Molded Interconnect Device Market Report

Published Date: 31 January 2026 | Report Code: molded-interconnect-device

Molded Interconnect Device Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Molded Interconnect Device market, covering key insights, forecasts, and data trends from 2023 to 2033. It explores market dynamics, regional segments, and future growth trajectories.

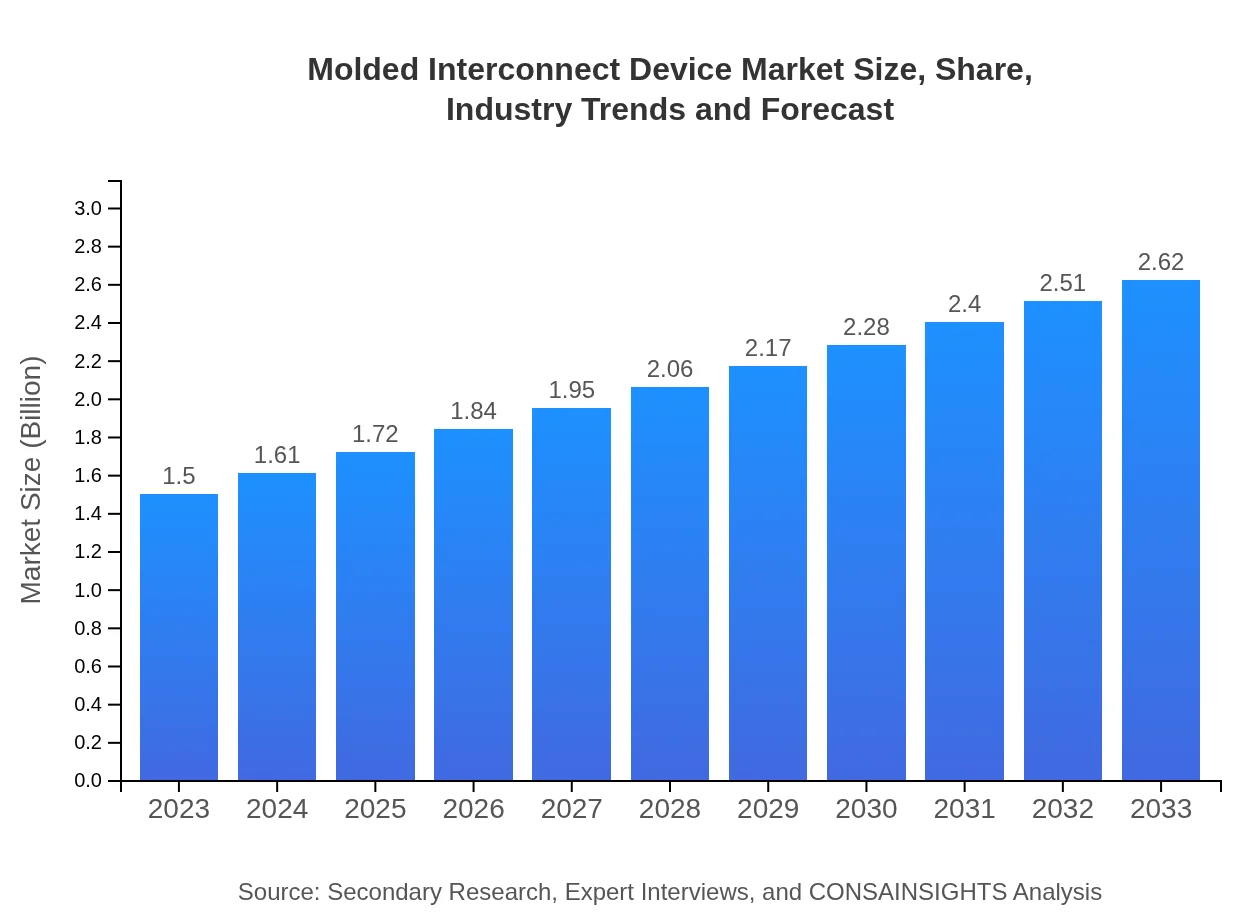

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $2.62 Billion |

| Top Companies | Rohm Semiconductor, Hirschmann Automation and Control, Flex Ltd. |

| Last Modified Date | 31 January 2026 |

Molded Interconnect Device Market Overview

Customize Molded Interconnect Device Market Report market research report

- ✔ Get in-depth analysis of Molded Interconnect Device market size, growth, and forecasts.

