Military Simulation And Training Market Report

Published Date: 31 January 2026 | Report Code: military-simulation-and-training

Military Simulation And Training Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the Military Simulation and Training market, covering insights from 2023 to 2033, including market trends, size, and forecasts. It aims to provide valuable data for stakeholders, industry practitioners, and policymakers to make informed decisions.

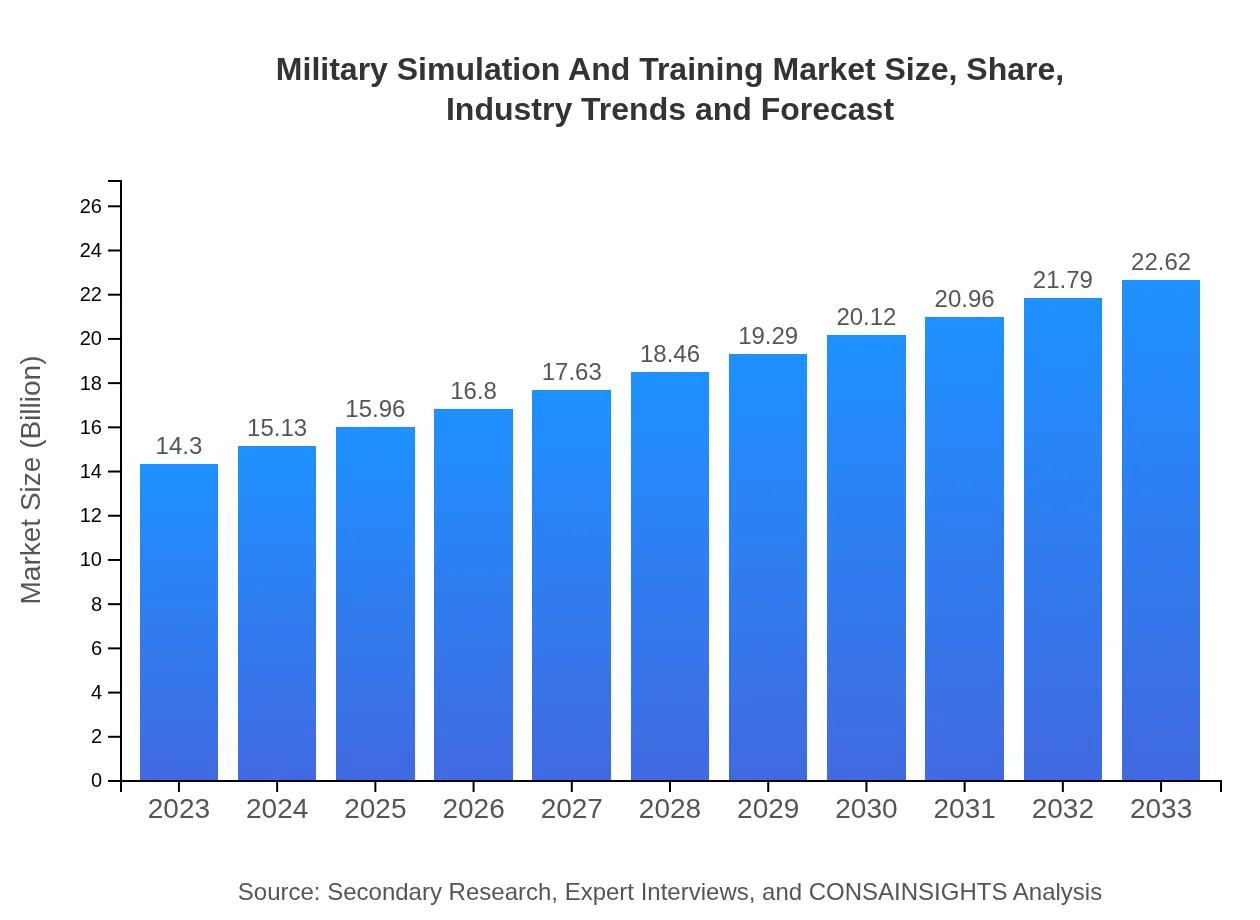

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.30 Billion |

| CAGR (2023-2033) | 4.6% |

| 2033 Market Size | $22.62 Billion |

| Top Companies | CAE Inc., Lockheed Martin Corporation, BAE Systems, Raytheon Technologies Corporation, Northrop Grumman Corporation |

| Last Modified Date | 31 January 2026 |

Military Simulation And Training Market Overview

Customize Military Simulation And Training Market Report market research report

- ✔ Get in-depth analysis of Military Simulation And Training market size, growth, and forecasts.

