Molecular Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: molecular-diagnostics

Molecular Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Molecular Diagnostics market from 2023 to 2033, offering insights into market trends, segmentation, regional performance, and the competitive landscape, along with future forecasts.

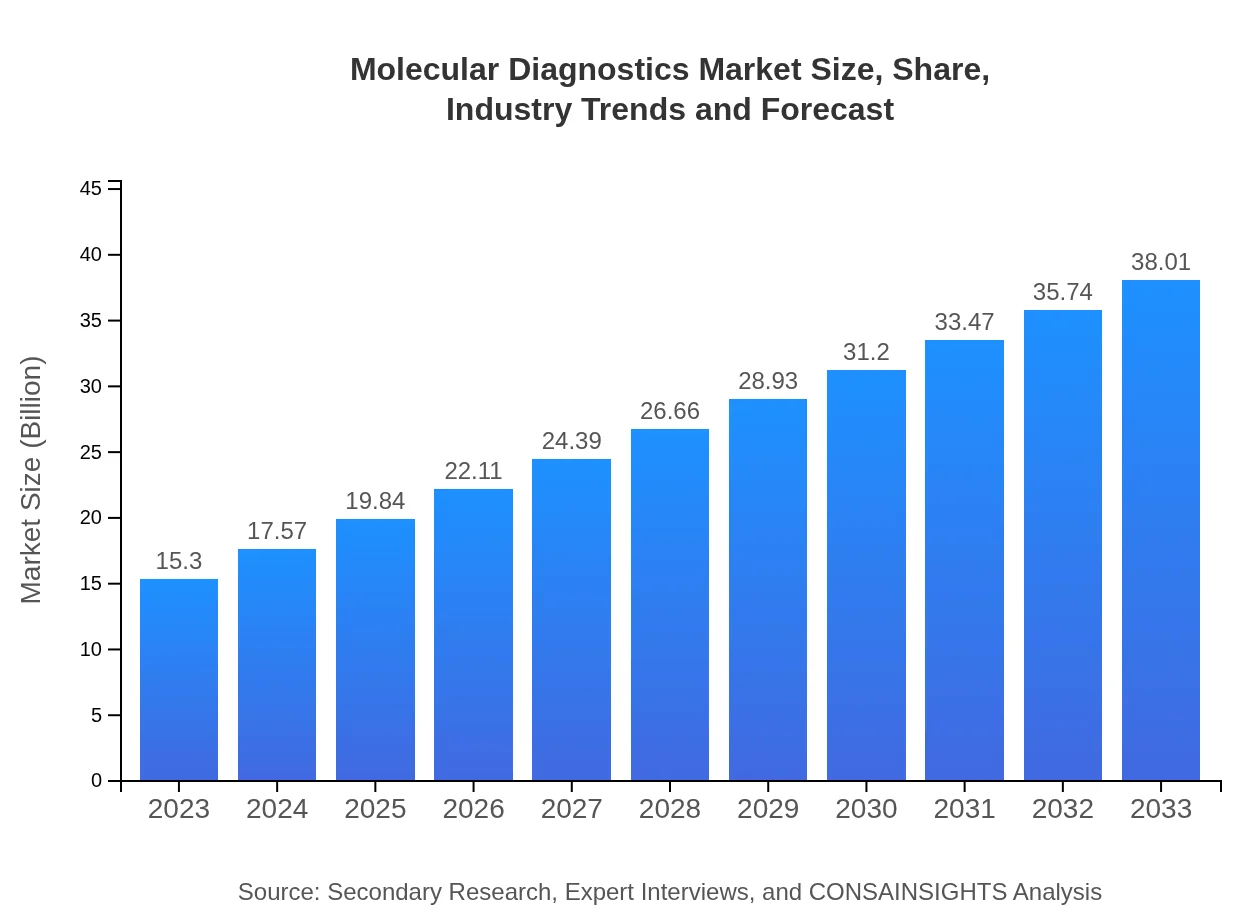

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $38.01 Billion |

| Top Companies | Thermo Fisher Scientific, Roche Diagnostics, Abbott Laboratories, Illumina, Qiagen |

| Last Modified Date | 31 January 2026 |

Molecular Diagnostics Market Overview

Customize Molecular Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Molecular Diagnostics market size, growth, and forecasts.

