Mobile Mapping Market Report

Published Date: 31 January 2026 | Report Code: mobile-mapping

Mobile Mapping Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Mobile Mapping market, including current trends, forecasts, and insights from 2023 to 2033. It covers market sizes, regional breakdowns, and key players in the industry.

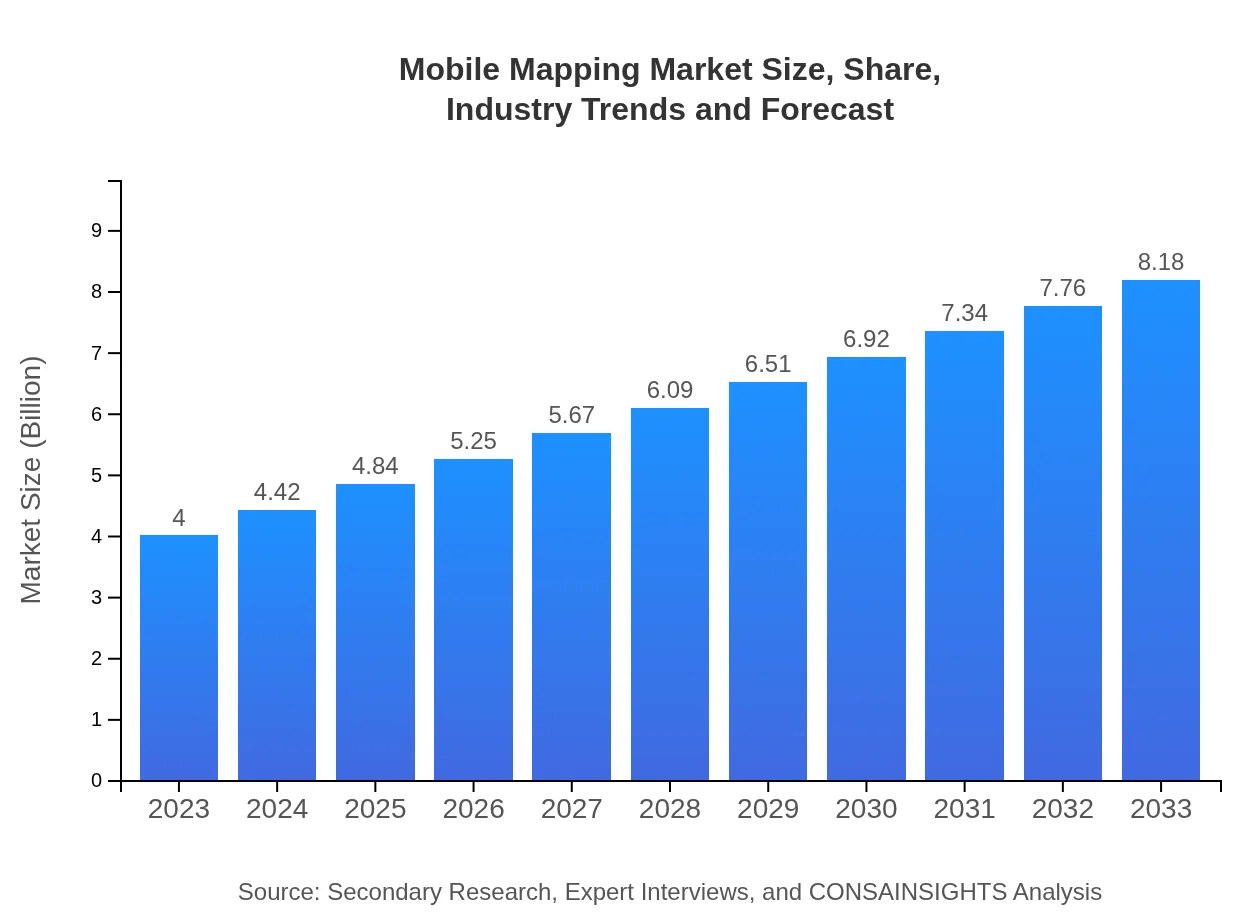

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $8.18 Billion |

| Top Companies | Google, Trimble, Leica Geosystems, Topcon Corporation, RIEGL |

| Last Modified Date | 31 January 2026 |

Mobile Mapping Market Overview

Customize Mobile Mapping Market Report market research report

- ✔ Get in-depth analysis of Mobile Mapping market size, growth, and forecasts.

