Mobile Wallet Market Report

Published Date: 31 January 2026 | Report Code: mobile-wallet

Mobile Wallet Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Mobile Wallet market, covering market size projections, growth trends, technological advancements, and regional insights from 2023 to 2033. It aims to furnish stakeholders with critical data to guide strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

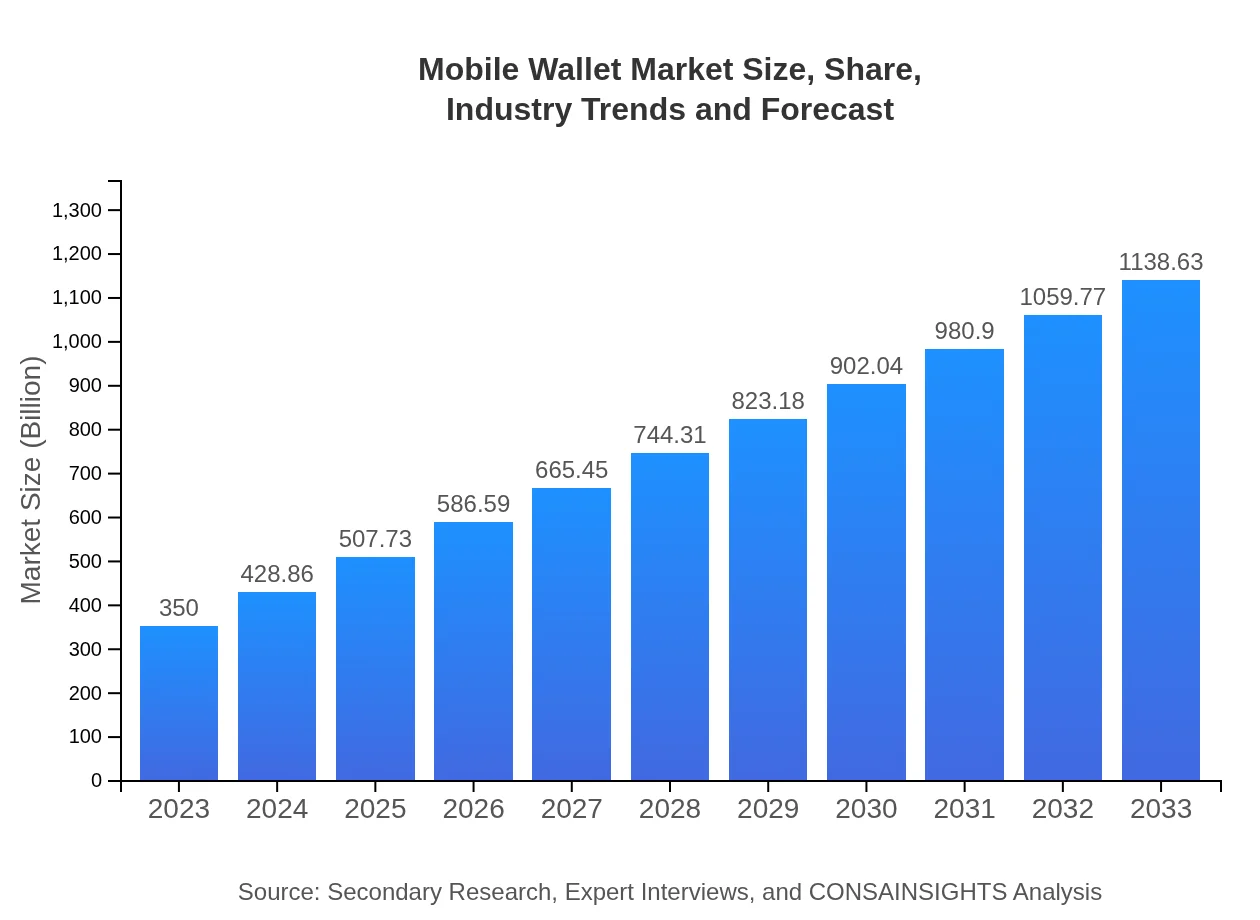

| 2023 Market Size | $350.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $1138.63 Billion |

| Top Companies | PayPal, Apple Pay, Google Pay, Samsung Pay, Venmo |

| Last Modified Date | 31 January 2026 |

Mobile Wallet Market Overview

Customize Mobile Wallet Market Report market research report

- ✔ Get in-depth analysis of Mobile Wallet market size, growth, and forecasts.