- ✔ Understand Military Simulation And Training's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Simulation And Training

What is the Market Size & CAGR of Military Simulation And Training market in 2023?

Military Simulation And Training Industry Analysis

Military Simulation And Training Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Simulation And Training Market Analysis Report by Region

Europe Military Simulation And Training Market Report:

The European market is estimated at USD 4.28 billion in 2023, with a forecasted growth to USD 6.77 billion by 2033, driven by collaborative defense initiatives and the enhanced focus on joint military exercises across NATO countries.Asia Pacific Military Simulation And Training Market Report:

In the Asia Pacific region, the Military Simulation and Training market is estimated at USD 2.84 billion in 2023, anticipating growth to USD 4.49 billion by 2033. Factors driving this increase include ongoing defense reforms and the strategic importance of military preparedness in the region.North America Military Simulation And Training Market Report:

North America remains the largest market, with projections rising from USD 4.93 billion in 2023 to USD 7.80 billion in 2033. This growth is attributed to significant defense budgets and advanced technological integration in training solutions.South America Military Simulation And Training Market Report:

South America presents a burgeoning market, with a size of USD 1.16 billion in 2023 projected to rise to USD 1.83 billion by 2033. Nations are increasingly investing in simulation technologies to modernize their militaries and enhance training.Middle East & Africa Military Simulation And Training Market Report:

In the Middle East and Africa, the market is expected to grow from USD 1.09 billion in 2023 to USD 1.72 billion by 2033, as countries in this region prioritize military training amid growing security threats.Tell us your focus area and get a customized research report.

