Mobile Phone Insurance Market Report

Published Date: 31 January 2026 | Report Code: mobile-phone-insurance

Mobile Phone Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Mobile Phone Insurance market, covering market size, growth forecasts, trends, segmentation, and regional insights, with a focus on the period from 2023 to 2033.

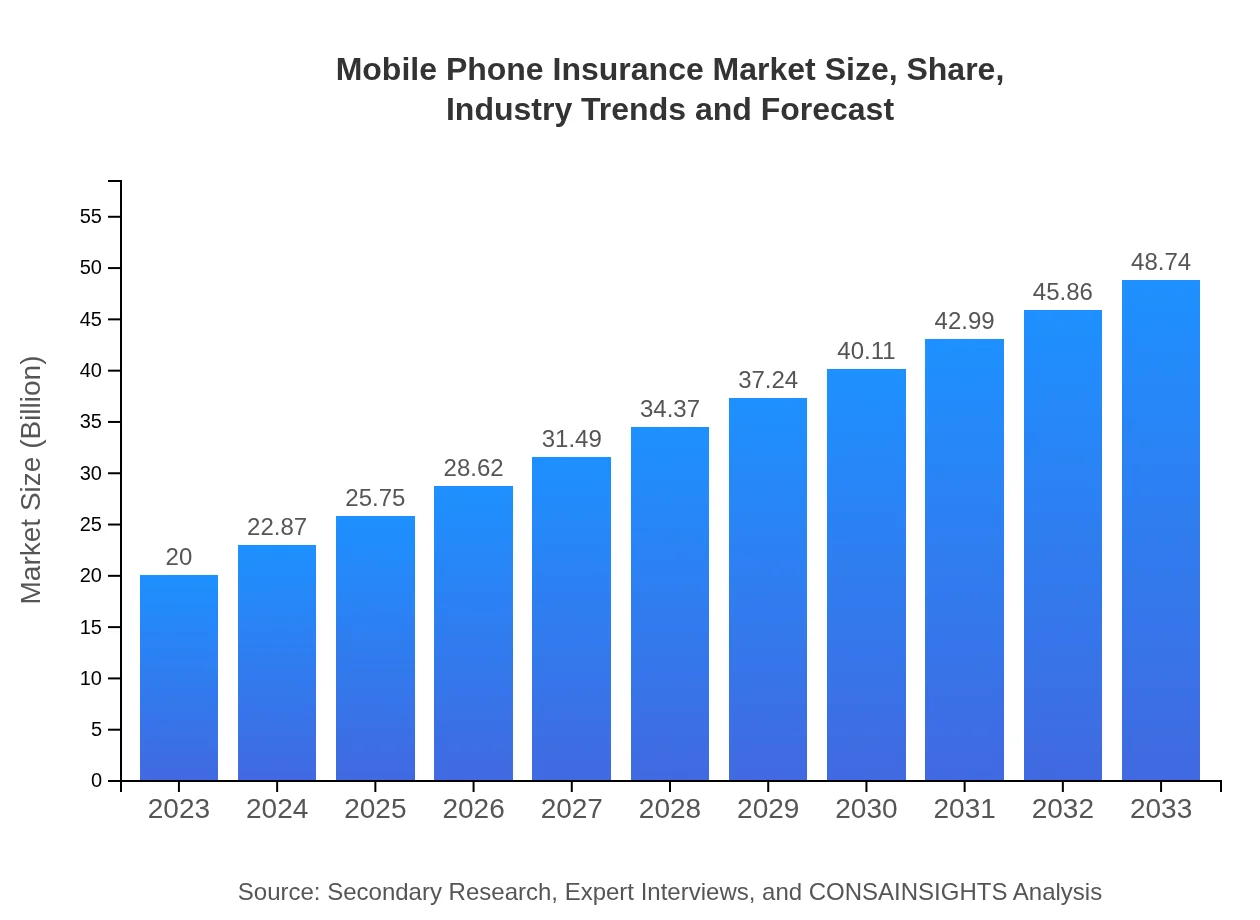

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 9% |

| 2033 Market Size | $48.74 Billion |

| Top Companies | Allianz, Asurion, SquareTrade, AXA |

| Last Modified Date | 31 January 2026 |

Mobile Phone Insurance Market Overview

Customize Mobile Phone Insurance Market Report market research report

- ✔ Get in-depth analysis of Mobile Phone Insurance market size, growth, and forecasts.