- ✔ Understand Mobile Mapping's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Mapping

What is the Market Size & CAGR of Mobile Mapping market in 2023?

Mobile Mapping Industry Analysis

Mobile Mapping Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Mapping Market Analysis Report by Region

Europe Mobile Mapping Market Report:

In Europe, the market is set to grow significantly from $1.01 billion in 2023 to $2.07 billion by 2033. European countries are increasingly investing in smart city initiatives and infrastructure projects, driving the demand for mobile mapping technologies.Asia Pacific Mobile Mapping Market Report:

The Asia Pacific region is experiencing significant growth in the Mobile Mapping market, projected to grow from $0.80 billion in 2023 to $1.63 billion by 2033. The increasing urbanization and infrastructure development in countries like China and India drive the demand for mobile mapping solutions, facilitating efficient urban planning and infrastructure management.North America Mobile Mapping Market Report:

North America remains a dominant player in the Mobile Mapping market, with a market size of $1.33 billion in 2023, anticipated to reach $2.72 billion by 2033. The strong presence of key market players and high adoption rates of advanced mapping technologies in the U.S. and Canada facilitate this growth.South America Mobile Mapping Market Report:

The South American market is also on the rise, with expectations of expanding from $0.39 billion in 2023 to $0.81 billion by 2033. Growth in sectors such as environmental monitoring and urban planning is creating opportunities for mobile mapping solutions in this region, particularly in Brazil and Argentina.Middle East & Africa Mobile Mapping Market Report:

The Middle East and Africa Mobile Mapping market is expected to grow from $0.46 billion in 2023 to $0.95 billion by 2033. Rapid urbanization and increased investments in infrastructure are propelling the demand for mobile mapping solutions in this region.Tell us your focus area and get a customized research report.

