Military Robots Market Report

Published Date: 31 January 2026 | Report Code: military-robots

Military Robots Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Military Robots market, covering insights from 2023 to 2033. It includes market size, growth trends, regional analyses, technology advancements, product performance, and forecasts to inform stakeholders about the evolving dynamics of the industry.

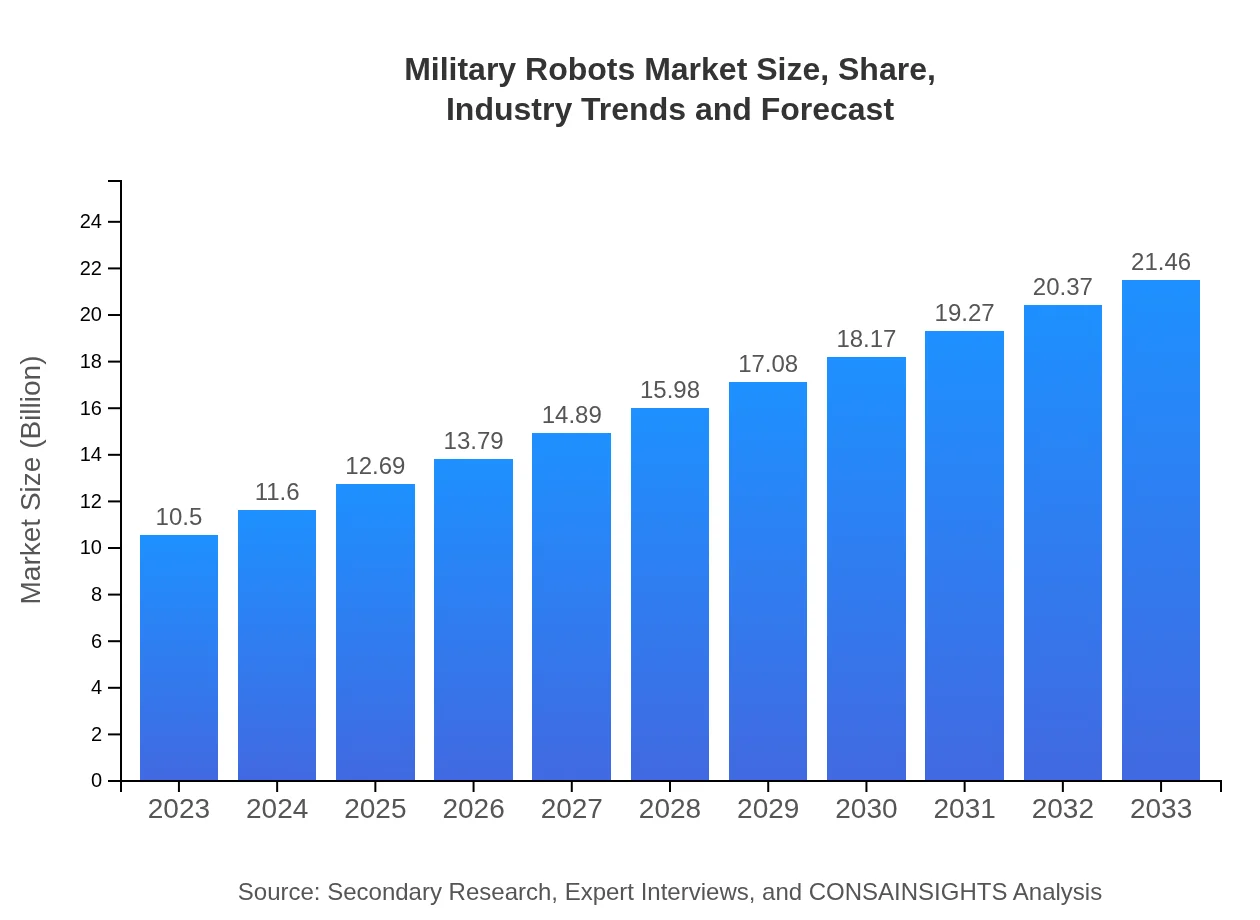

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Northrop Grumman, Boston Dynamics, Lockheed Martin, General Dynamics, BAE Systems |

| Last Modified Date | 31 January 2026 |

Military Robots Market Overview

Customize Military Robots Market Report market research report

- ✔ Get in-depth analysis of Military Robots market size, growth, and forecasts.

