Mine Ventilation Market Report

Published Date: 22 January 2026 | Report Code: mine-ventilation

Mine Ventilation Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Mine Ventilation market, including insights on market size, segmentation, industry trends, and forecasts from 2023 to 2033, as well as key players shaping the landscape.

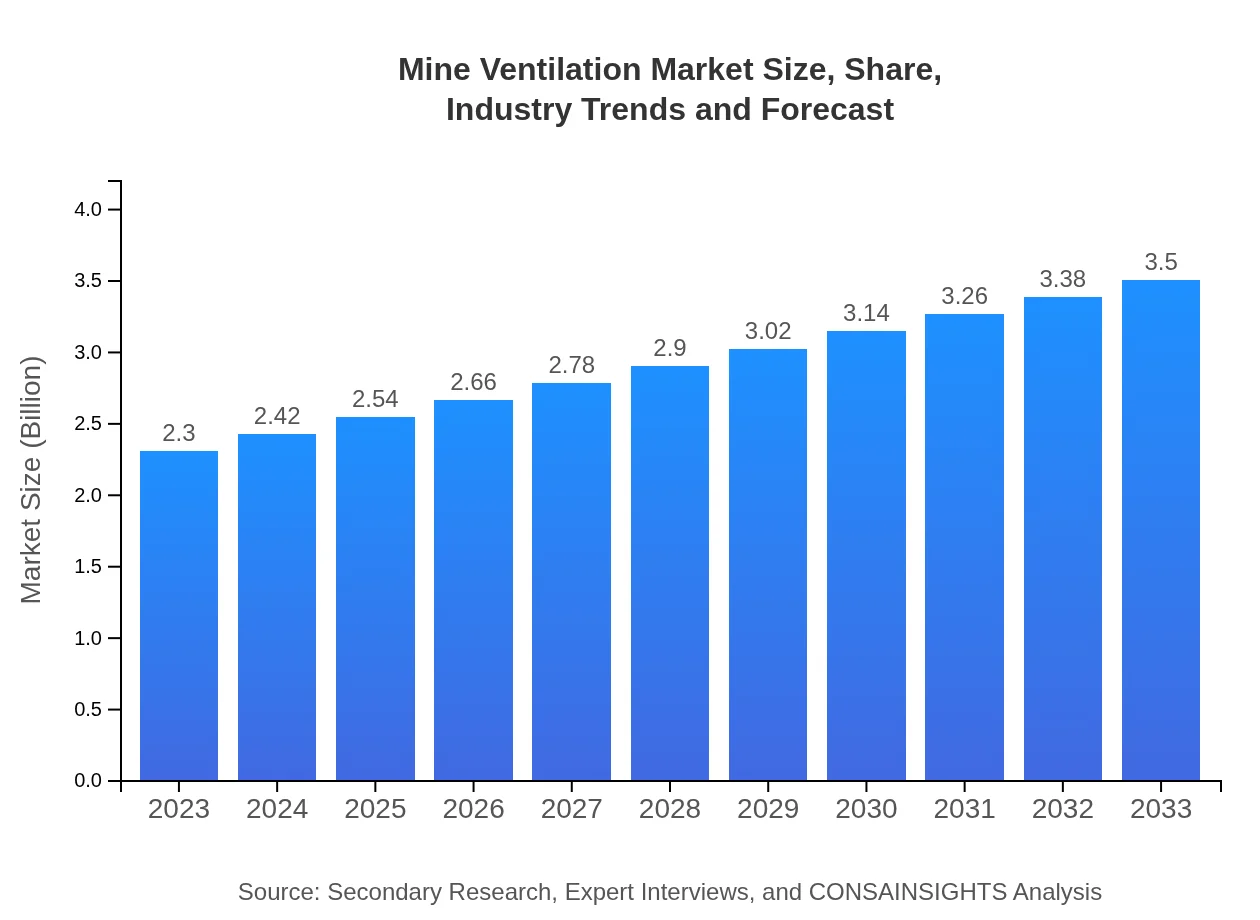

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $3.50 Billion |

| Top Companies | Howden Group Limited, Mecair, Ventilation and Air Quality Solutions, Inc. |

| Last Modified Date | 22 January 2026 |

Mine Ventilation Market Overview

Customize Mine Ventilation Market Report market research report

- ✔ Get in-depth analysis of Mine Ventilation market size, growth, and forecasts.

