Mobile Backhaul Market Report

Published Date: 31 January 2026 | Report Code: mobile-backhaul

Mobile Backhaul Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Mobile Backhaul market, offering insights into market size, growth predictions through 2033, technology trends, regional breakdowns, and profiles of industry leaders to help stakeholders make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

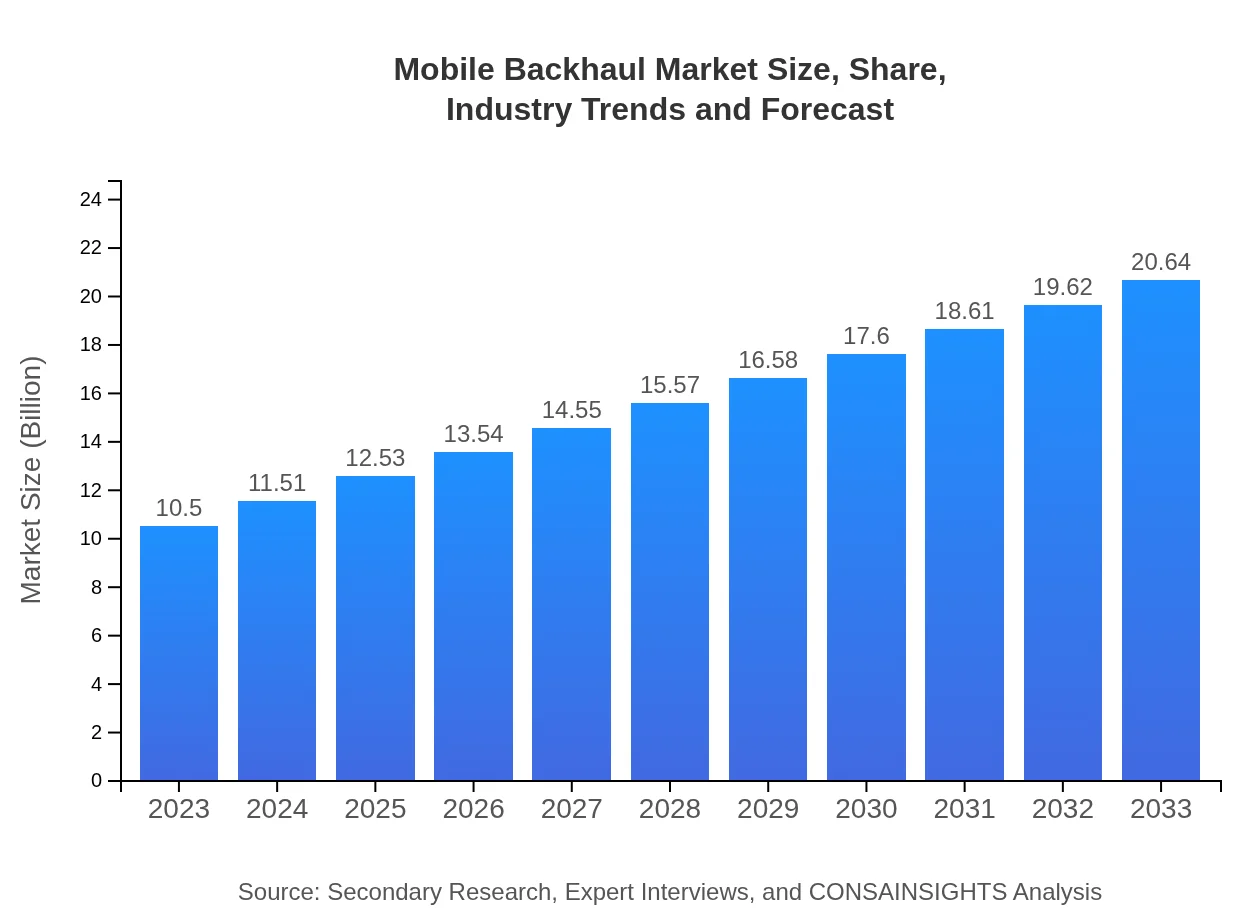

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Cisco Systems, Inc., Huawei Technologies Co., Ltd., Ericsson , Nokia Corporation, ZTE Corporation |

| Last Modified Date | 31 January 2026 |

Mobile Backhaul Market Overview

Customize Mobile Backhaul Market Report market research report

- ✔ Get in-depth analysis of Mobile Backhaul market size, growth, and forecasts.

