Mobile Biometrics Market Report

Published Date: 31 January 2026 | Report Code: mobile-biometrics

Mobile Biometrics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the mobile biometrics market, encompassing insights into market size, growth trends, regional dynamics, and key players. The forecast spans from 2023 to 2033, offering a detailed understanding of industry developments and projections for the future.

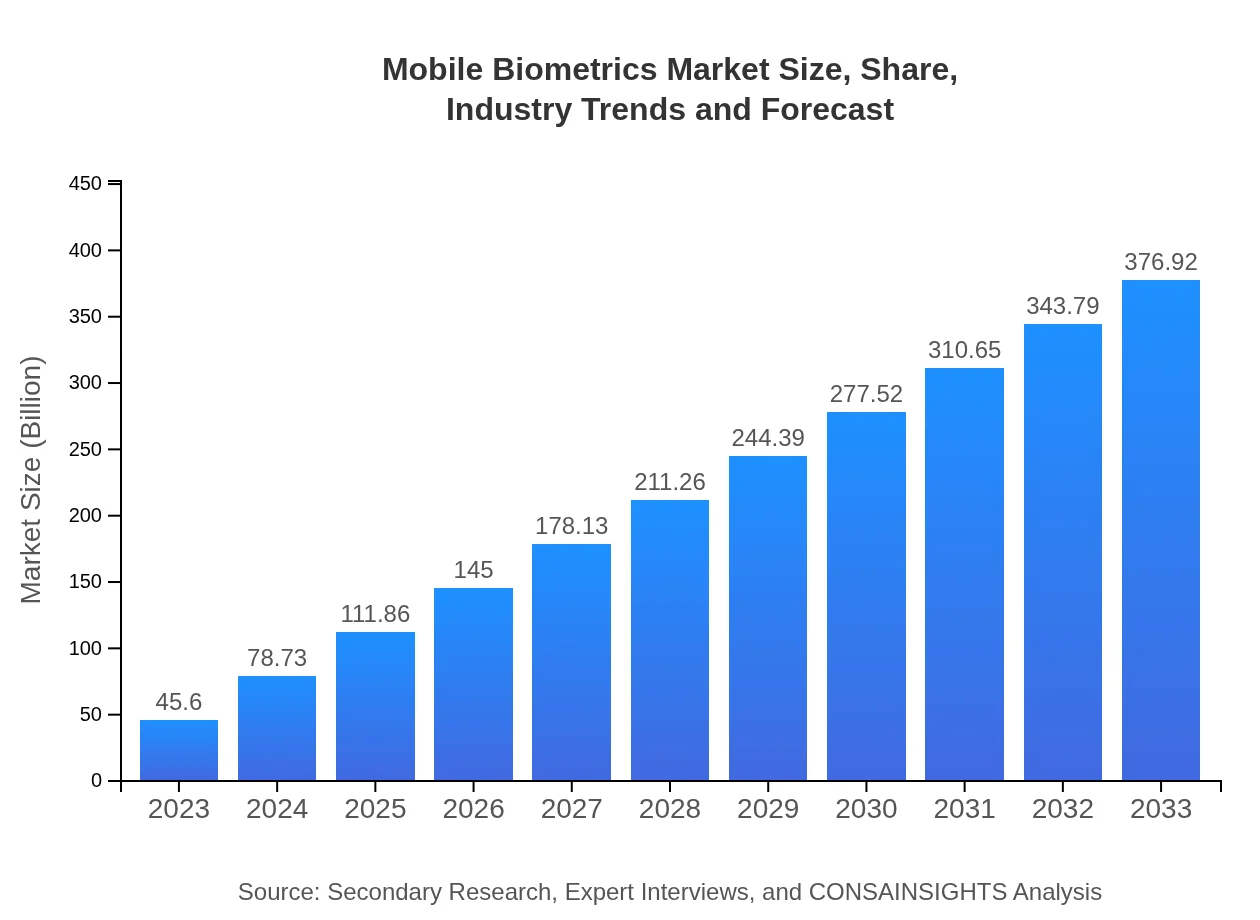

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 22.1% |

| 2033 Market Size | $376.92 Billion |

| Top Companies | Apple Inc., Samsung Electronics, Tech4home, Gemalto (Thales Group) |

| Last Modified Date | 31 January 2026 |

Mobile Biometrics Market Overview

Customize Mobile Biometrics Market Report market research report

- ✔ Get in-depth analysis of Mobile Biometrics market size, growth, and forecasts.