- ✔ Understand Mine Ventilation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mine Ventilation

What is the Market Size & CAGR of Mine Ventilation market in 2023?

Mine Ventilation Industry Analysis

Mine Ventilation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mine Ventilation Market Analysis Report by Region

Europe Mine Ventilation Market Report:

In Europe, the market will expand from $0.67 billion in 2023 to $1.01 billion by 2033, driven by a focus on sustainable mining practices and regulatory compliance.Asia Pacific Mine Ventilation Market Report:

The Asia Pacific Mine Ventilation market is projected to grow from $0.43 billion in 2023 to $0.65 billion by 2033, driven by increasing mining activities in countries like China and Australia and the adoption of advanced ventilation technologies.North America Mine Ventilation Market Report:

The North American market is anticipated to grow from $0.88 billion in 2023 to $1.33 billion by 2033, primarily due to stringent safety regulations and technological advancements in ventilation systems.South America Mine Ventilation Market Report:

In South America, the Mine Ventilation market is expected to increase from $0.20 billion in 2023 to $0.30 billion by 2033. Factors such as resource demand and investments in mining infrastructure are fuelling this growth.Middle East & Africa Mine Ventilation Market Report:

The Mine Ventilation market in the Middle East and Africa region is expected to move from $0.13 billion in 2023 to $0.20 billion by 2033. Growth in this region is supported by rising investments in mining projects and the need for enhanced safety measures.Tell us your focus area and get a customized research report.

