Mobile Money Market Report

Published Date: 31 January 2026 | Report Code: mobile-money

Mobile Money Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the current landscape and future projections of the Mobile Money market from 2023 to 2033, providing insights on market size, trends, segmentation, and key players in the industry.

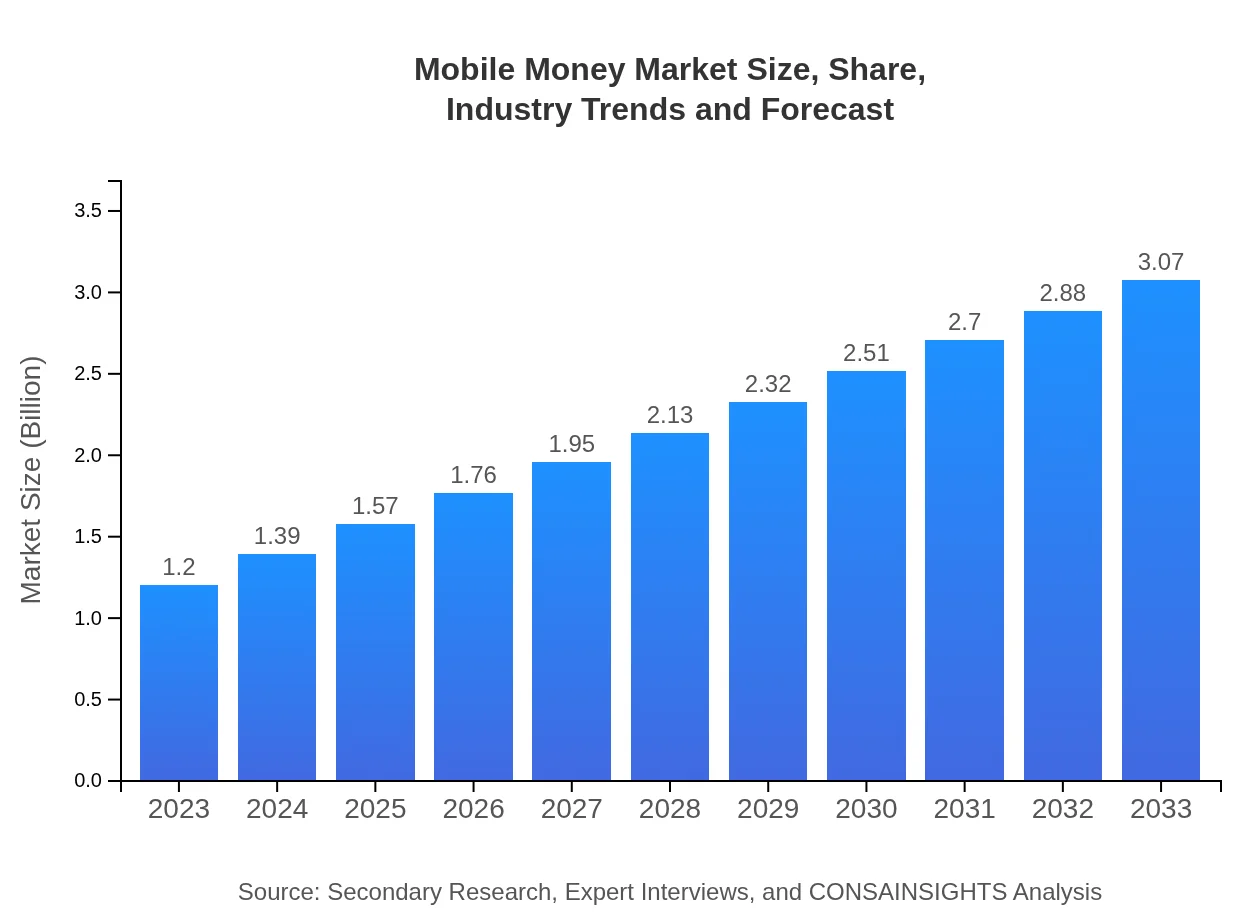

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Trillion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $3.07 Trillion |

| Top Companies | PayPal, Square, MTN Mobile Money, Ant Group, Google Pay |

| Last Modified Date | 31 January 2026 |

Mobile Money Market Overview

Customize Mobile Money Market Report market research report

- ✔ Get in-depth analysis of Mobile Money market size, growth, and forecasts.