- ✔ Understand Military Robots's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Robots

What is the Market Size & CAGR of Military Robots market in 2023?

Military Robots Industry Analysis

Military Robots Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Robots Market Analysis Report by Region

Europe Military Robots Market Report:

In Europe, the market size is expected to grow from USD 2.73 billion in 2023 to USD 5.58 billion by 2033. The NATO members are prioritizing defense technology to adapt to modern warfare challenges, enhancing their capabilities through the integration of UAVs and UGVs.Asia Pacific Military Robots Market Report:

In the Asia Pacific region, the Military Robots market is expected to expand from USD 2.26 billion in 2023 to USD 4.63 billion by 2033, driven by increasing defense budgets and rising territorial disputes. Countries like China and India are investing heavily in robotic systems to modernize their armed forces, focusing on UAVs and UGVs.North America Military Robots Market Report:

North America remains a dominant region, with the Military Robots market anticipated to increase from USD 3.89 billion in 2023 to USD 7.95 billion by 2033. The United States is a leader in military robotics innovation, driven by significant investments in autonomous technology and robust defense spending.South America Military Robots Market Report:

The South American market for Military Robots is projected to grow from USD 0.42 billion in 2023 to USD 0.86 billion by 2033. Although smaller in size, countries like Brazil and Colombia are increasingly recognizing the importance of robotics in national defense and public safety, leading to gradual investments.Middle East & Africa Military Robots Market Report:

The Middle East and Africa market is set to grow from USD 1.20 billion in 2023 to USD 2.45 billion by 2033. Regional conflicts and terrorism threats are encouraging countries like Israel and the UAE to invest heavily in military robotics technology to strengthen their defense systems.Tell us your focus area and get a customized research report.