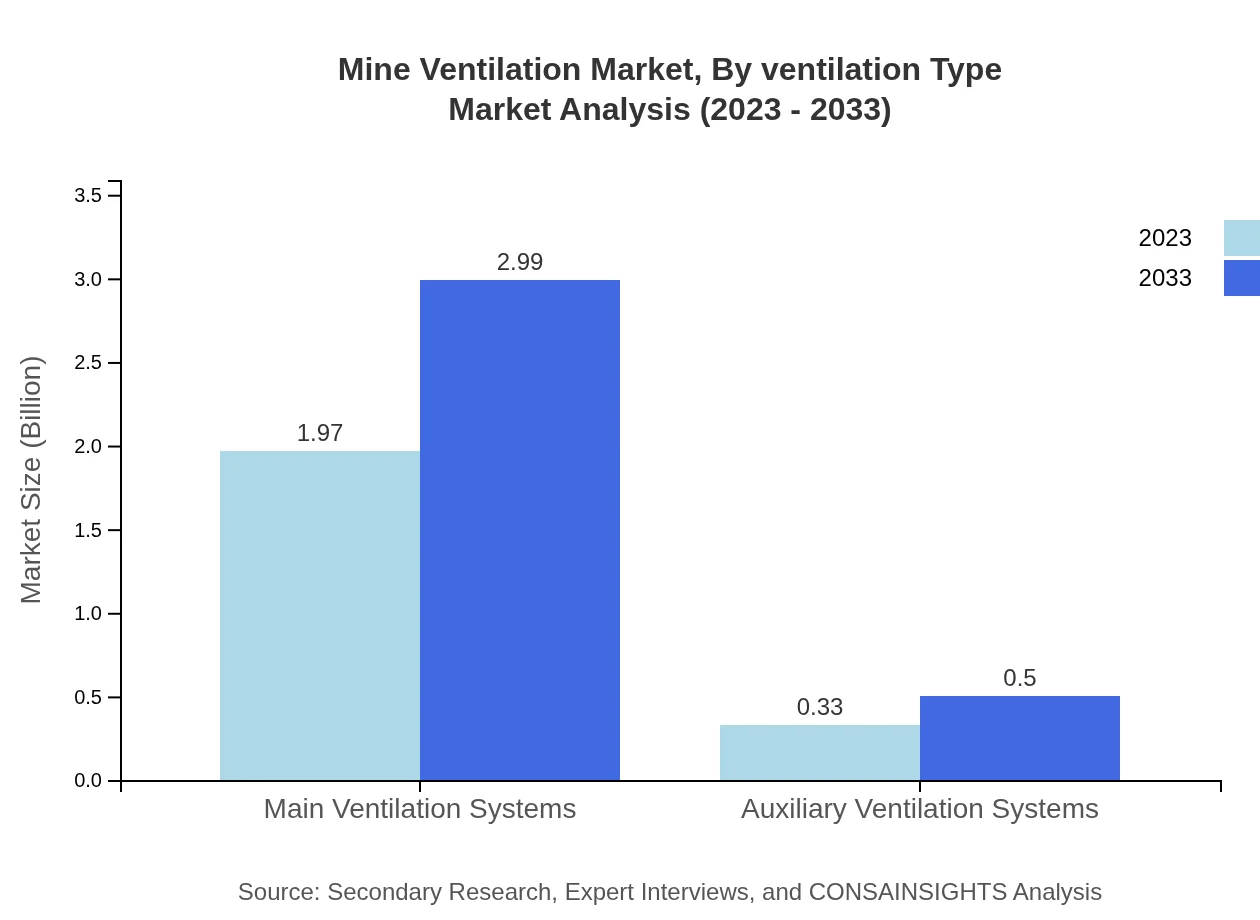

Mine Ventilation Market Analysis By Ventilation Type

The ventilation type segment is crucial for determining the operational efficiency of mining activities. Main ventilation systems account for a significant portion of the market, with a size of $1.97 billion in 2023 and projected to grow to $2.99 billion by 2033. Auxiliary systems, although smaller, also contribute significantly, with a size of $0.33 billion in 2023 and expected to increase to $0.50 billion by 2033.

