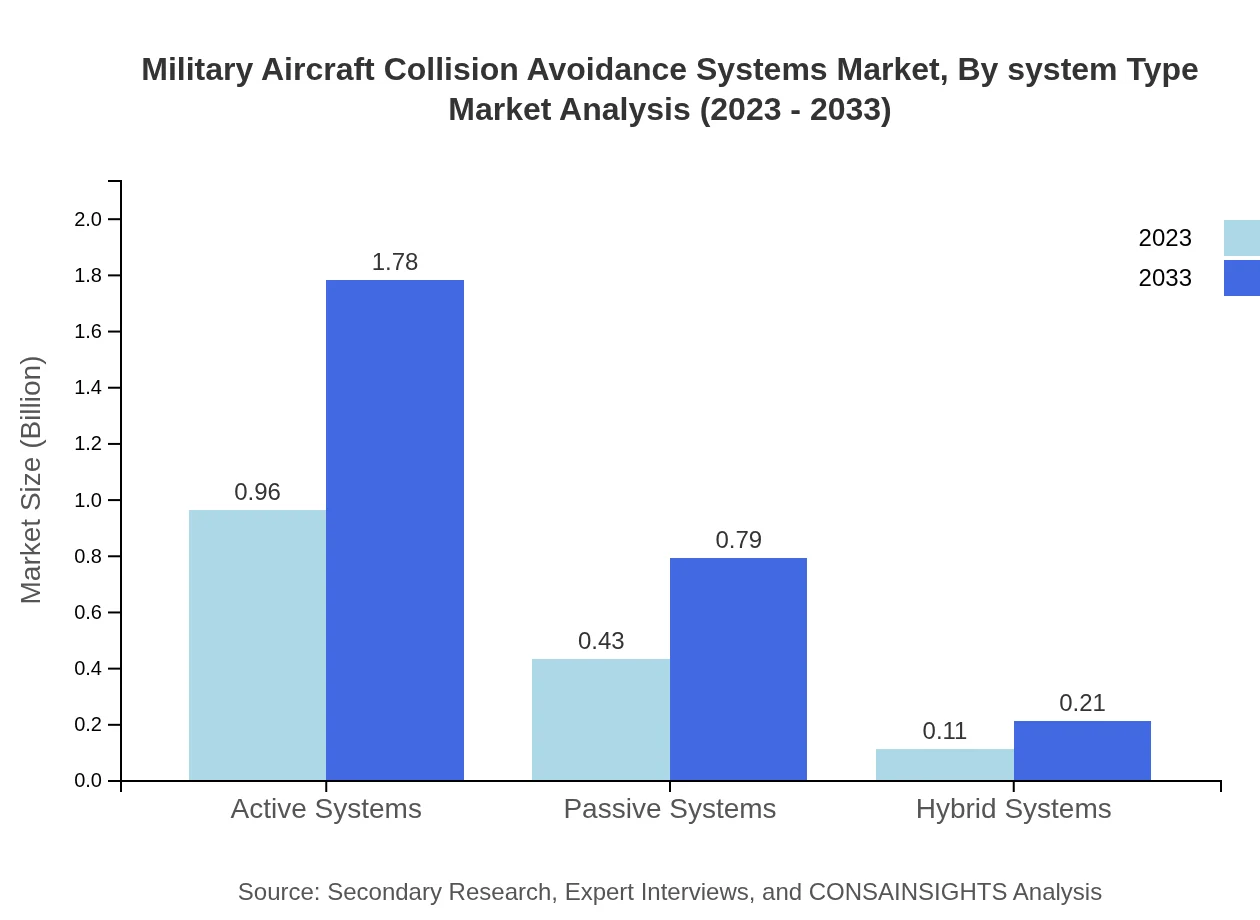

Military Aircraft Collision Avoidance Systems Market Analysis By System Type

In 2023, active systems dominate the Military Aircraft Collision Avoidance Systems market with a size of $0.96 billion, expected to grow to $1.78 billion by 2033, capturing a market share of 64.11%. Passive systems follow with a market size of $0.43 billion in 2023, projected to increase to $0.79 billion by 2033, maintaining a share of 28.41%. Hybrid systems, although smaller, show growth potential, expected to rise from $0.11 billion in 2023 to $0.21 billion by 2033, holding a 7.48% market share.

