Military Aircraft Market Report

Published Date: 03 February 2026 | Report Code: military-aircraft

Military Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Military Aircraft market from 2023 to 2033, including detailed market analysis, segmentation, regional insights, and future forecasts that inform stakeholders about trends affecting growth and development in the industry.

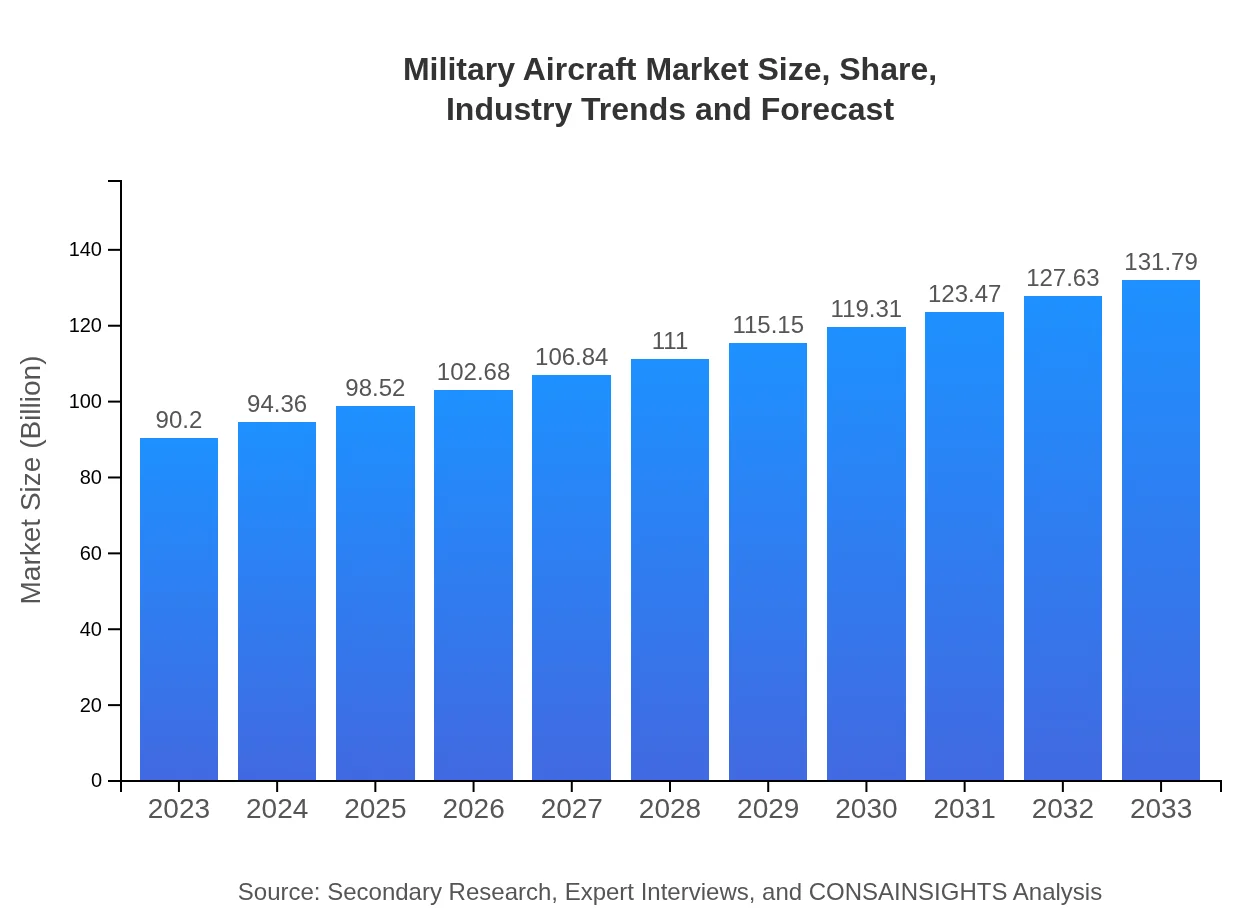

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $90.20 Billion |

| CAGR (2023-2033) | 3.8% |

| 2033 Market Size | $131.79 Billion |

| Top Companies | Lockheed Martin, Boeing Defense, Space & Security, Northrop Grumman, BAE Systems, Airbus Defense and Space |

| Last Modified Date | 03 February 2026 |

Military Aircraft Market Overview

Customize Military Aircraft Market Report market research report

- ✔ Get in-depth analysis of Military Aircraft market size, growth, and forecasts.

