Modular Data Center Market Report

Published Date: 31 January 2026 | Report Code: modular-data-center

Modular Data Center Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Modular Data Center market, emphasizing market size, trends, and forecasts from 2023 to 2033. It includes insights on key segments, regional performances, and industry leaders, ensuring a strategic overview for stakeholders.

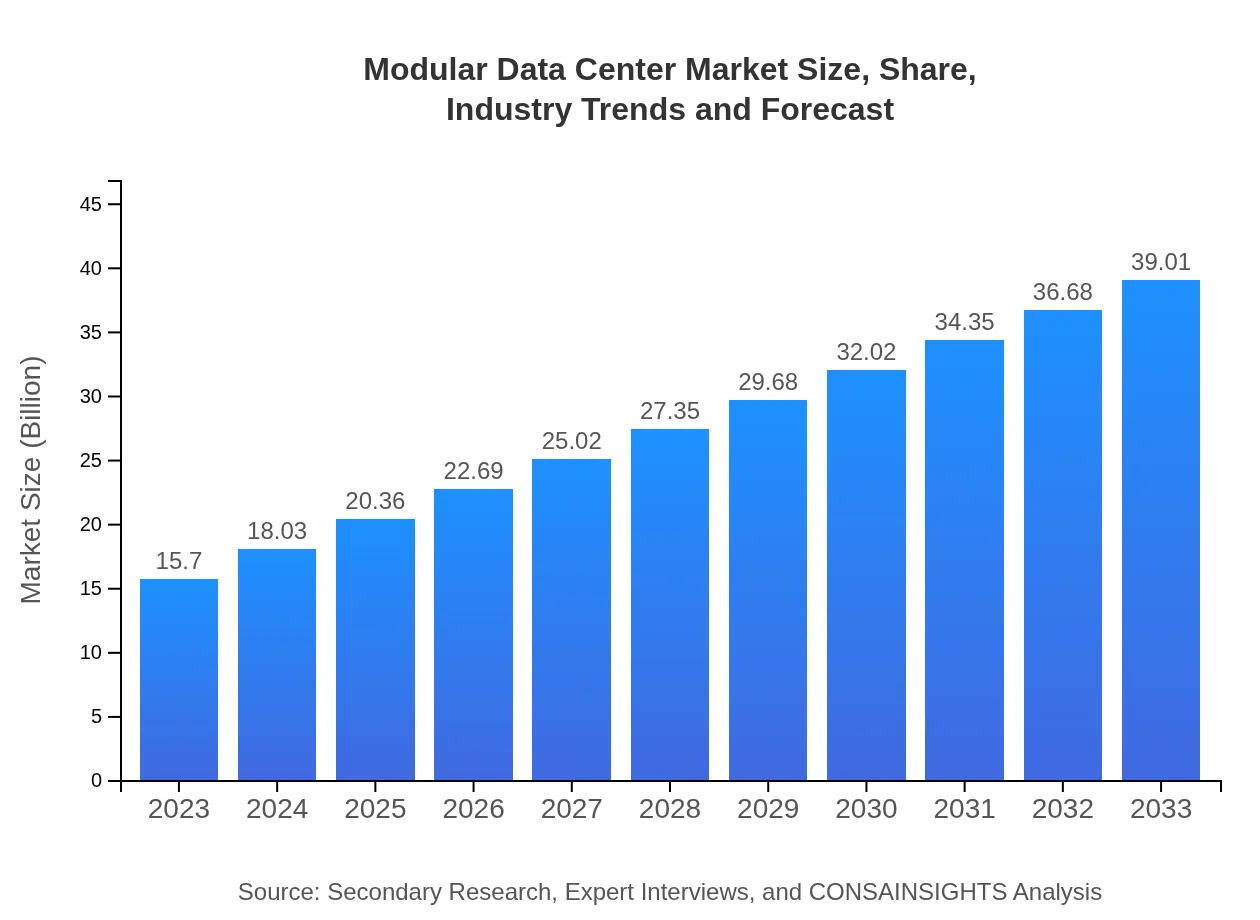

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $39.01 Billion |

| Top Companies | Schneider Electric, Dell Technologies, IBM Corporation, Huawei Technologies, Vertiv Co. |

| Last Modified Date | 31 January 2026 |

Modular Data Center Market Overview

Customize Modular Data Center Market Report market research report

- ✔ Get in-depth analysis of Modular Data Center market size, growth, and forecasts.