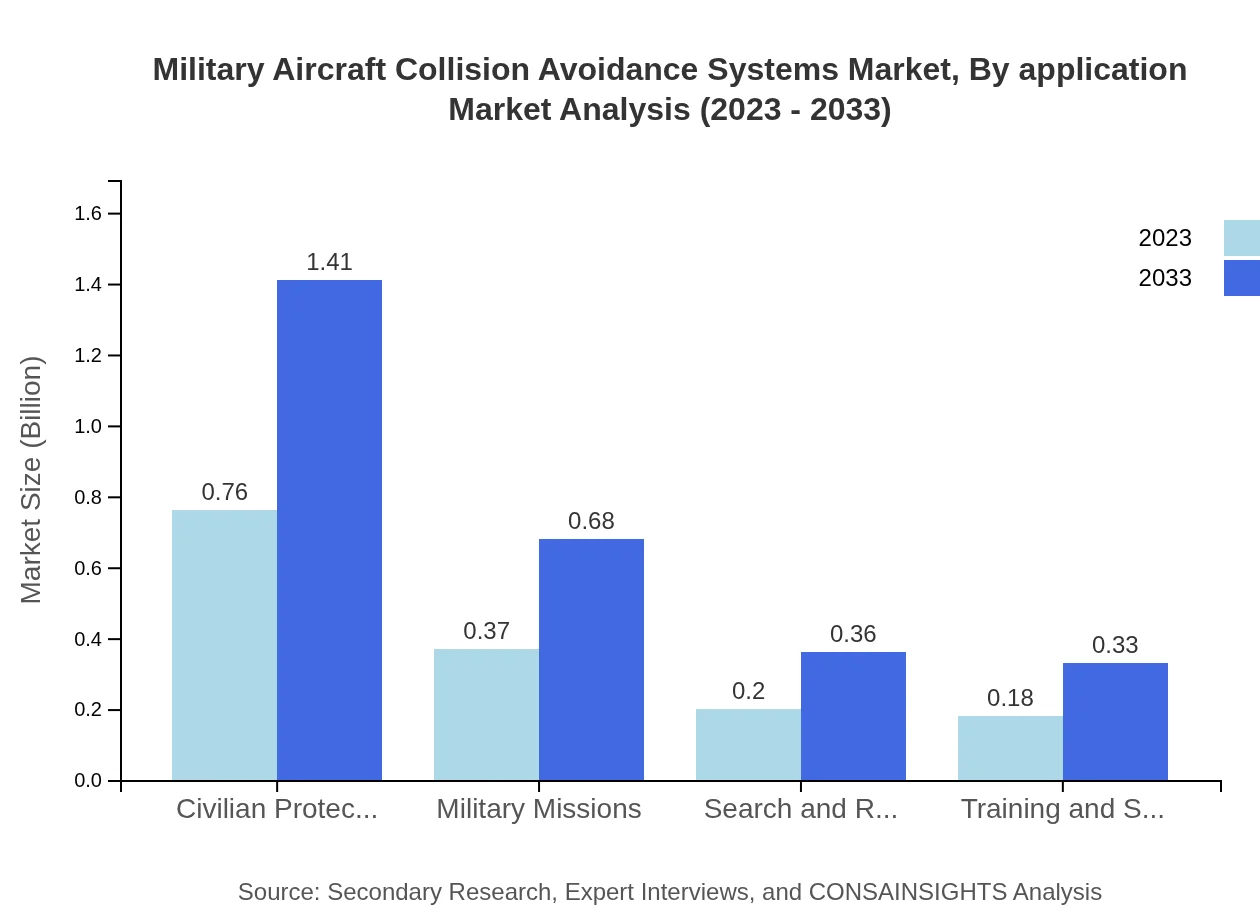

Military Aircraft Collision Avoidance Systems Market Analysis By Application

The 'Civilian Protection' segment leads with a size of $0.76 billion in 2023, growing to $1.41 billion by 2033, comprising 50.76% of the market share. 'Military Missions' stand at $0.37 billion in 2023, expected to reach $0.68 billion by 2033, accounting for 24.42%. Other applications, including 'Search and Rescue Operations' and 'Training and Simulation', are smaller but show incremental growth.

