Minimally Invasive Surgery Devices Market Report

Published Date: 31 January 2026 | Report Code: minimally-invasive-surgery-devices

Minimally Invasive Surgery Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Minimally Invasive Surgery Devices market, covering trends, segments, and forecasts from 2023 to 2033. It includes detailed analysis of regional markets and key players shaping the industry.

| Metric | Value |

|---|---|

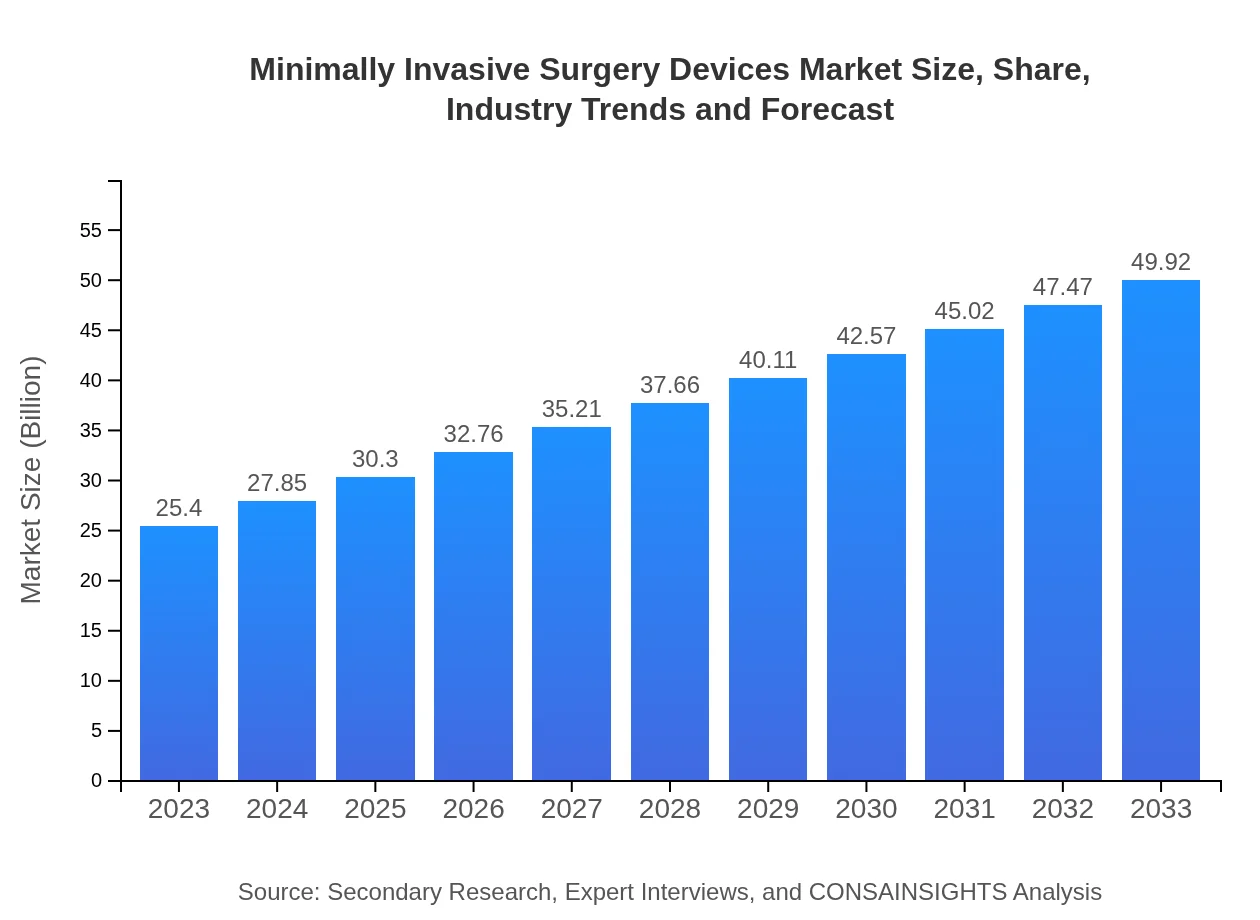

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $49.92 Billion |

| Top Companies | Medtronic , Johnson & Johnson, Stryker Corporation, Boston Scientific, Karl Storz |

| Last Modified Date | 31 January 2026 |

Minimally Invasive Surgery Devices Market Overview

Customize Minimally Invasive Surgery Devices Market Report market research report

- ✔ Get in-depth analysis of Minimally Invasive Surgery Devices market size, growth, and forecasts.

