Mobile Payment Security Software Market Report

Published Date: 31 January 2026 | Report Code: mobile-payment-security-software

Mobile Payment Security Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Mobile Payment Security Software market, including insights on its size, growth, segmentation, and key players. It covers data from 2023 to 2033, offering projections and trends shaping the industry.

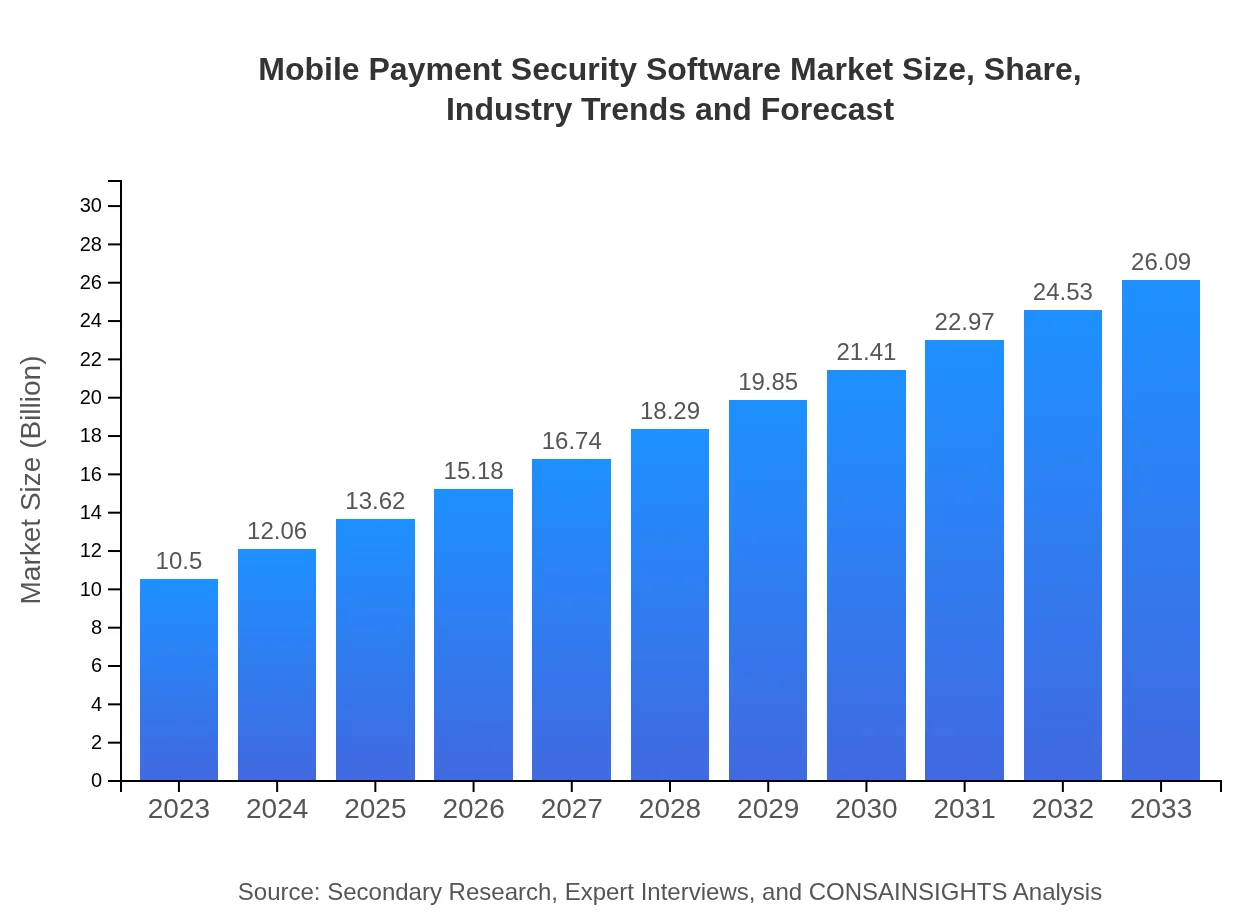

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | Symantec Corporation, IBM Corporation, McAfee, LLC, Fortinet Inc., Oracle Corporation |

| Last Modified Date | 31 January 2026 |

Mobile Payment Security Software Market Overview

Customize Mobile Payment Security Software Market Report market research report

- ✔ Get in-depth analysis of Mobile Payment Security Software market size, growth, and forecasts.