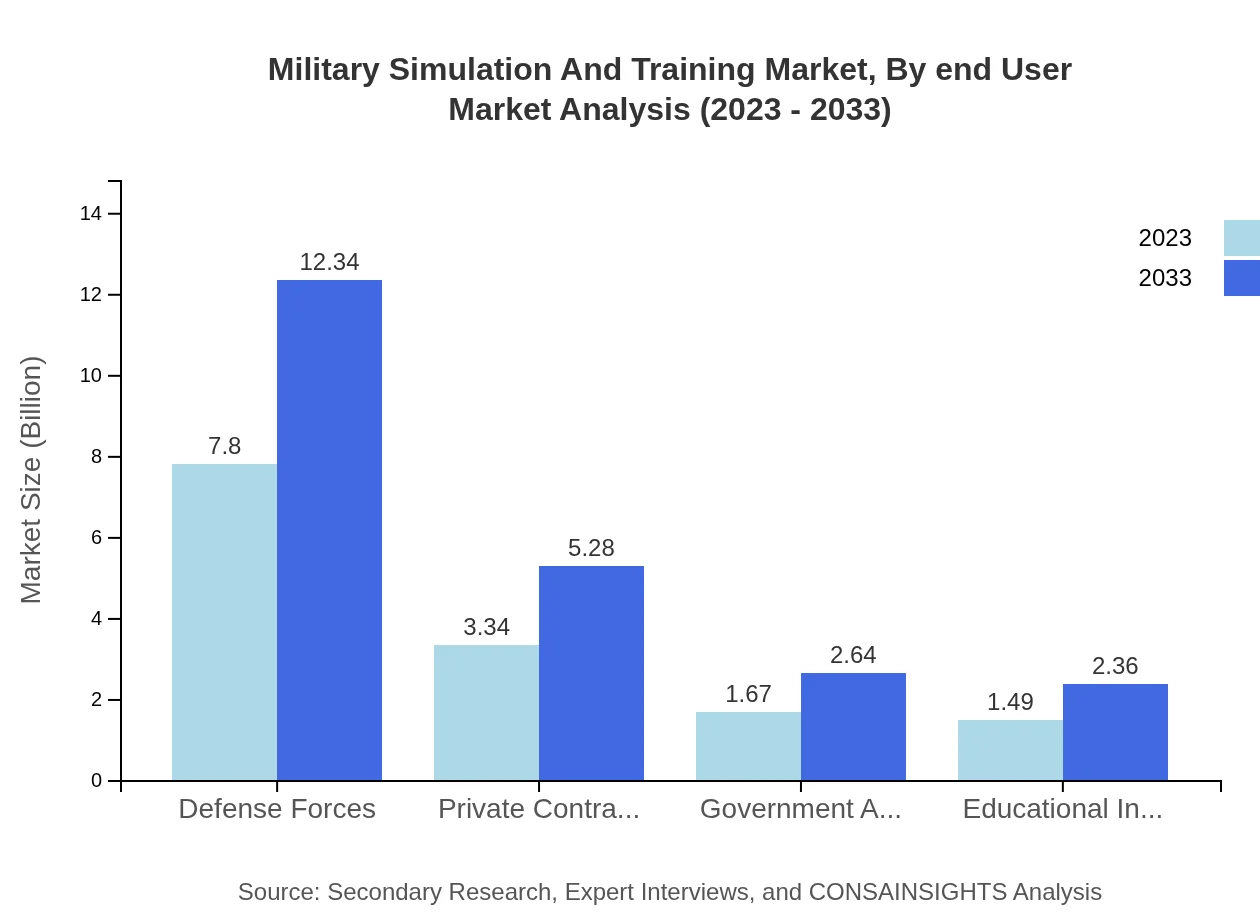

Military Simulation And Training Market Analysis By End User

The major end-users of the Military Simulation and Training market are Defense Forces, Private Contractors, Government Agencies, and Educational Institutions. Defense Forces dominate this segment, with a market size of USD 7.80 billion in 2023, expected to rise to USD 12.34 billion by 2033. Private Contractors and Government Agencies contribute significantly as well, reflecting the reliance on third-party training solutions and consultancy services.