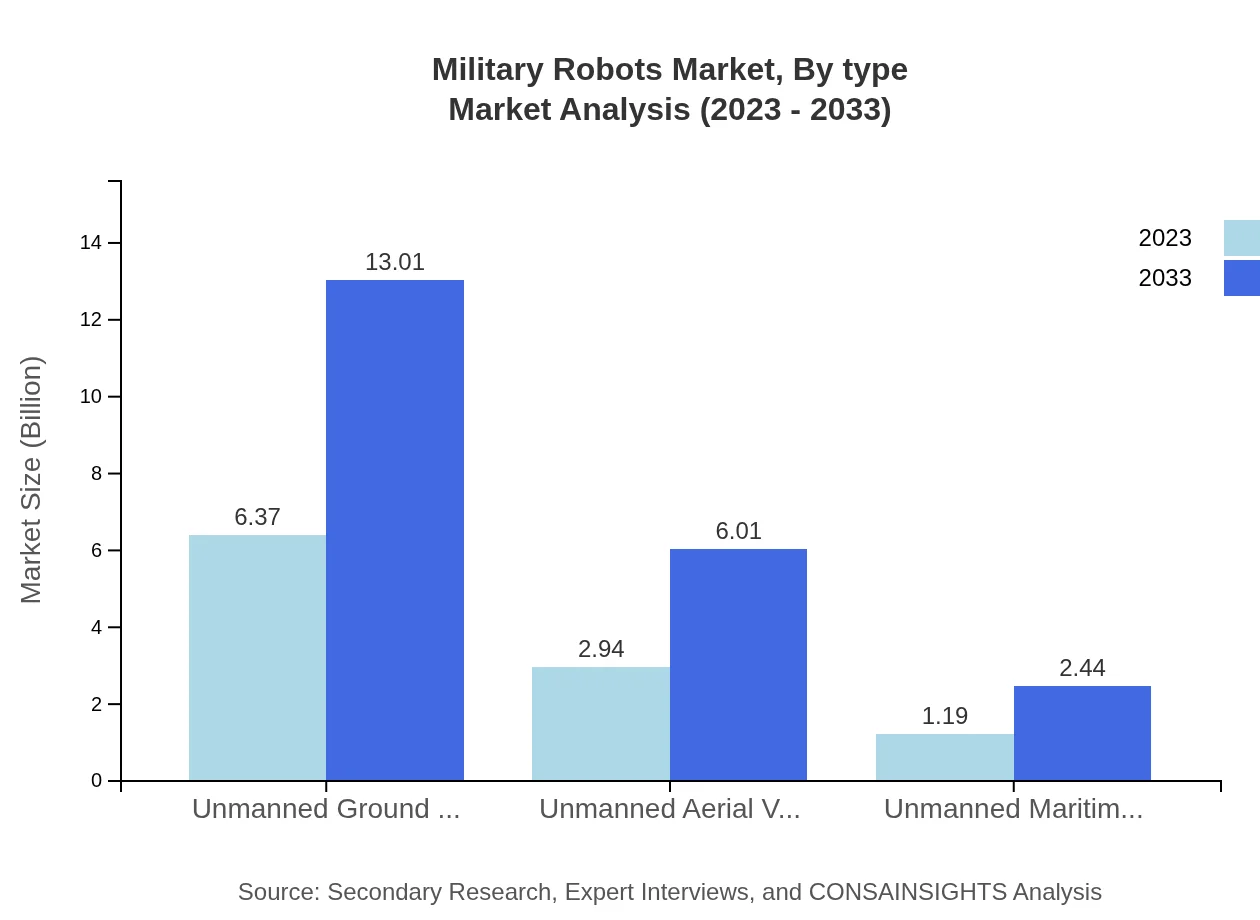

Military Robots Market Analysis By Type

The Military Robots market, segmented by type, has shown that Unmanned Ground Vehicles (UGVs) are projected to grow from USD 6.37 billion in 2023 to USD 13.01 billion in 2033, holding a market share of 60.63%. Unmanned Aerial Vehicles (UAVs) are also significant, expected to increase from USD 2.94 billion in 2023 to USD 6.01 billion by 2033, capturing 28.02% of the market share. Similarly, Unmanned Maritime Vehicles (UMVs) are valued at USD 1.19 billion in 2023, advancing to USD 2.44 billion by 2033, representing 11.35% of the market.