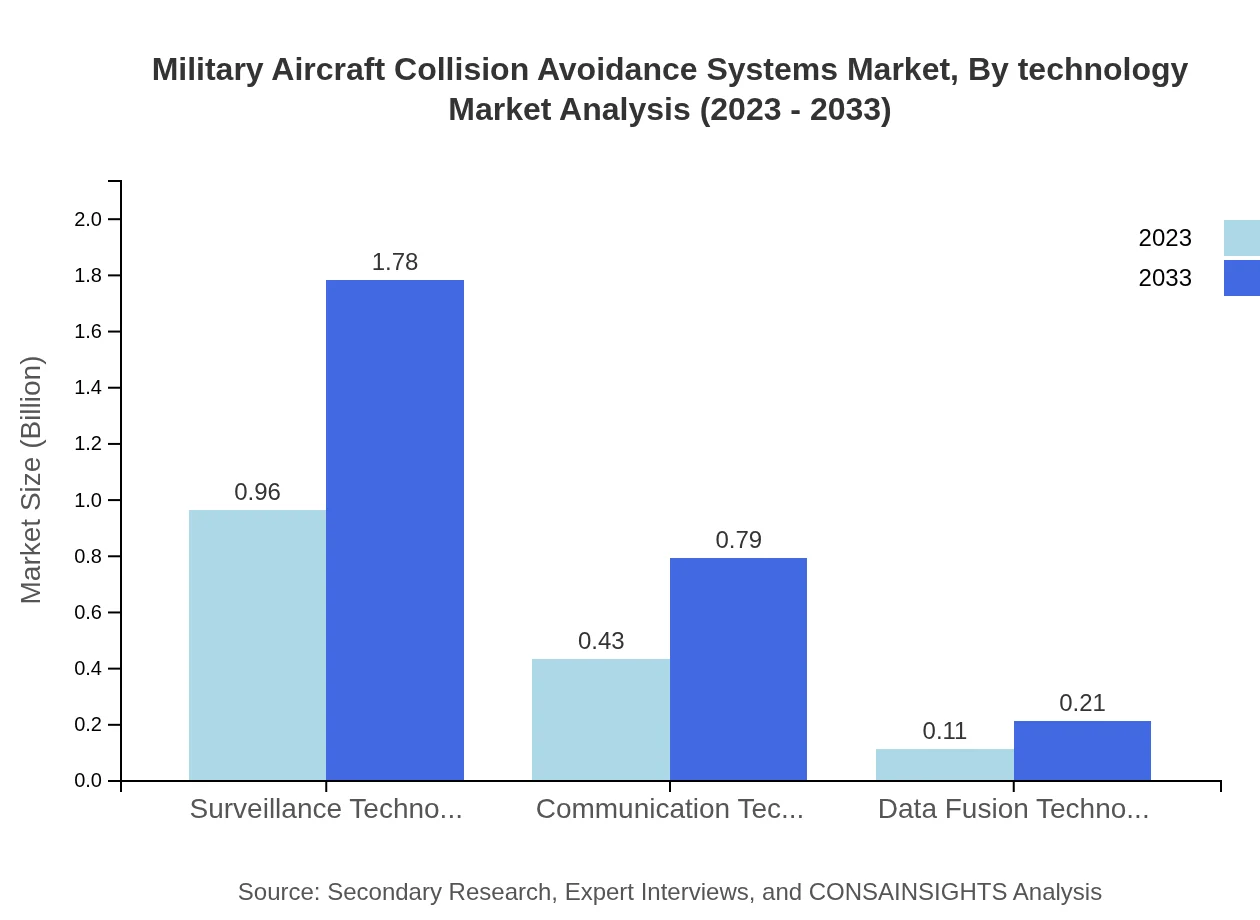

Military Aircraft Collision Avoidance Systems Market Analysis By Technology

In terms of technology, surveillance technology is dominant, valued at $0.96 billion in 2023, projected to reach $1.78 billion by 2033, holding a 64.11% share. Communication technology and data fusion technology also contribute significantly, with respective shares of 28.41% and 7.48%, reflecting the importance of integrated technological solutions in enhancing safety.