- ✔ Understand Military Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Aircraft

What is the Market Size & CAGR of Military Aircraft market in 2023?

Military Aircraft Industry Analysis

Military Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Aircraft Market Analysis Report by Region

Europe Military Aircraft Market Report:

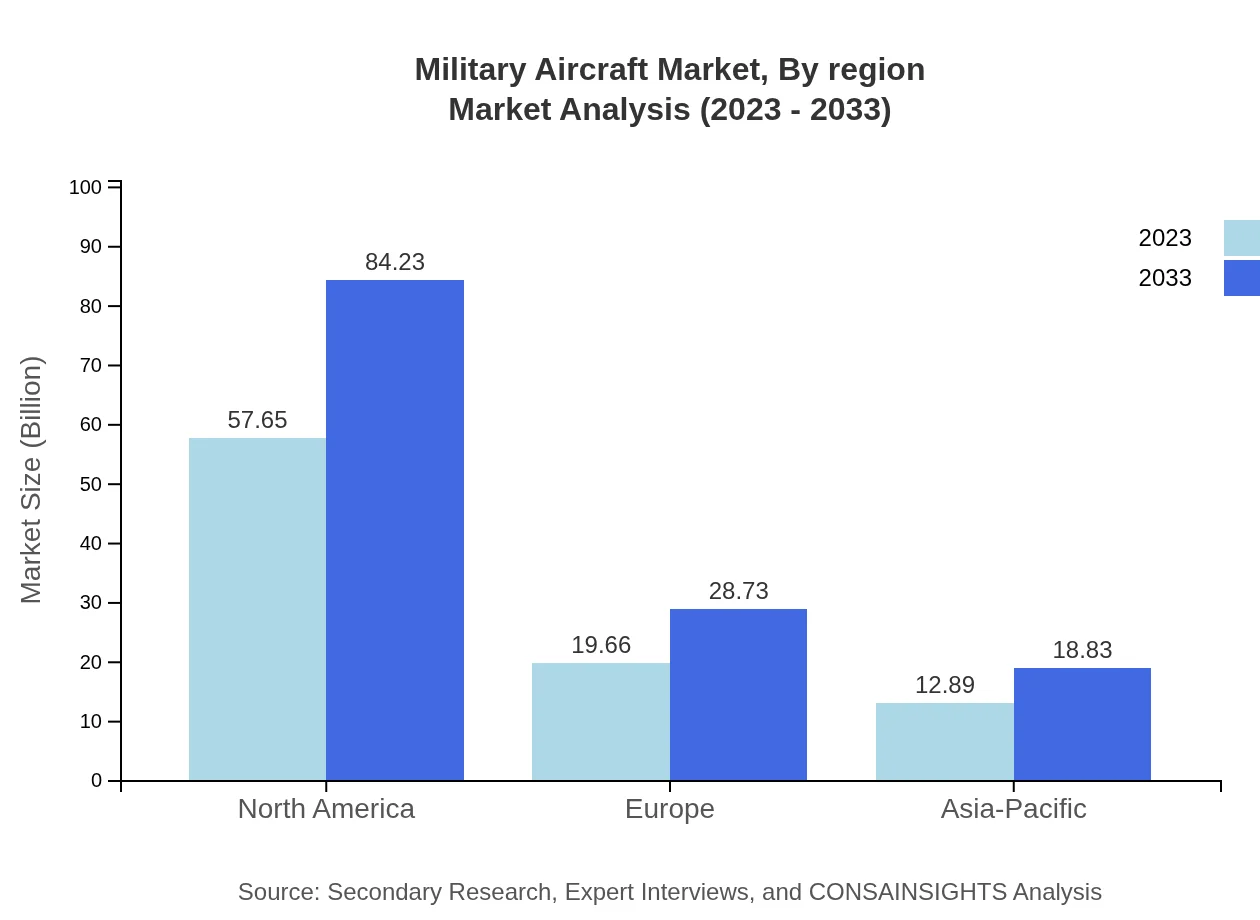

The European Military Aircraft market reached $25.79 billion in 2023 and is projected to grow to $37.68 billion by 2033. Political tensions and the need for enhanced defense strategies post-Brexit underline the importance of modernizing air fleets in countries such as France and Germany.Asia Pacific Military Aircraft Market Report:

In the Asia Pacific region, the Military Aircraft market was valued at $16.69 billion in 2023, and it is expected to reach $24.38 billion by 2033, demonstrating a significant growth trajectory fueled by rising defense budgets and regional conflicts. Countries such as India and China are primarily driving this growth due to their ongoing military modernization programs.North America Military Aircraft Market Report:

North America dominates the Military Aircraft market with a value of $34.20 billion in 2023, anticipated to rise to $49.97 billion by 2033. The United States' defense spending capabilities and its sustained focus on technological innovation in military aviation solidify its market leader status.South America Military Aircraft Market Report:

The South American Military Aircraft market stood at $3.36 billion in 2023, forecasted to grow to $4.92 billion by 2033. The growth in this region is slower compared to others, primarily due to economic constraints; however, countries like Brazil are making strides to enhance their defense procurements and capabilities.Middle East & Africa Military Aircraft Market Report:

In the Middle East and Africa, the Military Aircraft market valued at $10.16 billion in 2023 is expected to achieve $14.84 billion by 2033. Increased military investments driven by geopolitical instability and defense partnerships are notable factors affecting this growth.Tell us your focus area and get a customized research report.

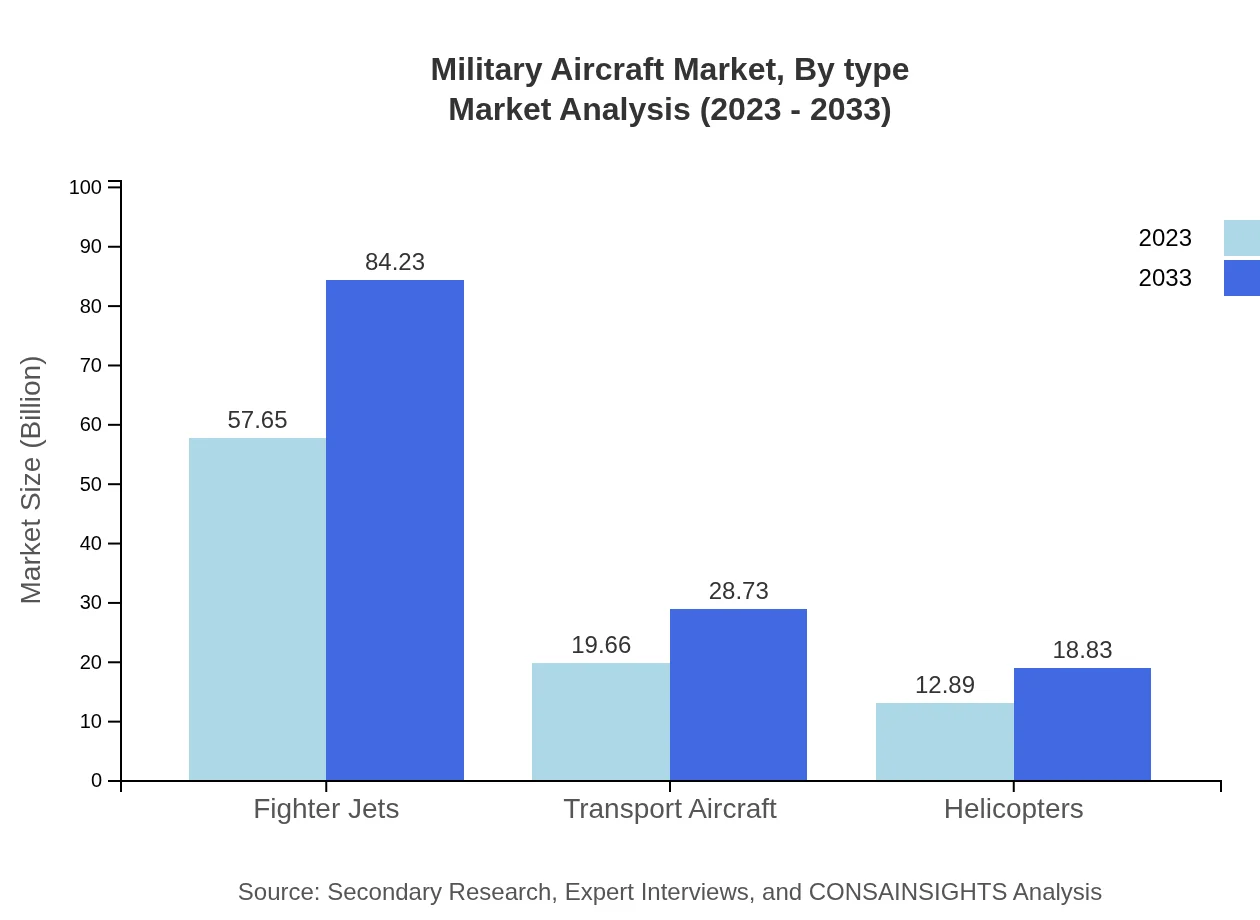

Military Aircraft Market Analysis By Type

The Military Aircraft Market is significantly segmented by type, including Fighter Jets, Transport Aircraft, and Helicopters. Fighter Jets dominate the segment with a market value of $57.65 billion in 2023, projected to soar to $84.23 billion by 2033, holding a market share of 63.91%. Transport Aircraft are valued at $19.66 billion in 2023 with a predicted increase to $28.73 billion by 2033, representing a market share of 21.8%. Helicopters account for $12.89 billion currently and are set to grow to $18.83 billion, covering a share of 14.29%.