- ✔ Understand Mobile Payment Security Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Payment Security Software

What is the Market Size & CAGR of Mobile Payment Security Software market in 2023?

Mobile Payment Security Software Industry Analysis

Mobile Payment Security Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Payment Security Software Market Analysis Report by Region

Europe Mobile Payment Security Software Market Report:

The European market is currently valued at USD 2.61 billion in 2023, projected to grow to USD 6.48 billion by 2033. Stringent regulations like GDPR and robust consumer protection laws create a strong impetus for companies to implement secure mobile payment solutions. The increasing trend of e-commerce and mobile banking in European countries fuels this growth.Asia Pacific Mobile Payment Security Software Market Report:

In the Asia Pacific region, the Mobile Payment Security Software market is valued at USD 2.19 billion in 2023 and is projected to grow to USD 5.44 billion by 2033. The rapid digitalization of economies, particularly in countries like China and India, is driving the demand for enhanced mobile payment security solutions. Increased mobile penetration and government initiatives to promote cashless transactions further augment market growth in this region.North America Mobile Payment Security Software Market Report:

North America dominates the Mobile Payment Security Software market, valued at USD 3.78 billion in 2023, anticipated to reach USD 9.39 billion by 2033. With a mature financial sector and a high concentration of cybersecurity firms, North America leads in the adoption of advanced security measures. Regulatory frameworks and consumer preference for mobile payments drive continuous growth in this market.South America Mobile Payment Security Software Market Report:

The South American market for Mobile Payment Security Software stands at USD 0.65 billion in 2023, forecasted to rise to USD 1.60 billion by 2033. Though currently smaller, the region is experiencing growth due to the increased adoption of digital banking and mobile wallets, along with a rising awareness of cybersecurity challenges.Middle East & Africa Mobile Payment Security Software Market Report:

The Middle East and Africa Mobile Payment Security Software market is valued at USD 1.28 billion in 2023 and expected to grow to USD 3.17 billion by 2033. The expansion of mobile services and a rising number of tech-savvy consumers are key drivers in this region. Additionally, governments are investing in improving cybersecurity frameworks to bolster digital economies.Tell us your focus area and get a customized research report.

