Monochloroacetic Acid Market Report

Published Date: 02 February 2026 | Report Code: monochloroacetic-acid

Monochloroacetic Acid Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the monochloroacetic acid sector, with insights into market size, growth forecasts, trends, and competitive landscape from 2023 to 2033.

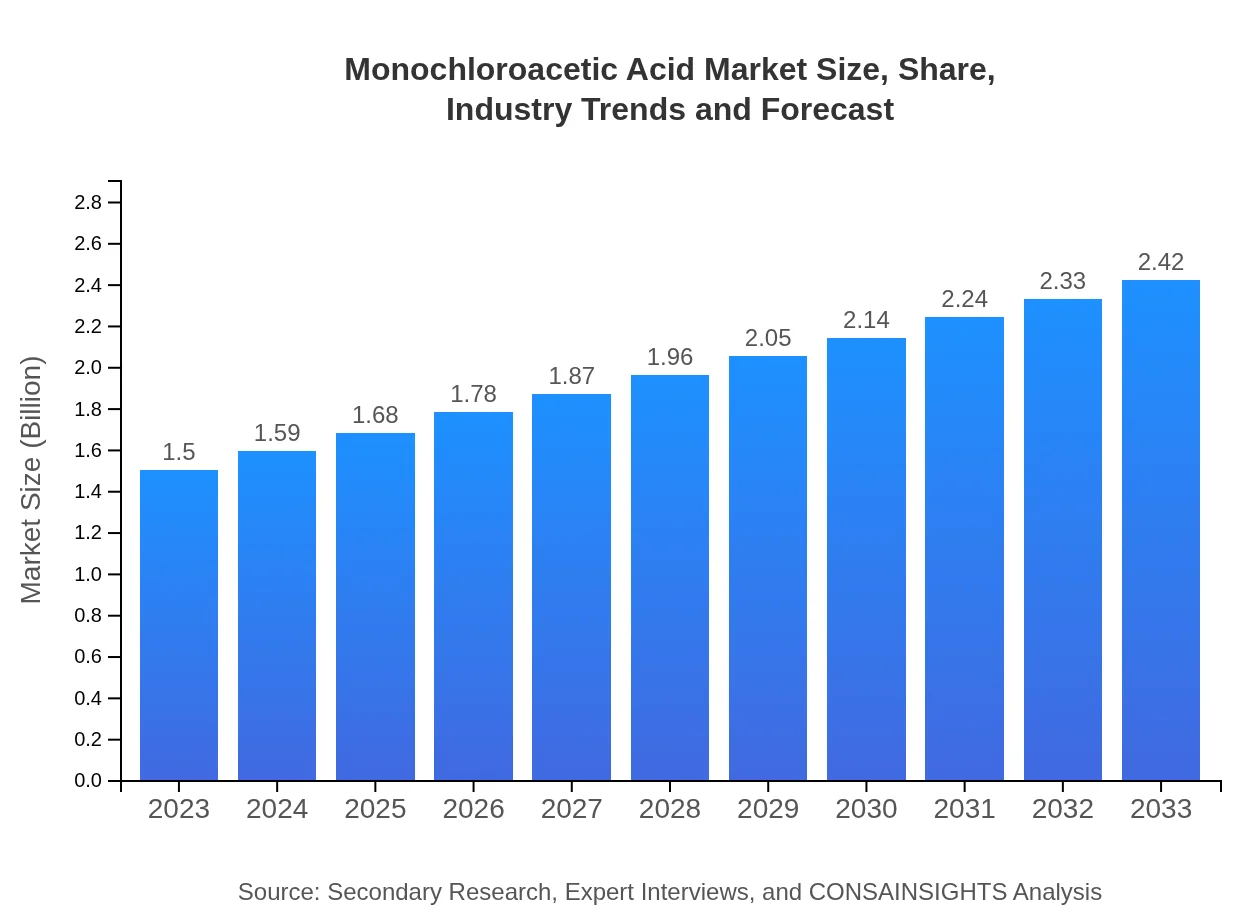

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $2.42 Billion |

| Top Companies | AkzoNobel, Shandong Minji Chemical, Merck KGaA, CABB Group |

| Last Modified Date | 02 February 2026 |

Monochloroacetic Acid Market Overview

Customize Monochloroacetic Acid Market Report market research report

- ✔ Get in-depth analysis of Monochloroacetic Acid market size, growth, and forecasts.

