Mobile Security Market Report

Published Date: 31 January 2026 | Report Code: mobile-security

Mobile Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Mobile Security market, highlighting significant trends, growth opportunities, and key players from 2023 to 2033. It includes detailed insights on market size, CAGR, segmentation, regional performance, and technology advancements.

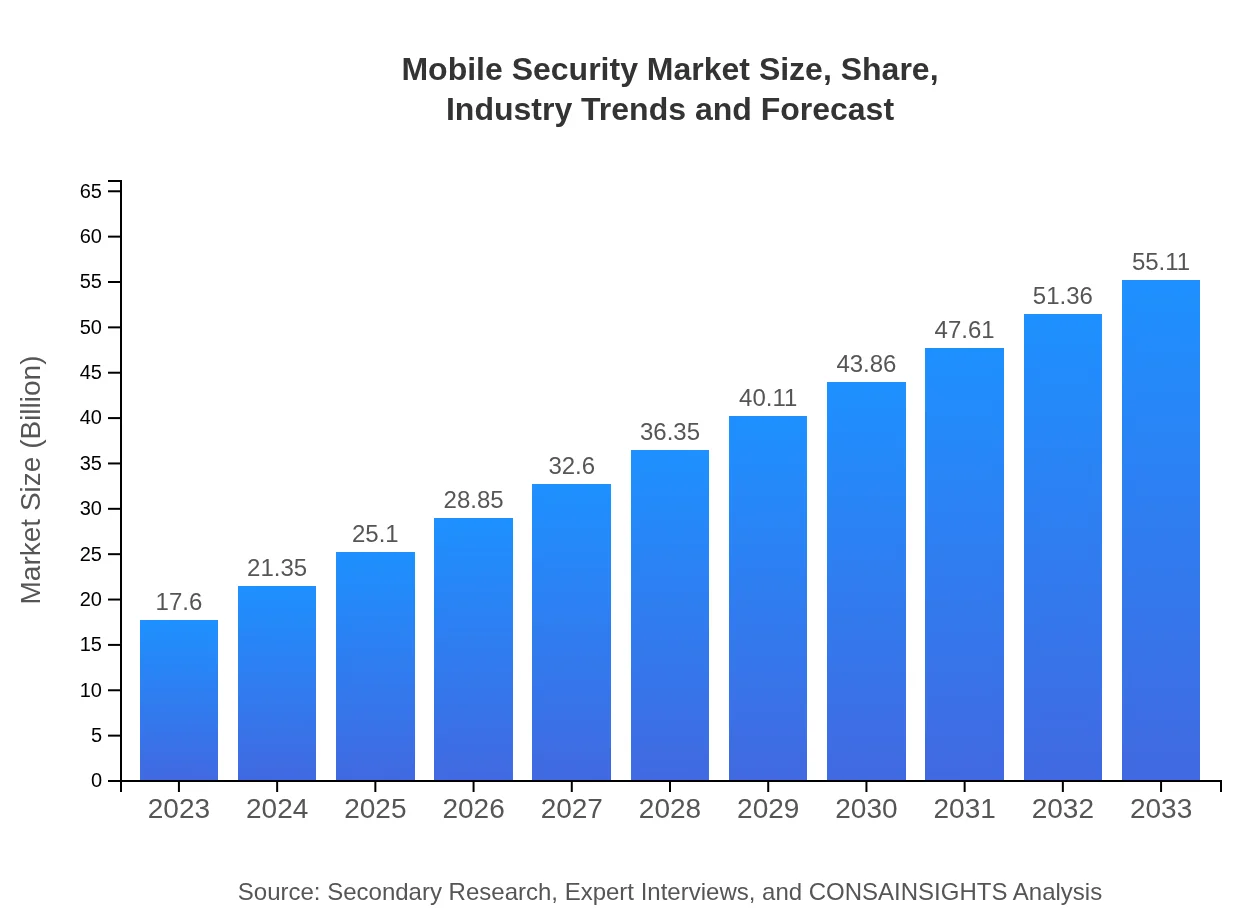

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $17.60 Billion |

| CAGR (2023-2033) | 11.6% |

| 2033 Market Size | $55.11 Billion |

| Top Companies | McAfee, Symantec, Kaspersky Lab, IBM |

| Last Modified Date | 31 January 2026 |

Mobile Security Market Overview

Customize Mobile Security Market Report market research report

- ✔ Get in-depth analysis of Mobile Security market size, growth, and forecasts.

