Monolithic Microwave Ic Market Report

Published Date: 31 January 2026 | Report Code: monolithic-microwave-ic

Monolithic Microwave Ic Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Monolithic Microwave IC market, covering market size, trends, segmentation, and forecasts from 2023 to 2033, alongside regional insights and competitive landscape assessments.

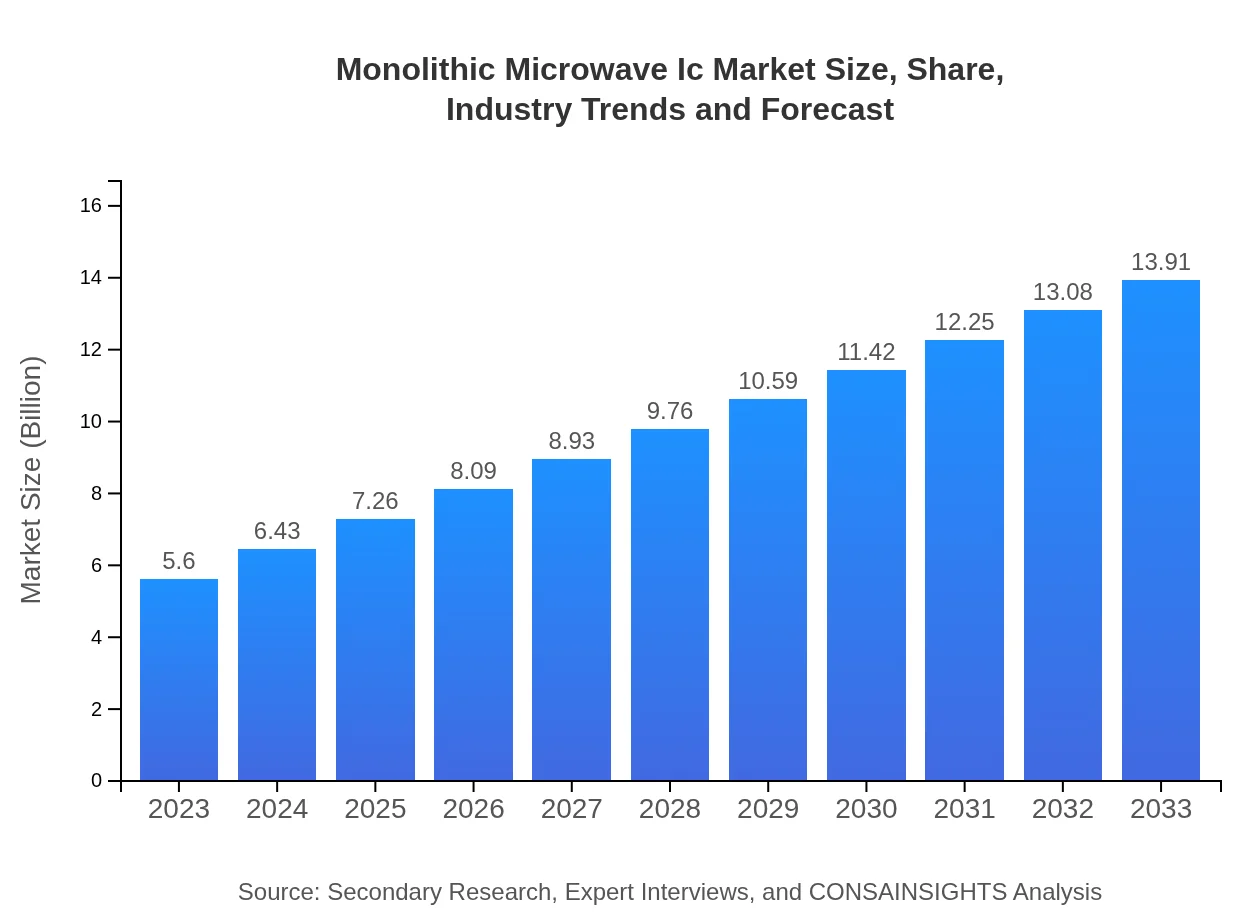

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Analog Devices, Inc., NXP Semiconductors, Qorvo, Inc., Infineon Technologies AG, Broadcom Inc. |

| Last Modified Date | 31 January 2026 |

Monolithic Microwave IC Market Overview

Customize Monolithic Microwave Ic Market Report market research report

- ✔ Get in-depth analysis of Monolithic Microwave Ic market size, growth, and forecasts.