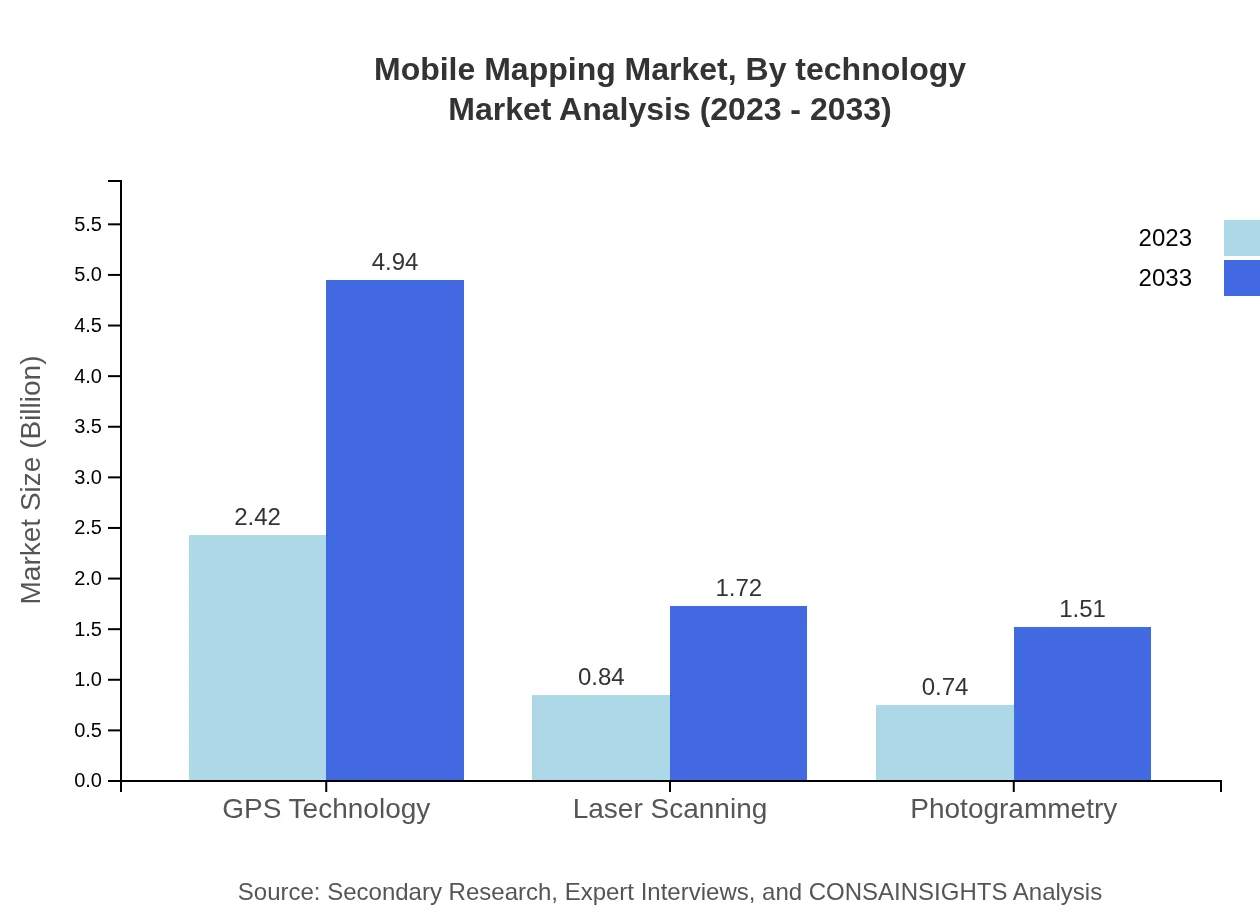

Mobile Mapping Market Analysis By Technology

The technology segment includes GPS technology, which accounts for 60.45% of the market share in 2023, projected to grow significantly due to ongoing advancements in satellite technology and data accuracy. Laser scanning and photogrammetry also play crucial roles, with respective market shares of 21.08% and 18.47% by 2023.