- ✔ Understand Mobile Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Security

What is the Market Size & CAGR of Mobile Security market in 2023?

Mobile Security Industry Analysis

Mobile Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Security Market Analysis Report by Region

Europe Mobile Security Market Report:

In Europe, the Mobile Security market was valued at approximately $5.43 billion in 2023, with forecasts indicating growth to roughly $17.00 billion by 2033. The strong regulatory environment regarding data protection and the growing adoption of mobile payment solutions bolster the market.Asia Pacific Mobile Security Market Report:

In the Asia Pacific region, the Mobile Security market is valued at approximately $2.97 billion in 2023 and is projected to expand to around $9.29 billion by 2033. Factors such as a growing mobile user base, increasing digital transactions, and rising awareness of cybersecurity are driving this growth.North America Mobile Security Market Report:

North America dominates the Mobile Security market, with a valuation of approximately $6.59 billion in 2023, expected to rise to around $20.63 billion by 2033. The presence of key security vendors and the increasing deployment of mobile applications in enterprises are significant contributors to this growth.South America Mobile Security Market Report:

The South American Mobile Security market is valued at about $1.18 billion in 2023, with growth projections reaching approximately $3.69 billion by 2033. The increasing need for mobile security solutions due to rising cyber threats and mobile adoption is fueling market growth.Middle East & Africa Mobile Security Market Report:

The Middle East and Africa region has a Mobile Security market valued at $1.44 billion in 2023, expected to reach approximately $4.51 billion by 2033. The growing shift towards mobile banking and increasing smartphone penetration contributes to the demand for mobile security solutions.Tell us your focus area and get a customized research report.