- ✔ Understand Mobile Biometrics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Biometrics

What is the Market Size & CAGR of Mobile Biometrics market in 2023?

Mobile Biometrics Industry Analysis

Mobile Biometrics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

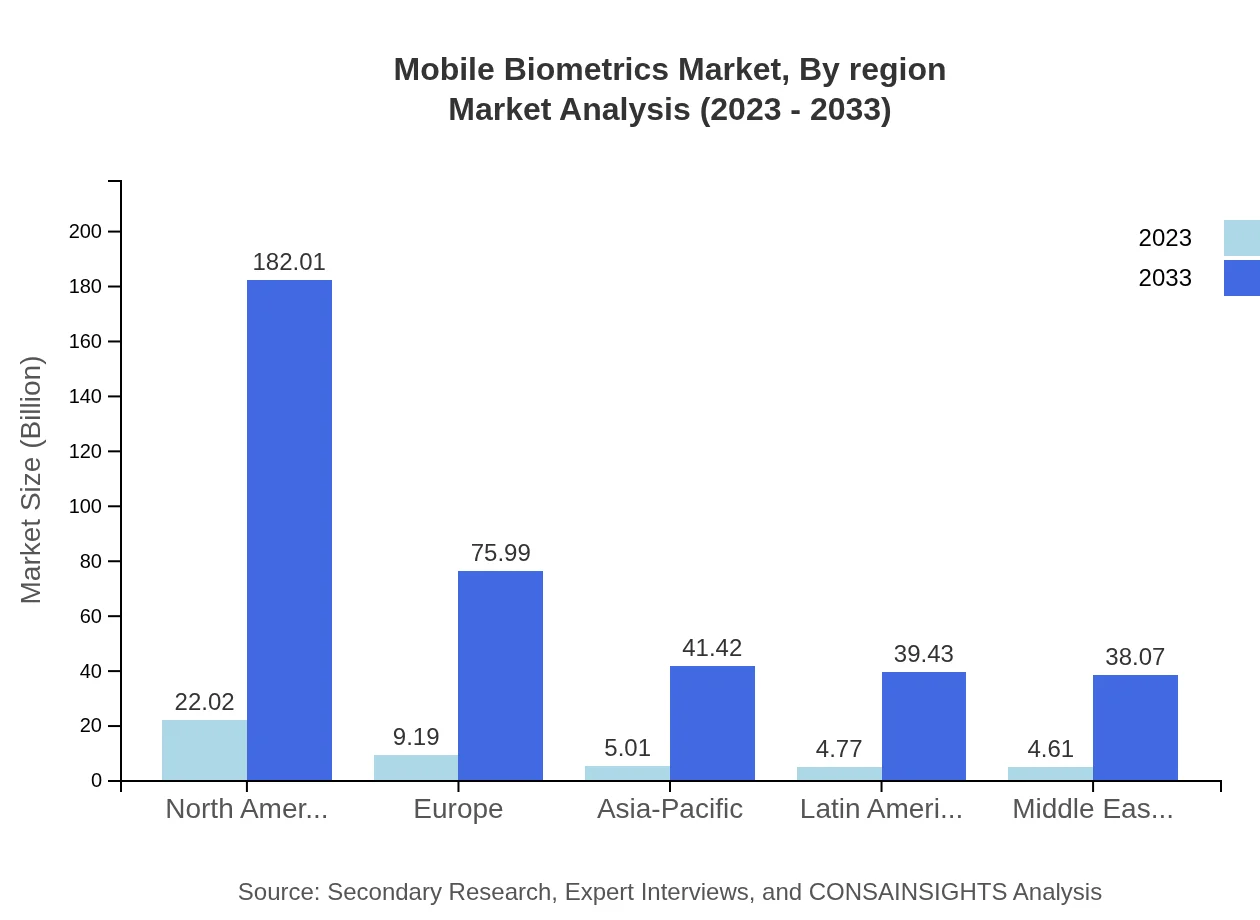

Mobile Biometrics Market Analysis Report by Region

Europe Mobile Biometrics Market Report:

The European market is forecasted to grow from $12.02 billion in 2023 to $99.32 billion by 2033. Factors such as increasing e-commerce and stringent data protection laws are driving the adoption of biometric methods.Asia Pacific Mobile Biometrics Market Report:

The Asia Pacific region is experiencing significant market growth, projected to expand from $9.57 billion in 2023 to $79.12 billion by 2033. The growing adoption of smartphones and increasing awareness of identity theft are pivotal drivers.North America Mobile Biometrics Market Report:

North America is expected to dominate the market, growing from $16.27 billion in 2023 to $134.45 billion by 2033. The key factors driving this growth include high smartphone penetration and strong government regulations promoting security enhancements.South America Mobile Biometrics Market Report:

In South America, the market will grow from $1.49 billion in 2023 to $12.33 billion by 2033. Enhanced digital payment interfaces and rising consumer electronics usage are propelling this growth.Middle East & Africa Mobile Biometrics Market Report:

The Middle East and Africa market will increase from $6.26 billion in 2023 to $51.71 billion by 2033, driven by investments in technology and heightened security protocols across various sectors.Tell us your focus area and get a customized research report.

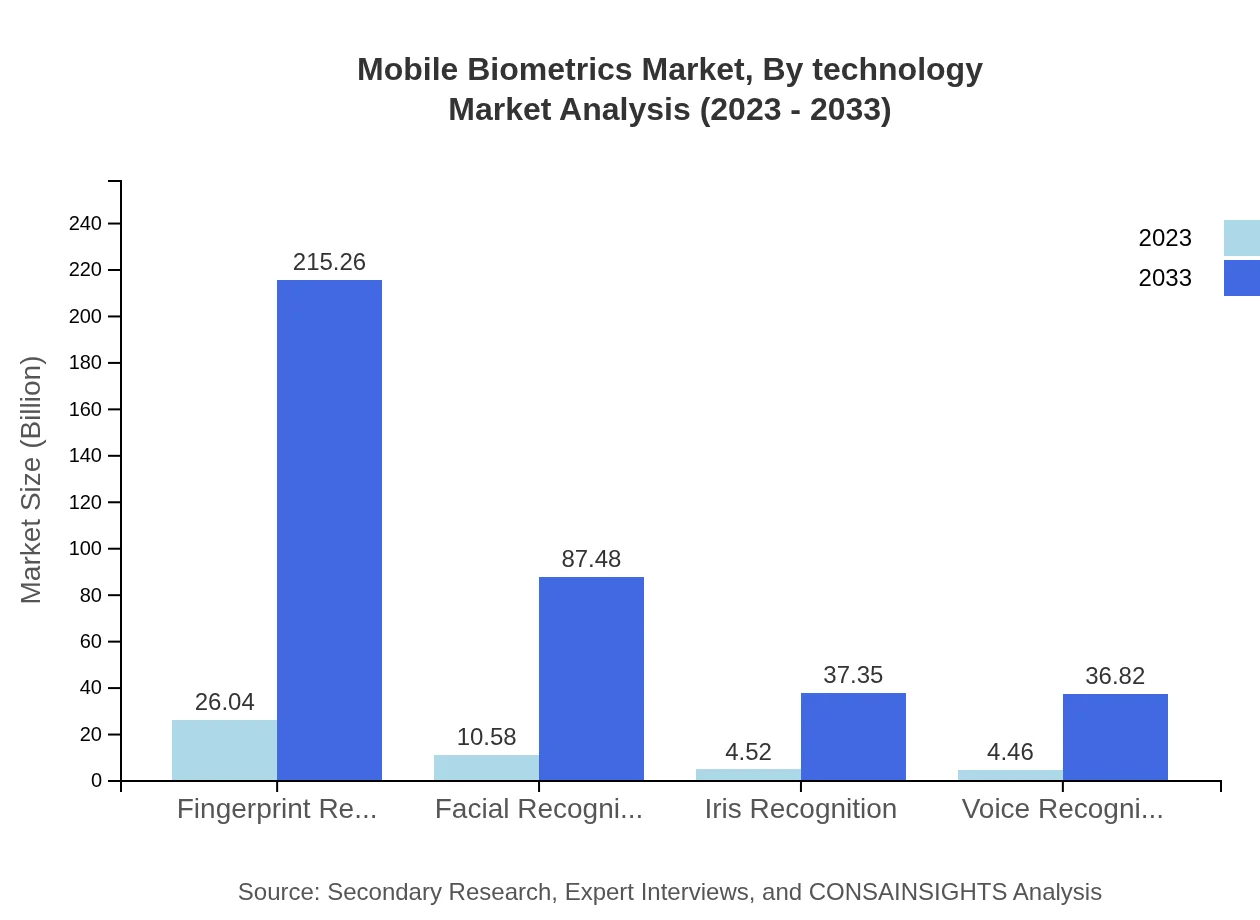

Mobile Biometrics Market Analysis By Technology

Fingerprint recognition captures the largest share, accounting for approximately 57.11% of the market in 2023, estimated to maintain its dominance with an expected growth from $26.04 billion in 2023 to $215.26 billion by 2033. Other technologies like facial recognition ($10.58 billion in 2023), iris recognition ($4.52 billion), and voice recognition ($4.46 billion) are also projected to grow significantly.