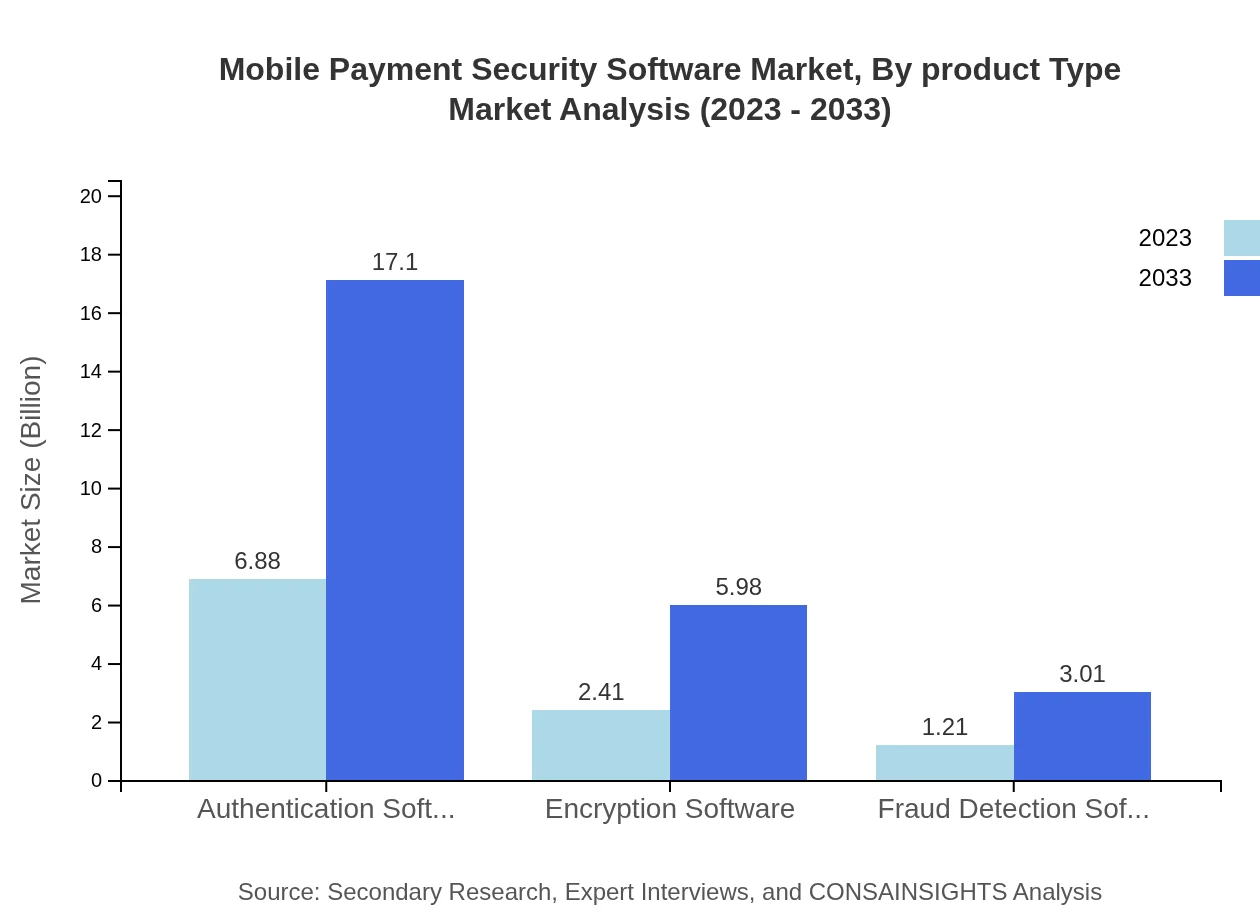

Mobile Payment Security Software Market Analysis By Product Type

The segmentation of Mobile Payment Security Software by product type shows significant market performance variance: - Authentication Software holds a market size of USD 6.88 billion in 2023, projected to grow to USD 17.10 billion by 2033, capturing 65.56% market share in both years. - Encryption Software, currently valued at USD 2.41 billion, is expected to reach USD 5.98 billion, representing 22.92% market share. - Fraud Detection Software, valued at USD 1.21 billion in 2023, anticipates growth to USD 3.01 billion, with an 11.52% market share.

