Mobile Satellite Services Market Report

Published Date: 31 January 2026 | Report Code: mobile-satellite-services

Mobile Satellite Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Mobile Satellite Services market, covering key insights, industry trends, market segmentation, and future forecasts from 2023 to 2033.

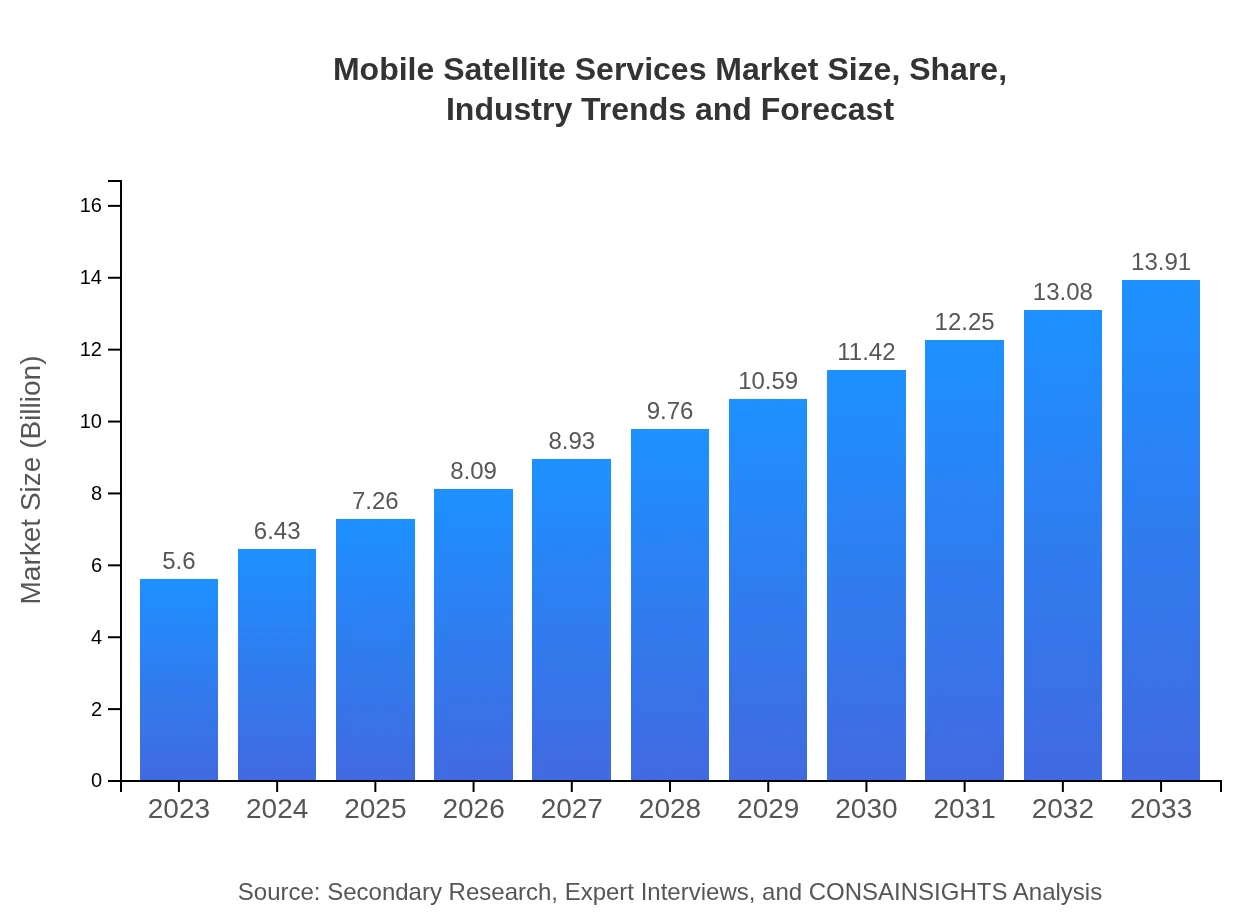

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Intelsat, Inmarsat, SES S.A., Iridium Communications Inc. |

| Last Modified Date | 31 January 2026 |

Mobile Satellite Services Market Overview

Customize Mobile Satellite Services Market Report market research report

- ✔ Get in-depth analysis of Mobile Satellite Services market size, growth, and forecasts.