- ✔ Understand Monochloroacetic Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Monochloroacetic Acid

What is the Market Size & CAGR of Monochloroacetic Acid market in 2023?

Monochloroacetic Acid Industry Analysis

Monochloroacetic Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Monochloroacetic Acid Market Analysis Report by Region

Europe Monochloroacetic Acid Market Report:

In Europe, the monochloroacetic acid market is expected to reach $0.62 billion in 2033 from $0.38 billion in 2023. This growth is attributed to robust regulatory support for pesticides and advancements in textile and pharmaceutical applications requiring high purity MCA. The focus on research and development within this region is a driver for innovation.Asia Pacific Monochloroacetic Acid Market Report:

The Asia Pacific region holds a substantial portion of the monochloroacetic acid market, mainly driven by high agricultural output, particularly in countries like China and India. The market size in this region is projected to grow from $0.30 billion in 2023 to $0.49 billion by 2033, facilitated by increasing farmer awareness regarding advanced agricultural inputs and government support for pesticide use.North America Monochloroacetic Acid Market Report:

The North American market is projected to rise from $0.49 billion in 2023 to $0.78 billion by 2033. This market expansion is underpinned by advanced agricultural practices and the increasing use of MCA as an intermediate in the pharmaceutical sector. The U.S. leads in the market share due to its established infrastructure and innovative chemical manufacturing processes.South America Monochloroacetic Acid Market Report:

In South America, the market is expected to grow steadily from $0.13 billion in 2023 to $0.20 billion by 2033. This growth is primarily due to the increasing demand for herbicides in Brazil and Argentina. The adoption of sustainable agricultural practices and rising awareness of crop protection chemicals are key trends enhancing market dynamics.Middle East & Africa Monochloroacetic Acid Market Report:

The Middle East and Africa region is poised for growth, with market sizes expected to increase from $0.20 billion in 2023 to $0.33 billion by 2033. Rising agricultural practices and initiatives to support chemical manufacturing are pivotal trends. Additionally, the development of local production facilities is anticipated to create a favorable environment for MCA market growth.Tell us your focus area and get a customized research report.