- ✔ Understand Monolithic Microwave Ic's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Monolithic Microwave Ic

What is the Market Size & CAGR of Monolithic Microwave IC market in 2023?

Monolithic Microwave IC Industry Analysis

Monolithic Microwave IC Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Monolithic Microwave IC Market Analysis Report by Region

Europe Monolithic Microwave Ic Market Report:

The European MMIC market is experiencing steady growth, with a value of $1.59 billion in 2023 expected to reach $3.94 billion by 2033. The region's strong regulatory framework and focus on innovation contribute to advancements in telecommunications and defense applications.Asia Pacific Monolithic Microwave Ic Market Report:

The Asia-Pacific region is a burgeoning hub for Monolithic Microwave ICs, with a market value of $1.06 billion in 2023, expected to grow to $2.64 billion by 2033. The growth is majorly driven by increased investments in telecommunications and a booming electronics manufacturing sector in countries like China, Japan, and South Korea.North America Monolithic Microwave Ic Market Report:

North America is currently the leading market for Monolithic Microwave ICs, valued at $2.11 billion in 2023 and projected to grow to $5.24 billion by 2033. The region's dominance is attributed to the presence of major defense contractors and telecommunications giants actively investing in next-generation communication systems.South America Monolithic Microwave Ic Market Report:

In South America, the Monolithic Microwave IC market was valued at $0.26 billion in 2023, anticipated to reach $0.64 billion by 2033. The growth is fueled by government initiatives to enhance communication infrastructure and the increasing adoption of wireless technologies.Middle East & Africa Monolithic Microwave Ic Market Report:

The Middle East and Africa market is projected to grow from $0.58 billion in 2023 to $1.45 billion by 2033. The growth is supported by increasing defense spending and advancements in satellite communication technologies in the region.Tell us your focus area and get a customized research report.