- ✔ Understand Mobile Satellite Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Satellite Services

What is the Market Size & CAGR of Mobile Satellite Services market in 2023?

Mobile Satellite Services Industry Analysis

Mobile Satellite Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Satellite Services Market Analysis Report by Region

Europe Mobile Satellite Services Market Report:

Europe's MSS market, valued at $1.43 billion in 2023, is anticipated to grow to $3.56 billion by 2033. The increasing demand for secure communications and robust emergency response services is propelling growth in this region.Asia Pacific Mobile Satellite Services Market Report:

In 2023, the Asia Pacific region holds a market value of $1.14 billion, which is projected to rise to $2.84 billion by 2033. The growing adoption of mobile satellite services, driven by increasing geographic challenges and investment in telecommunications infrastructure, is expected to propel this growth.North America Mobile Satellite Services Market Report:

North America leads the MSS market with a valuation of $1.91 billion in 2023, expected to grow to $4.74 billion by 2033. The region benefits from advanced satellite technology adoption and high demand for commercial applications across its vast territory.South America Mobile Satellite Services Market Report:

The South American market demonstrates a steady growth trajectory, starting at $0.54 billion in 2023 and projected to reach $1.34 billion by 2033. The need for enhanced connectivity in remote areas and developments in disaster recovery technology will be key drivers.Middle East & Africa Mobile Satellite Services Market Report:

The Middle East and Africa market stands at $0.57 billion in 2023, with projections estimating it will reach $1.43 billion by 2033. Growth is driven primarily by the growing need for communication in offshore and rural areas.Tell us your focus area and get a customized research report.