- ✔ Understand Minimally Invasive Surgery Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Minimally Invasive Surgery Devices

What is the Market Size & CAGR of Minimally Invasive Surgery Devices market in 2023?

Minimally Invasive Surgery Devices Industry Analysis

Minimally Invasive Surgery Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Minimally Invasive Surgery Devices Market Analysis Report by Region

Europe Minimally Invasive Surgery Devices Market Report:

In Europe, the market value stands at $8.19 billion in 2023, projected to increase to $16.10 billion by 2033, highlighting a CAGR of 7.2%. Growth in Europe is facilitated by an aging population, rising incidences of chronic diseases, and demand for improved surgical outcomes.Asia Pacific Minimally Invasive Surgery Devices Market Report:

The Asia Pacific region in 2023 has a market value of approximately $4.73 billion, anticipated to reach $9.30 billion by 2033, at a CAGR of around 7.2%. This growth is driven by increasing healthcare expenditure, a rise in chronic disease prevalence, and advancements in surgical technologies.North America Minimally Invasive Surgery Devices Market Report:

North America, a leader in surgical innovation, has a market size of $8.77 billion in 2023, expected to soar to $17.23 billion by 2033, showcasing a robust CAGR of 7.5%. Driving forces include high healthcare spending, sophisticated technological advancements, and an increasing demand for outpatient surgical procedures.South America Minimally Invasive Surgery Devices Market Report:

In South America, the MIS market is valued at $2.50 billion in 2023, projected to nearly double to $4.92 billion by 2033. Growing healthcare investments and improved access to innovative medical technologies are significant growth factors in this region.Middle East & Africa Minimally Invasive Surgery Devices Market Report:

The Middle East and Africa market is valued at $1.20 billion in 2023, with a projected growth to $2.37 billion by 2033. Factors such as improving healthcare infrastructure and a pressing need for advanced surgical solutions significantly contribute to this growth.Tell us your focus area and get a customized research report.

