Mobile Medical Imaging Services Market Report

Published Date: 31 January 2026 | Report Code: mobile-medical-imaging-services

Mobile Medical Imaging Services Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Mobile Medical Imaging Services market, focusing on insights and trends from 2023 to 2033, including market size, segmentation, regional performance, and key industry players.

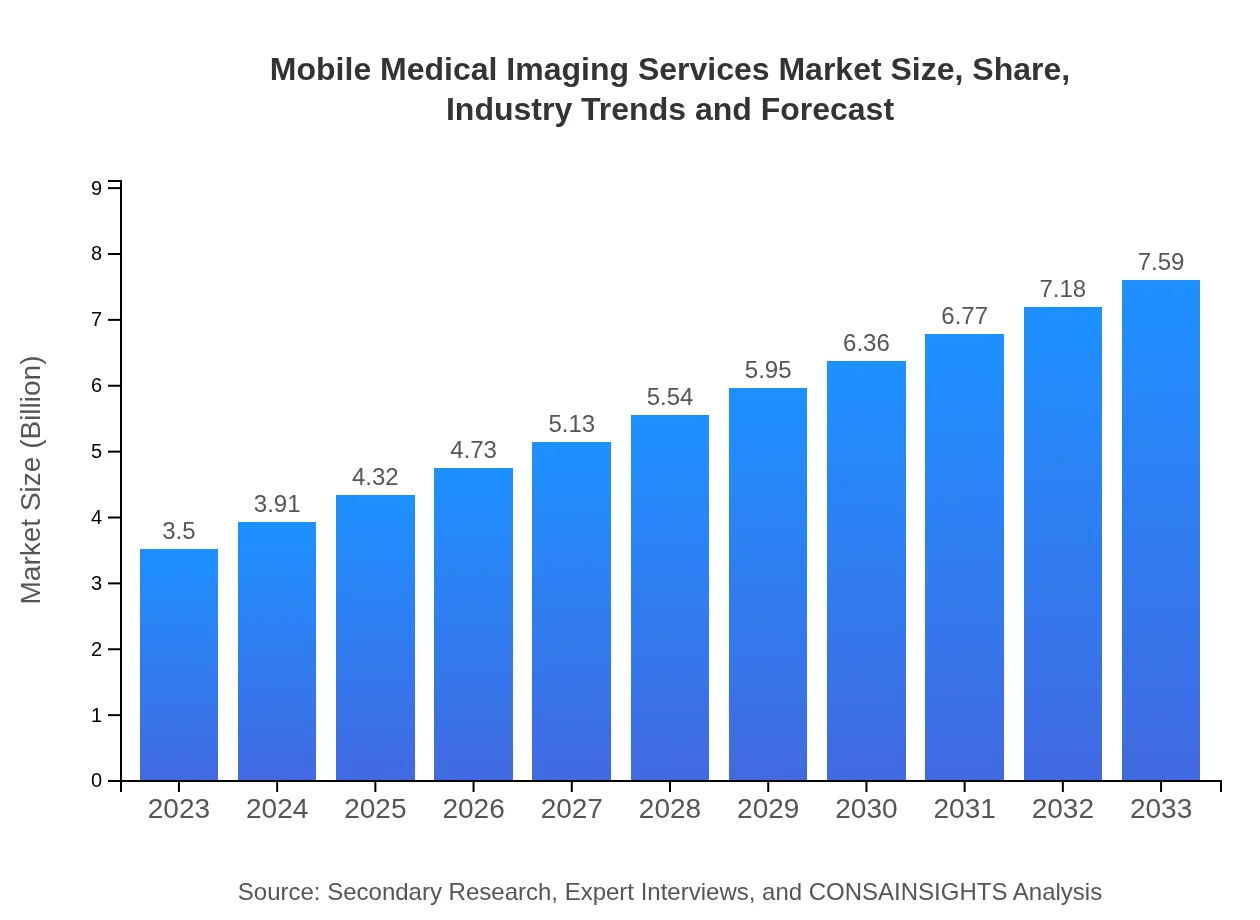

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $7.59 Billion |

| Top Companies | Siemens Healthineers, GE Healthcare, Philips Healthcare, Roche Diagnostics, Mobius Biomedical |

| Last Modified Date | 31 January 2026 |

Mobile Medical Imaging Services Market Overview

Customize Mobile Medical Imaging Services Market Report market research report

- ✔ Get in-depth analysis of Mobile Medical Imaging Services market size, growth, and forecasts.