- ✔ Understand Molecular Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Molecular Diagnostics

What is the Market Size & CAGR of Molecular Diagnostics market in 2023?

Molecular Diagnostics Industry Analysis

Molecular Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Molecular Diagnostics Market Analysis Report by Region

Europe Molecular Diagnostics Market Report:

In Europe, the market is expected to grow from $4.35 billion in 2023 to $10.80 billion by 2033. The increasing prevalence of diseases, coupled with a growing emphasis on research and development in molecular diagnostics, is fueling this market's growth.Asia Pacific Molecular Diagnostics Market Report:

The Asia Pacific region is witnessing substantial growth with a market size projected to reach $6.77 billion by 2033, up from $2.72 billion in 2023. Factors such as increasing healthcare expenditure, rising prevalence of chronic diseases, and rapid technological advancements in molecular diagnostics are driving this growth.North America Molecular Diagnostics Market Report:

North America leads the market with a projected increase from $5.94 billion in 2023 to $14.76 billion by 2033. The region benefits from high healthcare spending, a strong presence of leading diagnostic companies, and significant advancements in molecular testing technologies.South America Molecular Diagnostics Market Report:

The South American region is expected to grow from $0.43 billion in 2023 to $1.06 billion by 2033. The gradual adoption of advanced diagnostic technologies and a rising focus on improving healthcare infrastructure are key contributors to this market expansion.Middle East & Africa Molecular Diagnostics Market Report:

The Middle East and Africa region shows growth potential, with the market size forecasted to rise from $1.87 billion in 2023 to $4.63 billion by 2033. Enhanced healthcare facilities and rising investments in healthcare technologies play a crucial role in this region's market development.Tell us your focus area and get a customized research report.