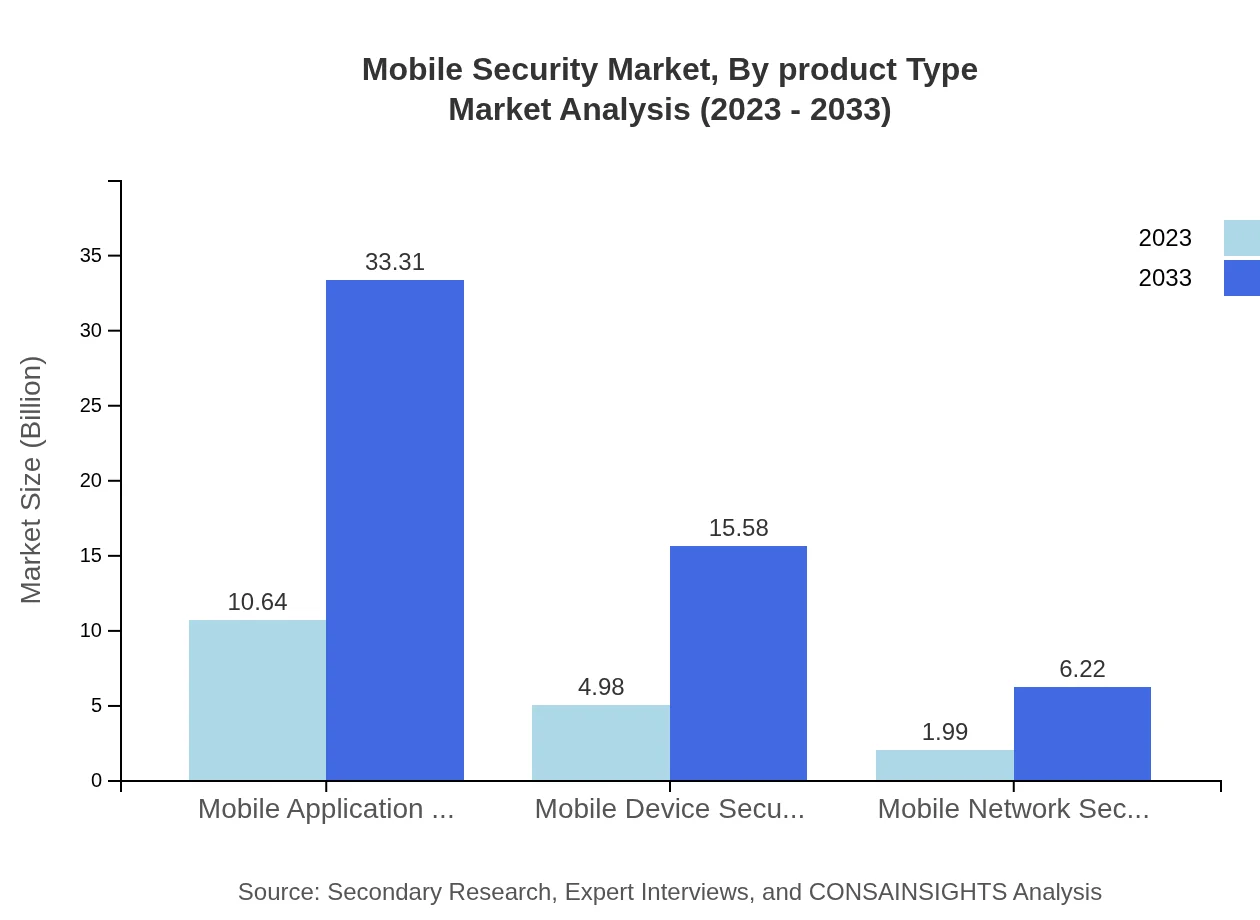

Mobile Security Market Analysis By Product Type

The Mobile Security market by product type includes Mobile Application Security, Mobile Device Security, and Mobile Network Security. Mobile Application Security is projected to grow from $10.64 billion in 2023 to $33.31 billion in 2033, representing a significant share of the market. Mobile Device Security is anticipated to increase from $4.98 billion to $15.58 billion, while Mobile Network Security is expected to grow from $1.99 billion to $6.22 billion, reflecting their importance in the overarching security framework.