- ✔ Understand Mobile Medical Imaging Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Medical Imaging Services

What is the Market Size & CAGR of Mobile Medical Imaging Services market in 2023?

Mobile Medical Imaging Services Industry Analysis

Mobile Medical Imaging Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Medical Imaging Services Market Analysis Report by Region

Europe Mobile Medical Imaging Services Market Report:

The European Mobile Medical Imaging Services market is likely to grow from USD 950 million in 2023 to USD 2.07 billion by 2033. A robust healthcare infrastructure, increased focus on preventive care, and the aging demographic in Europe drive the demand for mobile imaging services.Asia Pacific Mobile Medical Imaging Services Market Report:

In the Asia Pacific region, the market size is expected to grow from USD 660 million in 2023 to USD 1.44 billion by 2033. Factors driving this growth include increasing healthcare spending, a rising population requiring diagnostics, and advancements in imaging technologies. The region's focus on improving healthcare access in rural areas further enhances market potential.North America Mobile Medical Imaging Services Market Report:

North America is projected to witness significant growth from USD 1.36 billion in 2023 to USD 2.96 billion by 2033. The region's strong emphasis on innovative medical technologies, heightened demand for home care services, and rising patient preferences for non-traditional healthcare delivery models contribute to this remarkable growth.South America Mobile Medical Imaging Services Market Report:

The South American market is anticipated to expand from USD 300 million in 2023 to approximately USD 650 million by 2033. This growth is influenced by government initiatives aimed at improving healthcare infrastructure, along with an increasing prevalence of chronic diseases necessitating diagnostic services.Middle East & Africa Mobile Medical Imaging Services Market Report:

In the Middle East and Africa, the market is expected to grow from USD 220 million in 2023 to USD 470 million by 2033. The healthcare sector in these regions is rapidly evolving, with rising healthcare investments and growing awareness regarding early disease detection pushing the demand for mobile imaging solutions.Tell us your focus area and get a customized research report.