- ✔ Understand Mobile Wallet's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mobile Wallet

What is the Market Size & CAGR of Mobile Wallet market in 2023?

Mobile Wallet Industry Analysis

Mobile Wallet Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Mobile Wallet Market Analysis Report by Region

Europe Mobile Wallet Market Report:

Europe's market starts at $97.55 billion in 2023 and is projected to grow to $317.34 billion by 2033, as regulatory frameworks around consumer data protection and digital payments standardization evolve.Asia Pacific Mobile Wallet Market Report:

In the Asia Pacific region, the market is expected to grow from $66.67 billion in 2023 to $216.91 billion by 2033, driven by a high population density, technological adoption, and supportive government regulations for digital payments.North America Mobile Wallet Market Report:

In North America, the market, valued at $124.04 billion in 2023, is set to reach $403.53 billion by 2033. The robust infrastructure and high consumer trust in digital payments contribute to this impressive growth.South America Mobile Wallet Market Report:

The South American market, with an initial size of $12.74 billion in 2023, is forecasted to reach $41.45 billion by 2033. The growth is propelled by increasing smartphone penetration and the adoption of digital payment solutions among a largely unbanked population.Middle East & Africa Mobile Wallet Market Report:

The Middle East and Africa is anticipated to rise from $49.00 billion in 2023 to $159.41 billion by 2033, attributed to increasing smartphone usage and a shift towards a cashless economy.Tell us your focus area and get a customized research report.

