Military Aircraft Modernization And Retrofit Market Report

Published Date: 03 February 2026 | Report Code: military-aircraft-modernization-and-retrofit

Military Aircraft Modernization And Retrofit Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Military Aircraft Modernization and Retrofit market from 2023 to 2033, covering market size, growth trends, segmentation, and regional insights, aimed at guiding stakeholders in making informed decisions.

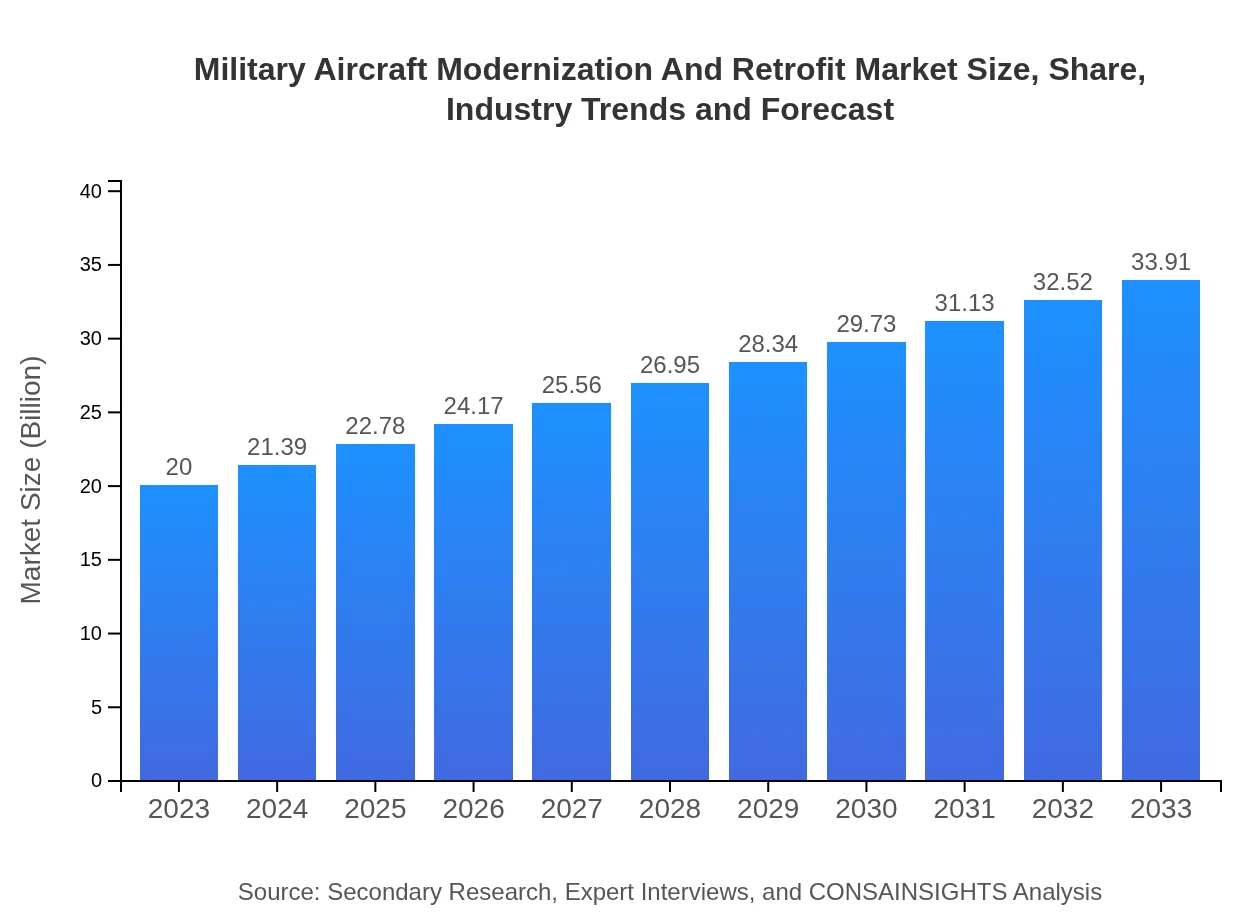

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $33.91 Billion |

| Top Companies | Lockheed Martin, Boeing , Northrop Grumman, BAE Systems, Raytheon Technologies |

| Last Modified Date | 03 February 2026 |

Military Aircraft Modernization And Retrofit Market Overview

Customize Military Aircraft Modernization And Retrofit Market Report market research report

- ✔ Get in-depth analysis of Military Aircraft Modernization And Retrofit market size, growth, and forecasts.