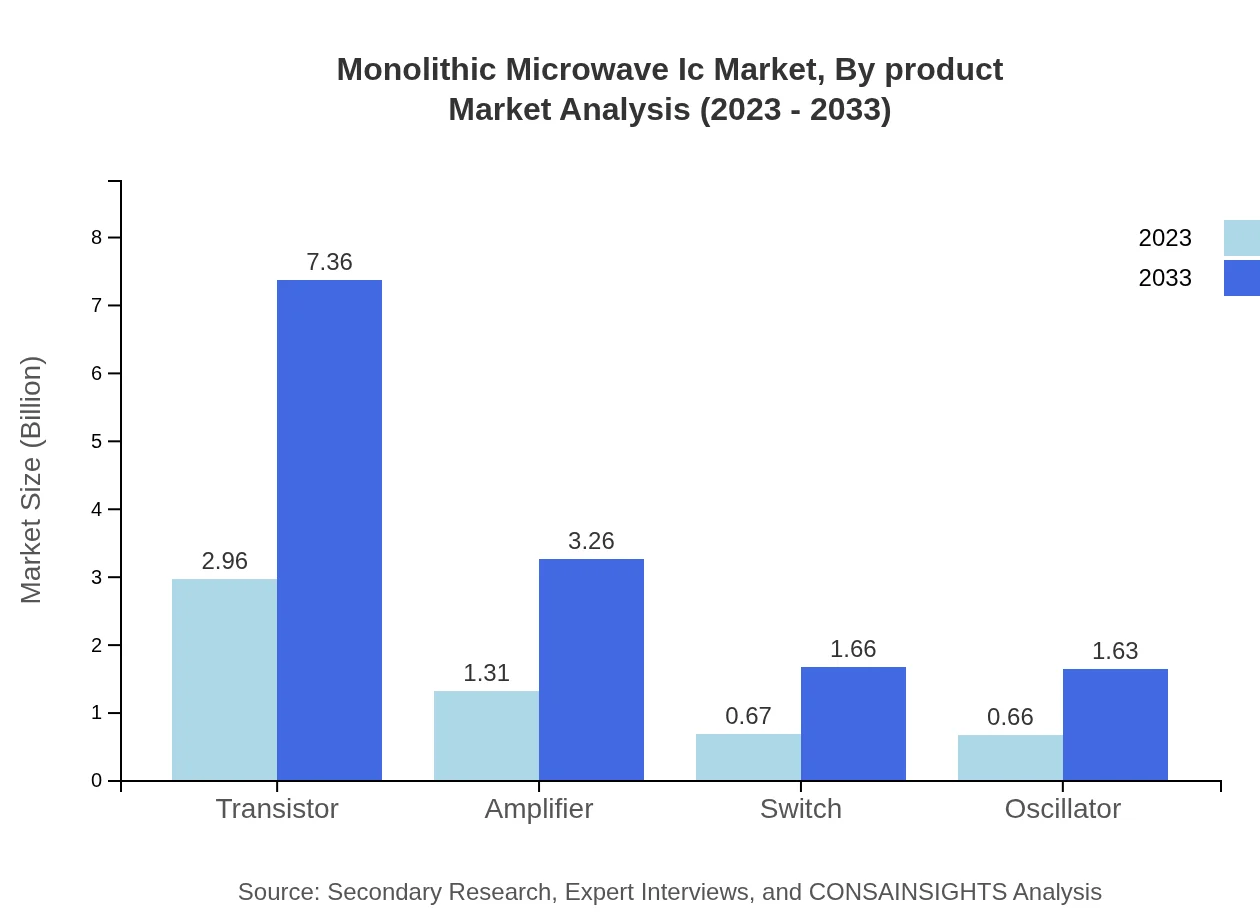

Monolithic Microwave Ic Market Analysis By Product

The Monolithic Microwave IC market is significantly influenced by product types. Transistors lead the segment with a market size of $2.96 billion in 2023, projected to grow to $7.36 billion by 2033, capturing 52.89% share. Amplifiers follow, starting at $1.31 billion in 2023 and reaching $3.26 billion by 2033 (23.41% share). Switches and oscillators hold smaller shares, yet their growing use in varied applications indicates their increasing significance.