- ✔ Understand Mobile Backhaul's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Backhaul

What is the Market Size & CAGR of Mobile Backhaul market in 2023?

Mobile Backhaul Industry Analysis

Mobile Backhaul Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Backhaul Market Analysis Report by Region

Europe Mobile Backhaul Market Report:

Europe's Mobile Backhaul market is anticipated to expand from $2.81 billion in 2023 to $5.52 billion by 2033. The region is characterized by significant investments in network upgrades to support 5G functionality, particularly in Western European countries.Asia Pacific Mobile Backhaul Market Report:

In the Asia Pacific region, the Mobile Backhaul market is expected to grow from $2.06 billion in 2023 to $4.05 billion by 2033. This growth is supported by increasing mobile penetration and the implementation of 5G networks across key markets like China, India, and Japan.North America Mobile Backhaul Market Report:

North America leads the Mobile Backhaul market with a size of $4.01 billion in 2023, projected to grow to $7.87 billion by 2033. The presence of major telecom operators and early adoption of 5G technology fuels this growth.South America Mobile Backhaul Market Report:

The South American market for Mobile Backhaul is on a growth trajectory, increasing from $0.54 billion in 2023 to an expected $1.06 billion by 2033. Factors driving this growth include rising internet usage and investments in telecom infrastructure in countries like Brazil and Argentina.Middle East & Africa Mobile Backhaul Market Report:

In the Middle East and Africa, the market is projected to increase from $1.08 billion in 2023 to $2.12 billion by 2033. The growth is spurred by increasing mobile usage and infrastructural development in urban areas.Tell us your focus area and get a customized research report.