- ✔ Understand Mobile Phone Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Phone Insurance

What is the Market Size & CAGR of Mobile Phone Insurance market in 2023?

Mobile Phone Insurance Industry Analysis

Mobile Phone Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Phone Insurance Market Analysis Report by Region

Europe Mobile Phone Insurance Market Report:

The European market for Mobile Phone Insurance is valued at approximately $5.65 billion in 2023, with estimations of growing to $13.78 billion by 2033. The region showcases a mature insurance market with low awareness still impacting full utilization of mobile insurance services.Asia Pacific Mobile Phone Insurance Market Report:

The Asia Pacific region's Mobile Phone Insurance market was valued at approximately $3.67 billion in 2023, expected to grow to $8.95 billion by 2033. This growth is driven by rapid smartphone adoption, increased disposable incomes, and rising awareness of mobile insurance benefits among consumers.North America Mobile Phone Insurance Market Report:

North America is a dominant region in the Mobile Phone Insurance market, valued at $7.72 billion in 2023 and expected to reach $18.82 billion by 2033. The high value of smartphones and well-established insurance services influence this significant growth, coupled with an increasing number of tech-savvy consumers.South America Mobile Phone Insurance Market Report:

In South America, the Mobile Phone Insurance market stands at around $0.92 billion in 2023, projected to expand to $2.23 billion by 2033. Factors contributing to this growth include increasing smartphone penetration and improvements in the economic landscape, which enhance consumers' willingness to invest in insurance products.Middle East & Africa Mobile Phone Insurance Market Report:

In 2023, the Mobile Phone Insurance market in the Middle East and Africa is valued at $2.03 billion, anticipated to grow to $4.96 billion by 2033. The emergence of a digital economy in this region and rising smartphone usage amongst the population are central to this growth.Tell us your focus area and get a customized research report.