- ✔ Understand Military Aircraft Modernization And Retrofit's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Aircraft Modernization And Retrofit

What is the Market Size & CAGR of Military Aircraft Modernization And Retrofit market in 2033?

Military Aircraft Modernization And Retrofit Industry Analysis

Military Aircraft Modernization And Retrofit Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Aircraft Modernization And Retrofit Market Analysis Report by Region

Europe Military Aircraft Modernization And Retrofit Market Report:

In Europe, market growth will see an increase from $6.06 billion in 2023 to $10.27 billion by 2033. Nations such as France, the UK, and Germany are focusing heavily on modernization in light of increased military readiness in response to geopolitical tensions.Asia Pacific Military Aircraft Modernization And Retrofit Market Report:

The Asia Pacific region's Military Aircraft Modernization and Retrofit market is projected to grow from $3.90 billion in 2023 to $6.62 billion by 2033. Growing defense budgets, especially in countries like India, Japan, and Australia, alongside rising participation in joint military exercises, are key drivers in this region's modernization efforts.North America Military Aircraft Modernization And Retrofit Market Report:

North America holds a significant share of the market, projected to grow from $7.02 billion in 2023 to $11.91 billion in 2033. The United States, being the largest military spender globally, prioritizes modernization programs for its air force, thus driving growth in this region.South America Military Aircraft Modernization And Retrofit Market Report:

In South America, the market size is expected to increase from $1.27 billion in 2023 to $2.15 billion in 2033. Brazil leads investment in military upgrades, focusing on enhancing air capabilities to address regional security challenges.Middle East & Africa Military Aircraft Modernization And Retrofit Market Report:

The Middle East and Africa market is expected to grow from $1.75 billion in 2023 to $2.96 billion by 2033. With ongoing conflicts and regional tensions, nations in this region are investing in modernizing their aerial capabilities to enhance national security.Tell us your focus area and get a customized research report.