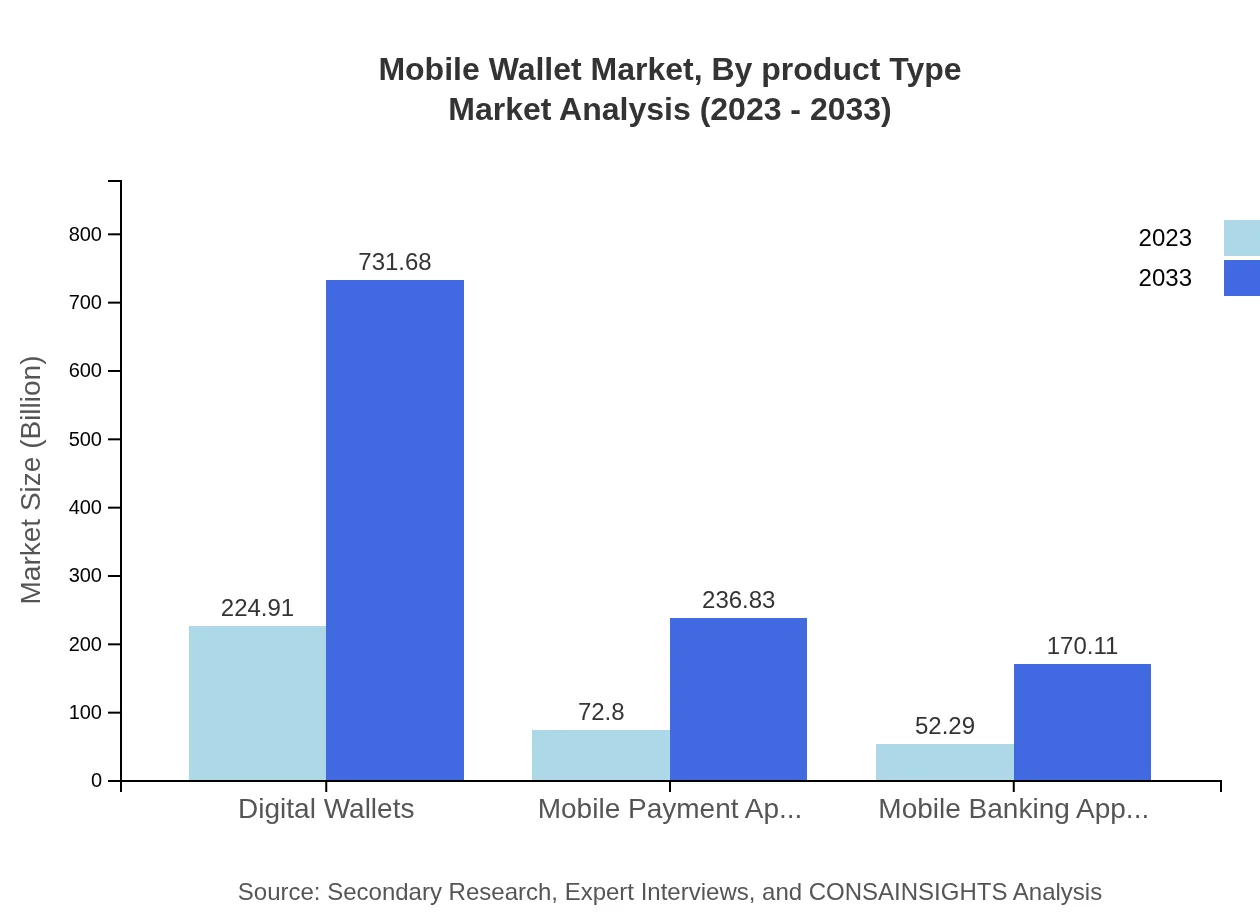

Mobile Wallet Market Analysis By Product Type

The Mobile Wallet Market by Product Type includes Consumers, Merchants, and Enterprises. In 2023, the market size for consumers stands at $224.91 billion, expected to rise to $731.68 billion by 2033. Merchants represent a market value of $72.80 billion in 2023, projected to grow to $236.83 billion by 2033. Enterprises start at $52.29 billion and are expected to reach $170.11 billion in the same period.