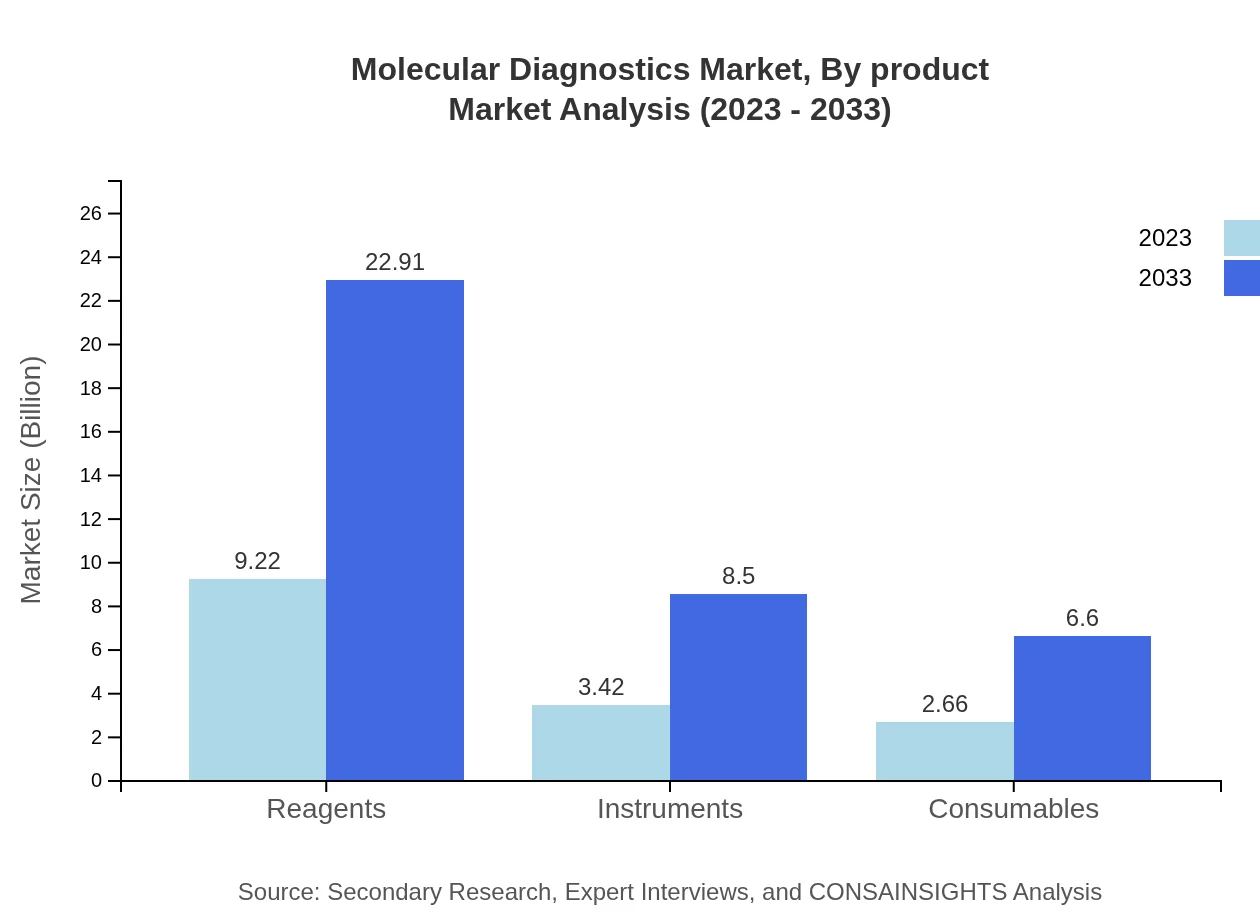

Molecular Diagnostics Market Analysis By Product

Reagents dominate the Molecular Diagnostics market, growing from $9.22 billion in 2023 to $22.91 billion by 2033, accounting for 60.28% of market share. Instruments and consumables also play vital roles, with instruments growing from $3.42 billion to $8.50 billion and consumables from $2.66 billion to $6.60 billion, representing shares of 22.35% and 17.37% respectively.

