Mining Laboratory Automation Market Report

Published Date: 22 January 2026 | Report Code: mining-laboratory-automation

Mining Laboratory Automation Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Mining Laboratory Automation market from 2023-2033, providing insights into market size, trends, technological advancements, and regional analysis. It aims to equip stakeholders with data-driven insights for strategic decision-making.

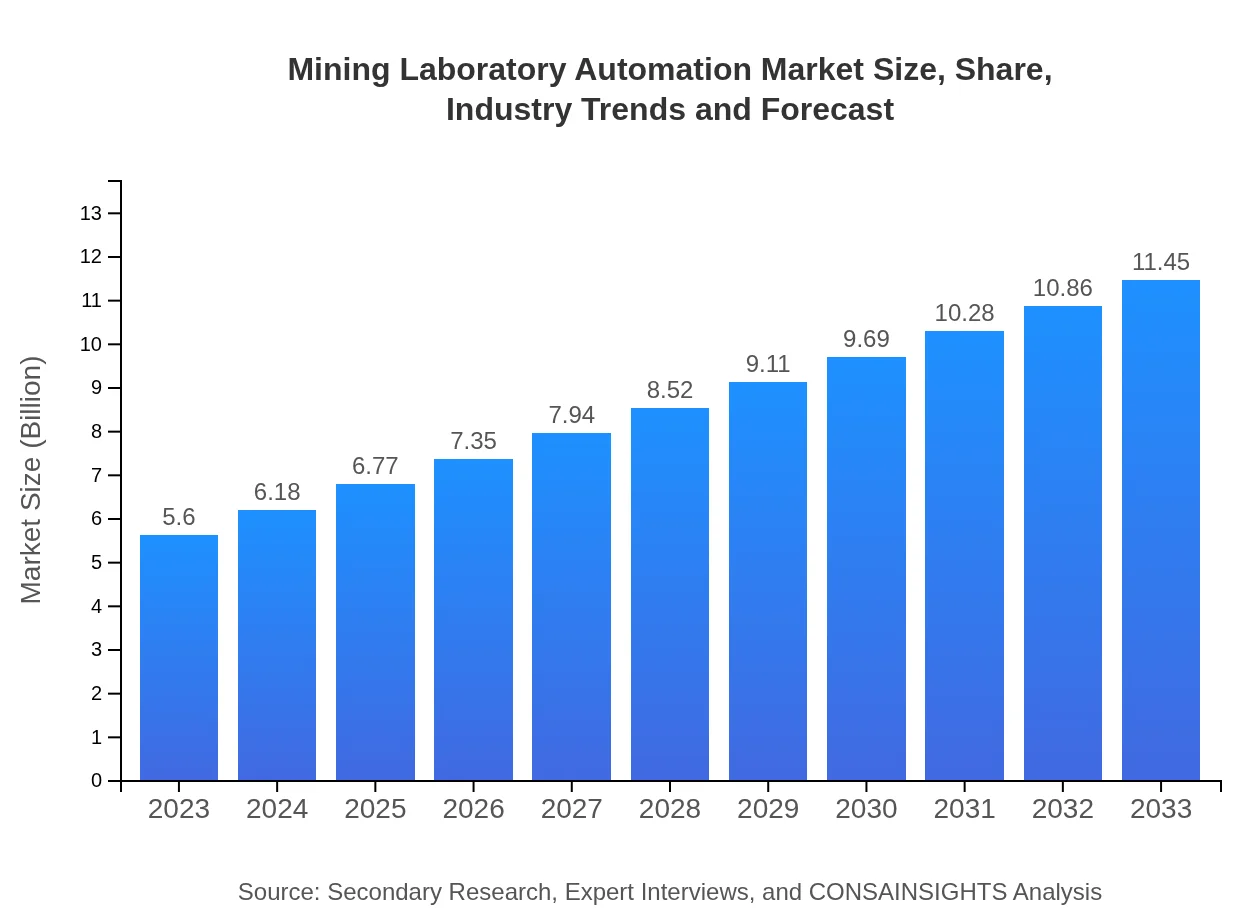

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Thermo Fisher Scientific, Agilent Technologies, Siemens AG, ABB Ltd., Hitachi High-Tech Corporation |

| Last Modified Date | 22 January 2026 |

Mining Laboratory Automation Market Overview

Customize Mining Laboratory Automation Market Report market research report

- ✔ Get in-depth analysis of Mining Laboratory Automation market size, growth, and forecasts.