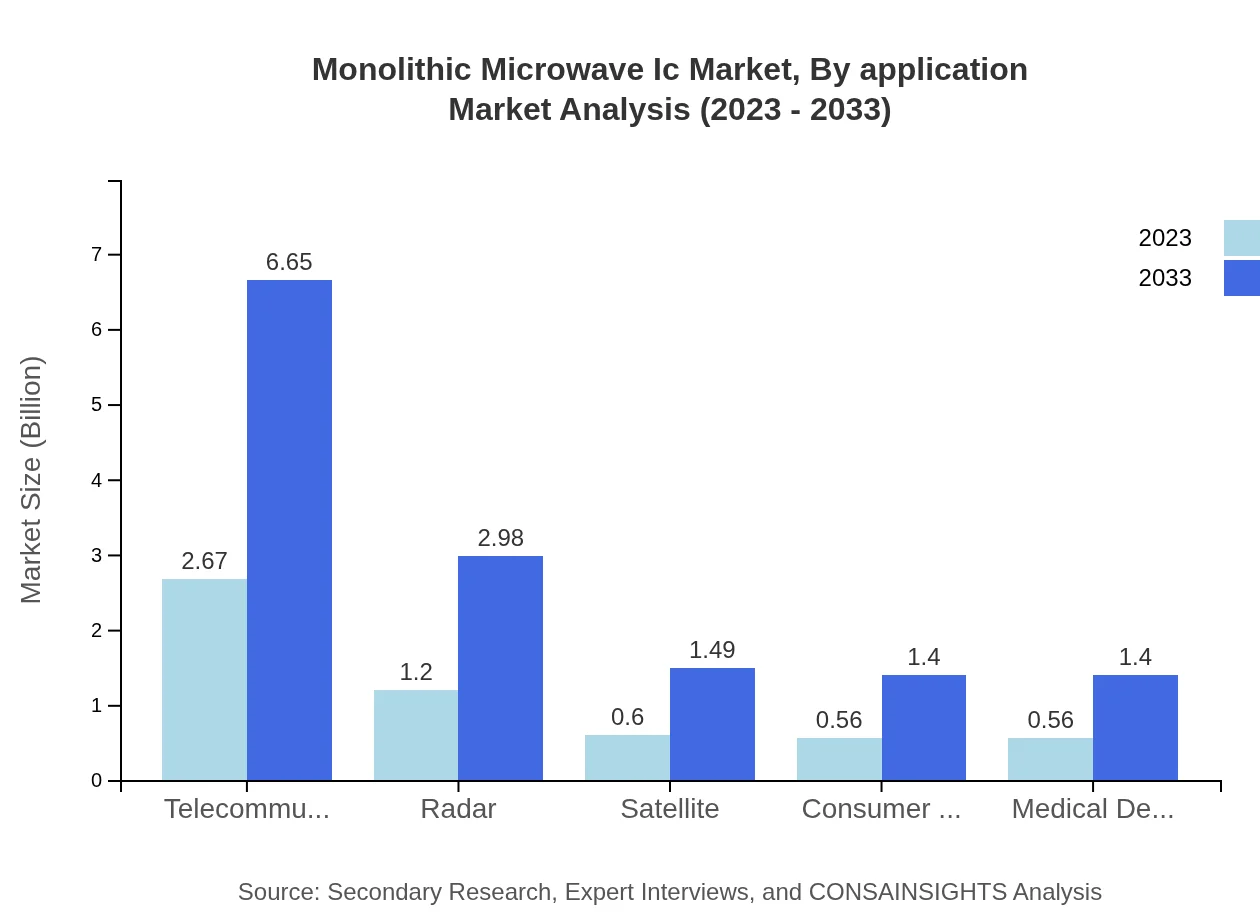

Monolithic Microwave Ic Market Analysis By Application

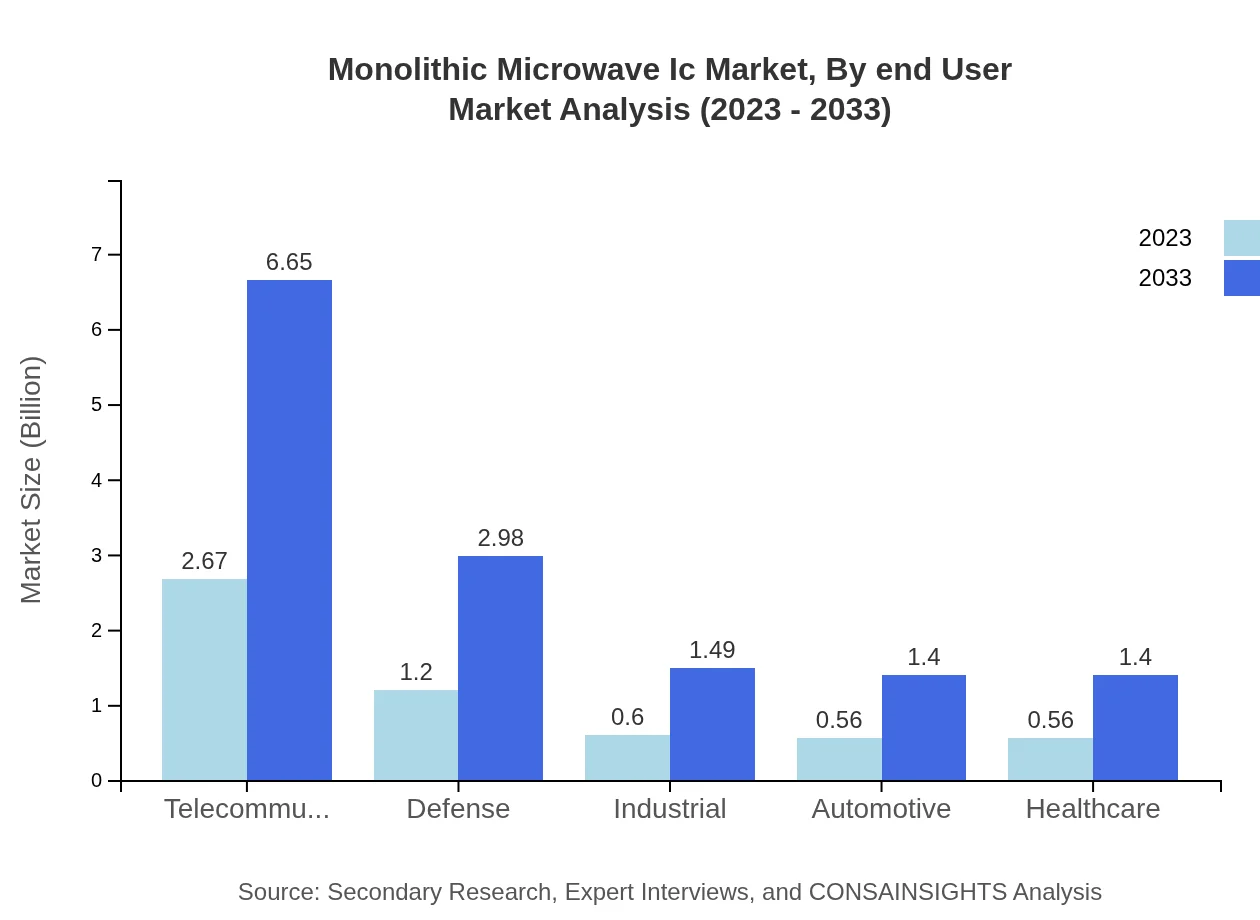

Telecommunications dominate the application segment with a size of $2.67 billion in 2023, expected to rise to $6.65 billion by 2033 (47.76% market share). Defense applications also play a crucial role with a current market size of $1.20 billion, increasing to $2.98 billion (21.41%). Other key applications include industrial, automotive, and medical devices, each contributing significantly to market dynamics.

