Mobile And Wireless Backhaul Market Report

Published Date: 31 January 2026 | Report Code: mobile-and-wireless-backhaul

Mobile And Wireless Backhaul Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Mobile and Wireless Backhaul market, covering market size, trends, technology advancements, and regional insights. Forecasting from 2023 to 2033, it aims to equip stakeholders with valuable data to support strategic decision-making.

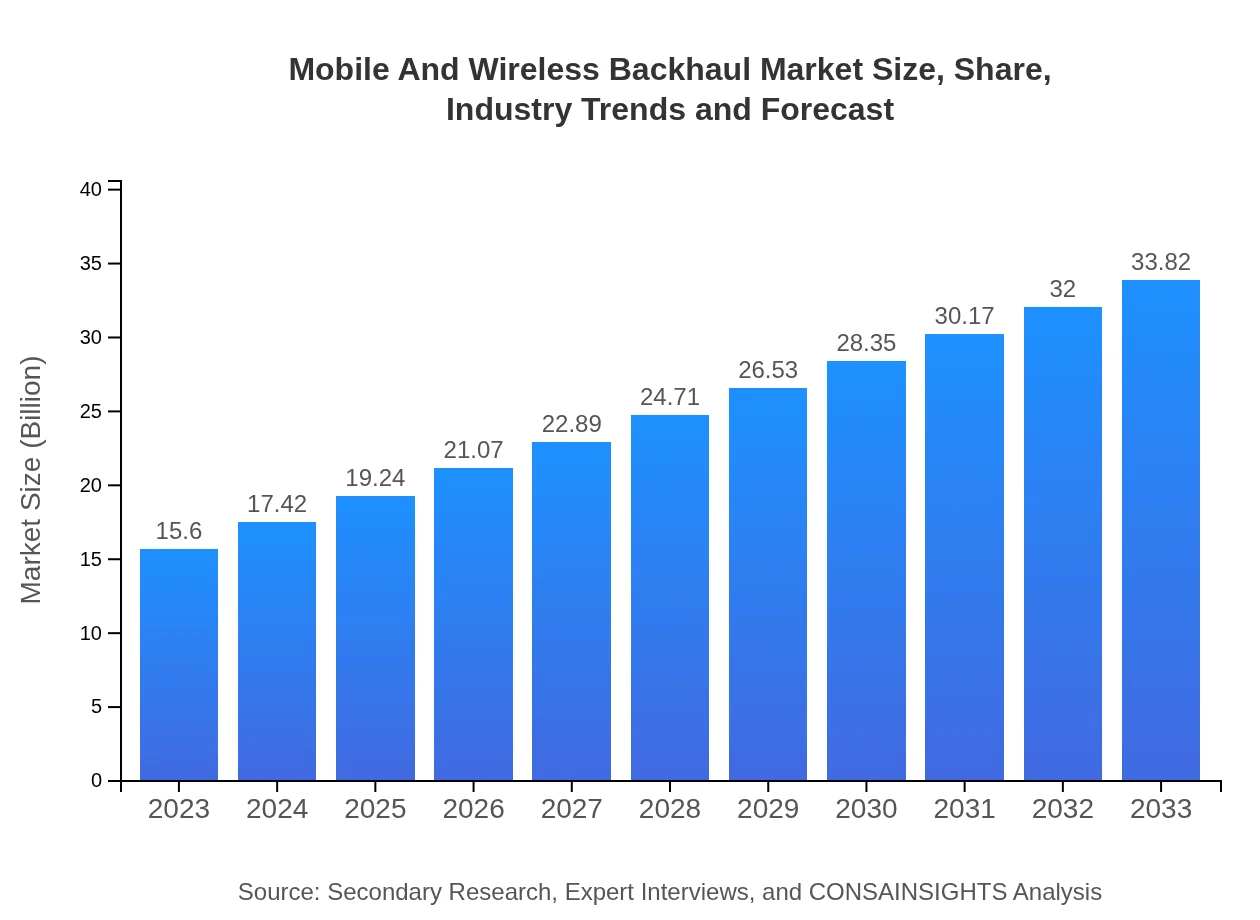

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $33.82 Billion |

| Top Companies | Cisco Systems, Inc., Huawei Technologies Co., Ltd., Ericsson , Nokia Corporation, ZTE Corporation |

| Last Modified Date | 31 January 2026 |

Mobile And Wireless Backhaul Market Overview

Customize Mobile And Wireless Backhaul Market Report market research report

- ✔ Get in-depth analysis of Mobile And Wireless Backhaul market size, growth, and forecasts.