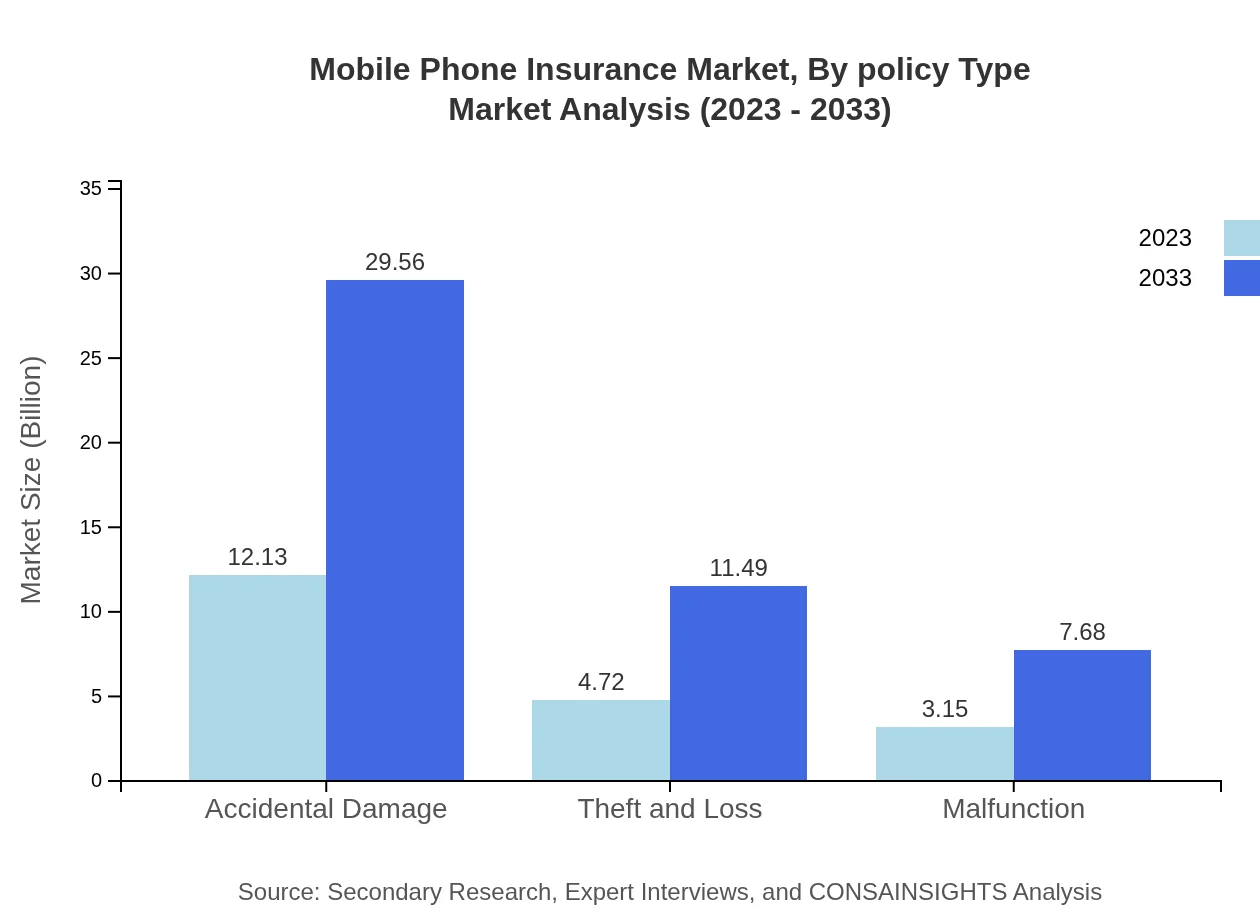

Mobile Phone Insurance Market Analysis By Policy Type

The policy type segment is vital in understanding consumer preferences. Full Coverage accounts for a significant market share, valued at $17.53 billion in 2023, with expectations of rising to $42.73 billion by 2033. Limited Coverage and Accidental Damage contribute to the market, valued at $2.47 billion and $12.13 billion respectively in 2023. Theft and Loss market valued at $4.72 billion, and Malfunction at $3.15 billion also play crucial roles. The market dynamics of these segments will evolve as consumers demand coverage tailored to their risks.

