Mobile Payments Market Report

Published Date: 31 January 2026 | Report Code: mobile-payments

Mobile Payments Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Mobile Payments market from 2023 to 2033, including insights into market size, forecast growth, segmentation, regional insights, technology trends, and key industry players.

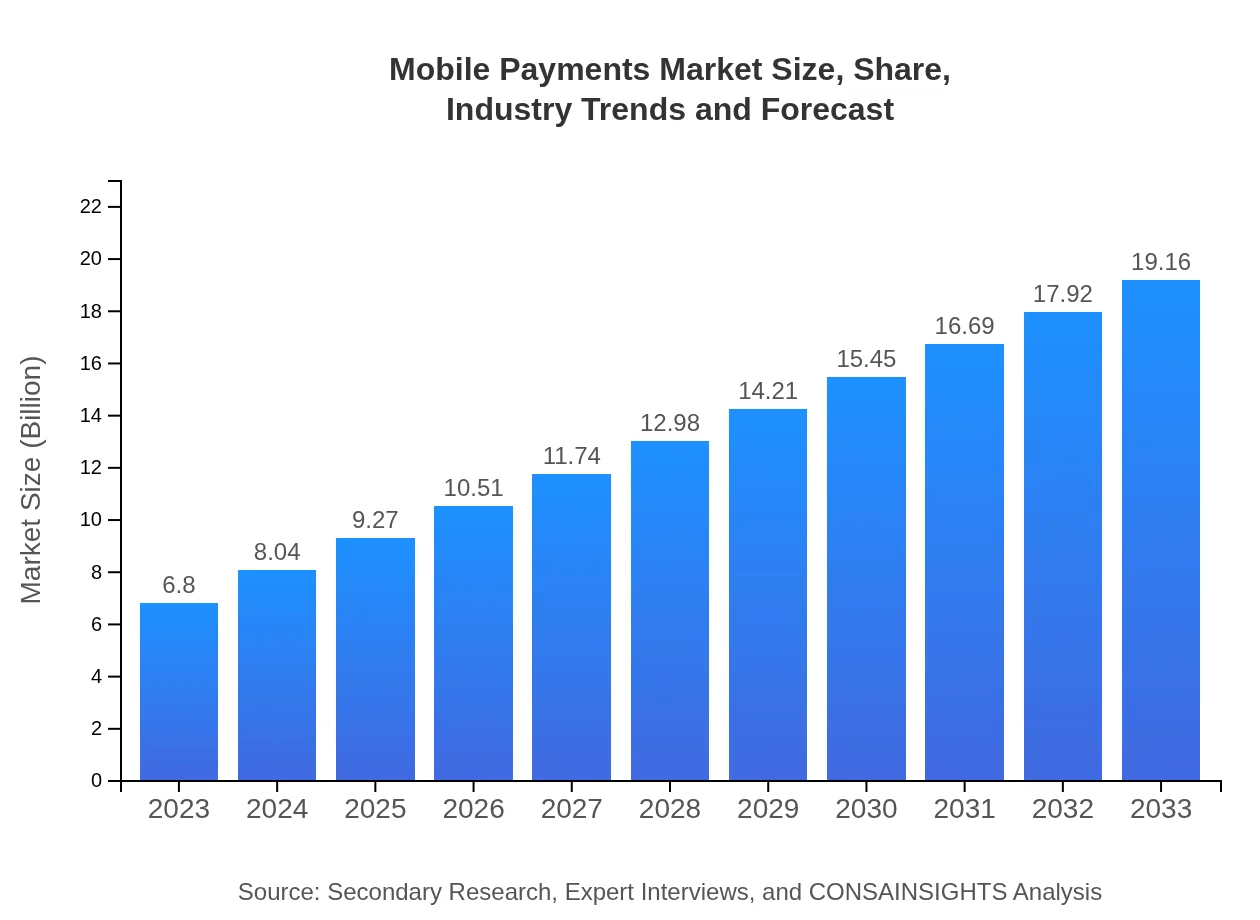

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Trillion |

| CAGR (2023-2033) | 10.5% |

| 2033 Market Size | $19.16 Trillion |

| Top Companies | PayPal, Alipay, Square, Apple Pay, Google Pay |

| Last Modified Date | 31 January 2026 |

Mobile Payments Market Overview

Customize Mobile Payments Market Report market research report

- ✔ Get in-depth analysis of Mobile Payments market size, growth, and forecasts.