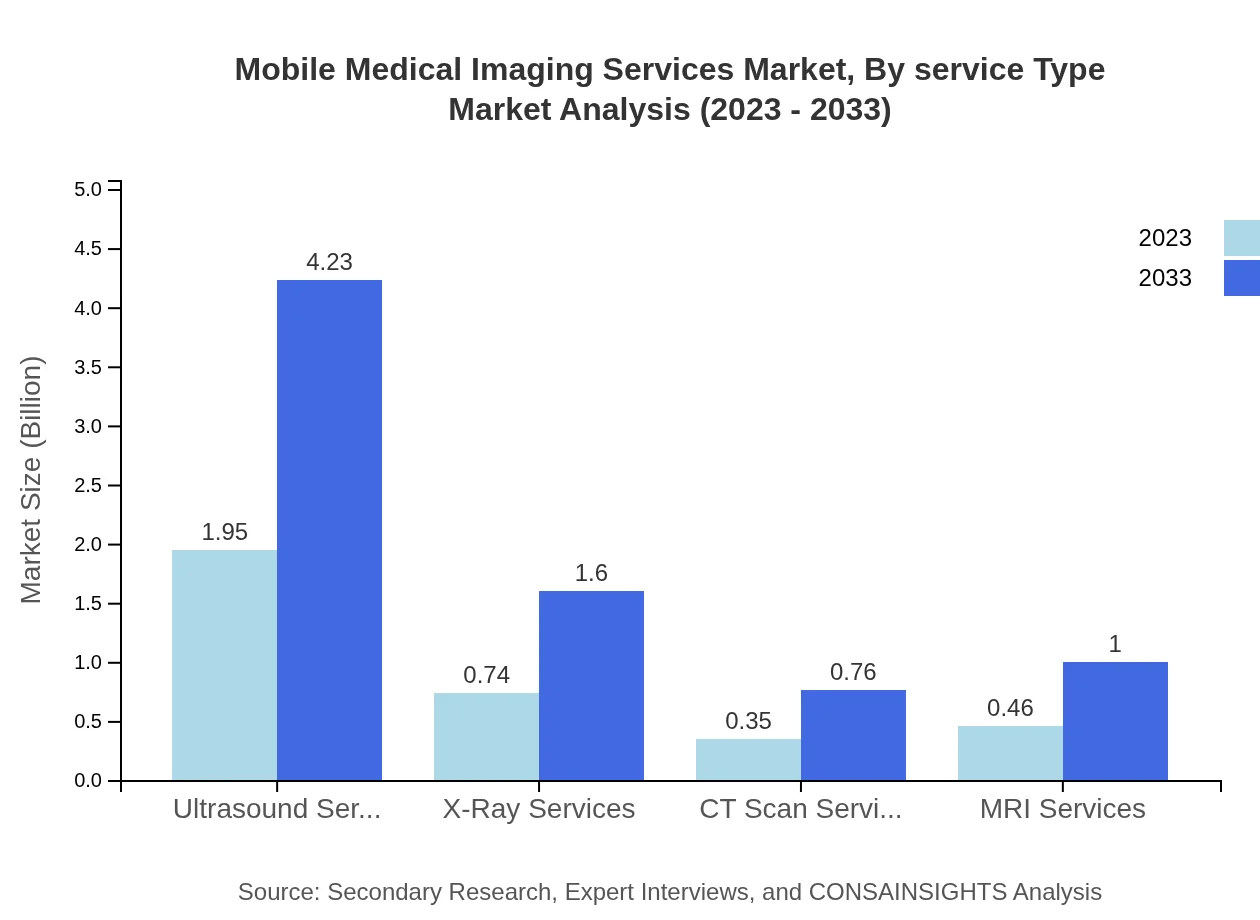

Mobile Medical Imaging Services Market Analysis By Service Type

The by-service-type segment of the Mobile Medical Imaging Services market reveals that ultrasound services are expected to dominate with a market size of $1.95 billion in 2023, escalating to $4.23 billion by 2033, holding a significant market share of 55.71%. Other critical services include diagnostic centers, emergency services, and digital imaging technologies, which are pivotal to enhancing patient outcomes.