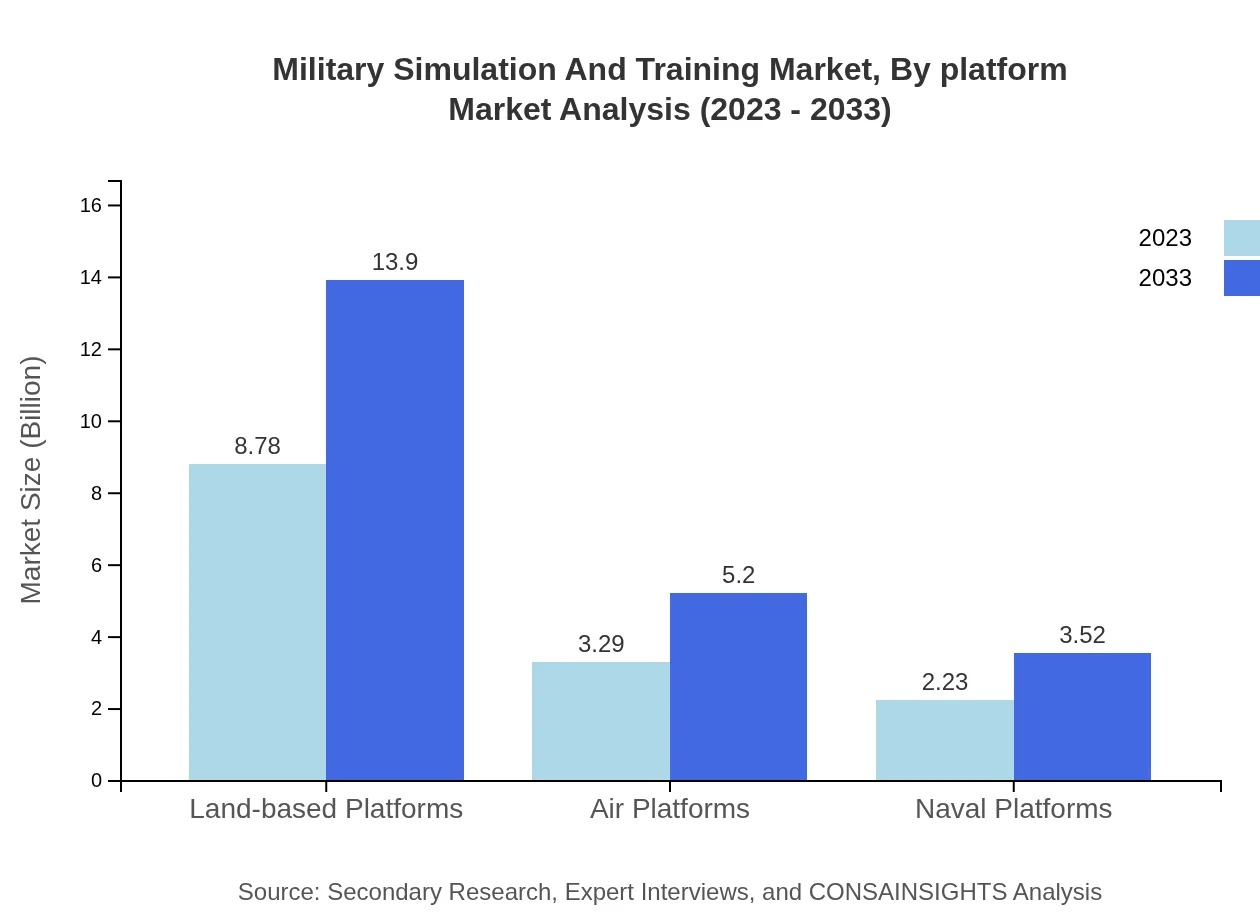

Military Simulation And Training Market Analysis By Platform

The platforms used in military simulation include Land-based, Air, Naval, and emerging virtual platforms. Land-based platforms have the largest share, with a size of USD 8.78 billion in 2023, anticipated to grow to USD 13.90 billion by 2033. This highlights the essential need for ground troops to engage in realistic training scenarios.

Military Simulation And Training Market Analysis By Application

Applications in the market include Combat Training, Mission Planning, Tactical Training, and Strategic Planning. Combat Training leads with a market size of USD 7.80 billion in 2023, representing a significant portion due to the pressing requirements for effective troop readiness in combat scenarios.