- ✔ Understand Mobile And Wireless Backhaul's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile And Wireless Backhaul

What is the Market Size & CAGR of Mobile And Wireless Backhaul market in 2023?

Mobile And Wireless Backhaul Industry Analysis

Mobile And Wireless Backhaul Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile And Wireless Backhaul Market Analysis Report by Region

Europe Mobile And Wireless Backhaul Market Report:

The European market is projected to grow from $4.02 billion in 2023 to $8.70 billion by 2033. Factors like increased investment in network infrastructure, advancements in backhaul technology, and the drive towards smart city developments are significant contributors to this growth. Regulatory bodies also play a key role, promoting competition and innovation.Asia Pacific Mobile And Wireless Backhaul Market Report:

In the Asia Pacific region, the market is valued at approximately $3.40 billion in 2023 and is projected to grow to $7.38 billion by 2033. The growth is driven by rapid urbanization and digital transformation initiatives. Countries like China and India are heavily investing in telecommunication infrastructure to support their growing population and technological demands.North America Mobile And Wireless Backhaul Market Report:

North America stands out with a market size of $5.17 billion in 2023, anticipated to nearly double to $11.21 billion by 2033. The early adoption of 5G technology, coupled with a mature telecommunications infrastructure, ensures robust growth. Major players are focusing on expanding their backhaul capacities to accommodate burgeoning data traffic.South America Mobile And Wireless Backhaul Market Report:

The South American Mobile and Wireless Backhaul market, valued at $1.07 billion in 2023, is expected to reach $2.32 billion by 2033. Rising Internet penetration and increasing mobile data usage among consumers and businesses are fueling demand. Expansion projects in the telecommunications sector are also supported by government initiatives aiming to improve connectivity.Middle East & Africa Mobile And Wireless Backhaul Market Report:

In the Middle East and Africa, the market is valued at $1.94 billion in 2023, expanding to $4.21 billion by 2033. Urbanization and the increasing penetration of smartphones are primary drivers. National initiatives focused on digital transformation and infrastructure development are set to boost investments in mobile backhaul solutions.Tell us your focus area and get a customized research report.