- ✔ Understand Mining Laboratory Automation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mining Laboratory Automation

What is the Market Size & CAGR of Mining Laboratory Automation market in 2023?

Mining Laboratory Automation Industry Analysis

Mining Laboratory Automation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mining Laboratory Automation Market Analysis Report by Region

Europe Mining Laboratory Automation Market Report:

The European market is expected to nearly double, growing from $1.40 billion in 2023 to $2.85 billion by 2033, driven by stringent regulations requiring enhanced efficiency and reduction of environmental impact in mining.Asia Pacific Mining Laboratory Automation Market Report:

In the Asia Pacific region, the market is anticipated to grow from $1.11 billion in 2023 to $2.26 billion by 2033. The growing mining industry in countries like China and India, coupled with the push for modernization, drives this demand.North America Mining Laboratory Automation Market Report:

North America is projected to experience significant growth, increasing from $2.16 billion in 2023 to $4.41 billion by 2033. The region's strong focus on technological innovation and automation in mining processes serves as a catalyst for this growth.South America Mining Laboratory Automation Market Report:

The South American market is expected to progress from $0.26 billion in 2023 to $0.52 billion by 2033. This growth is primarily due to increased investments in mineral exploration and the adoption of automation in mining operations to improve efficiency.Middle East & Africa Mining Laboratory Automation Market Report:

The market in the Middle East and Africa is also poised for growth, moving from $0.68 billion in 2023 to $1.40 billion by 2033. Increasing mining activities and the search for sustainable practices are encouraging the adoption of laboratory automation.Tell us your focus area and get a customized research report.