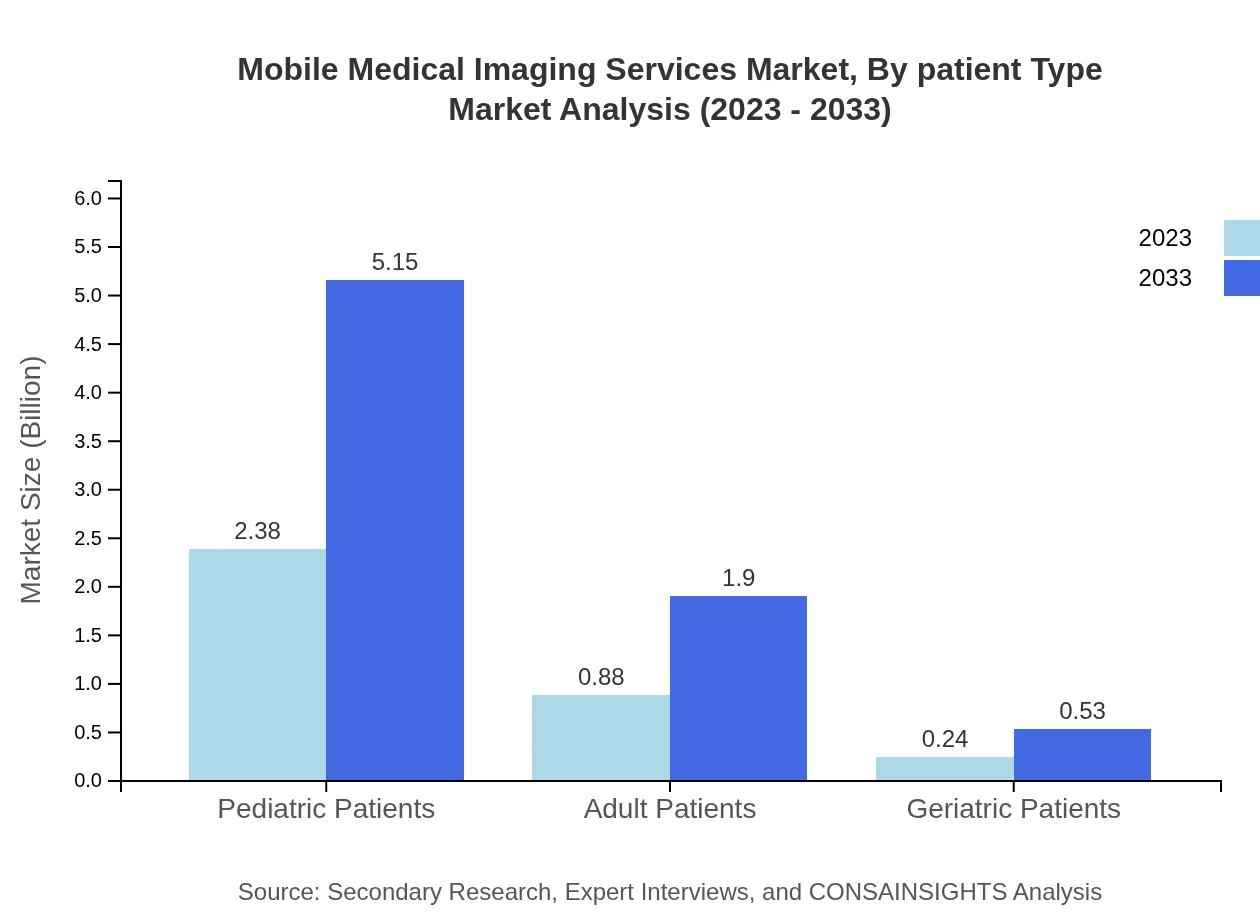

Mobile Medical Imaging Services Market Analysis By Patient Type

When categorized by patient type, pediatric patients represent the largest segment, with a market size of $2.38 billion in 2023 and a forecast of $5.15 billion by 2033, comprising 67.92% of the market share. This is followed by adult patients and geriatric patients, with notable sizes reflecting the diverse needs for mobile imaging services.

