Millimeter Wave Technology Market Report

Published Date: 22 January 2026 | Report Code: millimeter-wave-technology

Millimeter Wave Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Millimeter Wave Technology market, highlighting key insights, industry trends, and growth forecasts from 2023 to 2033, including regional performances and competitive landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

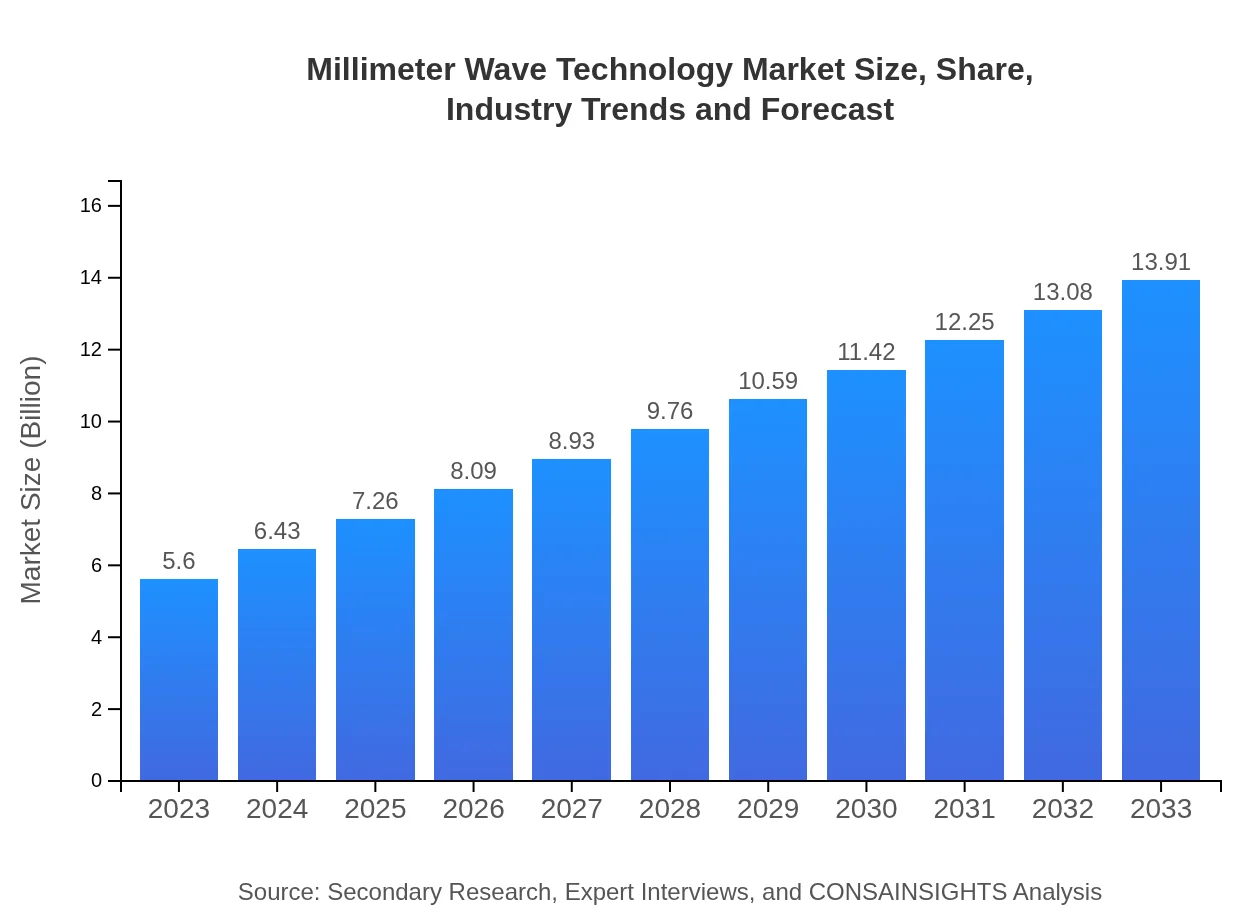

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Keysight Technologies, Rohde & Schwarz, Nokia , Verizon Communications |

| Last Modified Date | 22 January 2026 |

Millimeter Wave Technology Market Overview

Customize Millimeter Wave Technology Market Report market research report

- ✔ Get in-depth analysis of Millimeter Wave Technology market size, growth, and forecasts.

