Motor Lamination Market Report

Published Date: 22 January 2026 | Report Code: motor-lamination

Motor Lamination Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Motor Lamination market, covering insights, forecasts, and trends from 2023 to 2033. It examines market size, segmentation, regional analysis, and key players shaping the industry.

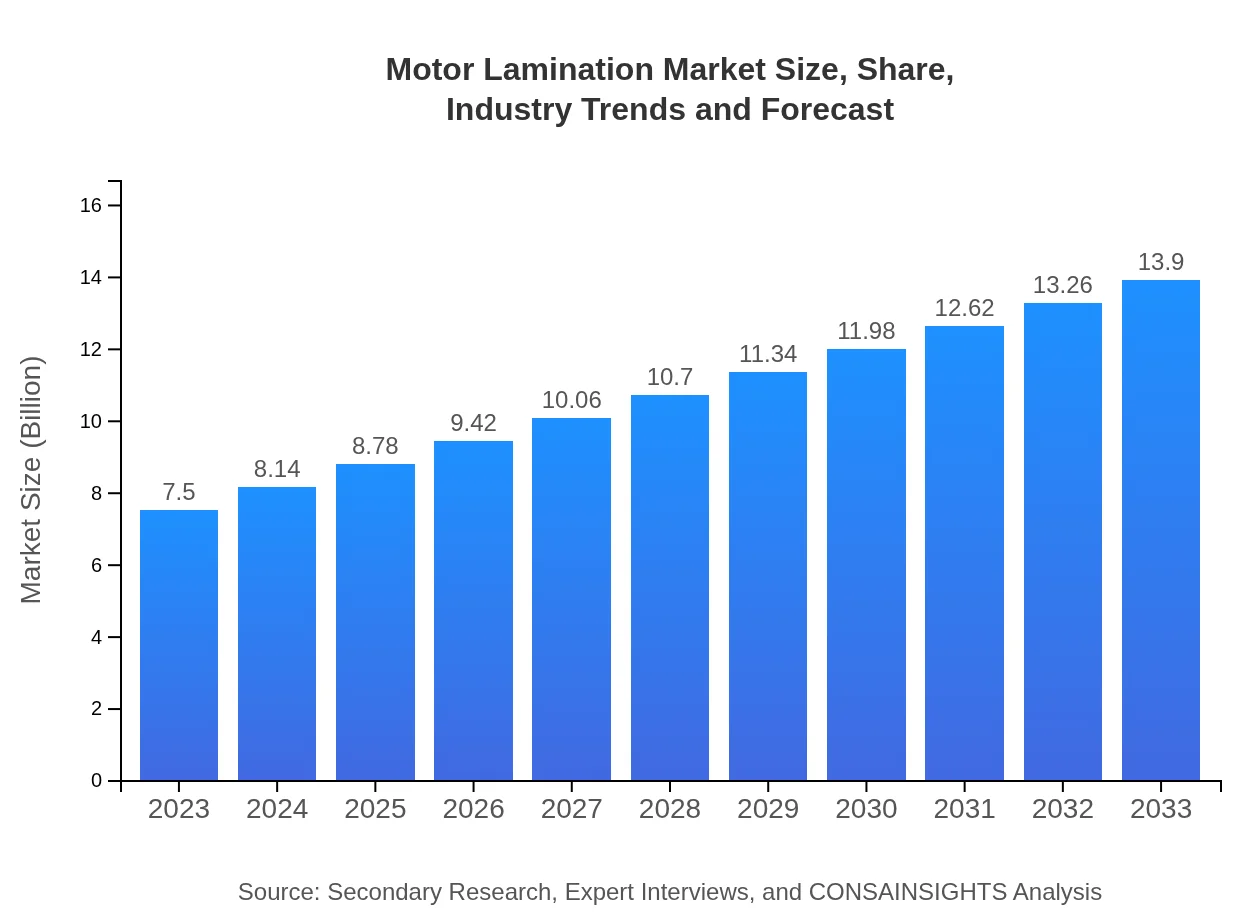

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $13.90 Billion |

| Top Companies | Nippon Steel Corporation, Thyssenkrupp, JFE Steel, AK Steel, POSCO |

| Last Modified Date | 22 January 2026 |

Motor Lamination Market Overview

Customize Motor Lamination Market Report market research report

- ✔ Get in-depth analysis of Motor Lamination market size, growth, and forecasts.

- ✔ Understand Motor Lamination's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Motor Lamination

What is the Market Size & CAGR of Motor Lamination market in 2023?