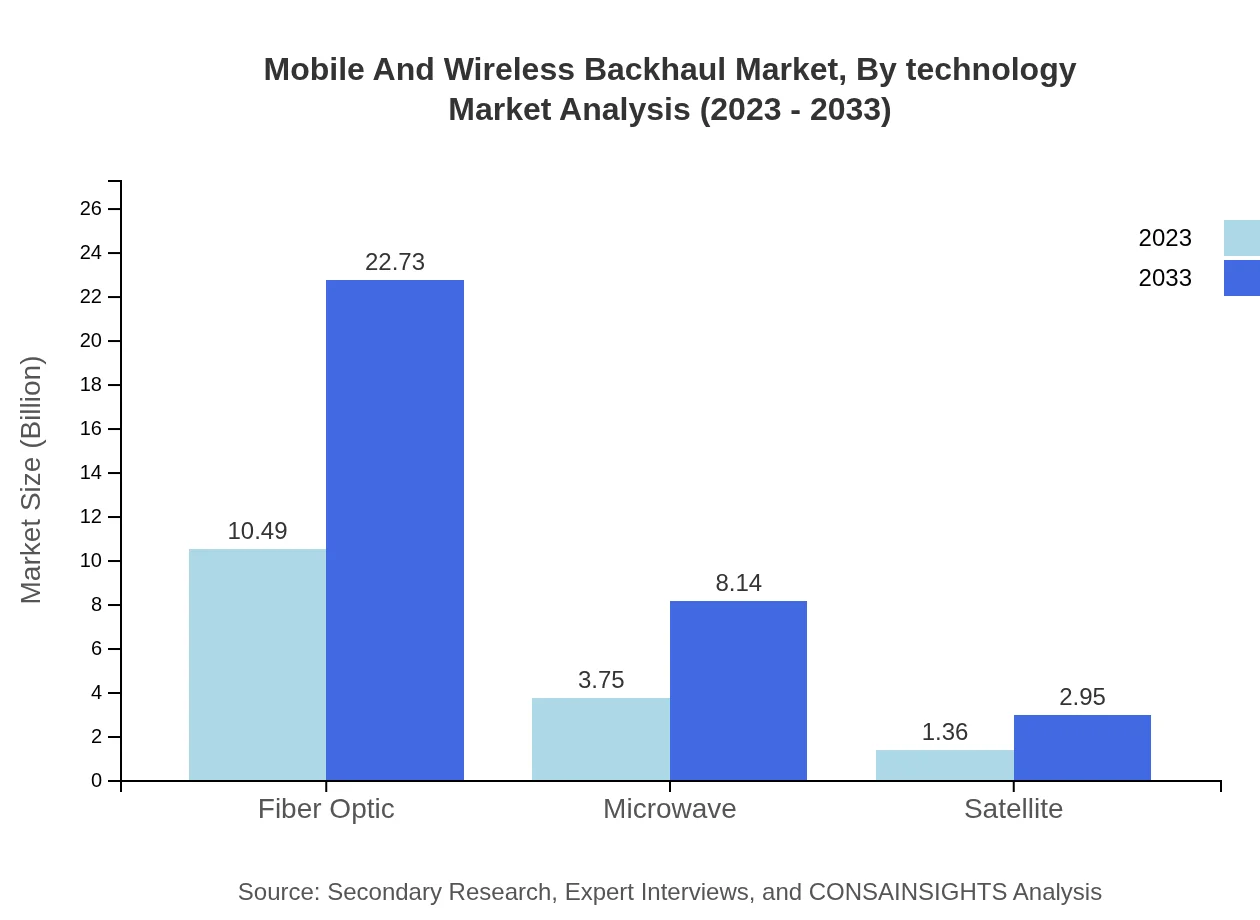

Mobile And Wireless Backhaul Market Analysis By Technology

The Mobile and Wireless Backhaul market is segmented into Fiber Optic, Microwave, and Satellite technologies. Fiber optic remains the dominant technology due to its high-speed data transmission capabilities, making up about 67.22% of the market. Microwave technology, while holding a smaller share at 24.07%, is favored in areas where fiber installation is challenging. Satellite technology accounts for 8.71% of the market, offering unique solutions in remote regions.