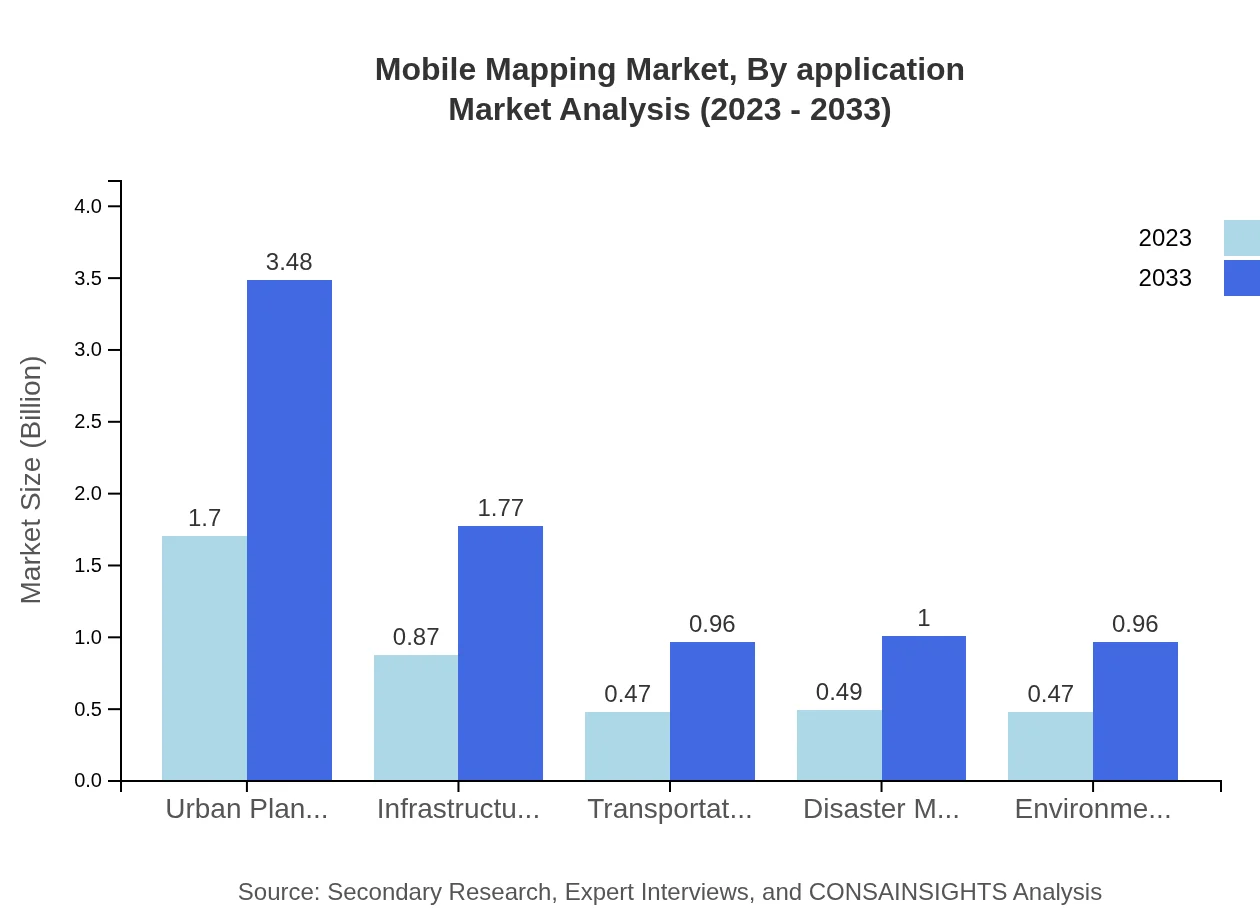

Mobile Mapping Market Analysis By Application

Applications in urban planning and infrastructure management dominate the Mobile Mapping sector, contributing to 42.55% and 21.69% of market share respectively. With increased urbanization, demand for precise mapping services in these areas is expected to continue growing.