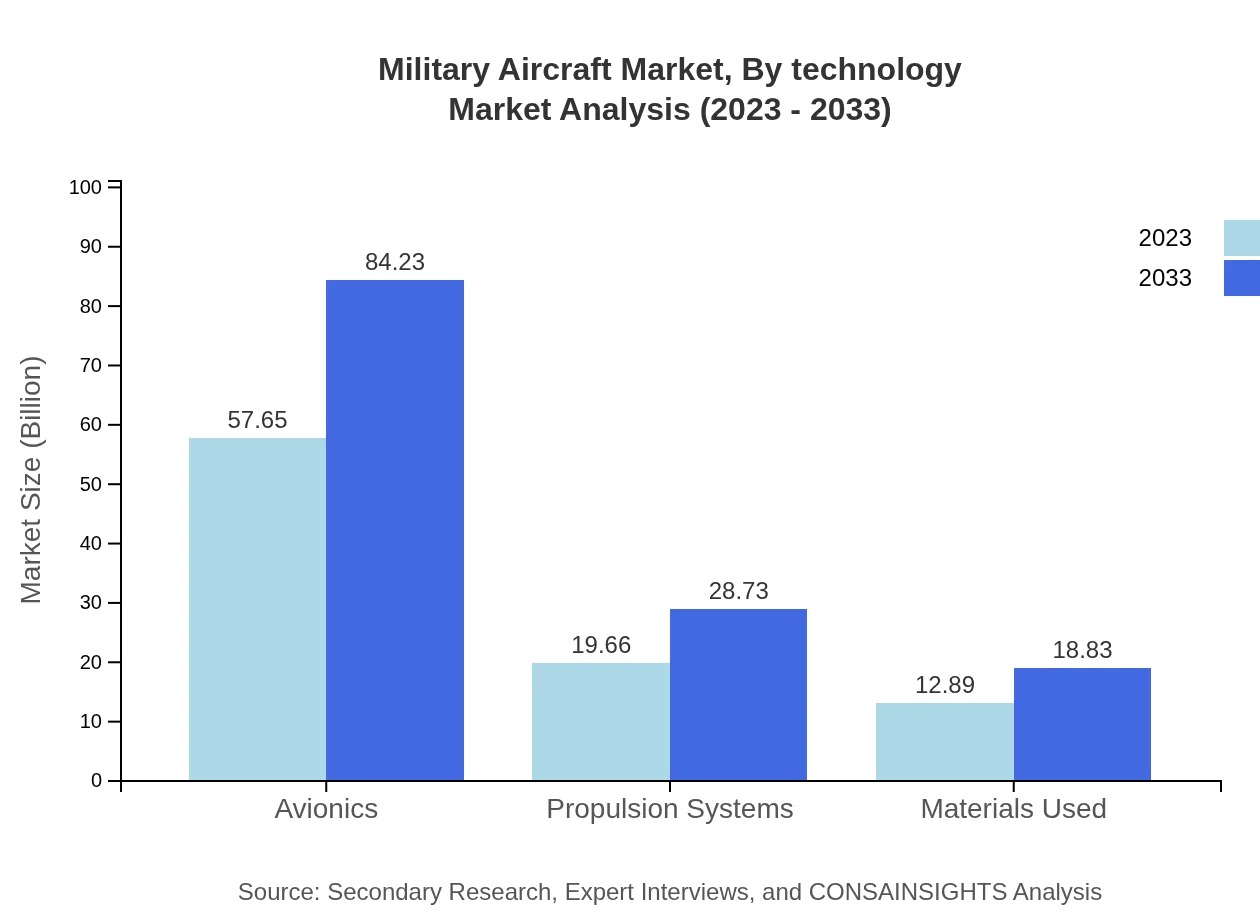

Military Aircraft Market Analysis By Technology

Technological advancements are central to the Military Aircraft market. Key areas of innovation include avionics, propulsion systems, and materials used in aircraft manufacturing. Avionics holds a prevalent market size of $57.65 billion in 2023, expected to reach $84.23 billion by 2033, while Propulsion Systems are projected to grow from $19.66 billion to $28.73 billion in the same period. Materials used will also see growth, from $12.89 billion to $18.83 billion, as manufacturers look to enhance the performance and reduce the weight of aircraft.

