Military Embedded Systems Market Report

Published Date: 31 January 2026 | Report Code: military-embedded-systems

Military Embedded Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Military Embedded Systems market from 2023 to 2033, including market trends, segmentation, geographic insights, and forecasts. It highlights key players and technologies shaping the industry.

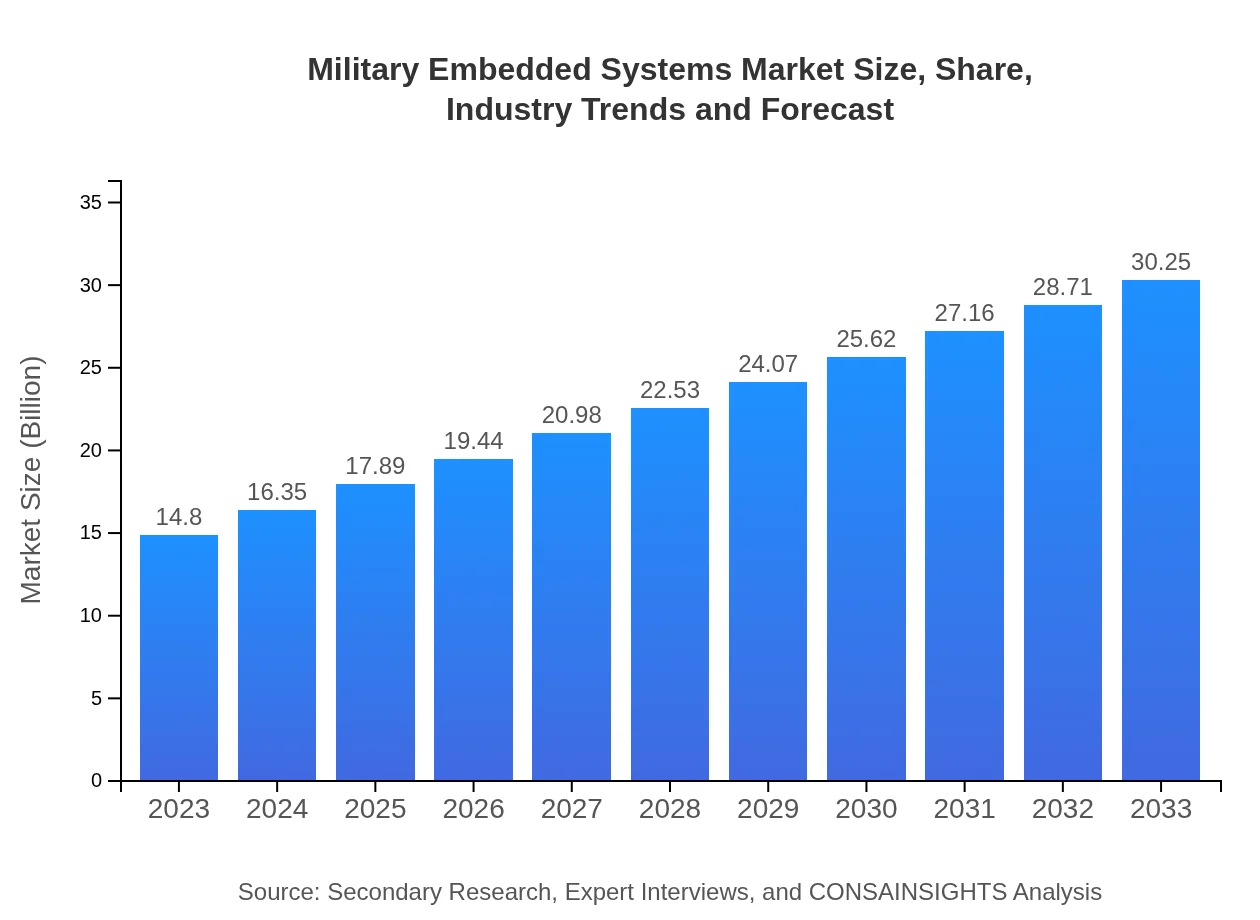

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $30.25 Billion |

| Top Companies | Raytheon Technologies, Lockheed Martin, Thales Group, Northrop Grumman |

| Last Modified Date | 31 January 2026 |

Military Embedded Systems Market Overview

Customize Military Embedded Systems Market Report market research report

- ✔ Get in-depth analysis of Military Embedded Systems market size, growth, and forecasts.