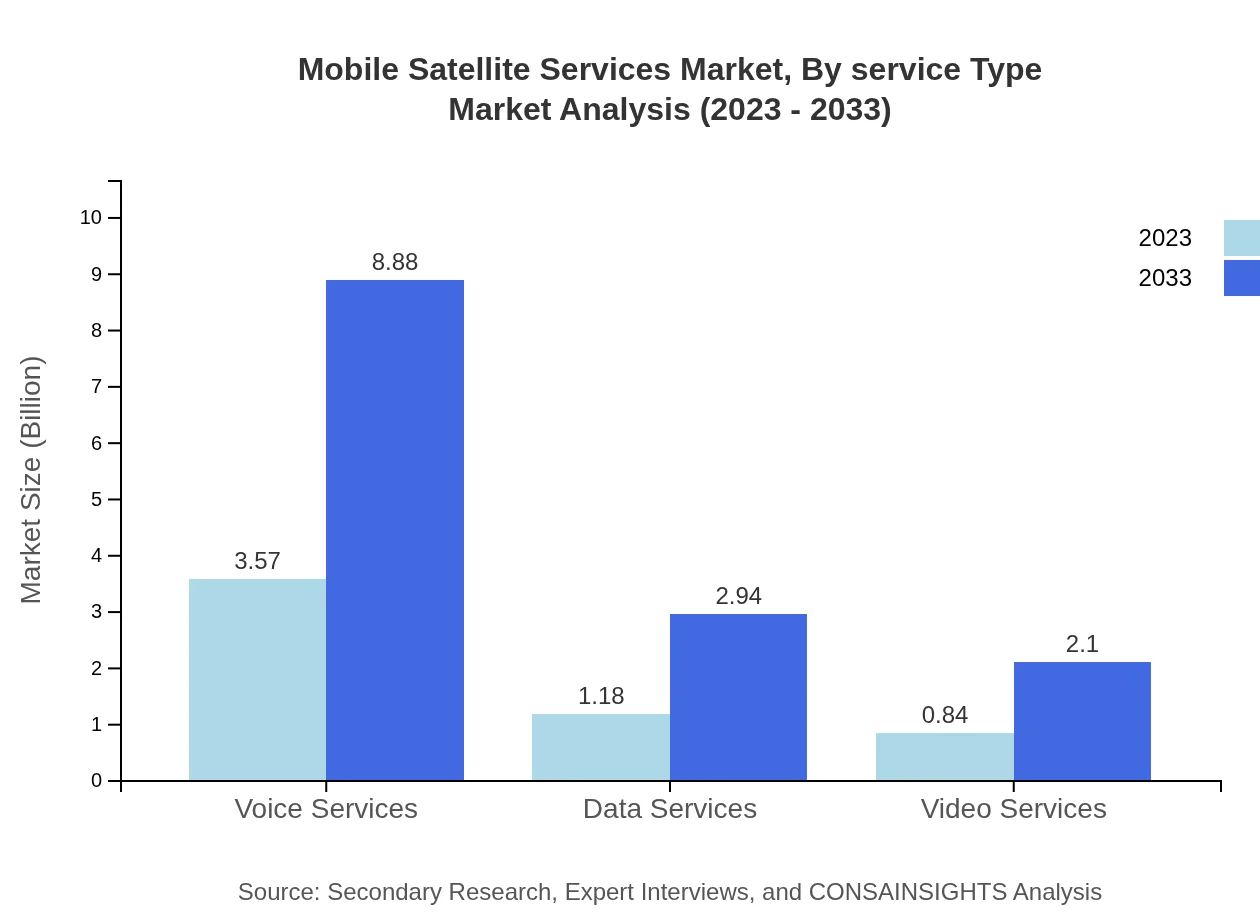

Mobile Satellite Services Market Analysis By Service Type

The MSS market is characterized by three primary service types: voice services, data services, and video services. Voice services dominate the market, valued at $3.57 billion in 2023, with expected growth to $8.88 billion by 2033. Data services follow at $1.18 billion and are projected to scale up to $2.94 billion. Video services have a valuation of $0.84 billion, forecasted to reach $2.10 billion within the same period.