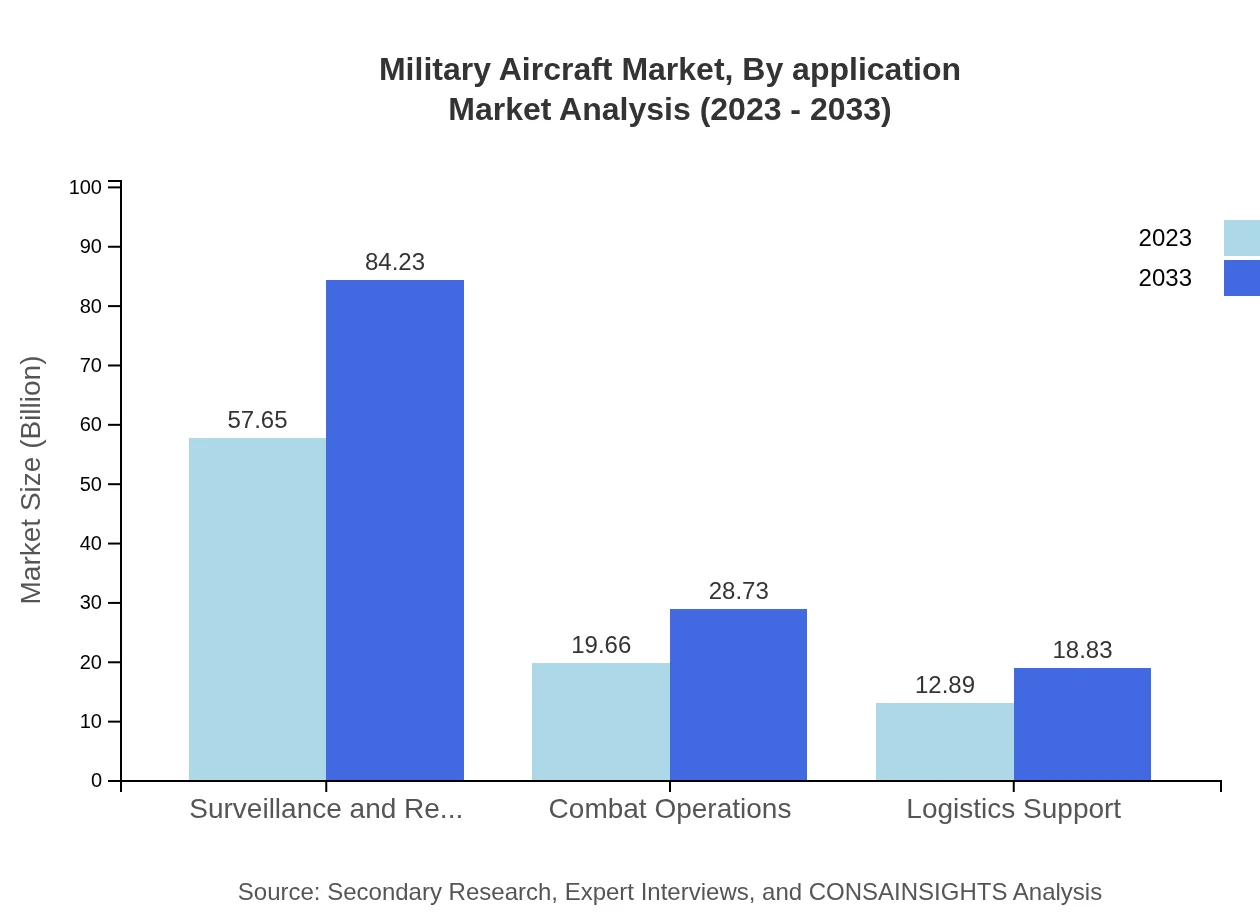

Military Aircraft Market Analysis By Application

The application segment of the Military Aircraft market focuses on different operational roles including Surveillance and Reconnaissance, Combat Operations, and Logistics Support. Surveillance and Reconnaissance applications lead, with a market size of $57.65 billion in 2023 and growth to $84.23 billion by 2033. Combat Operations follow with a market size forecast of $19.66 billion to $28.73 billion, while Logistics Support remains essential with an increase from $12.89 billion to $18.83 billion over the same forecast period.