- ✔ Understand Mobile Money's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Money

What is the Market Size & CAGR of Mobile Money market in 2023?

Mobile Money Industry Analysis

Mobile Money Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Money Market Analysis Report by Region

Europe Mobile Money Market Report:

Europe's Mobile Money market, currently valued at $0.33 trillion, is forecasted to reach $0.85 trillion by 2033. The region’s strong regulatory framework promoting digital payment methods and high smartphone penetration contribute positively to market dynamics.Asia Pacific Mobile Money Market Report:

The Asia Pacific region, with a market value of $0.24 trillion in 2023, is expected to surge to $0.62 trillion by 2033. Enhanced internet infrastructure and mobile penetration, particularly in countries like India and China, drive this growth. Additionally, government initiatives to promote digital payments have further fueled market expansion.North America Mobile Money Market Report:

In North America, the market is projected to experience significant growth, increasing from $0.39 trillion in 2023 to $1.00 trillion by 2033. The presence of advanced financial technology platforms and a shift towards digital wallets are pivotal trends supporting this growth.South America Mobile Money Market Report:

South America's market is expected to grow from $0.09 trillion in 2023 to $0.22 trillion by 2033. The rise in smartphone users and a burgeoning middle class are key factors driving the adoption of Mobile Money services across this region.Middle East & Africa Mobile Money Market Report:

The Middle East and Africa are expected to see the market grow from $0.15 trillion in 2023 to $0.39 trillion by 2033. This growth is led by increased smartphone adoption and initiatives aimed at boosting financial inclusion across various demographics.Tell us your focus area and get a customized research report.