- ✔ Understand Military Embedded Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Embedded Systems

What is the Market Size & CAGR of Military Embedded Systems market in 2023?

Military Embedded Systems Industry Analysis

Military Embedded Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Embedded Systems Market Analysis Report by Region

Europe Military Embedded Systems Market Report:

Europe's Military Embedded Systems market is projected to grow from $3.67 billion in 2023 to $7.50 billion by 2033. The emphasis on NATO cooperation and technological innovation is pivotal in shaping growth in the defense sector.Asia Pacific Military Embedded Systems Market Report:

In 2023, the Asia Pacific Military Embedded Systems market is valued at $3.13 billion and projected to reach $6.39 billion by 2033. The region exhibits a growing defense expenditure aimed at technological upgrades and modernization of military equipment, with significant investments in R&D for advanced embedded systems.North America Military Embedded Systems Market Report:

North America, with a market size of $5.22 billion in 2023, is anticipated to reach $10.68 billion by 2033. The presence of leading defense manufacturers and substantial government spending on defense technologies support the region’s dominance in the market.South America Military Embedded Systems Market Report:

The South America region is expected to grow from $1.00 billion in 2023 to $2.05 billion by 2033. Increased focus on improving defense capabilities and addressing security challenges, particularly in border areas, is driving the demand for military embedded solutions.Middle East & Africa Military Embedded Systems Market Report:

The Middle East and Africa market is valued at $1.78 billion in 2023 and expected to reach $3.63 billion by 2033. Rising geopolitical tensions and a focus on defense modernization contribute significantly to market growth.Tell us your focus area and get a customized research report.