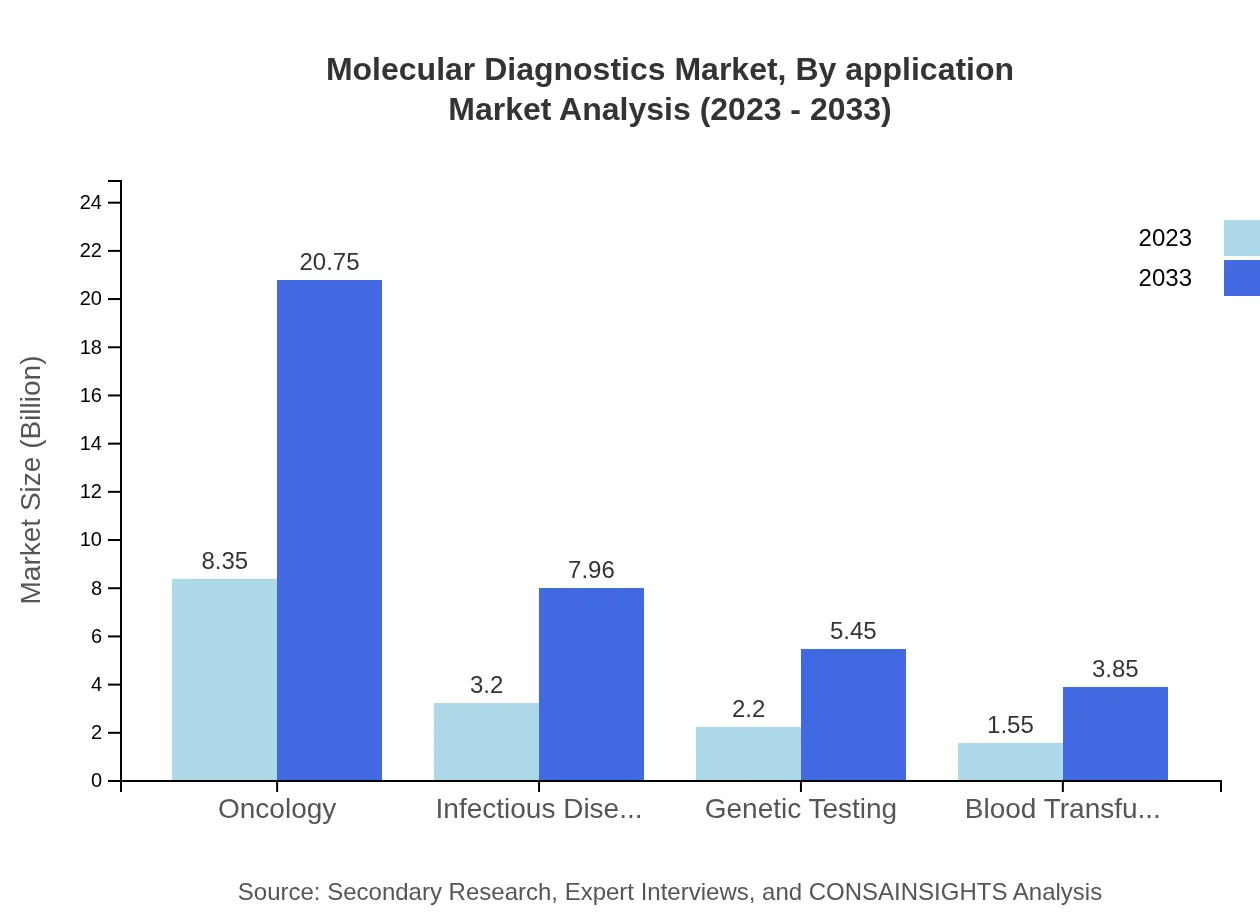

Molecular Diagnostics Market Analysis By Application

Oncology remains the leading application area, expected to grow from $8.35 billion in 2023 to $20.75 billion by 2033, holding a 54.58% share. Infectious diseases and genetic testing follow, with sizes of $3.20 billion to $7.96 billion and $2.20 billion to $5.45 billion, reflecting shares of 20.94% and 14.35%.