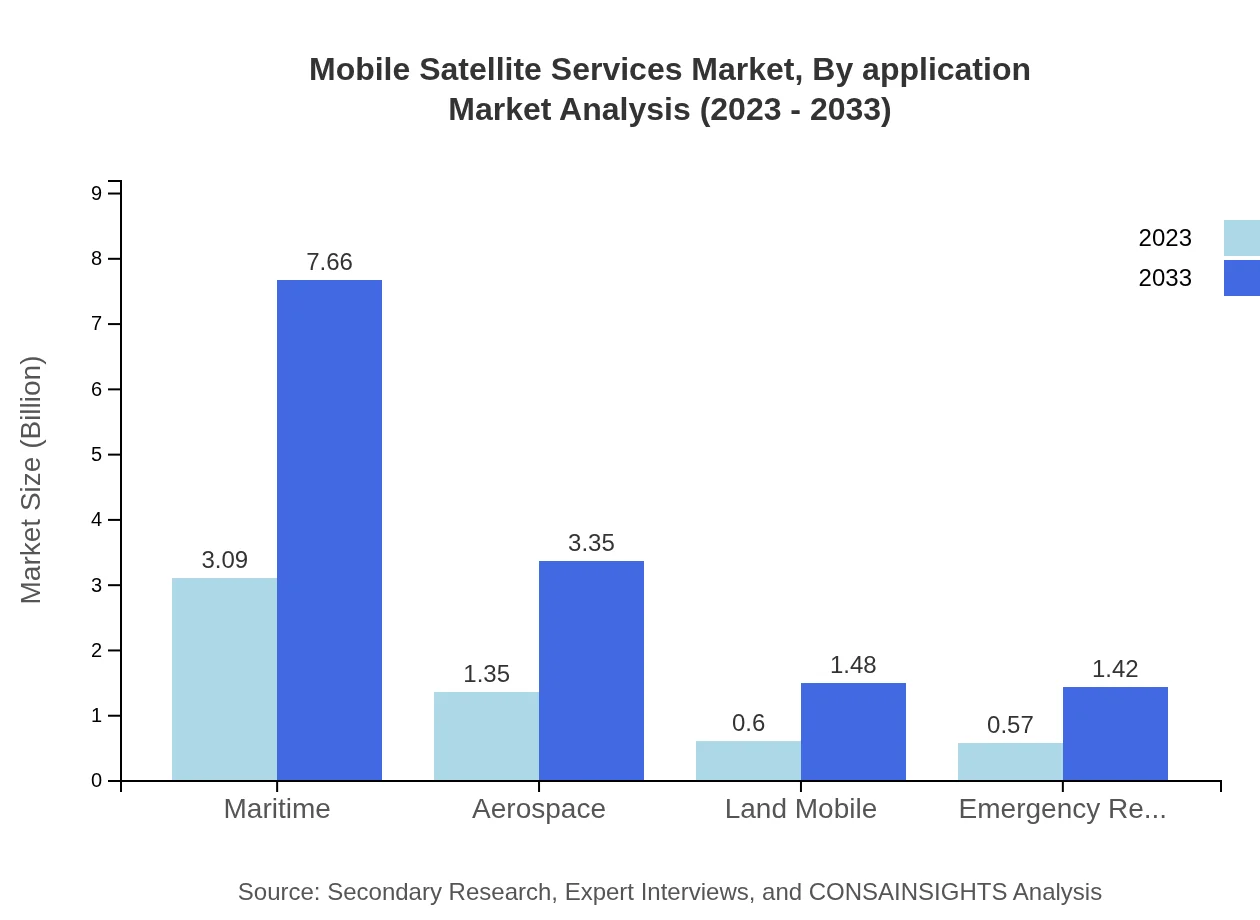

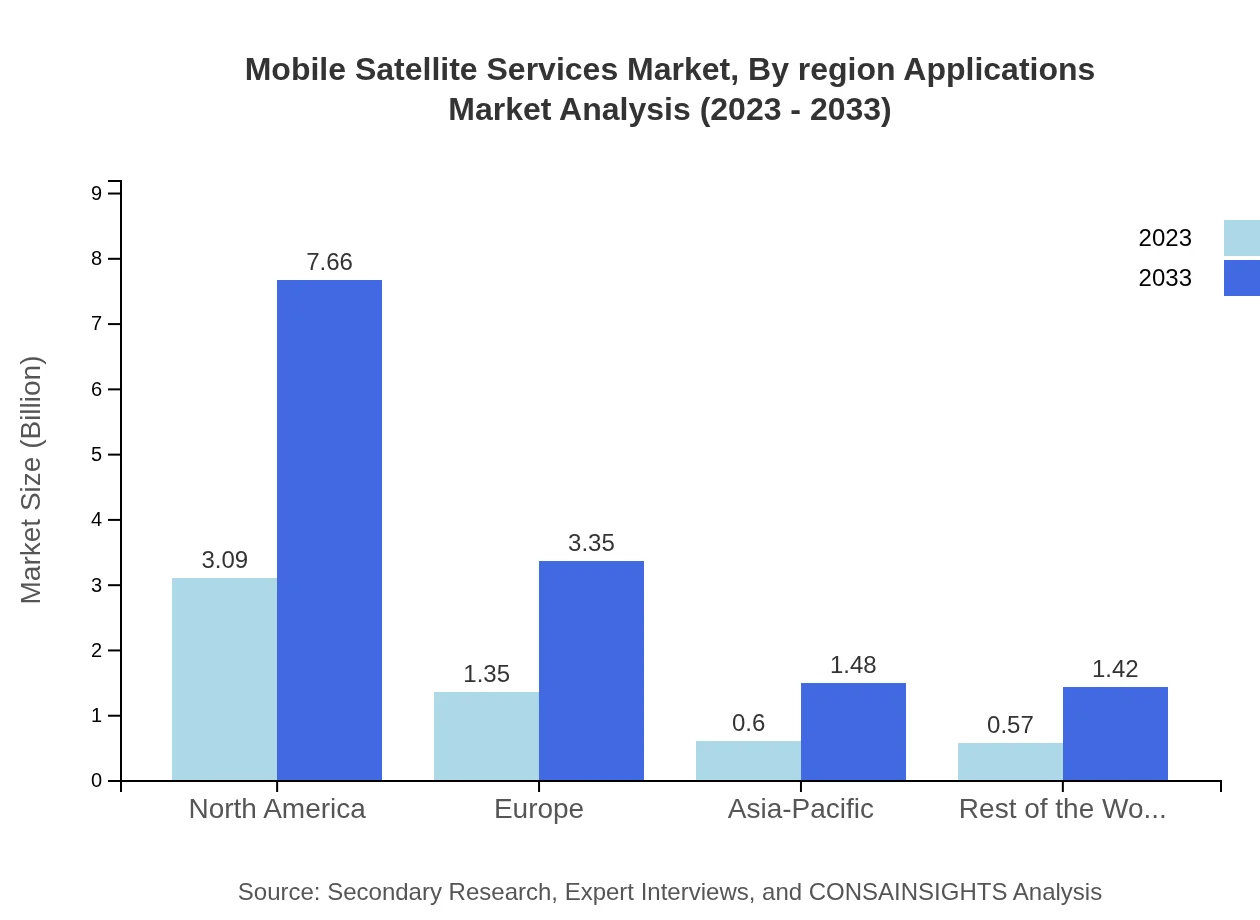

Mobile Satellite Services Market Analysis By Application

The MSS market spans diverse applications including maritime, aerospace, emergency services, and land mobile. Maritime applications currently hold a significant share, commanding $3.09 billion and anticipated to reach $7.66 billion by 2033. The aerospace segment is projected to grow from $1.35 billion in 2023 to $3.35 billion, reflecting increased demand for in-flight connectivity and other services.