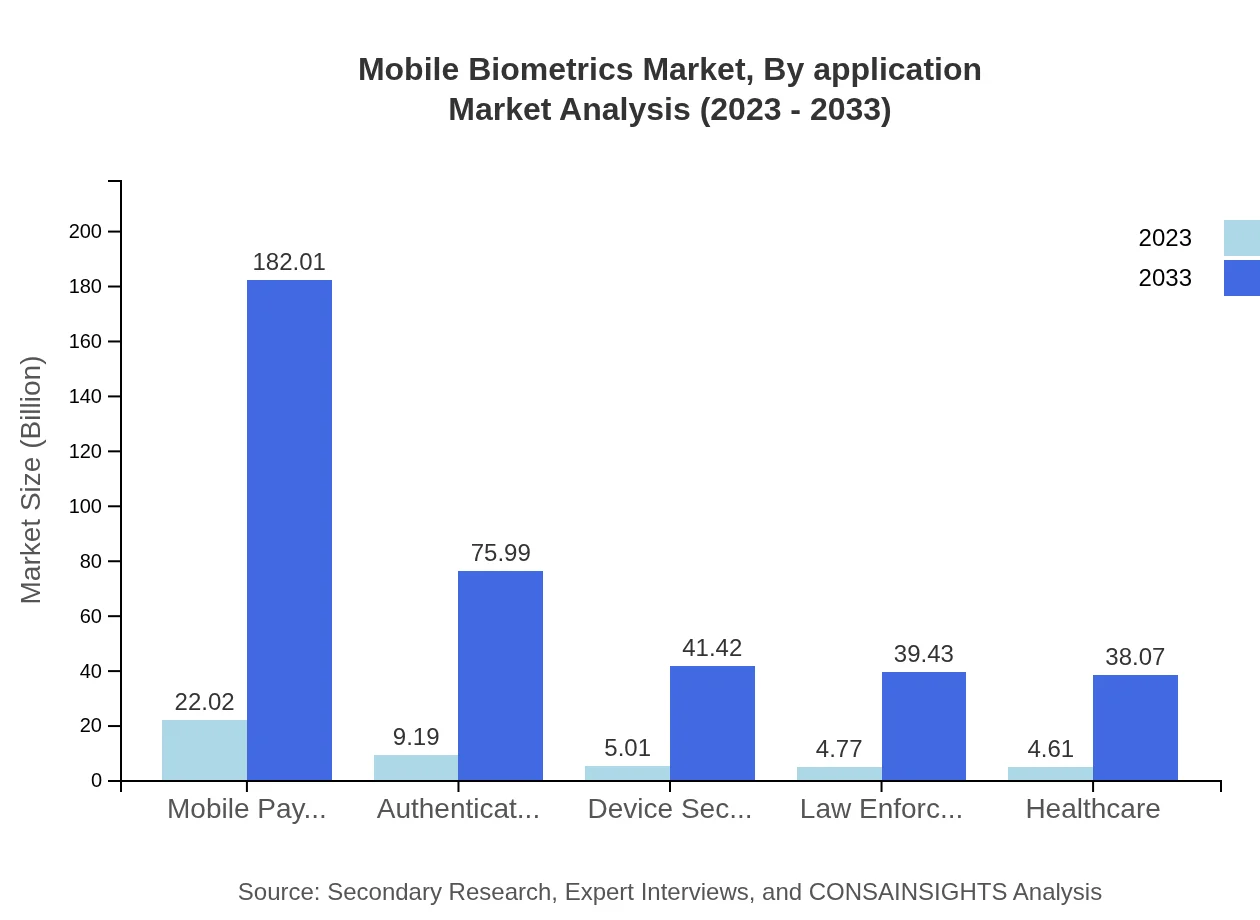

Mobile Biometrics Market Analysis By Application

The mobile payments segment leads the application market, with a significant share expected to grow from $22.02 billion in 2023 to $182.01 billion by 2033. The authentication sector, currently valued at $9.19 billion, will also see substantial growth due to the increasing consumer need for secure access.