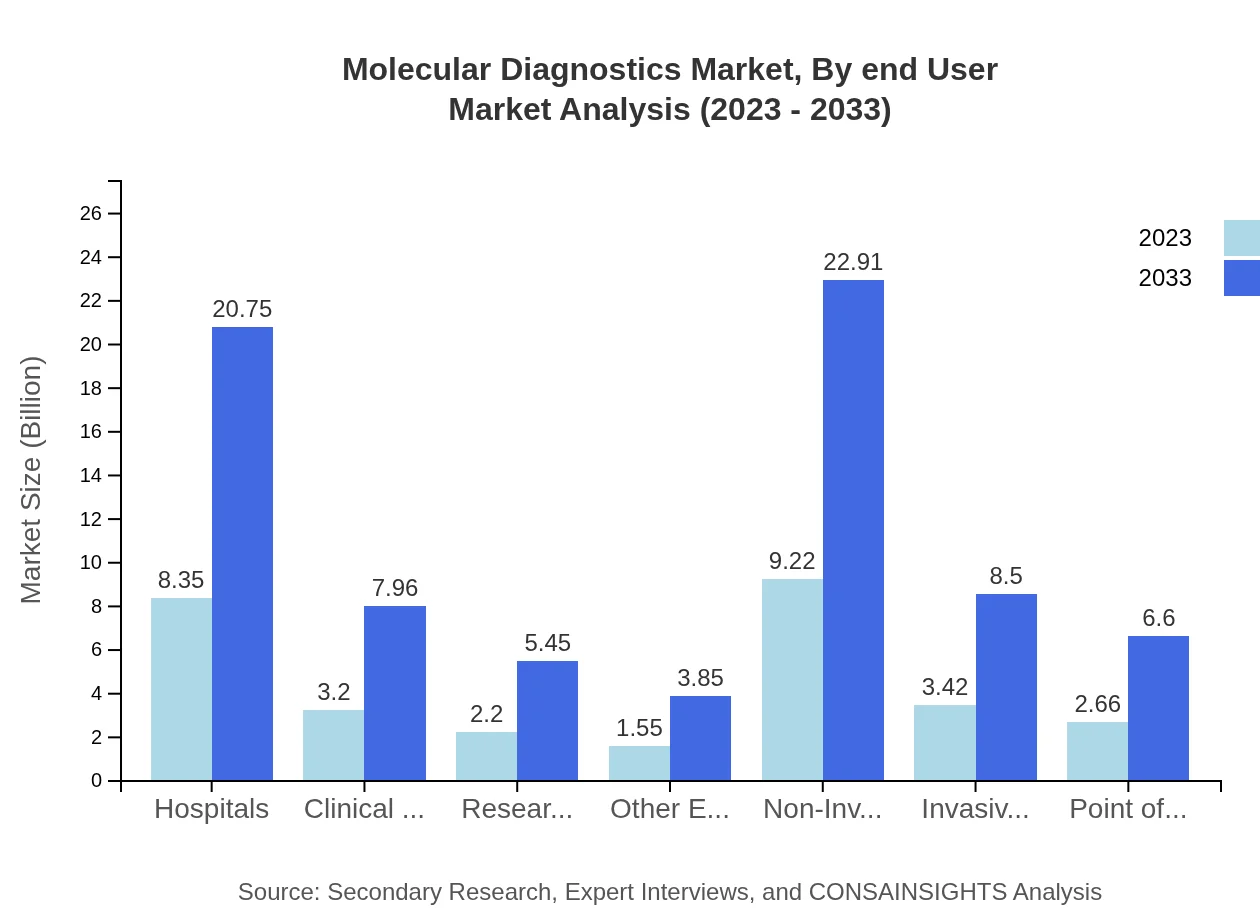

Molecular Diagnostics Market Analysis By End User

Hospitals are the primary end-users of molecular diagnostics, growing from $8.35 billion in 2023 to $20.75 billion by 2033 and maintaining a 54.58% market share. Clinical laboratories and research institutes are also significant, with their share remaining at 20.94% and 14.35% respectively.