- ✔ Understand Modular Data Center's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Modular Data Center

What is the Market Size & CAGR of Modular Data Center market in 2033?

Modular Data Center Industry Analysis

Modular Data Center Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Modular Data Center Market Analysis Report by Region

Europe Modular Data Center Market Report:

Europe's market for Modular Data Centers is anticipated to rise from $4.68 billion in 2023 to $11.64 billion by 2033. The demand is driven by stringent regulations surrounding data privacy and energy efficiency, prompting businesses to adopt more flexible, sustainable data solutions.Asia Pacific Modular Data Center Market Report:

The Asia Pacific Modular Data Center market is expected to grow from $3.15 billion in 2023 to $7.83 billion by 2033, reflecting a strong CAGR driven by rapid technology adoption and urbanization. Countries like China and India are spearheading this growth due to their extensive investments in cloud infrastructure and data management technologies.North America Modular Data Center Market Report:

North America commands a significant portion of the Modular Data Center market, expected to grow from $5.36 billion in 2023 to $13.31 billion by 2033. This robust growth is fueled by high demand from enterprises seeking agile data management solutions and the region's leading technology players investing heavily in infrastructure.South America Modular Data Center Market Report:

In South America, the market is projected to expand from $0.61 billion in 2023 to $1.53 billion by 2033. This reflects steady growth as local firms begin to explore modular solutions for data processing and storage needs, spurred by increasing digitalization and the rise of e-commerce.Middle East & Africa Modular Data Center Market Report:

The Modular Data Center market in the Middle East and Africa is expected to escalate from $1.89 billion in 2023 to $4.70 billion by 2033. This growth reflects advancements in infrastructure and increased government support for digitization initiatives across various sectors.Tell us your focus area and get a customized research report.