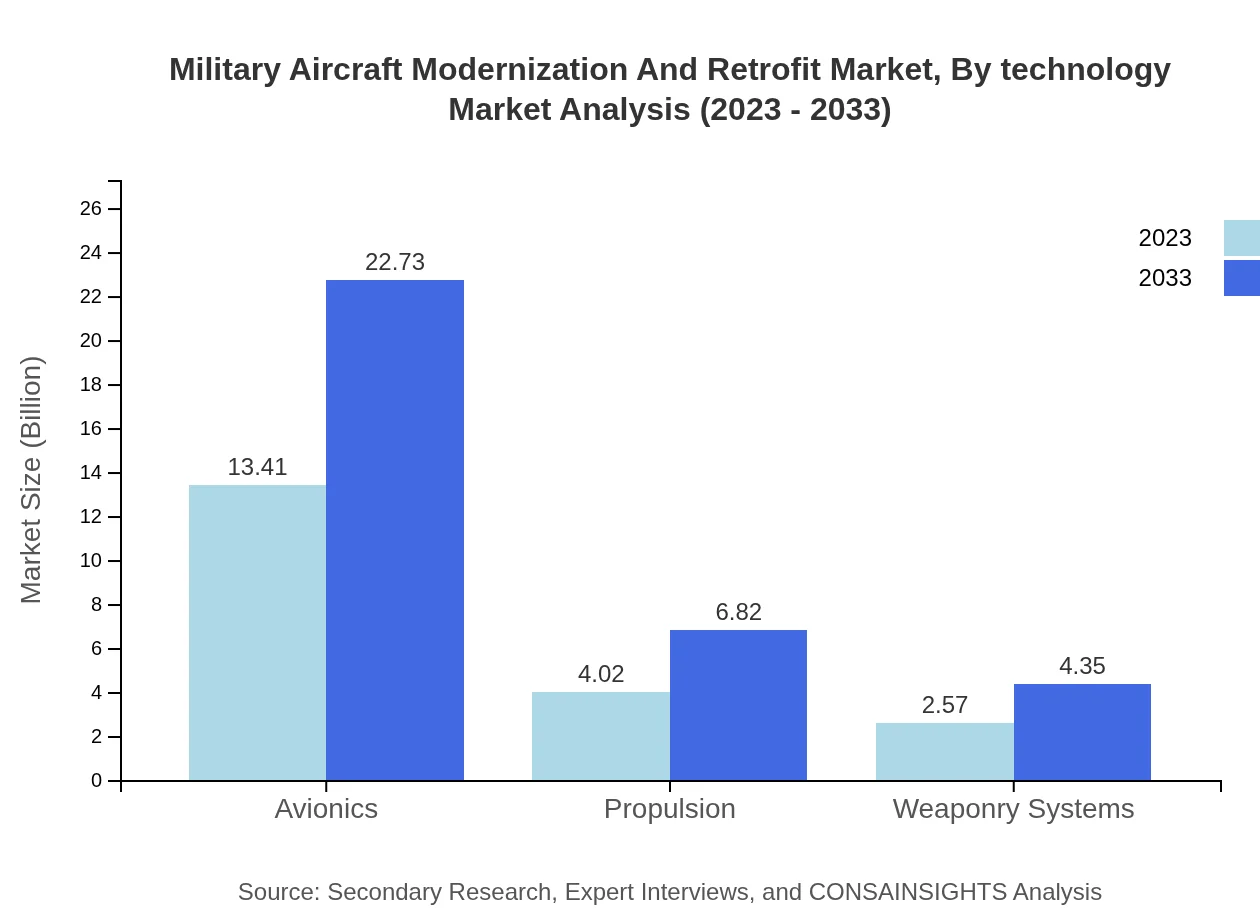

Military Aircraft Modernization And Retrofit Market Analysis By Technology

The analysis across technological advancements reveals that avionics upgrades dominate the segment with a market size of $13.41 billion in 2023, expected to rise to $22.73 billion by 2033. Incremental upgrades and complete refurbishments also hold significant shares, representing vital aspects of modernization efforts.