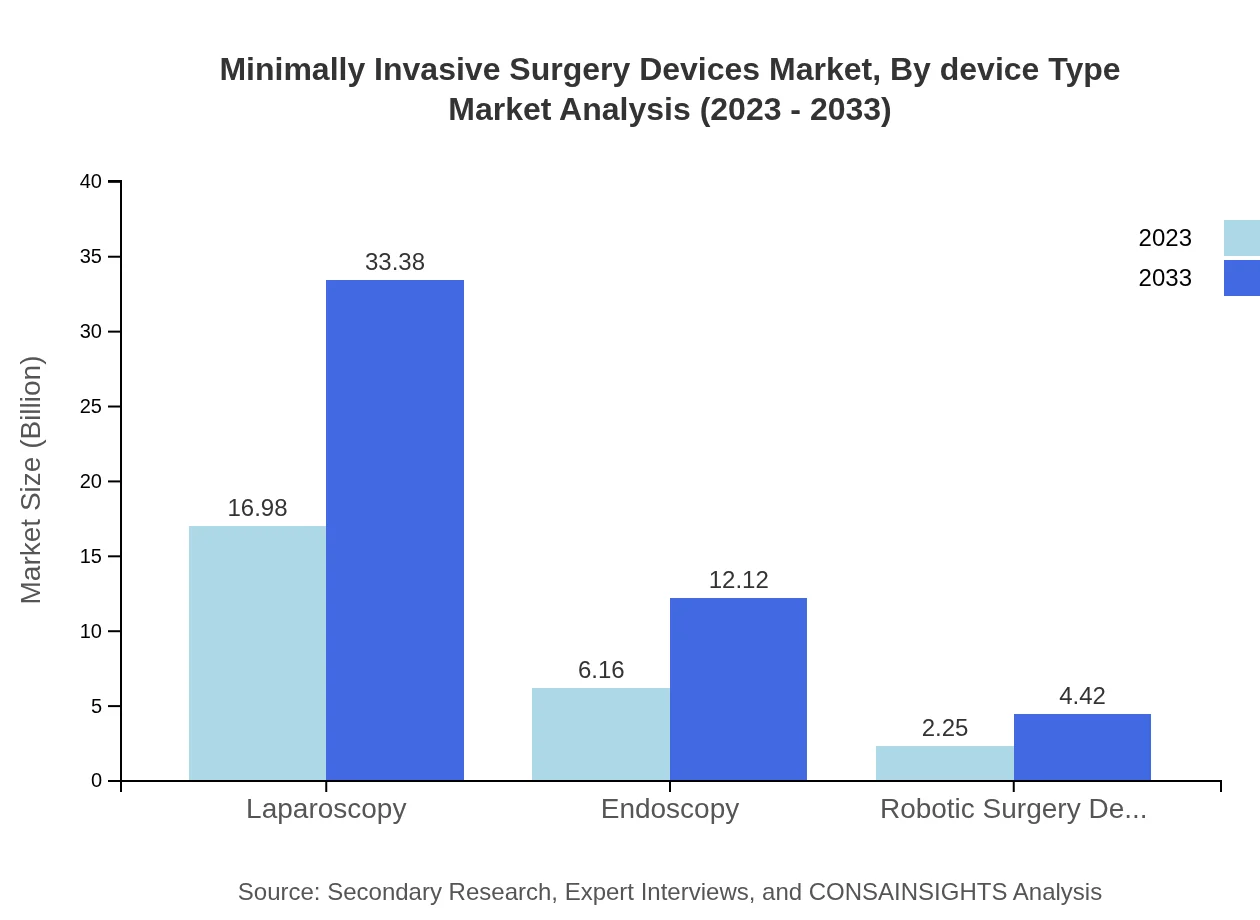

Minimally Invasive Surgery Devices Market Analysis By Device Type

Minimally Invasive Surgery Devices are categorized into various device types including Laparoscopic instruments, Endoscopic devices, Robotic surgery devices, etc. Laparoscopy devices dominate the market, accounting for approximately 66.87% share in 2023, with significant growth expected to continue in subsequent years.