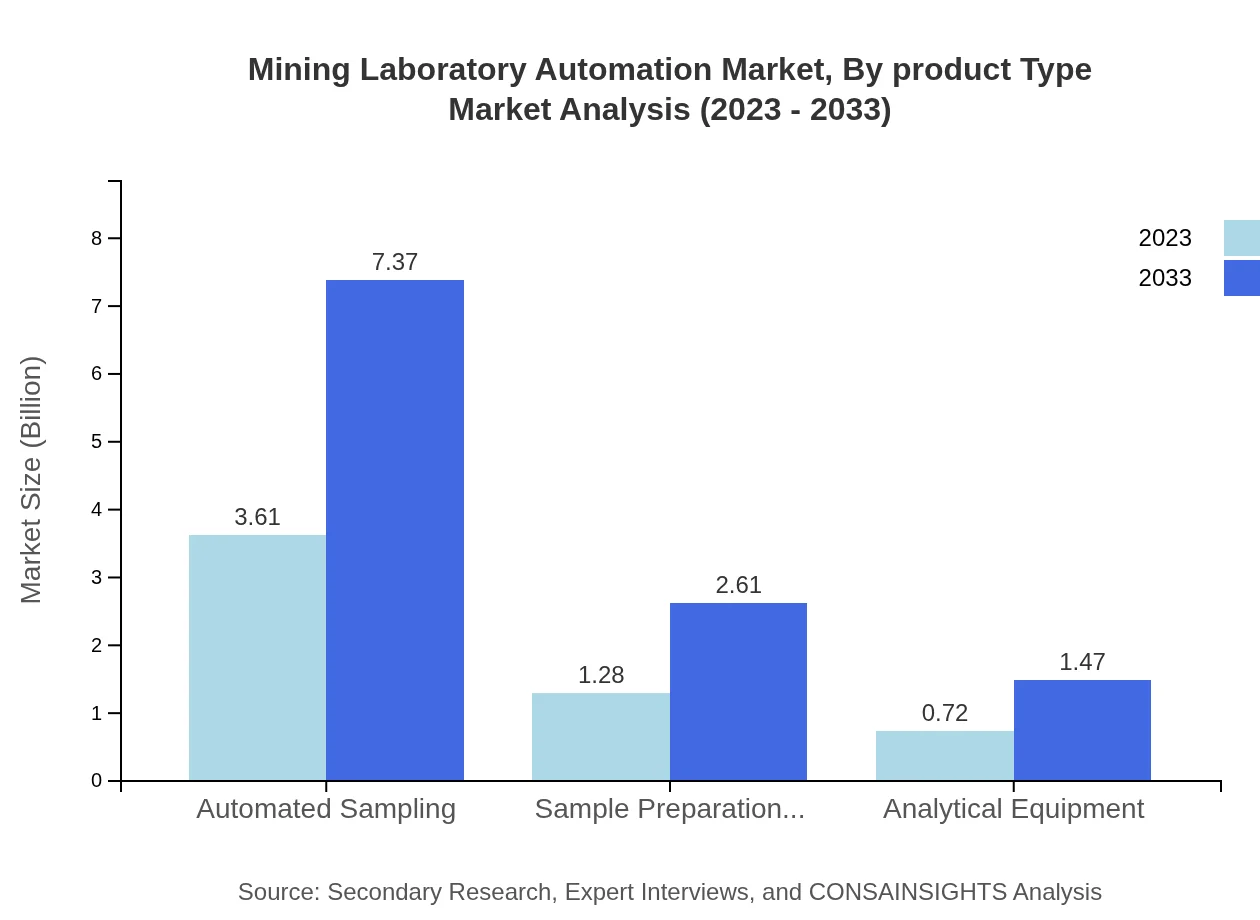

Mining Laboratory Automation Market Analysis By Product Type

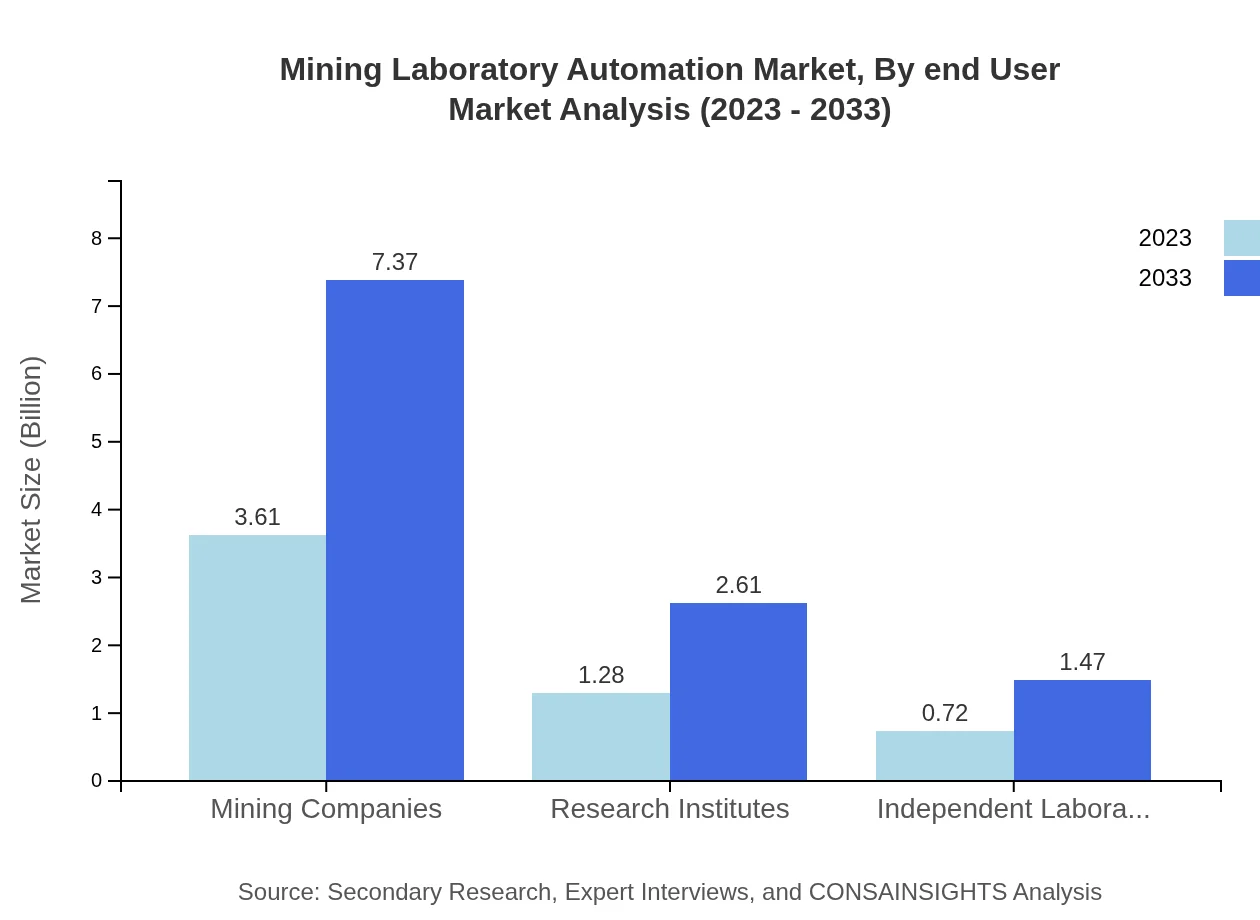

In 2023, the Mining Companies segment leads the market with a size of $3.61 billion, projected to grow to $7.37 billion by 2033. Research Institutes and Independent Laboratories also show significant growth, with expected sizes of $1.28 billion and $0.72 billion in 2023 respectively.