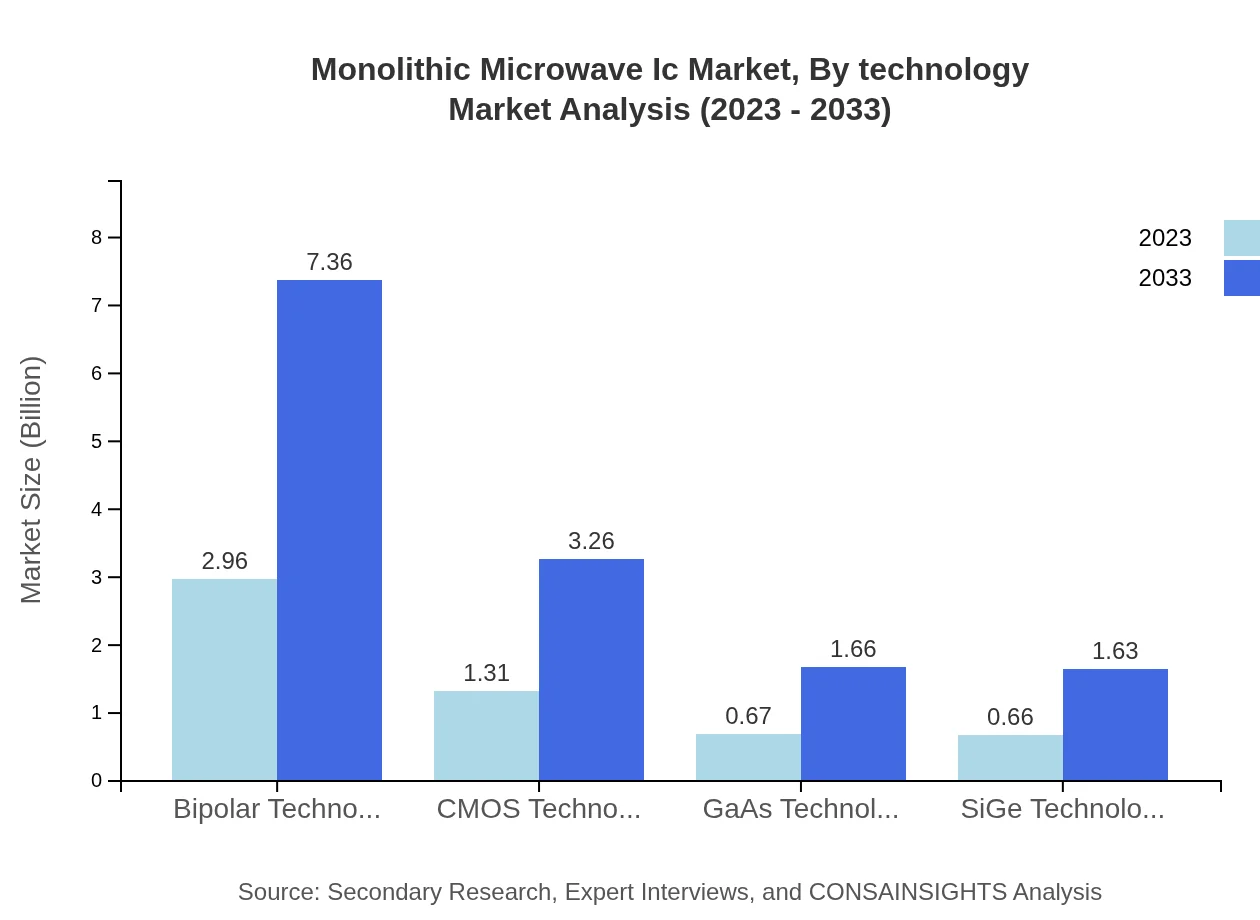

Monolithic Microwave Ic Market Analysis By Technology

Technological advancements have shaped the growth of the Monolithic Microwave IC market. Bipolar technology is leading with a market size of $2.96 billion in 2023, projected to grow to $7.36 billion by 2033. CMOS technology follows, currently valued at $1.31 billion and expected to reach $3.26 billion. GaAs and SiGe technologies are also critical, providing specific advantages across applications in the MMIC landscape.

Monolithic Microwave Ic Market Analysis By End User

The end-user segment showcases diverse industries utilizing MMICs. Telecommunications leads with significant traction, followed by defense and aerospace, industrial applications, and consumer electronics. The automotive end user showcases growing demand as well, particularly in autonomous vehicles and smart technologies, reinforcing the versatility of MMIC applications.