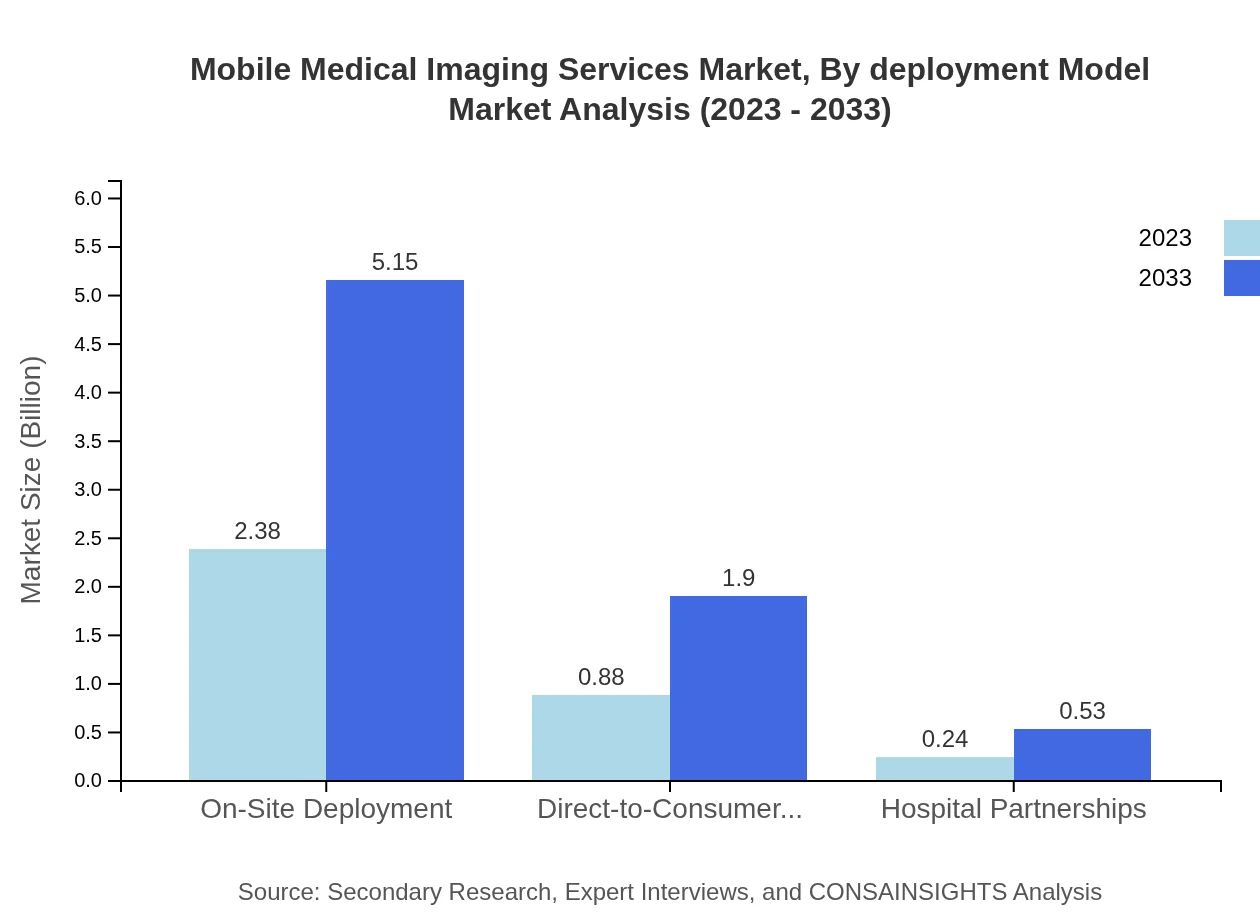

Mobile Medical Imaging Services Market Analysis By Deployment Model

In terms of deployment models, on-site deployment leads with a market size of $2.38 billion in 2023, scaling to $5.15 billion by 2033, capturing 67.92% market share. This model's effectiveness and convenience resonate strongly with both patients and healthcare providers, facilitating immediate and efficient diagnostic solutions.

