Military Helmet And Helmet Mounted Display Systems Market Report

Published Date: 03 February 2026 | Report Code: military-helmet-and-helmet-mounted-display-systems

Military Helmet And Helmet Mounted Display Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Military Helmet and Helmet Mounted Display Systems market, covering its size, growth forecasts, and technological trends from 2023 to 2033.

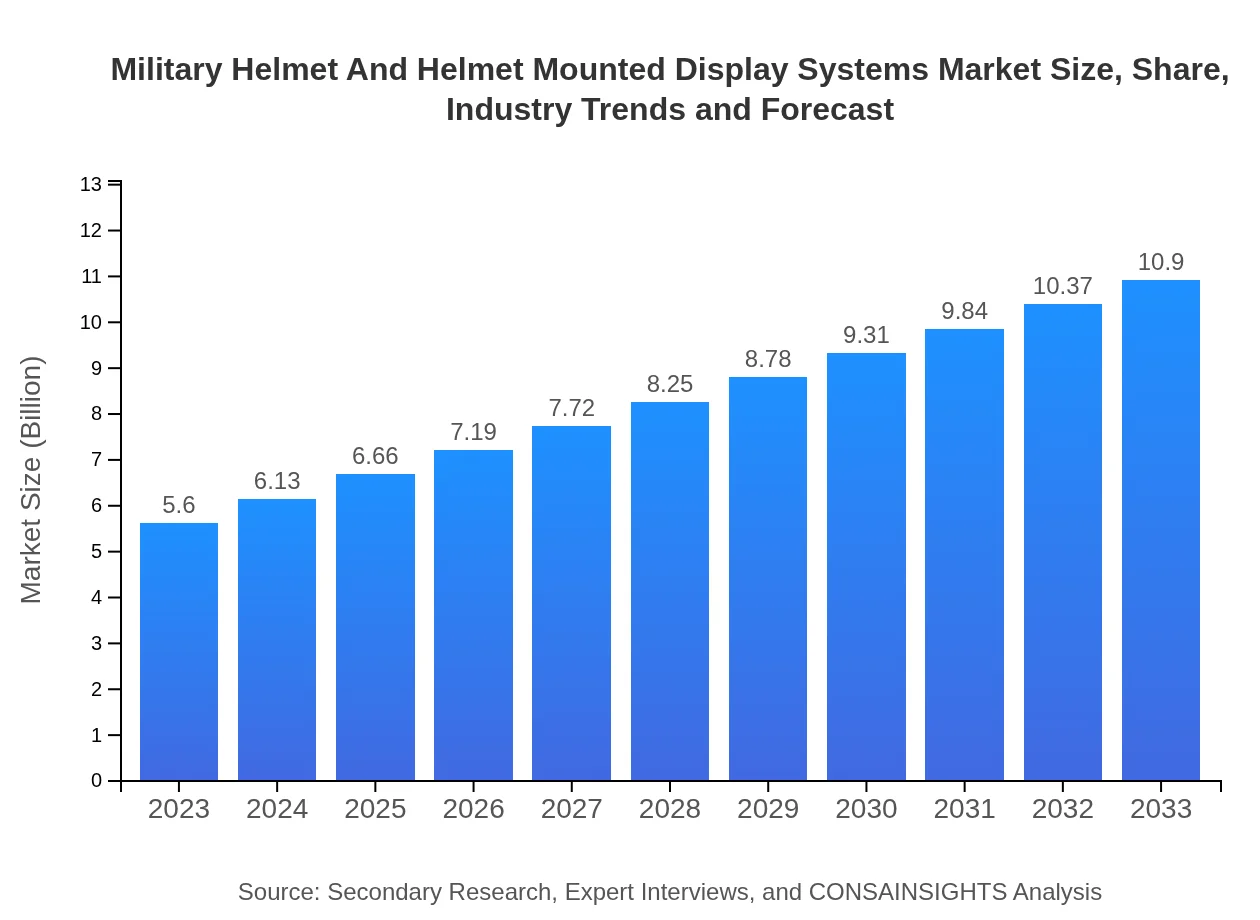

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $10.90 Billion |

| Top Companies | Gentex Corporation, BAE Systems, Honeywell International Inc., 3M Company |

| Last Modified Date | 03 February 2026 |

Military Helmet And Helmet Mounted Display Systems Market Overview

Customize Military Helmet And Helmet Mounted Display Systems Market Report market research report

- ✔ Get in-depth analysis of Military Helmet And Helmet Mounted Display Systems market size, growth, and forecasts.