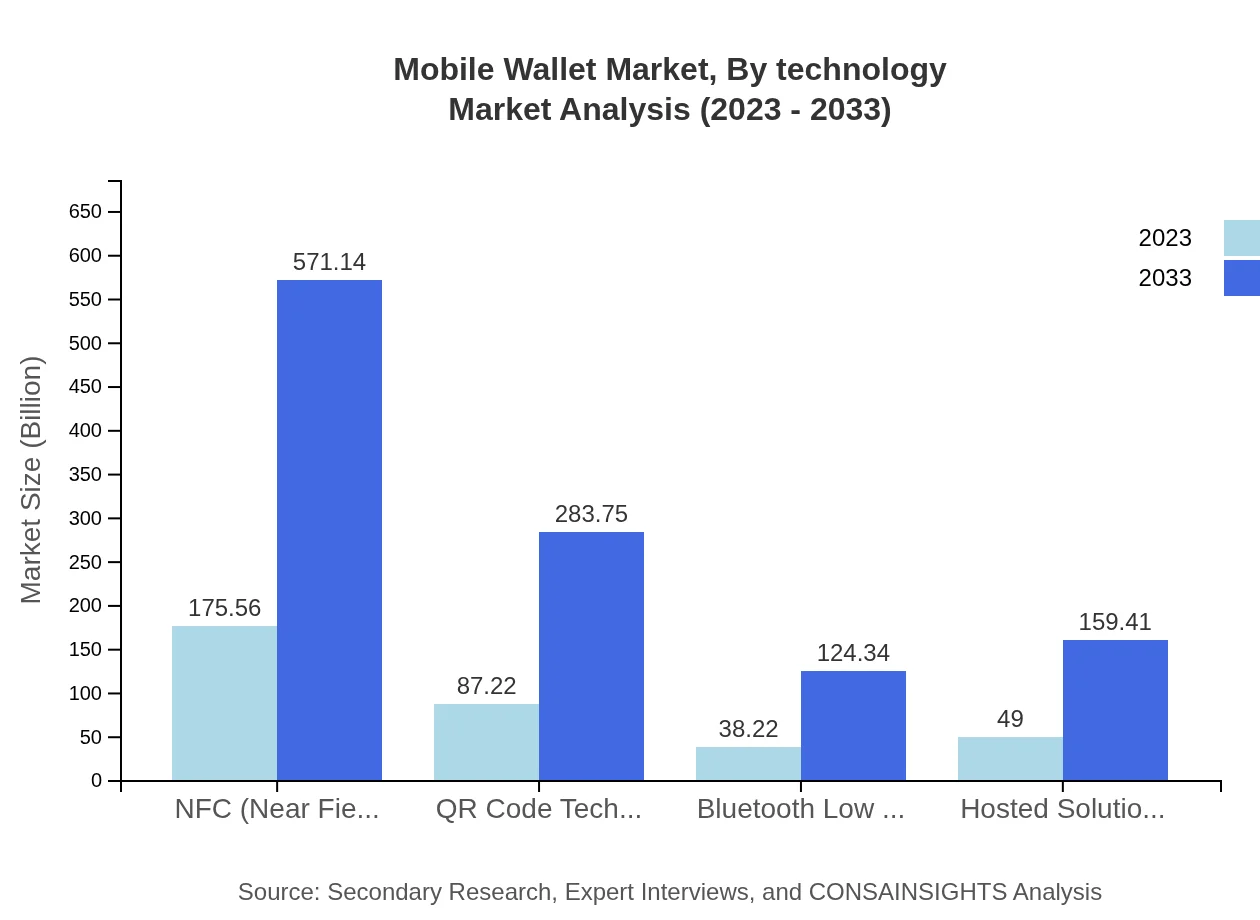

Mobile Wallet Market Analysis By Technology

Mobile Wallet Technology Segmentation includes NFC, QR Code Technology, Bluetooth Low Energy, and Hosted Solutions. NFC technology dominates with an estimated market size of $175.56 billion in 2023, growing to $571.14 billion by 2033. QR Code technology starts at $87.22 billion, anticipated to reach $283.75 billion by 2033. Bluetooth Low Energy and Hosted Solutions are projected to grow from $38.22 billion to $124.34 billion and $49.00 billion to $159.41 billion, respectively.