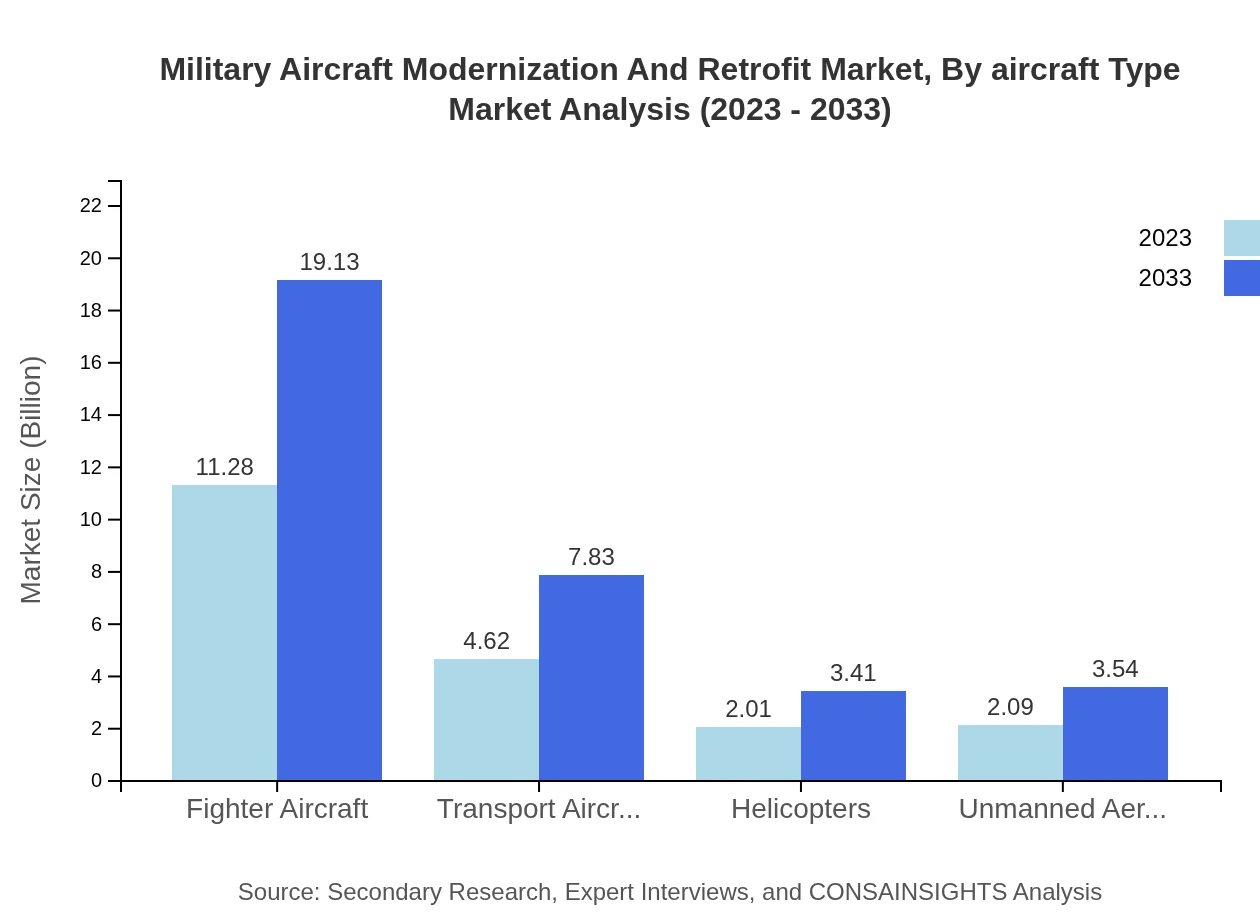

Military Aircraft Modernization And Retrofit Market Analysis By Aircraft Type

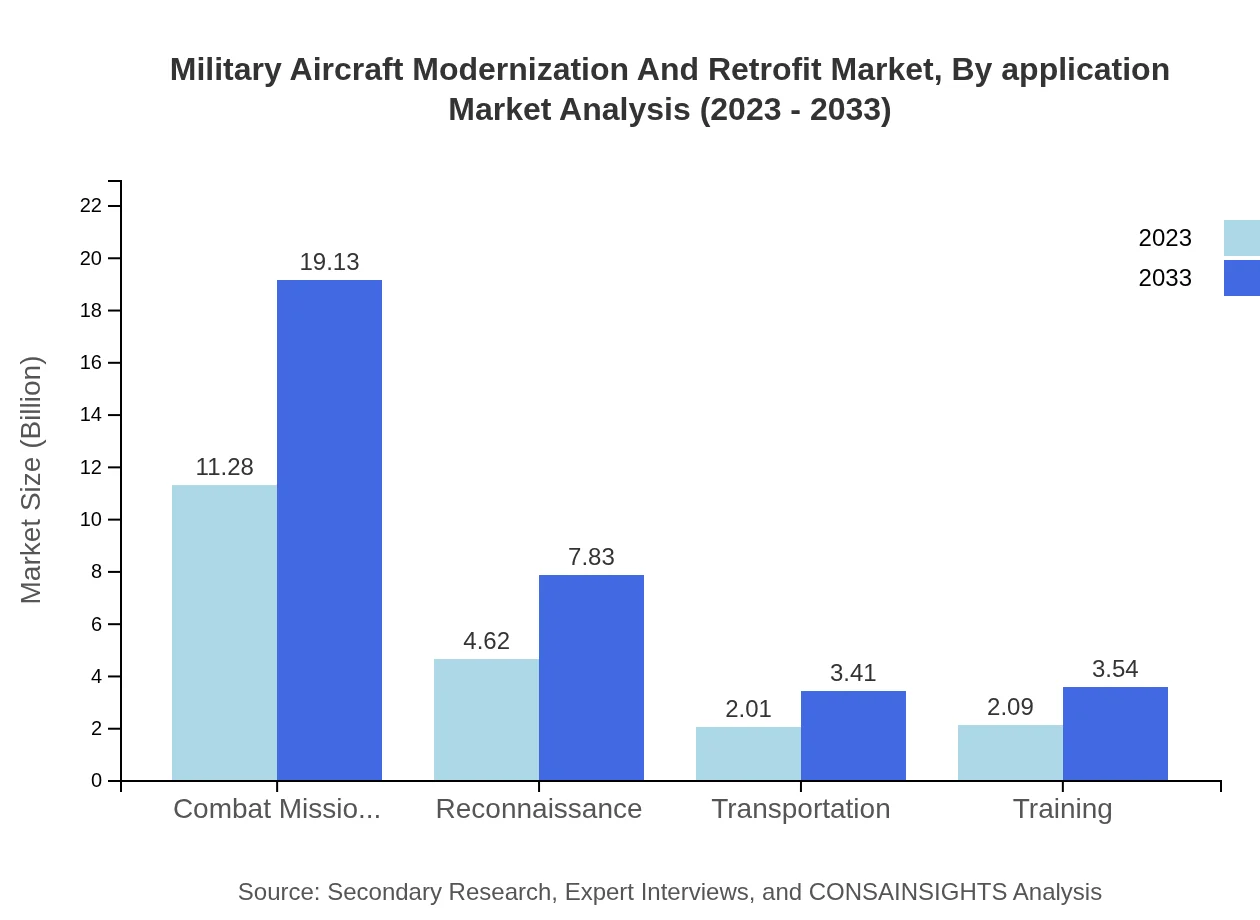

Fighter aircraft, with a market size of $11.28 billion in 2023 projected to grow to $19.13 billion by 2033, represent the largest segment within aircraft types undergoing modernization. Transport aircraft and helicopters also play critical roles in overall military capabilities.