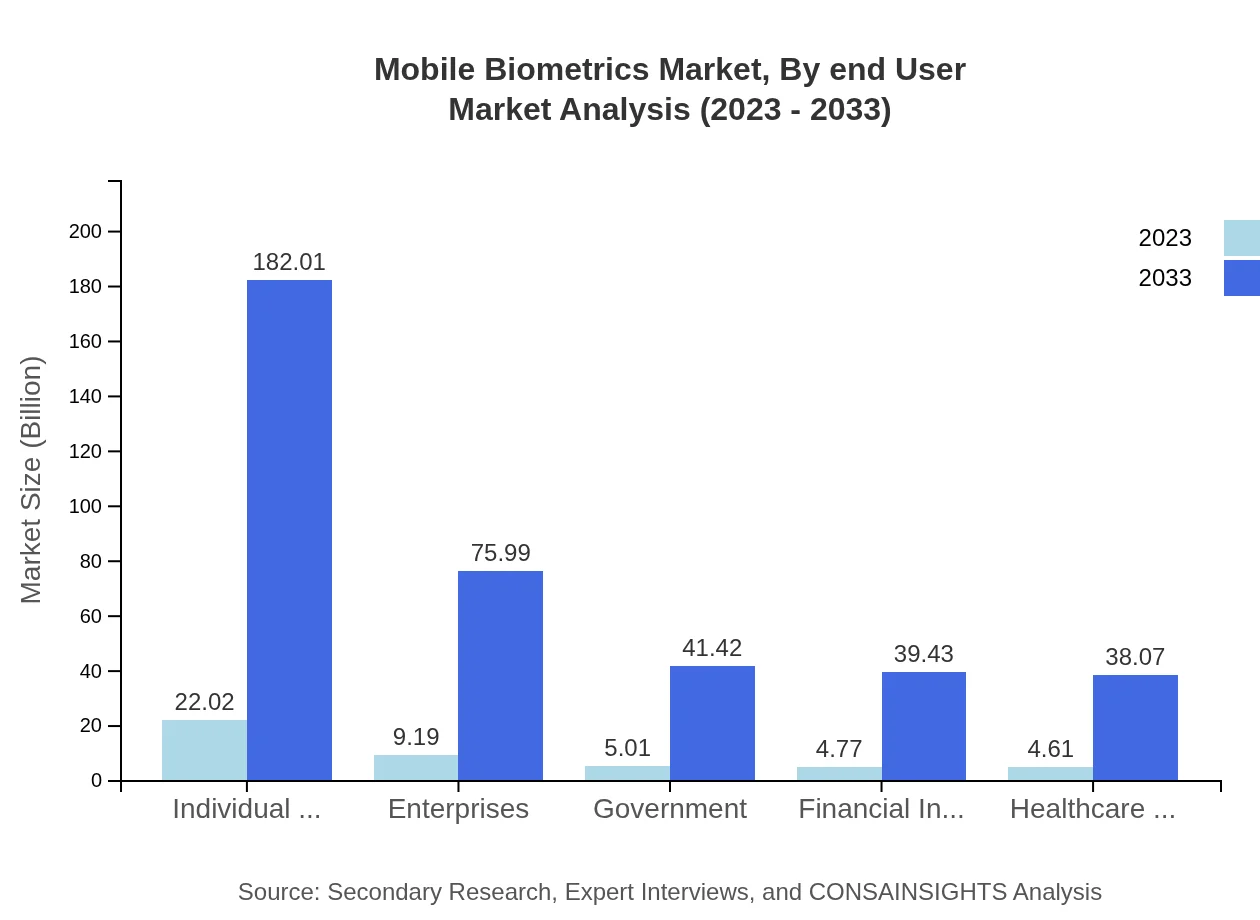

Mobile Biometrics Market Analysis By End User

Individual consumers represent a substantial portion of the market, with revenues expected to rise from $22.02 billion in 2023 to $182.01 billion by 2033, directly associated with consumer preferences towards secure mobile experiences. Enterprises and government sectors are also pivotal, reflecting increased investments in biometric technology.

Mobile Biometrics Market Analysis By Region

Regional analysis showcases varying growth trajectories with North America leading, followed by Europe and Asia Pacific. Each region's technology uptake and regulatory environment will define its position in the next decade.

Mobile Biometrics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Biometrics Industry

Apple Inc.:

Apple has pioneered biometric innovations like Touch ID and Face ID, shaping the mobile biometrics landscape.Samsung Electronics:

Samsung's Galaxy line features advanced biometric capabilities, making it a key player in the industry.Tech4home:

A notable player providing biometric solutions for secure transactions and identity verification.Gemalto (Thales Group):

Specializes in secure biometric solutions for identity verification across sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Biometrics?

The mobile biometrics market is valued at approximately $45.6 billion in 2023, with a significant projected compound annual growth rate (CAGR) of 22.1%. This growth is driven by increasing security demands and advancements in biometric technologies.

What are the key market players or companies in the mobile Biometrics industry?

Key players in the mobile biometrics market include prominent companies such as Apple, Samsung, Microsoft, and NEC Corporation, alongside specialized firms like Cognitec Systems and Validsoft. These companies lead in innovation and development of biometric solutions.