- ✔ Understand Mobile Payments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Payments

What is the Market Size & CAGR of Mobile Payments market in 2023?

Mobile Payments Industry Analysis

Mobile Payments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Payments Market Analysis Report by Region

Europe Mobile Payments Market Report:

The European market will expand from $2.38 billion in 2023 to $6.71 billion in 2033, as stringent regulations promote secure payment solutions and technology integration. European governments' support for digital transition further strengthens the mobile payments landscape across the continent.Asia Pacific Mobile Payments Market Report:

The Asia Pacific region dominates the Mobile Payments market, with a projected growth from $1.25 billion in 2023 to $3.51 billion by 2033. Factors contributing to this growth include a high adoption rate of smartphones, a large unbanked population increasingly using mobile payments, and government initiatives supporting cashless transactions.North America Mobile Payments Market Report:

North America’s Mobile Payments market is set to see growth from $2.37 billion in 2023 to $6.69 billion by 2033, driven by technological advancements and a robust fintech ecosystem. The region is characterized by high consumer awareness and widespread acceptance of mobile payment options.South America Mobile Payments Market Report:

In contrast, South America presents challenges for mobile payments, with projections of a decrease in market size from $-0.12 billion in 2023 to $-0.34 billion by 2033. Economic instability and limited infrastructure hinder mobile payment adoption, despite rising interest in digital solutions.Middle East & Africa Mobile Payments Market Report:

The Middle East and Africa anticipate a rise in market size from $0.92 billion in 2023 to $2.59 billion by 2033, driven by growing smartphone penetration and mobile internet usage, although high poverty rates and limited infrastructure remain challenges.Tell us your focus area and get a customized research report.

