Military Sensors Market Report

Published Date: 31 January 2026 | Report Code: military-sensors

Military Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Military Sensors market from 2023 to 2033, detailing market trends, growth forecasts, and insights across various segments and regions. It aims to inform industry stakeholders about current conditions and future opportunities in this vital defense sector.

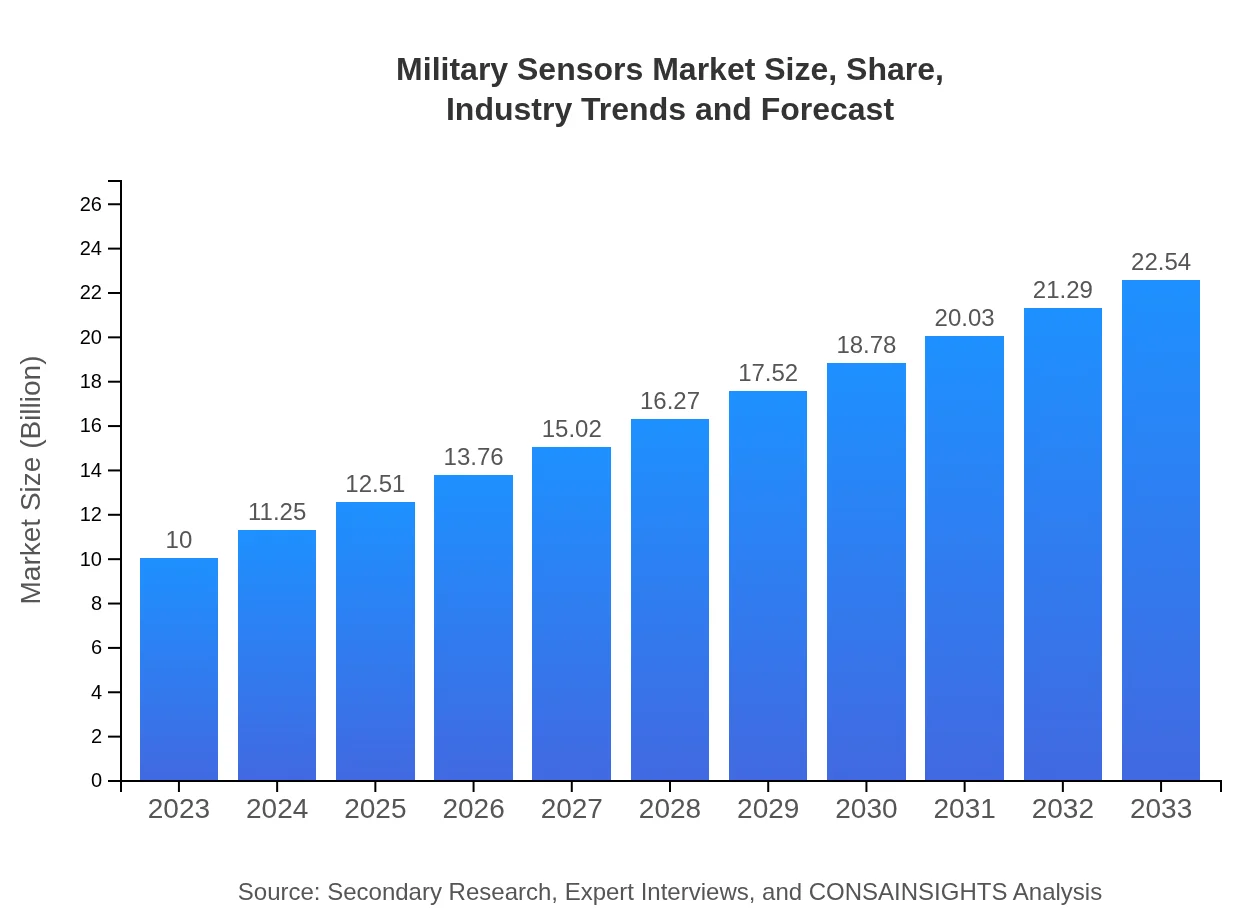

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $22.54 Billion |

| Top Companies | Raytheon Technologies, Northrop Grumman Corporation, Lockheed Martin, Thales Group, BAE Systems |

| Last Modified Date | 31 January 2026 |

Military Sensors Market Overview

Customize Military Sensors Market Report market research report

- ✔ Get in-depth analysis of Military Sensors market size, growth, and forecasts.