- ✔ Understand Military Helmet And Helmet Mounted Display Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Helmet And Helmet Mounted Display Systems

What is the Market Size & CAGR of Military Helmet And Helmet Mounted Display Systems market in 2023?

Military Helmet And Helmet Mounted Display Systems Industry Analysis

Military Helmet And Helmet Mounted Display Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Helmet And Helmet Mounted Display Systems Market Analysis Report by Region

Europe Military Helmet And Helmet Mounted Display Systems Market Report:

The European market stands at $1.90 billion in 2023 and is projected to rise to $3.70 billion by 2033. The increasing threats to national security and focus on NATO defense initiatives are catalysts for this growth.Asia Pacific Military Helmet And Helmet Mounted Display Systems Market Report:

In the Asia Pacific, the market in 2023 is valued at $0.98 billion and is projected to reach $1.91 billion by 2033. Increasing military expenditures by countries like China and India highlight the growing demand for advanced helmet systems within this region, driven by modernization initiatives.North America Military Helmet And Helmet Mounted Display Systems Market Report:

North America leads the market with a value of $2.01 billion in 2023, expected to reach $3.91 billion by 2033. The U.S. military's transition to advanced technologies drives this growth, alongside increasing contracts awarded to defense contractors.South America Military Helmet And Helmet Mounted Display Systems Market Report:

The South American market for Military Helmet and Helmet Mounted Display Systems is valued at $0.33 billion in 2023 and is expected to grow to $0.65 billion by 2033. Brazil and Argentina are the main contributors, with a rising focus on security by governmental forces.Middle East & Africa Military Helmet And Helmet Mounted Display Systems Market Report:

In the Middle East and Africa, the market is valued at $0.37 billion in 2023, forecasted to double to $0.73 billion by 2033. Political instability and ongoing conflicts enhance the need for protective gear among military forces in this region.Tell us your focus area and get a customized research report.