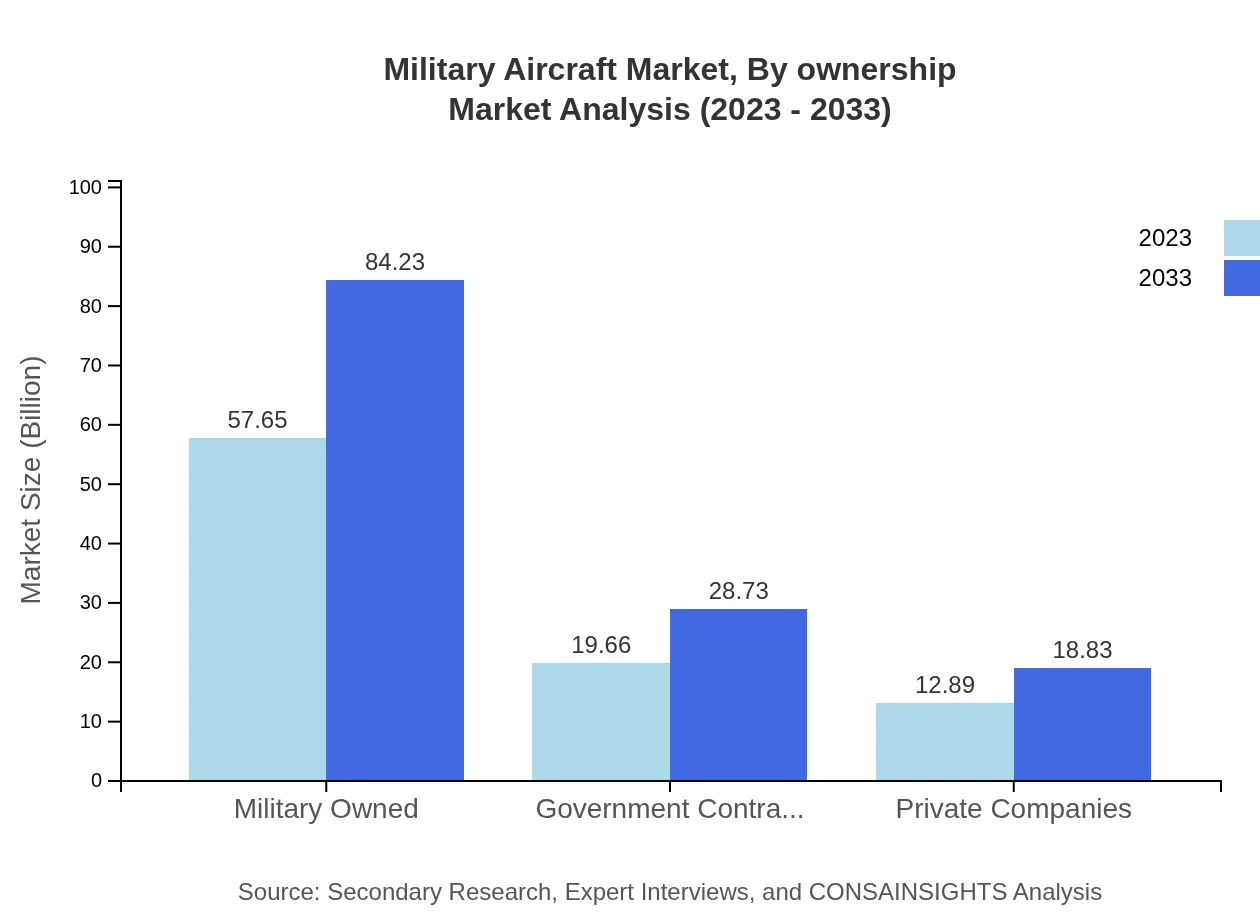

Military Aircraft Market Analysis By Ownership

Ownership segment analysis reveals trends among different types of operators: Military Owned, Government Contractors, and Private Companies. Military Owned aircraft dominate with a market size of $57.65 billion in 2023, projected to reach $84.23 billion by 2033. Government Contractors are valued at $19.66 billion currently, set to grow to $28.73 billion, while Private Companies will rise from $12.89 billion to $18.83 billion, signifying their growing role in the market.

Military Aircraft Market Analysis By Region

As noted earlier, the regional segmentation highlights North America as the most lucrative, followed by Europe and Asia Pacific. Each region's strategy around military aircraft development and acquisition significantly contributes to the overall growth of the market, with emerging economies adding new demand drivers.

Military Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Aircraft Industry

Lockheed Martin:

A leading global aerospace and defense company known for its production of advanced military aircraft, including the F-35 Lightning II stealth fighter.Boeing Defense, Space & Security:

Part of The Boeing Company, it focuses on defense and aerospace with renowned products like the KC-46 Pegasi tanker and the AH-64 Apache helicopter.Northrop Grumman:

Specializes in aerospace and defense and provides advanced military capabilities, particularly in unmanned aerial vehicles (UAVs).BAE Systems:

Offers advanced military aircraft and system solutions, with products including the Eurofighter Typhoon and various transport aircraft.Airbus Defense and Space:

Engages in the manufacturing and supply of military aircraft like the A400M Atlas and supports various defense initiatives globally.We're grateful to work with incredible clients.

FAQs

What is the market size of military aircraft?

The military aircraft market is projected to reach $90.2 billion by 2033, with a compound annual growth rate (CAGR) of 3.8%. This steady growth reflects increased defense spending globally and the modernization of military fleets.