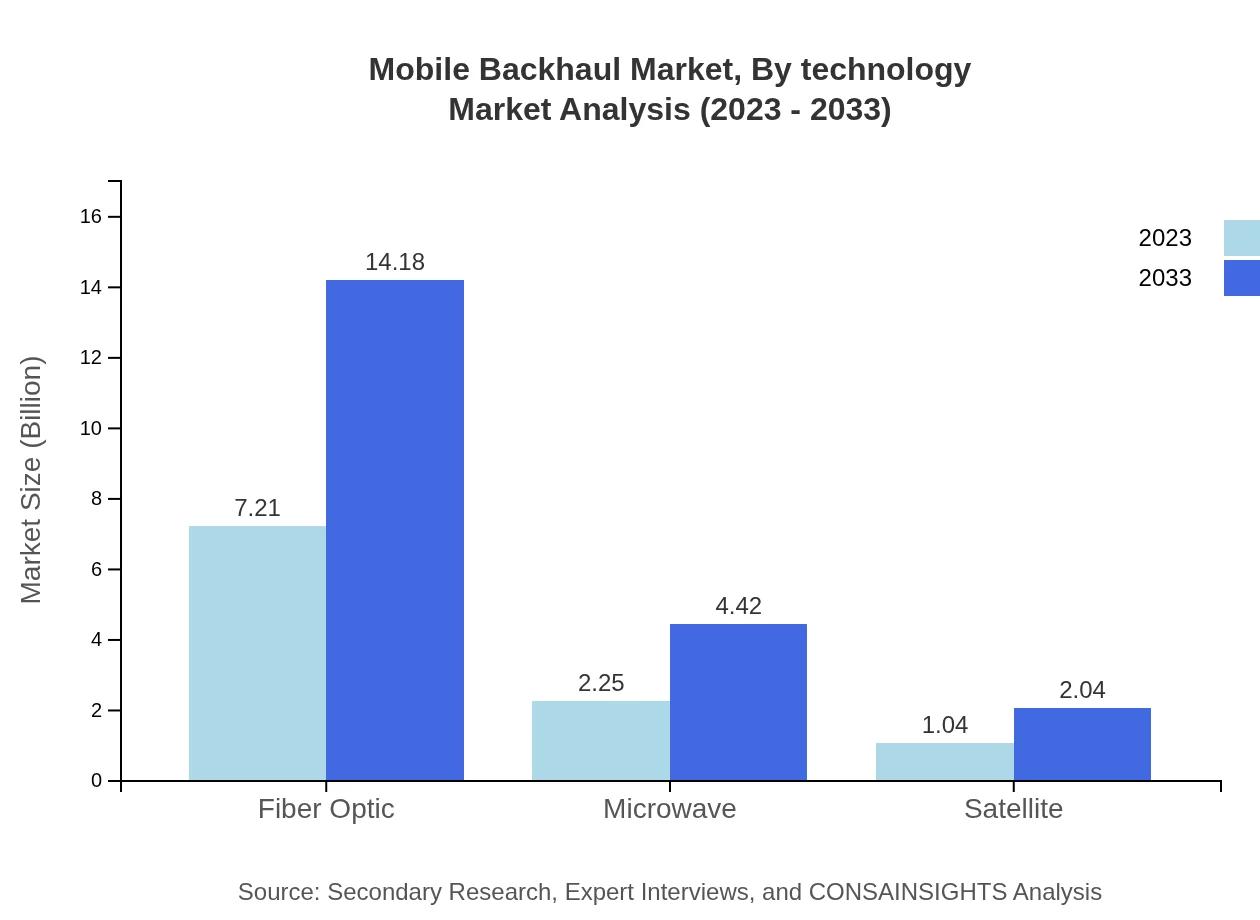

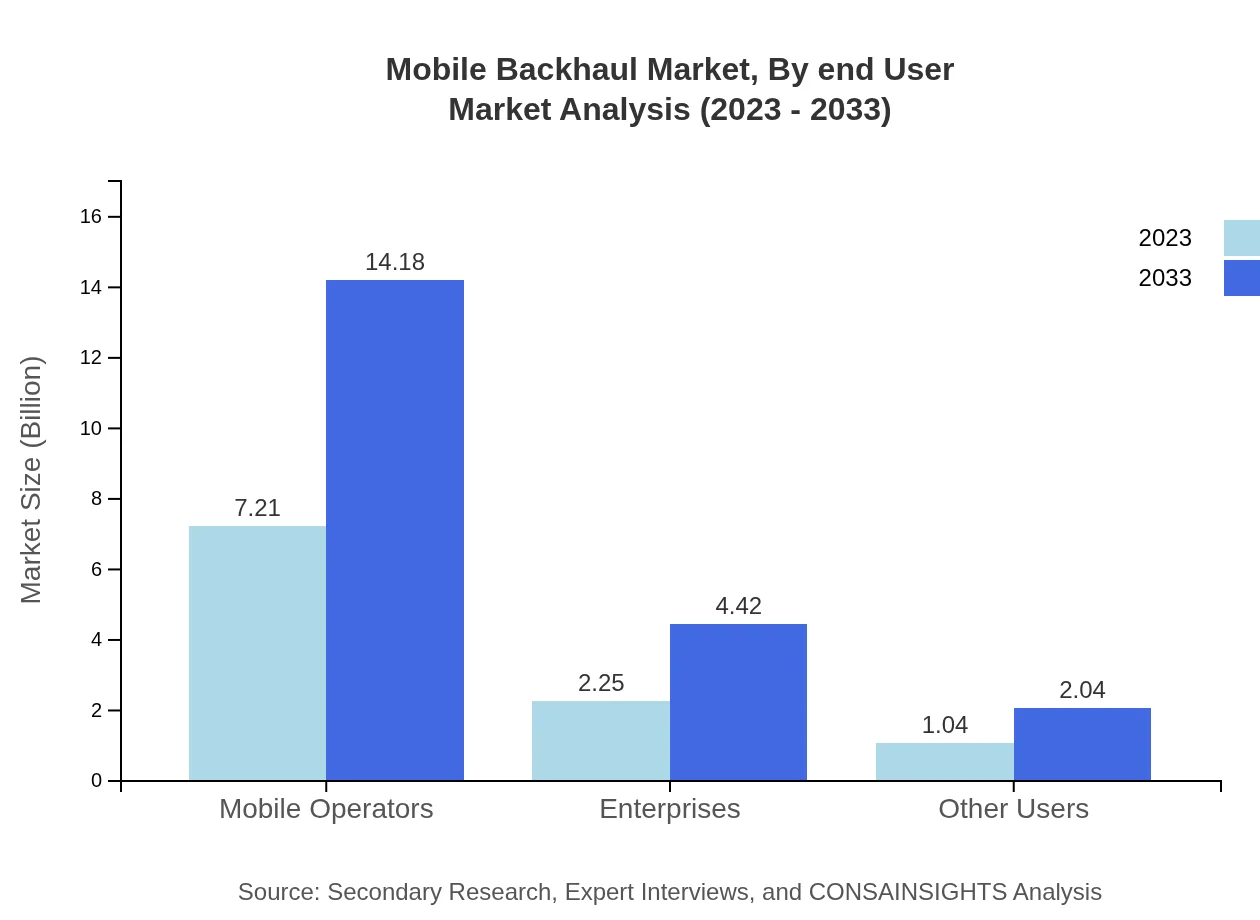

Mobile Backhaul Market Analysis By Technology

The Mobile Backhaul market by technology is predominantly led by fiber optics, accounting for a significant market share, with a size of $7.21 billion in 2023 and expected to reach $14.18 billion by 2033. Microwaves follow, with a market size of $2.25 billion in 2023 and a growth forecast to $4.42 billion by 2033, while satellite technology caters to niche requirements, growing from $1.04 billion to $2.04 billion in the same period.