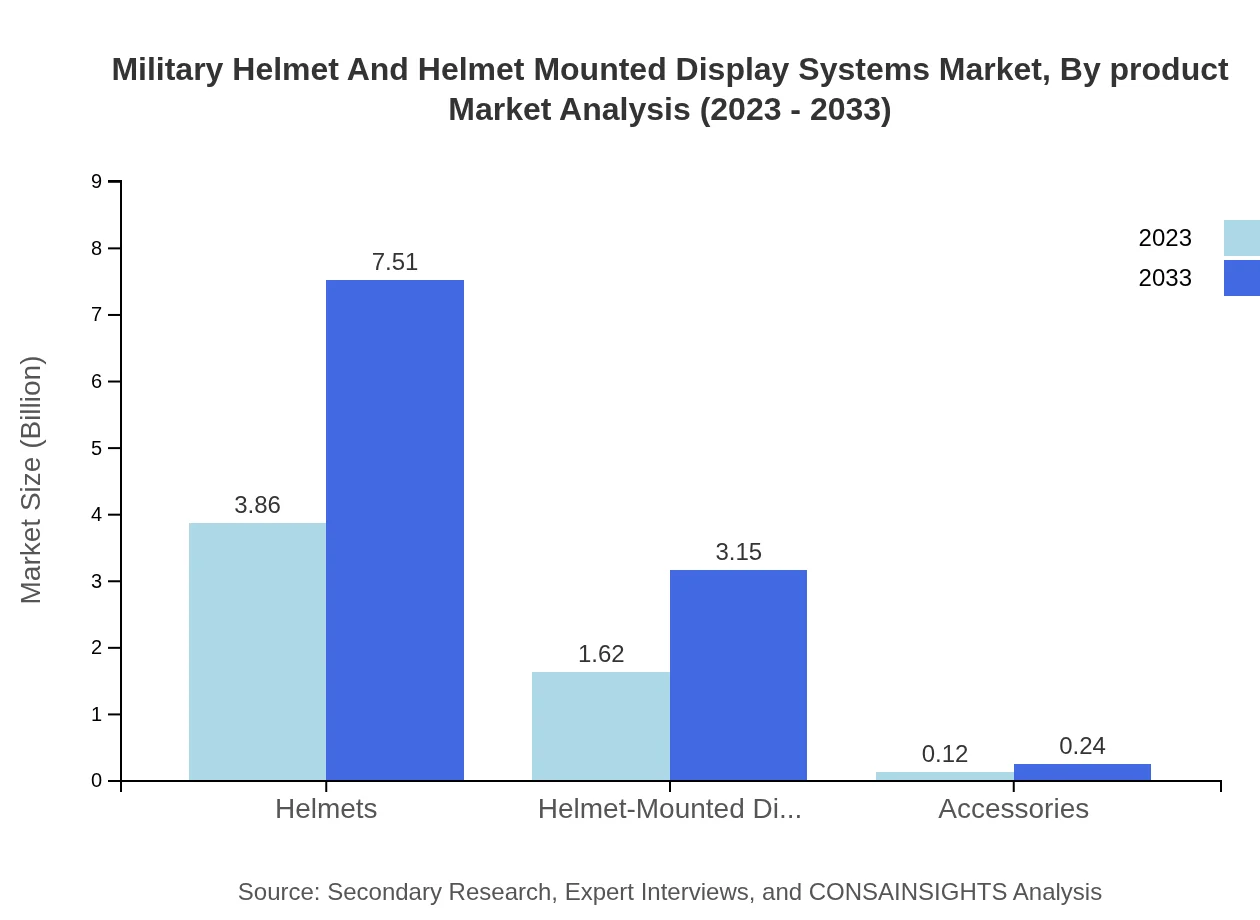

Military Helmet And Helmet Mounted Display Systems Market Analysis By Product

The Helmets segment dominates the market, representing a size of $3.86 billion in 2023 and expected to reach $7.51 billion by 2033, accounting for 68.9% due to substantial investments for military protection. Helmet-Mounted Displays, valued at $1.62 billion in 2023, will grow to $3.15 billion by 2033, capturing 28.94% of the market share. Accessories currently make up a smaller fraction, with a forecast from $0.12 billion to $0.24 billion.