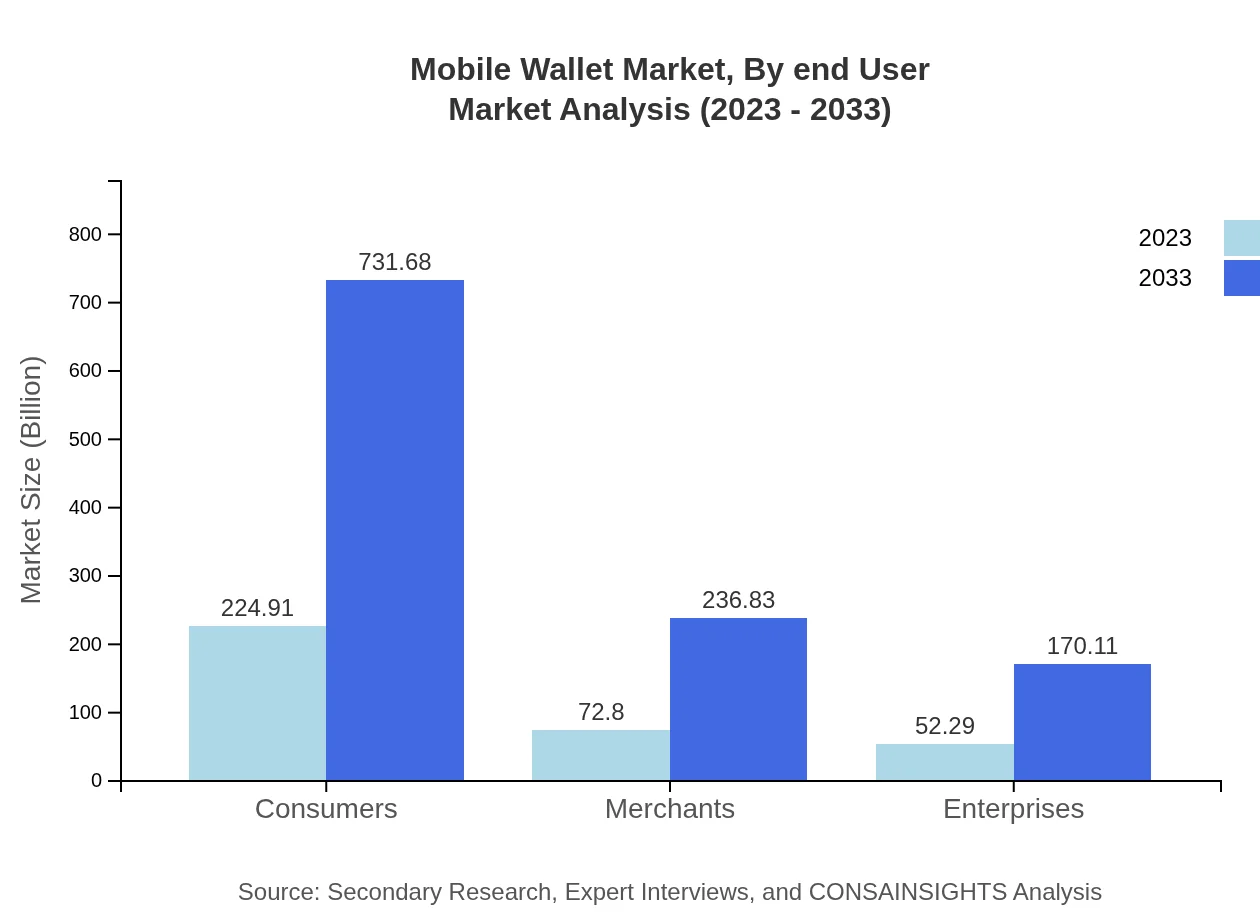

Mobile Wallet Market Analysis By End User

The end-user analysis shows Consumers significantly leading the market with $224.91 billion in 2023, growing to $731.68 billion by 2033. Merchants will see growth from $72.80 billion to $236.83 billion. Enterprises start at $52.29 billion and expand to $170.11 billion. Each segment underlines the increasing reliance on mobile wallets across various user bases.

