Military Laser Systems Market Report

Published Date: 31 January 2026 | Report Code: military-laser-systems

Military Laser Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Military Laser Systems market from 2023 to 2033, including insights on market size, trends, technology innovations, geographical analysis, and key players influencing the industry landscape.

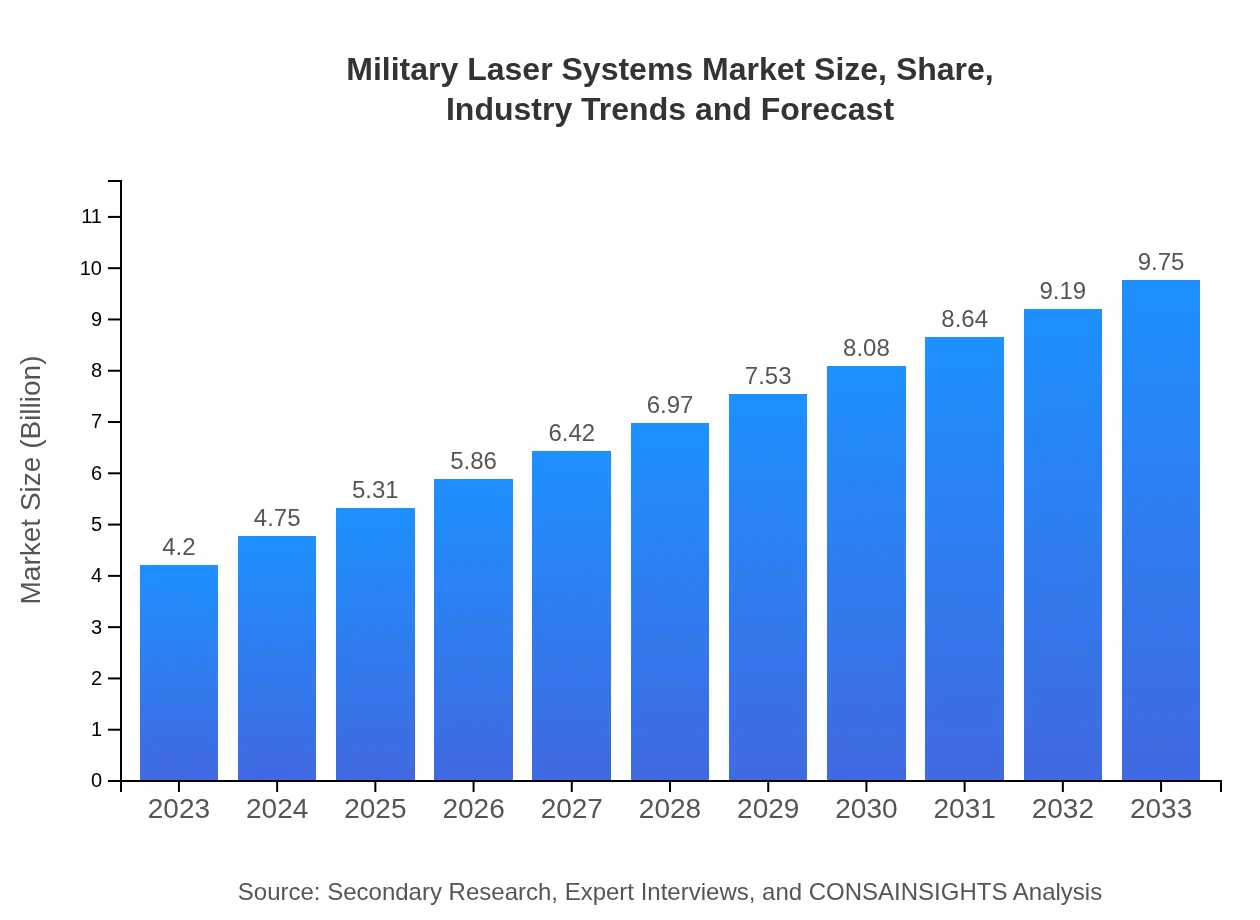

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.20 Billion |

| CAGR (2023-2033) | 8.5% |

| 2033 Market Size | $9.75 Billion |

| Top Companies | Raytheon Technologies, Lockheed Martin, Northrop Grumman, Boeing , Thales Group |

| Last Modified Date | 31 January 2026 |

Military Laser Systems Market Overview

Customize Military Laser Systems Market Report market research report

- ✔ Get in-depth analysis of Military Laser Systems market size, growth, and forecasts.