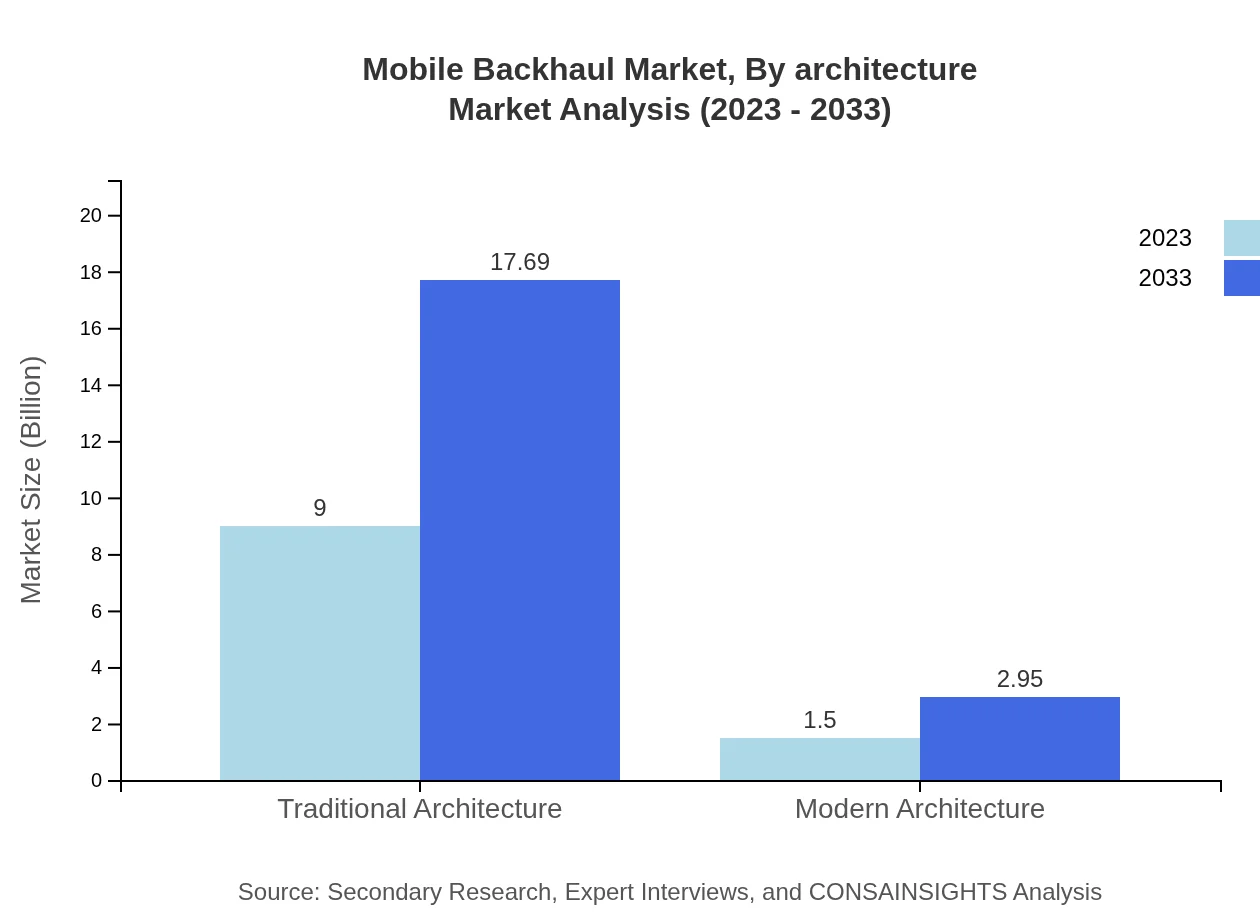

Mobile Backhaul Market Analysis By Architecture

Traditional architecture continues to dominate the Mobile Backhaul segment, growing from a market size of $9.00 billion in 2023 to $17.69 billion by 2033, maintaining a consistent share of 85.7%. Meanwhile, modern architecture is anticipated to increase from $1.50 billion to $2.95 billion, reflecting growing adoption amid evolving networking needs.