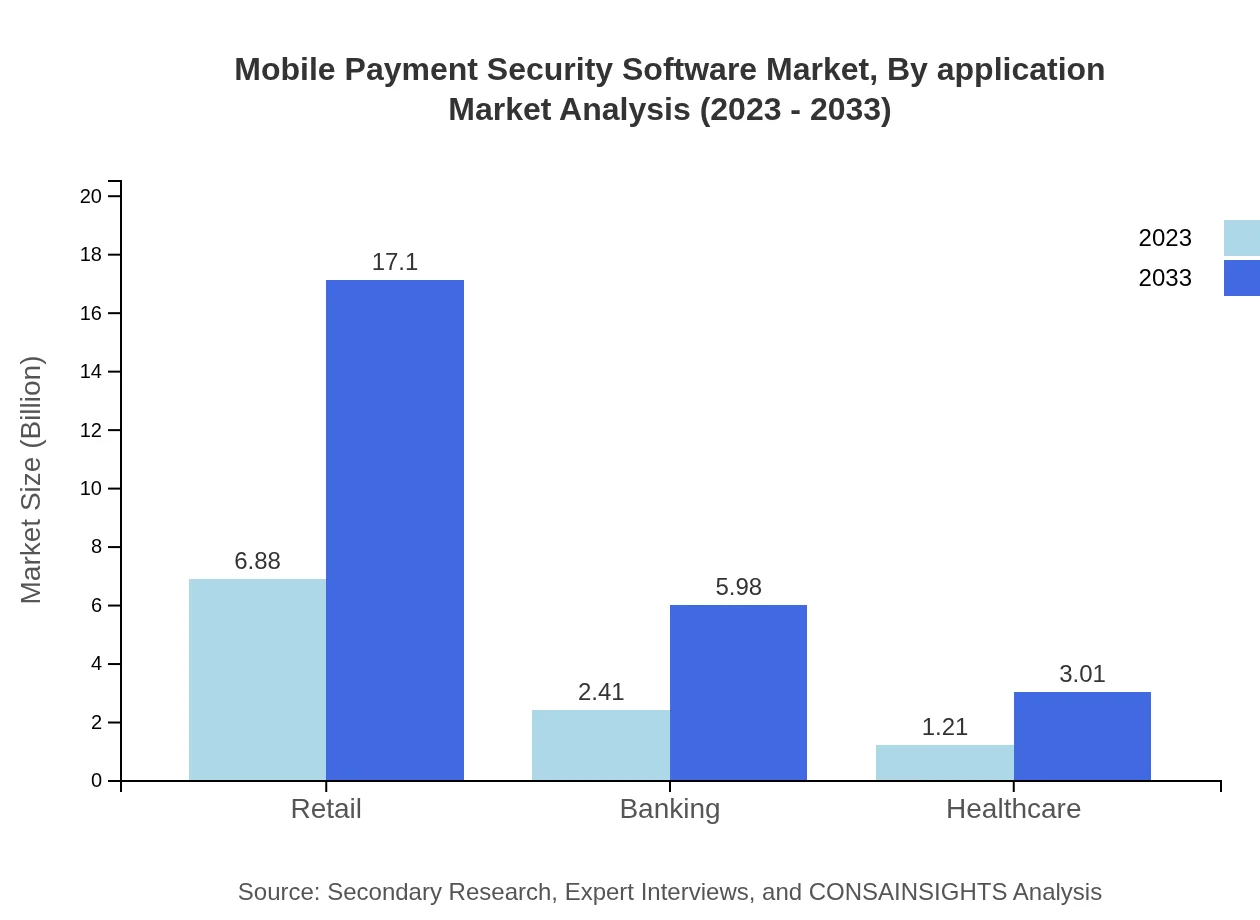

Mobile Payment Security Software Market Analysis By Application

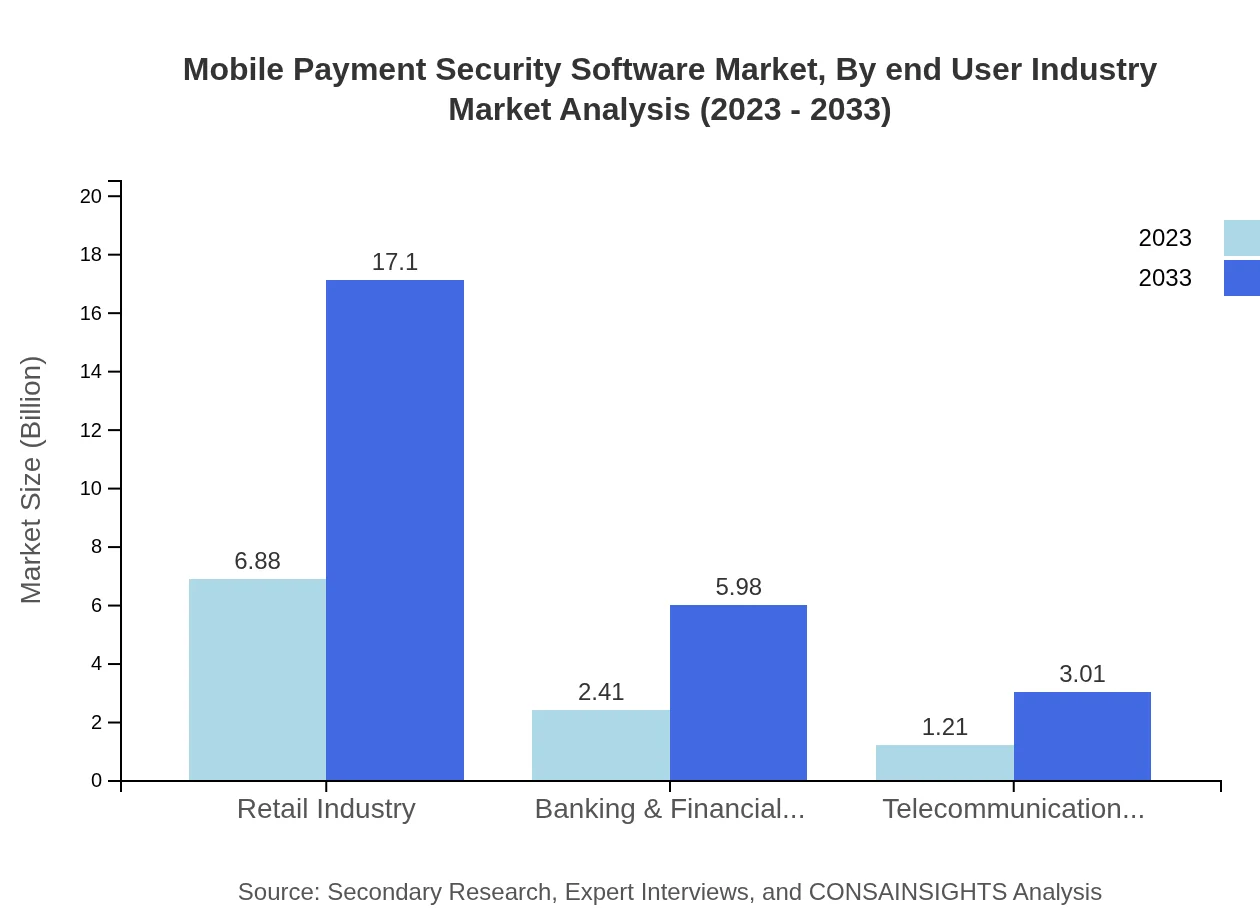

The analysis of market segments by application reveals strong demand across various sectors: - Retail, with a market size of USD 6.88 billion in 2023, is projected to reach USD 17.10 billion by 2033, maintaining a sizable market share of 65.56%. - Banking & Financial Services, currently at USD 2.41 billion, is expected to grow to USD 5.98 billion, holding a 22.92% market share. - The telecommunications sector, having a market size of USD 1.21 billion, is anticipated to grow to USD 3.01 billion by 2033.