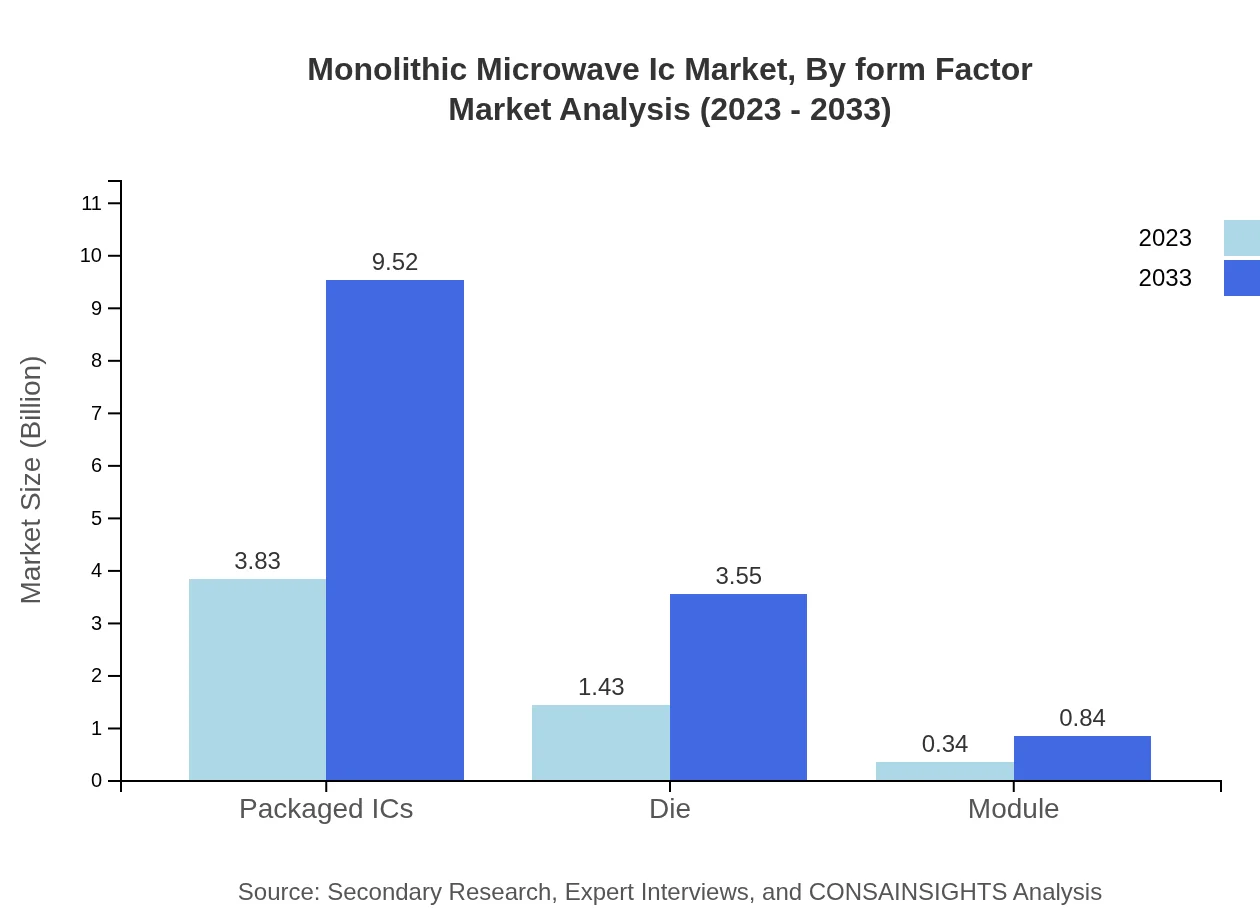

Monolithic Microwave Ic Market Analysis By Form Factor

Monolithic Microwave ICs are available in various form factors, including packaged ICs, die, and modules. Packaged ICs dominate the market with a size of $3.83 billion in 2023, expected to grow to $9.52 billion by 2033, representing 68.45% of the market share. Die and module forms are also gaining prevalence as advanced solutions for specific applications.

Monolithic Microwave IC Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Monolithic Microwave IC Industry

Analog Devices, Inc.:

A leading manufacturer of high-performance analog, mixed-signal, and digital signal processing ICs, renowned for its extensive portfolio within the MMIC market.NXP Semiconductors:

A prominent player specializing in secure connectivity solutions for various applications, NXP is well-recognized for its innovations in microwave IC technologies.Qorvo, Inc.:

Known for its RF solutions and GaN technology, Qorvo is instrumental in developing advanced MMICs tailored for telecommunications and aerospace industries.Infineon Technologies AG:

With a strong emphasis on efficient semiconductor solutions, Infineon contributes significantly to the MMIC market through innovations and key partnerships.Broadcom Inc.:

A technology leader that specializes in broadband and wireless communications, Broadcom plays a vital role in advancing MMIC applications across various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of Monolithic Microwave IC?

The Monolithic Microwave IC market is valued at approximately $5.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.2% expected to continue through 2033.

What are the key market players or companies in this Monolithic Microwave IC industry?

Key players in the Monolithic Microwave IC market include established semiconductor companies specializing in RF design, integrated circuit manufacturing, and telecommunication solutions, along with defense tech firms driving innovation in this sector.

What are the primary factors driving the growth in the Monolithic Microwave IC industry?

Growth in the Monolithic Microwave IC market is driven by increasing demand for high-frequency applications, advancements in mobile communications, and the need for compact, efficient devices in defense and automotive sectors.

Which region is the fastest Growing in the Monolithic Microwave IC?

The Asia Pacific region is the fastest-growing market for Monolithic Microwave IC, with its market size expected to grow from $1.06 billion in 2023 to $2.64 billion by 2033, reflecting a robust CAGR.

Does ConsaInsights provide customized market report data for the Monolithic Microwave IC industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, providing in-depth analysis and insights into segments and trends within the Monolithic Microwave IC industry.

What deliverables can I expect from this Monolithic Microwave IC market research project?

Expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive landscape assessments, segment data breakdowns, and insights into regional dynamics and industry trends.

What are the market trends of Monolithic Microwave IC?

Current market trends in Monolithic Microwave IC include increased adoption in telecommunications, advancements in 5G technology, and the trend towards smaller, integrated devices across various applications from industrial to consumer electronics.