Mobile Device Management Market Report

Published Date: 31 January 2026 | Report Code: mobile-device-management

Mobile Device Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Mobile Device Management (MDM) market, detailing current trends, competitive landscape, and future forecasts spanning from 2023 to 2033. Insights include market sizing, segment analyses, and regional overviews.

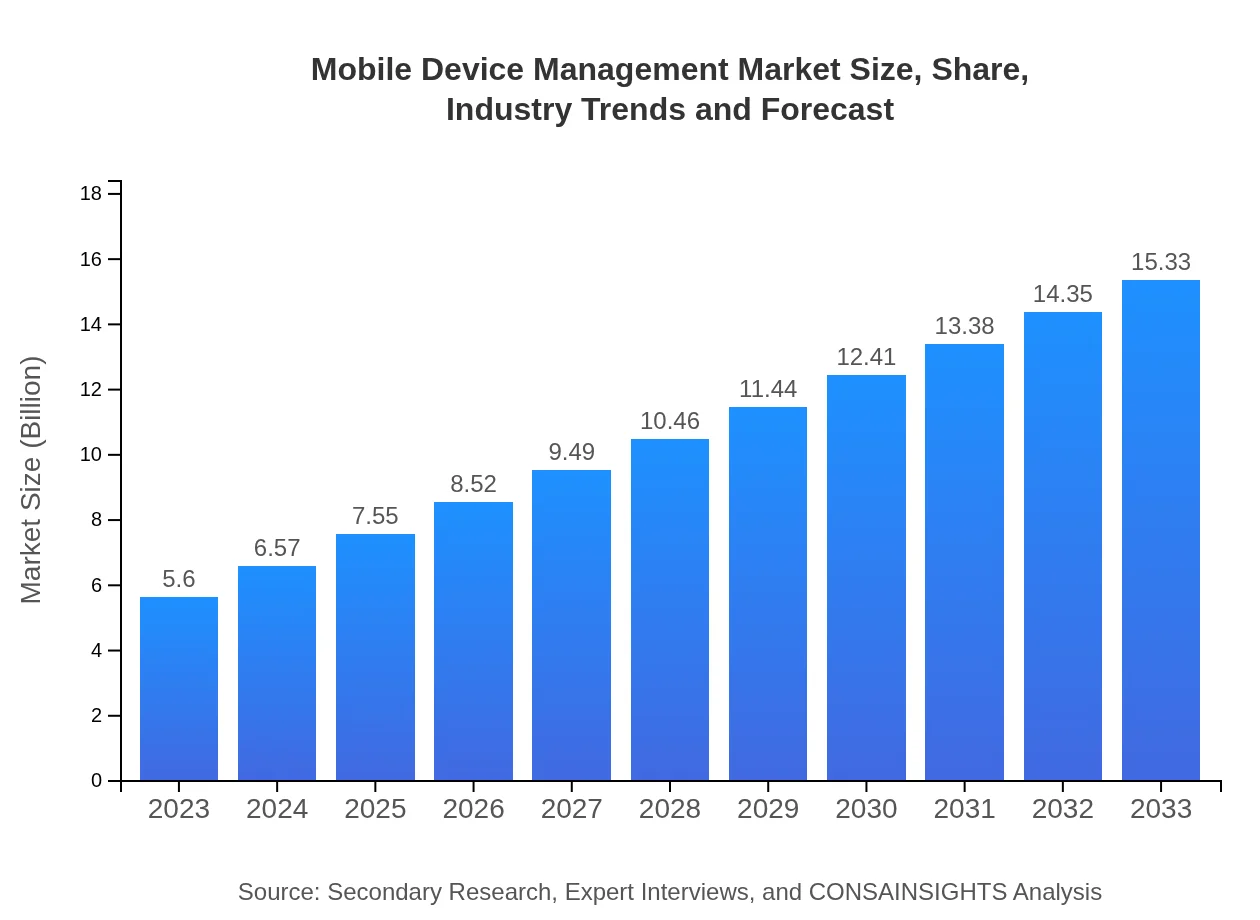

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $15.33 Billion |

| Top Companies | VMware, Microsoft, IBM, Citrix, Cisco |

| Last Modified Date | 31 January 2026 |

Mobile Device Management Market Overview

Customize Mobile Device Management Market Report market research report

- ✔ Get in-depth analysis of Mobile Device Management market size, growth, and forecasts.