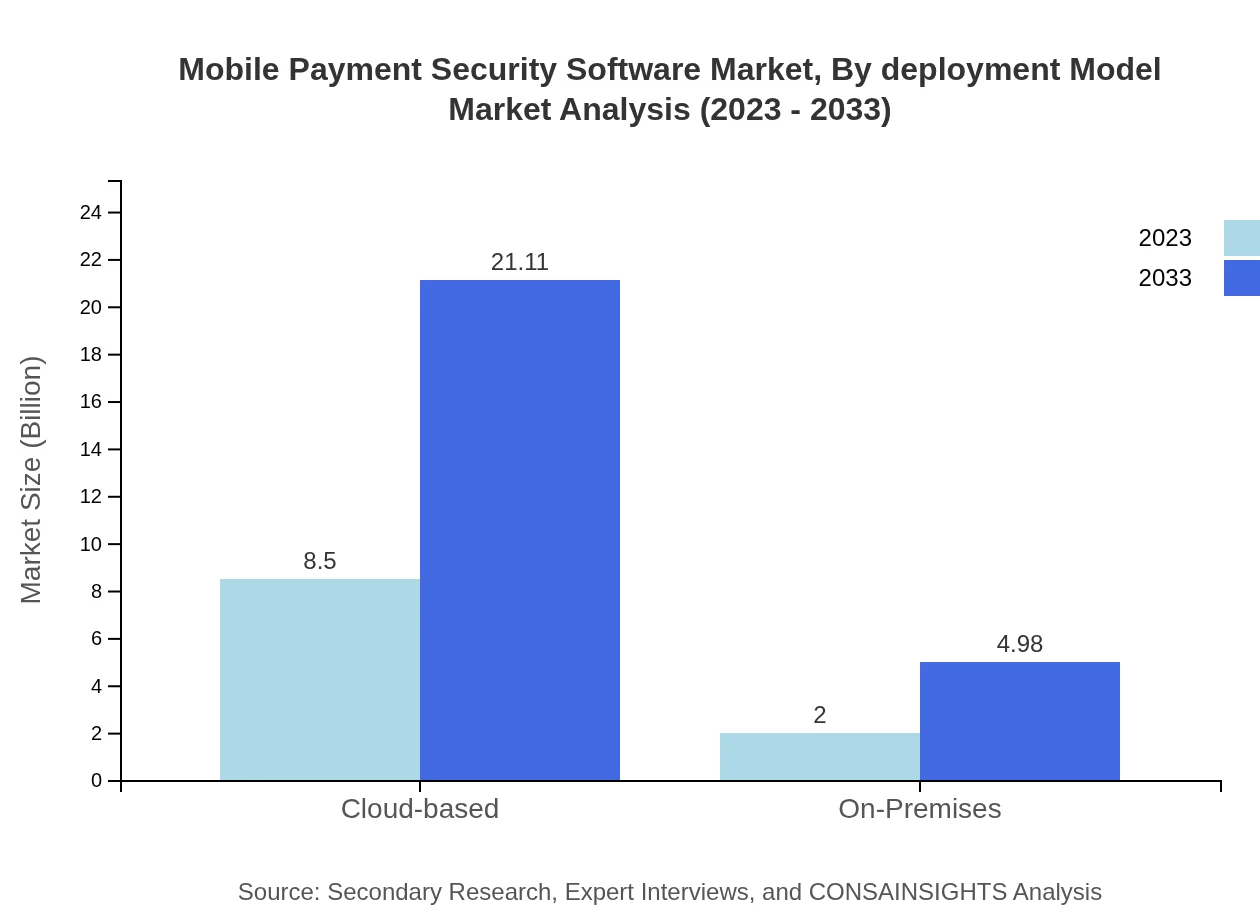

Mobile Payment Security Software Market Analysis By Deployment Model

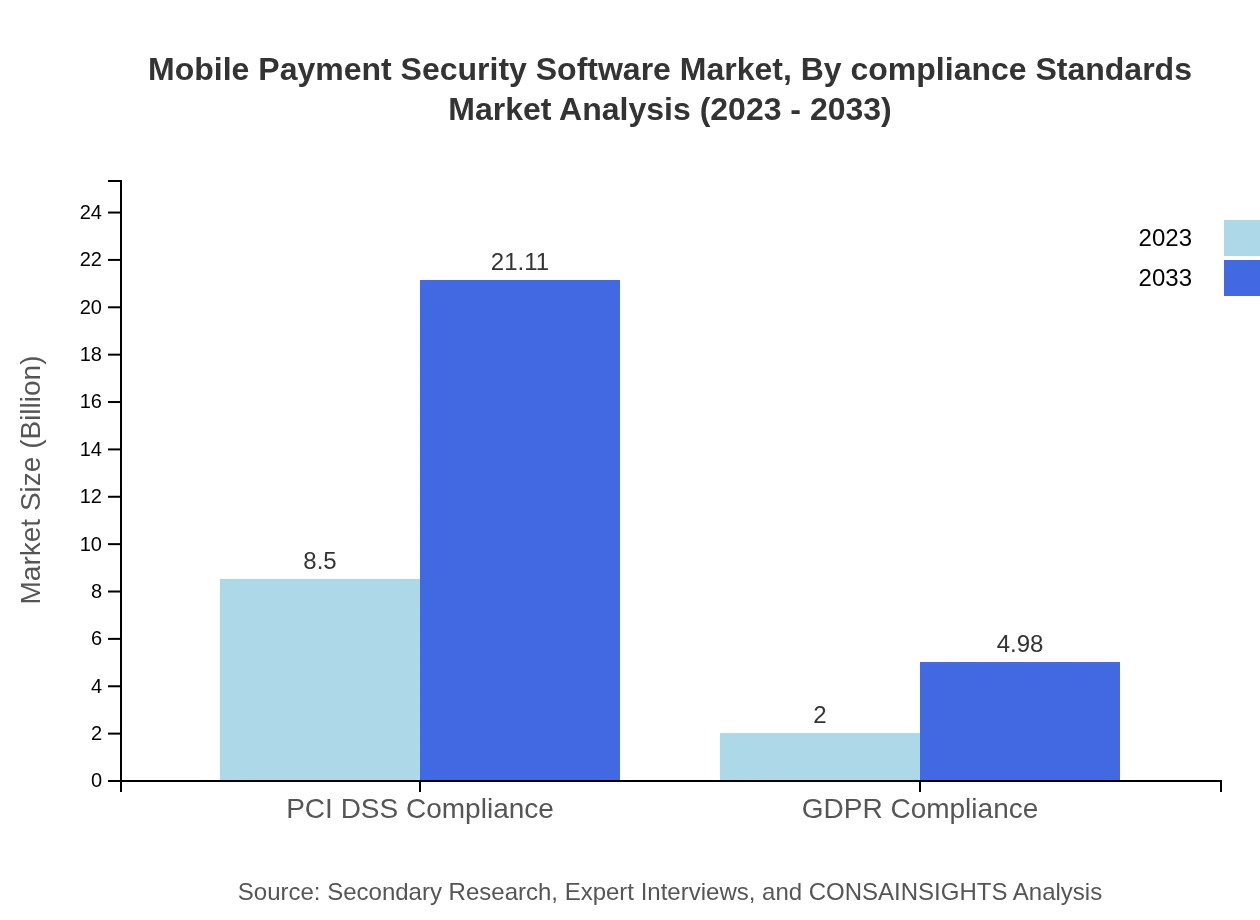

The deployment models for Mobile Payment Security Software showcase varied adoption rates: - Cloud-based solutions dominate the market with a size of USD 8.50 billion in 2023, projected to rise to USD 21.11 billion by 2033, holding 80.91% market share. - On-Premises systems, valued at USD 2.00 billion, are expected to grow moderately to USD 4.98 billion, with a 19.09% market share.

Mobile Payment Security Software Market Analysis By End User Industry

The end-user industry analysis reveals significant usage across sectors: - The retail industry, commanding a market size of USD 6.88 billion in 2023, is predicted to expand to USD 17.10 billion by 2033, maintaining a robust 65.56% market share. - Banking & Financial Services is expected to grow from USD 2.41 billion to USD 5.98 billion, retaining a 22.92% share. - Telecommunications is projected to increase from USD 1.21 billion to USD 3.01 billion by the end of the forecast period.

Mobile Payment Security Software Market Analysis By Compliance Standards

The compliance standards segment is critical for the Mobile Payment Security Software market: - PCI DSS Compliance is valued at USD 8.50 billion in 2023, set to reach USD 21.11 billion by 2033, capturing a large market share of 80.91%. - GDPR Compliance currently stands at USD 2.00 billion, with a forecasted growth to USD 4.98 billion, maintaining a 19.09% share.

Mobile Payment Security Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Payment Security Software Industry

Symantec Corporation:

Symantec provides comprehensive security solutions including advanced threat protection and encryption software specifically targeting mobile transactions.IBM Corporation:

IBM offers robust mobile payment security services through its Watson AI and cloud technologies, driving innovation in fraud detection and prevention.McAfee, LLC:

McAfee specializes in endpoint security and offers solutions designed to protect mobile devices during transactions.Fortinet Inc.:

Fortinet is known for its network security solutions, which include mobile payment protection and compliance tools.Oracle Corporation:

Oracle provides comprehensive data security solutions for financial transactions through its cloud services and compliance support.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Payment Security Software?