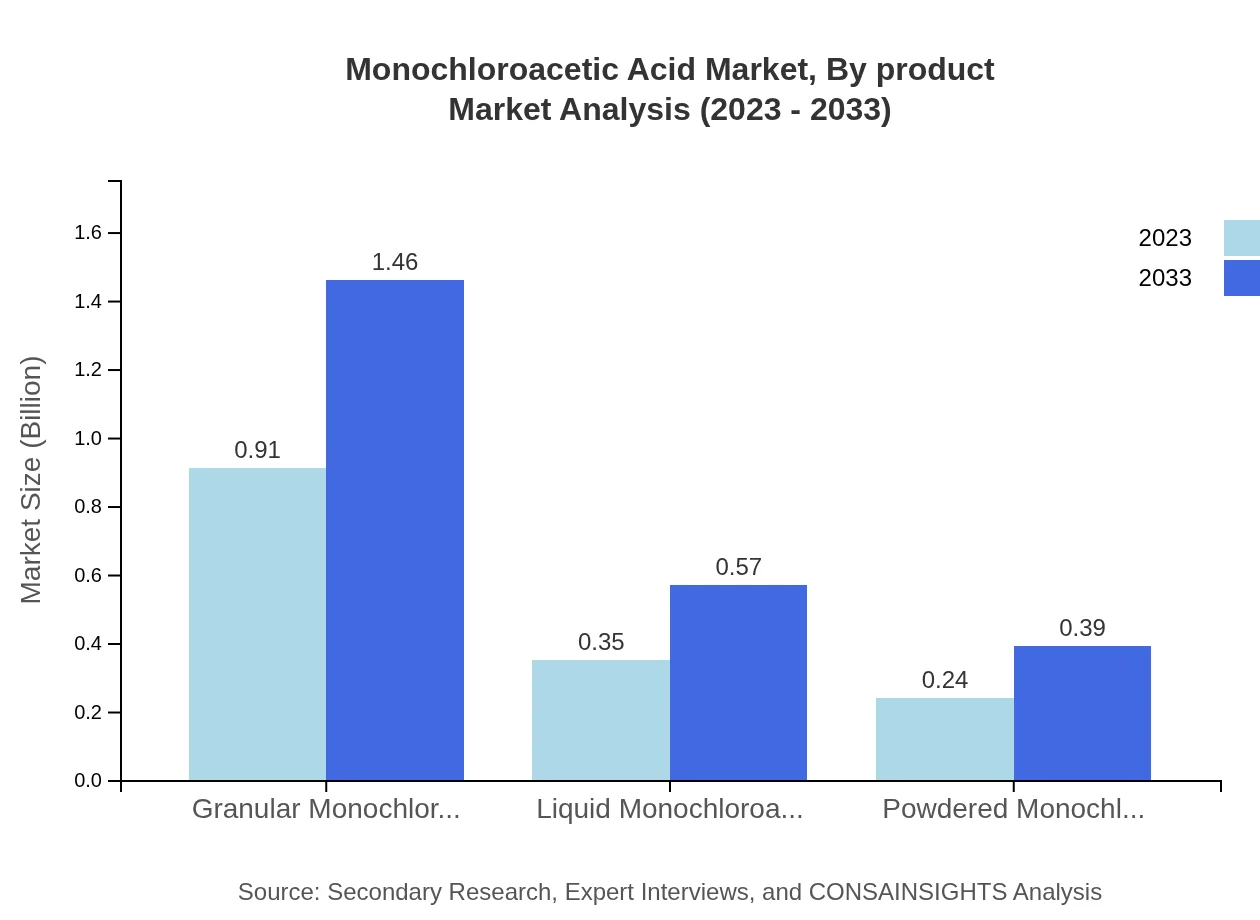

Monochloroacetic Acid Market Analysis By Product

In 2023, the granular form of monochloroacetic acid is expected to dominate the market with a volume of $0.91 billion, growing to $1.46 billion by 2033, accounting for 60.36% of the market share. The liquid form is also significant, projected to reach $0.57 billion by 2033, while the powdered variant is expected to grow to $0.39 billion.