- ✔ Understand Mobile Device Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Device Management

What is the Market Size & CAGR of Mobile Device Management market in 2023?

Mobile Device Management Industry Analysis

Mobile Device Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

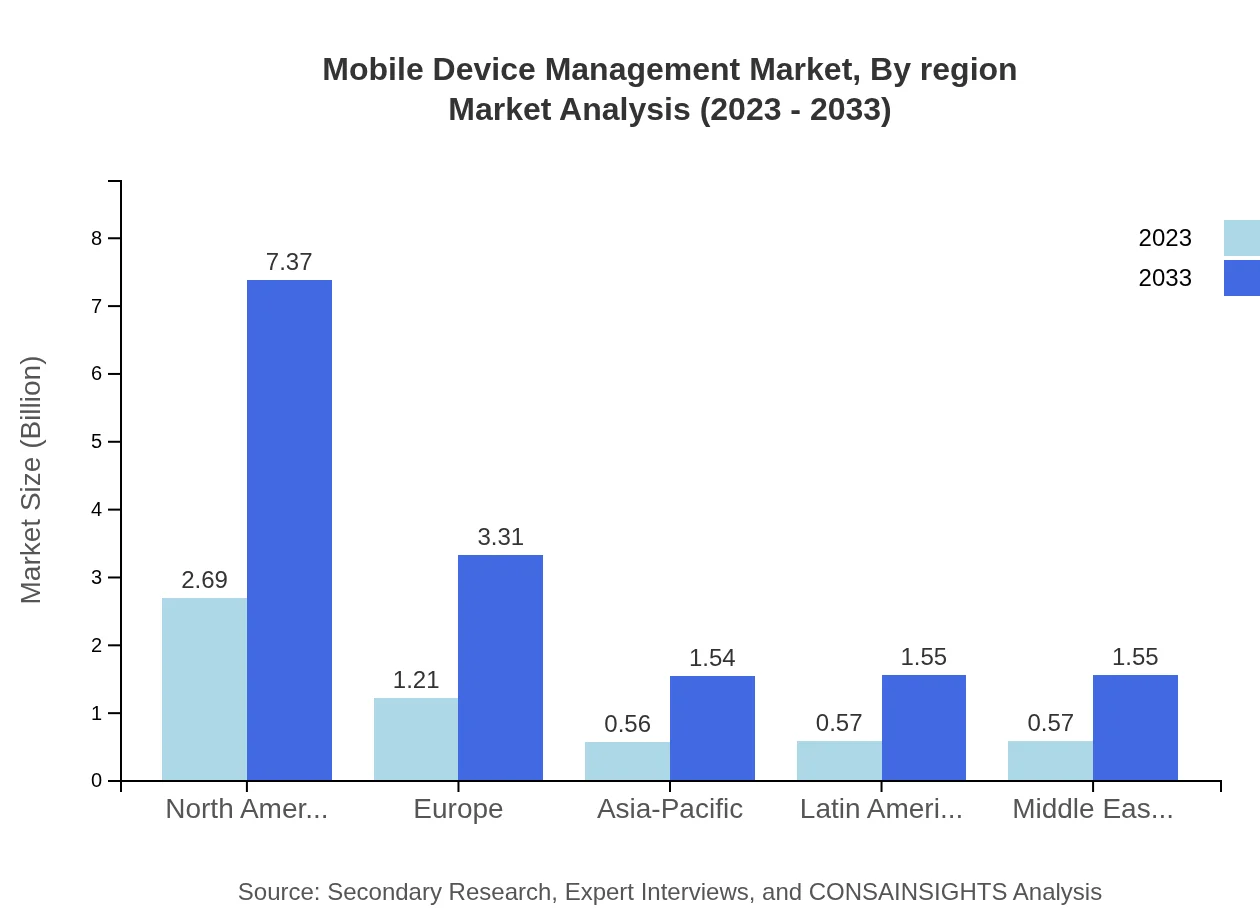

Mobile Device Management Market Analysis Report by Region

Europe Mobile Device Management Market Report:

Europe's MDM market is set to increase from $1.90 billion in 2023 to $5.21 billion in 2033. GDPR regulations and the increasing complexity of mobile device environments are major driving forces behind the growth, leading to heightened investments in effective MDM solutions.Asia Pacific Mobile Device Management Market Report:

The Asia Pacific MDM market is expected to grow from $0.99 billion in 2023 to $2.70 billion by 2033. Countries like China, India, and Japan are leading the charge with rapid digitalization and increasing mobile connectivity. The demand for secure mobile environments in industries such as manufacturing, retail, and IT is pushing growth in this region.North America Mobile Device Management Market Report:

In North America, the market is anticipated to rise from $1.99 billion in 2023 to $5.44 billion in 2033, driven by heightened cybersecurity concerns and sophisticated mobile environments. Enterprises in the US and Canada are increasingly implementing MDM solutions to manage compliance and increase operational efficiency.South America Mobile Device Management Market Report:

The South American MDM market is projected to move from $0.17 billion in 2023 to $0.46 billion by 2033. The adoption rate is slower compared to other regions but is gaining momentum as organizations become more aware of mobile security needs and the digitization of processes.Middle East & Africa Mobile Device Management Market Report:

The Middle East and Africa region's MDM market is projected to grow from $0.56 billion in 2023 to $1.52 billion by 2033. The rise of mobile usage in enterprises and a growing emphasis on securing sensitive data in sectors such as finance and healthcare are fuelling market adoption.Tell us your focus area and get a customized research report.