Motor Lamination Industry Analysis

Motor Lamination Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Motor Lamination Market Analysis Report by Region

Europe Motor Lamination Market Report:

The European region shows significant growth potential, increasing from $2.44 billion in 2023 to $4.52 billion by 2033, driven by stringent regulatory frameworks promoting energy efficiency and sustainability in manufacturing practices.Asia Pacific Motor Lamination Market Report:

In the Asia Pacific region, the Motor Lamination market is expected to grow from $1.36 billion in 2023 to $2.51 billion by 2033, driven by rapid industrialization, a growing automotive sector, and increasing consumer electronics demand.North America Motor Lamination Market Report:

In North America, the market is anticipated to expand from $2.66 billion in 2023 to $4.93 billion by 2033, fueled by advancements in automation technology and the increasing adoption of electric vehicles.South America Motor Lamination Market Report:

The South American market for Motor Lamination is projected to rise from $0.09 billion in 2023 to $0.16 billion by 2033, bolstered by growing investments in infrastructure and automotives, albeit at a slower pace due to economic challenges.Middle East & Africa Motor Lamination Market Report:

The Middle East and Africa market is expected to grow from $0.95 billion in 2023 to $1.76 billion by 2033, influenced by rising demand for electrical infrastructure and energy-efficient solutions in various sectors.Tell us your focus area and get a customized research report.

