Military Antenna Market Report

Published Date: 31 January 2026 | Report Code: military-antenna

Military Antenna Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Military Antenna market, detailing market size, trends, and forecasts from 2023 to 2033. Key insights include segmentation breakdowns, regional analyses, and the impactful technologies shaping the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

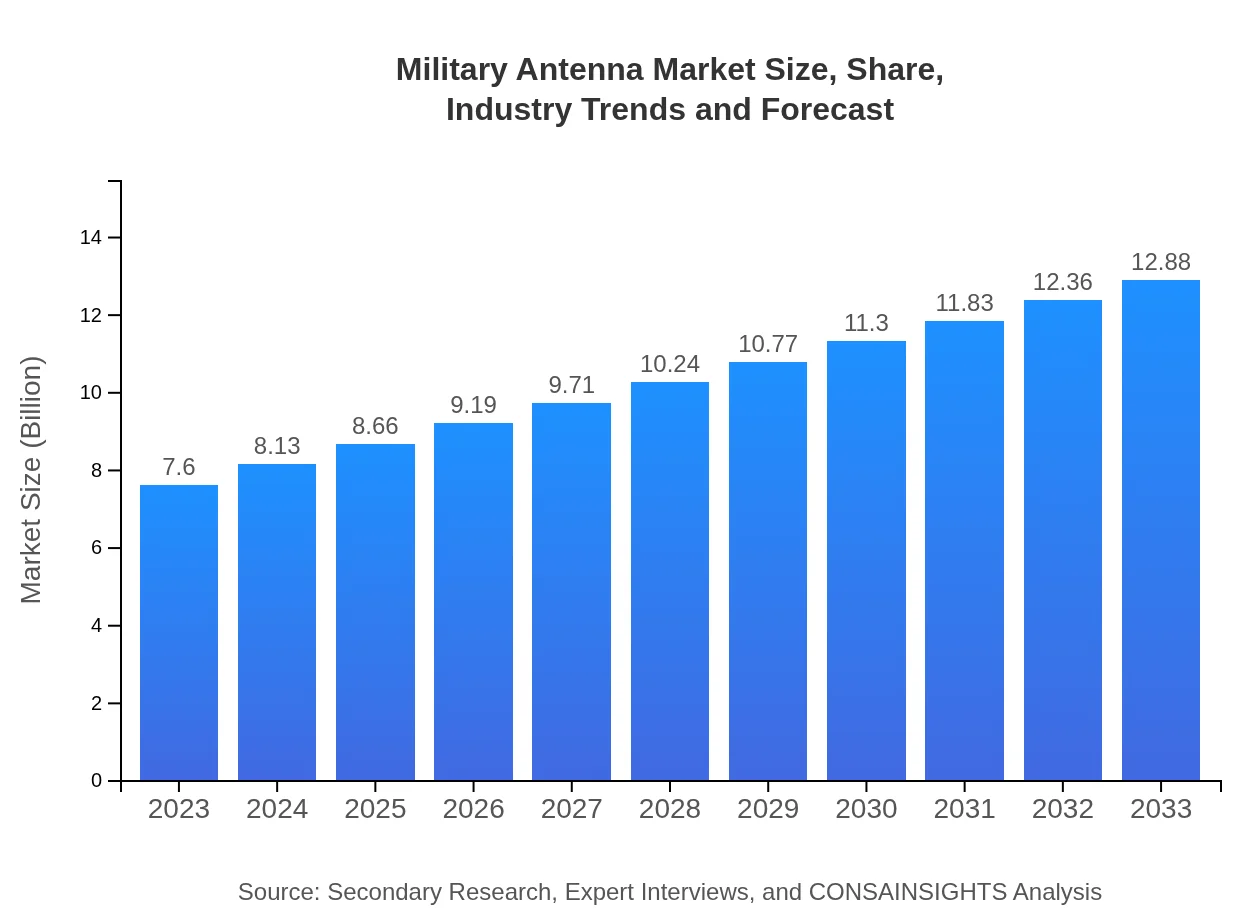

| 2023 Market Size | $7.60 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $12.88 Billion |

| Top Companies | Harris Corporation, Raytheon Technologies, General Dynamics, Northrop Grumman |

| Last Modified Date | 31 January 2026 |

Military Antenna Market Overview

Customize Military Antenna Market Report market research report

- ✔ Get in-depth analysis of Military Antenna market size, growth, and forecasts.