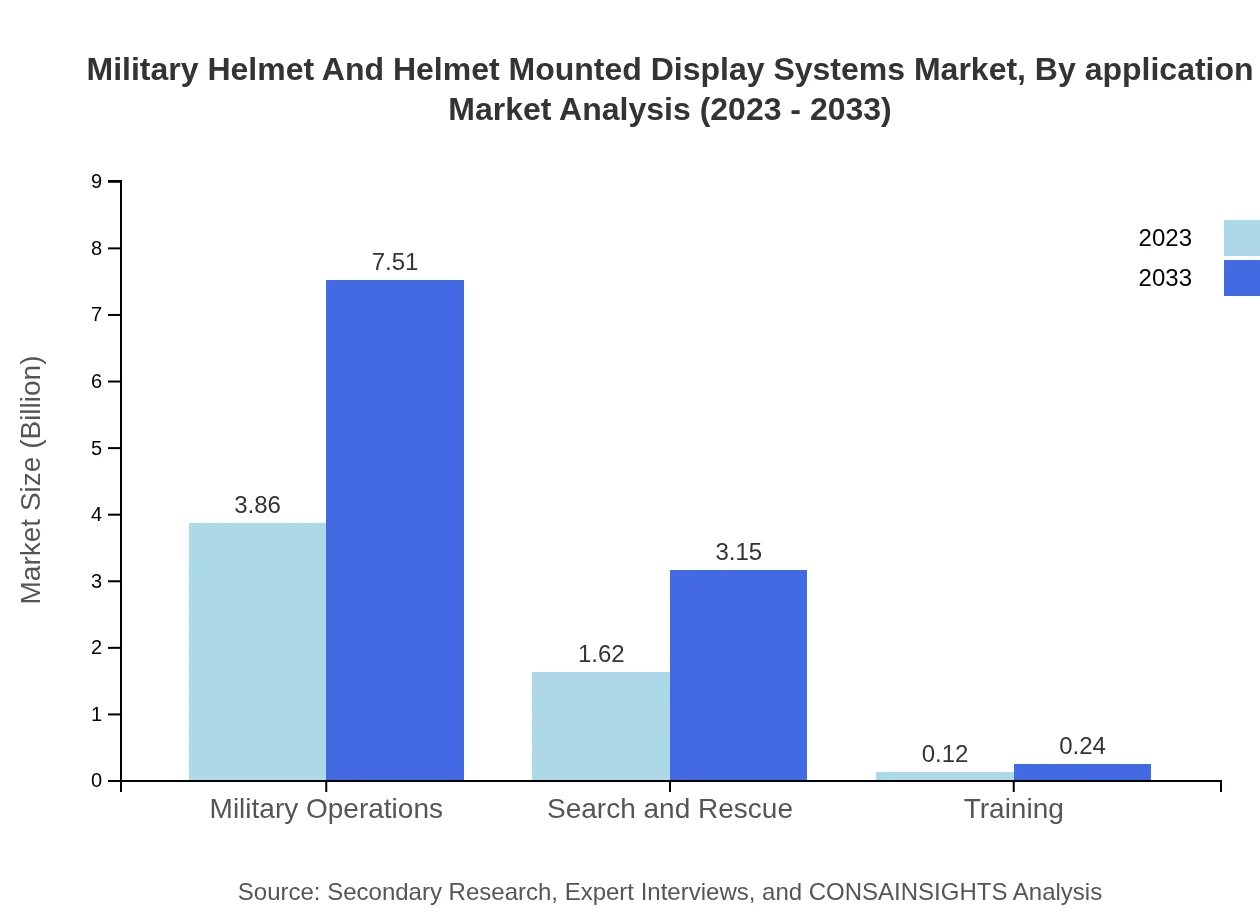

Military Helmet And Helmet Mounted Display Systems Market Analysis By Application

The Military Operations segment, representing $3.86 billion in 2023, is essential for defense applications and is expected to reach $7.51 billion by 2033. Search and Rescue applications accounted for $1.62 billion in 2023 and are forecasted to grow to $3.15 billion. Training, while currently smaller, signifies an emerging need for advanced helmets in safety and training environments.