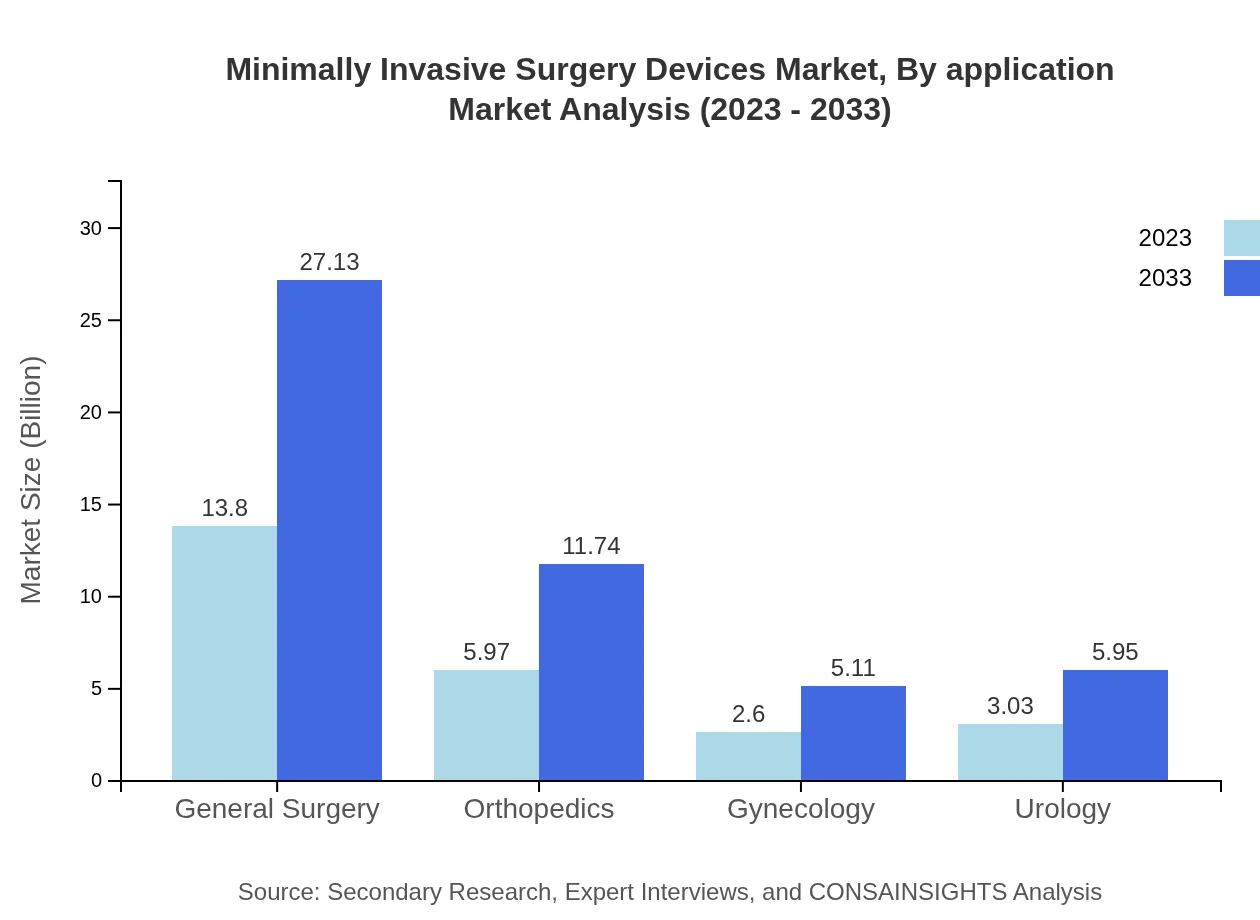

Minimally Invasive Surgery Devices Market Analysis By Application

Key application segments include General Surgery, Orthopedics, Gynecology, Urology, and others. General Surgery holds the largest share at approximately 54.34% in 2023, with significant growth rates anticipated in the Orthopedics and Urology sectors as well.