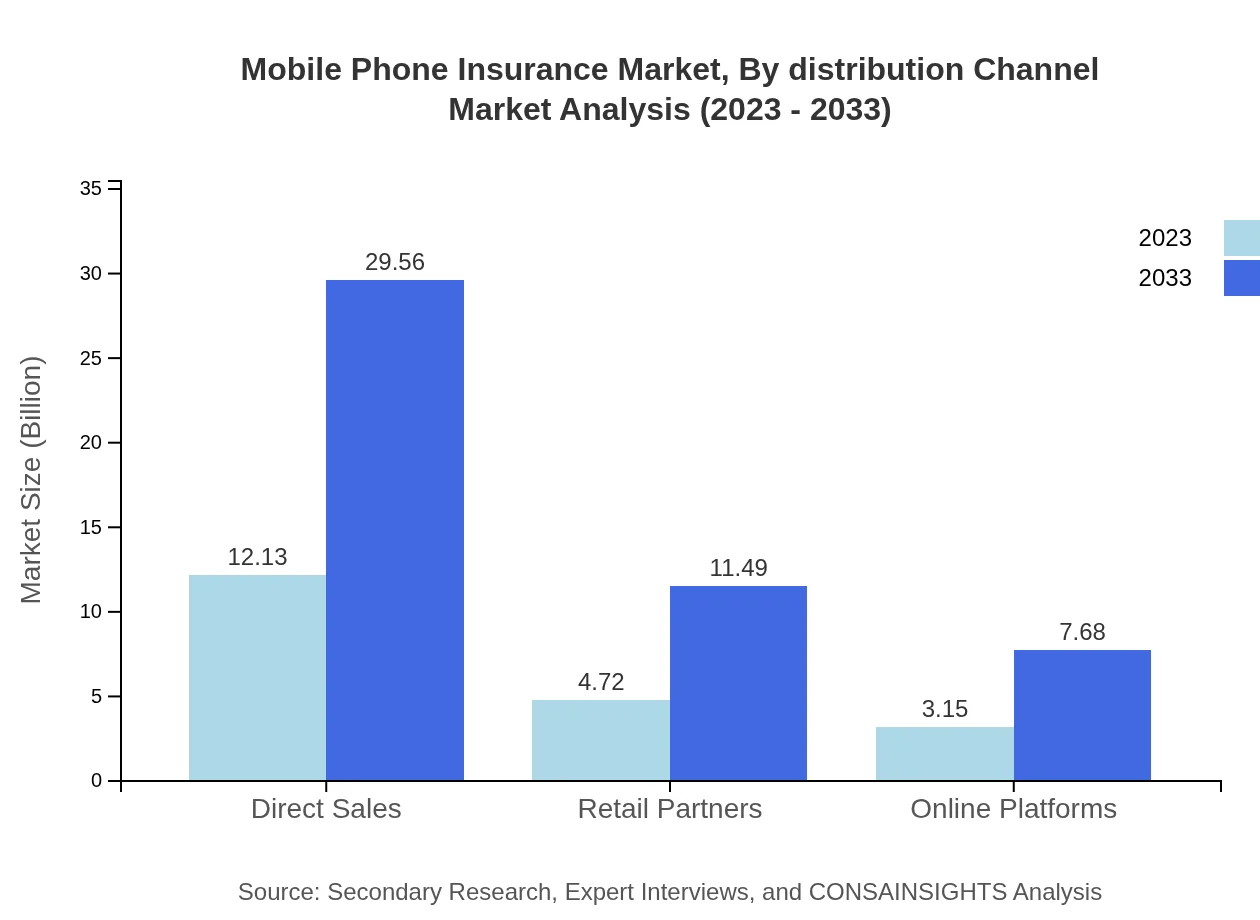

Mobile Phone Insurance Market Analysis By Distribution Channel

The distribution channel segment focuses on how mobile phone insurance products reach consumers. Direct Sales dominate the segment, valued at $12.13 billion in 2023, projected to grow to $29.56 billion by 2033. Retail Partners and Online Platforms are also significant contributors, valued at $4.72 billion and $3.15 billion in 2023 respectively. The market's future will likely see a stronger shift towards digital platforms as e-commerce continues to expand.