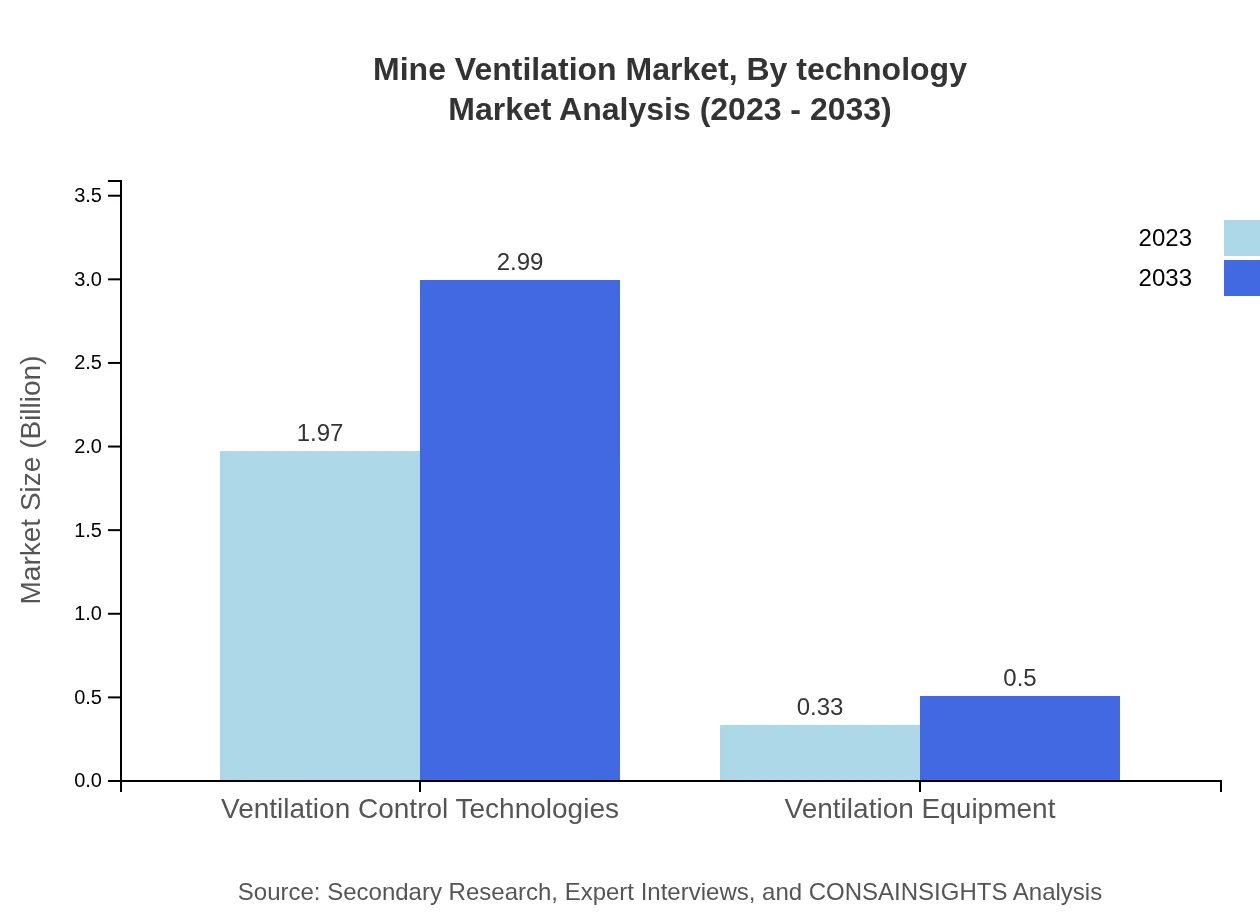

Mine Ventilation Market Analysis By Technology

The technology segment illustrates the advancement of both ventilation control technologies and ventilation equipment. Control technologies lead the segment with a market size of $1.97 billion in 2023, reaching $2.99 billion by 2033, while ventilation equipment grows from $0.33 billion to $0.50 billion in the same period. This segment reflects continuous innovation and the pursuit of improved efficiency.