- ✔ Understand Military Laser Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Laser Systems

What is the Market Size & CAGR of Military Laser Systems market in 2023?

Military Laser Systems Industry Analysis

Military Laser Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Laser Systems Market Analysis Report by Region

Europe Military Laser Systems Market Report:

Europe's military laser systems market is set to grow from $1.28 billion in 2023 to $2.97 billion by 2033. NATO countries are significantly increasing their defense budgets to enhance military readiness and improve technological capabilities across their forces. Importantly, this region is also experiencing collaborations with major defense firms for innovative military solutions.Asia Pacific Military Laser Systems Market Report:

The Asia Pacific region is anticipated to grow substantially, with the market projected to increase from $0.82 billion in 2023 to $1.90 billion by 2033. Countries like China and India are ramping up their military expenditures, emphasizing the development of advanced laser technologies for various applications such as unmanned systems and precision artillery.North America Military Laser Systems Market Report:

North America dominates the Military Laser Systems market, with values expected to rise from $1.38 billion in 2023 to approximately $3.21 billion by 2033. The United States is heavily investing in laser technologies for applications in missile defense and combat operations, supported by ongoing innovations by major defense contractors.South America Military Laser Systems Market Report:

In South America, the Military Laser Systems market is expected to see moderate growth, rising from $0.19 billion in 2023 to $0.44 billion by 2033. The region's military forces are increasingly exploring modern systems to enhance their operational capabilities, particularly in border defense and surveillance.Middle East & Africa Military Laser Systems Market Report:

The Middle East and Africa region presents a burgeoning market, expected to grow from $0.53 billion in 2023 to $1.22 billion by 2033. The ongoing conflicts and rising defense spending due to security concerns drive interest in advanced laser systems for both offensive and defensive applications.Tell us your focus area and get a customized research report.