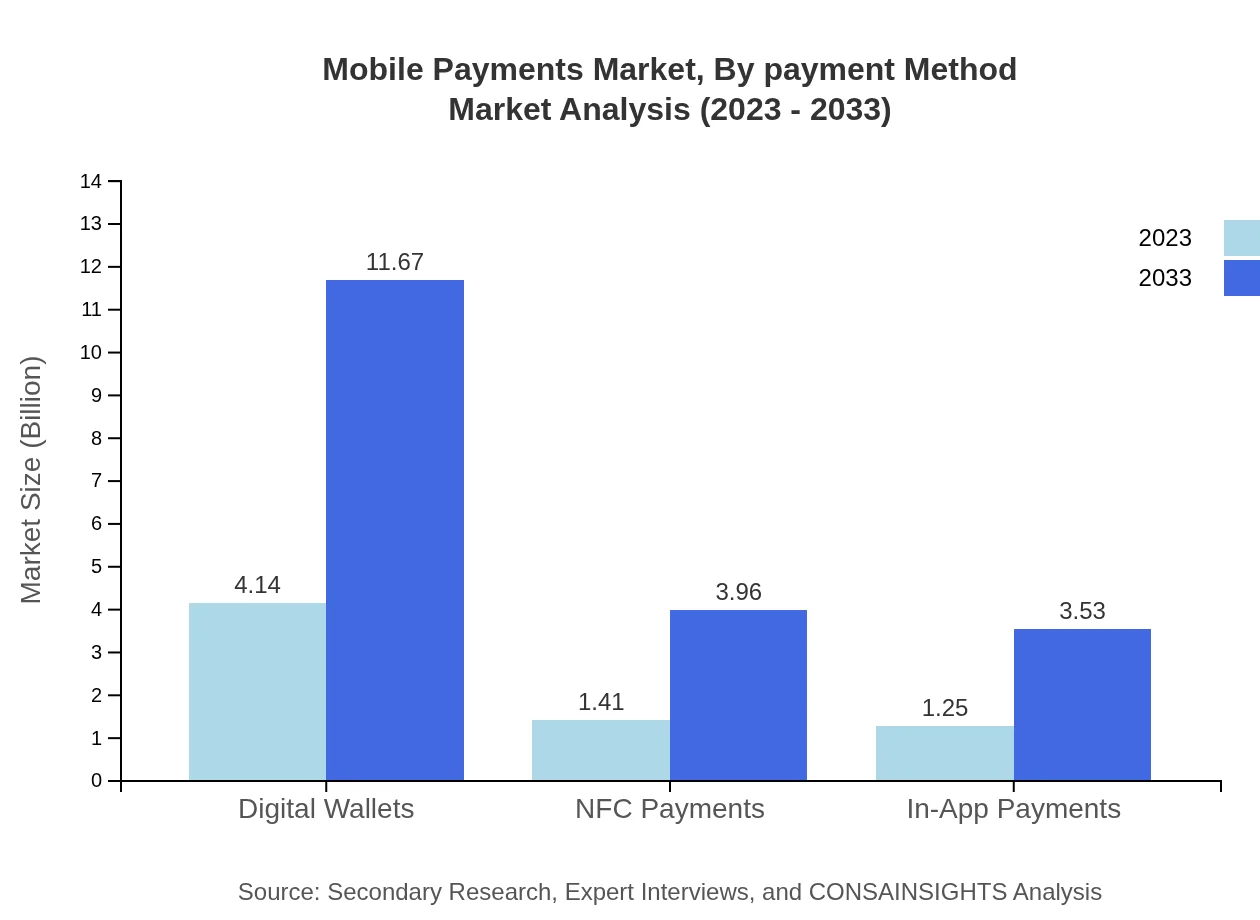

Mobile Payments Market Analysis By Payment Method

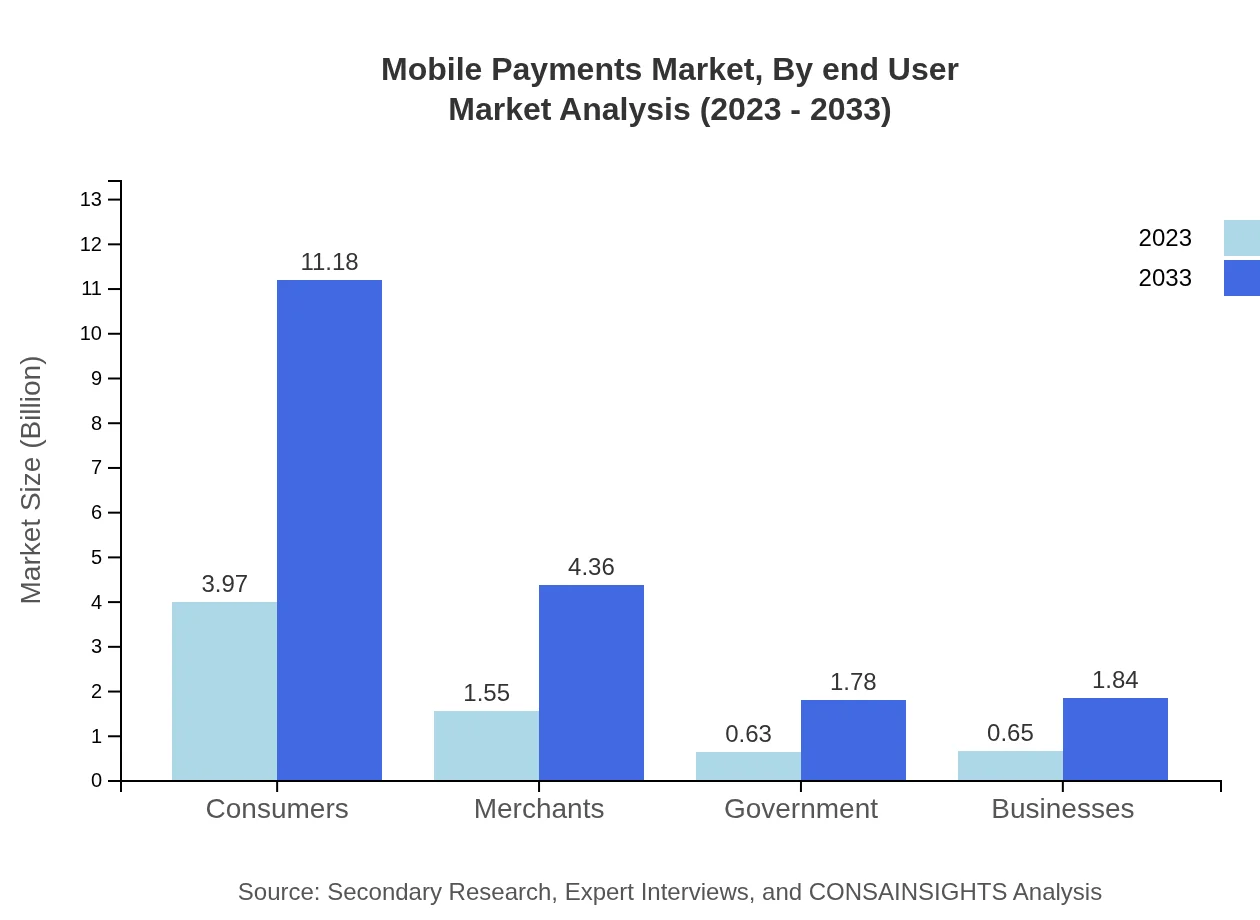

In the payment method segment, consumers lead with a market size of $3.97 billion in 2023, anticipated to rise to $11.18 billion by 2033, reflecting the widespread adoption of digital wallets. Merchants constitute a growing market at $1.55 billion in 2023, expected to reach $4.36 billion. Government and businesses are also notable segments, aiming to expand their mobile payment solutions.