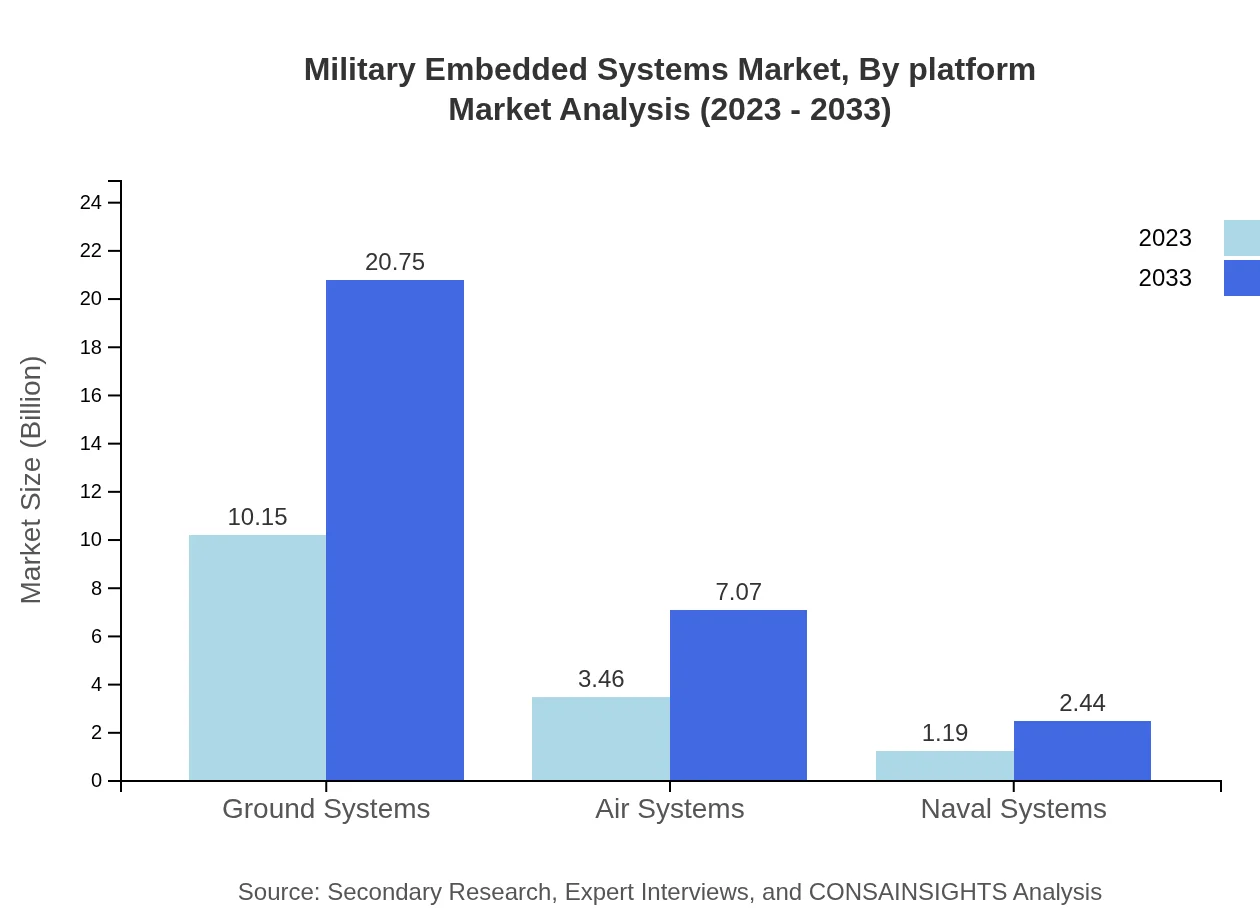

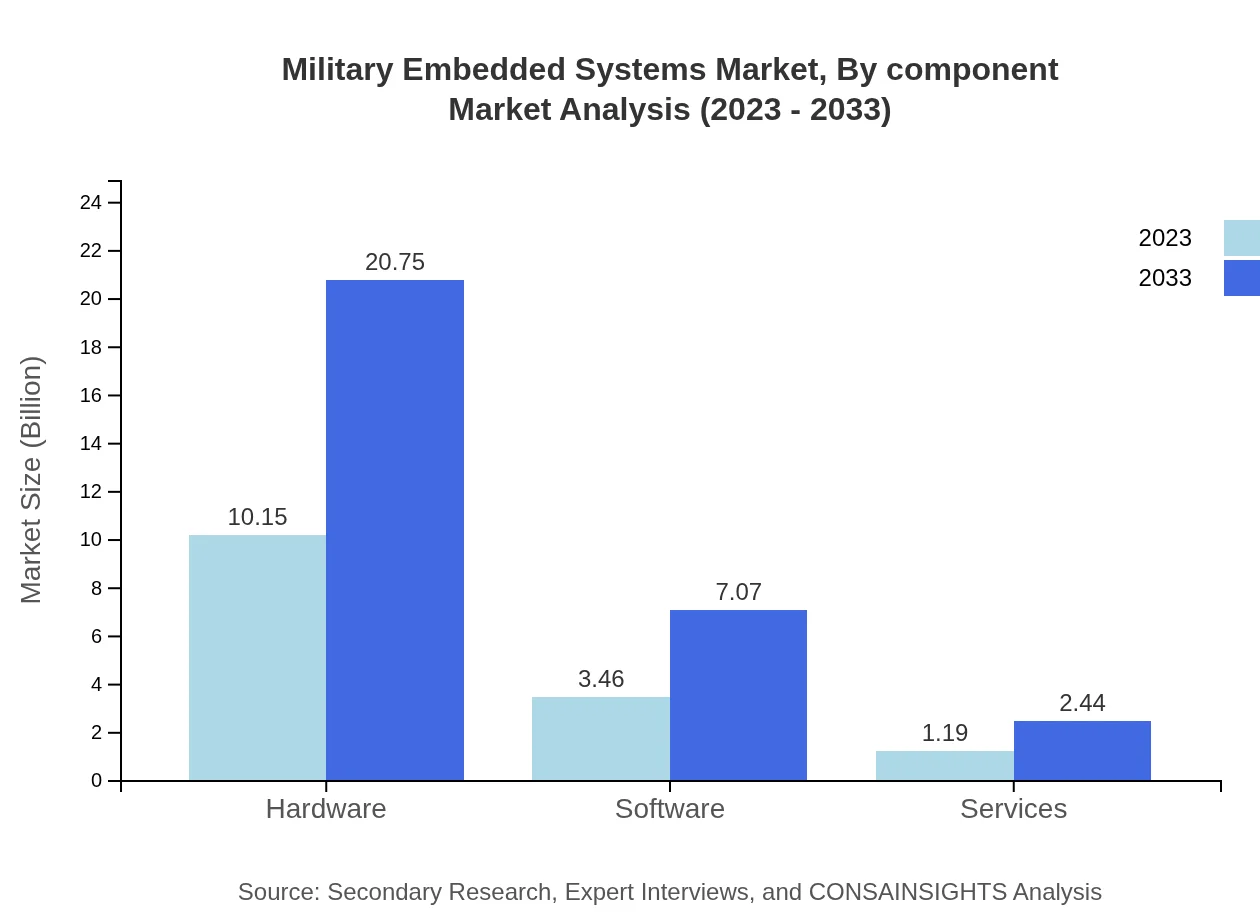

Military Embedded Systems Market Analysis By Platform

The market is heavily influenced by ground systems, accounting for $10.15 billion in 2023, growing to $20.75 billion by 2033 with a stable market share of 68.58%. Air systems follow, with a market growth from $3.46 billion to $7.07 billion. Naval systems demonstrate a modest increase from $1.19 billion to $2.44 billion. This segmentation reveals the dominant reliance on ground-based operations.