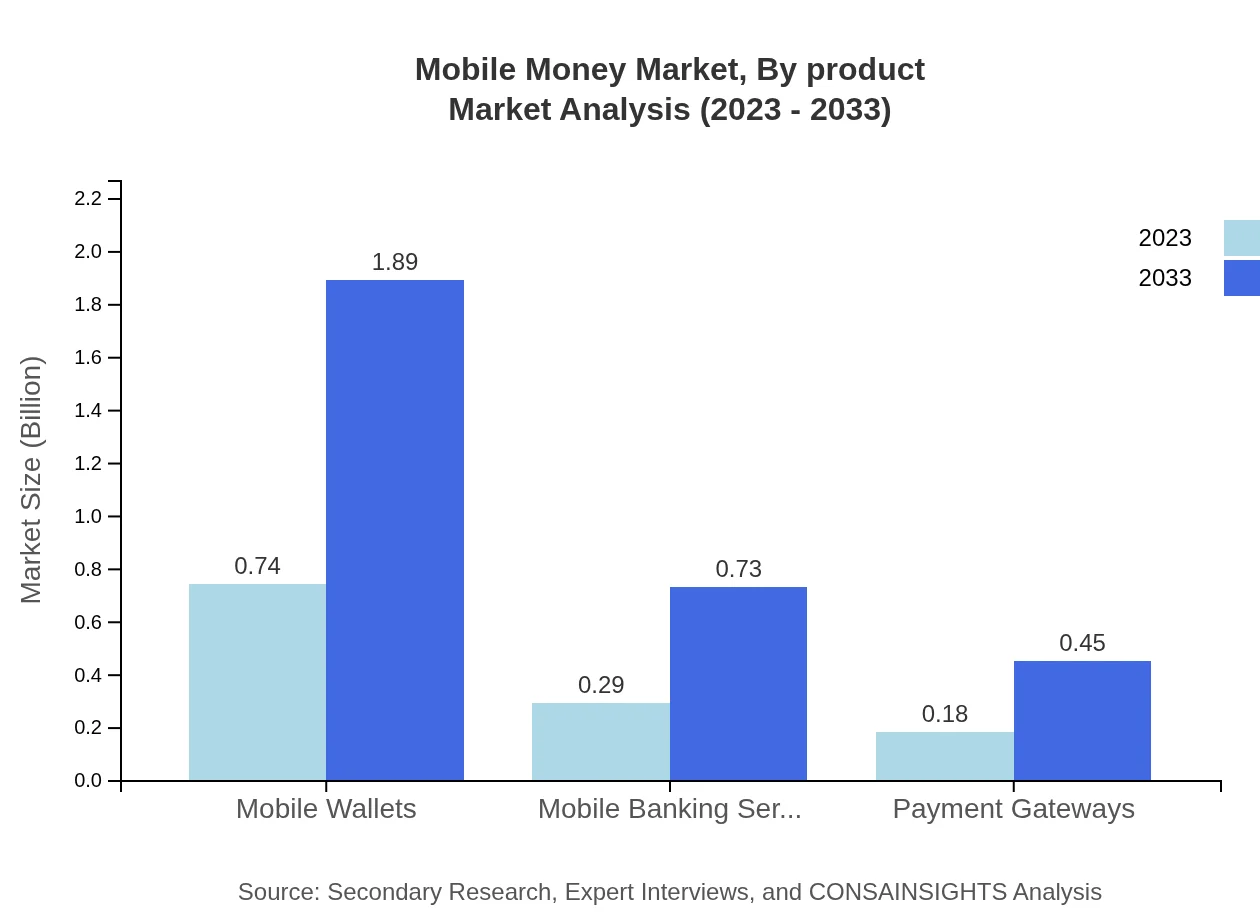

Mobile Money Market Analysis By Product

The segment for Peer-to-Peer Transfers is projected to dominate the market, with an expected growth from $0.74 trillion in 2023 to $1.89 trillion in 2033, capturing a market share of 61.56%. Increasing consumer preferences for swift and simple transaction modes drive this trend. Merchant Payments will also grow, climbing to $0.73 trillion from $0.29 trillion. Other segments, including Remittances and Mobile Wallets, reflect similar upward trajectories, emphasizing the broadening acceptance and adoption of Mobile Money services.