- ✔ Understand Military Antenna's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Antenna

What is the Market Size & CAGR of Military Antenna market in 2023?

Military Antenna Industry Analysis

Military Antenna Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Antenna Market Analysis Report by Region

Europe Military Antenna Market Report:

Europe's Military Antenna market is expected to grow from $1.87 billion in 2023 to $3.17 billion by 2033. NATO initiatives and rising geopolitical threats in Eastern Europe are promoting modernization and investment in military communication systems.Asia Pacific Military Antenna Market Report:

In the Asia Pacific region, the Military Antenna market was valued at approximately $1.60 billion in 2023 and is projected to reach $2.71 billion by 2033, driven by increasing defense budgets and modernization efforts in countries like China and India.North America Military Antenna Market Report:

North America dominates the Military Antenna market with a size of $2.81 billion in 2023, projected to grow to $4.77 billion by 2033. The U.S. invests heavily in advanced military systems, driving demand for sophisticated antennas.South America Military Antenna Market Report:

The South American market, valued at around $0.52 billion in 2023, is expected to grow to $0.87 billion by 2033. The growth is attributed to enhanced military collaborations and investments in defense technologies in countries such as Brazil and Argentina.Middle East & Africa Military Antenna Market Report:

The Middle East and Africa market, valued at $0.81 billion in 2023, is forecasted to reach $1.37 billion by 2033, influenced by ongoing conflicts and the need for robust communication solutions.Tell us your focus area and get a customized research report.