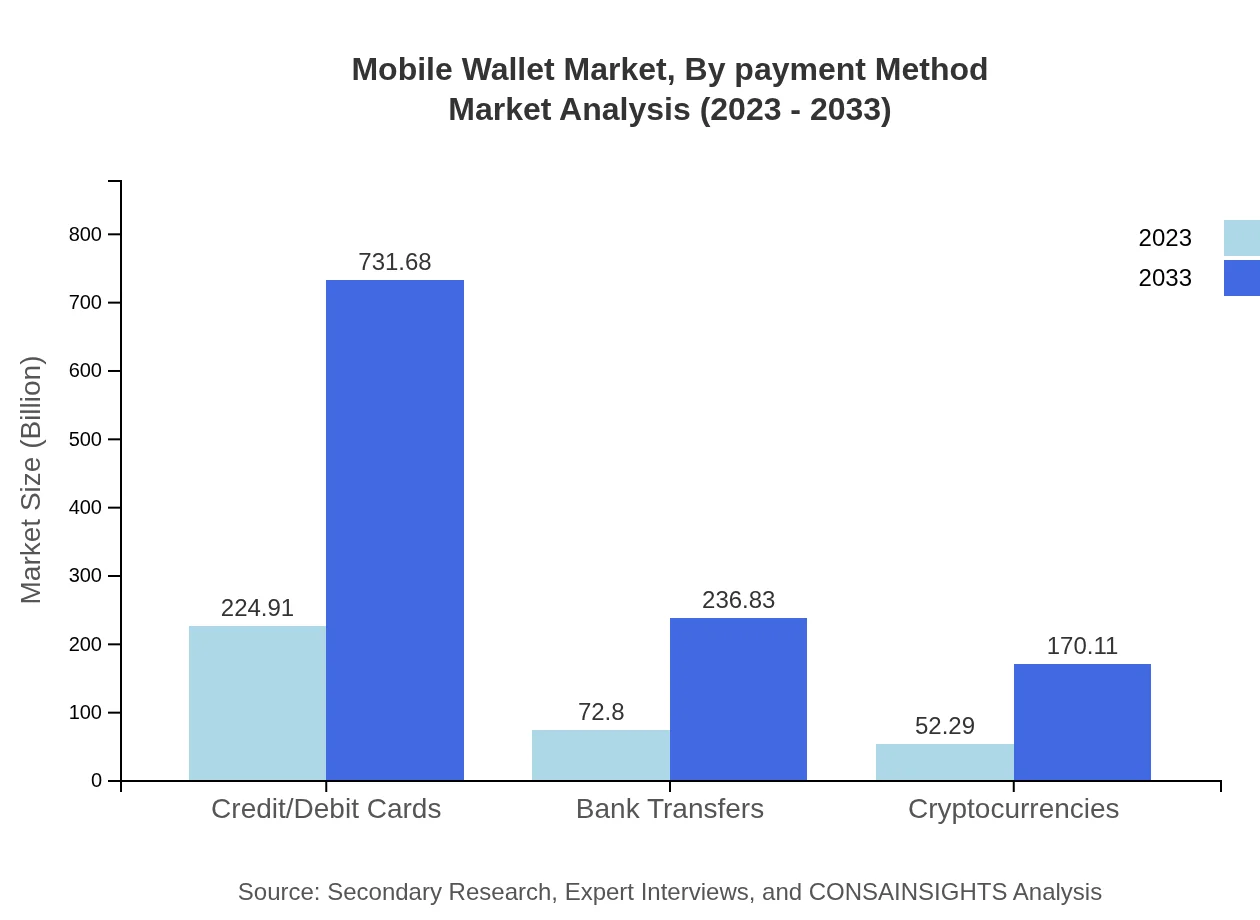

Mobile Wallet Market Analysis By Payment Method

In terms of payment methods, Credit/Debit Cards and Bank Transfers are significant. Credit/Debit Cards account for $224.91 billion in 2023 and are set to reach $731.68 billion by 2033. Bank Transfers grow from $72.80 billion to $236.83 billion in the same timeframe. The integration of Cryptocurrencies is also expected to rise from $52.29 billion to $170.11 billion by 2033.