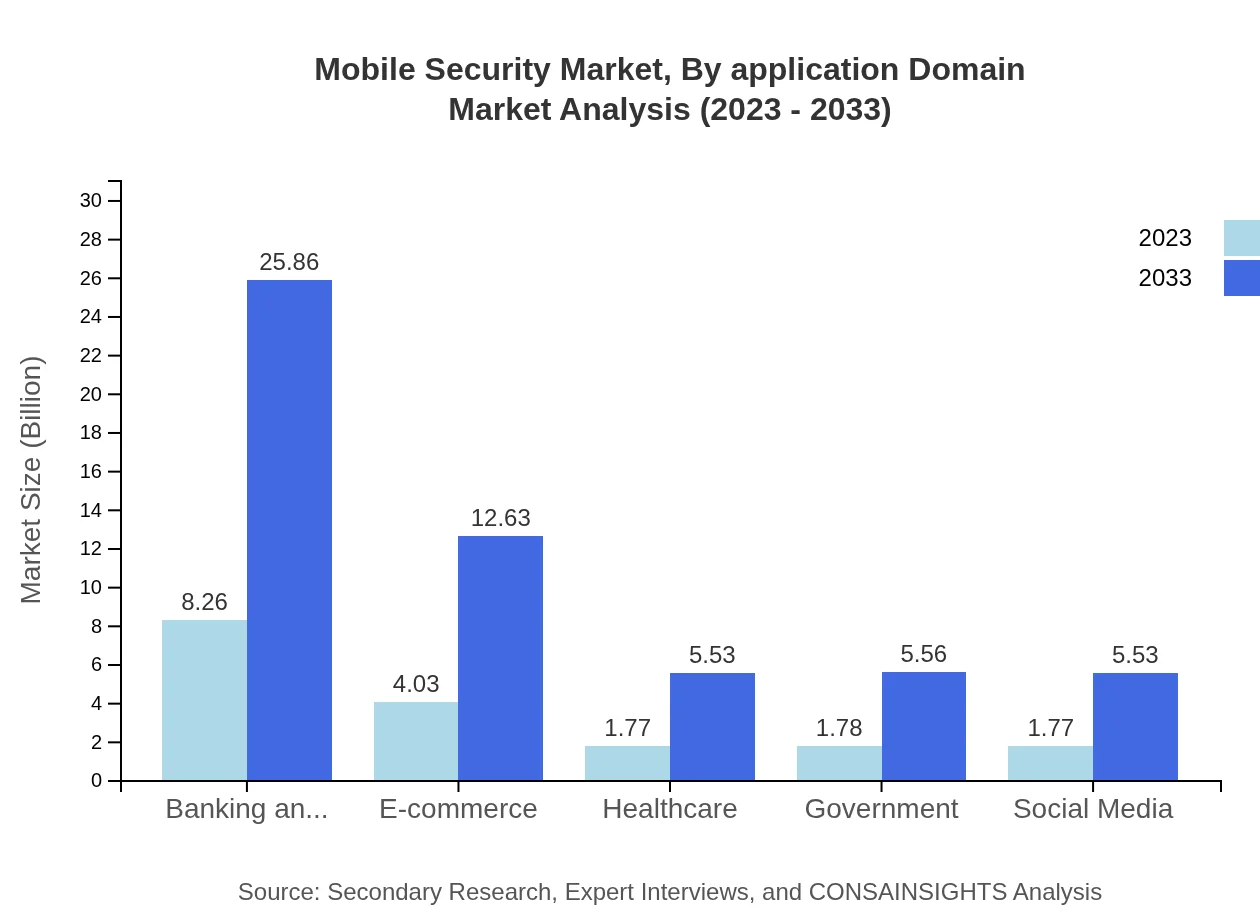

Mobile Security Market Analysis By Application Domain

Segmentation by application domain highlights the significance of sectors such as Banking and Financial Services, expected to grow from $8.26 billion in 2023 to $25.86 billion in 2033. E-commerce and Healthcare also show notable growth, with E-commerce projected to rise from $4.03 billion to $12.63 billion, reflecting increasing digital transactions and the need for secure mobile platforms across various industries.