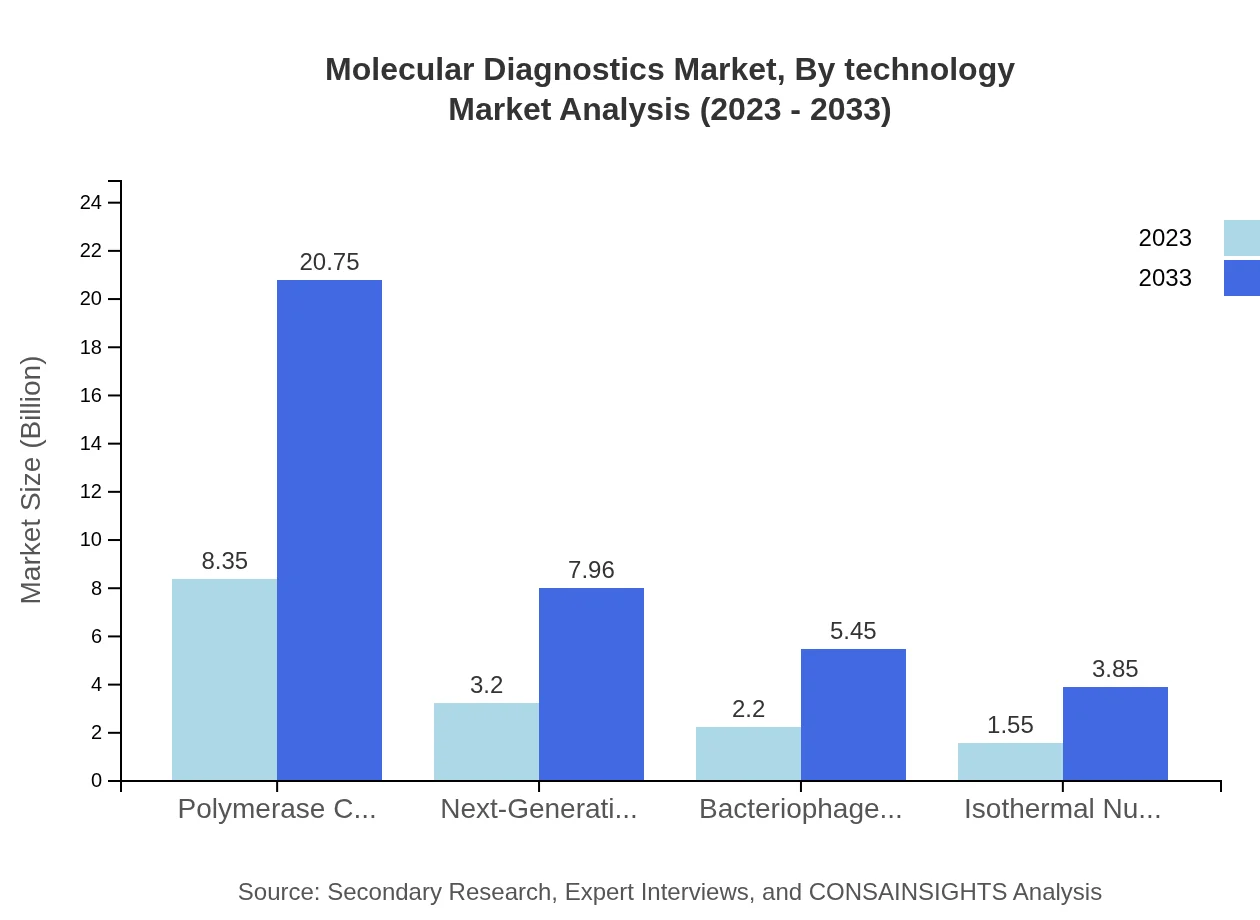

Molecular Diagnostics Market Analysis By Technology

Technologies such as Polymerase Chain Reaction (PCR) dominate the market, expanding from $8.35 billion to $20.75 billion in the forecast period, contributing a sustained 54.58% share. Next-Generation Sequencing (NGS) and Bacteriophage feedback technologies will also see growth, from $3.20 billion to $7.96 billion and from $2.20 billion to $5.45 billion respectively.

Molecular Diagnostics Market Analysis By Test Type

Global Molecular Diagnostics Market, By Test Type Market Analysis (2023 - 2033)

Non-invasive testing techniques, such as liquid biopsies, will grow significantly from $9.22 billion in 2023 to $22.91 billion by 2033, maintaining a leading 60.28% share. Invasive testing and point-of-care testing will also increase, reflecting expanding utility in clinical settings.

Molecular Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Molecular Diagnostics Industry

Thermo Fisher Scientific:

Renowned for its advanced molecular diagnostic instruments and reagents, Thermo Fisher Scientific is a major player with innovative solutions in various applications, including genomics and infectious diseases.Roche Diagnostics:

Roche is a leader in the molecular diagnostics market, offering a range of diagnostic tests and platforms that enhance accuracy in disease detection, especially in oncology.Abbott Laboratories:

Abbott is recognized for its cutting-edge molecular diagnostics solutions and plays a significant role in advancing point-of-care testing diagnostics.Illumina:

A pioneer in next-generation sequencing technologies, Illumina leads the field in genomic analysis for both research and clinical applications.Qiagen :

Qiagen specializes in molecular testing technologies and provides significant contributions to sample and assay technologies, with a focus on genomics and infectious disease diagnostics.We're grateful to work with incredible clients.

FAQs

What is the market size of molecular Diagnostics?

The molecular diagnostics market is valued at approximately $15.3 billion in 2023, with an estimated CAGR of 9.2% projected through 2033. This growth trajectory indicates increasing demand across various sectors, driven by technological advancements and the rising prevalence of diseases.

What are the key market players or companies in this molecular Diagnostics industry?

Key players in the molecular diagnostics industry include Thermo Fisher Scientific, Roche, Abbott Laboratories, QIAGEN, and Illumina. These companies lead the market through innovative solutions and comprehensive product portfolios, such as diagnostics and reagents, catering to clinical and research applications.

What are the primary factors driving the growth in the molecular diagnostics industry?

Growth in molecular diagnostics is driven by rising cases of infectious diseases, advancements in genetic testing technologies, increased investments in R&D, and a shift towards personalized medicine. The growing awareness of early disease detection and its benefits further fuels market expansion.

Which region is the fastest Growing in the molecular diagnostics?

The fastest-growing region in the molecular diagnostics market is North America, projected to grow from $5.94 billion in 2023 to $14.76 billion by 2033. Europe and Asia Pacific also experience significant growth, driven by increasing healthcare expenditures and technological advancements.

Does ConsaInsights provide customized market report data for the molecular diagnostics industry?

Yes, ConsaInsights offers customized market report data for the molecular diagnostics industry. Clients can request tailored insights that cater to specific needs and requirements, ensuring they receive relevant data that aligns with their strategic objectives.

What deliverables can I expect from this molecular diagnostics market research project?

Deliverables from the molecular diagnostics market research project typically include detailed reports on market size, growth forecasts, competitive analysis, segmentation insights, and trend analysis. Clients may also receive presentations summarizing key findings and recommendations.

What are the market trends of molecular diagnostics?

Current trends in the molecular diagnostics market include the adoption of non-invasive testing methods, rise in personalized medicine applications, and advancements in technologies such as PCR and NGS. Additionally, increasing collaborations among industry players are enhancing innovation.