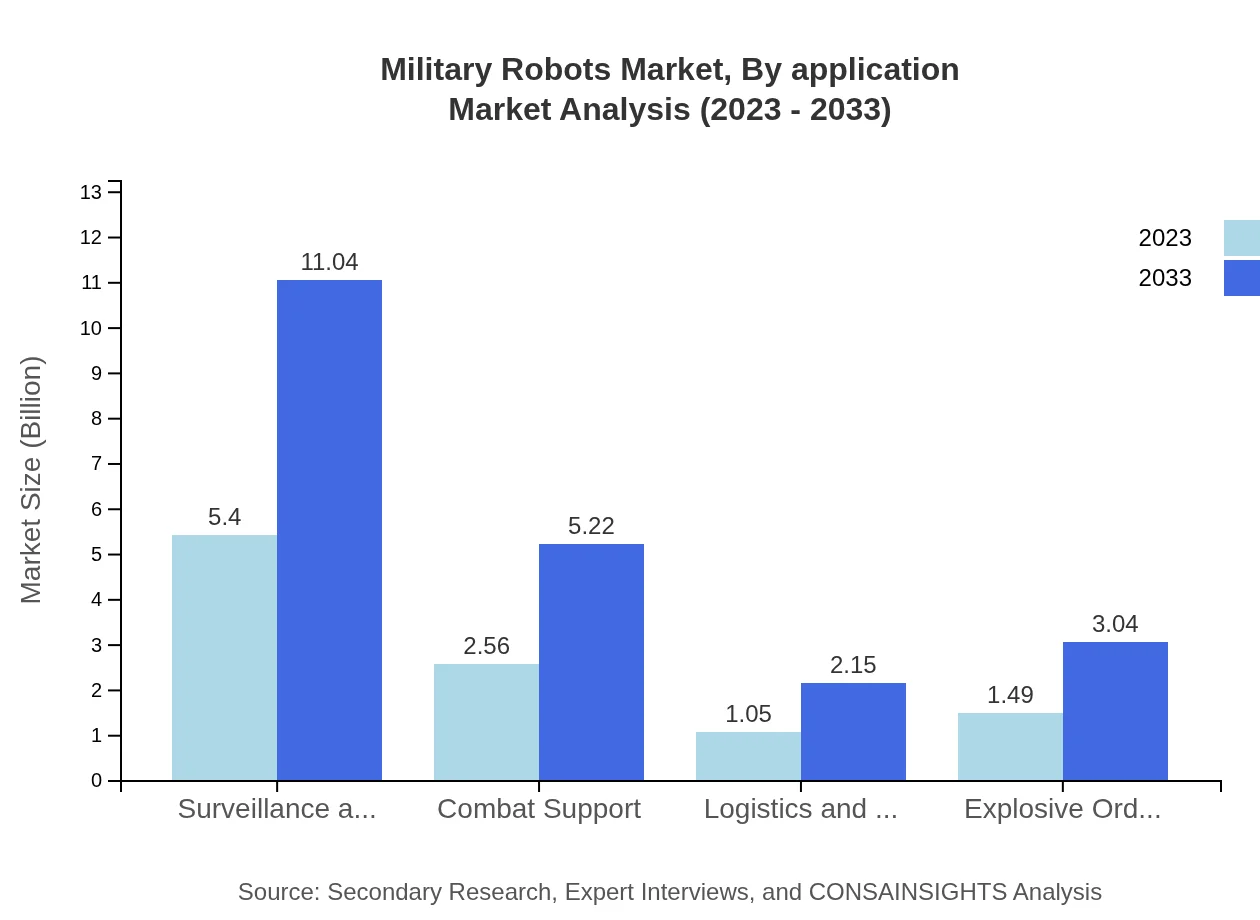

Military Robots Market Analysis By Application

In terms of applications, the market for surveillance and reconnaissance applications accounted for 51.45% of the market share, valued at USD 5.40 billion in 2023, and is forecast to grow to USD 11.04 billion by 2033. Combat support applications will reach USD 2.56 billion projected to USD 5.22 billion, marking a 24.34% share. Logistics and supply applications are anticipated to rise from USD 1.05 billion to USD 2.15 billion, representing a 10.04% share.