The mobile payment security software market is projected to reach approximately $10.5 billion by 2033, expanding at a CAGR of 9.2% from its current valuation. This growth reflects increasing demand for secure payment processing solutions globally.

What are the key market players or companies in this mobile Payment Security Software industry?

Major players in the mobile payment security software market include vendors specializing in cybersecurity solutions such as PayPal, Forter, and Gemalto, among others. These companies focus on developing advanced technologies to enhance payment security.

What are the primary factors driving the growth in the mobile payment security software industry?

Key growth drivers include rising incidences of digital fraud, increasing smartphone penetration, a shift towards cashless transactions, and stringent data protection regulations. These factors alongside consumer awareness boost demand for robust security solutions.

Which region is the fastest Growing in the mobile payment security software market?

North America is currently the fastest-growing region in the mobile payment security software market, with a market size projected to expand from $3.78 billion in 2023 to $9.39 billion by 2033, supported by a strong technological infrastructure.

Does ConsaInsights provide customized market report data for the mobile payment security software industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the mobile payment security software industry, allowing clients to gain specific insights based on their interest areas, market segments, or geographic focus.

What deliverables can I expect from this mobile payment security software market research project?

Clients can expect comprehensive deliverables including detailed market analysis reports, segmentation data, actionable insights, forecasts, and strategic recommendations designed to support decision-making within the mobile payment security landscape.

What are the market trends of mobile payment security software?

Current market trends include the rising adoption of cloud-based solutions, an increasing emphasis on fraud prevention technologies, growing regulatory compliance needs (e.g., PCI DSS), and the integration of AI and machine learning in payment security.