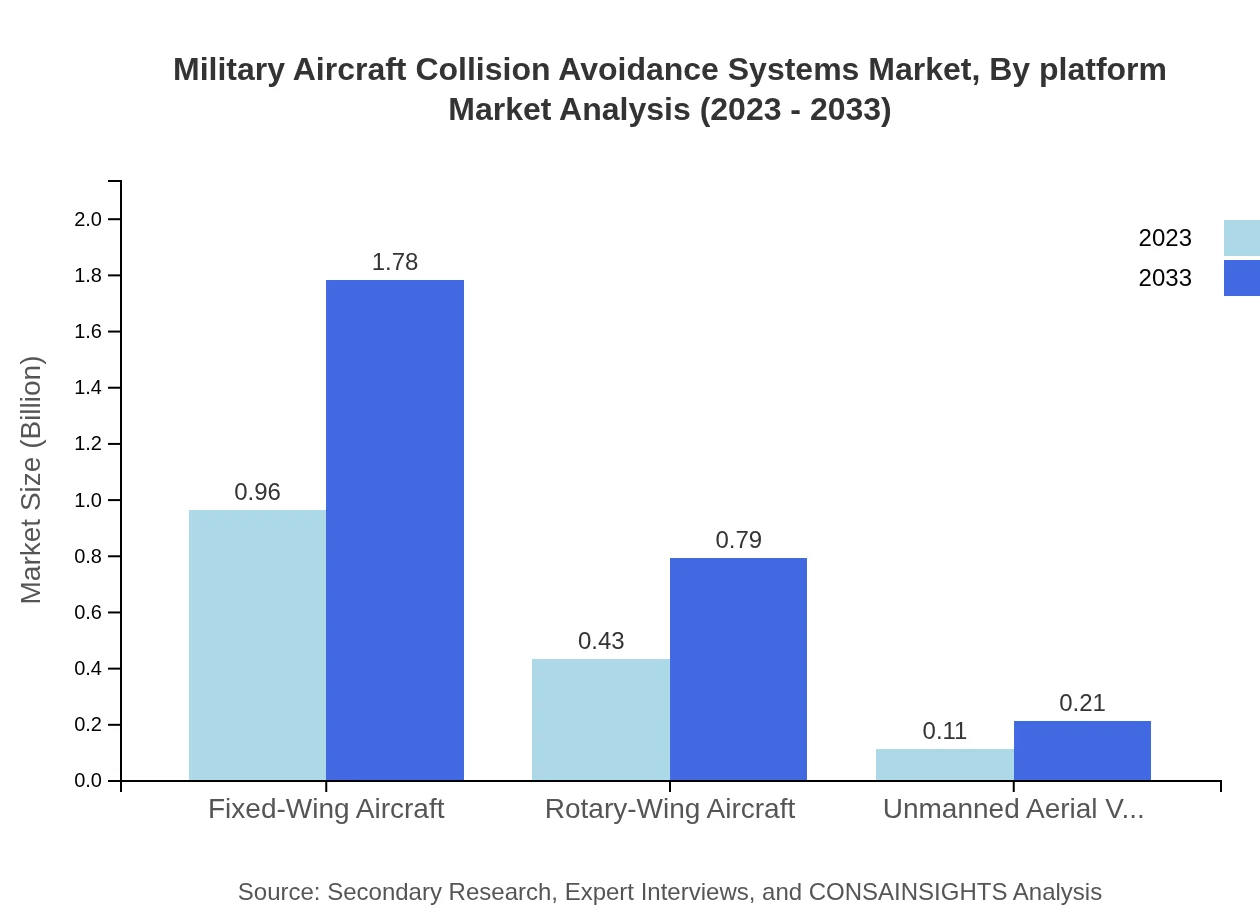

Military Aircraft Collision Avoidance Systems Market Analysis By Platform

Fixed-wing aircraft account for the largest segment with a market size of $0.96 billion in 2023, projected to expand to $1.78 billion by 2033, reflecting a 64.11% market share. Rotary-wing and unmanned aerial vehicles (UAVs) follow, with 28.41% and 7.48% market shares, respectively, indicating a varied demand across different aircraft operability.