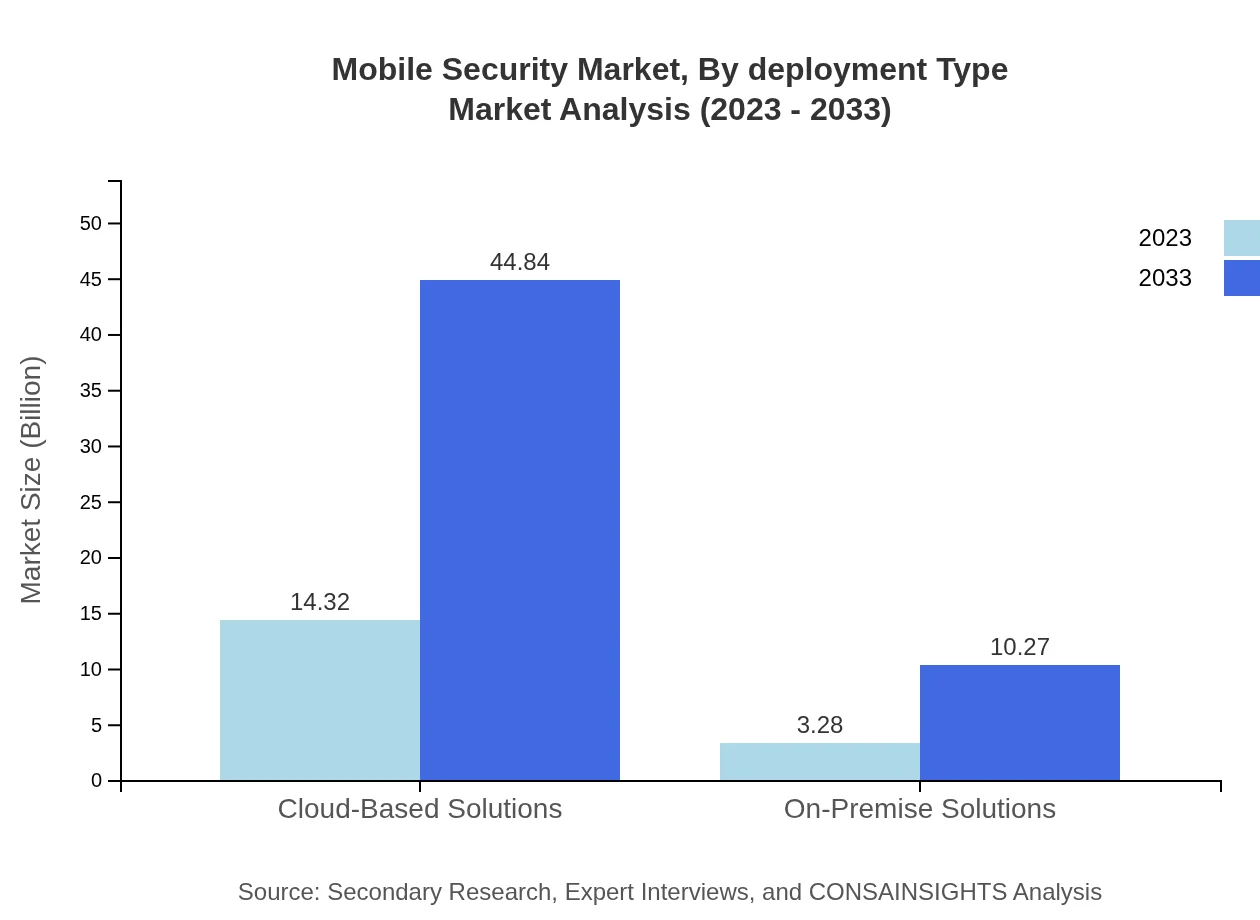

Mobile Security Market Analysis By Deployment Type

Analyzing deployment types, Cloud-Based Solutions represent the largest segment, growing from $14.32 billion in 2023 to $44.84 billion by 2033, while On-Premise Solutions are expected to grow from $3.28 billion to $10.27 billion. The cloud-based preference is mainly driven by cost-effectiveness, scalability, and accessibility, making it a go-to solution for many organizations.

