Motor Insurance Market Report

Published Date: 24 January 2026 | Report Code: motor-insurance

Motor Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Motor Insurance market from 2023 to 2033, highlighting key trends, market size, regional insights, and technological advancements impacting the industry.

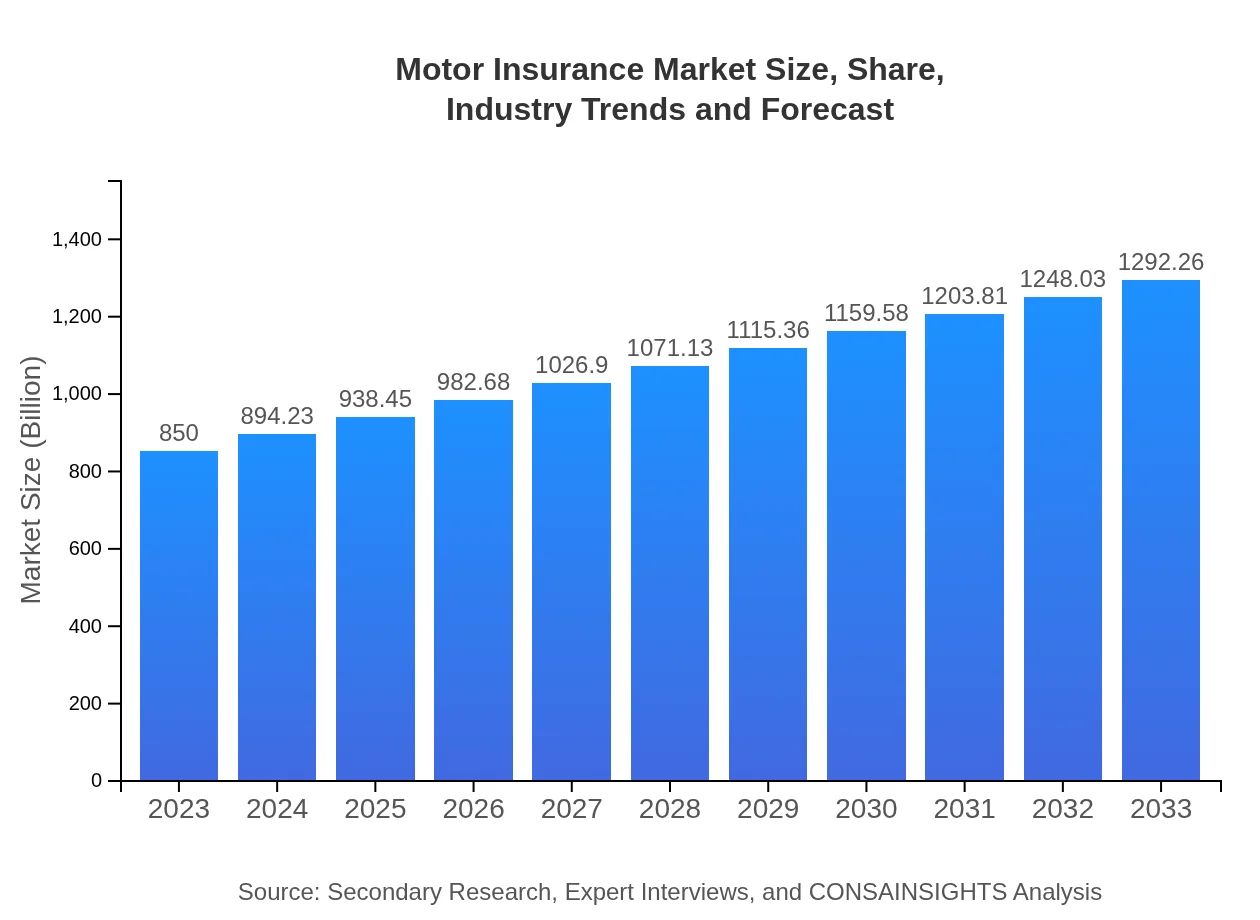

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $850.00 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $1292.26 Billion |

| Top Companies | State Farm, Allstate Insurance, Progressive Insurance, Geico, AXA |

| Last Modified Date | 24 January 2026 |

Motor Insurance Market Overview

Customize Motor Insurance Market Report market research report

- ✔ Get in-depth analysis of Motor Insurance market size, growth, and forecasts.