- ✔ Understand Millimeter Wave Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Millimeter Wave Technology

What is the Market Size & CAGR of Millimeter Wave Technology market in 2023?

Millimeter Wave Technology Industry Analysis

Millimeter Wave Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Millimeter Wave Technology Market Analysis Report by Region

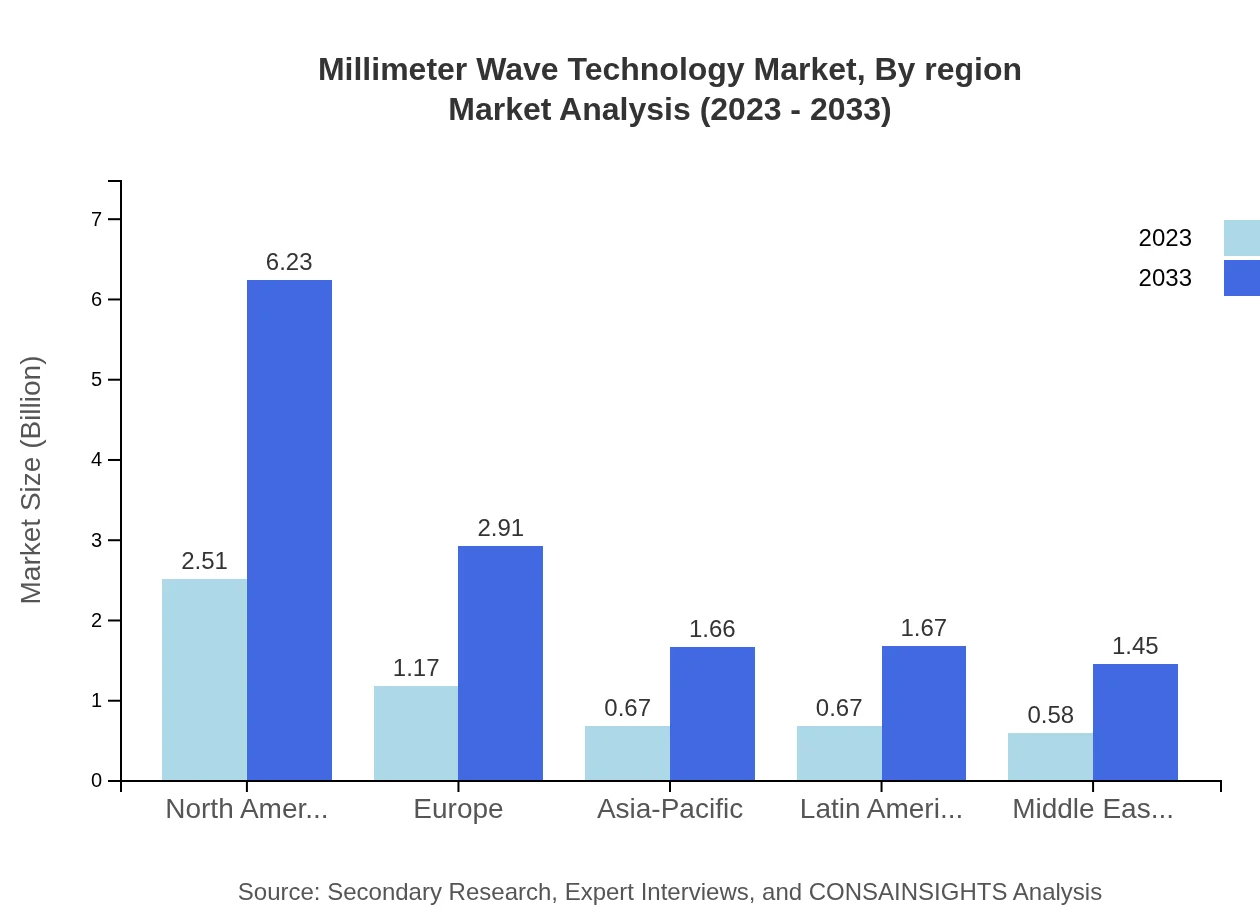

Europe Millimeter Wave Technology Market Report:

Europe’s Millimeter Wave Technology market, valued at $1.96 billion in 2023, is projected to grow to $4.87 billion by 2033. Much of this growth is driven by extensive research in telecommunication technologies and government initiatives to improve network infrastructures.Asia Pacific Millimeter Wave Technology Market Report:

In the Asia-Pacific region, the Millimeter Wave Technology market is projected to grow from $1.06 billion in 2023 to $2.63 billion by 2033. The region's rapid urbanization and increasing investments in ICT infrastructure are driving factors, alongside the rise of 5G networks.North America Millimeter Wave Technology Market Report:

North America leads the market standing at $1.81 billion in 2023, anticipated to reach $4.49 billion by 2033. The region benefits from early adoption of new technologies, particularly in telecommunications and automotive sectors deploying 5G and autonomous technologies.South America Millimeter Wave Technology Market Report:

South America shows potential growth, with the market expected to increase from $0.26 billion in 2023 to $0.64 billion by 2033. Initiatives to enhance connectivity and the development of smart cities could spur demand for millimeter wave technology.Middle East & Africa Millimeter Wave Technology Market Report:

The Middle East and Africa's market is witnessing growth from $0.51 billion in 2023 to $1.28 billion by 2033, as countries prioritize advancements in technology sectors, alongside increasing investments in 5G and IoT applications.Tell us your focus area and get a customized research report.