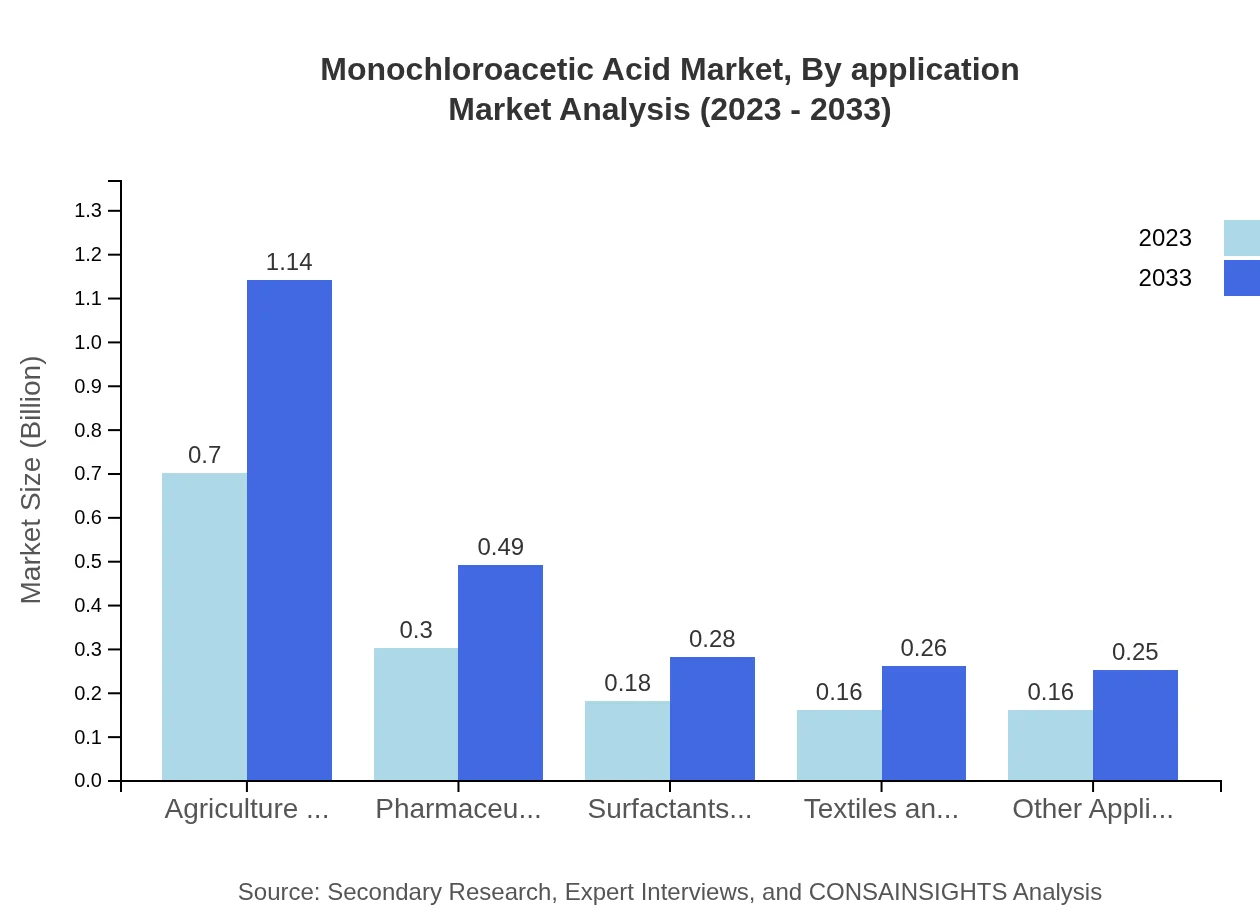

Monochloroacetic Acid Market Analysis By Application

The agriculture sector holds the most substantial application segment for monochloroacetic acid, starting with a market value of $0.70 billion in 2023, anticipated to increase to $1.14 billion by 2033. This segment represents 46.97% of applications. Pharmaceuticals are expected to follow with growth from $0.30 billion to $0.49 billion, showcasing their importance in MCA usage.