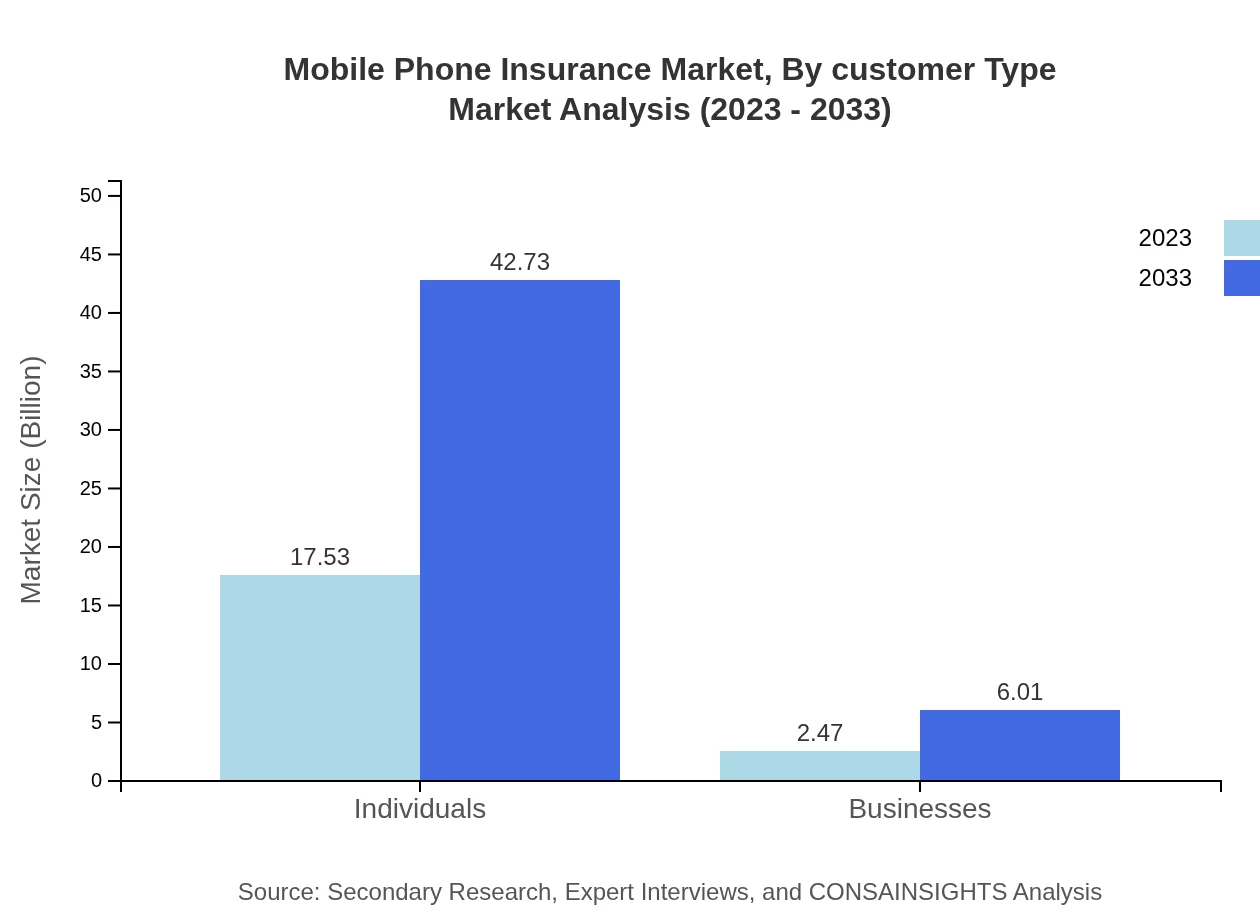

Mobile Phone Insurance Market Analysis By Customer Type

This segment differentiates the market by customer type, focusing on Individuals and Businesses. In 2023, the Individuals segment is valued at $17.53 billion, reaching $42.73 billion by 2033, whereas the Businesses segment valued at $2.47 billion is expected to grow to $6.01 billion. As corporations increasingly recognize the risks associated with mobile devices, the demand for comprehensive insurance among businesses is likely to rise.