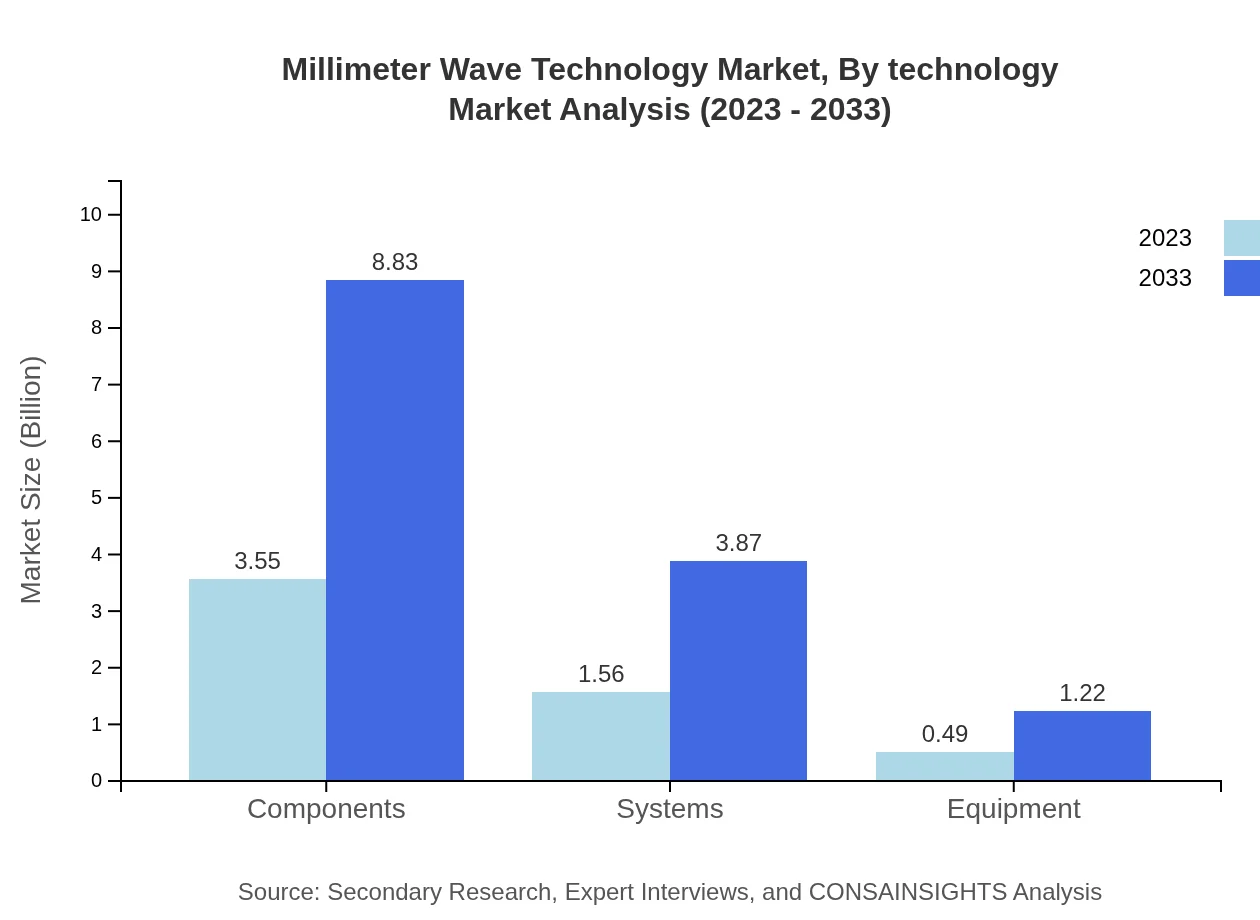

Millimeter Wave Technology Market Analysis By Technology

Millimeter Wave Technology market is segmented into technologies utilized, including communication systems and automotive applications. The technology segment forms a crucial part of the growth narrative, focusing on enhancing bandwidth and reducing latency.