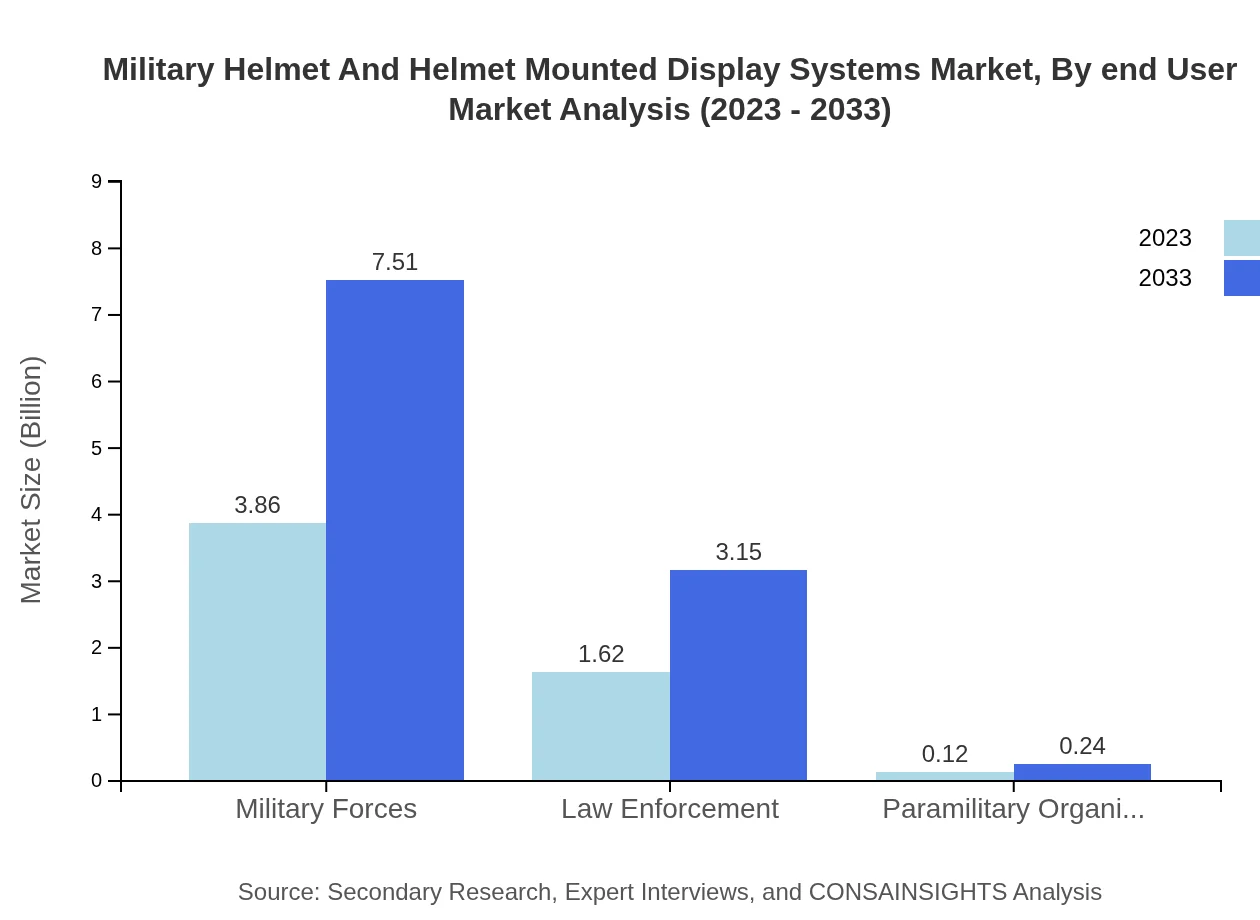

Military Helmet And Helmet Mounted Display Systems Market Analysis By End User

Military Forces comprise the bulk of the market, with a size of $3.86 billion in 2023 and projected to maintain its share. Law Enforcement, with $1.62 billion in 2023, is also growing due to the rising demand for effective crowd control and security equipment, while Paramilitary Organizations, though smaller at $0.12 billion, are seeing an increase in procurements.