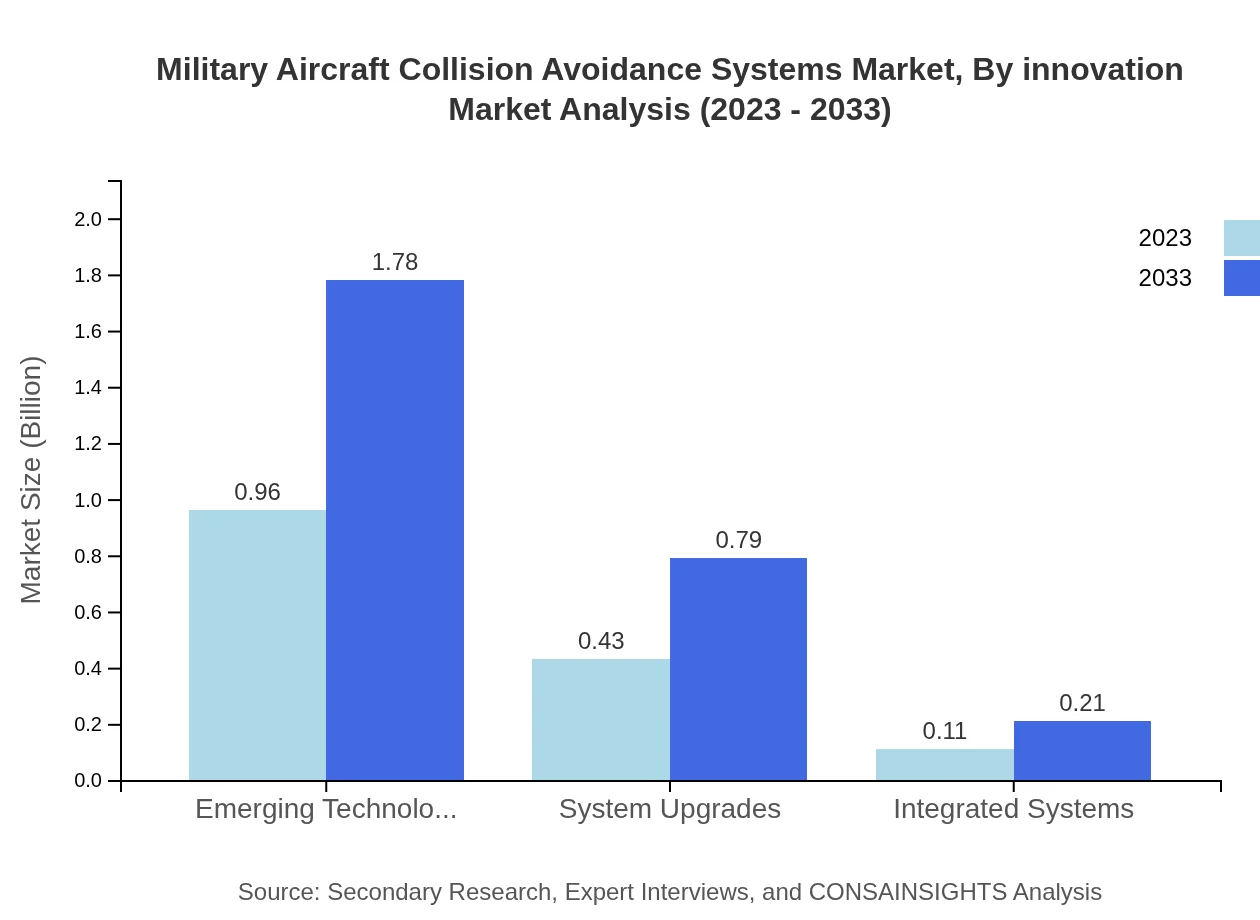

Military Aircraft Collision Avoidance Systems Market Analysis By Innovation

Emerging technologies play a vital role in shaping the future of collision avoidance systems. The market for emerging technologies is projected from $0.96 billion in 2023 to $1.78 billion by 2033, reflecting a 64.11% share, indicating a shift towards more technologically advanced solutions that enhance operational capabilities.

Military Aircraft Collision Avoidance Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Aircraft Collision Avoidance Systems Industry

Northrop Grumman Corporation:

Northrop Grumman is a leading global security company that provides integrated solutions to government and commercial customers worldwide, particularly known for its aerospace systems and advanced military technologies.Raytheon Technologies:

Raytheon Technologies specializes in aerospace and defense technologies, providing advanced systems and services for military applications including collision avoidance and air traffic management technologies.Honeywell International Inc.:

Honeywell is a multinational conglomerate, widely recognized for its aerospace and defense divisions, specializing in avionics and integrated systems that improve operational safety.General Dynamics:

General Dynamics delivers innovative technologies and solutions for defense applications, contributing significantly to collision avoidance systems used in military aviation.We're grateful to work with incredible clients.

FAQs

What is the market size of military Aircraft Collision Avoidance Systems?

The military aircraft collision avoidance systems market is valued at approximately $1.5 billion in 2023, with a compound annual growth rate (CAGR) of 6.2%, indicating steady growth. By 2033, this market is projected to expand, reflecting increased demand for safety technologies in military aviation.

What are the key market players or companies in the military Aircraft Collision Avoidance Systems industry?