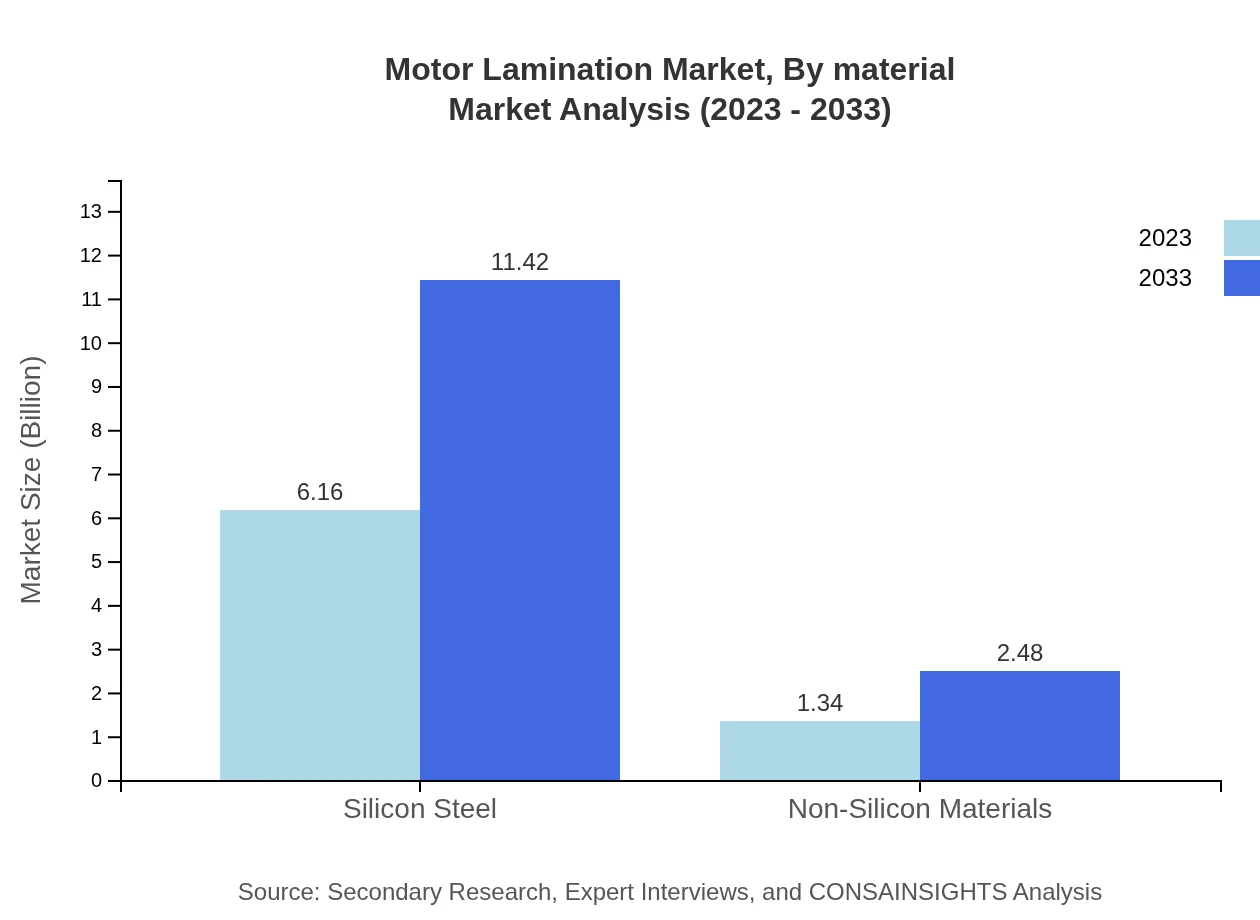

Motor Lamination Market Analysis By Material

The market segment for materials, particularly silicon steel, dominates the landscape with a projected growth from $6.16 billion in 2023 to $11.42 billion by 2033, attributed to its high efficiency and low electrical losses. Non-silicon materials, although smaller, are expected to gradually increase in presence, demonstrating the sector's innovation in composite materials.

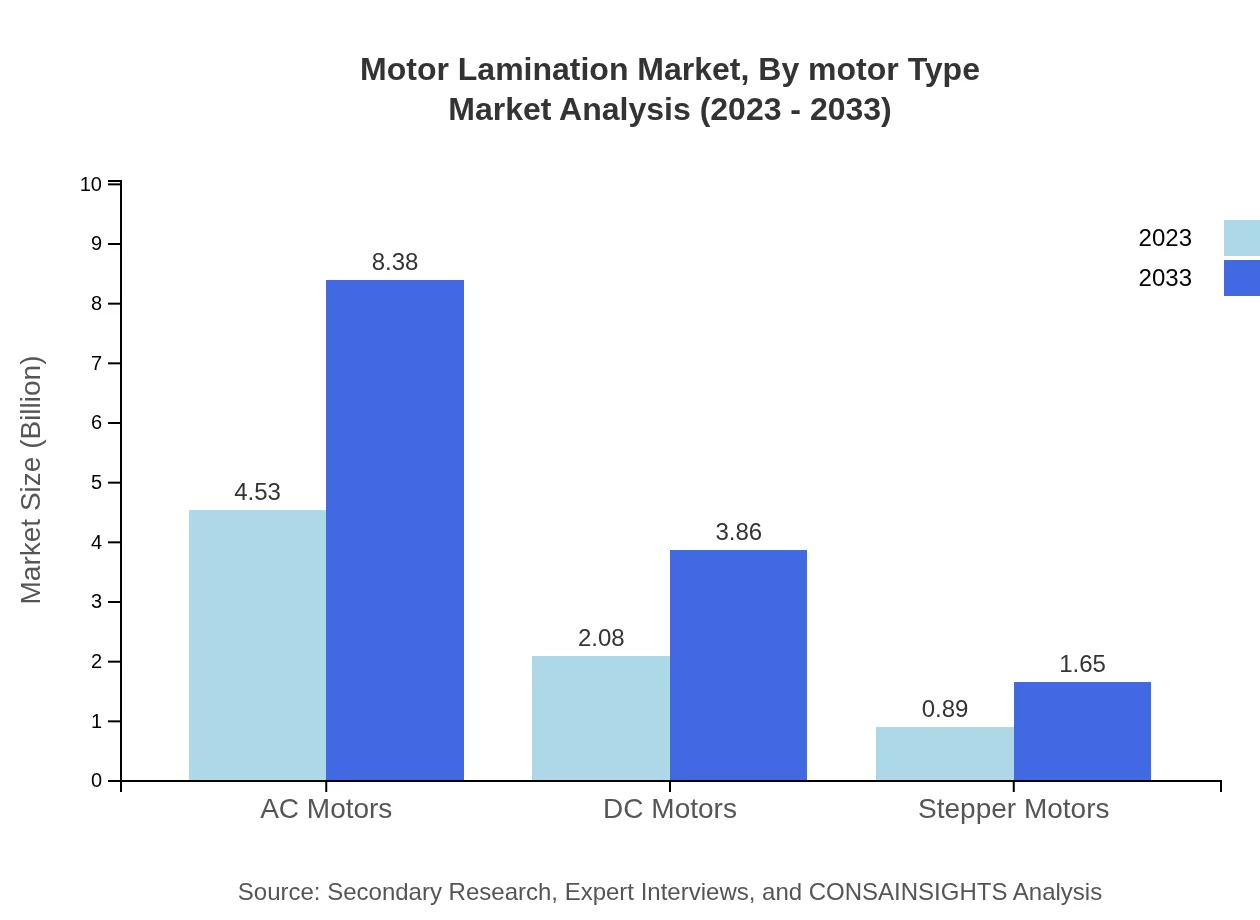

Motor Lamination Market Analysis By Motor Type

AC Motors represent the largest segment, expanding from $4.53 billion in 2023 to $8.38 billion in 2033. This segment benefits from the broad application in industrial and consumer electronics. Notably, the DC motor segment is also growing, from $2.08 billion to $3.86 billion, supported by demand in automotive and robotics industries.