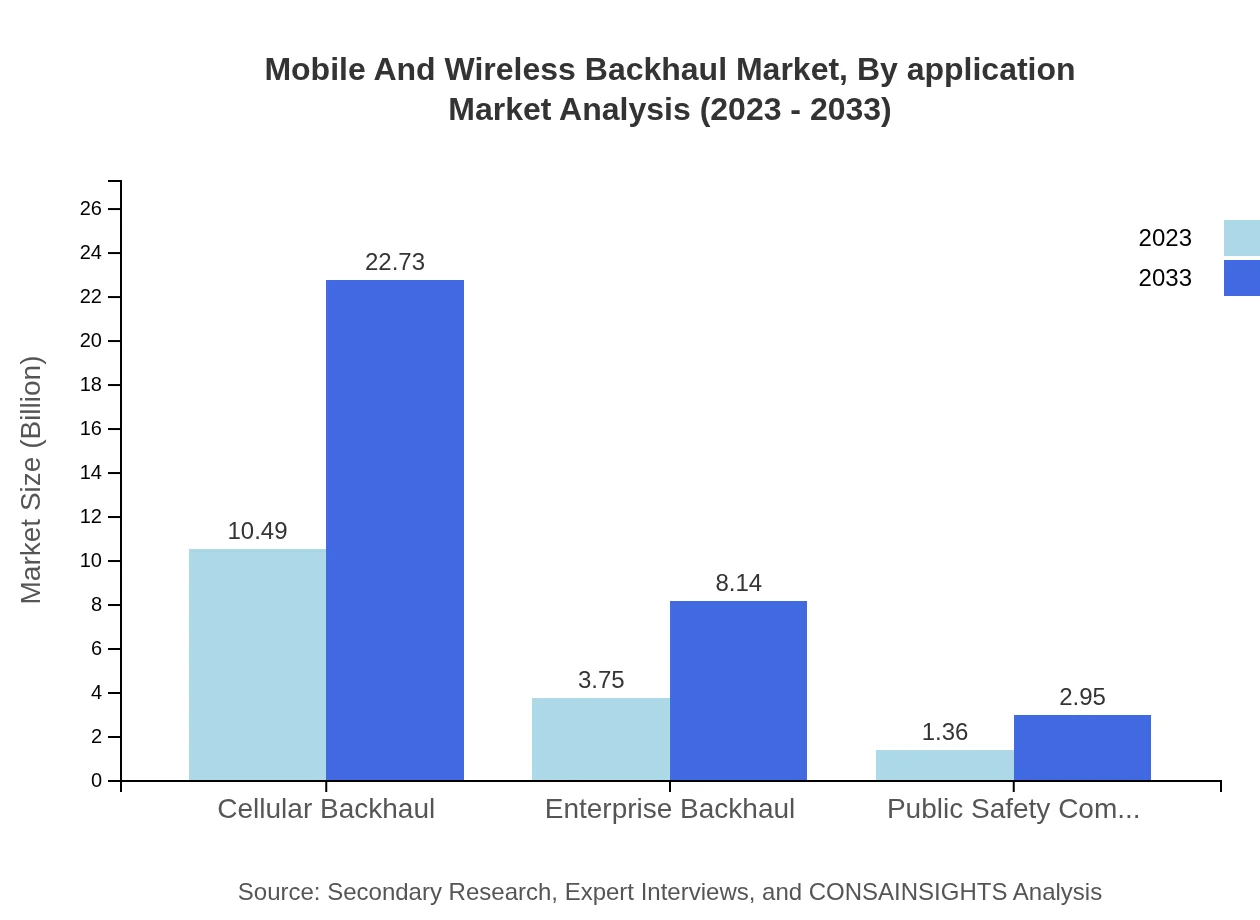

Mobile And Wireless Backhaul Market Analysis By Application

This market is further analyzed based on applications such as telecom operators, enterprise customers, and government agencies. Telecom operators lead with a significant share of 67.22%, reflecting their critical role in managing large data volumes. Enterprise customers represent 24.07%, driven by businesses' increasing reliance on data for operations. Government agencies, while smaller at 8.71%, are focusing on enhancing public safety communications.