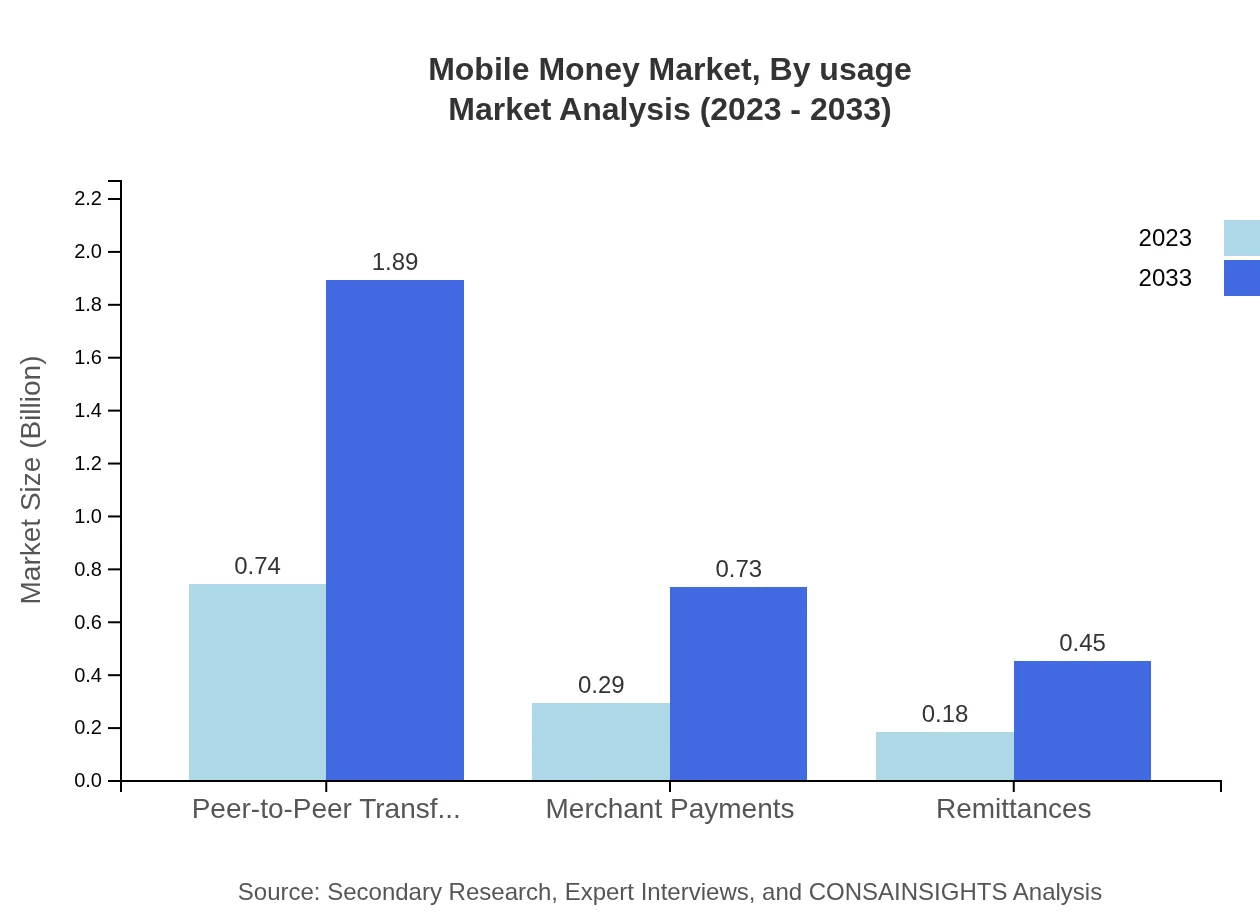

Mobile Money Market Analysis By Usage

Consumer applications of Mobile Money services will play a prominent role in market strategy, with individual users expected to represent the largest share. The growing trends toward digital transactions among consumers underscore the rising user adoption and preference for mobile solutions in financial dealings.