What are the primary factors driving the growth in the mobile Biometrics industry?

Factors driving mobile biometrics growth include rising security concerns, increasing adoption of mobile devices, and advancements in biometric technologies such as fingerprint and facial recognition. The integration of biometrics in payment systems also significantly boosts market expansion.

Which region is the fastest Growing in the mobile Biometrics market?

The Asia-Pacific region is the fastest-growing area in the mobile biometrics market, projected to grow from $9.57 billion in 2023 to $79.12 billion by 2033. This surge is fueled by the high adoption rates of smartphones and increasing safety regulations.

Does ConsaInsights provide customized market report data for the mobile Biometrics industry?

Yes, ConsaInsights specializes in providing customized market report data tailored to client needs in the mobile biometrics industry. This adaptation ensures that companies receive insights specific to their operational context and strategic goals.

What deliverables can I expect from this mobile Biometrics market research project?

Deliverables from a mobile-biometrics market research project typically include comprehensive market analysis reports, trend assessments, competitor insights, and data visualizations, all designed to support robust business decision-making and strategic planning.

What are the market trends of mobile Biometrics?

Current trends in mobile biometrics include the rise of multi-modal biometric systems, growing consumer preference for biometric security in mobile payments, and expanding applications in industries such as healthcare and finance. Enhanced privacy measures are also a key trend.