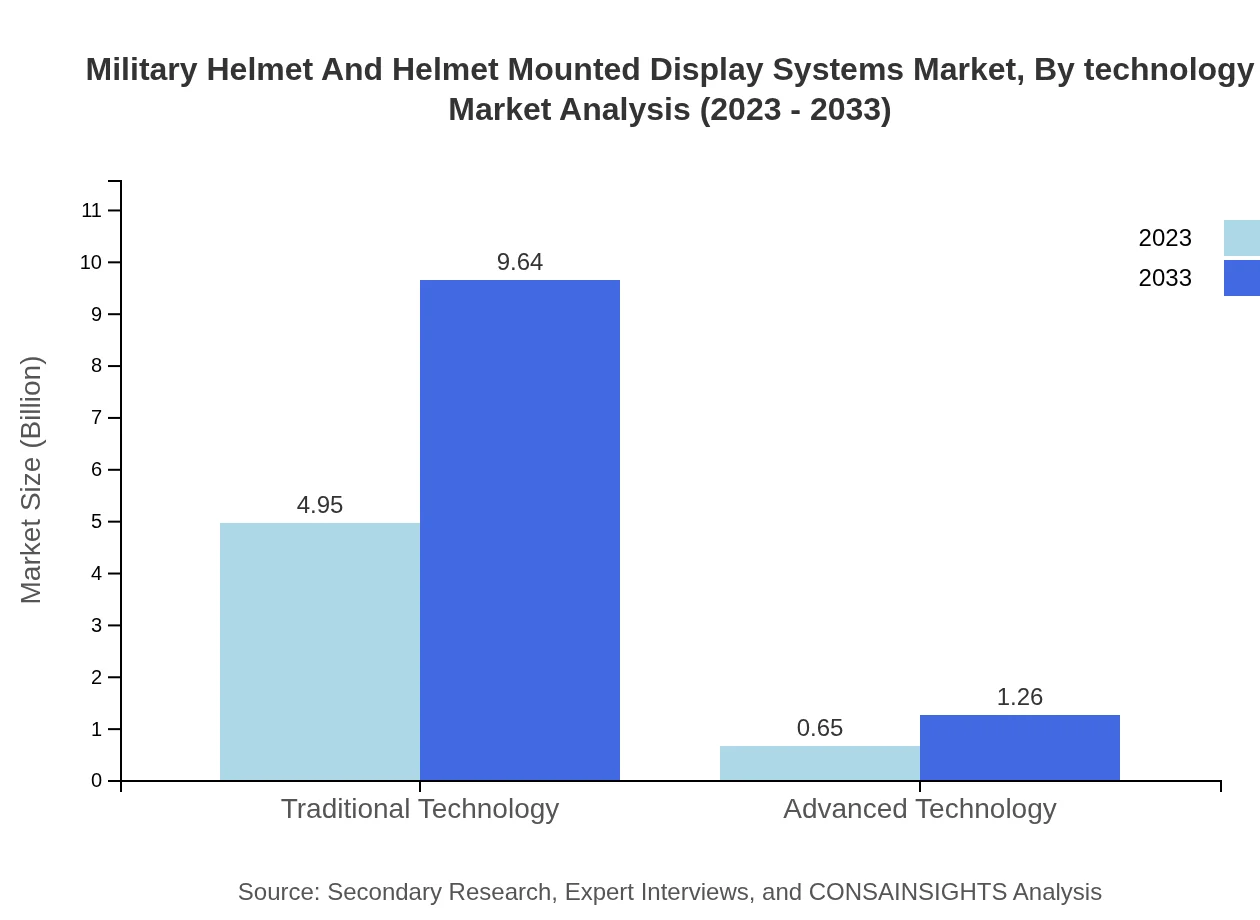

Military Helmet And Helmet Mounted Display Systems Market Analysis By Technology

Traditional Technology accounts for a major share with $4.95 billion in 2023, further expanding to $9.64 billion. Advanced technology, although currently representing only $0.65 billion in 2023, is expected to double as innovations such as AR and enhanced communication systems gain popularity.

Military Helmet And Helmet Mounted Display Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Helmet And Helmet Mounted Display Systems Industry

Gentex Corporation:

A leader in protective headgear and helmets, Gentex Corporation specializes in high-performance products focusing on safety and comfort for military applications.BAE Systems:

BAE Systems is a global defense, security, and aerospace company that provides cutting-edge helmet and display technologies tailored for military needs.Honeywell International Inc.:

Honeywell develops innovative helmet-mounted systems maximizing soldier efficiency and safety, integrating advanced displays for augmented reality operations.3M Company:

3M is a renowned manufacturer in the personal protective equipment sector, providing advanced helmet solutions for various military applications.We're grateful to work with incredible clients.

FAQs

What is the market size of military Helmet And Helmet Mounted Display Systems?

The global market size for military helmet and helmet-mounted display systems is estimated at $5.6 billion in 2023, with a projected CAGR of 6.7%, indicating a significant expansion by 2033.

What are the key market players or companies in this military Helmet And Helmet Mounted Display Systems industry?

Key players include prominent defense contractors and technology firms specializing in military equipment, such as companies engaged in helmets, helmet-mounted displays, and supporting accessories, contributing significantly to market advancements and innovations.

What are the primary factors driving the growth in the military Helmet And Helmet Mounted Display Systems industry?

Growth drivers include increased military spending globally, advancements in technology, rising demand for enhanced soldier safety, and the introduction of sophisticated helmet-mounted display features that improve operational performance in various scenarios.

Which region is the fastest Growing in the military Helmet And Helmet Mounted Display Systems?

Europe is the fastest-growing region in this market, expanding from $1.90 billion in 2023 to $3.70 billion by 2033. North America follows closely, with its market growing from $2.01 billion to $3.91 billion in the same timeframe.

Does ConsaInsights provide customized market report data for the military Helmet And Helmet Mounted Display Systems industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, providing in-depth data, insights, and analytics that cater to unique business requirements within the military helmet and helmet-mounted display systems industry.

What deliverables can I expect from this military Helmet And Helmet Mounted Display Systems market research project?

Expect comprehensive deliverables including detailed market analysis, segment breakdown, regional insights, competitor profiles, and future market projections, all designed to inform strategic decisions within the military helmet and helmet-mounted display systems sector.

What are the market trends of military Helmet And Helmet Mounted Display Systems?

Current trends indicate a shift towards advanced technologies for helmet-mounted displays, enhanced integration of digital and communication systems, and a growing emphasis on ergonomic designs to improve user experience and operational efficiency.