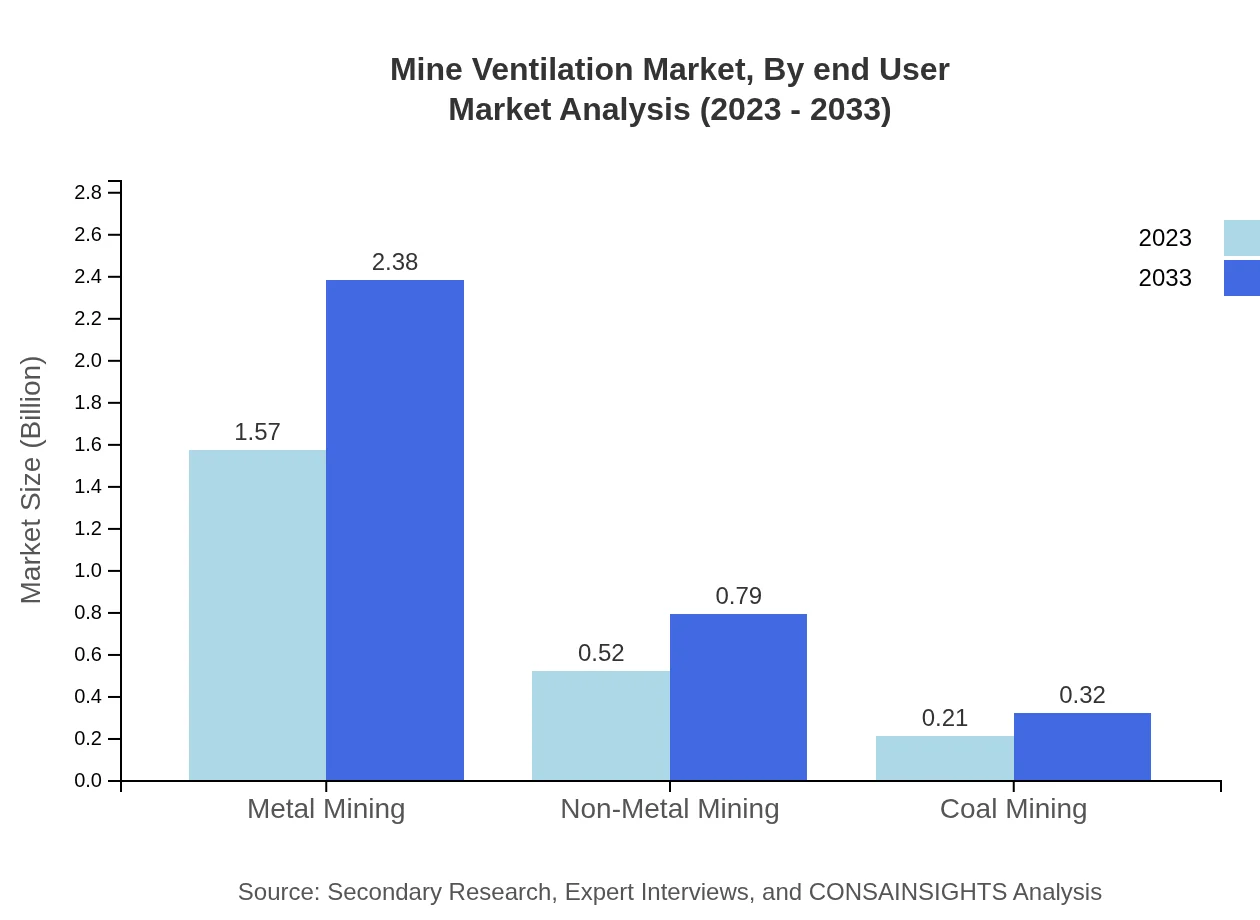

Mine Ventilation Market Analysis By End User

In the end-user segment, metal mining dominates with a market size of $1.57 billion in 2023, projected to reach $2.38 billion by 2033, capturing 68.13% of the market share. Non-metal mining holds $0.52 billion, growing to $0.79 billion (22.7% market share), while coal mining, though smaller, is expected to rise from $0.21 billion to $0.32 billion, maintaining a share of 9.17%.