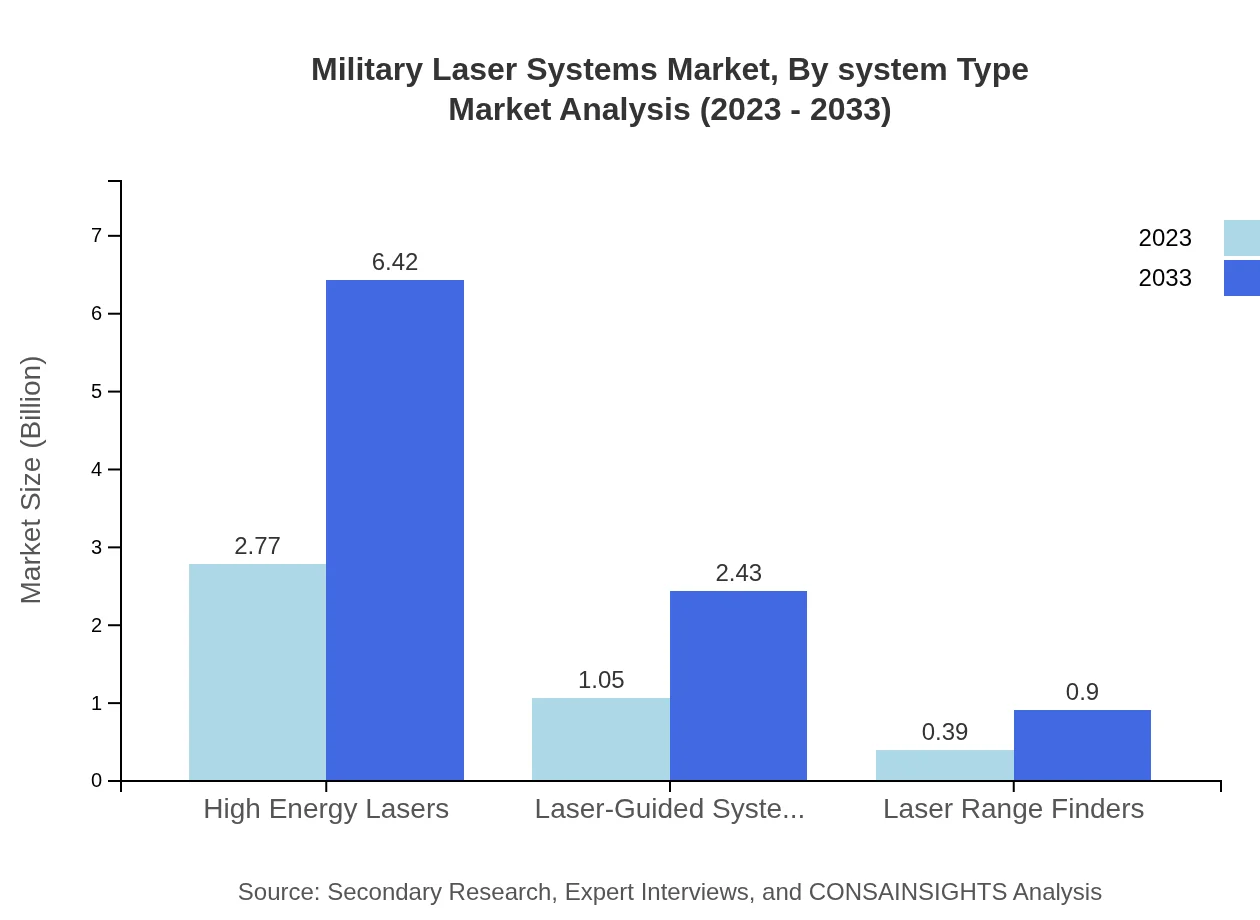

Military Laser Systems Market Analysis By System Type

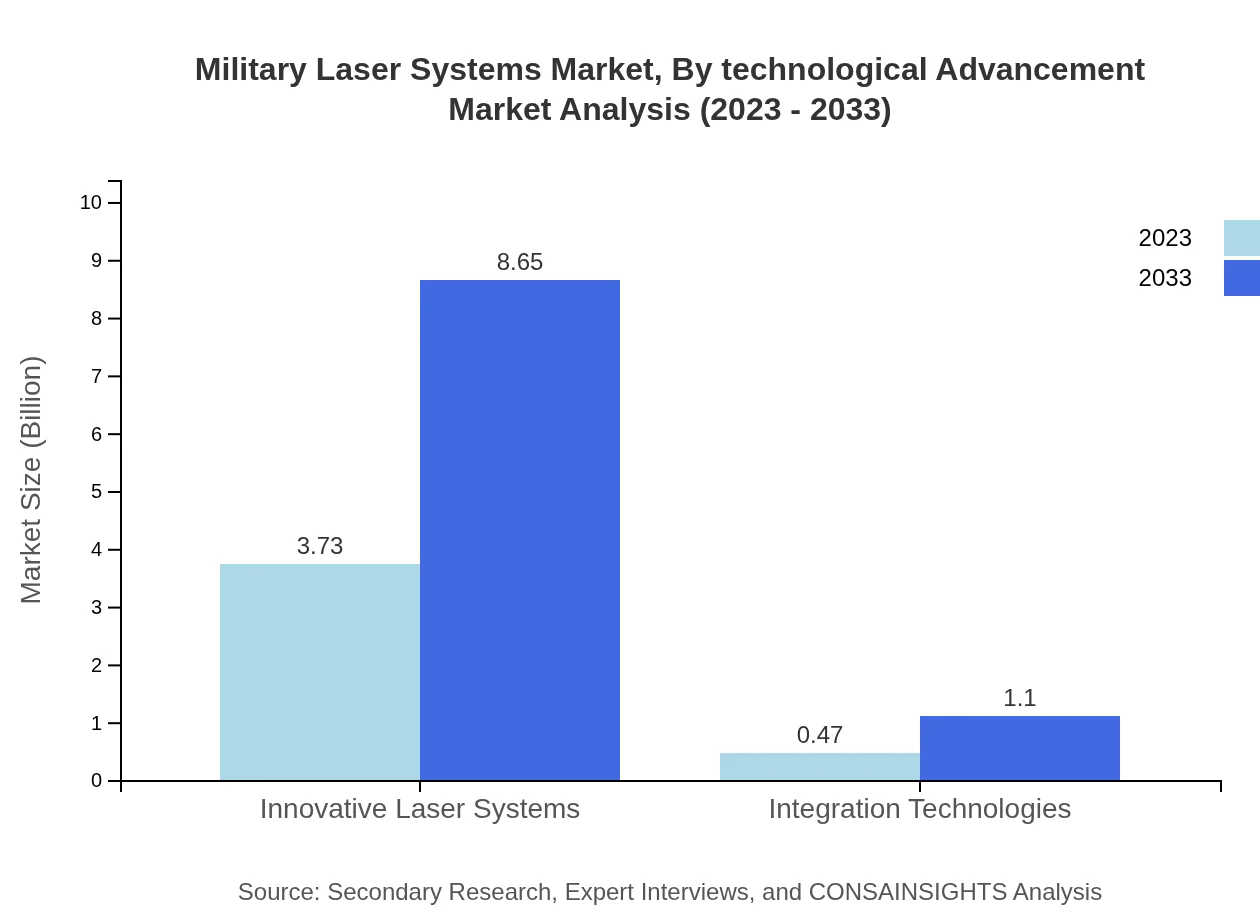

In the Military Laser Systems market by system type, the Armed Forces hold a significant size, estimated at $3.73 billion in 2023 and projected to grow to $8.65 billion by 2033, maintaining a stable share of 88.74%. Defensive Systems, with a market value of $2.77 billion in 2023, are also crucial, expected to rise to $6.42 billion. Offensive systems are anticipated to grow from $1.05 billion to $2.43 billion in the same period. Laser-guided systems, high energy lasers, and innovative laser systems also take considerable shares in this complex sector, each supporting various military operations in their respective capacities.