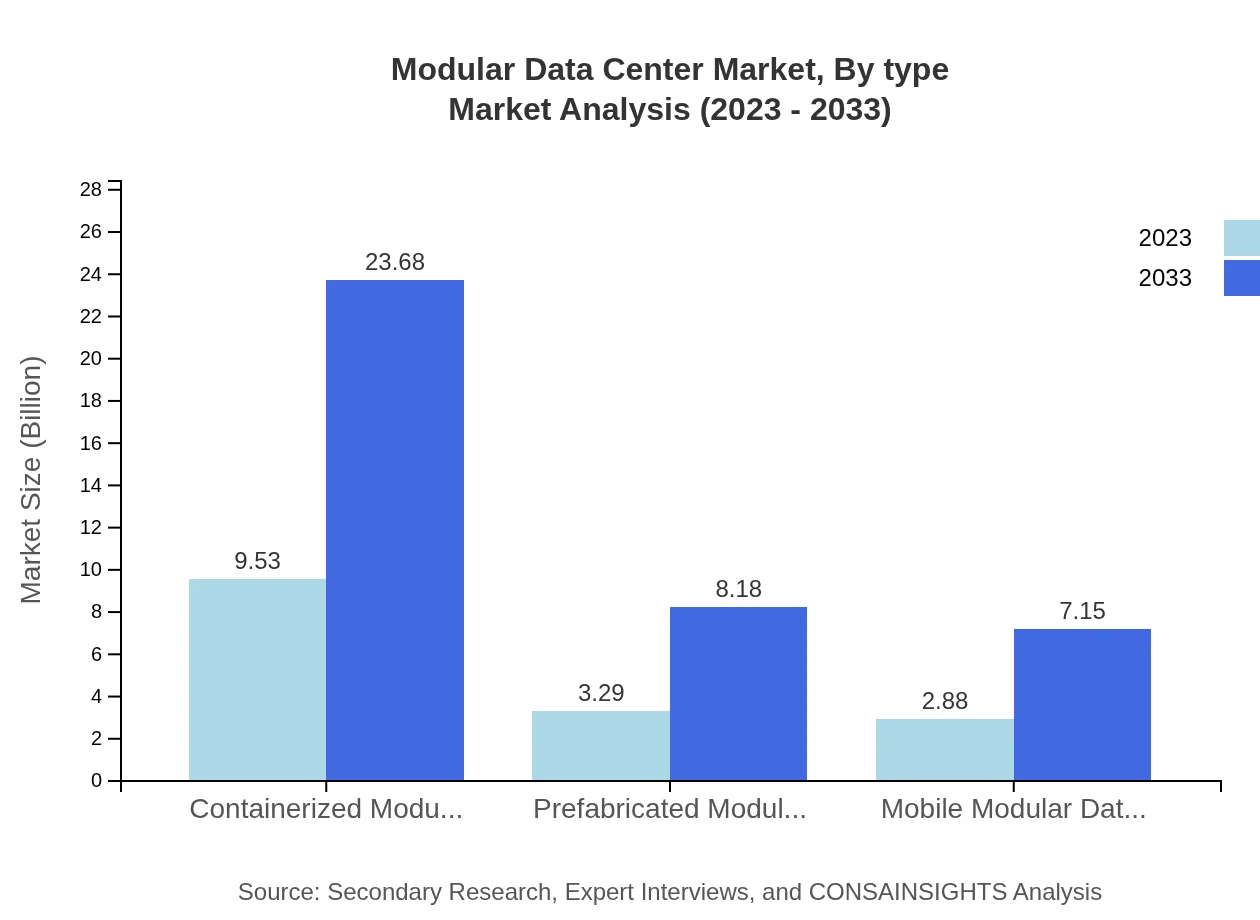

Modular Data Center Market Analysis By Type

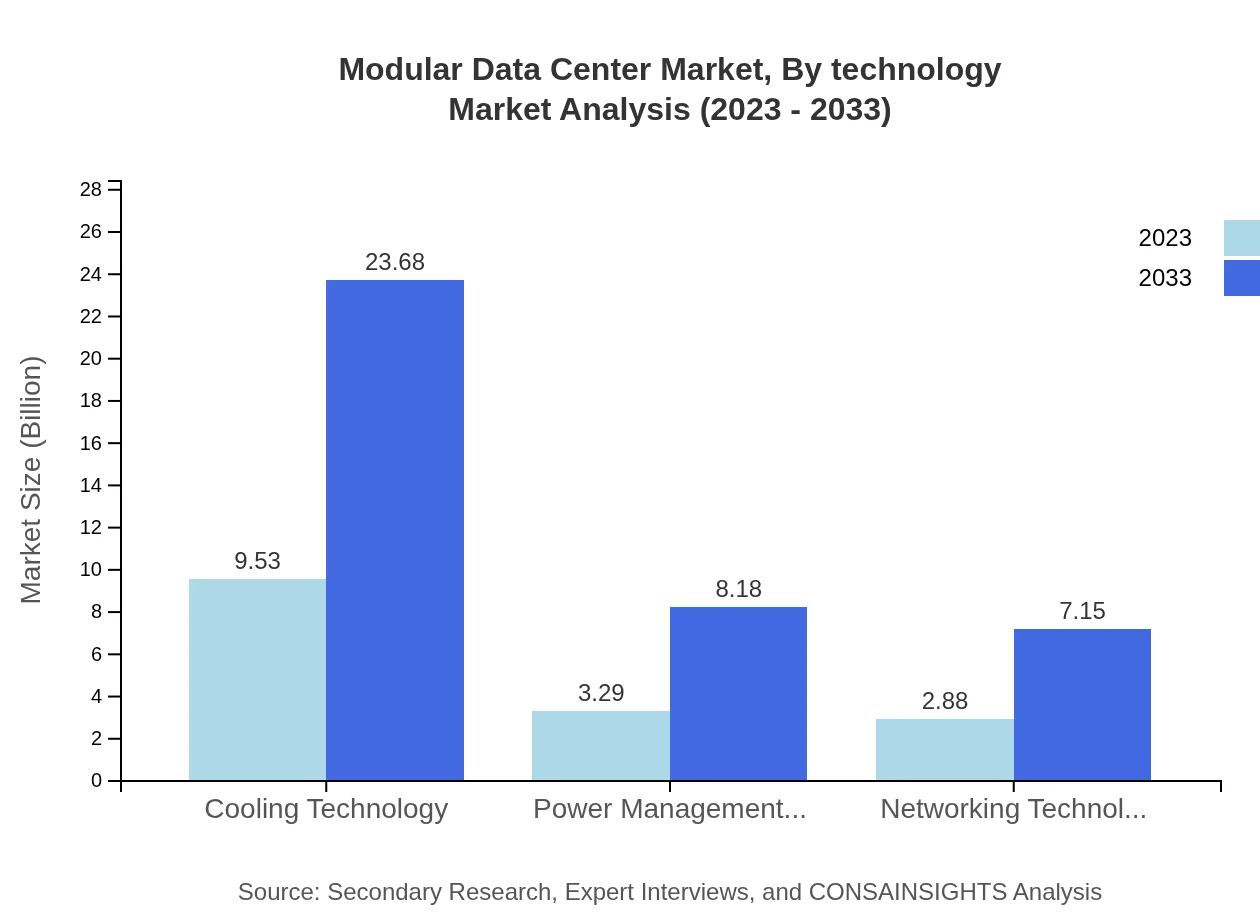

The Modular Data Center market by type is dominated by Containerized Modular Data Centers, with a market size expected to grow from $9.53 billion in 2023 to $23.68 billion by 2033, holding a market share of 60.71%. Prefabricated Modular Data Centers are also gaining traction, with an expected growth from $3.29 billion to $8.18 billion. Mobile modular options are projected to expand from $2.88 billion to $7.15 billion, emphasizing flexibility in operations.