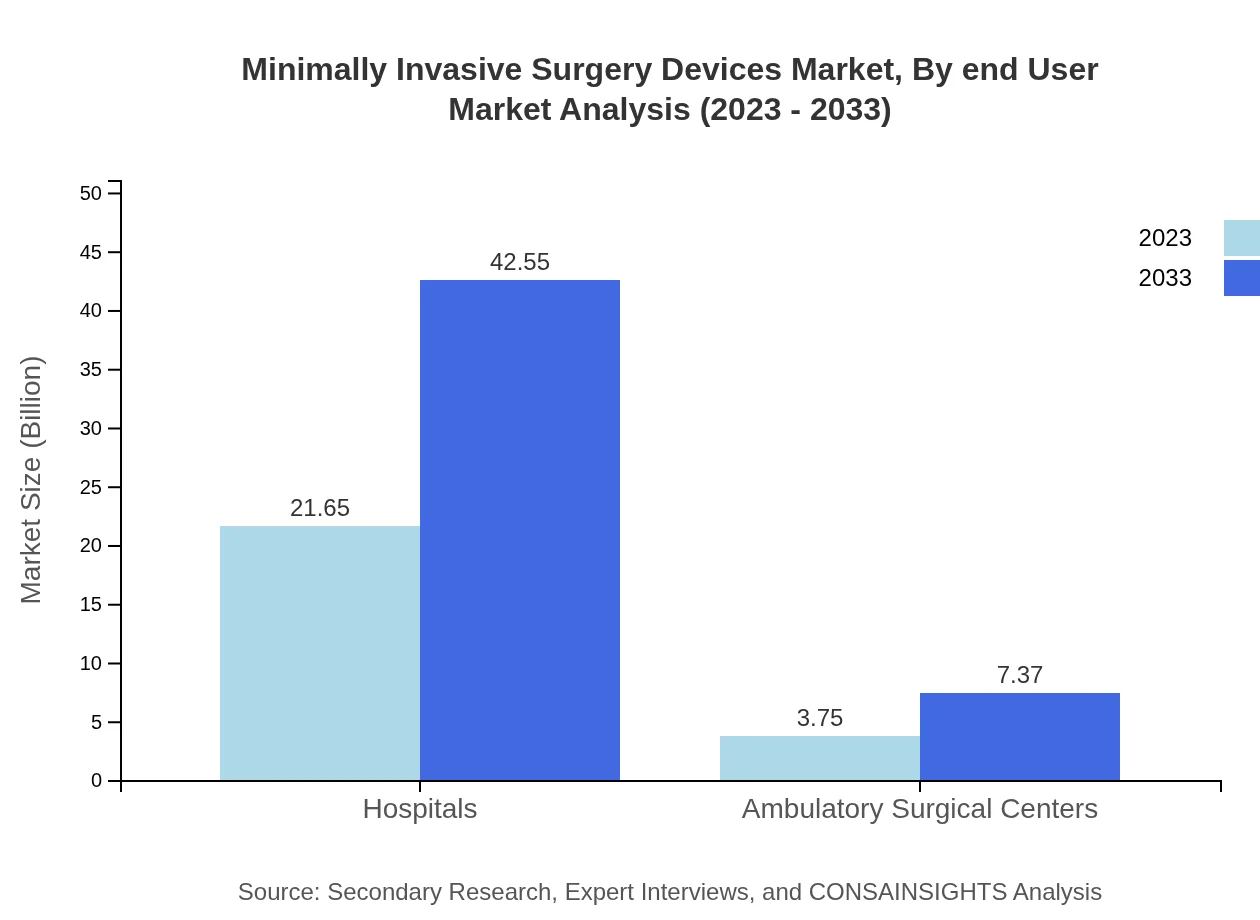

Minimally Invasive Surgery Devices Market Analysis By End User

The market is segmented by end-users such as Hospitals and Ambulatory Surgical Centers. Hospitals dominated the market, holding an impressive 85.24% share in 2023, while Ambulatory Surgical Centers are on a notable rise owing to cost-effective surgical procedures and shorter patient stay durations.