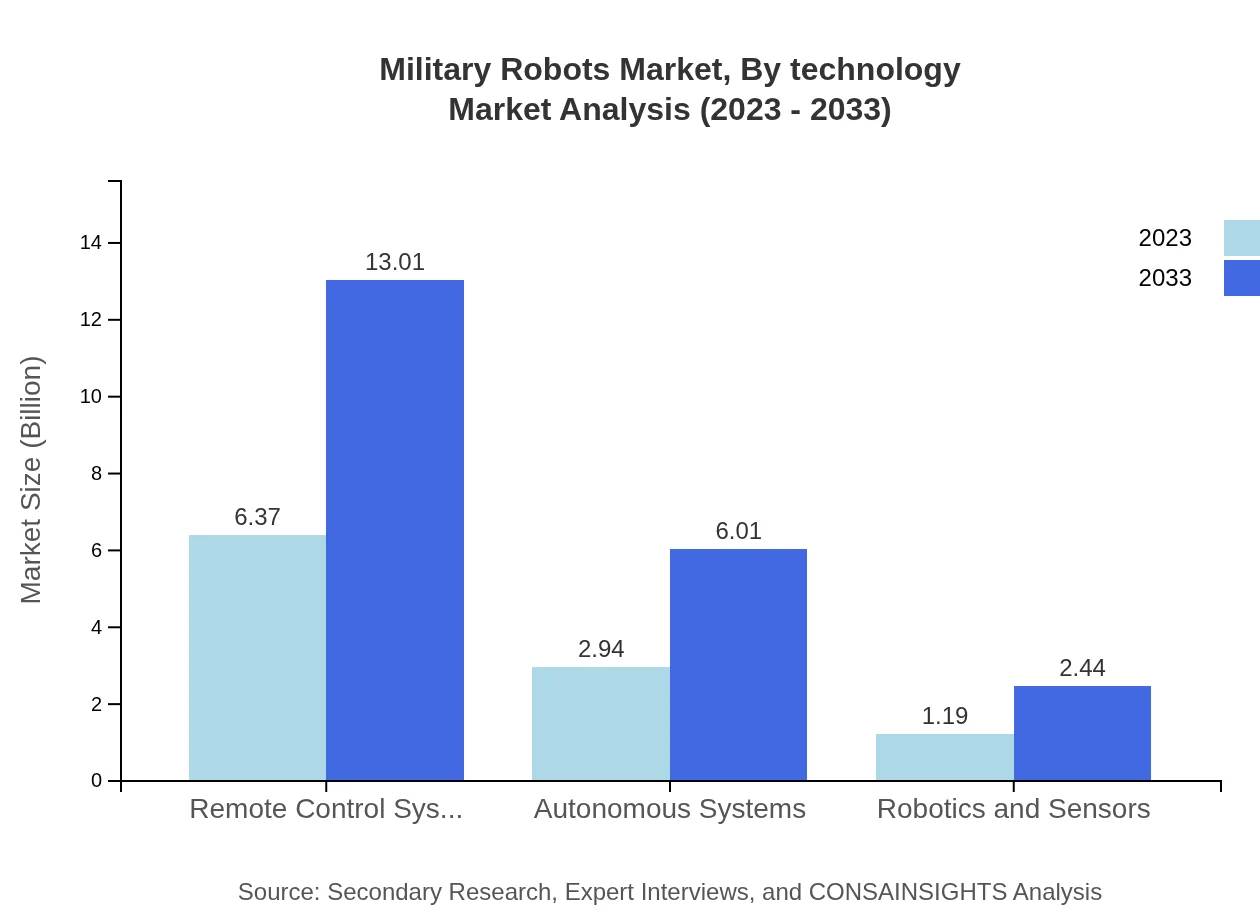

Military Robots Market Analysis By Technology

The technological advancements in the Military Robots market highlight the increasing dominance of remote control systems, which are expected to maintain a steady market size of USD 6.37 billion in 2023, reaching USD 13.01 billion by 2033 (60.63% market share). Autonomous systems will expand from USD 2.94 billion to USD 6.01 billion, retaining a 28.02% share.