- ✔ Understand Military Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Sensors

What is the Market Size & CAGR of Military Sensors market in 2023?

Military Sensors Industry Analysis

Military Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Sensors Market Analysis Report by Region

Europe Military Sensors Market Report:

In Europe, the Military Sensors market is projected to expand from $2.43 billion in 2023 to $5.47 billion by 2033. The increased focus on collaborative defense initiatives and a robust investment in next-generation technology are set to bolster this market amidst ongoing geopolitical tensions.Asia Pacific Military Sensors Market Report:

In 2023, the Asia Pacific Military Sensors market is valued at $1.97 billion and is forecasted to grow to $4.43 billion by 2033. This growth is driven by significant military modernization programs underway in countries like India, China, and Japan. Moreover, increased economic cooperation and defense partnerships among countries in this region are expected to accelerate advancements in sensor technologies.North America Military Sensors Market Report:

North America holds a substantial market share, valued at approximately $3.33 billion in 2023 and expected to grow to $7.51 billion by 2033. The extensive technological advancements, strong defense budgets, and demand for high-performance ISR platforms significantly contribute to the region's market expansion.South America Military Sensors Market Report:

The South American market for Military Sensors is anticipated to reach $0.90 billion in 2023, with forecasts suggesting an increase to $2.03 billion by 2033. The rising focus on countering internal security threats and modernizing military capabilities are key factors driving market growth across this region.Middle East & Africa Military Sensors Market Report:

The Middle East and Africa Military Sensors market is estimated to be valued at $1.37 billion in 2023, growing to $3.09 billion by 2033. The ongoing conflicts and instability in certain areas drive demand for advanced military capabilities, including improved sensor systems that enhance situational awareness for defense operations.Tell us your focus area and get a customized research report.