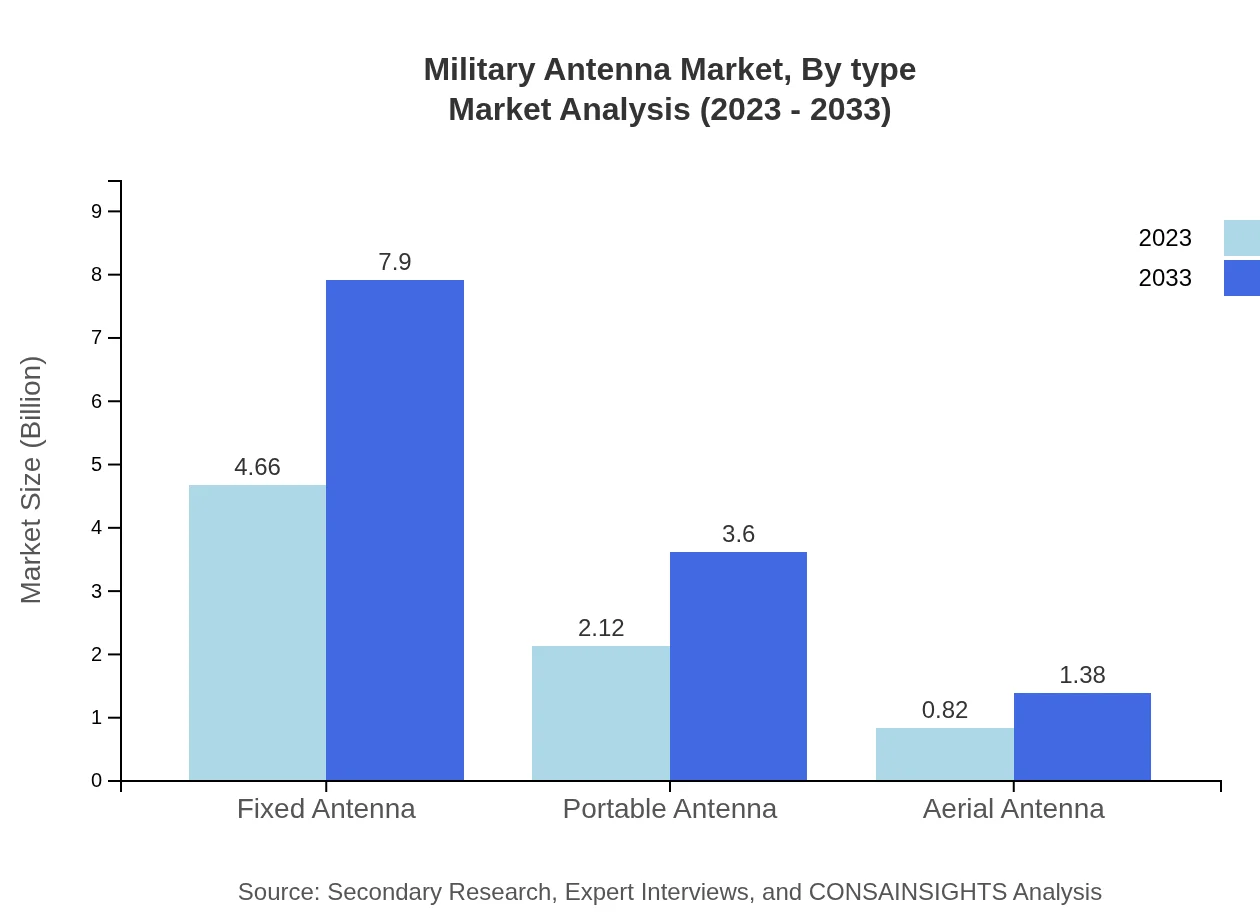

Military Antenna Market Analysis By Type

The analysis reveals that Fixed antennas lead the market with a size of $4.66 billion in 2023, expected to grow to $7.90 billion by 2033. Portable antennas follow with $2.12 billion, projected to reach $3.60 billion. Aerial antennas, while smaller, show growth from $0.82 billion in 2023 to $1.38 billion by 2033.