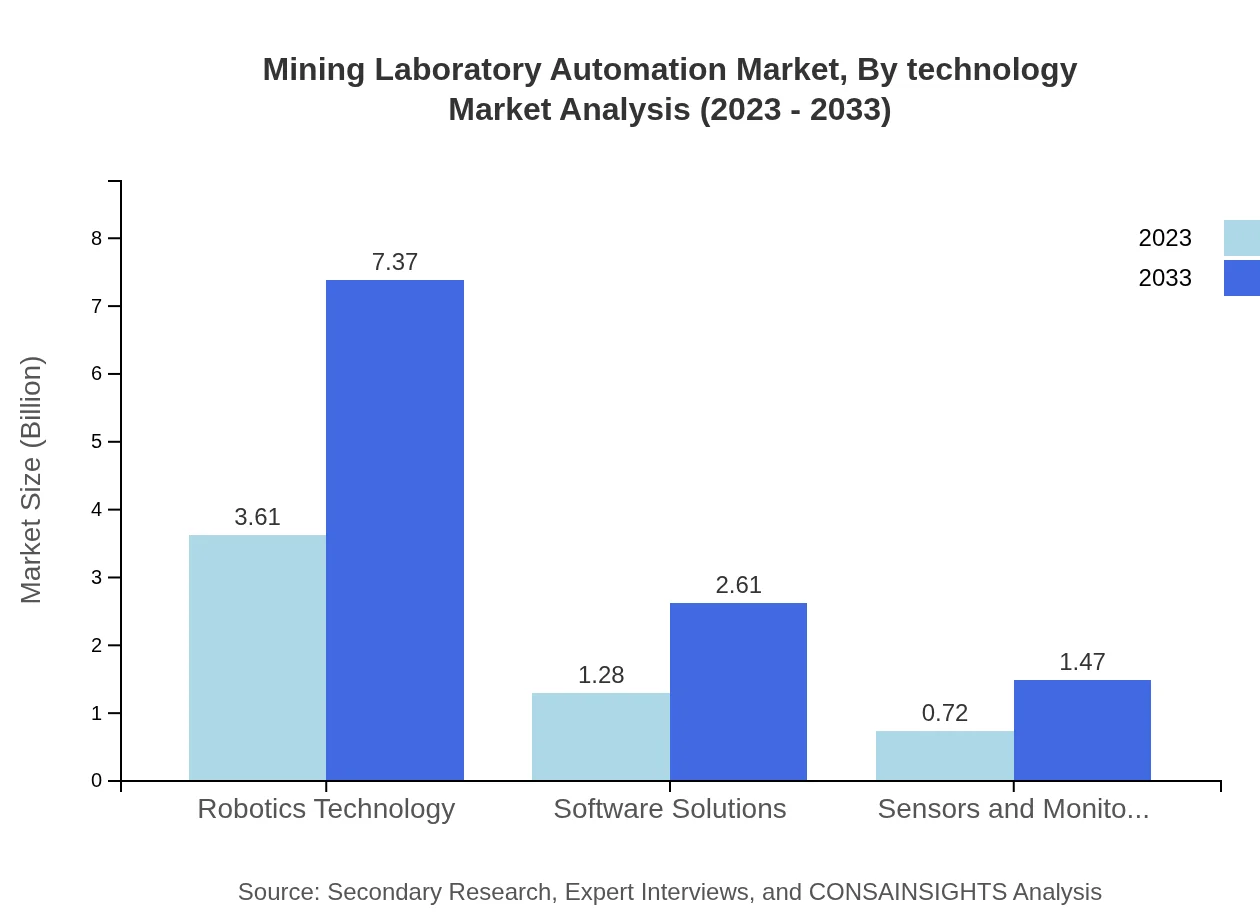

Mining Laboratory Automation Market Analysis By Technology

Technological advancements form the backbone of the market. Robotics Technology holds a market size of $3.61 billion in 2023 and is expected to maintain a dominant share by 2033. Software Solutions are projected to grow significantly, from $1.28 billion to $2.61 billion within the same period.

Mining Laboratory Automation Market Analysis By End User

The Mining Companies segment accounts for a substantial market share at 64.41%. Research Institutes follow with 22.78% market share, reflecting their crucial role in developing innovative solutions across the industry.