What are the key market players or companies in the military aircraft industry?

Key players in the military aircraft industry include Boeing, Lockheed Martin, Northrop Grumman, Airbus, and Raytheon Technologies. These companies dominate the market due to their extensive portfolios including fighter jets, transport aircraft, and helicopters.

What are the primary factors driving the growth in the military aircraft industry?

Growth in the military aircraft industry is driven by rising geopolitical tensions, technological advancements in avionics and propulsion systems, and increasing defense budgets among nations. Moreover, the need for modernization of aging military fleets plays a significant role in this growth.

Which region is the fastest Growing in the military aircraft market?

The North America region is poised to be the fastest-growing market, projected to increase from $34.20 billion in 2023 to $49.97 billion by 2033. This growth is buoyed by significant investments in defense technologies and a robust military infrastructure.

Does ConsaInsights provide customized market report data for the military aircraft industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the military aircraft industry. This service ensures comprehensive insights that meet specific research needs and business objectives, enhancing strategic planning.

What deliverables can I expect from this military aircraft market research project?

Deliverables from the military aircraft market research project include detailed market analysis reports, segment data, competitive landscape assessments, and actionable insights into trends and growth opportunities within the industry.

What are the market trends of military aircraft?

Current market trends in military aircraft include increased adoption of unmanned aerial vehicles (UAVs), advancements in stealth technology, and a surge in demand for combat-ready aircraft. Additionally, there is growing interest in sustainable aviation technologies.