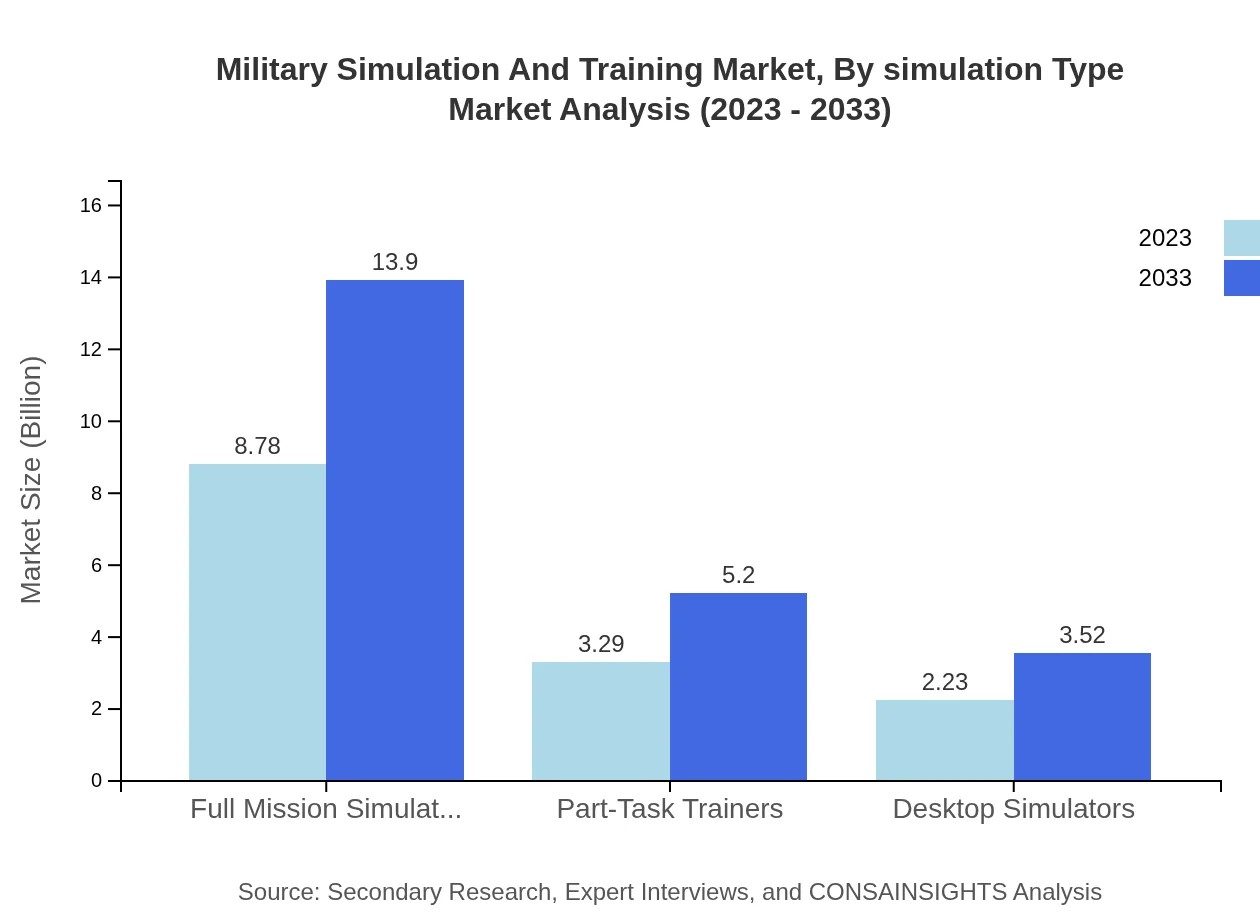

Military Simulation And Training Market Analysis By Simulation Type

Simulation Types cover Full Mission Simulators, Part-Task Trainers, and Desktop Simulators. Full Mission Simulators dominate, expected to grow from USD 8.78 billion in 2023 to USD 13.90 billion in 2033. This type of training allows for comprehensive mission context, providing deeper insights and enhanced learning outcomes.