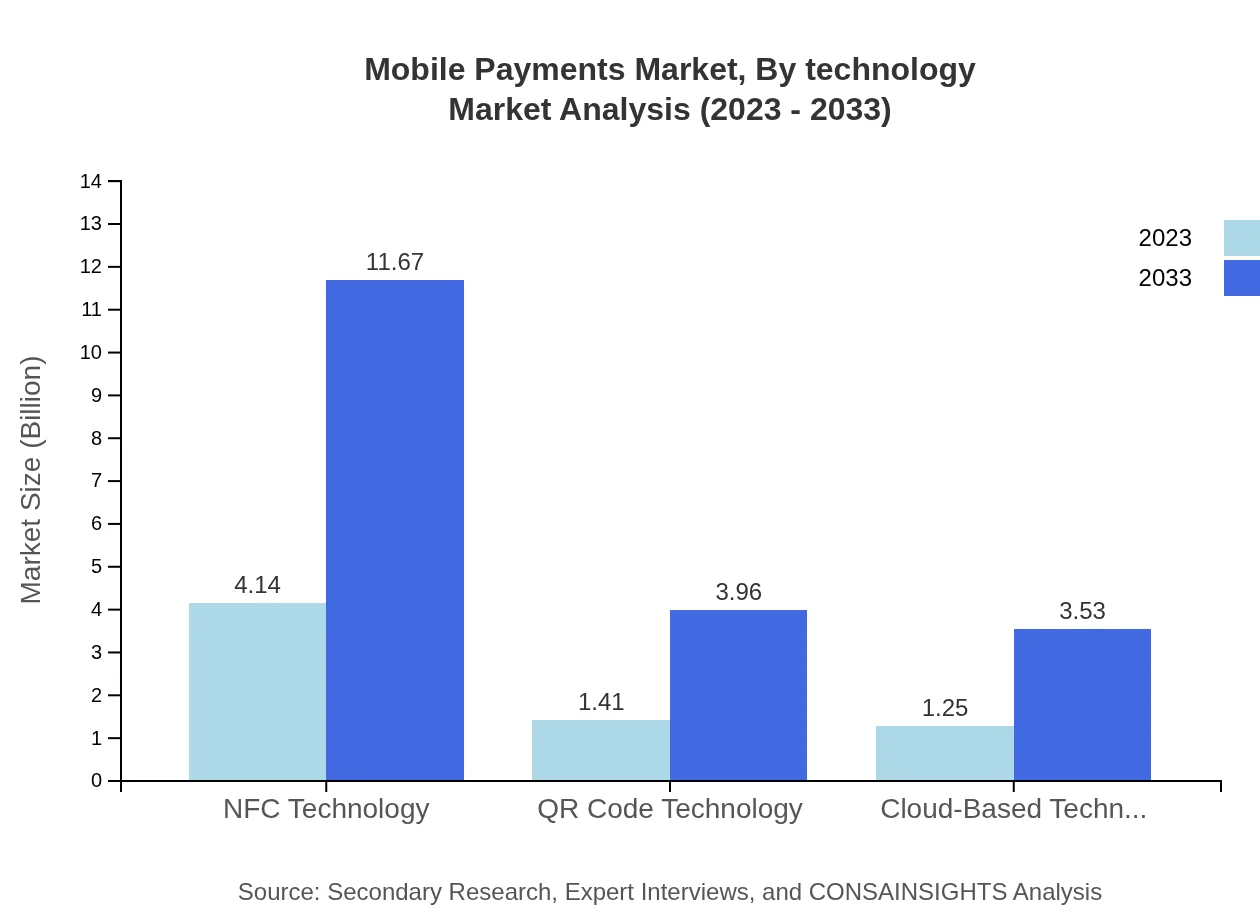

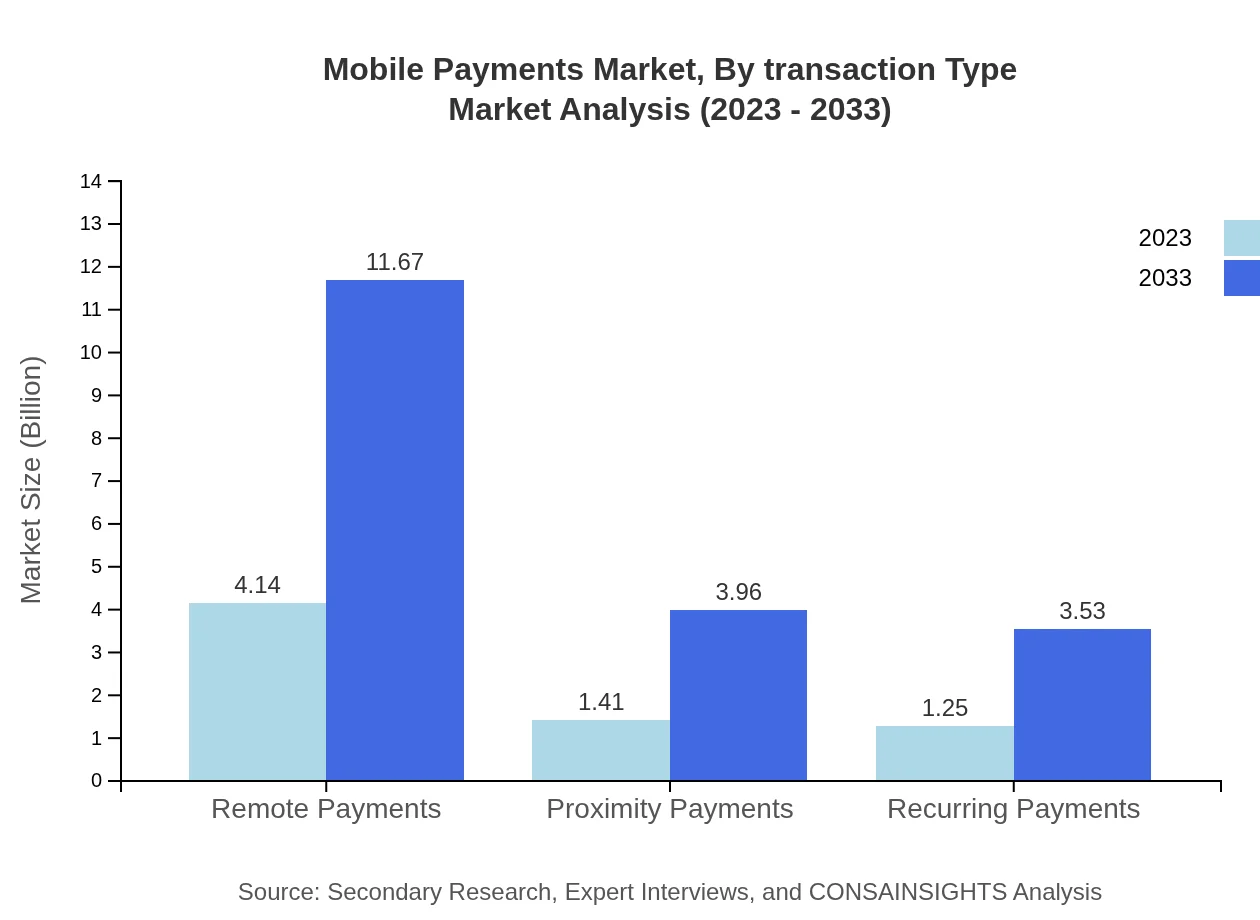

Mobile Payments Market Analysis By Technology

Within payment technologies, NFC leads with a share of 60.9% and market size growing from $4.14 billion in 2023 to $11.67 billion by 2033. QR code technology also plays a significant role, with a predicted rise from $1.41 billion to $3.96 billion, while cloud-based technologies will increase from $1.25 billion to $3.53 billion.