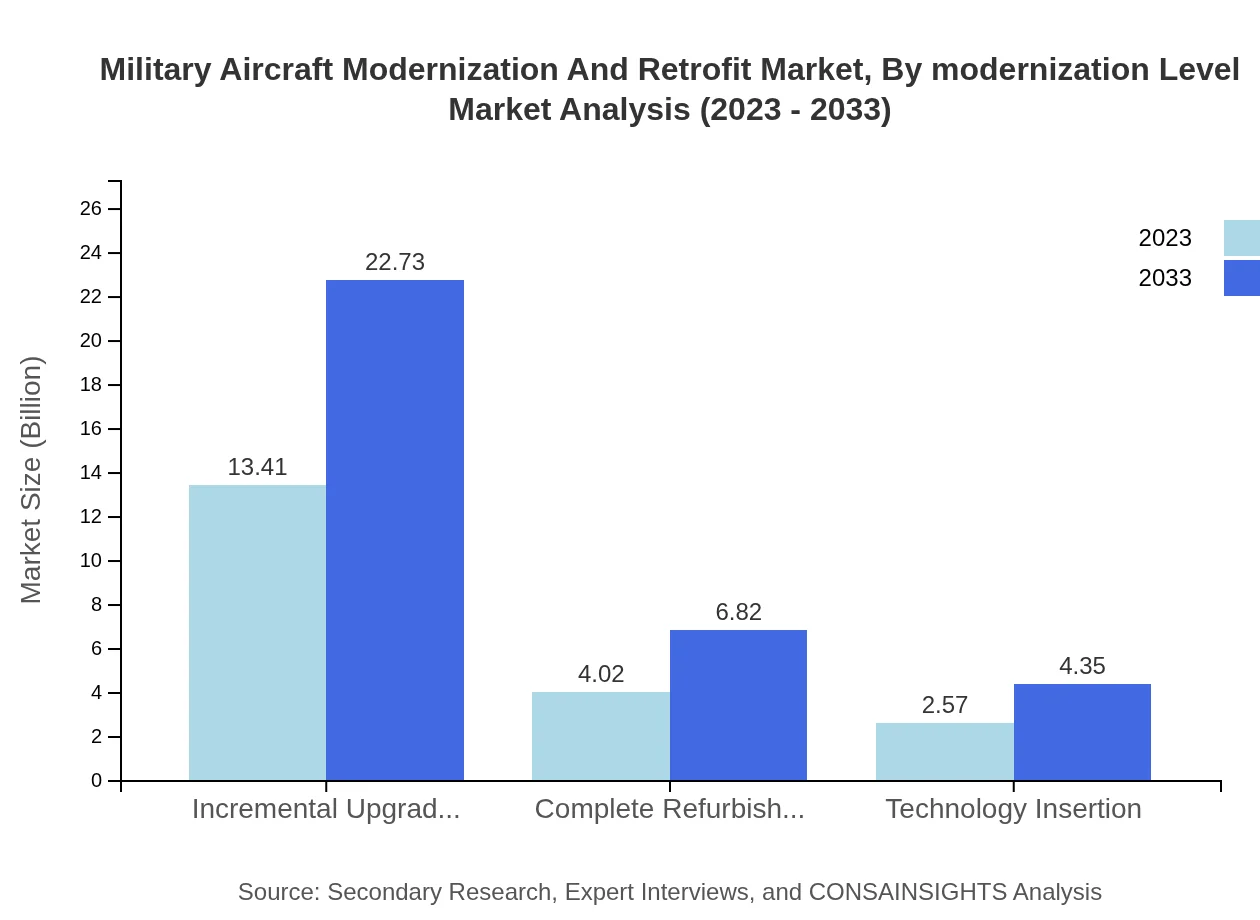

Military Aircraft Modernization And Retrofit Market Analysis By Modernization Level

Incremental upgrades are the leading focus area, valued at $13.41 billion in 2023 and expected to reach $22.73 billion by 2033, emphasizing strategic enhancements without complete overhaul. Complete refurbishments also represent a reasonable market size, catering to major upgrades.