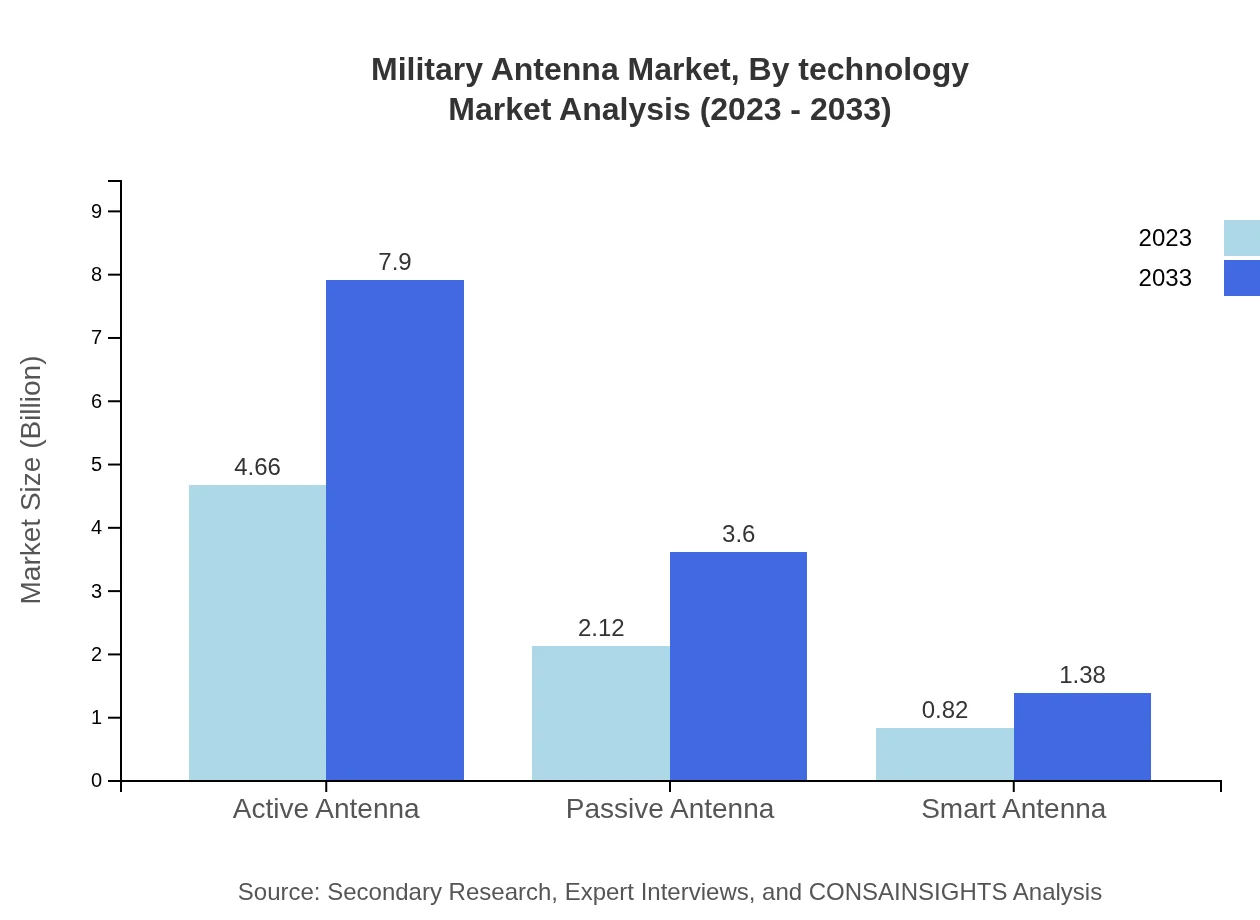

Military Antenna Market Analysis By Technology

Active antennas dominate with a market size of $4.66 billion in 2023, maintaining a significant market share of 61.34%. Passive antennas also contribute robustly at $2.12 billion, with a share of 27.92%. Innovations in smart antennas account for $0.82 billion with a stable share, indicating a trend towards multifunctional designs.