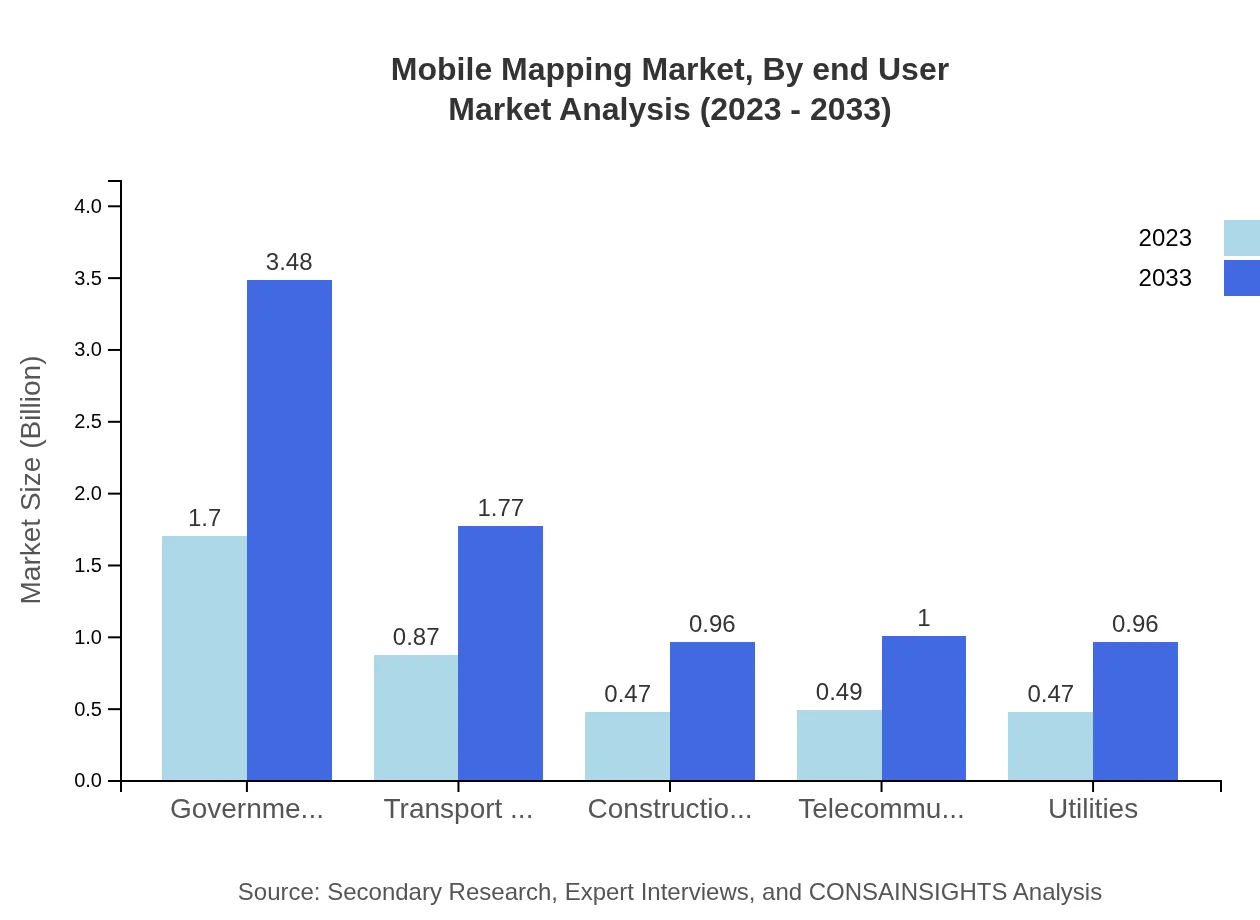

Mobile Mapping Market Analysis By End User

Government agencies represent a significant end-user segment, holding a market share of 42.55% in 2023 and projected to grow. Transport companies and construction firms also contribute notably due to their reliance on accurate geospatial data for planning and execution.