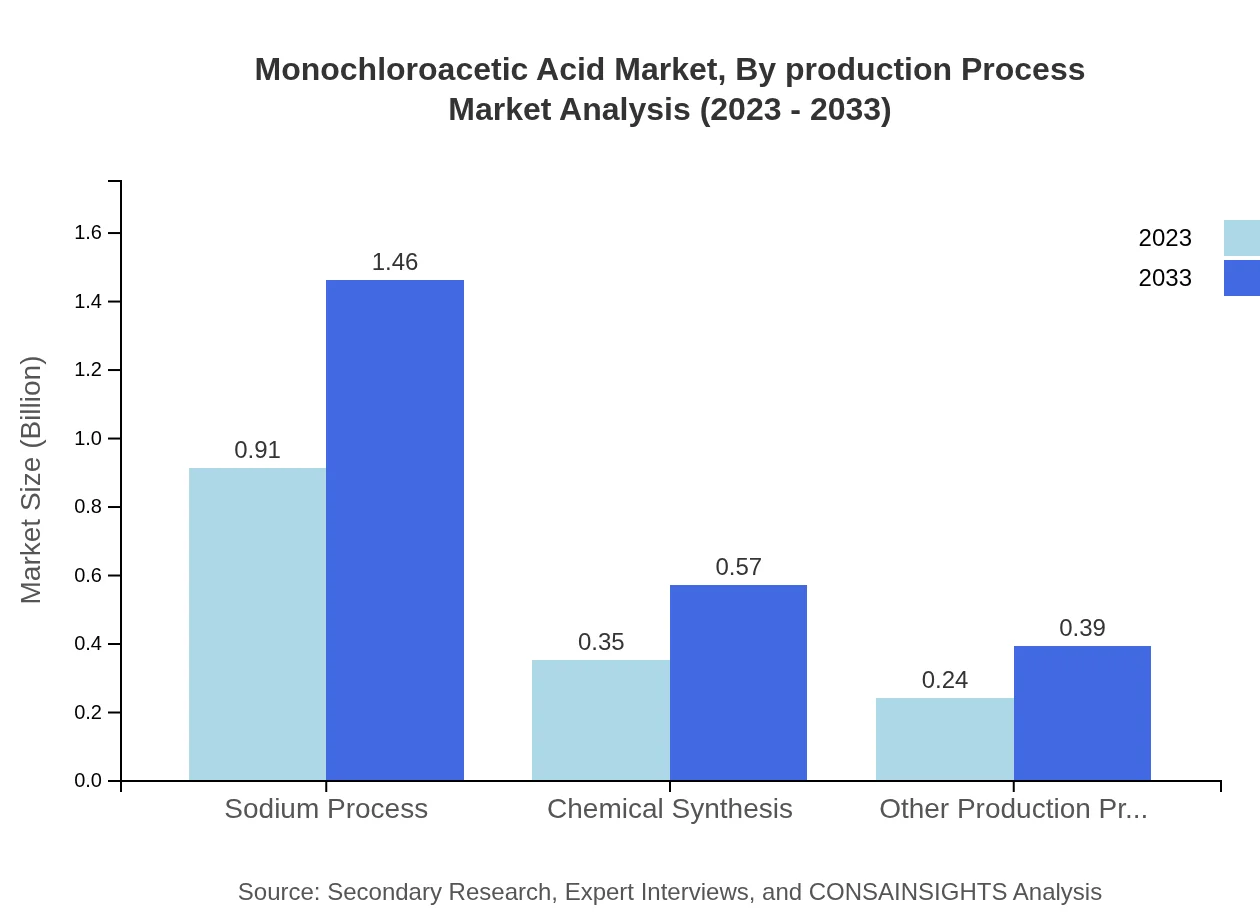

Monochloroacetic Acid Market Analysis By Production Process

The sodium process dominates the production approach for MCA, with revenues projected at $0.91 billion in 2023 and $1.46 billion by 2033. The chemical synthesis method is also relevant with a growth trajectory from $0.35 billion to $0.57 billion, representing increasing innovation in production modalities.