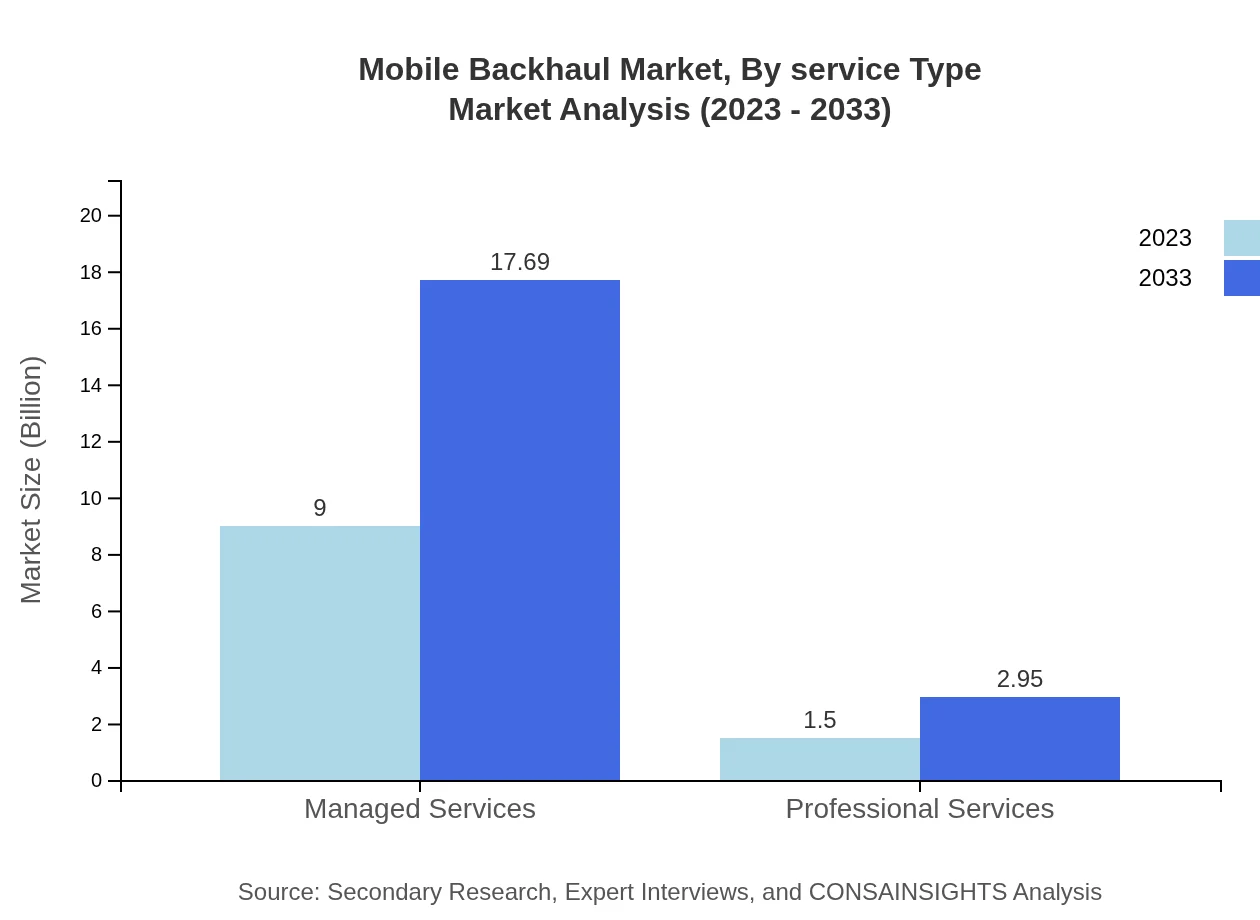

Mobile Backhaul Market Analysis By Service Type

Managed services remain the cornerstone of the Mobile Backhaul market, projected to grow from $9.00 billion in 2023 to $17.69 billion by 2033, with an 85.7% market share. Professional services, while smaller, are essential, expanding from $1.50 billion to $2.95 billion by 2033, holding a 14.3% share.