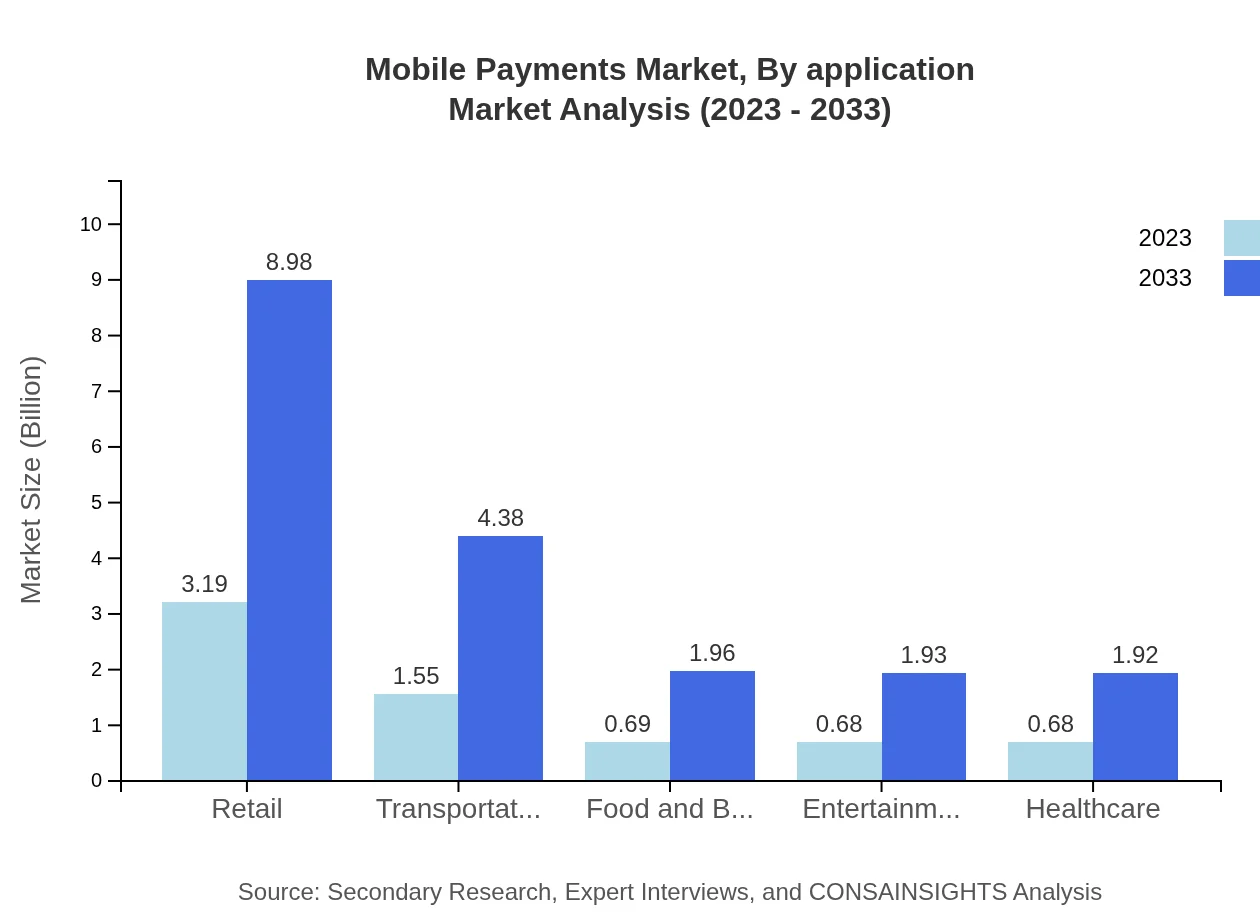

Mobile Payments Market Analysis By Application

The retail sector dominates the market, with a size increase from $3.19 billion in 2023 to $8.98 billion. Transportation and food & beverage sectors follow, launching innovative mobile payment solutions to enhance customer experiences mid-transaction.

Mobile Payments Market Analysis By End User

Consumers account for the highest market share at 58.37%, with significant growth projected through 2033. The merchant segment also continues to expand, with business solutions increasing demand for mobile payment services, capturing diverse user bases.

Mobile Payments Market Analysis By Transaction Type

The market for remote payments, projected to grow from $4.14 billion to $11.67 billion by 2033, demonstrates preferences for convenience. Proximity payments remain essential but lag in growth, indicating shifts in consumer behavior towards online and mobile commerce.

Mobile Payments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Payments Industry

PayPal:

A leader in digital payments, PayPal offers a range of services for consumers and merchants, consistently innovating mobile payment solutions.Alipay:

A major player in mobile payments in Asia, Alipay revolutionizes retail transactions with vast integration into e-commerce platforms.Square:

Known for its point-of-sale systems, Square equips businesses with tools to accept mobile payments seamlessly.Apple Pay:

Apple Pay transforms how consumers make payments using smartphones with a focus on security and user experience.Google Pay:

An essential player in mobile payments, Google Pay continues to leverage its ecosystem to enhance user convenience and transaction security.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile payments?

The mobile payments market is estimated to reach $6.8 trillion by 2033, growing at a CAGR of 10.5%. In 2023, the market stands at approximately $2 trillion, reflecting a significant rise in consumer adoption and technological advancements.

What are the key market players or companies in this mobile payments industry?

Key players in the mobile payments industry include PayPal, Square, Apple Pay, Google Wallet, Adyen, and Stripe. These companies dominate the market by providing innovative solutions and facilitating seamless transactions for both consumers and merchants.

What are the primary factors driving the growth in the mobile payments industry?

The growth in the mobile payments industry is driven by increasing smartphone penetration, the rise of e-commerce, enhanced security features, and the convenience of digital wallets. Additionally, contactless payment technology has gained traction, further propelling market growth.

Which region is the fastest Growing in the mobile payments sector?

The Asia Pacific region is the fastest-growing market for mobile payments, projected to escalate from $1.25 trillion in 2023 to $3.51 trillion by 2033. Factors include high mobile penetration rates and a rapidly growing tech-savvy population.

Does ConsaInsights provide customized market report data for the mobile payments industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the mobile payments industry. This service helps stakeholders make informed decisions based on detailed market analysis and insights relevant to their operations.

What deliverables can I expect from this mobile payments market research project?

Deliverables from the mobile payments market research project typically include in-depth market analysis, competitive landscape assessments, detailed forecasts, segment analyses, and consumer behavior insights. This comprehensive report aids strategic planning.

What are the market trends of mobile payments?

Current trends in the mobile payments market include a shift towards contactless payments, the adoption of blockchain technology, and an increase in regulatory compliance. Additionally, digital wallets are becoming increasingly popular among consumers seeking convenience.