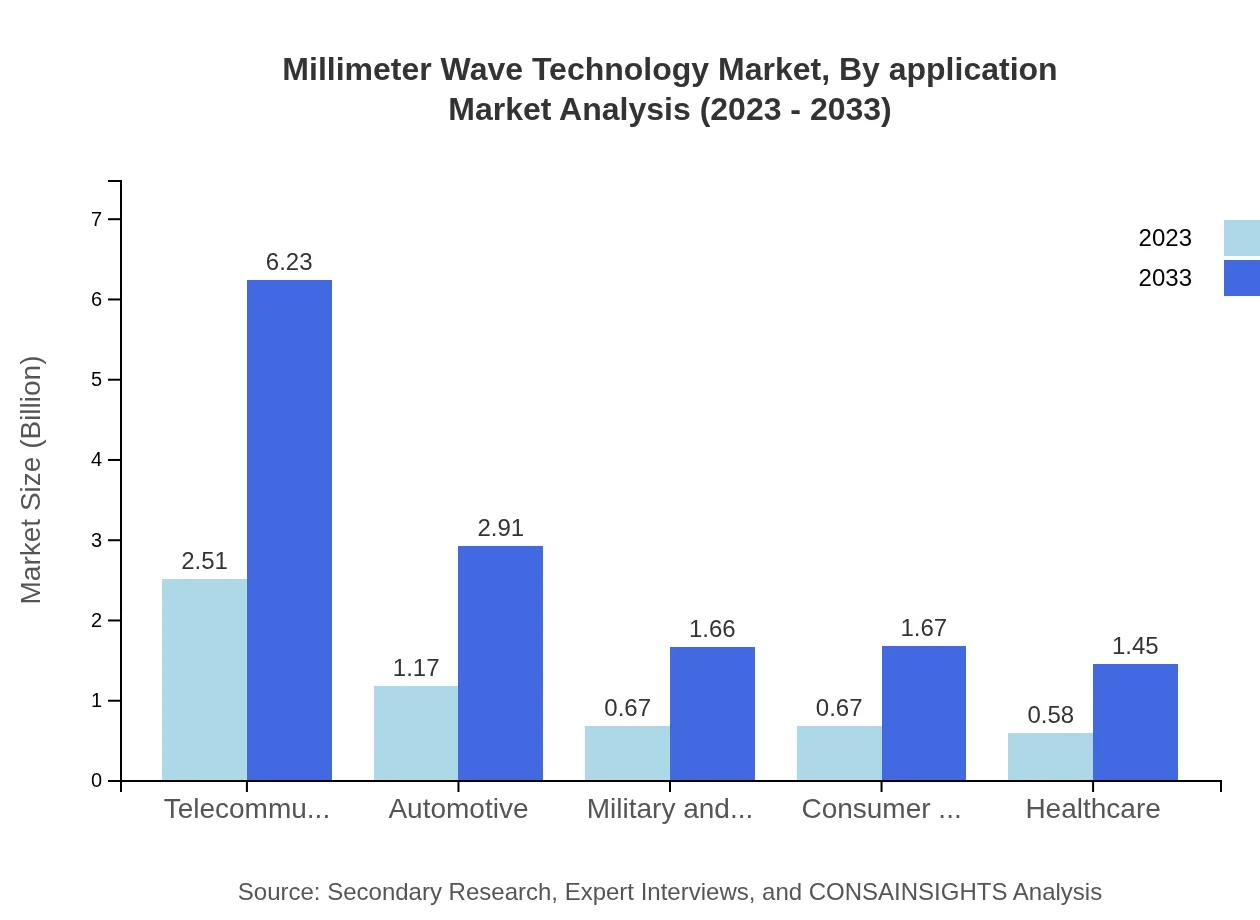

Millimeter Wave Technology Market Analysis By Application

Applications of millimeter wave technology encompass telecommunications, military communications, automotive radar systems, and healthcare imaging technologies, each representing a vital area of demand.