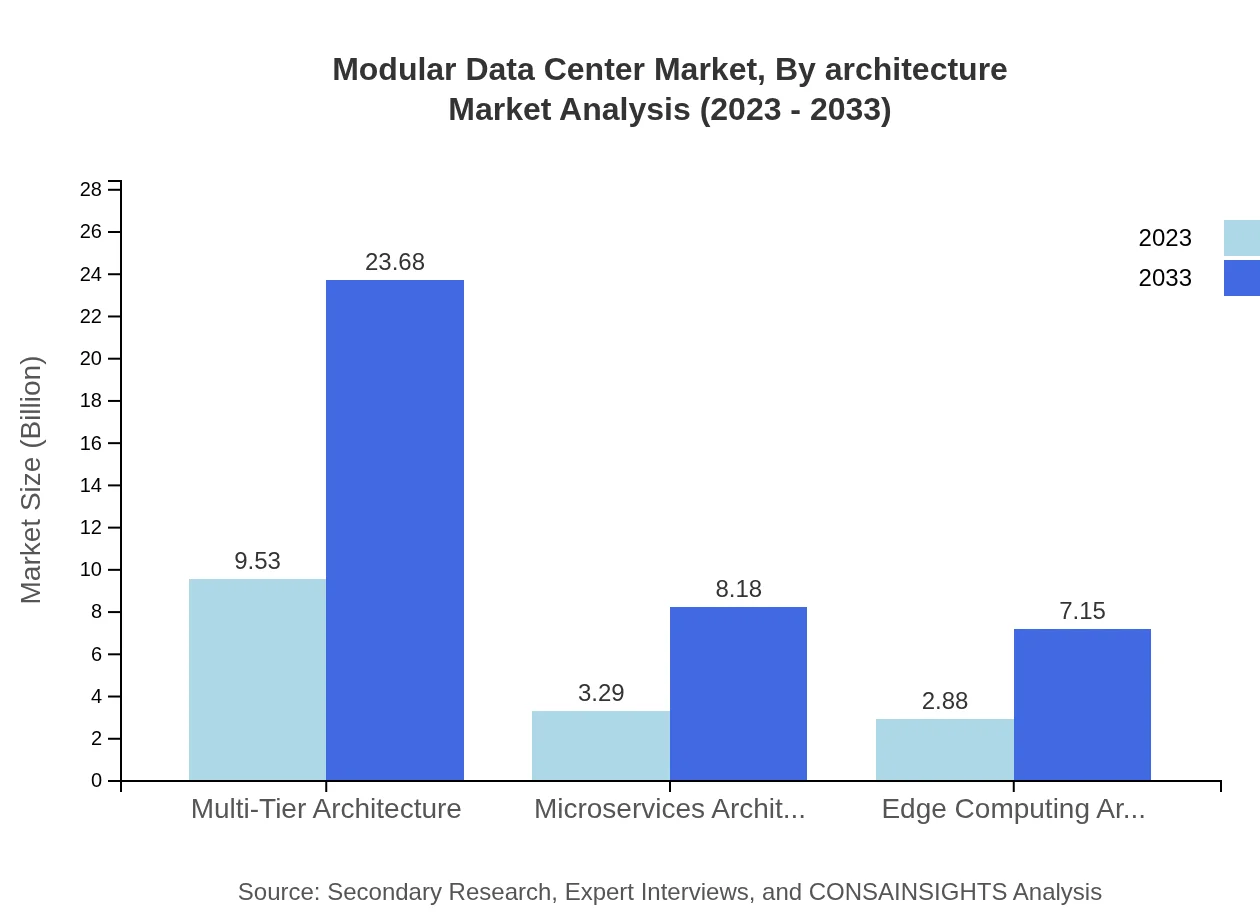

Modular Data Center Market Analysis By Architecture

The market showcases diverse architectures, with Multi-Tier Architecture leading at $9.53 billion in 2023, expected to reach $23.68 billion by 2033. This architecture supports scalability and efficiency. Microservices are also relevant, anticipated to grow from $3.29 billion to $8.18 billion, while Edge Computing Architecture is anticipated to expand from $2.88 billion to $7.15 billion, addressing localized processing needs.