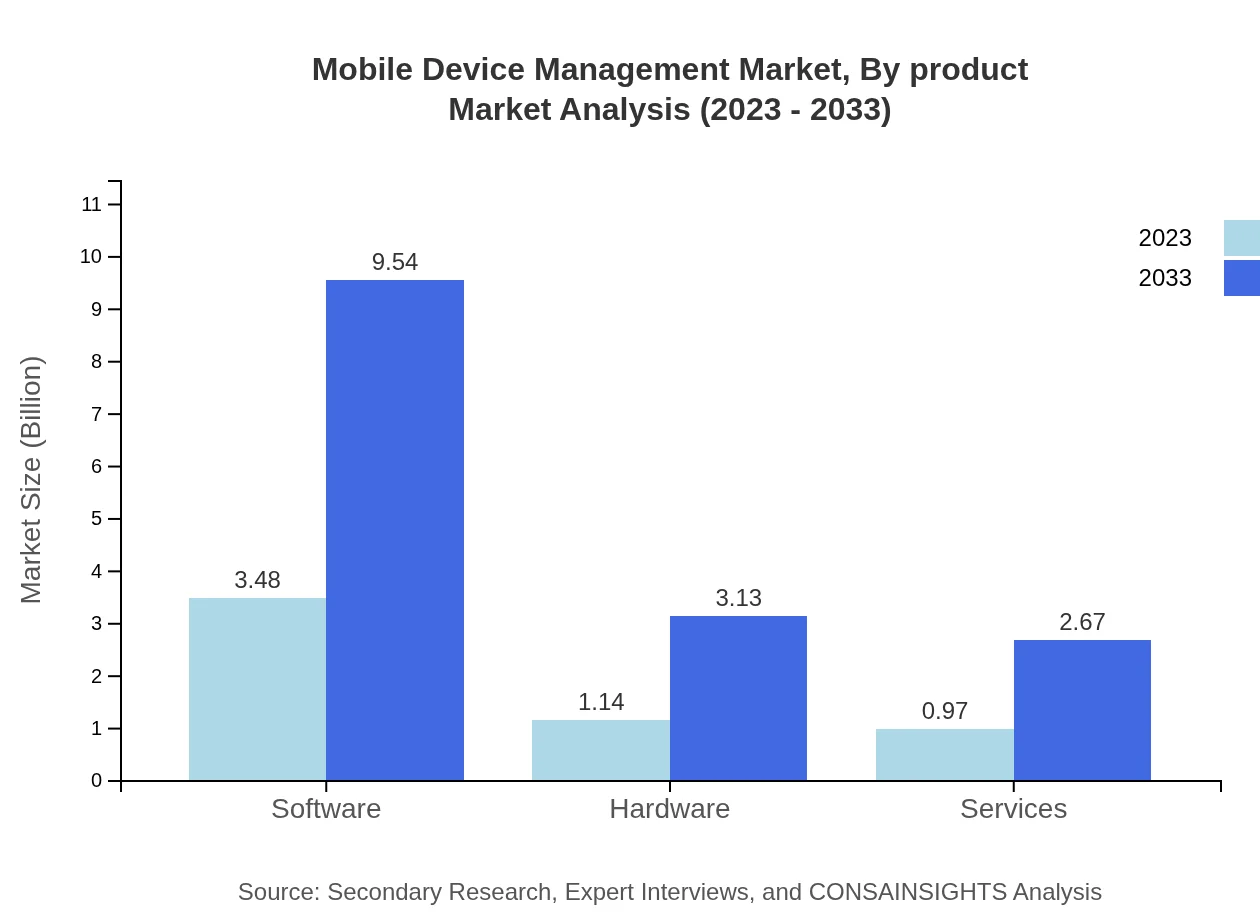

Mobile Device Management Market Analysis By Product

The Mobile Device Management market by product type offers a clear distinction between software, hardware, and services. Software holds a dominant market share of 62.21% in 2023, reflecting its critical role in MDM solutions. Hardware components, driven by the need for secure devices, account for about 20.39%, while services contribute significantly to customer support and integration at 17.4%.