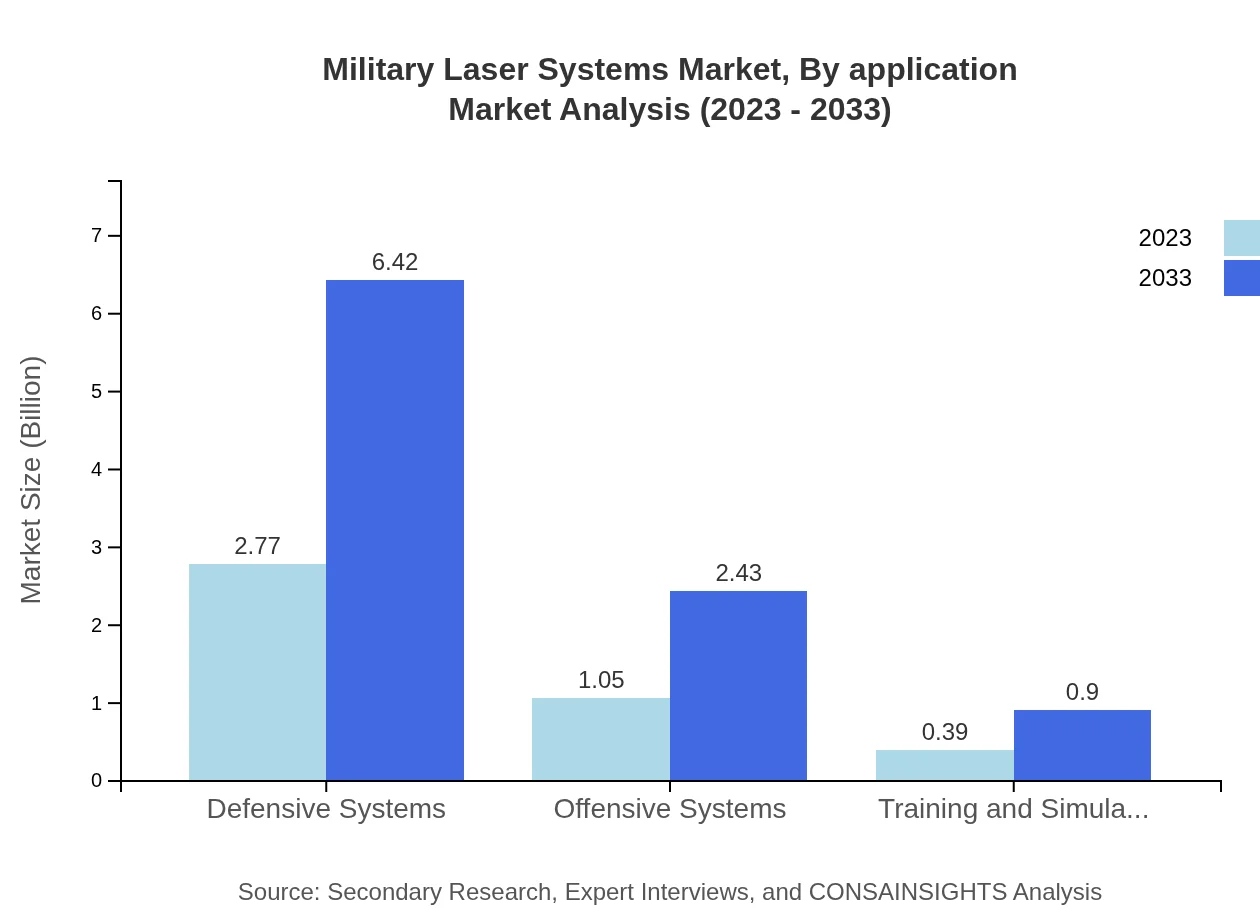

Military Laser Systems Market Analysis By Application

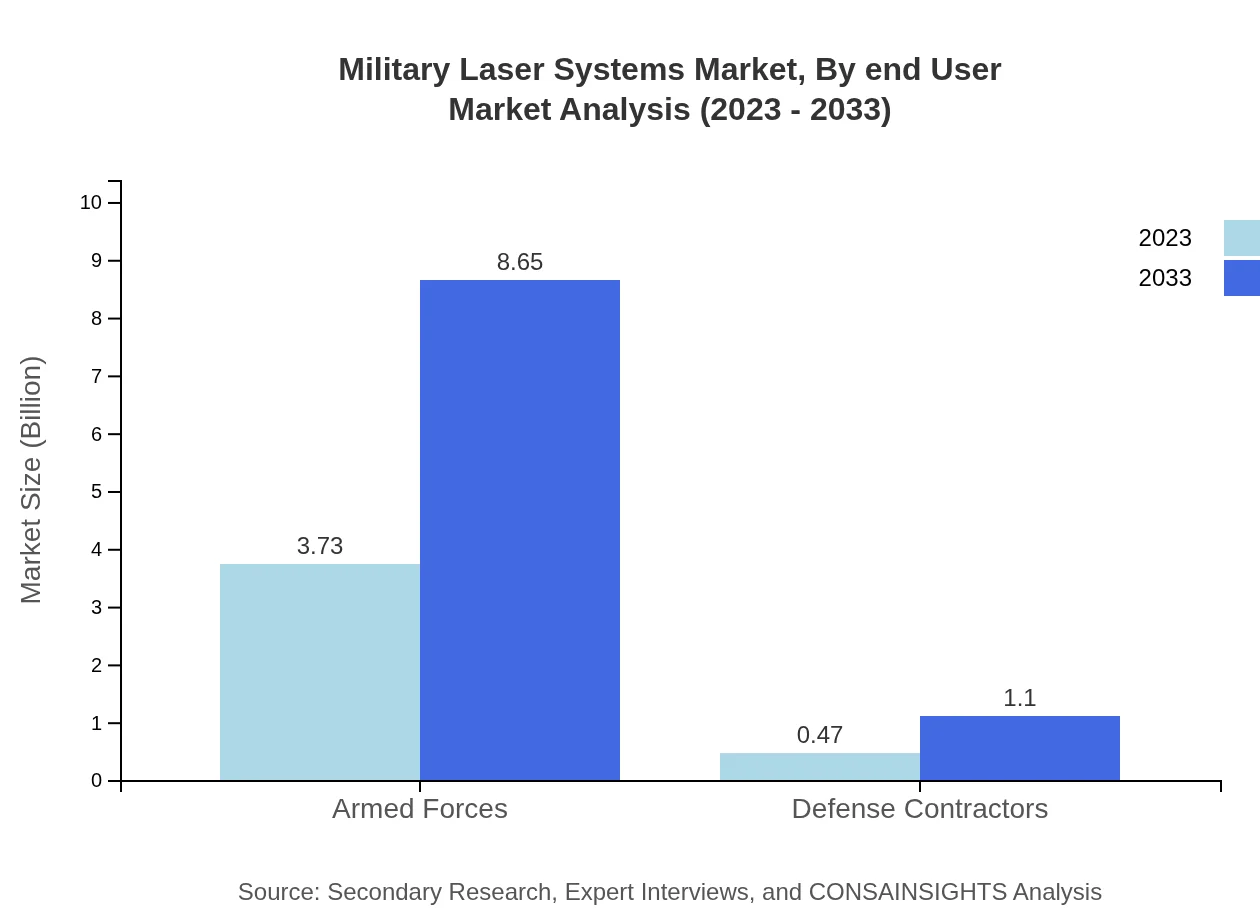

The classification of Military Laser Systems by application shows Armed Forces taking the lead with a significant share of 88.74% in 2023. The Defense Contractors are positioned at 11.26%. Notably, training and simulation applications are important for enhancing combat readiness, expected to grow significantly from $0.39 billion to $0.90 billion, reflecting the increasing reliance on simulation technologies for military training. Offensive and Defensive Systems collectively hold most of the share, indicating their critical role in military strategies.

Military Laser Systems Market Analysis By Technological Advancement

The technological advancement in Military Laser Systems is pivotal, with innovations driving enhanced performance and capabilities. High Energy Lasers dominate the market, captured growth from $2.77 billion to $6.42 billion, sustaining a major portion of the market share. Among innovative systems, the integration of advanced electronics, optics, and propulsion technologies enhances the operational reliability and efficacy of laser systems, marking a significant trend in defense applications.

Military Laser Systems Market Analysis By End User

End-user segment analysis showcases the Armed Forces as the primary consumers of Military Laser Systems, representing a substantial share of 88.74%. The significance of this sector is reflected in the substantial investment towards new laser technologies. Defense contractors have also emerged as key players, taking a relevant share with growing demands for innovative solutions in military applications.

Military Laser Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Laser Systems Industry

Raytheon Technologies:

A leading player in the defense sector, offering advanced laser systems for military applications including high energy lasers and directed energy systems.Lockheed Martin:

A prominent defense contractor providing innovative laser technologies designed for a variety of military operations and strategic defense initiatives.Northrop Grumman:

Key innovator in military laser systems, focusing on integrated solutions for high-end defense capabilities.Boeing :

Delivers advanced laser solutions and systems integration for military applications, enhancing tactical effectiveness.Thales Group:

A global leader in aerospace and defense, specializing in laser-powered systems and solutions across various military sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of military Laser Systems?

The military laser systems market is valued at approximately $4.2 billion in 2023, with a projected compound annual growth rate (CAGR) of 8.5% through 2033, indicating strong growth and investment in this sector over the next decade.

What are the key market players or companies in this military Laser Systems industry?

Key players in the military laser systems market include major defense contractors such as Lockheed Martin, Raytheon Technologies, Northrop Grumman, and Boeing. These companies lead in innovation, manufacturing, and delivery of advanced laser systems for military applications.

What are the primary factors driving the growth in the military Laser Systems industry?

Growth in the military laser systems market is driven by increased military budgets globally, advancements in laser technology, rising demand for precision weaponry, and the need for effective defense systems against emerging threats and electronic warfare.

Which region is the fastest Growing in the military Laser Systems?

North America is currently the fastest-growing region in the military laser systems market, projected to grow from $1.38 billion in 2023 to $3.21 billion by 2033, fueled by significant defense investments and technological advancements.

Does ConsaInsights provide customized market report data for the military Laser Systems industry?

Yes, ConsaInsights offers customized market report data specific to the military laser systems industry, enabling clients to access tailored insights and analytics tailored to their unique business requirements and market conditions.

What deliverables can I expect from this military Laser Systems market research project?

From this military laser systems market research project, clients can expect comprehensive reports detailing market size, growth forecasts, competitive analysis, regional trends, and strategic recommendations based on in-depth market analysis.

What are the market trends of military Laser Systems?

Market trends in military laser systems include the growing adoption of high-energy lasers in defense applications, increased focus on affordable and versatile laser systems, and an emphasis on integrating advanced technologies for enhanced operational effectiveness.