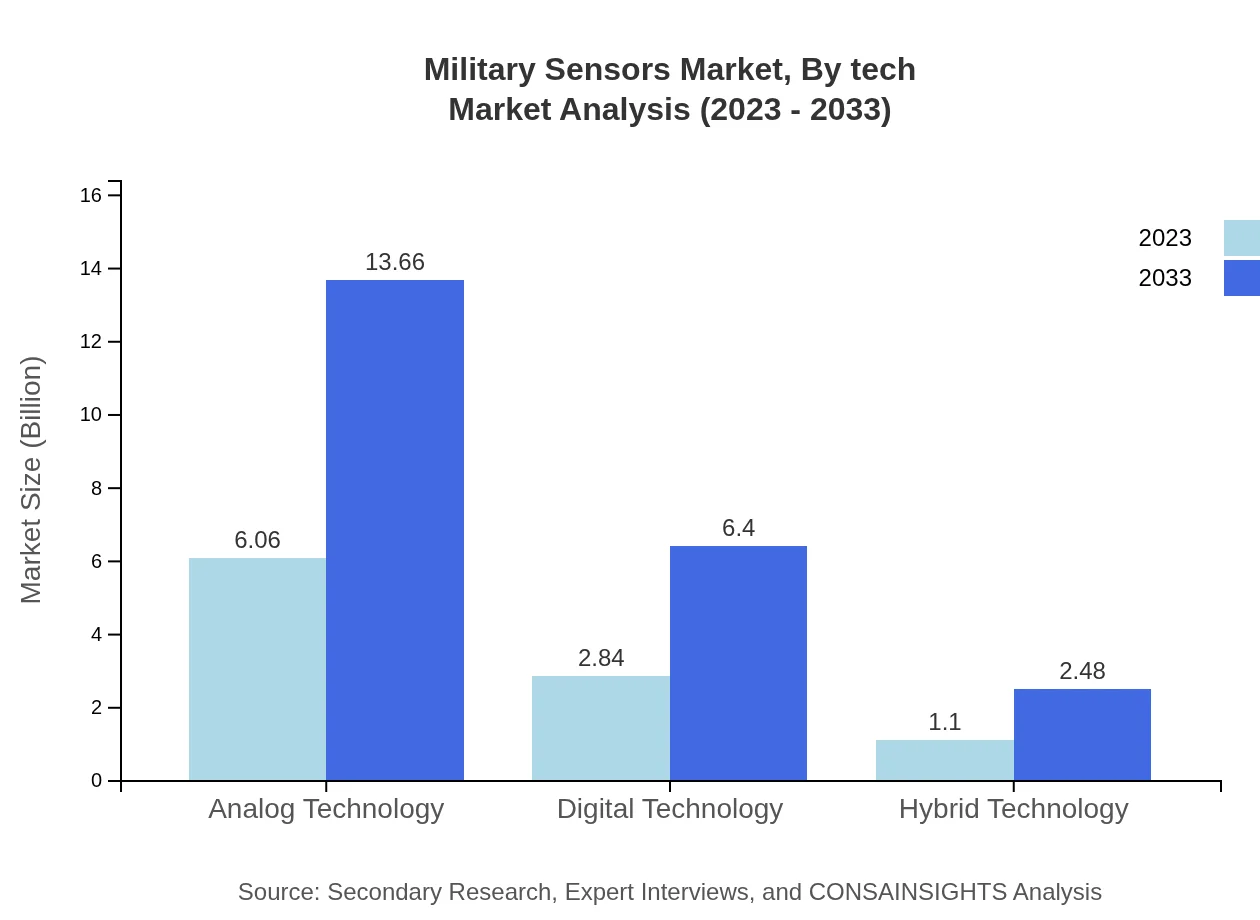

Military Sensors Market Analysis By Tech

The Military Sensors market segment by technology includes Analog, Digital, and Hybrid technologies. In 2023, the Analog technology segment is leading, with a market size of $6.06 billion and maintaining a share of 60.58%. Digital technology follows, valued at $2.84 billion, holding 28.4% of the market. Hybrid technology, although the smallest segment, shows promising growth from $1.10 billion in 2023 to $2.48 billion by 2033.