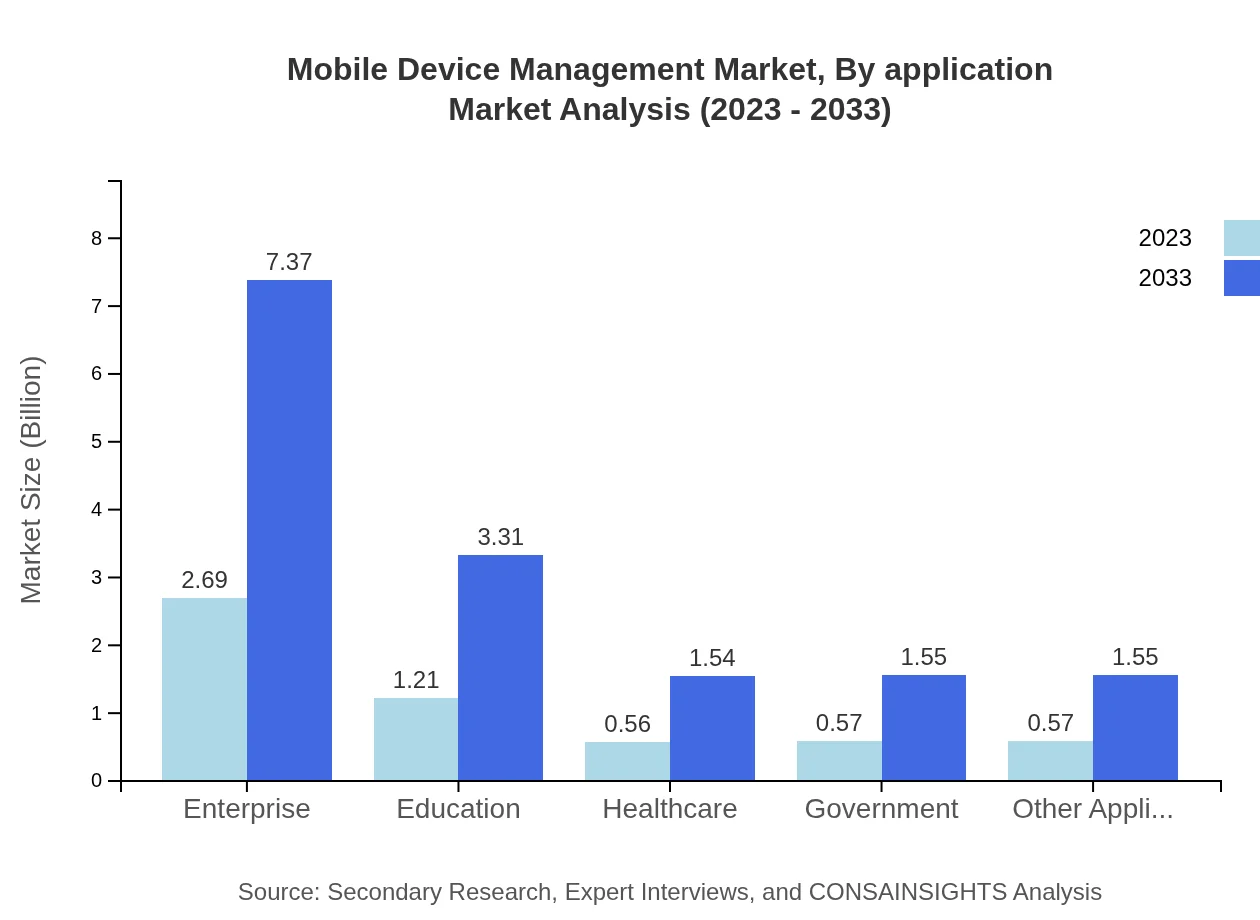

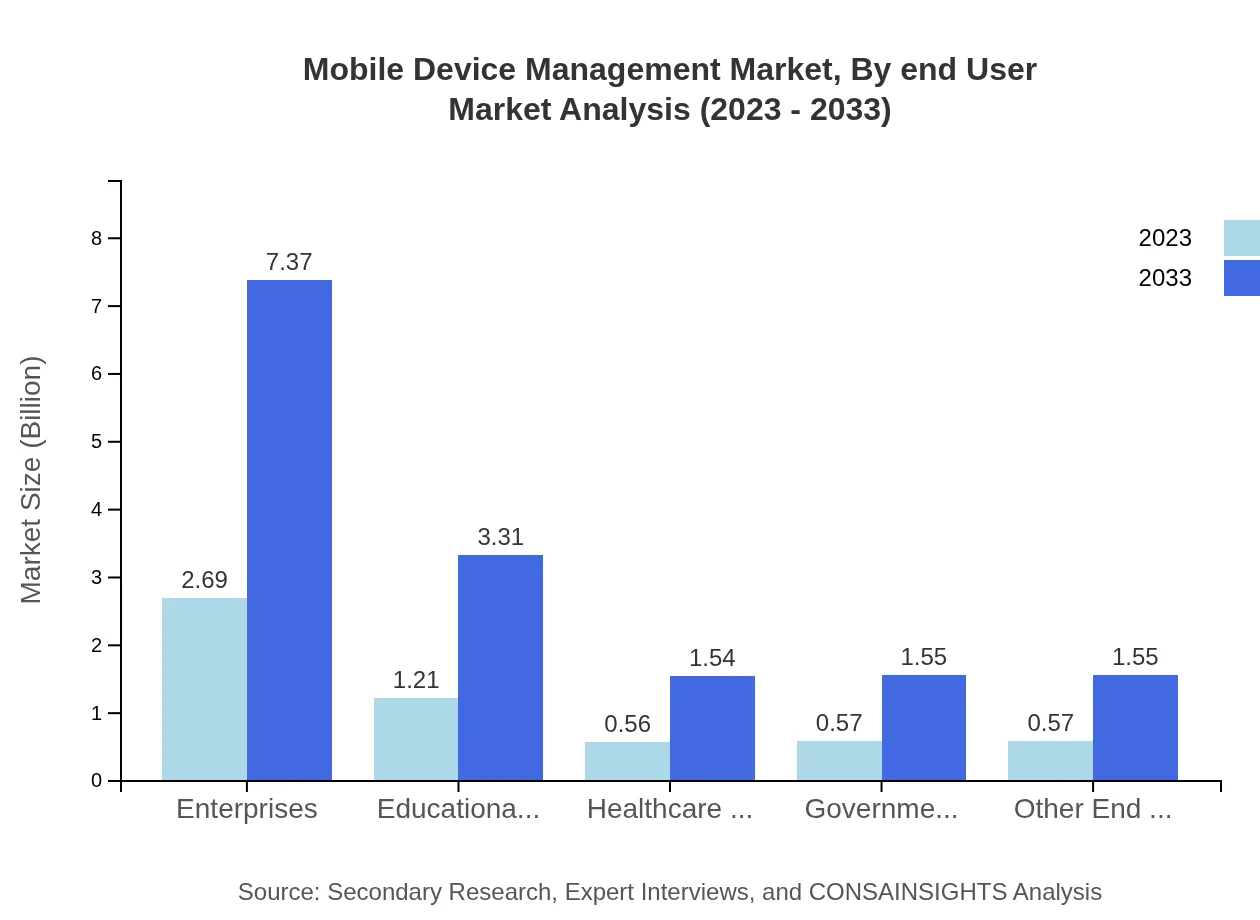

Mobile Device Management Market Analysis By Application

In terms of application, the enterprise segment is the largest in the MDM market, currently representing 48.11% of the total share. Other significant applications include the educational institutions segment at 21.61% and the healthcare providers segment at 10.06%, underscoring the need for secure data management in these sectors.