- ✔ Understand Motor Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Motor Insurance

What is the Market Size & CAGR of Motor Insurance market in 2023?

Motor Insurance Industry Analysis

Motor Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Motor Insurance Market Analysis Report by Region

Europe Motor Insurance Market Report:

The European motor insurance market is expected to grow from USD 251.60 billion in 2023 to USD 382.51 billion by 2033. This growth is fueled by stringent regulatory standards ensuring comprehensive coverage and the rising trend of electric vehicles, which introduces new insurance paradigms. Technological innovations, particularly in claims handling and risk assessment, are set to attract more consumers.Asia Pacific Motor Insurance Market Report:

The Asia Pacific motor insurance market is poised for significant growth, projected to increase from USD 174.84 billion in 2023 to USD 265.82 billion by 2033. This growth is attributed to rising disposable incomes, increasing vehicle ownership, and expanding urbanization. The digital transformation in insurance offerings, especially through mobile platforms, is accelerating the purchasing processes in markets such as India and China.North America Motor Insurance Market Report:

North America represents a significant share of the motor insurance market, with projections soaring from USD 281.94 billion in 2023 to USD 428.64 billion by 2033. The region's well-established insurance framework combined with an affluent consumer base fosters steady growth. The ongoing shift towards personalized insurance products and customer-centric services powered by data analytics will further augment market dynamics.South America Motor Insurance Market Report:

In South America, the motor insurance market is expected to grow from USD 27.46 billion in 2023 to USD 41.74 billion by 2033. However, the market faces challenges like economic fluctuations and consumer skepticism. Nonetheless, increasing awareness about insurance benefits is beginning to spur demand, particularly in Brazil and Argentina.Middle East & Africa Motor Insurance Market Report:

The Middle East and Africa motor insurance market is set to grow from USD 114.16 billion in 2023 to USD 173.55 billion by 2033. Growing economies and increasing vehicle ownership rates in countries like the UAE and South Africa are propelling the market forward. Challenges, including regulatory issues and customer education, remain, but opportunities for growth are evident as more consumers seek car insurance.Tell us your focus area and get a customized research report.