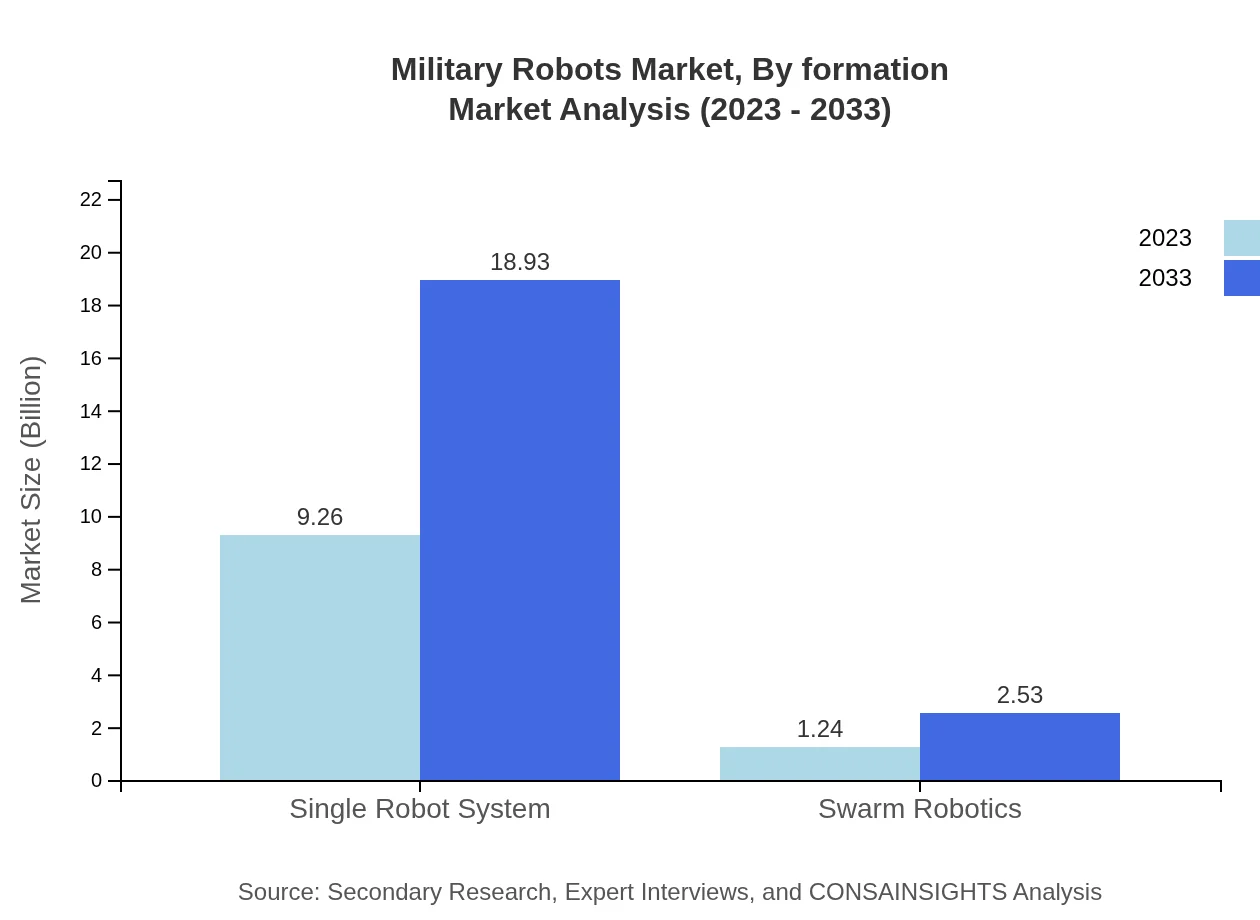

Military Robots Market Analysis By Formation

The Military Robots segment categorized by formation reveals that Single Robot Systems dominate the market with a share of 88.22%, valued at USD 9.26 billion in 2023, and projected to grow to USD 18.93 billion by 2033. Conversely, Swarm Robotics, although smaller at USD 1.24 billion in 2023, is expected to increase to USD 2.53 billion by 2033, capturing a promising 11.78% market share.