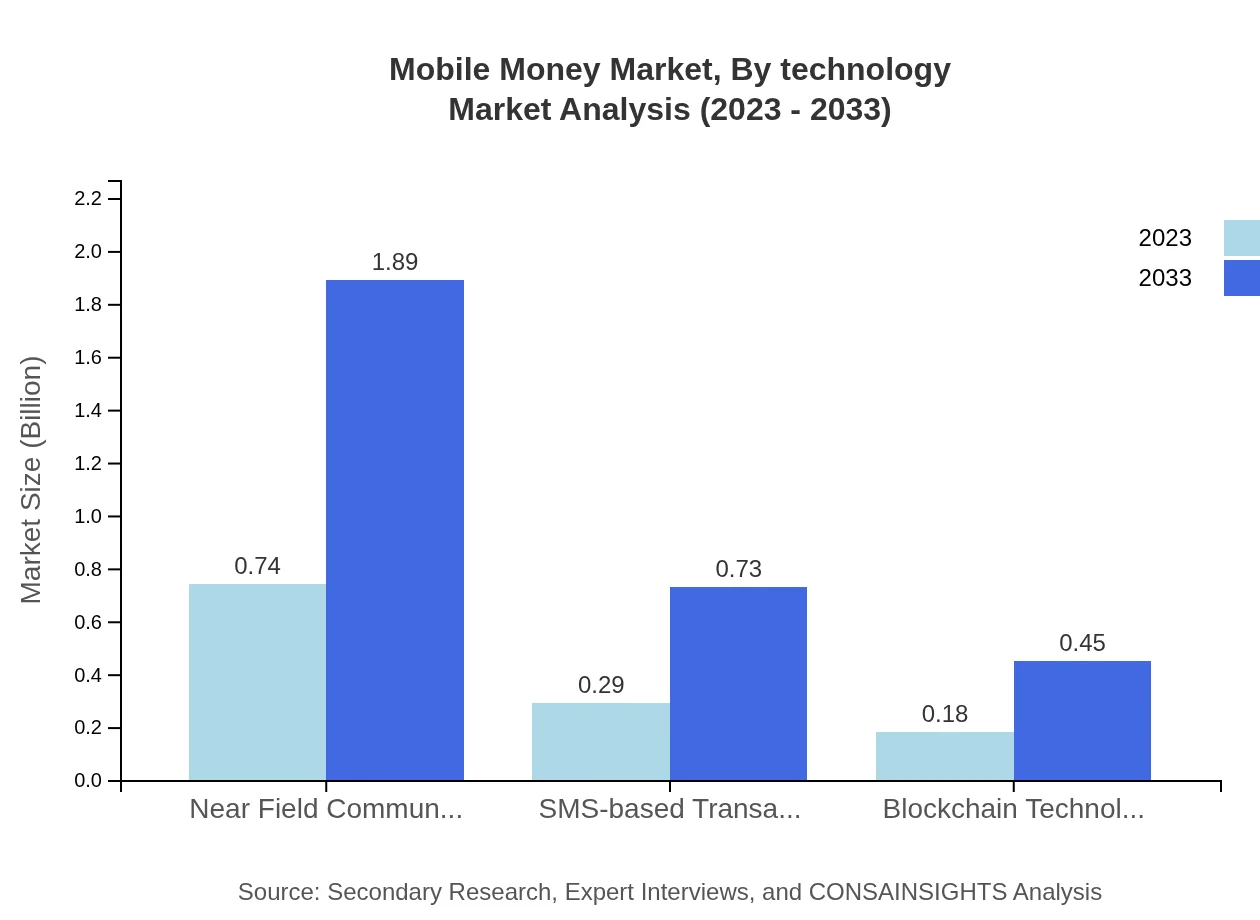

Mobile Money Market Analysis By Technology

Technological evolution is crucial for Mobile Money services, with Near Field Communication (NFC) leading the market due to its convenience in transactions. SMS-based transactions and Blockchain technology also play significant roles, ensuring secure and efficient processes across platforms.