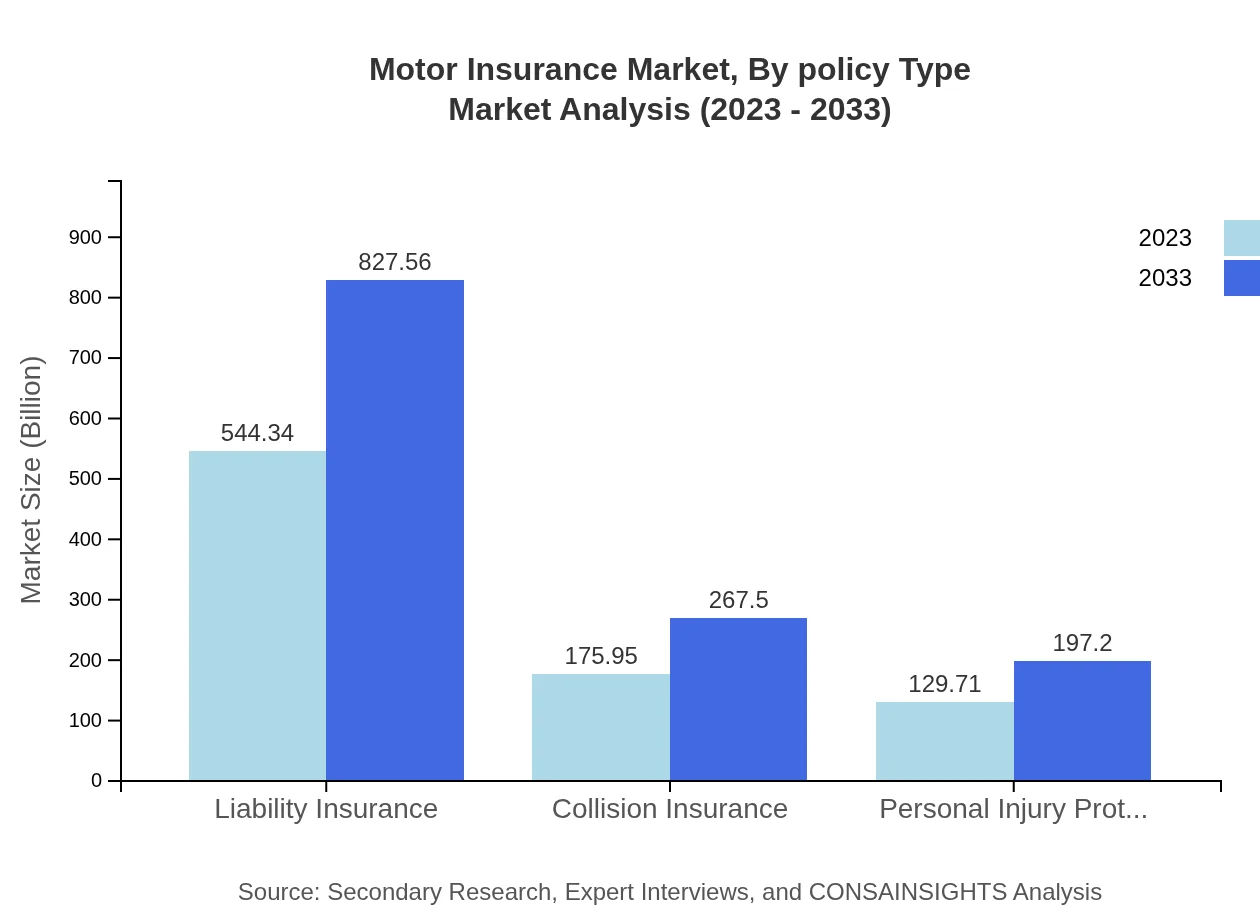

Motor Insurance Market Analysis By Policy Type

The Motor Insurance market can be categorized into several key policy types. Liability insurance leads with a market size of USD 544.34 billion in 2023, projected to grow to USD 827.56 billion by 2033. This segment is crucial due to legal requirements mandating vehicle owners to obtain liability coverage. Collision insurance, with a current market size of USD 175.95 billion, is expected to increase to USD 267.50 billion as more consumers seek protection against vehicle damages. Personal injury protection accounts for USD 129.71 billion in 2023 and is set to reach USD 197.20 billion, reflecting growing concerns over medical costs arising from accidents.