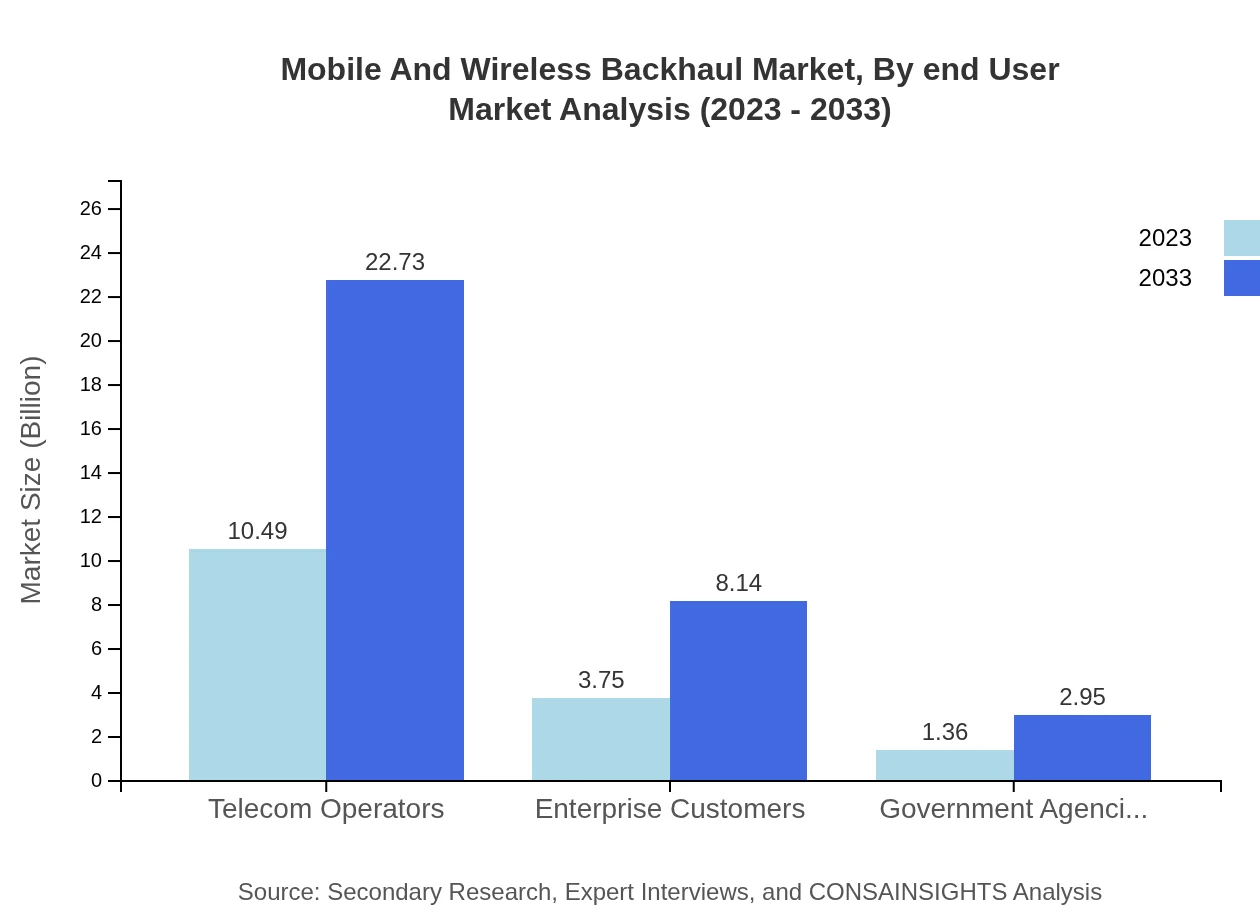

Mobile And Wireless Backhaul Market Analysis By End User

Key end-user segments include telecom operators, enterprise backhaul solutions, and public safety communications. Telecom operators dominate the space, accounting for 67.22% of the market share, indicating robust demand for backhaul networks. Enterprises account for 24.07%, leveraging backhaul technologies for operational efficiency. Public safety communications, though a smaller segment at 8.71%, are crucial for emergency response systems.