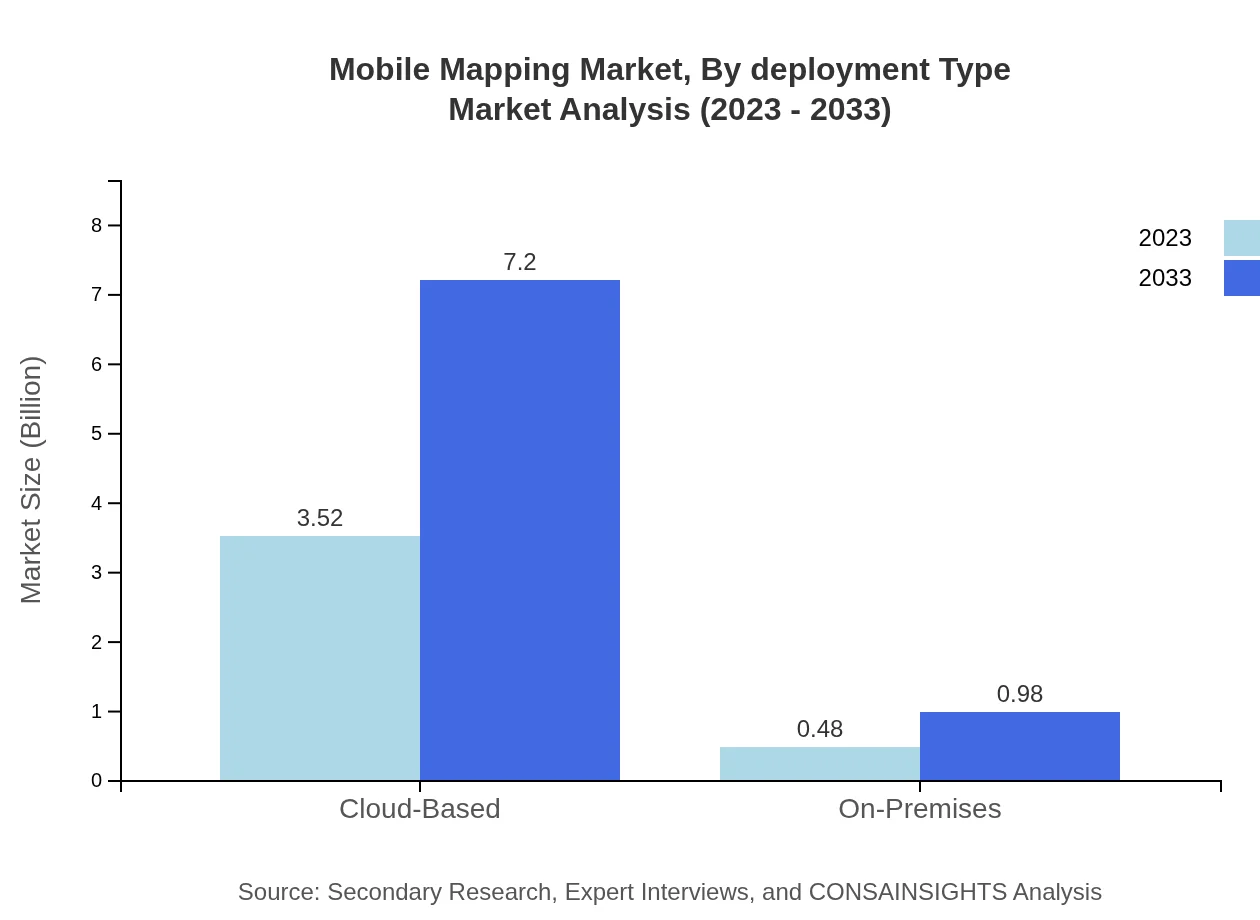

Mobile Mapping Market Analysis By Deployment Type

Cloud-based solutions dominate the deployment type segment, accounting for 88.06% of the market share in 2023. This growth is driven by the need for real-time data access and collaboration across various mobile mapping applications.