- ✔ Understand Molded Interconnect Device's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Molded Interconnect Device

What is the Market Size & CAGR of Molded Interconnect Device market in 2023?

Molded Interconnect Device Industry Analysis

Molded Interconnect Device Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Molded Interconnect Device Market Analysis Report by Region

Europe Molded Interconnect Device Market Report:

Europe's molded interconnect device market is anticipated to grow from USD 0.46 billion in 2023 to USD 0.80 billion by 2033. The growth is supported by stringent regulations on electronic waste leading to increased manufacturing efficiency. The automotive sector, driven by the EV revolution, significantly influences the MID market.Asia Pacific Molded Interconnect Device Market Report:

In Asia Pacific, the molded interconnect device market is projected to grow from USD 0.25 billion in 2023 to USD 0.44 billion by 2033. The region's growth is driven by burgeoning electronics manufacturing industries, especially in China, Japan, and South Korea. Technological advancements and increasing investments in smart manufacturing are significantly contributing to market expansion.North America Molded Interconnect Device Market Report:

The North American molded interconnect device market is forecasted to expand from USD 0.58 billion in 2023 to USD 1.01 billion by 2033. The increasing adoption of electric vehicles and the push for advanced manufacturing techniques are major contributors. The region is also a key player in developing innovative health and medical devices using MIDs.South America Molded Interconnect Device Market Report:

The South American market for molded interconnect devices is anticipated to grow modestly from USD 0.03 billion in 2023 to USD 0.06 billion by 2033. Although the market remains underdeveloped, rising demand for automation in agricultural and consumer electronics sectors could pave the way for future growth.Middle East & Africa Molded Interconnect Device Market Report:

In the Middle East and Africa, the molded interconnect device market is projected to grow from USD 0.18 billion in 2023 to USD 0.31 billion by 2033. The region's growth potential lies in diversification efforts towards advanced manufacturing and electronics production, leveraging its oil wealth to invest in technology-driven sectors.Tell us your focus area and get a customized research report.