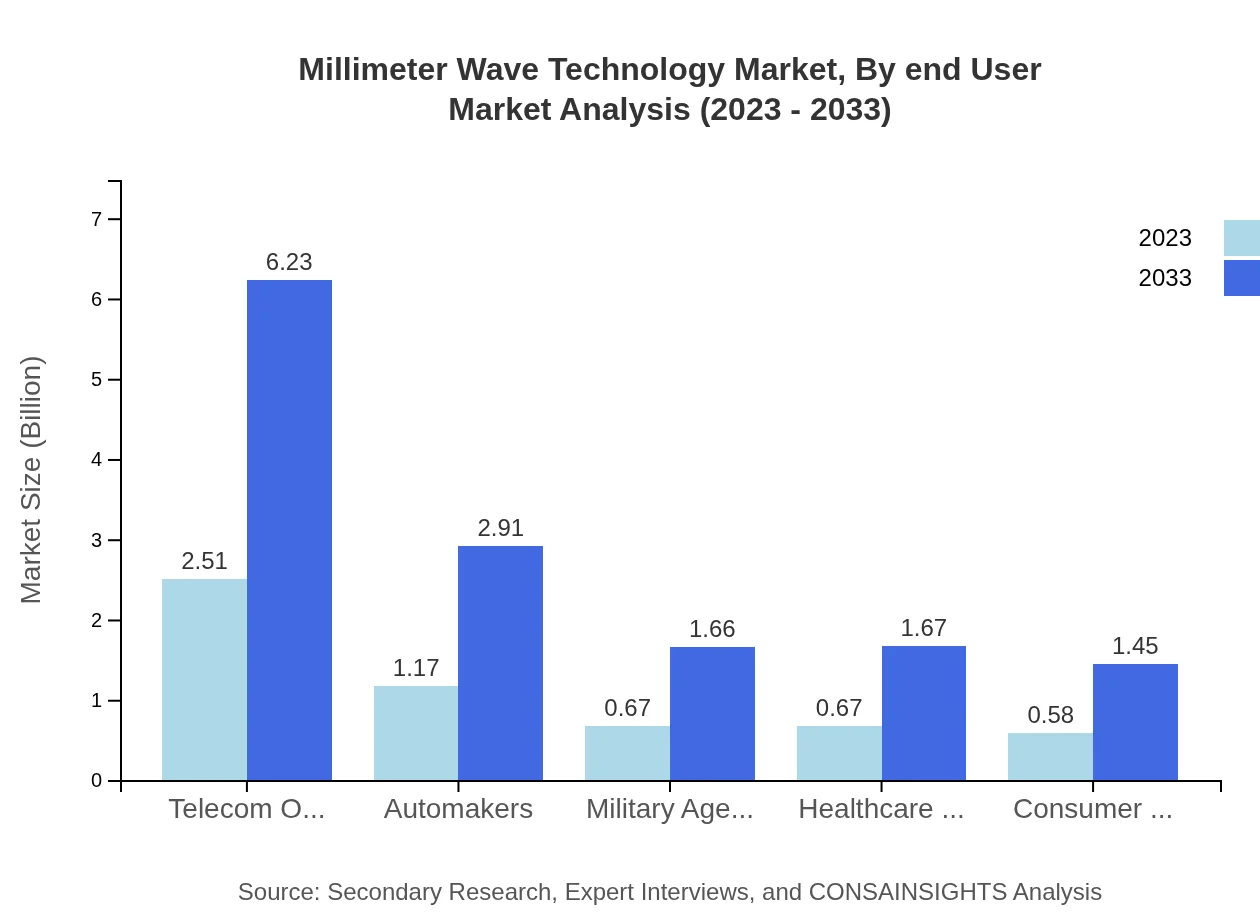

Millimeter Wave Technology Market Analysis By End User

The end-user segment includes telecom operators, automakers, military agencies, and healthcare providers. Dependencies on quick and reliable data transmission across these fields highlight the increasing relevance of millimeter wave technology.