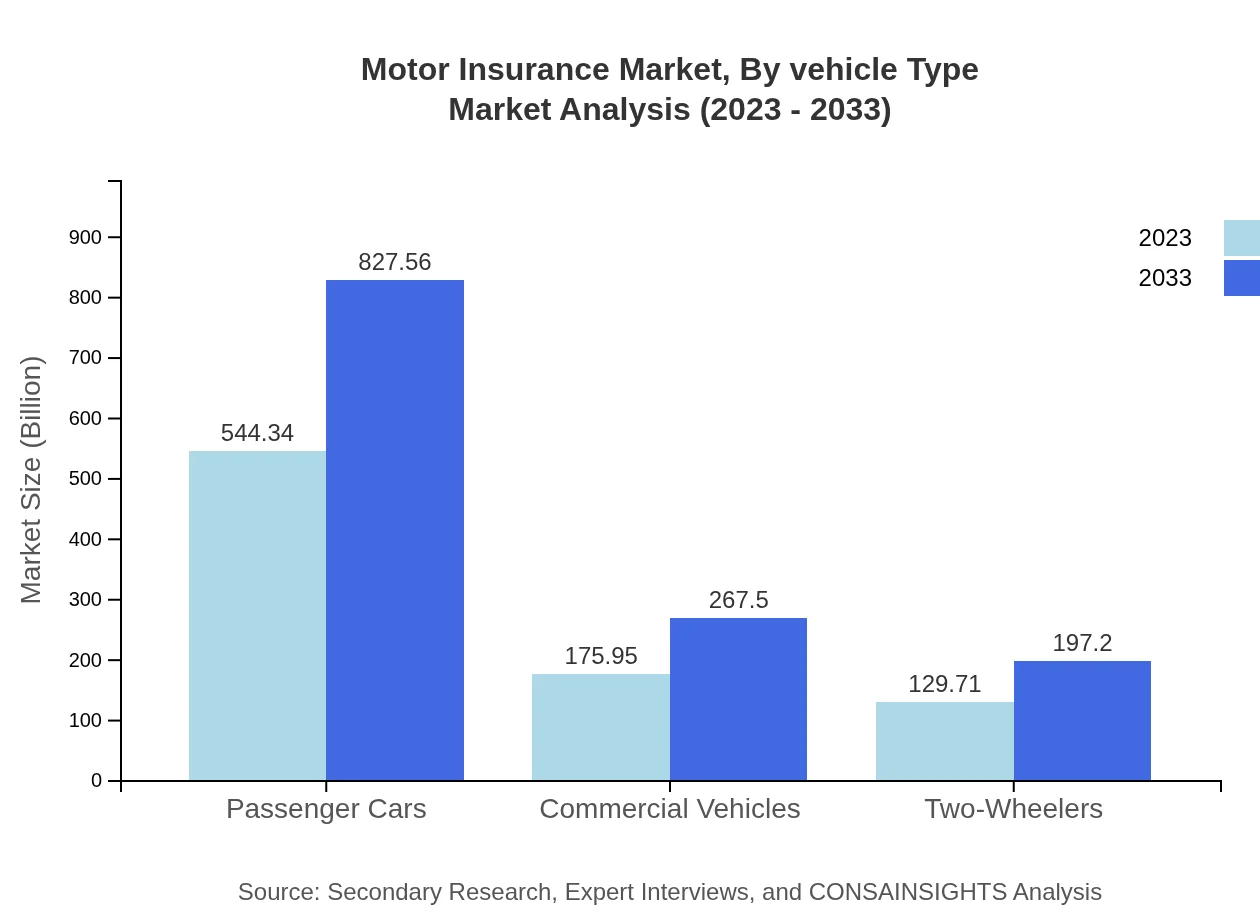

Motor Insurance Market Analysis By Vehicle Type

Segmentation by vehicle type shows significant variation in insurance demand. Passenger cars dominate, currently valued at USD 544.34 billion and anticipated to rise to USD 827.56 billion. Commercial vehicles follow closely, with a market size of USD 175.95 billion, projected to achieve USD 267.50 billion as more businesses recognize the necessity of insuring their fleets. Additionally, two-wheelers account for USD 129.71 billion in 2023, forecasted to increase to USD 197.20 billion, particularly notable in markets with high motorcycle usage like Southeast Asia.