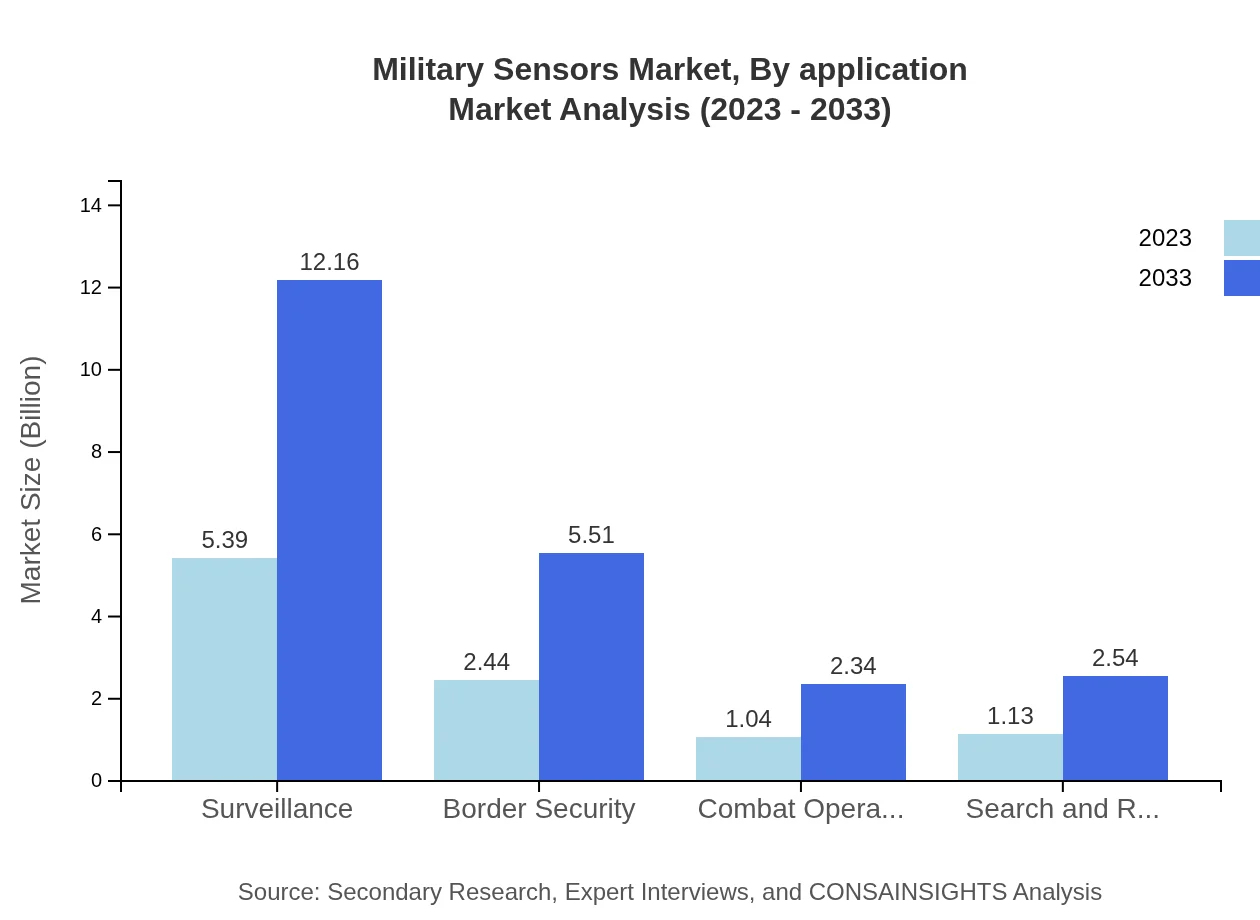

Military Sensors Market Analysis By Application

The Military Sensors market by application showcases Defense Forces, which dominate with a market size of $6.06 billion, accounting for 60.58% of the market share in 2023. Homeland Security is also a significant segment, valued at $2.84 billion, capturing 28.4% of the market. The market share of other agencies is expected to grow steadily, from $1.10 billion in 2023 to $2.48 billion by 2033.