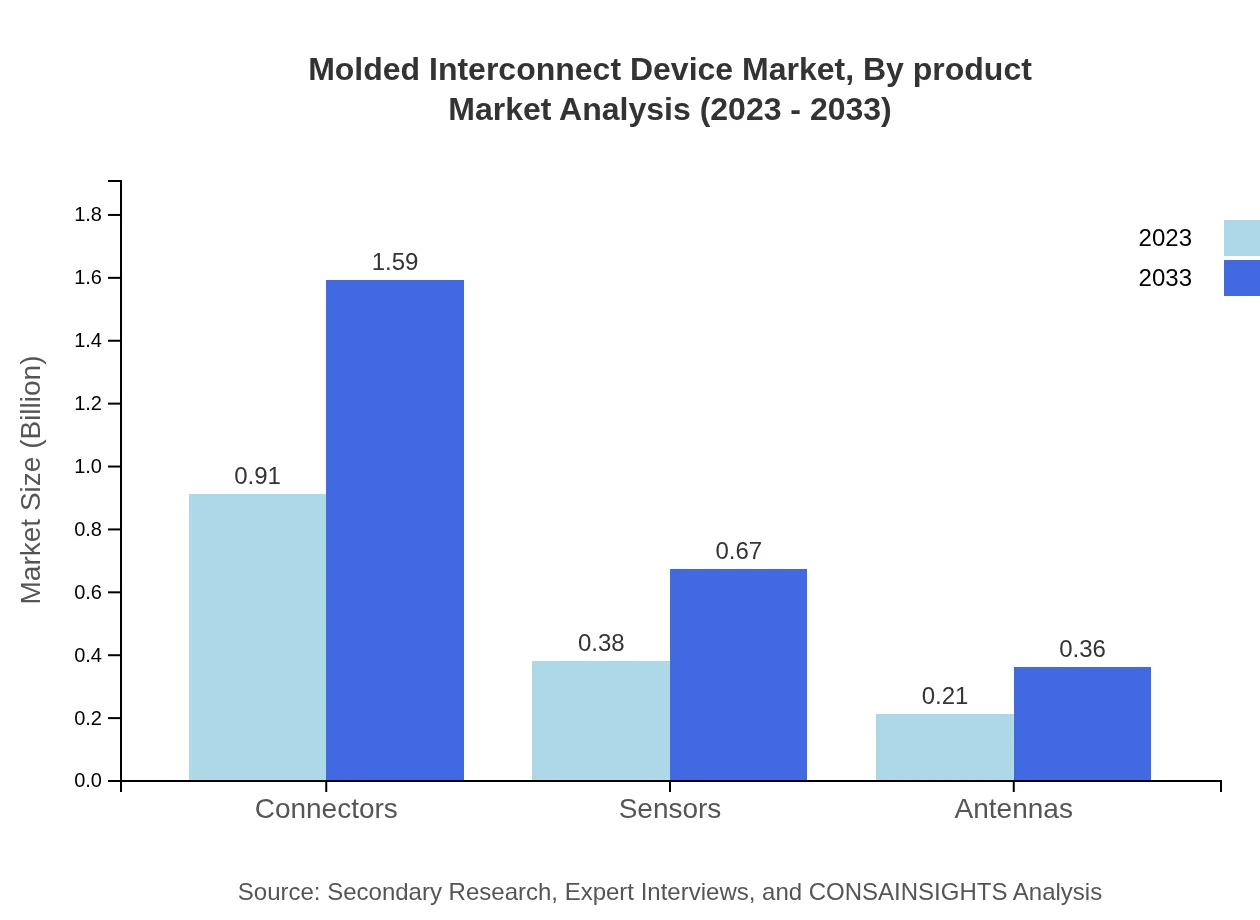

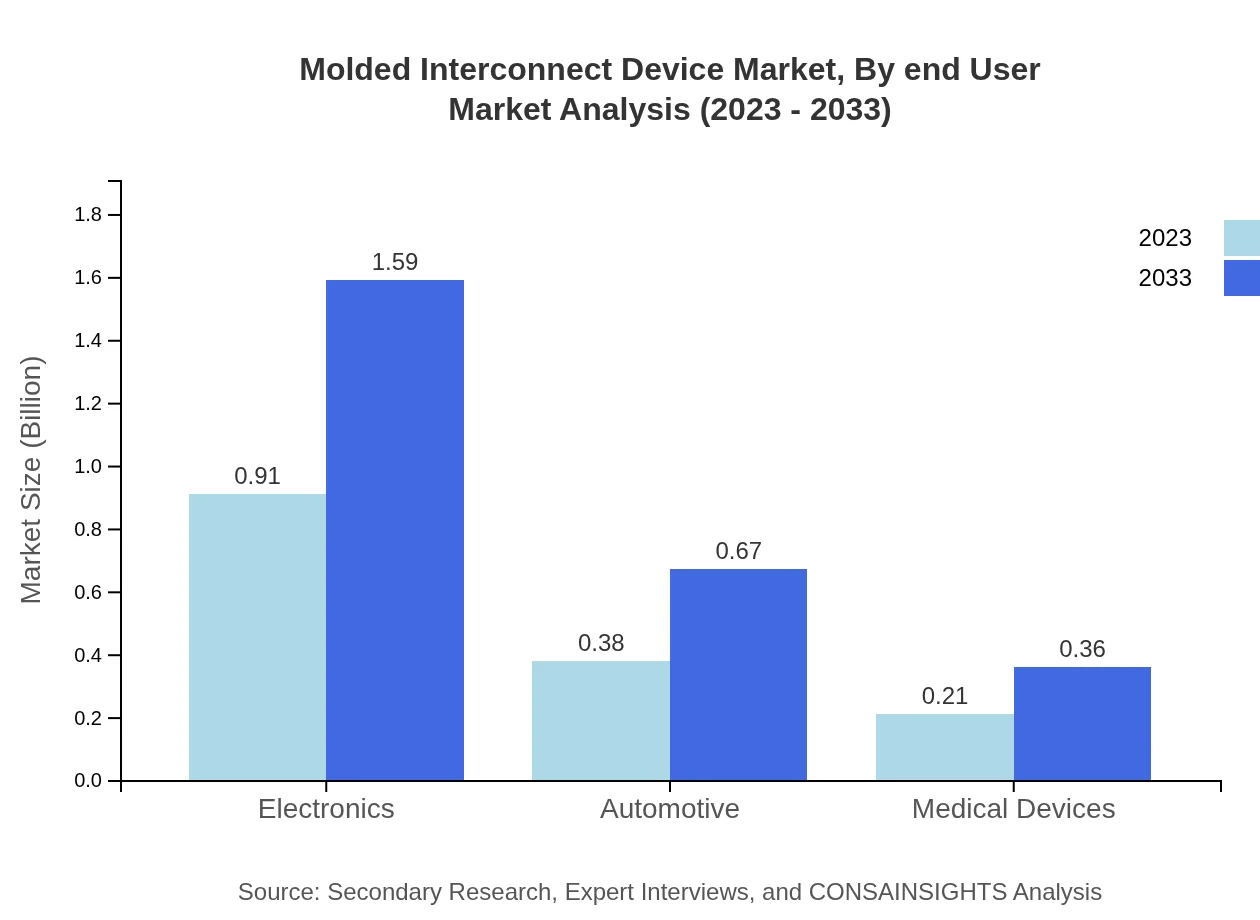

Molded Interconnect Device Market Analysis By Product

The MIDs market is primarily driven by product types such as connectors, sensors, and antennas. Connectors dominate the market with a size of USD 0.91 billion in 2023, growing to USD 1.59 billion by 2033, commanding a share of 60.66% throughout the period. Sensors follow with anticipated growth from USD 0.38 billion in 2023 to USD 0.67 billion by 2033, holding a steady market share of 25.41%. Antennas also show growth from USD 0.21 billion to USD 0.36 billion, with a 13.93% market share.