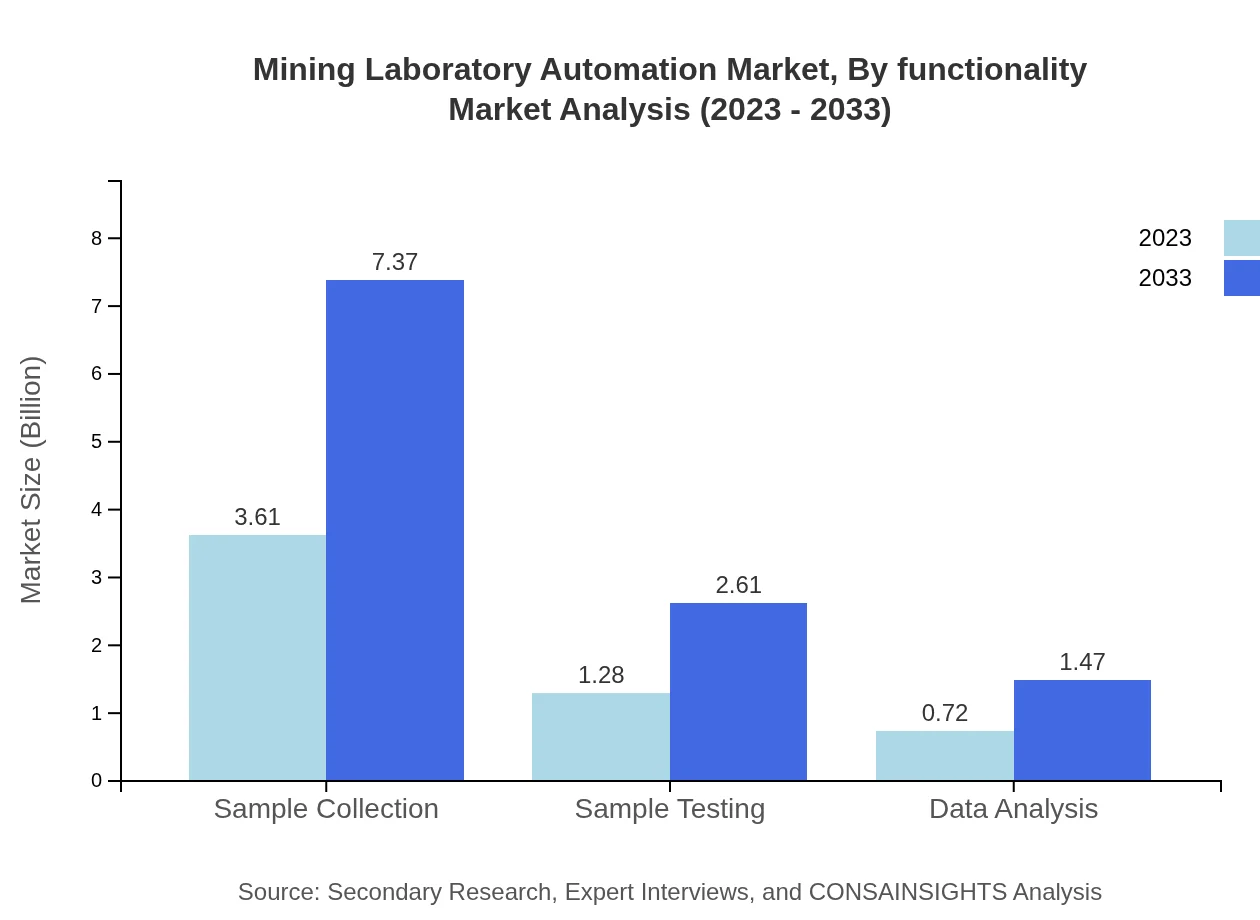

Mining Laboratory Automation Market Analysis By Functionality

Functionality-based segmentation showcases the growth potential. Automated sampling and sample preparation systems are expected to retain significant shares, primarily driving the demand for efficiency and precision in mining laboratory processes.