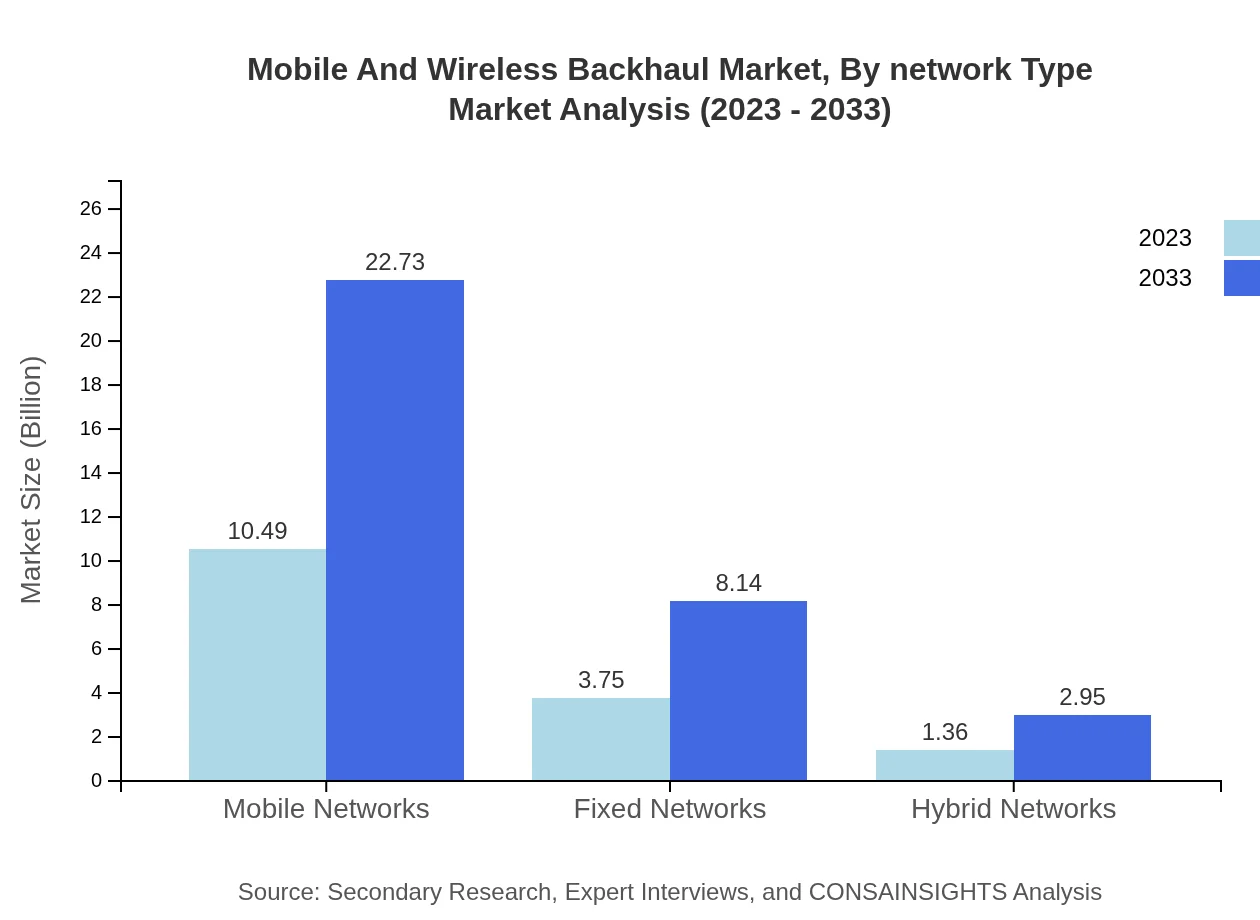

Mobile And Wireless Backhaul Market Analysis By Network Type

The market is categorized into Mobile Networks, Fixed Networks, and Hybrid Networks. Mobile Networks dominate, capturing 67.22% due to the widespread demand for mobile data services. Fixed Networks make up 24.07%, with enterprises investing in reliable backhaul solutions for data management. Hybrid Networks, while less prominent at 8.71%, provide flexibility in data transmission methods.