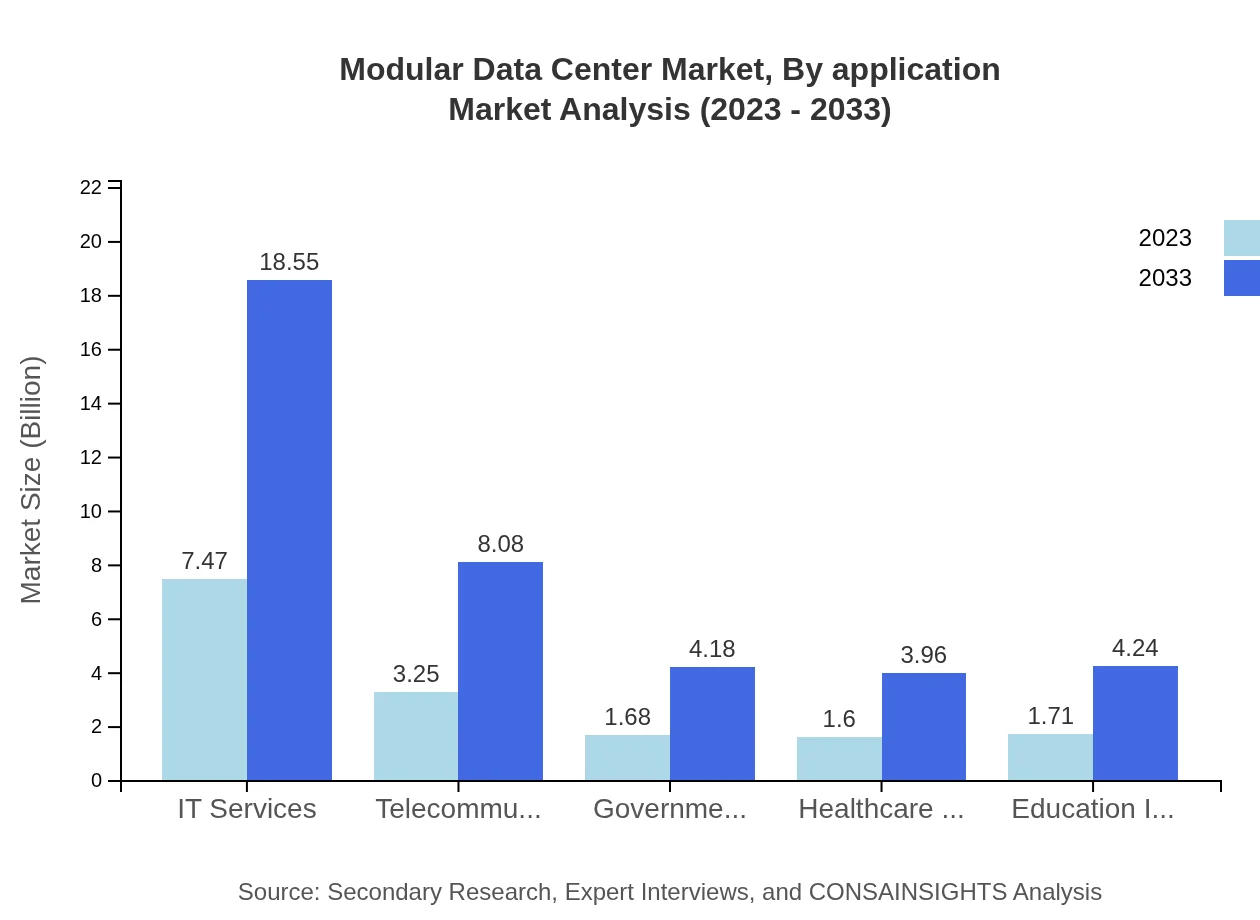

Modular Data Center Market Analysis By Application

IT Services dominate the application segment, with an expected growth from $7.47 billion in 2023 to $18.55 billion by 2033. Telecommunications and healthcare applications show parallel growth trends, emphasizing the need for efficient data handling in critical sectors. Each segment is critical to enhancing operational performance in diverse industries.