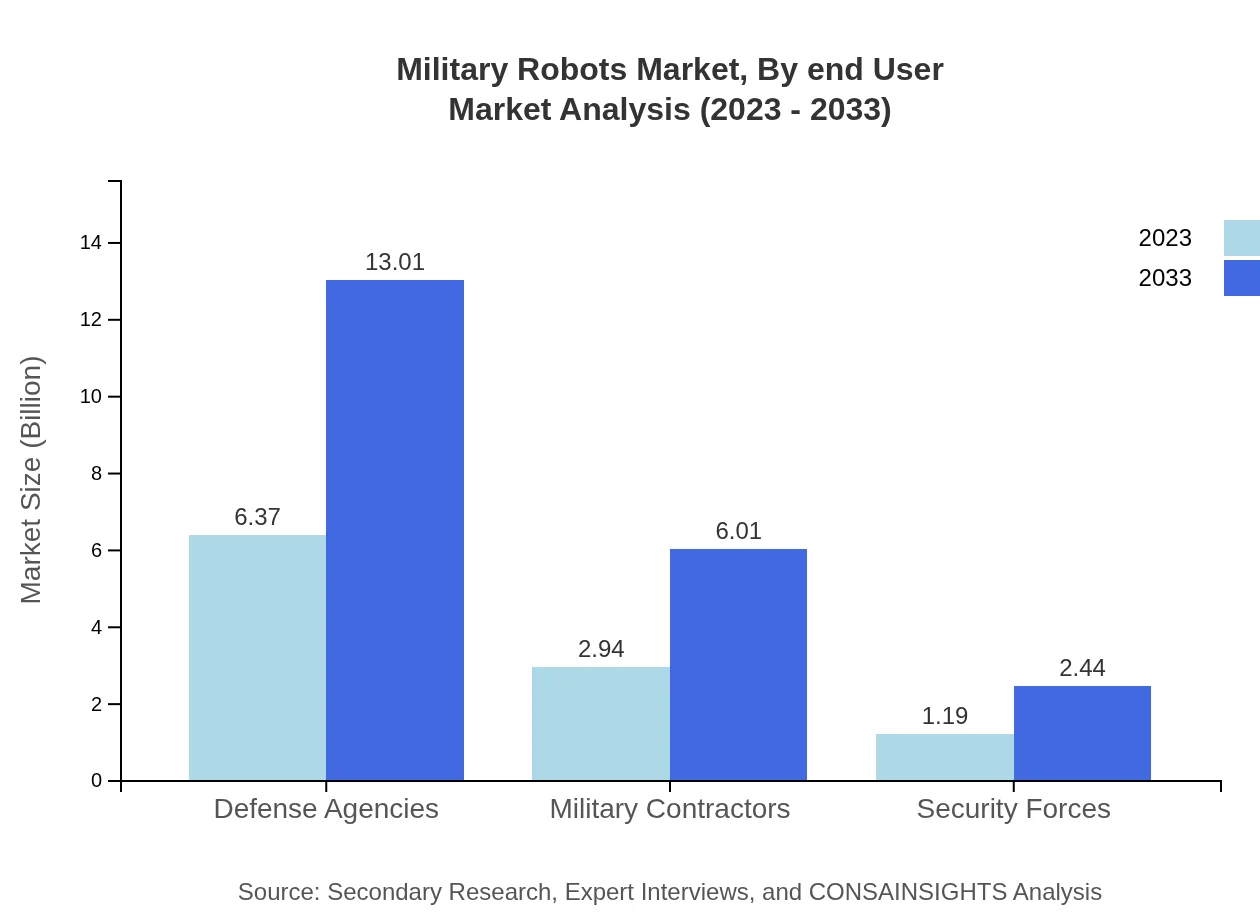

Military Robots Market Analysis By End User

The end-user segment showcases defense agencies commanding a significant 60.63% of the market share, valued at USD 6.37 billion in 2023, expanding to USD 13.01 billion by 2033. Military contractors hold a share of 28.02% with an increase from USD 2.94 billion to USD 6.01 billion. Security forces account for the remaining 11.35%, growing from USD 1.19 billion to USD 2.44 billion.

Military Robots Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Robots Industry

Northrop Grumman:

A prominent defense technology company spearheading innovations in military robotics, including UGVs and UAVs.Boston Dynamics:

Known for advanced robotics research and development, specializing in dynamic and versatile robots for various military applications.Lockheed Martin:

A key player in defense contracting, focusing on cutting-edge autonomous systems and military applications.General Dynamics:

A global aerospace and defense firm, providing state-of-the-art unmanned systems for military use.BAE Systems:

Involved in designing and manufacturing sophisticated military robots to enhance operational capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of military Robots?

The global military robots market is projected to grow from $10.5 billion in 2023 to significant amounts by 2033, with a compound annual growth rate (CAGR) of 7.2%. This growth highlights increasing investments in military technology and automation.

What are the key market players or companies in this military Robots industry?

Key players in the military robots market include major defense contractors and technology firms focused on robotics and AI. Examples include Northrop Grumman, General Dynamics, and Boeing, each contributing advanced solutions tailored for military applications.

What are the primary factors driving the growth in the military robots industry?

Factors driving growth include rising defense budgets, technological advancements in automation and AI, demand for unmanned systems, and the need for modernized military capabilities to address global security challenges.

Which region is the fastest Growing in the military robots market?

The fastest-growing region in the military robots market is North America, with the market expected to reach $7.95 billion by 2033, up from $3.89 billion in 2023, driven by defense spending and technological innovations.

Does ConsaInsights provide customized market report data for the military robots industry?

Yes, ConsaInsights offers customized market report data for the military robots industry. Clients can request tailored insights that reflect specific interests, needs, or regional focus areas for strategic planning and investment.

What deliverables can I expect from this military Robots market research project?

Deliverables may include detailed market analysis, segmentations, forecasts, competitive landscape assessments, and insights into regional dynamics. Clients can also expect recommendations based on thorough research methodologies.

What are the market trends of military robots?

Significant trends include the increasing adoption of unmanned ground and aerial vehicles, advancements in swarm robotics, enhanced surveillance capabilities, and a shift towards integrating AI technologies for autonomous operations.