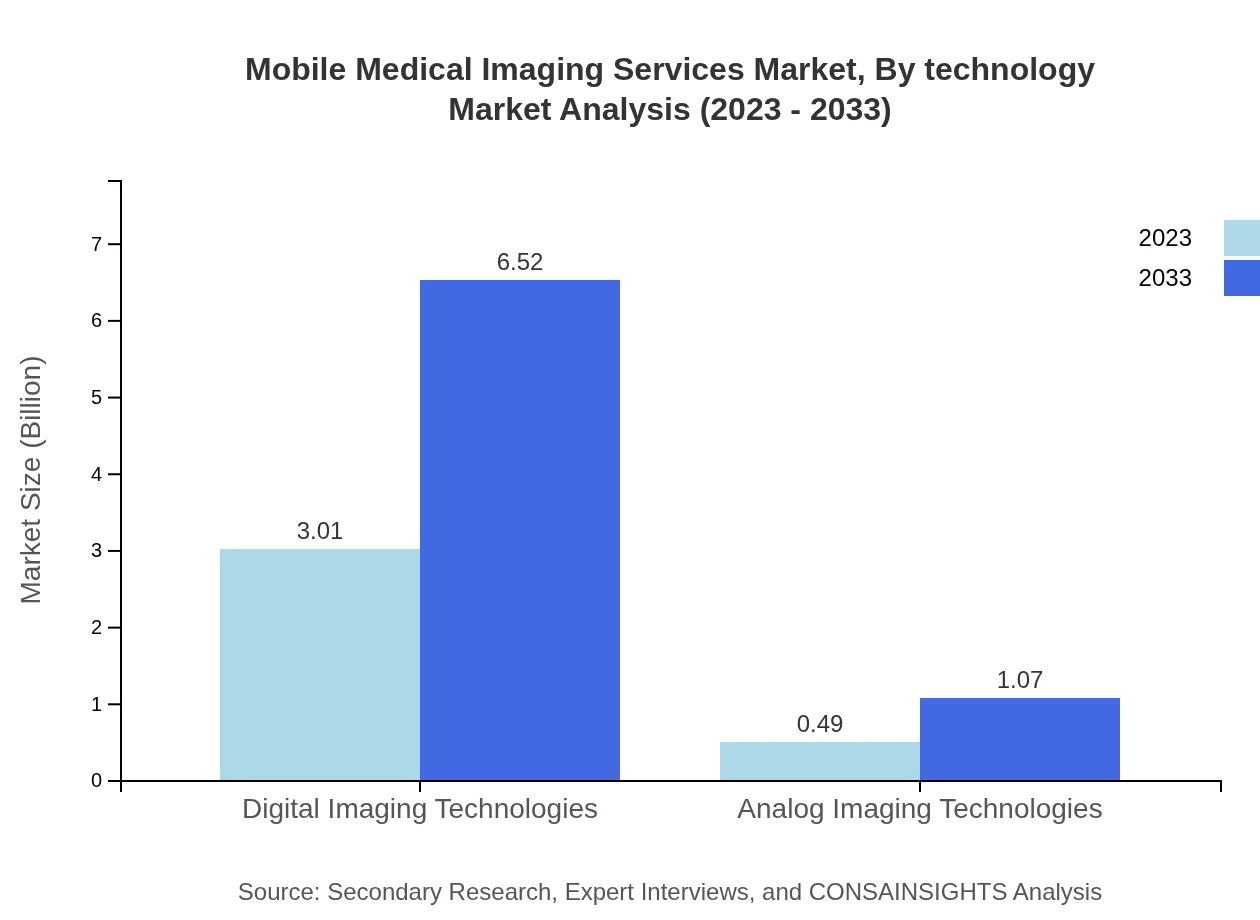

Mobile Medical Imaging Services Market Analysis By Technology

Digital imaging technologies dominate the market, valued at $3.01 billion in 2023 and projected to reach $6.52 billion by 2033, accounting for 85.89% market share. Innovations such as AI integration and portable devices optimize diagnostic accuracy and workflow efficiency within the mobile imaging sector.