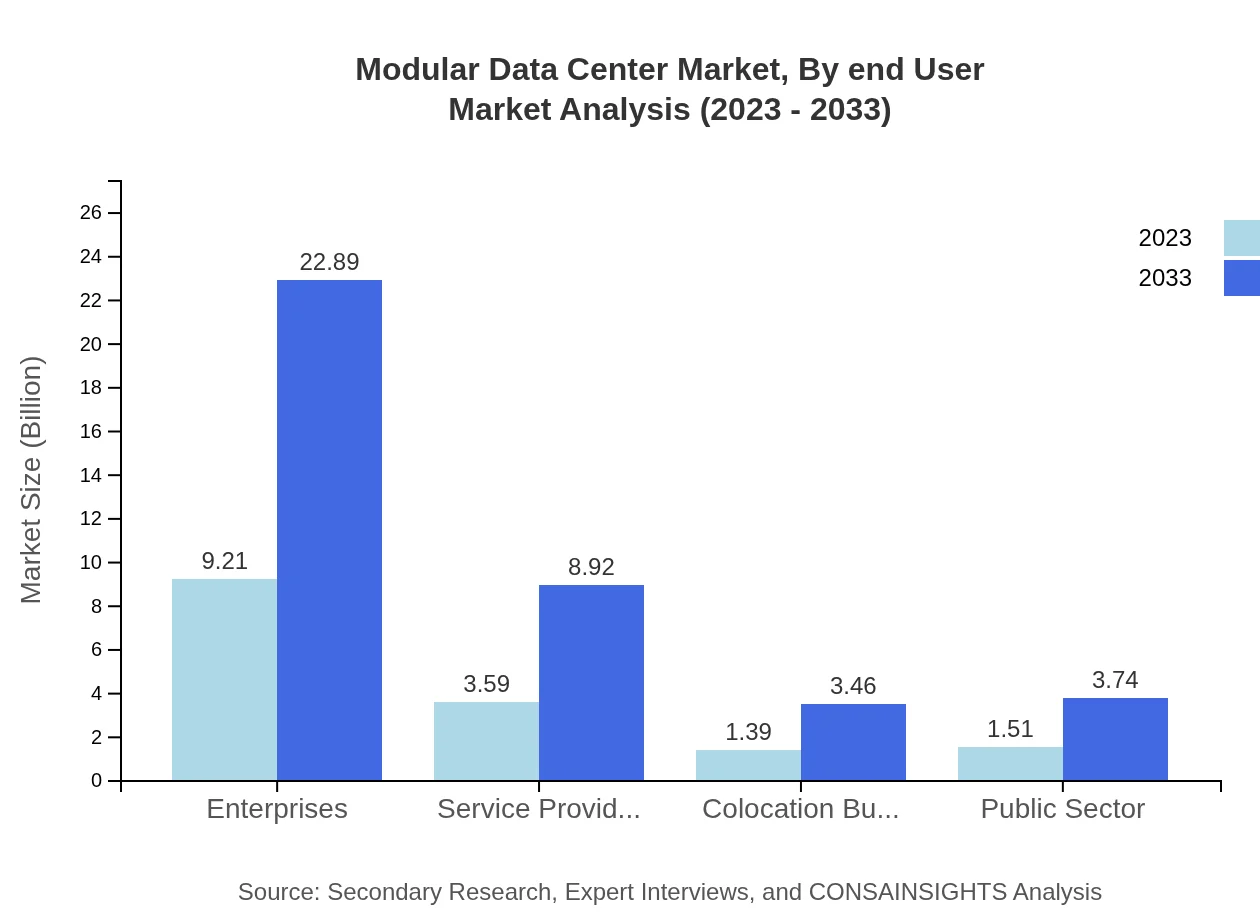

Modular Data Center Market Analysis By End User

In the end-user sector, enterprises account for the largest share with a projected increase from $9.21 billion to $22.89 billion, demonstrating a solid preference for modular solutions. Service providers and public sector institutions are also expanding their market presence as they seek innovative systems to support their infrastructures.

Modular Data Center Market Analysis By Technology

The market is characterized by various technologies, particularly in cooling and power management. Cooling technologies will grow from $9.53 billion to $23.68 billion and power management solutions from $3.29 billion to $8.18 billion, reflecting the growing emphasis on energy efficiency and sustainability. Networking technologies align with trends toward integrated communication providing a vital component for modular data centers.

Modular Data Center Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Modular Data Center Industry

Schneider Electric:

A leader in energy management and automation solutions, Schneider Electric is at the forefront of modular data center technologies, fostering sustainability and efficiency.Dell Technologies:

Known for its robust IT solutions, Dell provides a range of modular data center options that cater to various business needs, ensuring high performance and scalability.IBM Corporation:

IBM offers comprehensive modular data center solutions focusing on AI integration and cloud services, driving innovation in data management.Huawei Technologies:

Huawei is a key player in building advanced modular data centers that leverage telecommunications technology for superior connectivity and management.Vertiv Co.:

Vertiv specializes in critical digital infrastructure and continuity solutions, providing modular offerings that enhance operational reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of modular data center?

The global modular data center market size is projected to reach approximately $15.7 billion by 2033, growing at a CAGR of 9.2%. This growth reflects the increasing demand for efficient data center solutions.

What are the key market players or companies in this modular data center industry?

Key players in the modular data center market include companies like Schneider Electric, IBM, Dell Technologies, Huawei, and Vertiv. These companies lead the market with innovative solutions and extensive operational capabilities.

What are the primary factors driving the growth in the modular data centers industry?

Driving factors include the rising demand for scalable solutions, increased efficiency, and the growing need for data storage. Additionally, advances in technology and the need for sustainable energy solutions are significant growth catalysts.

Which region is the fastest Growing in the modular data center?

The fastest-growing region for modular data centers is Europe, projected to expand from $4.68 billion in 2023 to $11.64 billion by 2033. North America follows closely, with substantial growth anticipated in both regions.

Does ConsaInsights provide customized market report data for the modular data center industry?

Yes, ConsaInsights provides tailored market report data for modular data center industries. Clients can request specific market insights based on unique needs, ensuring relevant and actionable information.

What deliverables can I expect from this modular data centers market research project?

Deliverables typically include comprehensive reports, market analyses, forecasts, and strategic recommendations. Clients receive detailed segmented data, regional insights, and trend analyses tailored to their objectives.

What are the market trends of modular data center?

Current trends in the modular data center market include a shift towards containerized solutions, increasing adoption of prefabricated units, and a focus on energy efficiency and sustainability across various sectors.