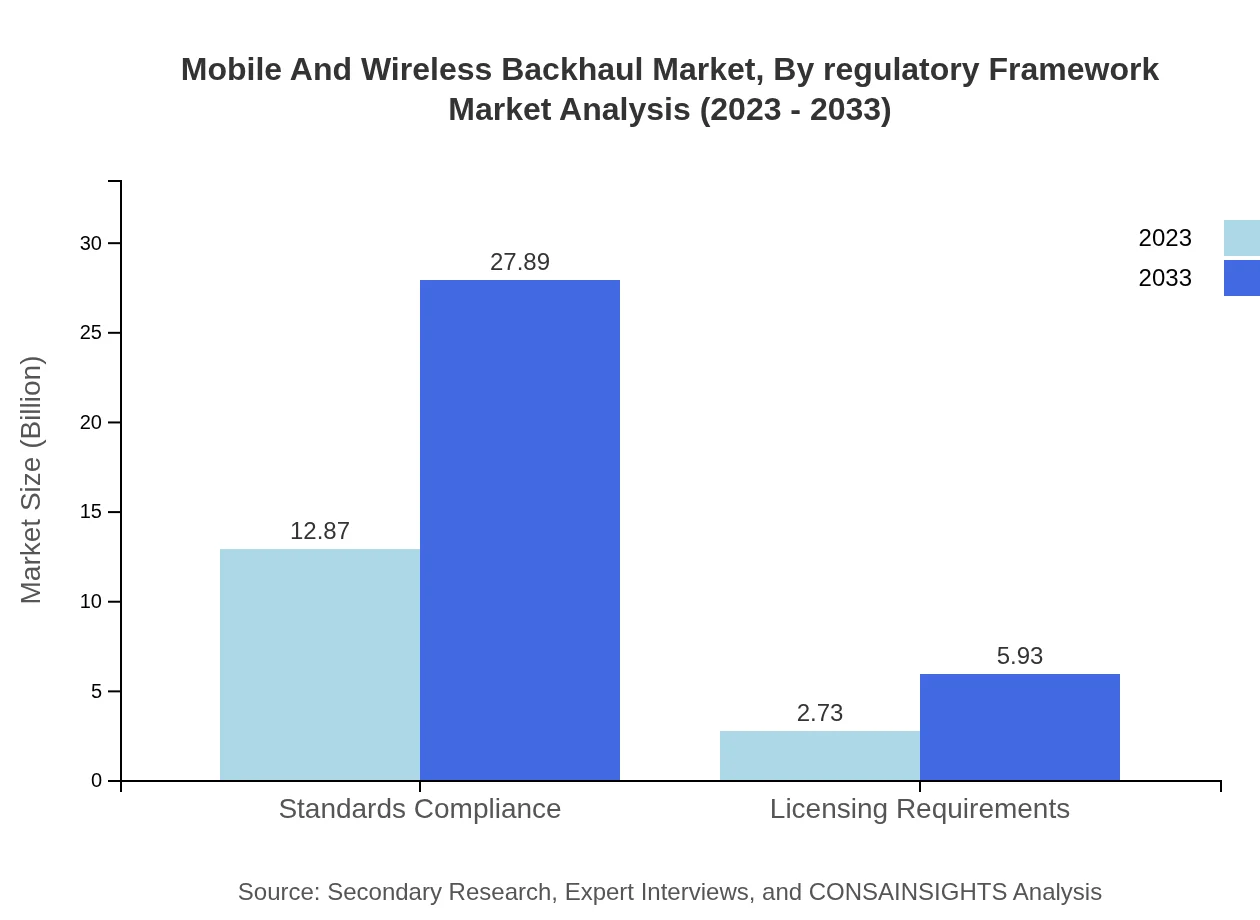

Mobile And Wireless Backhaul Market Analysis By Regulatory Framework

The regulatory landscape has a significant impact on market dynamics, segmented into Standards Compliance and Licensing Requirements. Standards Compliance is crucial for ensuring interoperability and reliability, accounting for 82.47% of the market. Licensing Requirements, though a smaller segment at 17.53%, ensure that operators adhere to regulations that govern telecommunications and backhaul services.

Mobile And Wireless Backhaul Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile And Wireless Backhaul Industry

Cisco Systems, Inc.:

Cisco is a leading technology company that specializes in networking hardware and software. They provide advanced backhaul solutions that support varying data demands.Huawei Technologies Co., Ltd.:

Huawei is a global telecommunications leader that offers a wide range of backhaul technologies, contributing significantly to 5G network deployments worldwide.Ericsson :

Ericsson is a prominent player in the mobile networking sector, delivering innovative backhaul solutions that enhance connectivity and performance for telecom operators.Nokia Corporation:

Nokia provides a comprehensive portfolio of networking solutions, including mobile and wireless backhaul products designed to optimize network performance.ZTE Corporation:

ZTE is a leading provider of telecommunications and information technology services, offering a variety of backhaul solutions to support network expansion.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile And Wireless Backhaul?

The mobile and wireless backhaul market is projected to reach approximately $15.6 billion by 2033, growing at a CAGR of 7.8%. This growth reflects increasing demand for enhanced connectivity and data services in the telecommunications sector.

What are the key market players or companies in this mobile And Wireless Backhaul industry?

Key players in the mobile and wireless backhaul industry include prominent telecommunications companies, infrastructure providers, and technology firms that specialize in network solutions. Their innovations and competitive strategies shape market dynamics and growth.

What are the primary factors driving the growth in the mobile And Wireless Backhaul industry?

Growth in the mobile and wireless backhaul market is driven by increased mobile network demands, the surge of internet users, and the proliferation of IoT devices. Investments in 5G technology and infrastructure improvements further contribute to market expansion.

Which region is the fastest Growing in the mobile And Wireless Backhaul?

The North American region is the fastest-growing market for mobile and wireless backhaul, with a projected market size growth from $5.17 billion in 2023 to $11.21 billion by 2033. This growth is fueled by robust telecommunications infrastructure and high demand for advanced data services.

Does ConsaInsights provide customized market report data for the mobile And Wireless Backhaul industry?

Yes, ConsaInsights offers customized market report data for the mobile and wireless backhaul industry, tailoring insights and analyses to meet specific client needs and ensuring relevant and actionable findings.

What deliverables can I expect from this mobile And Wireless Backhaul market research project?

Deliverables from the mobile and wireless backhaul market research project include comprehensive market analysis, regional insights, competitive landscape evaluations, growth forecasts, and strategic recommendations tailored to stakeholder interests.

What are the market trends of mobile And Wireless Backhaul?

Market trends indicate a shift towards fiber optics and microwave solutions, with telecom operators dominating the market. Sustainable technologies, increased digitalization, and the transition to 5G networks are key trends shaping the industry.