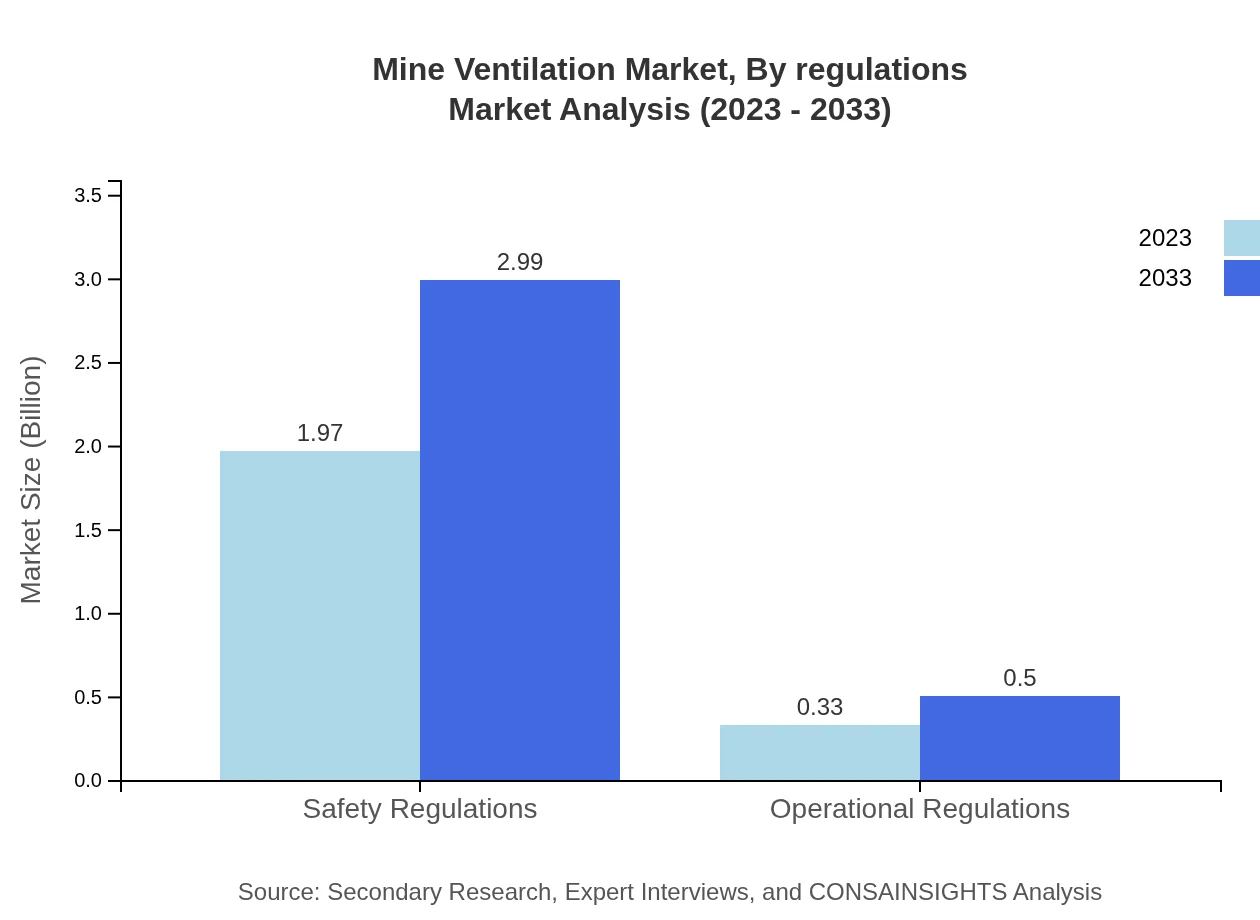

Mine Ventilation Market Analysis By Regulations

Regulations play a vital role in shaping the Mine Ventilation market, ensuring compliance and safety. Safety regulations dominate the segment with a size of $1.97 billion in 2023, expected to grow to $2.99 billion by 2033, constituting 85.56% market share. Operational regulations, while smaller at $0.33 billion, show consistent growth to $0.50 billion (14.44% market share) over the projected period.