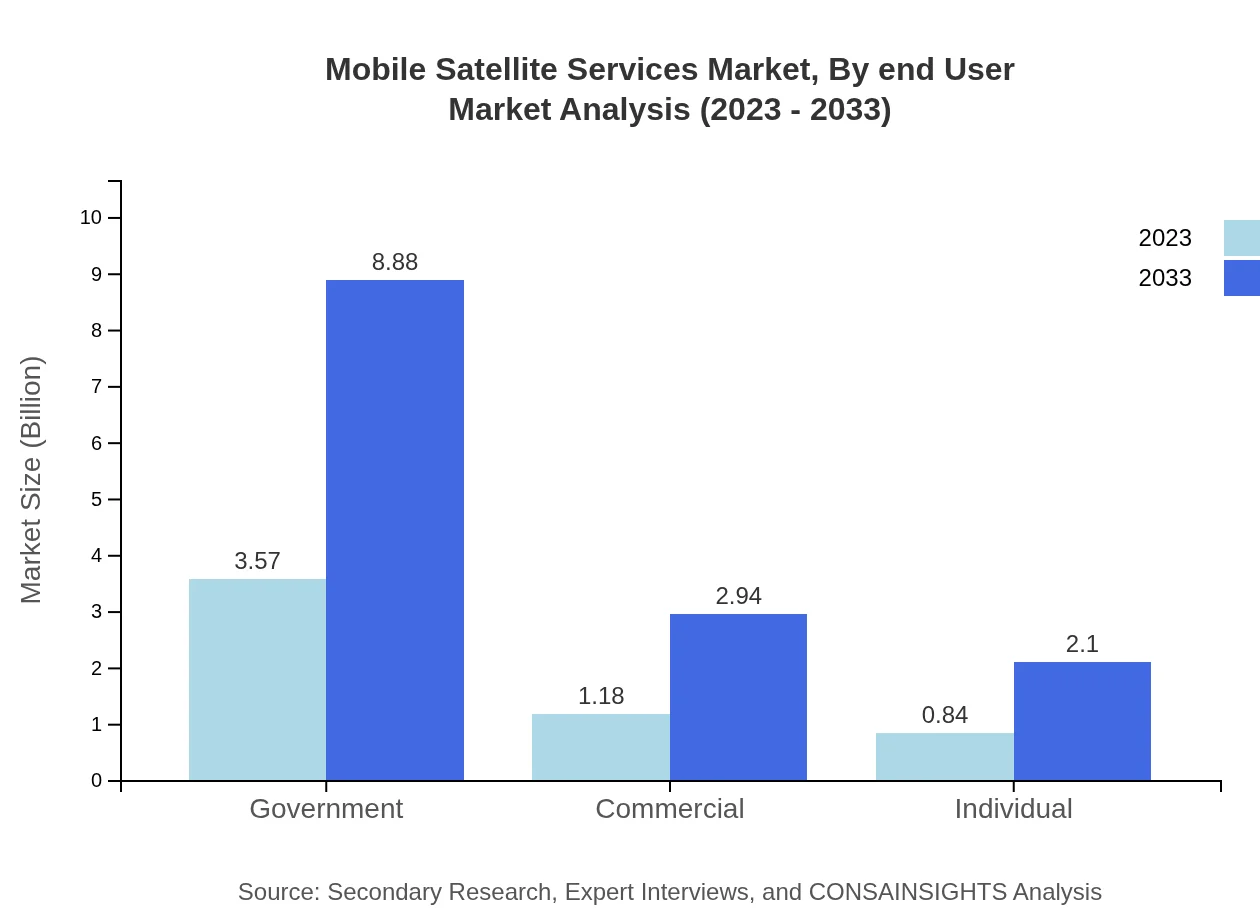

Mobile Satellite Services Market Analysis By End User

The end-user segmentation includes government, commercial, and individual users. The government sector holds a substantial market share at $3.57 billion in 2023, set to expand to $8.88 billion by 2033. The commercial sector currently stands at $1.18 billion with projected growth to $2.94 billion, while individual users will see an increase from $0.84 billion to $2.10 billion over the same decade.