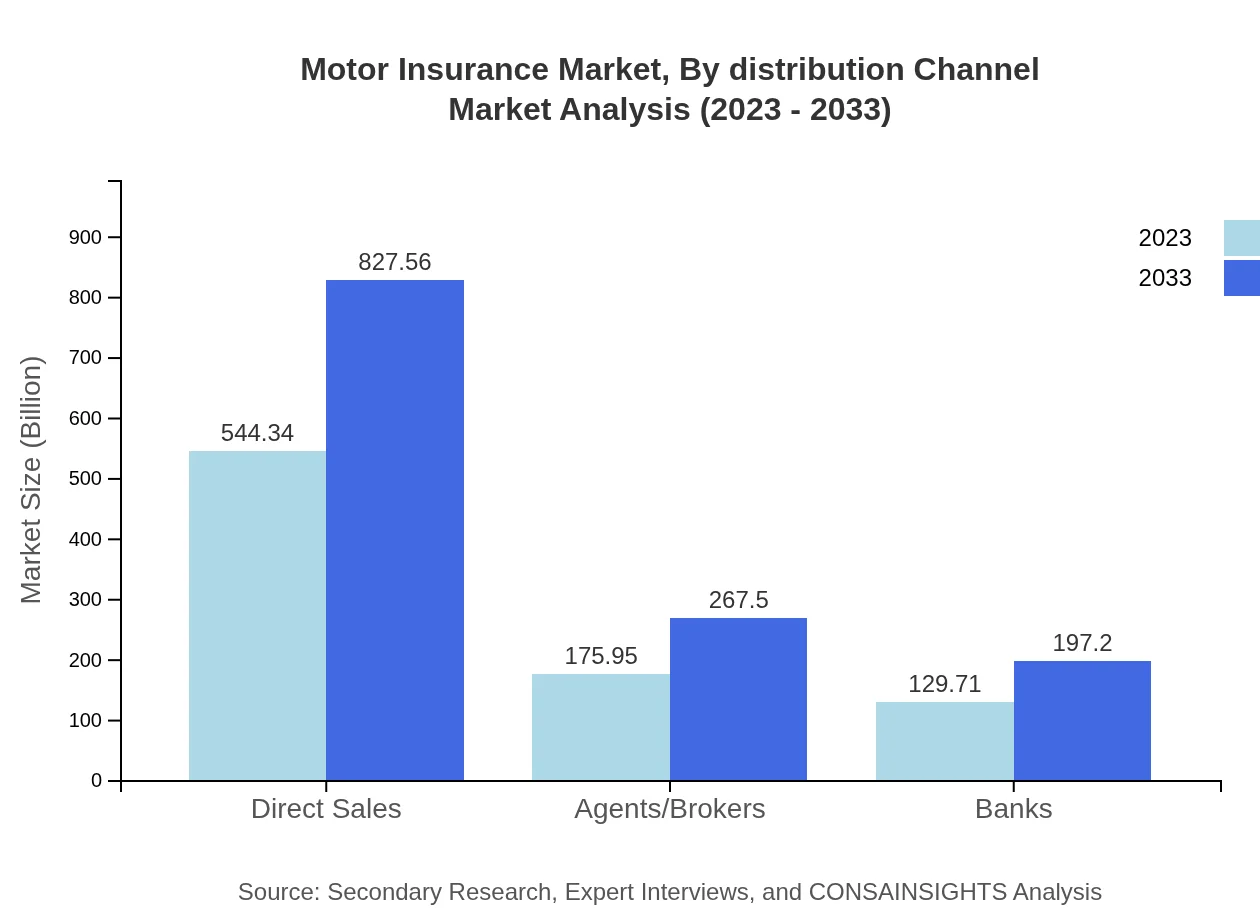

Motor Insurance Market Analysis By Distribution Channel

Distribution channels in the Motor Insurance sector have evolved with changing consumer preferences. Direct sales constitute a major channel, valued at USD 544.34 billion, projected to grow to USD 827.56 billion as customers increasingly prefer online purchases. Agents and brokers hold a significant share as well, with a market size of USD 175.95 billion expected to increase to USD 267.50 billion. Furthermore, banks also play a critical role, contributing USD 129.71 billion in 2023 and expected to rise to USD 197.20 billion, leveraging their established customer bases.