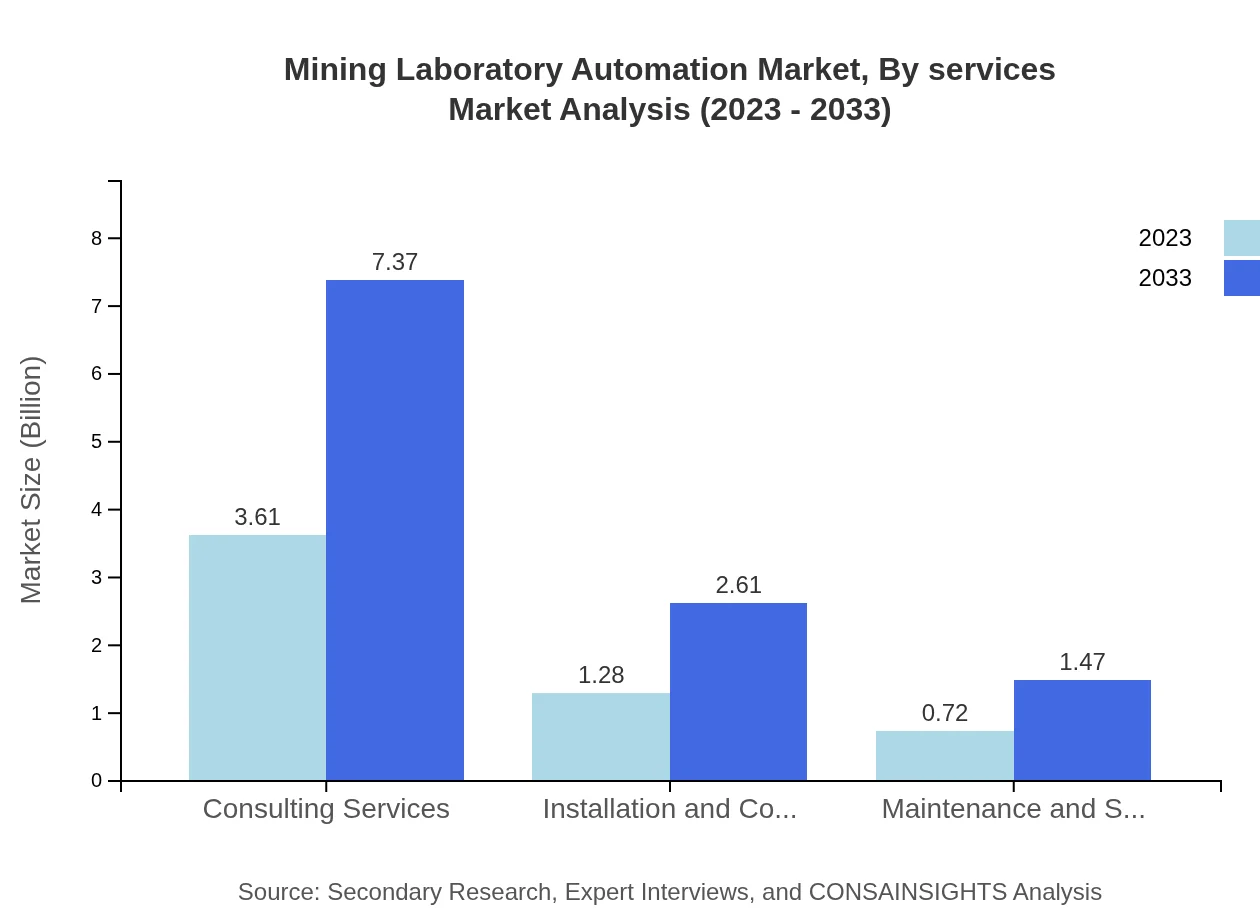

Mining Laboratory Automation Market Analysis By Services

Among services, consulting and maintenance support services represent critical components, expected to grow alongside product functionality, ensuring operational continuity and enhanced performance across laboratory operations.

Mining Laboratory Automation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mining Laboratory Automation Industry

Thermo Fisher Scientific:

A leading provider of laboratory automation solutions, Thermo Fisher manufactures a wide range of analytical instrumentation and software tailored for mining laboratory operations.Agilent Technologies:

Agilent specializes in analytical and automation solutions for laboratories, providing cutting-edge technology in the mining sector to enhance data analytics and testing accuracy.Siemens AG:

Siemens provides innovative automation solutions and technologies for the mining industry, focusing on improving efficiency and sustainability in mining operations.ABB Ltd.:

ABB is known for its automation products and solutions that cater to energy and mining companies, focusing on operational excellence and environmental stewardship.Hitachi High-Tech Corporation:

Hitachi offers advanced laboratory automation systems, providing tailored solutions for precise analytical testing in mining laboratories.We're grateful to work with incredible clients.

FAQs

What is the market size of mining Laboratory Automation?

The mining laboratory automation market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 7.2%. This steady growth indicates significant investments and the rising adoption of automated technologies in mining operations over the next decade.

What are the key market players or companies in this mining Laboratory Automation industry?

Key players in the mining laboratory automation industry include major companies involved in technology and equipment supply, such as ABB, Siemens Agil, and Thermo Fisher Scientific. These firms are leading innovations and expanding their product lines to meet market demands.

What are the primary factors driving the growth in the mining Laboratory Automation industry?

Growth in the mining laboratory automation industry is primarily driven by increasing demand for efficiency and accuracy, advancements in automation technologies, and the need to enhance safety protocols in mining operations.

Which region is the fastest Growing in the mining Laboratory Automation?

North America is the fastest-growing region in the mining laboratory automation sector, with a market size of $2.16 billion in 2023, projected to rise to $4.41 billion by 2033, driven by technological advancements and significant investments.

Does ConsaInsights provide customized market report data for the mining Laboratory Automation industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, giving clients insights into niche areas, trends, and forecasts in the mining laboratory automation industry.

What deliverables can I expect from this mining Laboratory Automation market research project?

Expect comprehensive reports that include market size, growth forecasts, segment analysis, competitor profiles, and regional insights, along with strategic recommendations based on the latest trends in mining laboratory automation.

What are the market trends of mining Laboratory Automation?

Key trends in mining laboratory automation include increased incorporation of IoT technologies, expanded use of robotics for sample handling, and a shift towards more integrated software solutions for process optimization.