Key players in the military aircraft collision avoidance systems include Northrop Grumman, Honeywell, and Raytheon Technologies. These companies lead the market by providing innovative solutions that enhance the safety and operational efficiency of military aviation.

What are the primary factors driving the growth in the military Aircraft Collision Avoidance Systems industry?

Growth drivers for the military aircraft collision avoidance systems include increasing demands for pilot safety, advancements in technology, and military modernization initiatives. These factors emphasize the importance of developing robust collision avoidance technologies for military aircraft.

Which region is the fastest Growing in the military Aircraft Collision Avoidance Systems?

North America is the fastest-growing region for military aircraft collision avoidance systems, with a market size projected to grow from $0.52 billion in 2023 to $0.97 billion by 2033, reflecting significant investments in aviation safety and technology.

Does ConsaInsights provide customized market report data for the military Aircraft Collision Avoidance Systems industry?

Yes, ConsaInsights offers customized market report data for military aircraft collision avoidance systems. Clients can request tailored insights that address their specific needs, ensuring they obtain relevant and actionable market intelligence.

What deliverables can I expect from this military Aircraft Collision Avoidance Systems market research project?

From this market research project, expect detailed reports containing market trends, forecasts, competitive analysis, and segment data. Deliverables will help in understanding the dynamics of the military aircraft collision avoidance systems market.

What are the market trends of military Aircraft Collision Avoidance Systems?

Current trends in the military aircraft collision avoidance systems market include the growing adoption of integrated systems, advancements in surveillance technology, and the expansion of system upgrades. These trends underscore the industry's focus on enhancing operational safety.