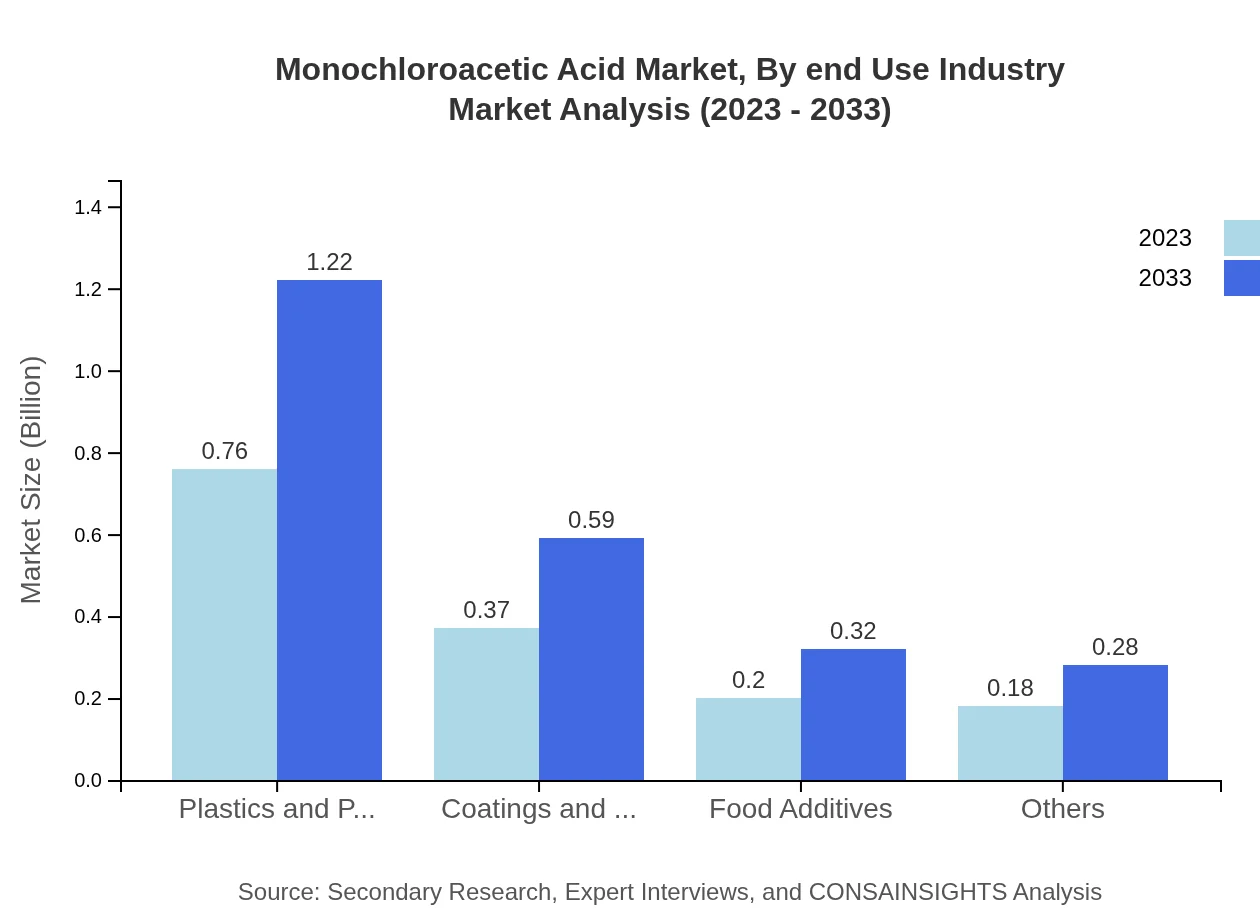

Monochloroacetic Acid Market Analysis By End Use Industry

The plastics and polymers industry utilizes monochloroacetic acid significantly, starting with a value of $0.76 billion in 2023 and forecasted to reach $1.22 billion by 2033. This segment represents 50.6% of the use of MCA across various industries, emphasizing the chemical's versatility.