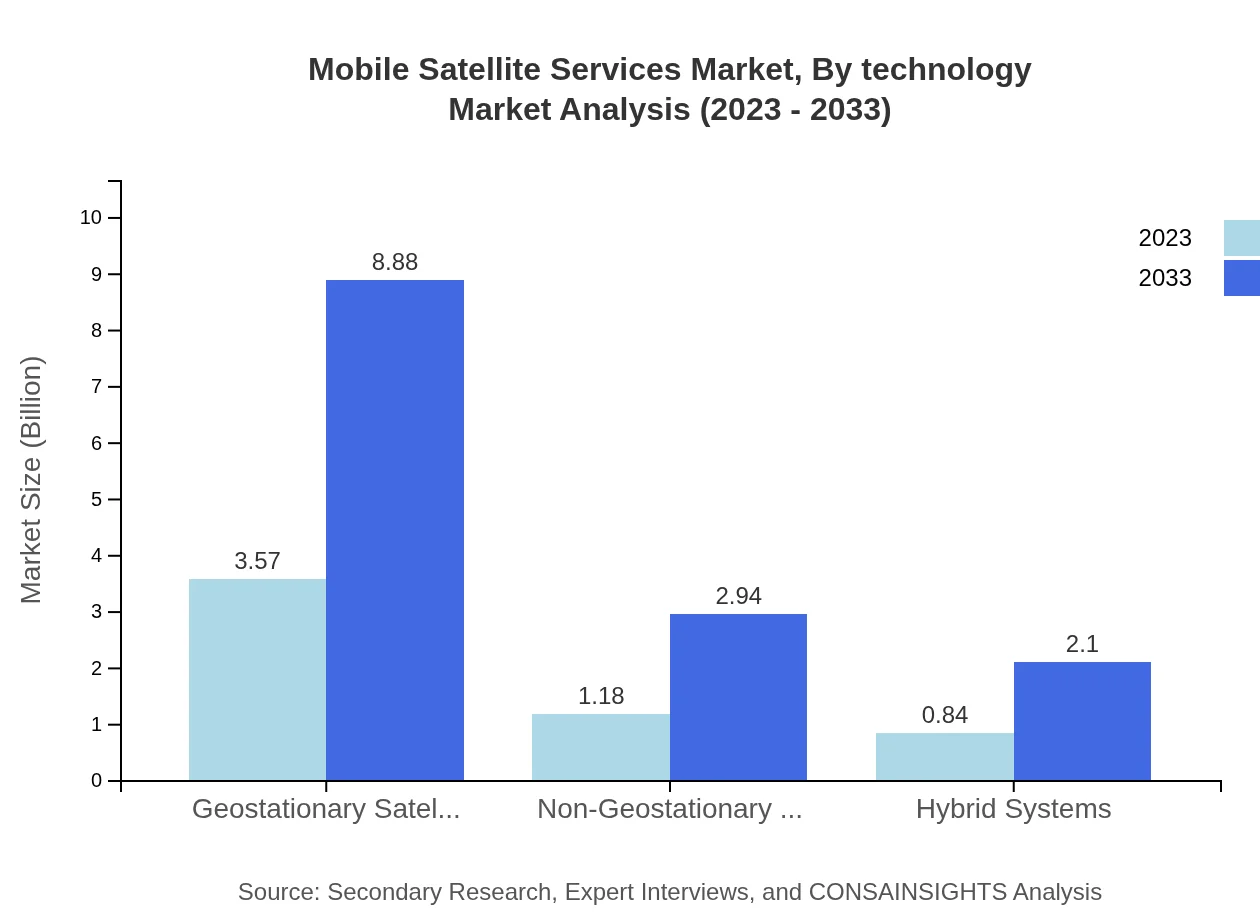

Mobile Satellite Services Market Analysis By Technology

Technological advancements such as Geostationary Satellites, Non-Geostationary Satellites, and Hybrid Systems are pivotal in shaping the MSS market. Geostationary Satellites dominate the landscape, expected to see growth from $3.57 billion to $8.88 billion. Non-Geostationary Satellites are also expected to grow significantly, from $1.18 billion to $2.94 billion, catering to businesses needing more flexible satellite communications.

Mobile Satellite Services Market Analysis By Region Applications

The various regions exhibit differing applications of MSS, driven by unique market demands. North America is leading with considerable investments in maritime and aerial applications. Europe reflects a growing need for emergency response services, while the Asia Pacific is focusing on e-governance and disaster management.

Mobile Satellite Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Satellite Services Industry

Intelsat:

Intelsat is a leading provider of satellite services and technology, offering global coverage and high-capacity services for various industries, including aerospace and maritime.Inmarsat:

Inmarsat specializes in mobile satellite communication, primarily for the aviation, maritime, and government sectors, focusing on delivering secure and reliable global connectivity.SES S.A.:

SES is a globally recognized leader in satellite-based communications, providing advanced solutions for enterprises and telecommunication partners across various sectors.Iridium Communications Inc.:

Iridium offers mobile voice and data satellite communications worldwide, serving both commercial and governmental clients with innovative solutions in critical environments.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Satellite Services?

The mobile satellite services market is projected to grow from $5.6 billion in 2023 to significantly larger figures by 2033, with an impressive CAGR of 9.2% over the forecast period.

What are the key market players or companies in this mobile Satellite Services industry?

Key players in the mobile satellite services industry include major companies like Inmarsat, Intelsat, SES S.A., Iridium Communications, and Eutelsat, which dominate the market with their innovative solutions.

What are the primary factors driving the growth in the mobile Satellite Services industry?

Growth in the mobile satellite services industry is driven by increased demand for connectivity in remote areas, advancements in satellite technology, and expanding applications in aviation, maritime, and defense.

Which region is the fastest Growing in the mobile Satellite Services?

The fastest-growing region in the mobile satellite services market is North America, where the market is expected to rise from $1.91 billion in 2023 to $4.74 billion by 2033, capitalizing on technological advancements.

Does ConsaInsights provide customized market report data for the mobile Satellite Services industry?

Yes, ConsaInsights offers customized market reports and tailored insights specific to the mobile satellite services industry, catering to individual client needs and preferences.

What deliverables can I expect from this mobile Satellite Services market research project?

Deliverables from this mobile satellite services market research project include detailed reports, insights on market trends, growth forecasts, and comprehensive analysis of key segments and geographic regions.

What are the market trends of mobile Satellite Services?

Key trends in mobile satellite services include the increasing adoption of hybrid systems, growth in data services, and heightened focus on environmental sustainability and efficient bandwidth management.