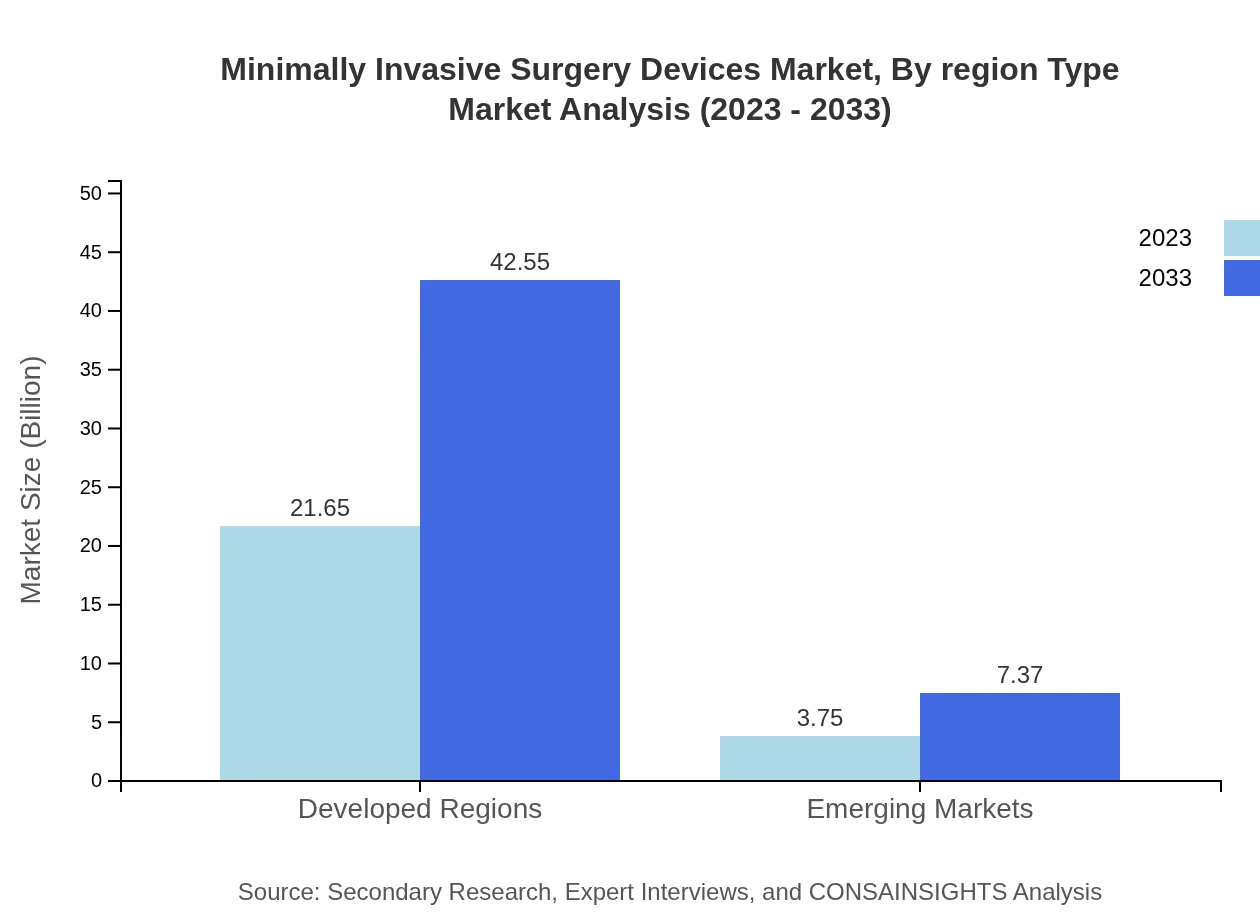

Minimally Invasive Surgery Devices Market Analysis By Region Type

The region type analysis highlights developed regions such as North America and Europe retaining the leading market share, while emerging markets in Asia-Pacific and Latin America showcase impressive growth potential driven by improving healthcare infrastructure and increasing access to technologies.

Minimally Invasive Surgery Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Minimally Invasive Surgery Devices Industry

Medtronic :

Medtronic is a leading global player specializing in medical devices, including advanced surgical tools and robotic-assisted systems that enhance minimally invasive procedures.Johnson & Johnson:

With a strong presence in the surgical devices market, Johnson & Johnson continues to innovate minimally invasive techniques, providing surgeons with cutting-edge technology.Stryker Corporation:

Stryker is known for its innovative orthopedic and surgical systems, significantly contributing to the advancements in minimally invasive surgery techniques.Boston Scientific:

Boston Scientific focuses on the development of medical devices that support minimally invasive procedures, particularly in the fields of cardiology and endoscopy.Karl Storz:

Specializing in endoscopy and minimally invasive surgical solutions, Karl Storz is a key contributor to the market with its high-quality imaging technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of minimally invasive surgery devices?

The minimally invasive surgery devices market is projected to reach $25.4 billion by 2033, growing at a CAGR of 6.8%. It reflects a significant increase from current levels, driven by advancements in surgical technology and increasing adoption rates.

What are the key market players or companies in this minimally invasive surgery devices industry?

Key players in the minimally invasive surgery devices market include Medtronic, Johnson & Johnson, Stryker, and Boston Scientific. These companies are pivotal in driving innovation and expanding product offerings to meet the rising demand.

What are the primary factors driving the growth in the minimally invasive surgery devices industry?

Growth in the minimally invasive surgery devices market is driven by factors such as technological advancements, increasing prevalence of chronic diseases, patient preference for minimally invasive procedures, and the expansion of healthcare infrastructure.

Which region is the fastest Growing in the minimally invasive surgery devices?

Asia Pacific is the fastest-growing region in the minimally invasive surgery devices market, expected to grow from $4.73 billion in 2023 to $9.30 billion by 2033. This growth is fueled by rising healthcare investments and improving surgical facilities.

Does ConsaInsights provide customized market report data for the minimally invasive surgery devices industry?

Yes, Consainsights provides customized market report data tailored to the specific needs of clients in the minimally invasive surgery devices industry. This includes detailed analysis and insights to help make informed decisions.

What deliverables can I expect from this minimally invasive surgery devices market research project?

Deliverables from the minimally invasive surgery devices market research project include comprehensive market analysis, competitive landscape overview, growth forecasts, segment-specific insights, and personalized recommendations based on the latest trends.

What are the market trends of minimally invasive surgery devices?

Trends in the minimally invasive surgery devices market include increased adoption of robotic surgical systems, enhanced imaging technologies, rising preference for outpatient procedures, and ongoing research into novel surgical techniques.