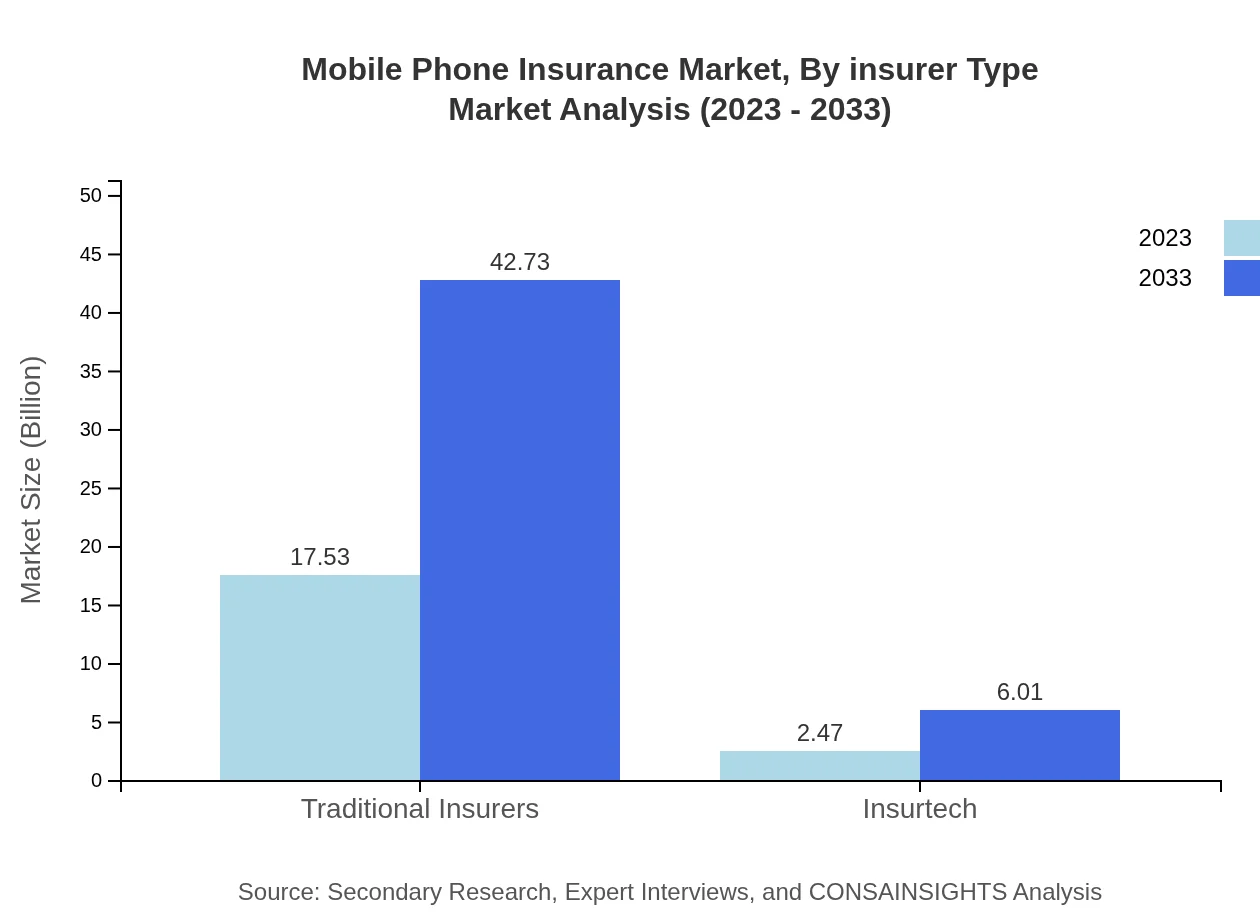

Mobile Phone Insurance Market Analysis By Insurer Type

The Mobile Phone Insurance market is characterized by Traditional Insurers and Insurtech firms. Traditional Insurers dominate the market, valued at $17.53 billion in 2023 and expected to grow to $42.73 billion. The Insurtech sector, starting at $2.47 billion, is gradually gaining traction, showing an increasing preference for agile and customer-centric insurance solutions that adapt to market demands.