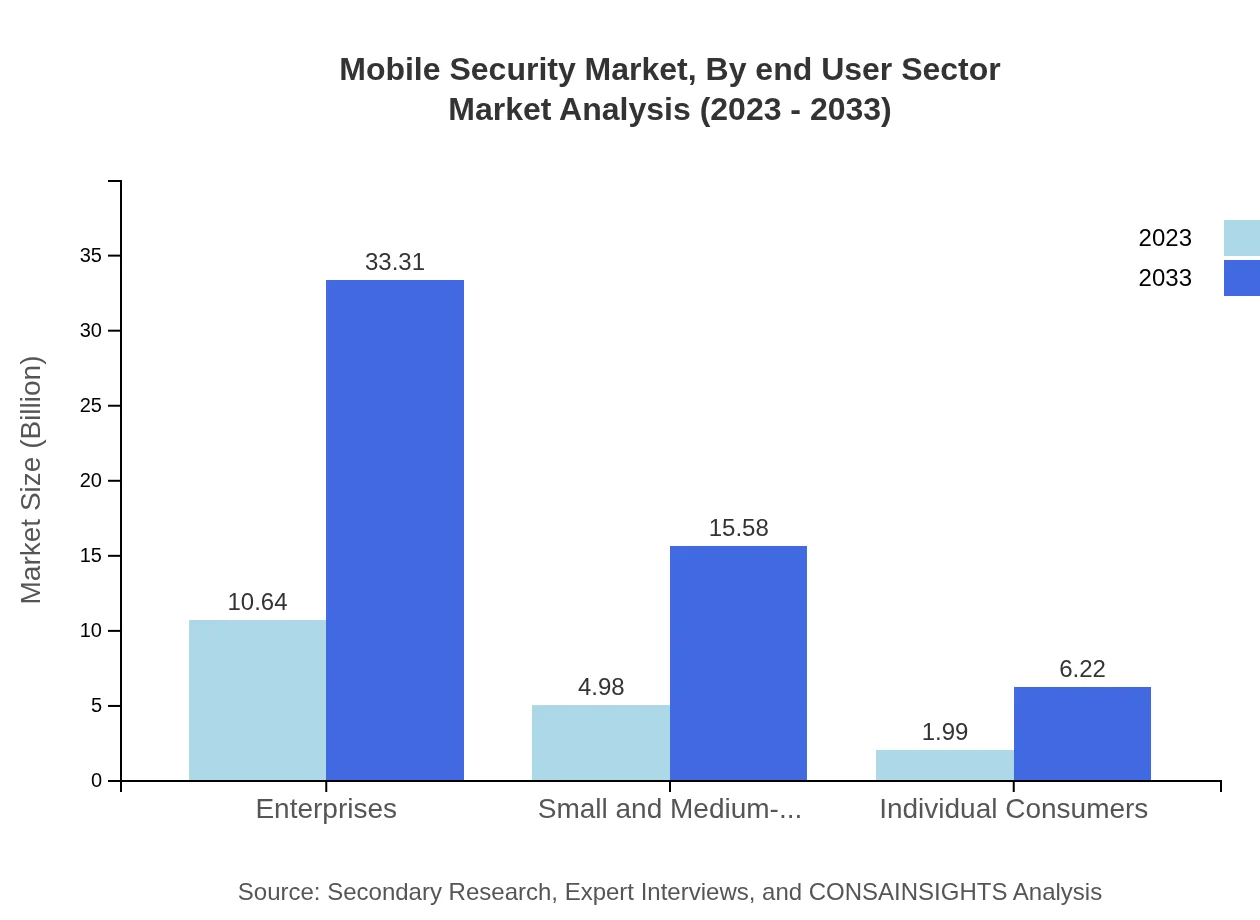

Mobile Security Market Analysis By End User Sector

The Mobile Security market is also segmented by end-user sector, with Enterprises leading at $10.64 billion in 2023, projected to reach $33.31 billion by 2033. Small and Medium-Sized Businesses are expected to grow from $4.98 billion to $15.58 billion, highlighting the widening scope for tighter mobile security in all business scales. Individual Consumers, Banking and Financial Services, and Healthcare also showcase potential for significant growth, ensuring safety across all touchpoints.

Mobile Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Security Industry

McAfee:

A leader in cybersecurity solutions, McAfee offers a comprehensive mobile security suite that protects against threats while ensuring privacy and data security.Symantec:

Known for its advanced threat protections, Symantec provides innovative mobile security solutions catering to both individual consumers and enterprises.Kaspersky Lab:

Kaspersky provides robust mobile security measures designed to combat malware and phishing attacks, recognized for its effectiveness and user-friendly interfaces.IBM:

IBM integrates mobile security into its broader cybersecurity framework, leveraging AI and machine learning to offer dynamic, enterprise-level security solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Security?

The global mobile security market is projected to grow to $17.6 billion by 2033, with a compound annual growth rate (CAGR) of 11.6% from 2023. This expansion reflects an increasing reliance on mobile devices and a growing emphasis on cybersecurity.

What are the key market players or companies in this mobile Security industry?

Key players in the mobile security industry include well-known firms like McAfee, Symantec, IBM, and AVG Technologies. These companies focus on innovative solutions and robust security frameworks to combat rising threats in mobile cybersecurity.

What are the primary factors driving the growth in the mobile Security industry?

The growth of the mobile security industry is driven by factors such as the increasing use of smartphones and tablets, a surge in cyber threats, rising data privacy regulations, and the growing need for businesses to secure sensitive information from mobile devices.

Which region is the fastest Growing in the mobile Security industry?

North America is expected to be the fastest-growing region in the mobile security industry, increasing from $6.59 billion in 2023 to $20.63 billion by 2033, as enterprises prioritize cybersecurity investments amid rising digital threats.

Does ConsaInsights provide customized market report data for the mobile Security industry?

Yes, ConsaInsights offers customized market report data tailored to the mobile security industry, enabling clients to obtain specific insights based on their requirements, market niches, and strategic goals.

What deliverables can I expect from this mobile Security market research project?

Deliverables from the mobile security market research project typically include comprehensive reports featuring market analysis, trends, forecasts, competitive landscape insights, and data-driven recommendations tailored to your business objectives.

What are the market trends of mobile Security?

Current trends in mobile security include the expansion of cloud-based solutions, increased focus on mobile application security, and rising adoption of AI-driven security features, reflecting a shift towards more proactive cybersecurity measures.