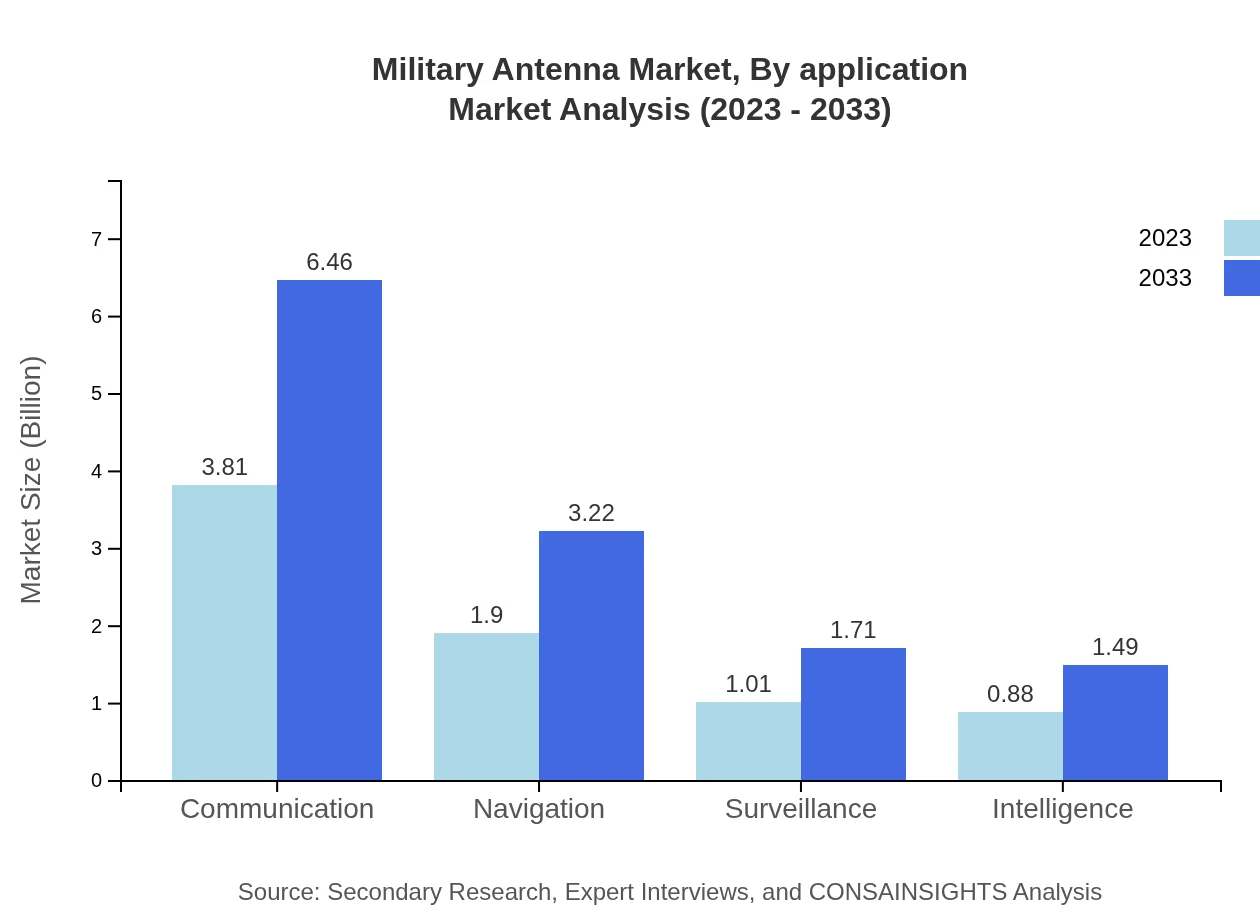

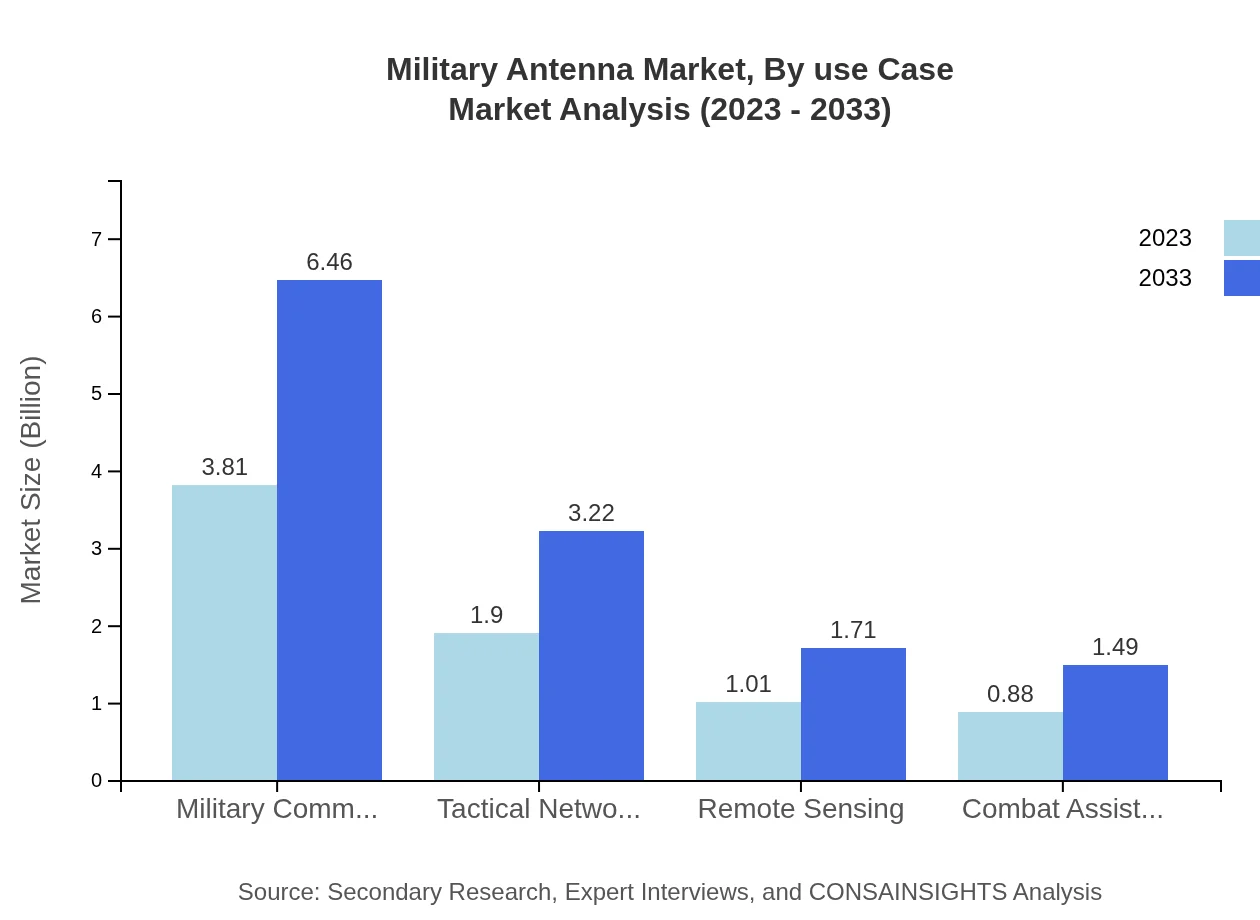

Military Antenna Market Analysis By Application

The market for Military Communications captures a lead with $3.81 billion in 2023 and is forecasted to grow to $6.46 billion. Tactical Networks and Navigation applications also play critical roles, transitioning from $1.90 to $3.22 billion and $1.90 to $3.22 billion, respectively over the same period.