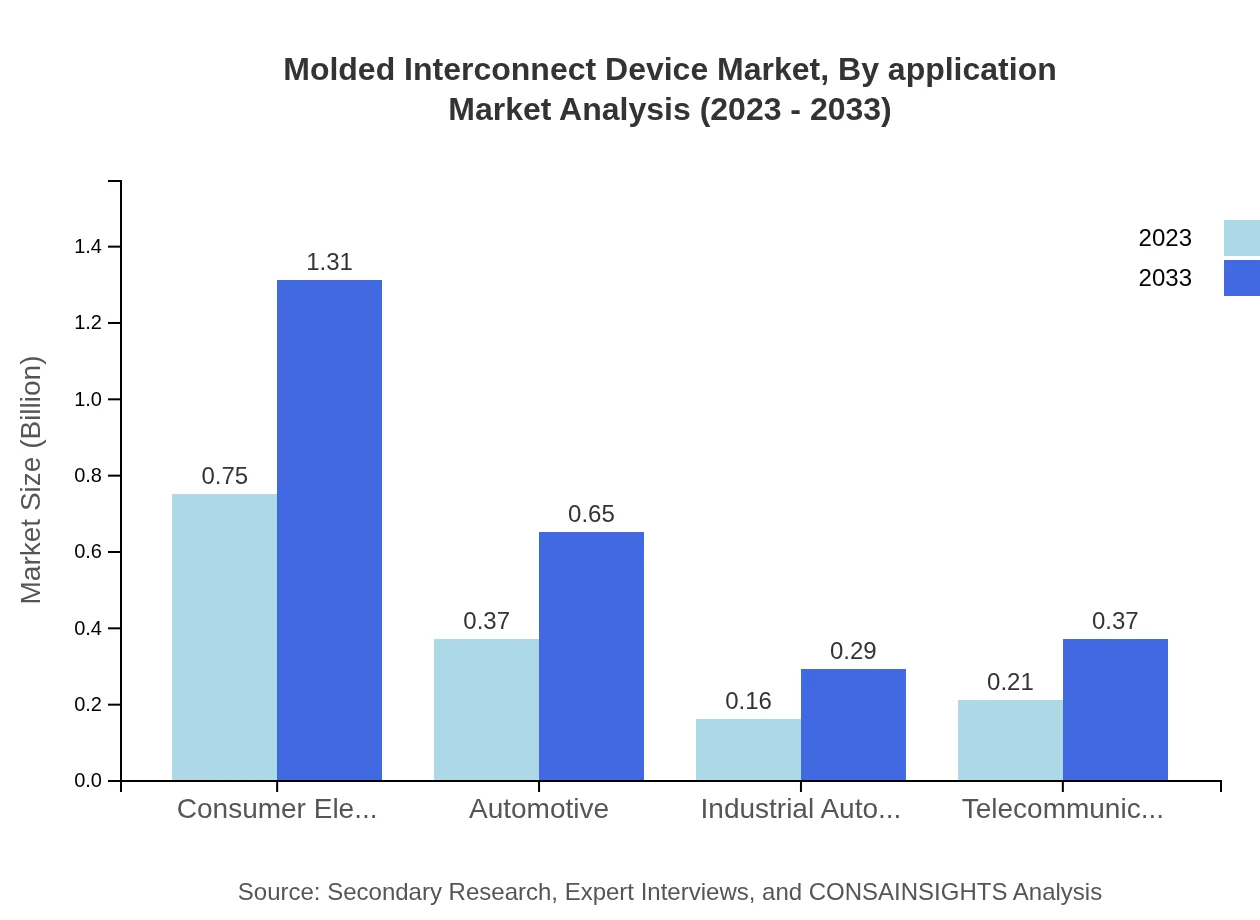

Molded Interconnect Device Market Analysis By Application

Applications for molded interconnect devices span multiple sectors including consumer electronics, automotive, medical devices, and industrial automation. Consumer electronics holds the significant market size of USD 0.75 billion in 2023, expanding to USD 1.31 billion by 2033, with a 50.12% market share. Automotive applications are expected to grow from USD 0.37 billion to USD 0.65 billion, holding a 24.99% share. Medical devices and industrial applications represent smaller yet growing segments, indicating diverse use cases for MIDs.