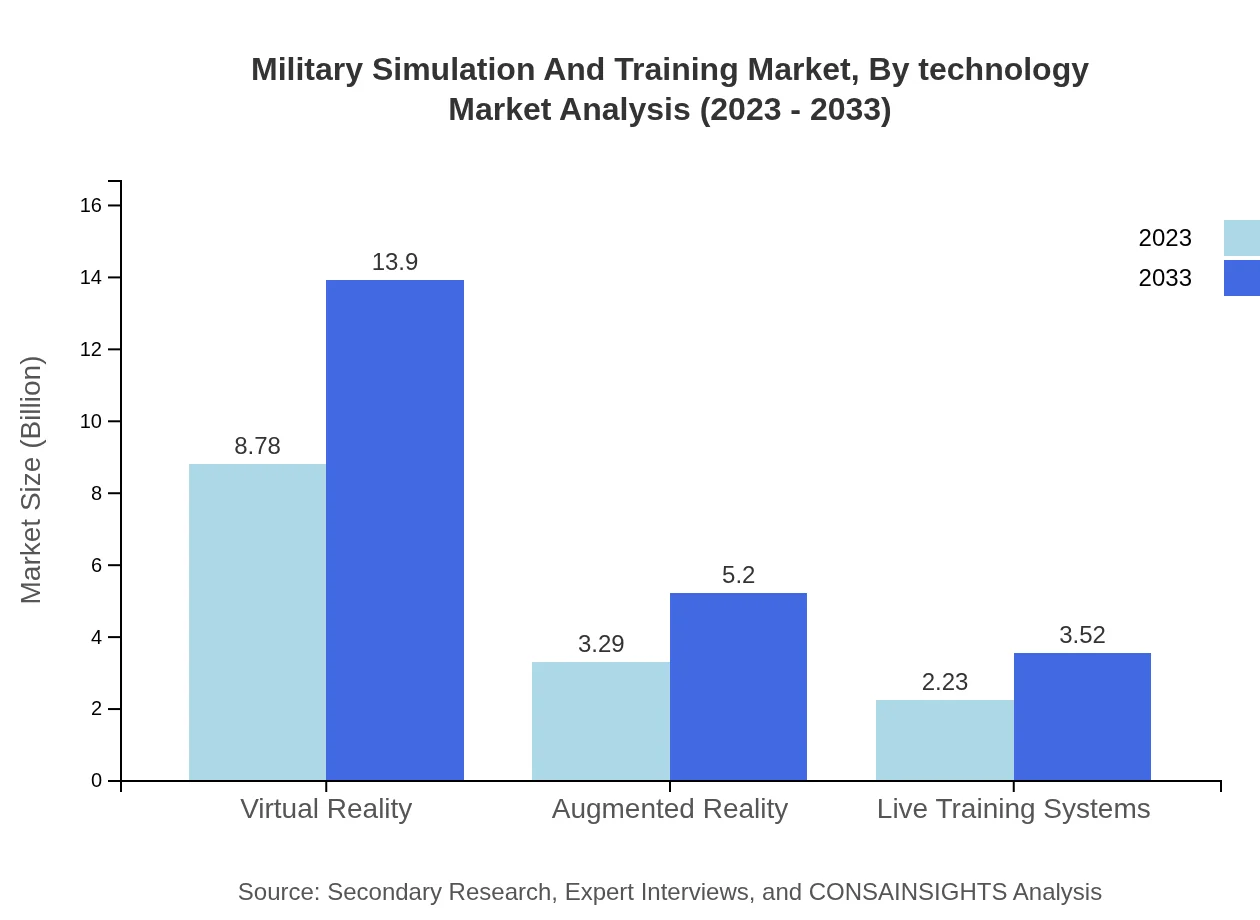

Military Simulation And Training Market Analysis By Technology

Technologies utilized include Virtual Reality, Augmented Reality, and Live Training Systems. Virtual Reality leads the market with a size of USD 8.78 billion in 2023, showcasing its potent ability to create immersive training environments that develop critical thinking and problem-solving skills.

Military Simulation And Training Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Simulation And Training Industry

CAE Inc.:

A leading provider of simulation and modeling technologies for civil aviation and defense and security markets, offering comprehensive training solutions tailored to the needs of military organizations.Lockheed Martin Corporation:

An innovation-focused global aerospace defense and security company, known for developing state-of-the-art simulation technologies to enhance military training efficacy.BAE Systems:

A multinational defense, security, and aerospace company that designs and manufactures advanced training systems to optimize military operations and readiness.Raytheon Technologies Corporation:

An aerospace and defense company providing advanced simulation technologies and integrated training solutions, essential for preparing armed forces for complex operations.Northrop Grumman Corporation:

Recognized for delivering innovative defense technology solutions, including cutting-edge simulation systems that enhance training for military personnel.We're grateful to work with incredible clients.

FAQs

What is the market size of military Simulation And Training?

The military simulation and training market size is estimated to be $14.3 billion in 2023, with a compound annual growth rate (CAGR) of 4.6% projected through 2033.

What are the key market players or companies in this military Simulation And Training industry?

Key players in the military simulation and training industry include top defense contractors like Lockheed Martin, Northrop Grumman, and Raytheon Technologies, as well as specialized simulation software companies focused on advanced training technologies.

What are the primary factors driving the growth in the military Simulation And Training industry?

Key growth drivers for the military simulation and training industry include increased defense budgets, technological advancements in simulation tools, and the rising need for realistic training environments to prepare military personnel for complex scenarios.

Which region is the fastest Growing in the military Simulation And Training?

The fastest-growing region in the military simulation and training market is North America, projected to expand from $4.93 billion in 2023 to $7.80 billion in 2033, driven by robust defense spending and technological innovation.

Does ConsaInsights provide customized market report data for the military Simulation And Training industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the military simulation and training industry, providing detailed insights and analysis based on unique client requirements.

What deliverables can I expect from this military Simulation And Training market research project?

Expect comprehensive deliverables including an executive summary, market analysis reports, trend forecasts, regional insights, and segmentation analyses specific to the military simulation and training industry.

What are the market trends of military Simulation And Training?

Trends in the military simulation and training market include the growing use of virtual and augmented reality technologies, increased integration of AI for enhanced training simulations, and a shift towards live training methodologies for realism.