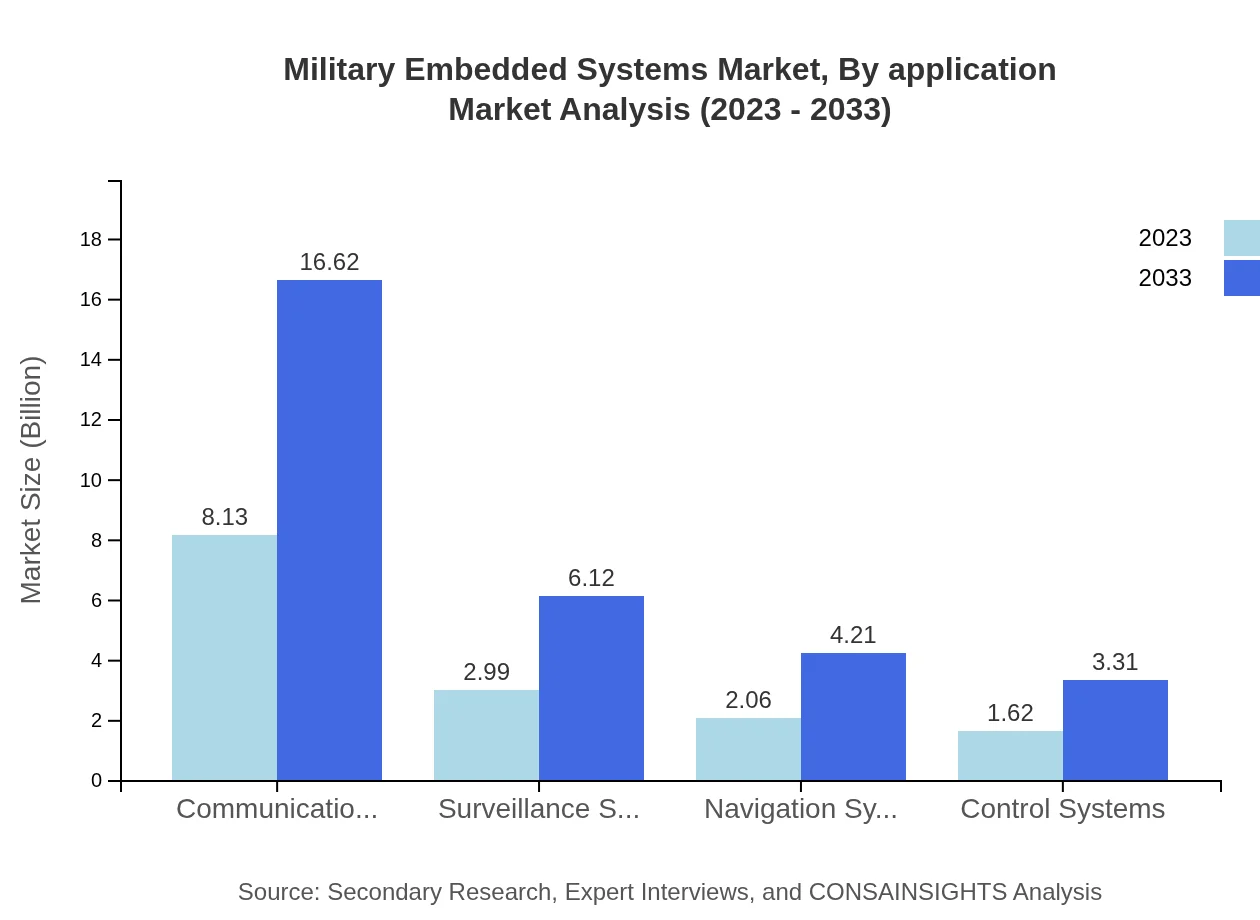

Military Embedded Systems Market Analysis By Application

The segment showcases significant contributions from processor and communication technologies, bolstering regional market shares. The application of these embedded systems extends across military communications, navigation systems, and surveillance technologies, which are becoming more integrated with advanced software solutions.