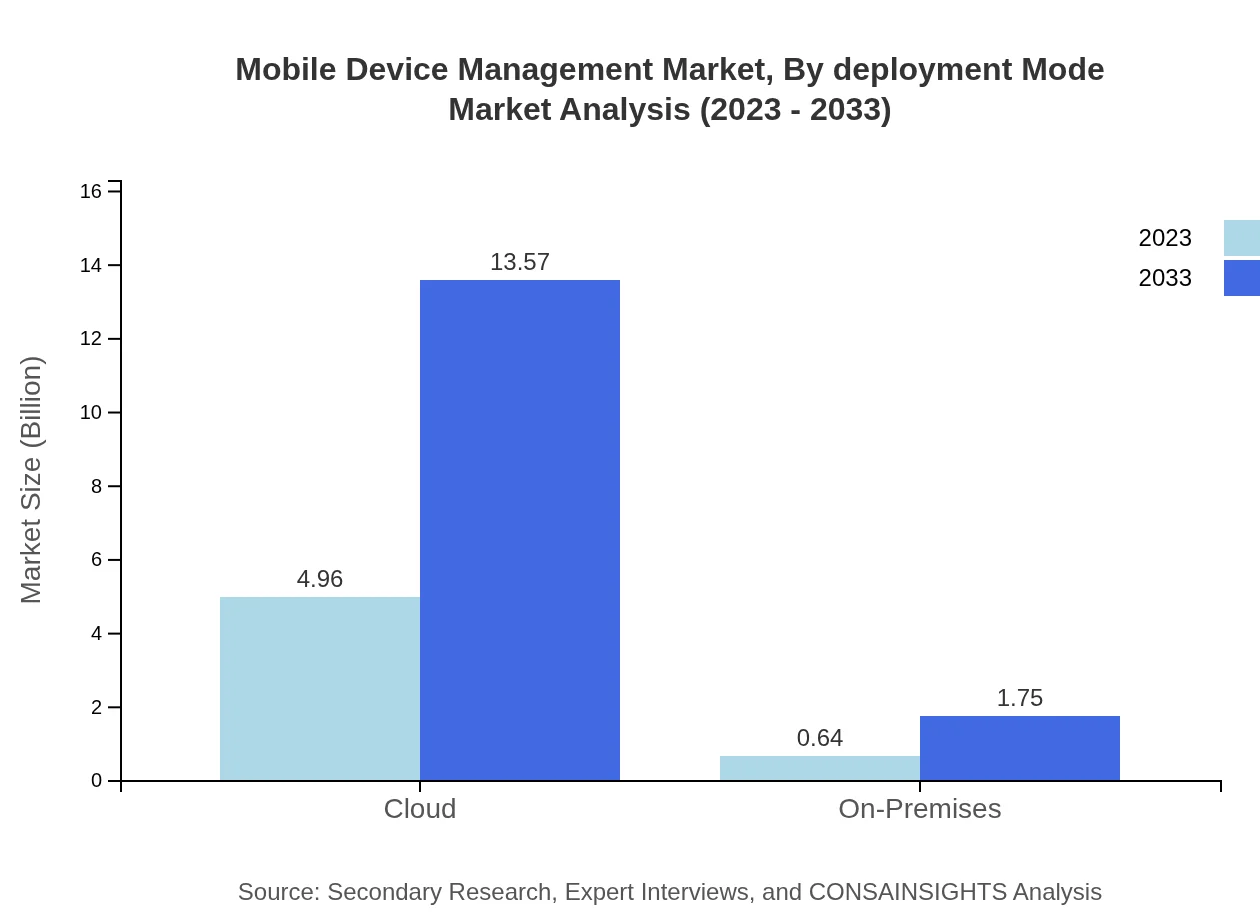

Mobile Device Management Market Analysis By Deployment Mode

The MDM market's deployment mode is bifurcated into cloud and on-premises solutions. Cloud-based MDM services dominate with an impressive share of 88.55% in 2023 and exhibit rapid growth due to their scalability and lower maintenance costs. On-premises solutions, although a fraction at 11.45%, cater to organizations with strict compliance requirements.

Mobile Device Management Market Analysis By Region

Conducting a regional analysis reveals North America as a stronghold for the MDM market, showcasing significant growth potential alongside Europe. Asia Pacific, while currently smaller, is rapidly emerging due to increasing mobile penetration and organizational awareness around mobile security.

Mobile Device Management Market Analysis By End User

Segments based on end-user industries illustrate strong engagement from enterprises, educational institutions, government agencies, and healthcare providers, all seeking robust MDM solutions to manage risks and streamline operations. The enterprise sector continues to show the highest engagement rates.

Mobile Device Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Device Management Industry

VMware:

VMware is a leader in providing virtualization technologies and offers comprehensive MDM solutions designed to enhance enterprise mobility management and security.Microsoft:

Microsoft provides Microsoft Intune, a cloud-based MDM solution that simplifies device management and enhances security for businesses leveraging Microsoft services.IBM:

IBM offers Watson Mobile Device Management, focusing on analytics and improving operational efficiency while maintaining high-security levels across devices.Citrix:

Citrix specializes in application and desktop virtualization solutions, providing robust MDM tools that facilitate remote working setups while ensuring data integrity.Cisco:

Cisco's MDM solutions focus on security and network management, supporting enterprises in managing mobile endpoints efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Device Management?

The mobile device management market is projected to reach approximately $5.6 billion by 2033, with a compound annual growth rate (CAGR) of 10.2%. This growth reflects increasing demand for secure mobile device management solutions among organizations globally.

What are the key market players or companies in this mobile Device Management industry?

Key players in the mobile device management industry include major technology firms such as VMware, IBM, Microsoft, Citrix, and MobileIron. These companies dominate the market by offering innovative management solutions to enhance security and productivity across digital workplaces.

What are the primary factors driving the growth in the mobile device management industry?

The growth in the mobile device management industry is driven by factors such as the increasing adoption of mobile devices in enterprises, a rise in cybersecurity threats, growing implementation of cloud-based solutions, and the need for efficient management of mobile applications.

Which region is the fastest Growing in the mobile device management?

The fastest-growing region in the mobile device management market is Europe, where the market is projected to grow from $1.90 billion in 2023 to $5.21 billion by 2033. This trend reflects heightened demand for MDM solutions across diverse industries in the region.

Does ConsaInsights provide customized market report data for the mobile device management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the mobile device management industry. Clients can request detailed reports that include unique insights, regional analyses, and segment-specific data to aid strategic decision-making.

What deliverables can I expect from this mobile device management market research project?

From the mobile device management market research project, expect deliverables such as detailed market analysis, forecasts, regional growth insights, competitive landscape assessments, and tailored recommendations designed to support strategic planning for stakeholders.

What are the market trends of mobile device management?

Current trends in the mobile device management market include an increasing shift towards cloud-based solutions, integration of artificial intelligence for enhanced analytics, emphasis on security protocols to address mobile threats, and growing requirements for compliance with data protection regulations.