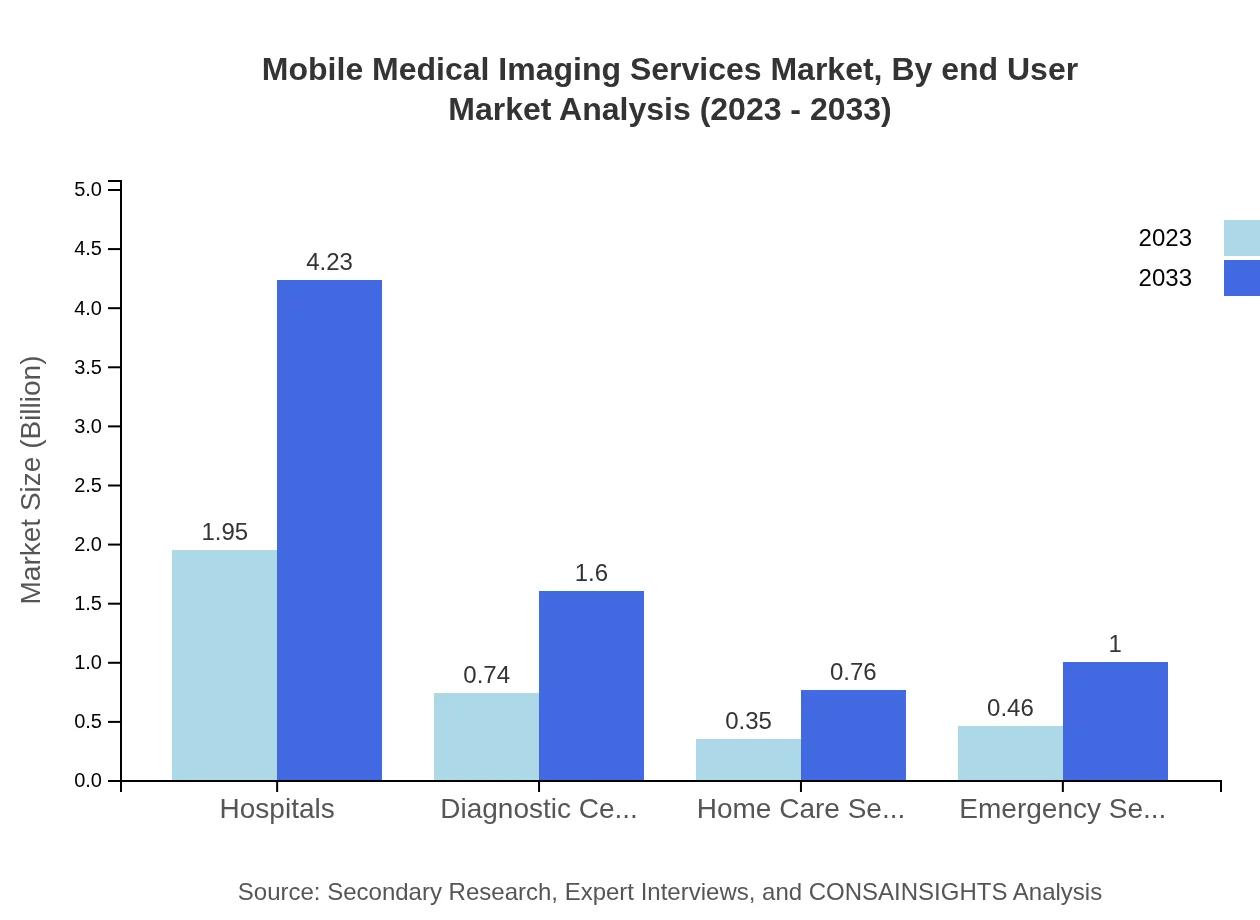

Mobile Medical Imaging Services Market Analysis By End User

By end-user, hospitals are the leading segment with a market value of $1.95 billion in 2023 and expected growth to $4.23 billion by 2033, holding a substantial market share of 55.71%. This reflects the indispensable nature of mobile imaging services in hospital settings amidst rising patient demands for prompt diagnostic services.

Mobile Medical Imaging Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Medical Imaging Services Industry

Siemens Healthineers:

Siemens Healthineers is a leading global provider of medical technology, particularly known for its advanced imaging solutions and diagnostic services, which significantly contribute to the growth of the mobile imaging sector.GE Healthcare:

GE Healthcare specializes in innovative medical technologies, including mobile imaging systems, playing a crucial role in enhancing diagnostic procedures and transforming patient care delivery.Philips Healthcare:

Philips Healthcare is recognized for its commitment to improving patient outcomes through advanced imaging technologies and mobile solutions, maintaining a strong presence in the global market.Roche Diagnostics:

Roche Diagnostics focuses on diagnostic solutions, integrating mobile imaging services into comprehensive healthcare solutions to improve access and efficiency in patient treatments.Mobius Biomedical:

Mobius Biomedical offers cutting-edge solutions in mobile imaging, enabling effective diagnostic services and contributing significantly to the mobile medical imaging landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile medical imaging services?

The global mobile medical imaging services market is valued at approximately $3.5 billion in 2023, with a projected CAGR of 7.8% through 2033. This growth indicates a significant escalation in demand for mobile imaging solutions in healthcare.

What are the key market players or companies in this mobile medical imaging services industry?

Key players include GE Healthcare, Siemens Healthineers, Philips Healthcare, Fujifilm Medical Systems, and Canon Medical Systems. These companies offer cutting-edge technologies and expand service offerings to enhance patient care and operational efficiency.

What are the primary factors driving the growth in the mobile medical imaging services industry?

Driving factors include increasing healthcare access needs, technological advancements in imaging technologies, rising prevalence of chronic diseases, and the growing demand for cost-efficient healthcare solutions, particularly in under-served regions.

Which region is the fastest Growing in the mobile medical imaging services?

Asia Pacific is the fastest-growing region, increasing from $0.66 billion in 2023 to $1.44 billion by 2033, reflecting robust economic growth, increased healthcare investments, and rising patient population demands in this area.

Does Consainsights provide customized market report data for the mobile medical imaging services industry?

Yes, Consainsights specializes in providing tailored market reports to meet specific client requirements, ensuring detailed and relevant data analysis that reflects unique market conditions and trends.

What deliverables can I expect from this mobile medical imaging services market research project?

Expect comprehensive deliverables including detailed market analysis, competitive landscape insights, segment breakdowns, regional performance assessments, and actionable strategic recommendations to inform business decisions.

What are the market trends of mobile medical imaging services?

Current trends include the rise of mobile imaging technologies, an increase in partnerships between health facilities and mobile service providers, and a push for telehealth integration to enhance service delivery and patient engagement.