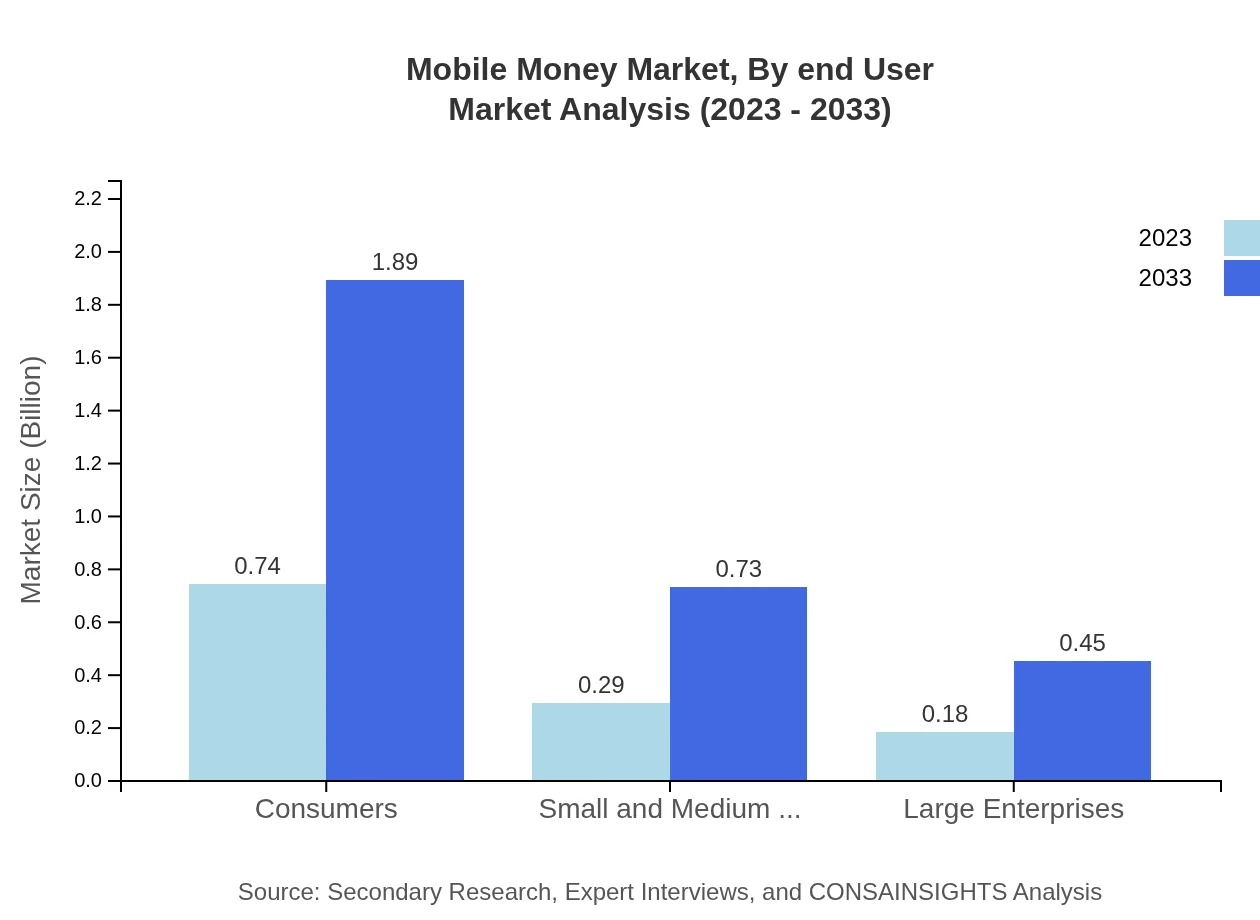

Mobile Money Market Analysis By End User

Consumers represent the bulk of the Mobile Money market, with Small and Medium Enterprises (SMEs) also emerging as crucial users due to their increasing dependence on digital transactions for operational efficiency. Large enterprises are increasingly adopting Mobile Money solutions, which allows them to improve customer interactions and streamline payment processes.