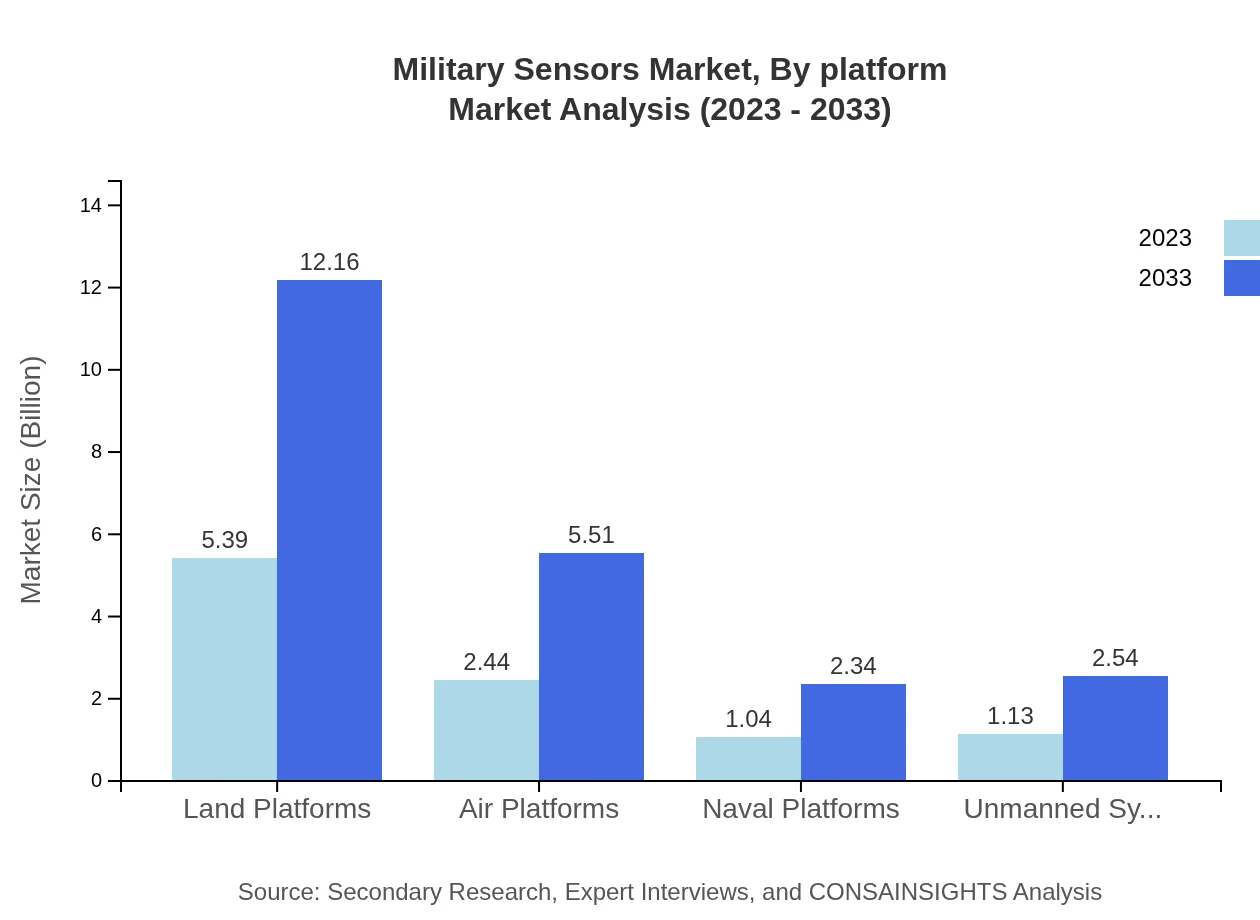

Military Sensors Market Analysis By Platform

In terms of platform segmentation, Land Platforms lead the market with a value of $5.39 billion, holding a 53.93% share in 2023. Air Platforms are valued at $2.44 billion, while Naval Platforms and Unmanned Systems follow, valued at $1.04 billion and $1.13 billion respectively. The overall trend for all platforms is a steady increase, reflecting advancements in military operational requirements.

Military Sensors Market Analysis By End User

Global Military Sensors Market, By End-User (2023 - 2033)

The end-user market analysis emphasizes Defense Forces as the primary users of military sensors. This segment is projected to grow from $6.06 billion in 2023 to $13.66 billion by 2033. Homeland security applications also show robust growth from a current value of $2.84 billion to $6.40 billion in the same period.

Military Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Sensors Industry

Raytheon Technologies:

A major player in the defense segment, focusing on advanced sensor technology and providing integrated solutions for military applications.Northrop Grumman Corporation:

Specializes in advanced technologies, including sensors for military use, contributing to enhanced operations through innovative designs.Lockheed Martin:

A leader in defense and aerospace, offering a broad portfolio of military sensors, including radar and intelligence systems.Thales Group:

Provides a wide range of sensors and defense technology solutions, with a strong focus on aeronautics and defense electronics.BAE Systems:

Engages in designing and manufacturing sophisticated sensor systems for defense applications, emphasizing real-time situational awareness.We're grateful to work with incredible clients.

FAQs

What is the market size of military Sensors?

The military sensors market is set to reach approximately $10 billion by the year 2033, growing at a compound annual growth rate (CAGR) of 8.2%. This growth indicates a significant expansion, influenced by technological advancements and rising defense budgets globally.

What are the key market players or companies in the military Sensors industry?

Key players in the military sensors market include Raytheon Technologies, Lockheed Martin, Northrop Grumman, and Thales Group. These companies are leaders in innovation and comprise a significant portion of the market share due to their extensive product offerings and global reach.

What are the primary factors driving the growth in the military sensors industry?

The growth in the military sensors industry is driven by factors such as increasing defense budgets, technological advancements, a rise in geopolitical tensions, and the demand for advanced surveillance systems. These elements collectively promote the development and procurement of versatile military sensors.

Which region is the fastest Growing in the military sensors market?

The fastest-growing region in the military sensors market is North America, expected to expand from $3.33 billion in 2023 to $7.51 billion by 2033. This growth is attributed to high defense spending and cutting-edge technological innovations in military sensor systems.

Does ConsaInsights provide customized market report data for the military sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the military sensors industry. Clients can receive detailed analyses and insights that are directly relevant to their business requirements or regional focuses.

What deliverables can I expect from this military sensors market research project?

From the military sensors market research project, you can expect deliverables such as detailed market analysis, growth forecasts, competitive landscape assessments, and insights on regional trends. This comprehensive overview supports strategic decision-making and business planning.

What are the market trends of military sensors?

Current market trends in military sensors include the increased use of digital and hybrid technologies, emphasis on unmanned systems, and a shift toward advanced surveillance capabilities. These trends reflect a market adaptive to evolving threats and technological advancements.