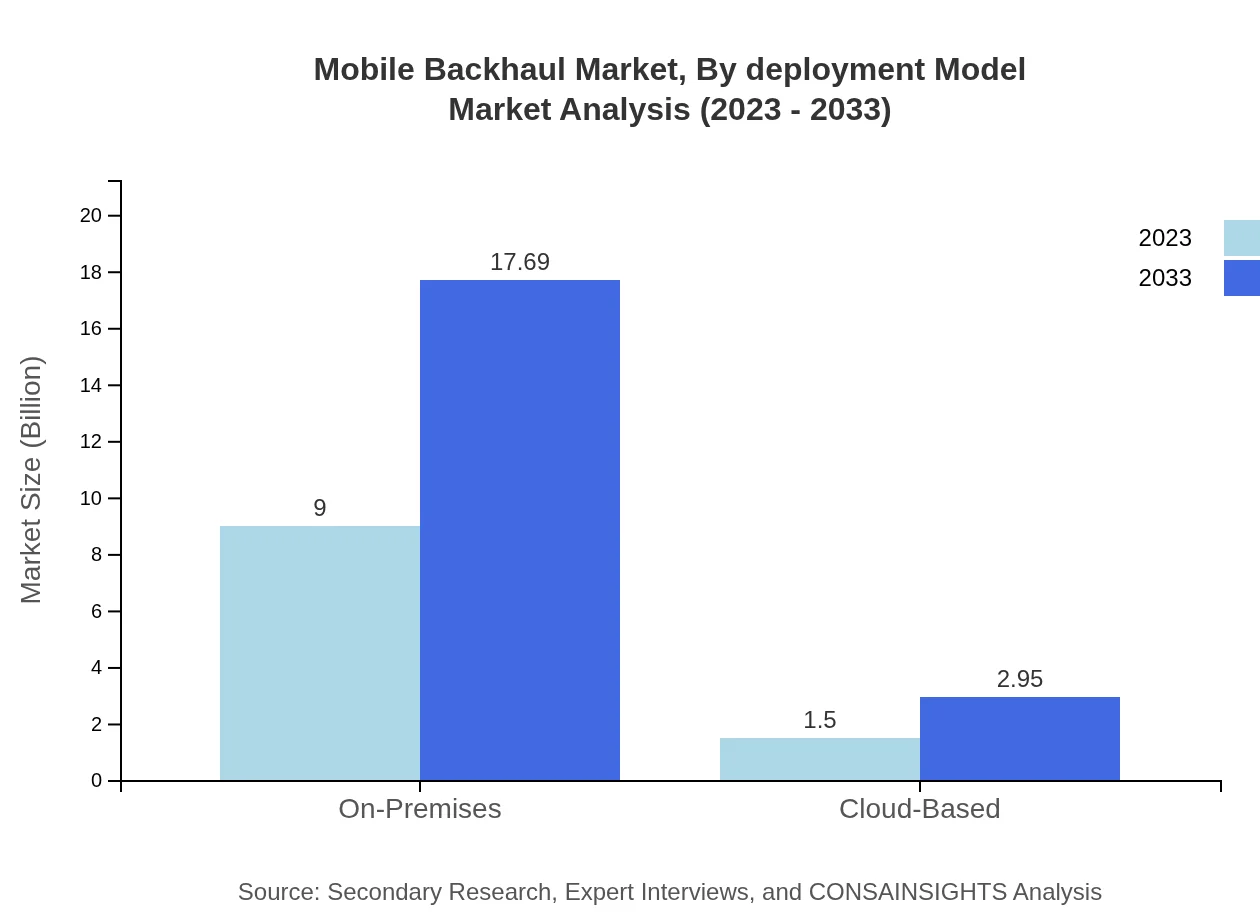

Mobile Backhaul Market Analysis By Deployment Model

The on-premises deployment model is expected to maintain its dominance, with market growth from $9.00 billion in 2023 to $17.69 billion in 2033, constituting 85.7% of the market share. In contrast, cloud-based solutions will grow from $1.50 billion to $2.95 billion, capturing the remaining 14.3%.

Mobile Backhaul Market Analysis By End User

Mobile operators are the primary consumers in the Mobile Backhaul segment, with a projected size of $7.21 billion in 2023, expected to reach $14.18 billion by 2033. This segment holds a steady 68.7% market share. Enterprises and other users also contribute prominently, expanding from $2.25 billion to $4.42 billion (21.42% share) and $1.04 billion to $2.04 billion (9.88% share), respectively.

Mobile Backhaul Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Backhaul Industry

Cisco Systems, Inc.:

A leading provider of networking solutions, Cisco plays a significant role in enhancing mobile backhaul capabilities, particularly in routing and switching technologies.Huawei Technologies Co., Ltd.:

Huawei is a key player in mobile backhaul infrastructure, offering comprehensive solutions focused on 5G networks and their integration into existing systems.Ericsson :

Ericsson provides advanced mobile backhaul solutions, focusing on microwave and optical technologies to improve connectivity and infrastructure.Nokia Corporation:

Nokia is known for its innovative approaches to networking, including mobile backhaul strategies that support enhanced data transmission for 5G.ZTE Corporation:

ZTE delivers competitive mobile backhaul products and solutions, emphasizing high-throughput capabilities and network reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Backhaul?

The mobile backhaul market is projected to grow from $10.5 billion in 2023 to significant values by 2033, with a CAGR of 6.8%. This growth is indicative of the increasing demand and technological advancements in mobile communications.

What are the key market players or companies in this mobile Backhaul industry?

Key players in the mobile backhaul industry include major telecommunications firms and technology providers that specialize in networking solutions. Their investments in infrastructure and innovative technologies are central to the industry's evolution.

What are the primary factors driving the growth in the mobile Backhaul industry?

Growth in the mobile backhaul industry is primarily driven by the increasing demand for mobile data services, the expansion of 5G networks, and the need for efficient data traffic management. Technological advancements also significantly contribute to market dynamics.

Which region is the fastest Growing in the mobile Backhaul?

The Asia-Pacific region is expected to be the fastest-growing in the mobile backhaul market, with the market size projected to grow from $2.06 billion in 2023 to $4.05 billion by 2033, reflecting robust infrastructure development and growing mobile penetration.

Does ConsaInsights provide customized market report data for the mobile Backhaul industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the mobile backhaul industry. Clients can request detailed insights and analyses to support strategic decision-making.

What deliverables can I expect from this mobile Backhaul market research project?

Deliverables from the mobile backhaul market research project typically include comprehensive market analysis reports, segmentation studies, competitive landscape assessments, and forecasts outlining growth opportunities and trends.

What are the market trends of mobile Backhaul?

Current market trends in the mobile backhaul sector include increased deployment of fiber optics, growth in managed services, and advancements in microwave technology, highlighting evolving preferences for data transmission methods.