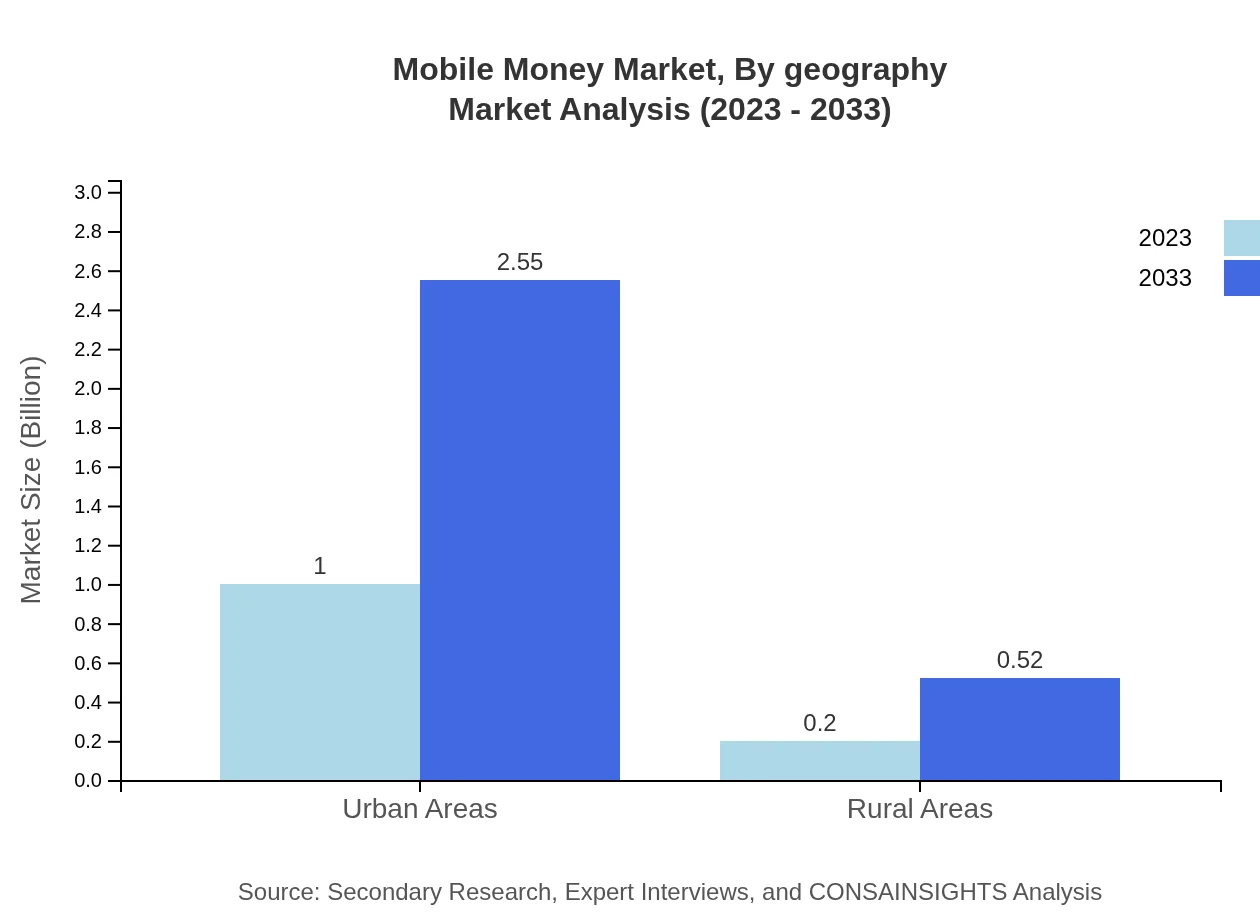

Mobile Money Market Analysis By Geography

Geographically, the market distribution showcases varying growth rates, with Asia Pacific and North America poised for rapid expansion compared to other regions. Each area presents unique trends and demands, generally influenced by regional economic conditions and technology adoption rates.

Mobile Money Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Money Industry

PayPal:

A leader in the digital payment space, PayPal has transformed online transactions, allowing users to send and receive money with ease globally.Square:

Square offers a suite of financial services, including its popular mobile payment processing platform, catering primarily to small businesses.MTN Mobile Money:

As a pioneer in mobile money services in Africa, MTN Mobile Money enables millions across the continent to make financial transactions, thereby enhancing financial inclusion.Ant Group:

Ant Group, with its Alipay platform, has revolutionized digital payments in China and is a significant player in the global Mobile Money market.Google Pay:

Google Pay facilitates mobile payments for users worldwide, integrating their services with online and offline merchants.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Money?

The mobile-money market is currently valued at approximately $1.2 trillion, with a projected compound annual growth rate (CAGR) of 9.5% from 2023 to 2033.

What are the key market players or companies in this mobile Money industry?

Key players in the mobile-money industry include major telecom operators, financial institutions, and technology firms, which contribute to the diverse ecosystem that facilitates mobile payments and services globally.

What are the primary factors driving the growth in the mobile Money industry?

The growth in the mobile-money industry is driven by increased smartphone penetration, the demand for cashless transactions, evolving consumer behaviors, and regulatory support for digital transactions worldwide.

Which region is the fastest Growing in the mobile Money market?

The fastest-growing region in the mobile-money market is Asia Pacific, with its market projected to grow from $0.24 trillion in 2023 to $0.62 trillion by 2033, indicating significant scalability and adoption.

Does ConsaInsights provide customized market report data for the mobile Money industry?

Yes, Consainsights offers customized market reports tailored to specific needs and insights from the mobile-money industry, ensuring businesses gain relevant and actionable intelligence.

What deliverables can I expect from this mobile Money market research project?

Deliverables from the mobile-money market research project typically include detailed reports, data analyses, market insights, trends, forecasts, and competitor analysis specific to the industry.

What are the market trends of mobile Money?

Market trends in mobile-money include the growing adoption of P2P transfers and mobile wallets, advancements in NFC and blockchain technologies, and an increasingly digital consumer landscape across regions and demographics.