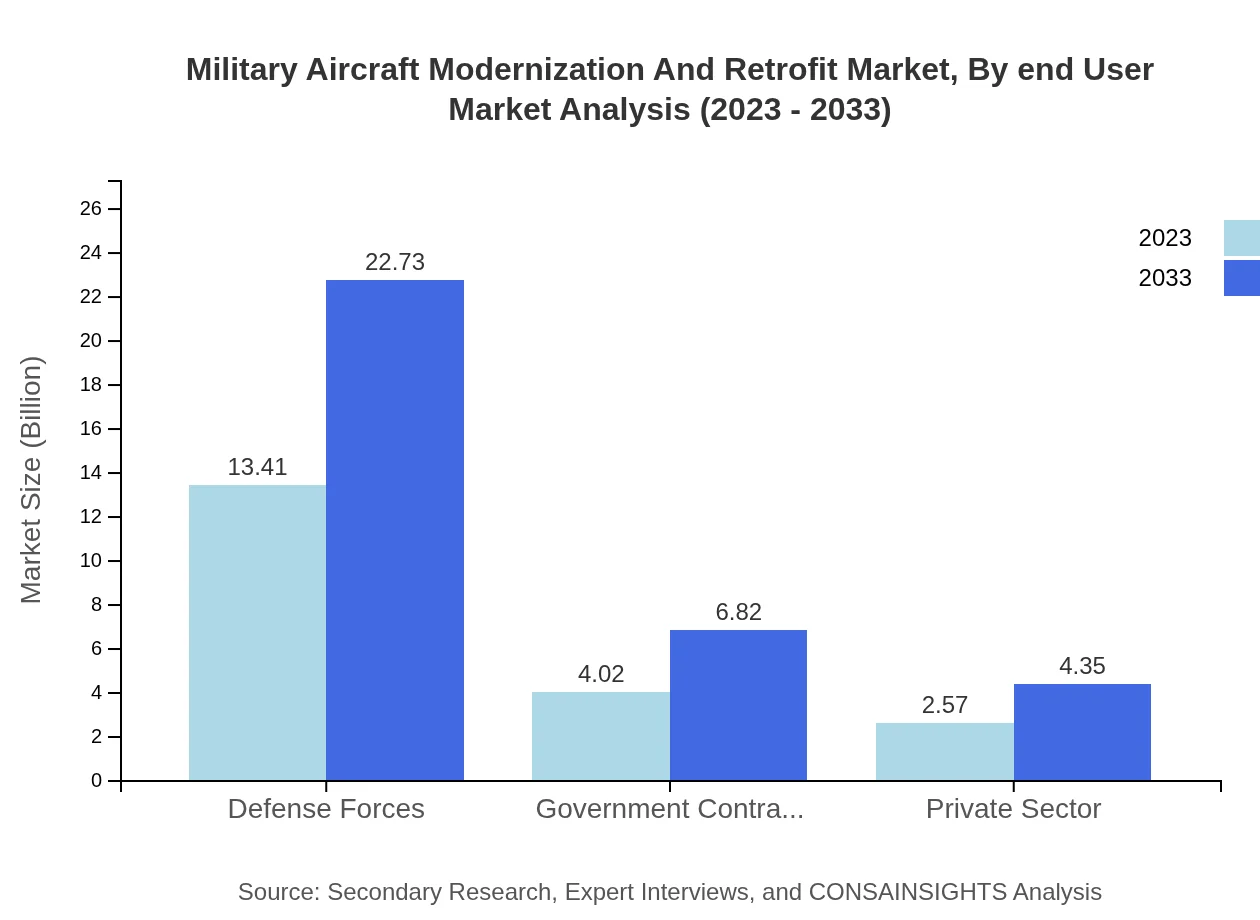

Military Aircraft Modernization And Retrofit Market Analysis By End User

Government entities, including defense forces, hold a substantial market share of around 67.05% and are projected to maintain this due to prevalent demand for reliable and efficient military aircraft.

Military Aircraft Modernization And Retrofit Market Analysis By Application

Combat missions represent the largest share of applications with projected growth driven by modernization efforts focused on enhancing operational capabilities essential for national defense.

Military Aircraft Modernization And Retrofit Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Aircraft Modernization And Retrofit Industry

Lockheed Martin:

A leading global aerospace, defense, and security company known for its high-tech military aircraft modernization efforts and strong innovation capabilities.Boeing :

Renowned for its comprehensive military aircraft solutions, including upgrades and maintenance services, contributing significantly to defense modernization efforts.Northrop Grumman:

Specializes in advanced technology solutions for military applications, driving modernization initiatives within air forces across various nations.BAE Systems:

A multinational defense, security and aerospace company, actively involved in providing innovative solutions for aircraft modernization.Raytheon Technologies:

Focuses on enhancing military aircraft capabilities through modernization of avionics and weapon systems.We're grateful to work with incredible clients.

FAQs

What is the market size of military aircraft modernization and retrofit?

The global market for military aircraft modernization and retrofit is valued at approximately $20 billion in 2023, with a projected CAGR of 5.3% over the next decade, indicating robust growth fueled by modernization efforts across defense sectors.

What are the key market players or companies in the military aircraft modernization and retrofit industry?

Key players in the military aircraft modernization and retrofit market include industry leaders like Lockheed Martin, Boeing, Northrop Grumman, and Raytheon. These companies are integral to delivering advanced technologies and upgrade solutions to military fleets globally.

What are the primary factors driving the growth in the military aircraft modernization and retrofit industry?

The growth is driven by increasing defense budgets, the need for enhanced operational capabilities, aging aircraft fleets requiring updates, and advancements in technology that facilitate modern warfare. These factors are compelling military organizations to invest in modernization.

Which region is the fastest Growing in the military aircraft modernization and retrofit market?

The fastest-growing region in the military aircraft modernization and retrofit market is Europe, with market growth projected from $6.06 billion in 2023 to $10.27 billion by 2033. This growth is attributed to rising defense expenditures and modernization initiatives.

Does ConsaInsights provide customized market report data for the military aircraft modernization and retrofit industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications for the military aircraft modernization and retrofit industry, allowing clients to gain unique insights relevant to their specific needs and strategies.

What deliverables can I expect from this military aircraft modernization and retrofit market research project?

Deliverables from the market research project include comprehensive reports detailing market size, trends, competitive analysis, segmentation data, forecasts, and strategic insights tailored to military aircraft modernization and retrofit initiatives.

What are the market trends of military aircraft modernization and retrofit?

Current trends in the military aircraft modernization and retrofit market include increased investment in technology insertion, focus on incremental upgrades, and leveraging of data analytics and AI to enhance operational efficiency and reduce operational costs.