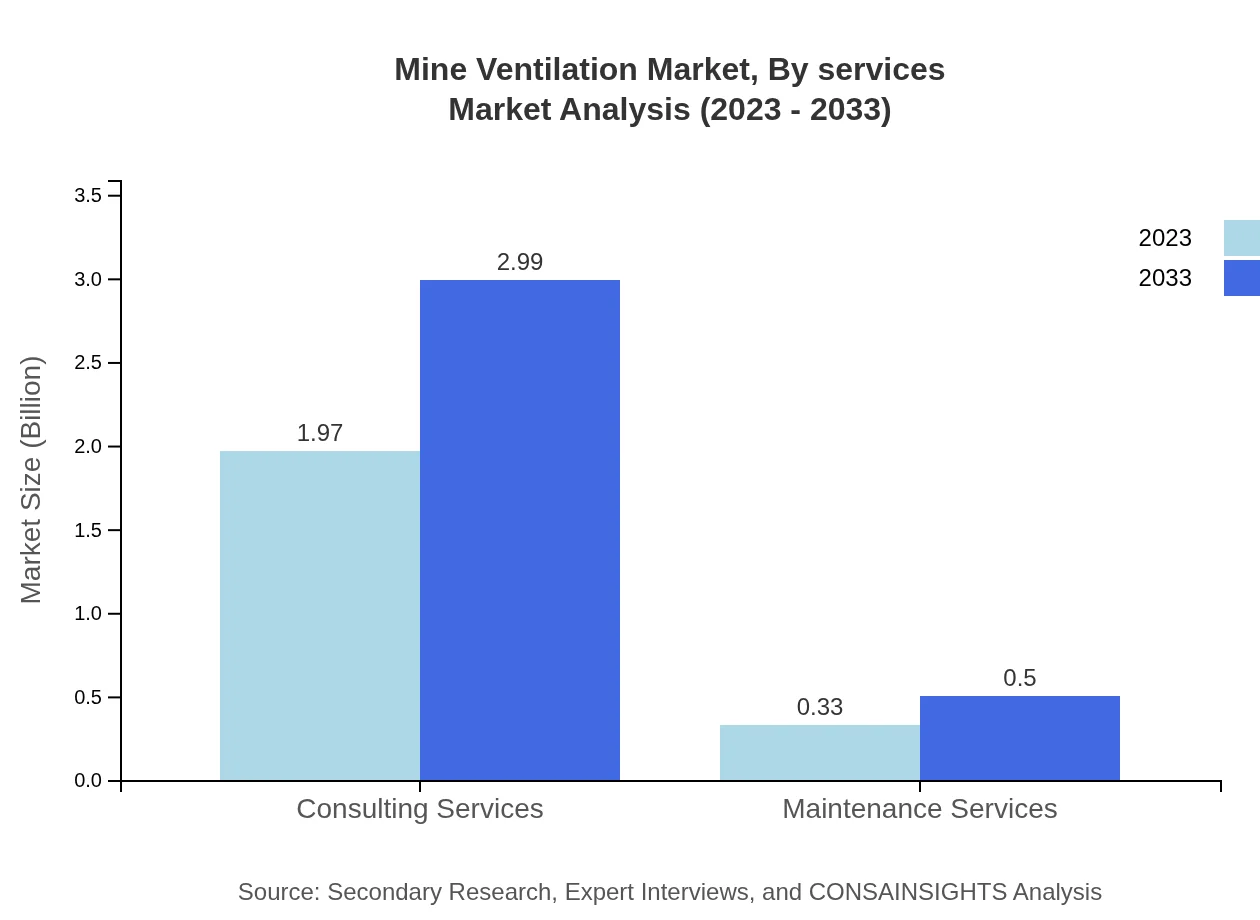

Mine Ventilation Market Analysis By Services

The services segment, including consulting and maintenance services, is essential for operational success. Consulting services lead with a size of $1.97 billion in 2023 and a projected reach of $2.99 billion by 2033 (85.56% market share). Maintenance services, while representing a smaller share, will grow from $0.33 billion to $0.50 billion (14.44% market share), emphasizing the need for ongoing support in ventilation systems.

Mine Ventilation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mine Ventilation Industry

Howden Group Limited:

Howden is a leading provider of air and gas handling solutions, specializing in system design, manufacturing, and installation of ventilation systems tailored for the mining industry.Mecair:

Mecair is known for its innovative filtration solutions and dust control systems, offering a range of products and services that enhance ventilation safety and efficiency in mining operations.Ventilation and Air Quality Solutions, Inc.:

This company specializes in providing advanced air quality solutions, focusing on ventilation control technologies that optimize underground mining safety.We're grateful to work with incredible clients.

FAQs

What is the market size of Mine-Ventilation?

The global mine ventilation market is currently valued at $2.3 billion, with a projected CAGR of 4.2%. By 2033, the market is expected to expand significantly, driven by increased demand for safe mining practices.

What are the key market players or companies in this Mine-Ventilation industry?

Key players in the mine ventilation industry include prominent companies specializing in ventilation solutions, equipment manufacturers and consulting firms. Their contributions are crucial for advancing technology and maintaining safety standards across mining operations.

What are the primary factors driving the growth in the Mine-Ventilation industry?

The growth of the mine ventilation industry is driven by increasing mining activities, stringent safety regulations, and the need for improved air quality management in mines. Technological advancements and emerging markets also contribute significantly.

Which region is the fastest Growing in the Mine-Ventilation?

The North America region is the fastest-growing market for mine ventilation, projected to grow from $0.88 billion in 2023 to $1.33 billion by 2033. Europe and Asia-Pacific also exhibit strong growth potential, with increasing investments.

Does ConsaInsights provide customized market report data for the Mine-Ventilation industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the mine ventilation industry. This includes in-depth analysis, tailored insights, and strategic recommendations based on current market trends.

What deliverables can I expect from this Mine-Ventilation market research project?

Expected deliverables from the mine ventilation market research include comprehensive market analysis reports, trend identification, regional insights, and strategic recommendations, enabling informed decision-making and strategy development.

What are the market trends of Mine-Ventilation?

Current trends in the mine ventilation industry include increasing automation, integration of IoT for monitoring, eco-friendly ventilation solutions, and innovations in ventilation equipment, all aimed at enhancing safety and operational efficiency.