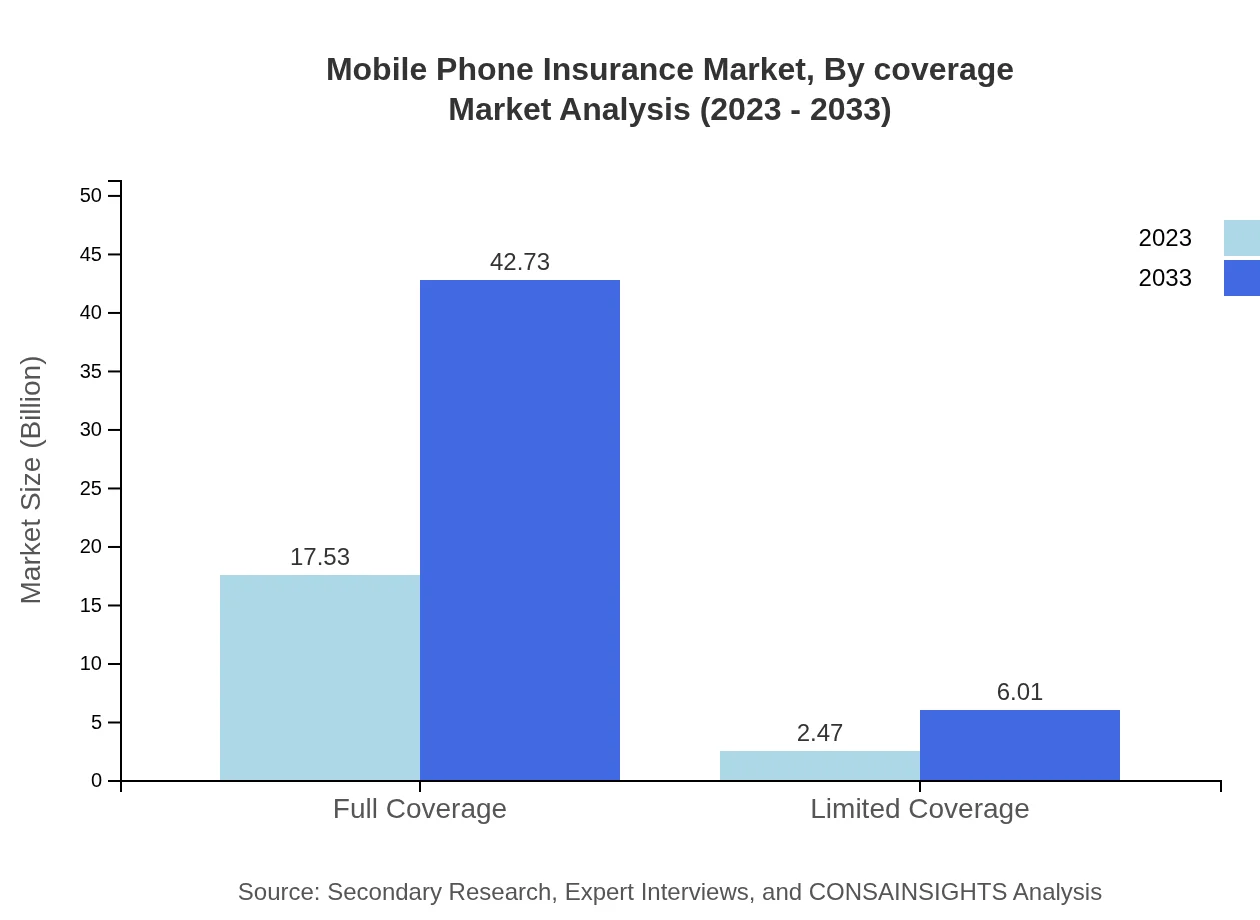

Mobile Phone Insurance Market Analysis By Coverage

Within coverage, Full Coverage is the standout segment with a market share of 87.67% in 2023, indicating strong consumer preference for comprehensive protection. Limited Coverage and other segments like Accidental Damage, Theft and Loss, and Malfunction account for varying shares but reveal growing awareness and uptake across all coverage types as insurance becomes a more critical component of device ownership.

Mobile Phone Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Phone Insurance Industry

Allianz:

Allianz is a leading global insurer with a robust Mobile Phone Insurance offering, known for their comprehensive policies and efficient claims processing.Asurion:

Asurion specializes in device protection services and mobile insurance, providing coverage options tailored to consumer electronics, ensuring customer satisfaction across diverse markets.SquareTrade:

SquareTrade is recognized for its innovative insurance solutions, focusing on accidental damage and theft, and has a significant share in the North American market.AXA:

AXA offers a range of insurance products including mobile phone insurance, with a strong emphasis on customer service and tailored solutions for various markets.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Phone Insurance?

The mobile phone insurance market is valued at approximately $20 billion in 2023, with a projected CAGR of 9% through 2033. This growth trajectory indicates an increasing demand for mobile phone protection services globally.

What are the key market players or companies in this mobile Phone Insurance industry?

Key players in the mobile phone insurance market include traditional insurers and insurtech firms, each providing diverse coverage options. This sector is marked by companies specializing in comprehensive protections against accidental damage, theft, and other malfunctions.

What are the primary factors driving the growth in the mobile Phone Insurance industry?

Growing smartphone usage, rising concerns about device protection, and increasing incidences of theft and accidental damage are primary growth drivers. The trend towards digital and online platforms for insurance acquisition further accelerates market expansion.

Which region is the fastest Growing in the mobile Phone Insurance?

The North America region is the fastest-growing for mobile phone insurance, with market size expanding from $7.72 billion in 2023 to $18.82 billion by 2033. Europe and Asia Pacific also show significant growth.

Does ConsaInsights provide customized market report data for the mobile Phone Insurance industry?

Yes, ConsaInsights offers customized market report data specifically tailored to the mobile phone insurance industry. This includes detailed insights on market segments, geographic trends, and competitive analyses.

What deliverables can I expect from this mobile Phone Insurance market research project?

From this market research project, you can expect comprehensive reports including market size, growth forecasts, segment analyses, regional breakdowns, and competitive landscape assessments tailored to mobile phone insurance.

What are the market trends of mobile Phone Insurance?

Current trends in the mobile phone insurance market include increased adoption of full coverage plans, heightened demand for online services, and the emergence of innovative insurtech solutions which are reshaping traditional insurance models.