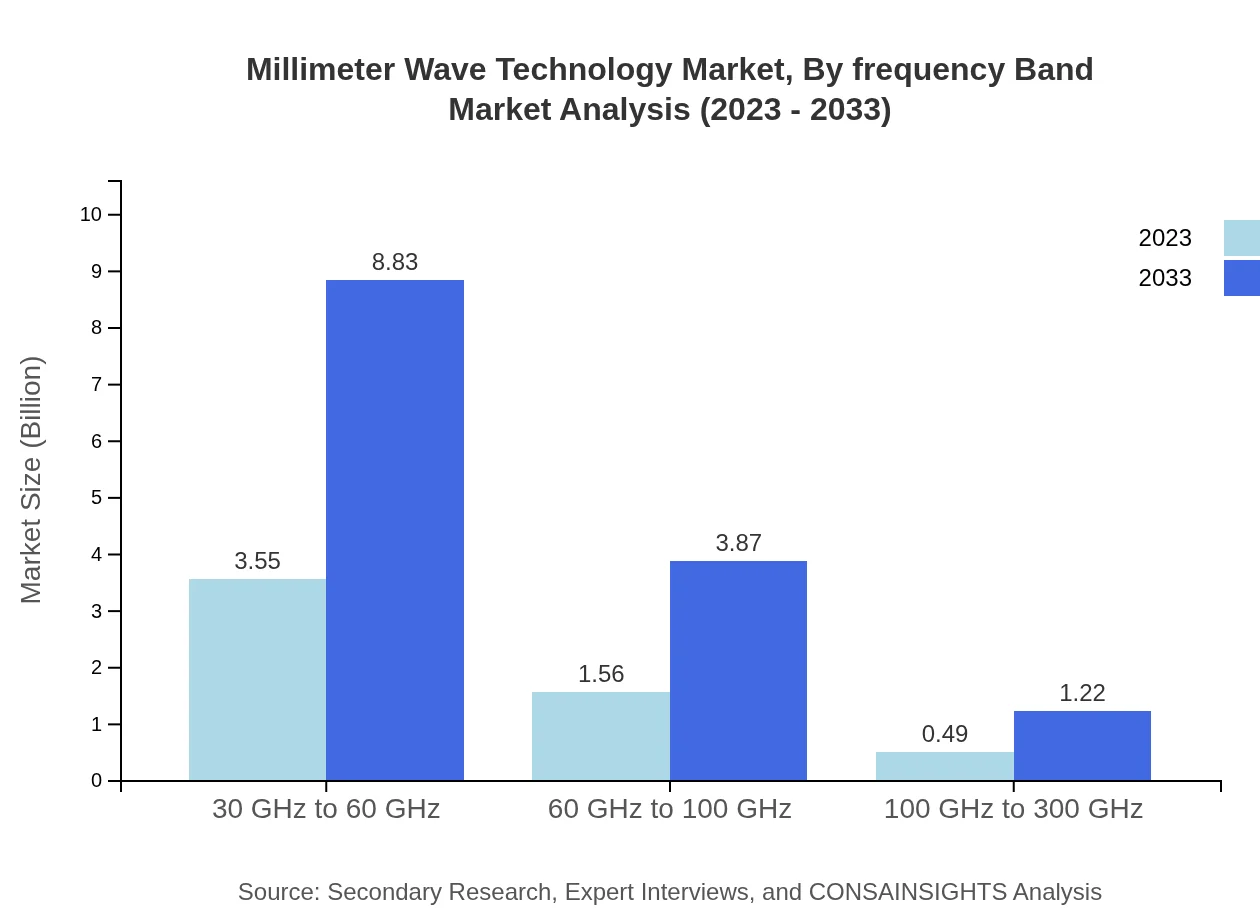

Millimeter Wave Technology Market Analysis By Frequency Band

The frequency band segment covers 30 GHz to 60 GHz, 60 GHz to 100 GHz, and 100 GHz to 300 GHz, where 30 GHz to 60 GHz dominates the market, accounting for a significant share due to its extensive applications in telecommunications.

Millimeter Wave Technology Market Analysis By Region

Market performance is expected to vary by region, with North America holding the largest share, followed closely by Europe and Asia-Pacific. Growth across these regions will largely depend on infrastructure development and technological advancements.

Millimeter Wave Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Millimeter Wave Technology Industry

Keysight Technologies:

Keysight Technologies specializes in electronic design automation and test and measurement solutions, particularly for high-frequency applications, crucial to millimeter wave technology.Rohde & Schwarz:

Rohde & Schwarz is a global leader in communications and electronic test solutions, providing critical components and systems that enhance millimeter wave technology deployment.Nokia :

Nokia develops and provides advanced telecommunications equipment and services with significant contributions to the development of millimeter wave technologies for 5G networks.Verizon Communications:

Verizon Communications integrates millimeter wave technology into its 5G offerings, pushing advances in telecommunications and supporting extensive applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Millimeter Wave Technology?

The global market size for Millimeter Wave Technology is projected at $5.6 billion in 2023, with a compound annual growth rate (CAGR) of 9.2%. This indicates robust growth potential as applications in telecommunications and automotive expand.

What are the key market players or companies in this Millimeter Wave Technology industry?

Key market players in the Millimeter Wave Technology industry include prominent telecommunications companies, automakers, and defense contractors. These entities are actively investing in advanced millimeter-wave applications, significantly enhancing network speeds and system functionalities.

What are the primary factors driving the growth in the Millimeter Wave Technology industry?

The growth in the Millimeter Wave Technology industry is driven by increasing demand for high-speed data in telecommunications, advancements in 5G networks, and the expanding use of autonomous vehicles. These trends necessitate enhanced bandwidth and low-latency communication.

Which region is the fastest Growing in the Millimeter Wave Technology?

The fastest-growing region in the Millimeter Wave Technology market is Europe, anticipated to grow from $1.96 billion in 2023 to $4.87 billion by 2033. Other notable regions include North America and Asia Pacific, reflecting strong market expansion.

Does ConsaInsights provide customized market report data for the Millimeter Wave Technology industry?

Yes, ConsaInsights offers customized market report data tailored to the Millimeter Wave Technology industry. This includes segment-specific insights, comprehensive regional analyses, and forecasts to assist businesses in strategic decision-making.

What deliverables can I expect from this Millimeter Wave Technology market research project?

From the Millimeter Wave Technology market research project, you can expect detailed market analysis reports, growth forecasts, competitive landscape evaluations, and actionable insights tailored to industry needs, aiding strategic planning and investment.

What are the market trends of Millimeter Wave Technology?

Current trends in Millimeter Wave Technology include the surge in 5G network deployments, increased investments in autonomous vehicle technologies, and the integration of millimeter-wave systems in consumer electronics, fostering higher data rates and connectivity.