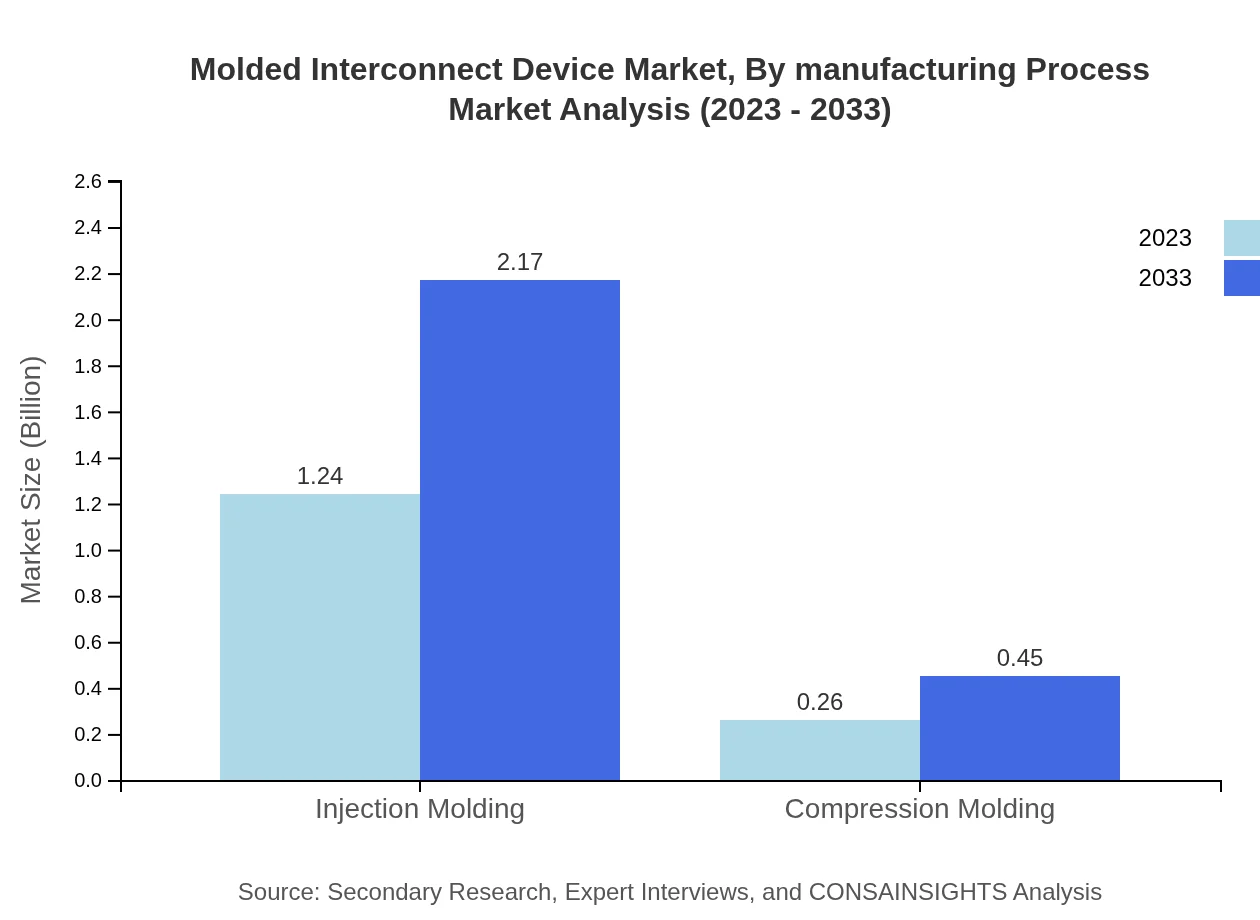

Molded Interconnect Device Market Analysis By Manufacturing Process

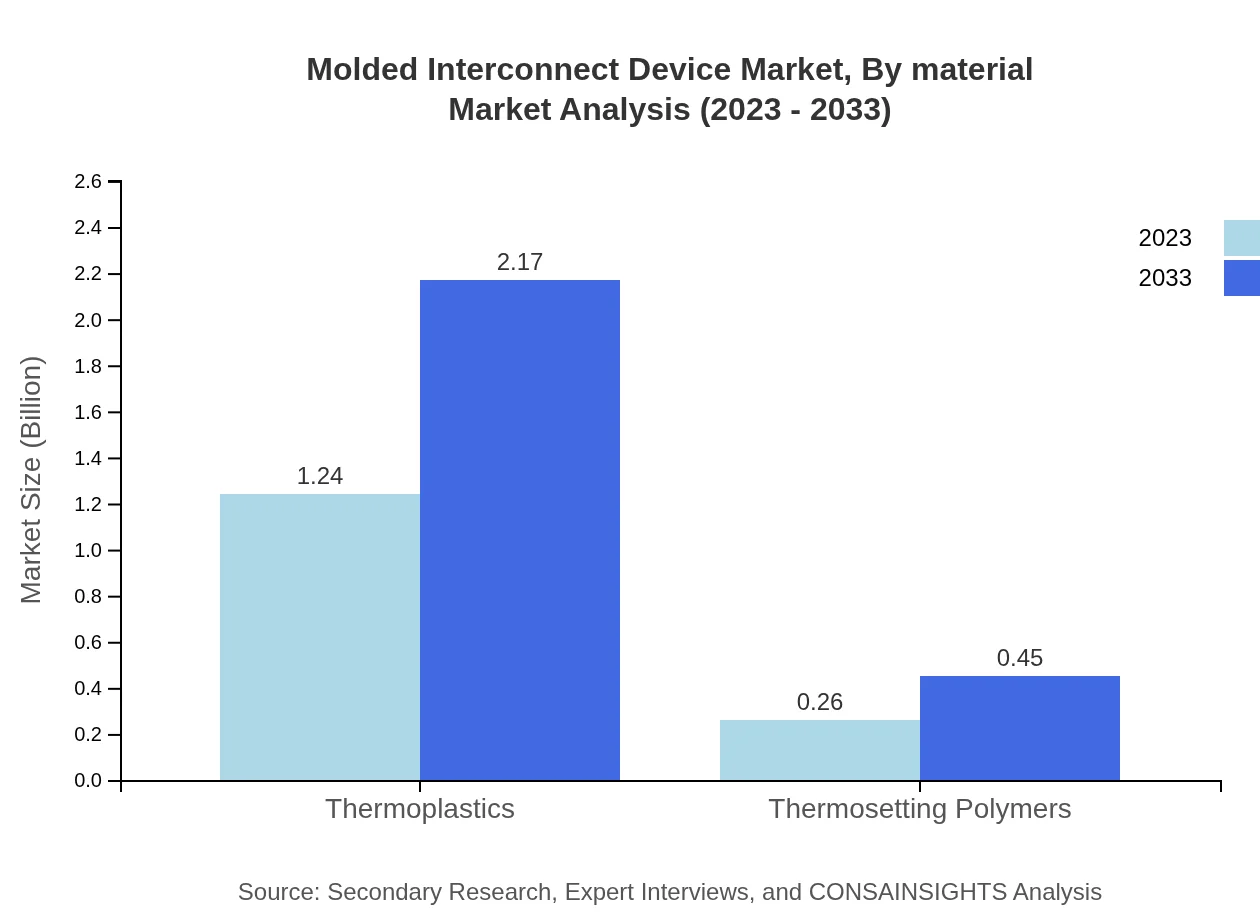

The manufacturing processes dominating the MDF sector include injection molding and compression molding. Injection molding accounts for the majority market size at USD 1.24 billion growing to USD 2.17 billion by 2033, with an 82.69% market share, primarily due to its scalability and efficiency in high-volume production. Compression molding, while smaller, shows growth from USD 0.26 billion to USD 0.45 billion, comprising 17.31% of market share.

Molded Interconnect Device Market Analysis By End User

End-user industries utilizing molded interconnect devices prominently include automotive, consumer electronics, medical devices, and telecommunications. The automotive segment is forecasted to grow significantly as new technologies require more compact interconnect solutions. Similarly, the telecommunications sector is growing as demand increases for more integrated network infrastructure involving MIDs.

Molded Interconnect Device Market Analysis By Material

Material types include thermoplastics and thermosetting polymers, with thermoplastics leading the market due to their flexibility and widespread use in various applications. Thermoplastics' market size is projected to rise from USD 1.24 billion in 2023 to USD 2.17 billion by 2033, commanding an 82.69% share. Thermosetting polymers are expected to increase from USD 0.26 billion to USD 0.45 billion, making up 17.31% of market share, particularly for applications requiring high heat resistance.

Molded Interconnect Device Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Molded Interconnect Device Industry

Rohm Semiconductor:

A leading global semiconductor manufacturer, Rohm specializes in developing cutting-edge integrated circuits and system-on-chip solutions using molded interconnect technology to enhance performance in consumer electronics.Hirschmann Automation and Control:

Notable for its expertise in automation and control systems, Hirschmann contributes significantly to the automotive and industrial sectors through innovative molded interconnect device solutions enhancing system integration.Flex Ltd.:

Flex provides electronic manufacturing solutions and is committed to incorporating molded interconnect devices into its portfolio, offering value-added services across electronics supply chains.We're grateful to work with incredible clients.

FAQs

What is the market size of molded Interconnect Device?

The molded interconnect device market is projected to reach $1.5 billion by 2033, growing at a CAGR of 5.6%. In 2023, the market size is estimated at $1.24 billion, driven by technological advancements and increased application in electronics.

What are the key market players or companies in this molded Interconnect Device industry?

Key players in the molded interconnect device industry include leading technology manufacturers, component suppliers, and innovators focusing on advanced materials and integration strategies. They strive to provide high-quality, reliable molded interconnect solutions.

What are the primary factors driving the growth in the molded Interconnect Device industry?

Growth in the molded interconnect device industry is driven by the rise in consumer electronics demand, advancements in automation, and the need for miniaturization in electronic components, which enhances performance and reduces costs.

Which region is the fastest Growing in the molded Interconnect Device?

Asia Pacific is the fastest-growing region in the molded interconnect device market, anticipated to increase from $0.25 billion in 2023 to $0.44 billion by 2033. Europe and North America also show substantial growth potential in this sector.

Does ConsaInsights provide customized market report data for the molded Interconnect Device industry?

Yes, ConsaInsights offers tailored market report data for the molded interconnect device industry, enabling clients to access specific insights that align with their strategic objectives and business needs.

What deliverables can I expect from this molded Interconnect Device market research project?

Deliverables from the molded interconnect device market research project include comprehensive market analysis, competitive landscape assessments, segment insights, and forecasts that aid in strategic decision-making.

What are the market trends of molded Interconnect Device?

Current trends in the molded interconnect device market include increased adoption in consumer electronics, advancements in smart technology integration, growth in automotive applications, and innovations in material sciences.