Monochloroacetic Acid Market Analysis By Distribution Channel

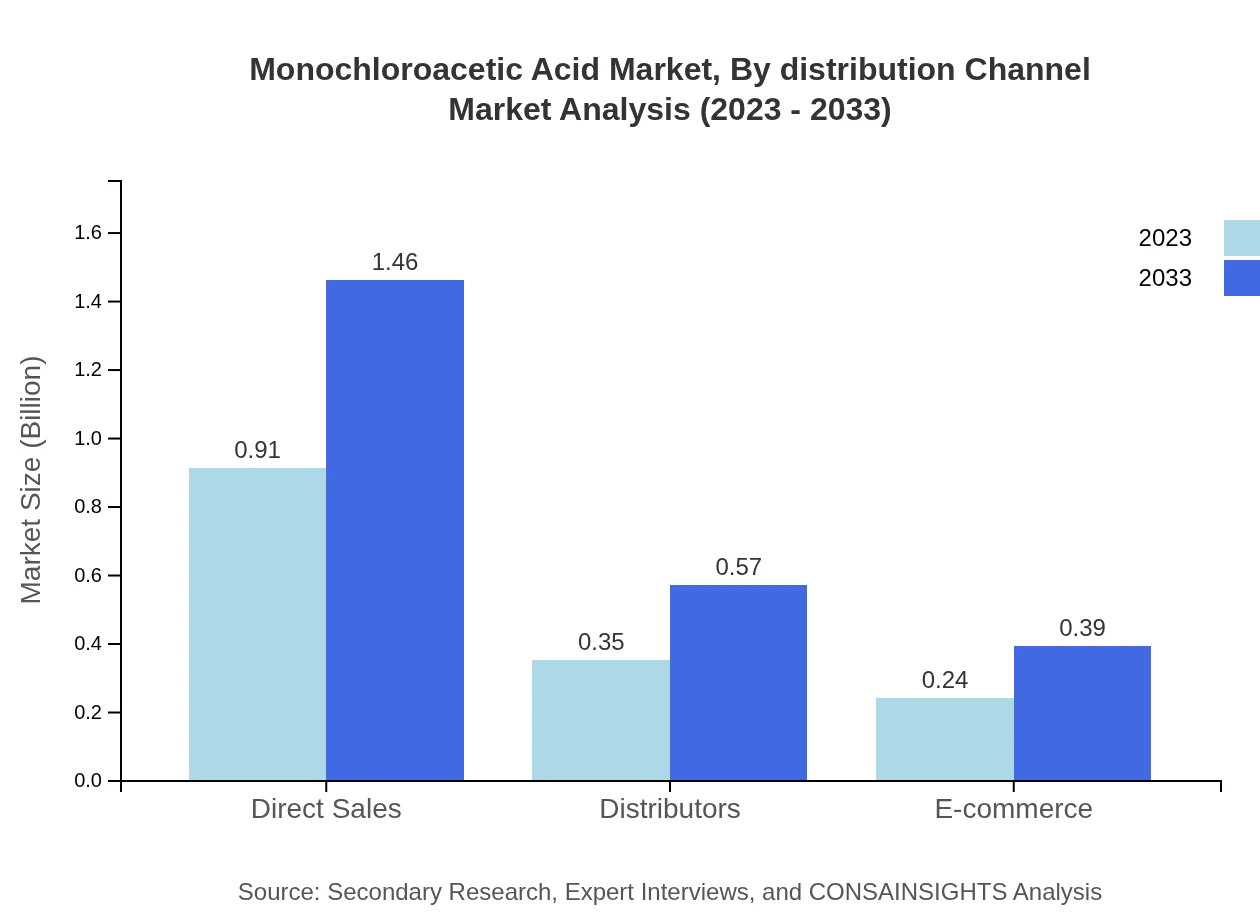

Direct sales dominate the distribution channel for monochloroacetic acid, forecasting $0.91 billion in 2023 and growing to $1.46 billion by 2033. Distributors maintain a critical role with projected revenues of $0.35 billion, while e-commerce channels portray growing relevance, highlighted by forecasted figures advancing to $0.39 billion.

Monochloroacetic Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Monochloroacetic Acid Industry

AkzoNobel:

A leading global paints and coatings company that manufactures monochloroacetic acid used in its chemical intermediates.Shandong Minji Chemical:

Renowned for its extensive chemical production capabilities, Shandong Minji Chemical produces various grades of monochloroacetic acid for global markets.Merck KGaA:

An international pharmaceutical and chemical company that creates high-purity monochloroacetic acid for pharmaceuticals and scientific applications.CABB Group:

CABB Group specializes in custom synthesis and offers a range of monochloroacetic acid products, prominently serving the agrochemical industry.We're grateful to work with incredible clients.

FAQs

What is the market size of monochloroacetic Acid?

The global market size for monochloroacetic acid is projected to reach approximately 1.5 billion USD by 2033, with a CAGR of 4.8% from 2023 to 2033. This growth reflects the increasing demand across various industries.

What are the key market players or companies in this monochloroacetic Acid industry?

Key players in the monochloroacetic acid market include prominent chemical manufacturers that focus on agricultural, pharmaceutical, and industrial applications. Their strategic expansions and product innovations significantly shape market dynamics and competition.

What are the primary factors driving the growth in the monochloroacetic Acid industry?

Growth in the monochloroacetic acid industry is driven by rising demand in agriculture for herbicides and pesticides, increasing utilization in pharmaceuticals, and a growing focus on high-performance surfactants across multiple sectors.

Which region is the fastest Growing in the monochloroacetic Acid?

Asia Pacific is the fastest-growing region for monochloroacetic acid, expanding from 0.30 billion USD in 2023 to 0.49 billion USD by 2033, marking significant growth as industrial activities increase in emerging markets.

Does ConsaInsights provide customized market report data for the monochloroacetic Acid industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the monochloroacetic acid sector. Clients can obtain detailed insights tailored to their operational requirements and strategic goals.

What deliverables can I expect from this monochloroacetic Acid market research project?

Expect comprehensive deliverables including market size data, growth forecasts, competitive landscape analysis, segmentation insights, and trend analyses to inform strategic decision-making in the monochloroacetic acid market.

What are the market trends of monochloroacetic Acid?

Current trends include increasing integration of eco-friendly production methods, a shift towards value-added applications in pharmaceuticals, and rising demand for granulated forms in agricultural sectors, indicating a dynamic market landscape.