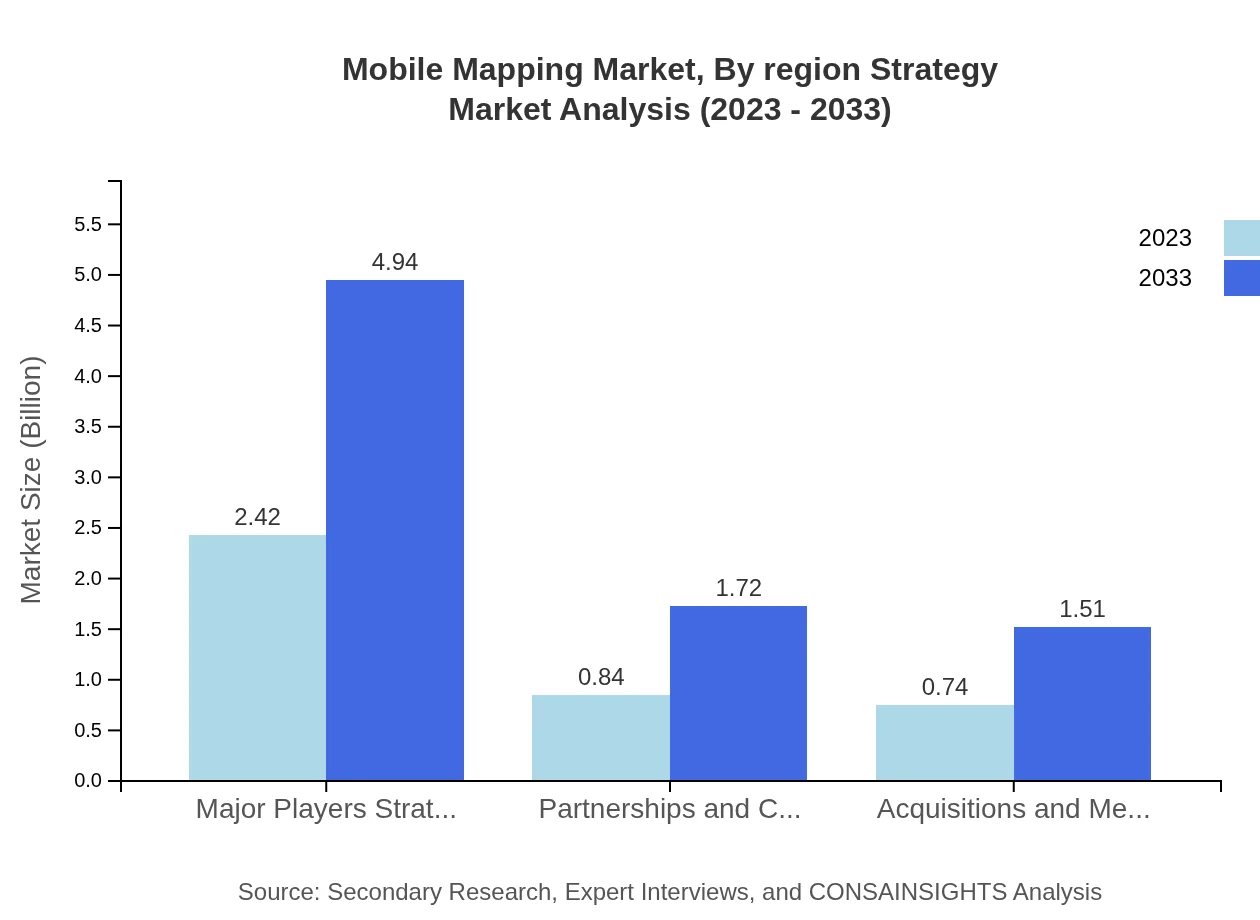

Mobile Mapping Market Analysis By Region Strategy

Key strategies among market players include partnerships and collaborations, which represent 21.08% of market share, enhancing capabilities and market reach. Acquisitions and mergers also significantly influence market dynamics, contributing to joint innovations and expanded service offerings.

Mobile Mapping Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Mapping Industry

Google:

Google has been a pioneer in mobile mapping technologies with its Google Maps and Street View services, continually innovating to enhance user experience and data accuracy.Trimble:

Trimble offers a wide range of mobile mapping solutions focusing on precision and efficiency in data collection for construction, surveying, and geospatial applications.Leica Geosystems:

Leica Geosystems specializes in advanced laser scanning and mobile mapping technologies, providing comprehensive solutions for high-precision mapping across various industries.Topcon Corporation:

Topcon provides innovative geospatial solutions, including mobile mapping systems that are widely used in transportation and infrastructure projects worldwide.RIEGL:

RIEGL is known for its cutting-edge LiDAR technology and mobile mapping systems, catering to a range of applications including environmental monitoring and urban planning.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Mapping?

The mobile mapping market size is projected to reach approximately $4 billion by 2033, growing at a CAGR of 7.2%. This growth is fueled by increasing demand for efficient surveying and mapping solutions across various sectors.

What are the key market players or companies in the mobile Mapping industry?

Key players in the mobile mapping industry include leading technology companies involved in GPS technology, Laser Scanning, and Photogrammetry solutions, contributing significantly to the overall market growth.

What are the primary factors driving the growth in the mobile mapping industry?

The growth of the mobile mapping industry is primarily driven by technological advancements in GPS and imaging systems, increasing applications in various sectors, and the rising need for accurate geographical data.

Which region is the fastest Growing in the mobile mapping?

The Asia Pacific region is the fastest-growing market for mobile mapping, transitioning from $0.80 billion in 2023 to $1.63 billion by 2033, indicating a robust demand in emerging economies.

Does ConsaInsights provide customized market report data for the mobile mapping industry?

Yes, ConsaInsights offers customized market report data tailored to the unique needs of stakeholders in the mobile mapping industry, ensuring relevant insights for strategic decision-making.

What deliverables can I expect from this mobile mapping market research project?

You can expect comprehensive reports including market size analysis, future growth forecasts, competitive landscape reviews, and insights into market trends and opportunities across various segments and regions.

What are the market trends of mobile mapping?

Current trends include increased adoption of cloud-based solutions, advancements in laser scanning and photogrammetry technologies, and rising investment in urban planning and infrastructure management applications.