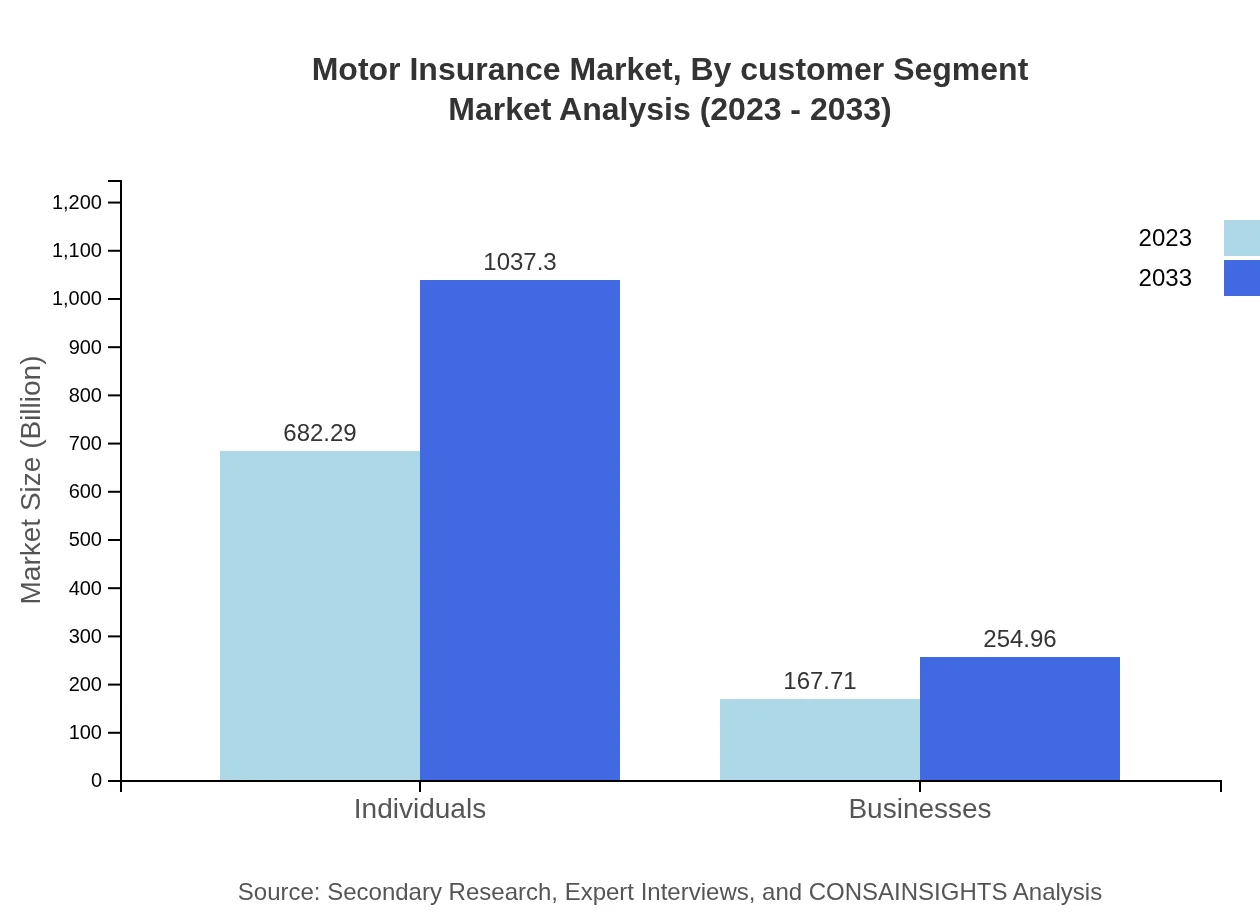

Motor Insurance Market Analysis By Customer Segment

The customer segment overview highlights two primary groups: individuals and businesses. Individuals dominate the market with a size of USD 682.29 billion in 2023, expected to grow to USD 1,037.30 billion by 2033, driven by increasing vehicle ownership among consumers. Businesses hold a smaller share at USD 167.71 billion, projected to rise to USD 254.96 billion, reflecting the growing importance of insuring workplace vehicles and fleet operations.

Motor Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Motor Insurance Industry

State Farm:

State Farm is one of the largest insurance providers in the U.S., renowned for its comprehensive auto insurance policies and customer service excellence.Allstate Insurance:

Allstate is recognized for its innovative insurance products and a strong focus on customer engagement through digital channels.Progressive Insurance:

Known for its competitive pricing and usage-based insurance options, Progressive remains a leader in the motor insurance sector.Geico:

Geico stands out for its extensive advertising strategies and tech-focused services, making insurance easily accessible to consumers.AXA:

A global leader in insurance and investment, AXA provides a wide range of insurance products and is known for its customer-centric approach.We're grateful to work with incredible clients.

FAQs

What is the market size of motor insurance?

The global motor insurance market is estimated to reach approximately $850 billion by 2033, growing at a CAGR of 4.2% from its current valuation. This significant market size indicates robust demand across regions and segments.

What are the key market players or companies in the motor insurance industry?

Key players in the motor insurance industry include Allianz, State Farm, Progressive, AXA, and Geico. These companies dominate the market by providing a range of insurance products and leveraging digital platforms for improved customer engagement.

What are the primary factors driving the growth in the motor insurance industry?

Primary factors include rising vehicle ownership, increased awareness of insurance products, government regulations mandating coverage, and advancements in motor vehicle safety technology. Additionally, the growth of online insurance platforms enhances accessibility and convenience.

Which region is the fastest Growing in the motor insurance?

The Asia Pacific region is the fastest-growing market for motor insurance, projected to grow from $174.84 billion in 2023 to $265.82 billion by 2033. Rapid urbanization and increasing disposable incomes drive this growth.

Does ConsaInsights provide customized market report data for the motor insurance industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the motor insurance industry. This includes insights based on segment, region, and market trends designed to meet unique business requirements.

What deliverables can I expect from this motor insurance market research project?

Deliverables typically include comprehensive market reports, executive summaries, data visualizations, regional analysis, and detailed segment breakdowns. Also, insights on emerging trends and competitor analyses will be provided.

What are the market trends of motor insurance?

Key trends include the rise of telematics-based insurance, increasing adoption of electric vehicles, and the use of AI for underwriting. Efforts to enhance customer experience through digital platforms and personalized offerings are also noteworthy.