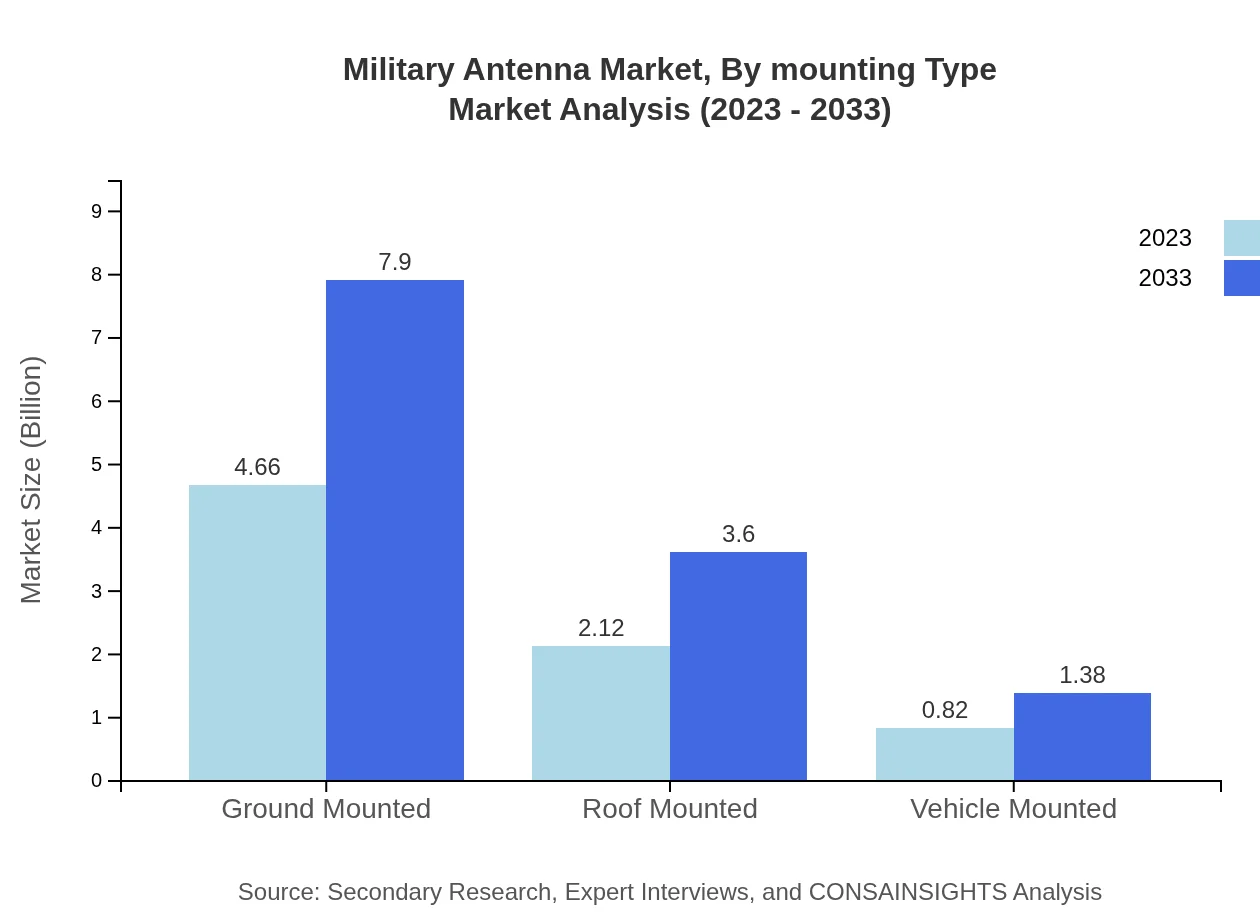

Military Antenna Market Analysis By Mounting Type

Ground Mounted antennas lead with $4.66 billion in 2023, while Roof Mounted antennas contribute $2.12 billion. Vehicle Mounted antennas provide critical capabilities, showcasing trends toward more versatile installations.

Military Antenna Market Analysis By Use Case

Surveillance and Intelligence use cases present significant opportunities, growing from $1.01 to $1.71 billion and $0.88 to $1.49 billion respectively. The increasing emphasis on security and cyber intelligence drives this trend.

Military Antenna Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Antenna Industry

Harris Corporation:

Harris Corporation is a major player in military communications, providing advanced solutions for tactical networks and surveillance systems.Raytheon Technologies:

Raytheon Technologies offers high-tech military antennas and communication systems that improve operational effectiveness in diverse environments.General Dynamics:

General Dynamics specializes in the production of robust military antennas, focusing on enhancing communication capabilities for ground and aerial applications.Northrop Grumman:

Northrop Grumman is recognized for its advanced antenna systems and solutions tailored for military applications across land, sea, and air.We're grateful to work with incredible clients.

FAQs

What is the market size of military Antenna?

The military antenna market is valued at approximately $7.6 billion in 2023, with a projected growth at a CAGR of 5.3% over the next decade, reaching around $12.35 billion by 2033.

What are the key market players or companies in this military Antenna industry?

Key players in the military antenna market include companies like Harris Corporation, Leonardo S.p.A., L3 Technologies, Northrop Grumman, and Thales Group, which are recognized for their innovative technologies and product offerings.

What are the primary factors driving the growth in the military antenna industry?

The growth in the military antenna industry is driven by factors such as increased military budget allocations, rising demand for advanced communication systems, and advancements in antenna technology for improved functionalities and enhanced performance.

Which region is the fastest Growing in the military Antenna?

The Asia Pacific region is the fastest-growing market for military antennas, projected to expand from $1.60 billion in 2023 to $2.71 billion by 2033, fueled by increased defense spending and modernization efforts.

Does ConsaInsights provide customized market report data for the military Antenna industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs and requirements within the military antenna industry, ensuring precise insights and actionable intelligence.

What deliverables can I expect from this military Antenna market research project?

Upon completion of the military antenna market research project, clients can expect comprehensive reports, detailed data analysis, market forecasts, competitive analysis, and tailored recommendations based on specific market conditions.

What are the market trends of military Antenna?

Current market trends in the military antenna space include the adoption of smart antennas, growing emphasis on frequency agility, and increasing integration of antennas in portable and tactical networks for enhanced operational capabilities.