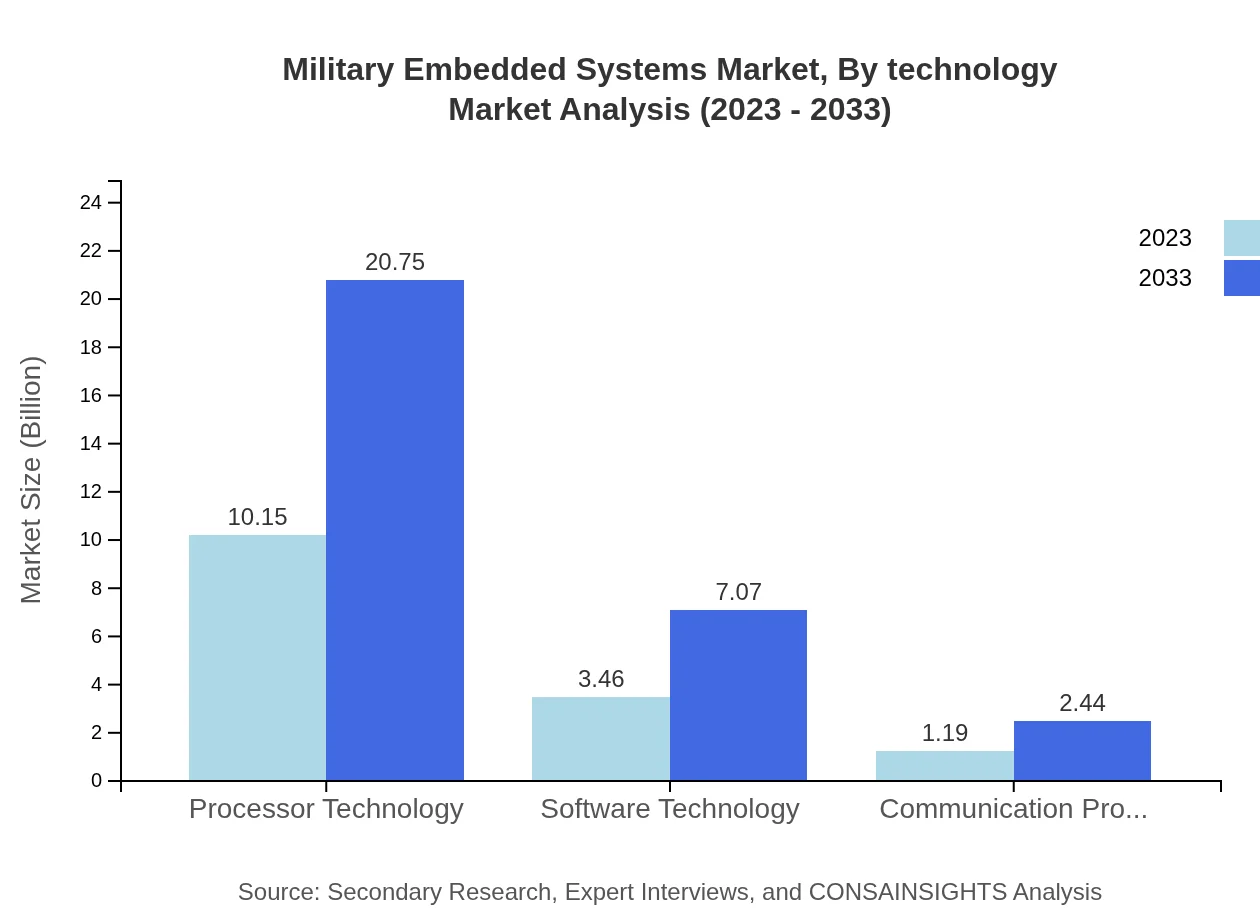

Military Embedded Systems Market Analysis By Technology

Key technologies include hardware and software innovations that enhance system performance. The hardware segment leads with a share of 68.58% in the market. Processor technologies are central to enhancing operational efficacy, and advanced software and communication protocols ensure timely and secure information exchange.

Military Embedded Systems Market Analysis By Component

Components include communication systems, surveillance systems, and networking equipment. For instance, communication systems’ market size elevates from $8.13 billion in 2023 to $16.62 billion by 2033, indicating the critical role of connectivity in modern military operations.

Military Embedded Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Embedded Systems Industry

Raytheon Technologies:

A leader in defense technologies, Raytheon offers advanced military embedded systems focused on communication and navigation to enhance situational awareness.Lockheed Martin:

Known for its fighter jets and advanced avionics, Lockheed Martin integrates state-of-the-art embedded systems into various military applications to ensure operational reliability.Thales Group:

Thales is a global technology leader providing embedded solutions tailored for military and defense, focusing on connectivity and cybersecurity.Northrop Grumman:

Northrop Grumman specializes in unmanned systems and embedded technologies that enhance airborne and ground defense capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of military Embedded Systems?

The military embedded systems market is currently valued at $14.8 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.2% from now until 2033, underscoring significant growth potential in this sector.

What are the key market players or companies in this military Embedded Systems industry?

Key players in the military embedded systems industry include major defense contractors and technology firms that specialize in providing innovative solutions and products for military applications, focusing on enhancing system performance and interoperability.

What are the primary factors driving the growth in the military Embedded Systems industry?

The growth in the military embedded systems sector is primarily driven by increasing defense budgets, rising demand for advanced military technologies, and the integration of IoT and AI in defense applications, enhancing system efficiency and operational capabilities.

Which region is the fastest Growing in the military Embedded Systems?

North America currently leads the military embedded systems market with a value of $5.22 billion in 2023, projected to reach $10.68 billion by 2033. Europe and Asia Pacific are also significant, indicating robust regional growth.

Does ConsaInsights provide customized market report data for the military Embedded Systems industry?

Yes, ConsaInsights offers tailored market report data for the military embedded systems industry, allowing clients to obtain specific insights and analyses tailored to their unique requirements and strategic needs.

What deliverables can I expect from this military Embedded Systems market research project?

Deliverables from the military embedded systems market research project include comprehensive reports with detailed market size, trends, competitive analysis, regional insights, and forecasts, ensuring stakeholders are well-informed for decision-making.

What are the market trends of military Embedded Systems?

Market trends indicate a growing investment in ground systems, air systems, and communication technologies. Increased collaboration between defense sectors and technology firms is prevalent, alongside advancements in AI and cybersecurity initiatives.