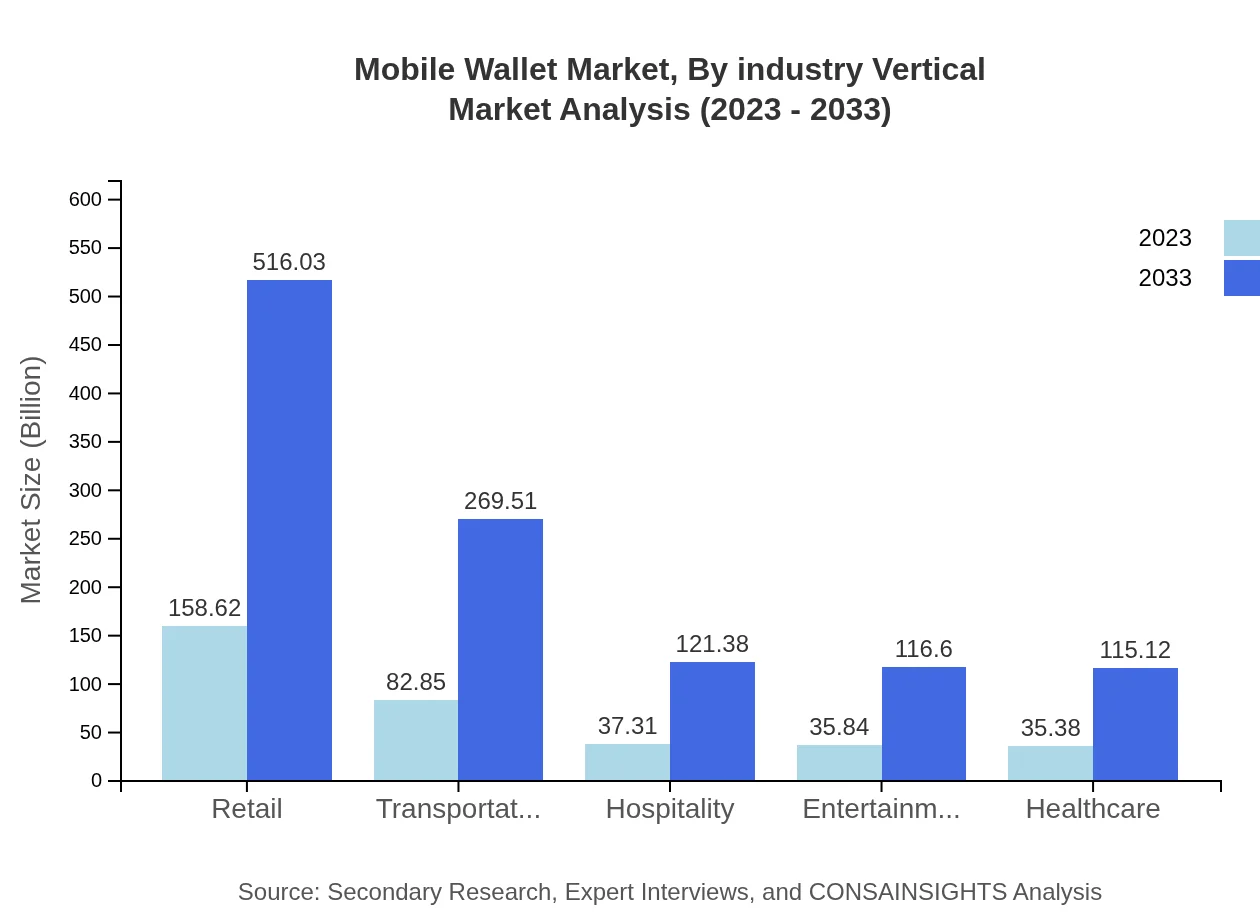

Mobile Wallet Market Analysis By Industry Vertical

Industry verticals such as Retail, Transportation, Hospitality, and Entertainment reflect strong growth patterns. Retail leads with $158.62 billion in 2023 and forecasts indicate a climb to $516.03 billion by 2033. Transportation follows with growth from $82.85 billion to $269.51 billion. Hospitality and Entertainment are also set to grow, validating the extensive application of mobile wallets across different sectors.

Mobile Wallet Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Mobile Wallet Industry

PayPal:

A leader in digital payments, PayPal facilitates online money transfers and serves as a digital wallet for users globally.Apple Pay:

Apple Pay is a mobile payment and digital wallet service that allows users to make payments in person, in iOS apps, and on the web.Google Pay:

A fast and simple way to pay using the PayPal platform or directly with Google, enhancing mobile transactions for various services.Samsung Pay:

Samsung Pay allows users to make payments using their Samsung devices, integrating NFC technology for contactless payments.Venmo:

A mobile payment service owned by PayPal, Venmo allows users to transfer money to others via a mobile app, expanding digital payment accessibility.We're grateful to work with incredible clients.

FAQs

What is the market size of mobile Wallet?

The global mobile wallet market size is projected to reach $350 billion by 2033, growing at a CAGR of 12% from its current value. This indicates a robust expansion, driven by increasing digital payment preferences.

What are the key market players or companies in this mobile Wallet industry?

Key players in the mobile wallet industry include PayPal, Apple Pay, Google Wallet, Samsung Pay, Stripe, and Square. These companies lead in innovation and adoption of mobile payment technologies, each capturing significant market share.

What are the primary factors driving the growth in the mobile wallet industry?

Factors driving growth in the mobile wallet industry include an increase in smartphone penetration, rising acceptance of digital payments, and convenience offered by mobile wallets for online and offline transactions.

Which region is the fastest Growing in mobile Wallet?

The Asia Pacific region is the fastest-growing market for mobile wallets, expanding from $66.67 billion in 2023 to $216.91 billion by 2033, indicating strong adoption and infrastructure improvements.

Does ConsaInsights provide customized market report data for the mobile Wallet industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the mobile wallet industry, ensuring clients receive relevant insights that align with their business objectives.

What deliverables can I expect from this mobile Wallet market research project?

From a mobile wallet market research project, you can expect detailed market analysis, segmentation reports, competitive landscape insights, consumer behavior studies, and market forecasts to aid strategic decision-making.

What are the market trends of mobile Wallet?

Current trends in the mobile wallet market include rising adoption of contactless payments, integration with cryptocurrencies, increasing merchant partnerships, and advancements in security measures like biometric authentication.