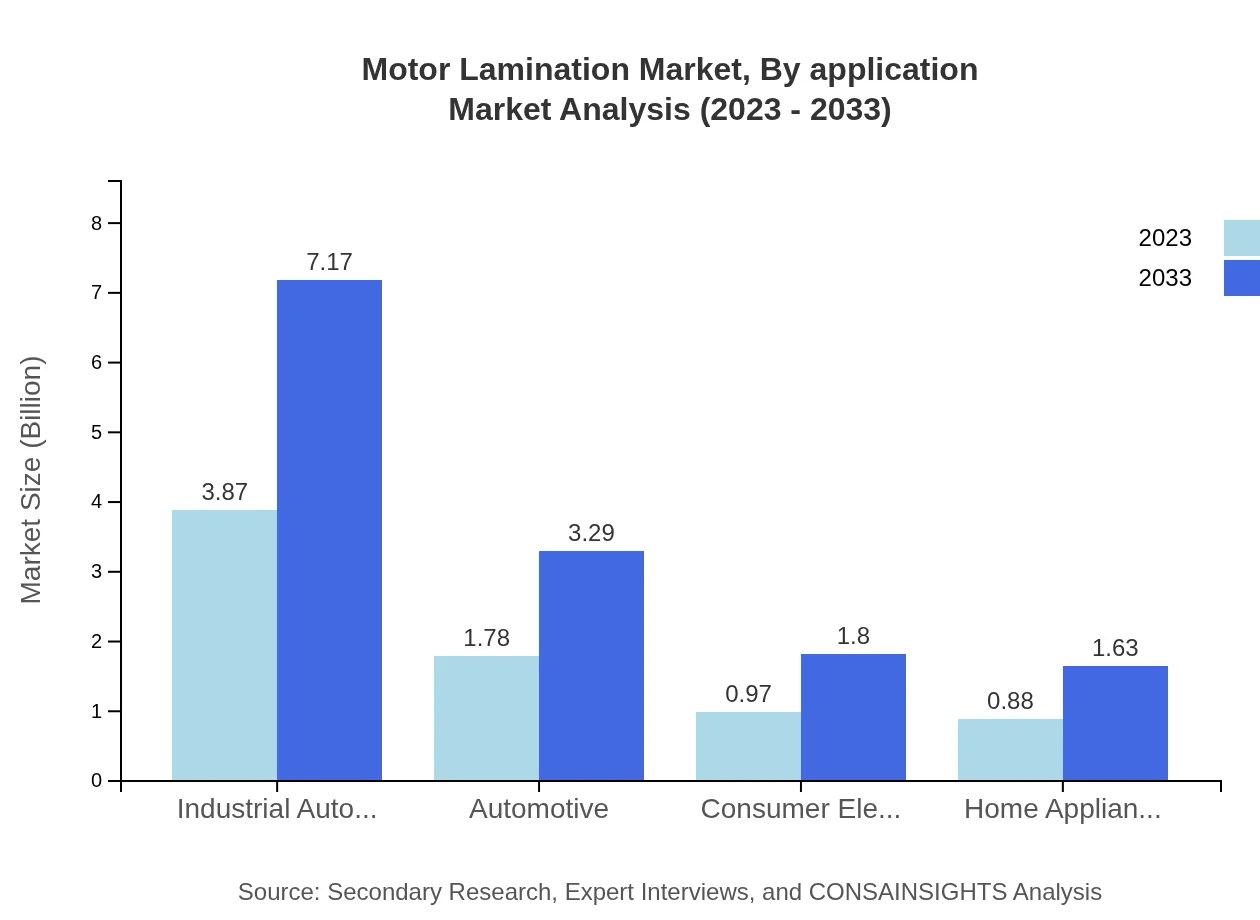

Motor Lamination Market Analysis By Application

The industrial automation segment is expected to witness significant growth, rising from $3.87 billion in 2023 to $7.17 billion by 2033, while the automotive segment also increases from $1.78 billion to $3.29 billion, reflecting the automotive industry's shift towards electric vehicles and advanced manufacturing processes.

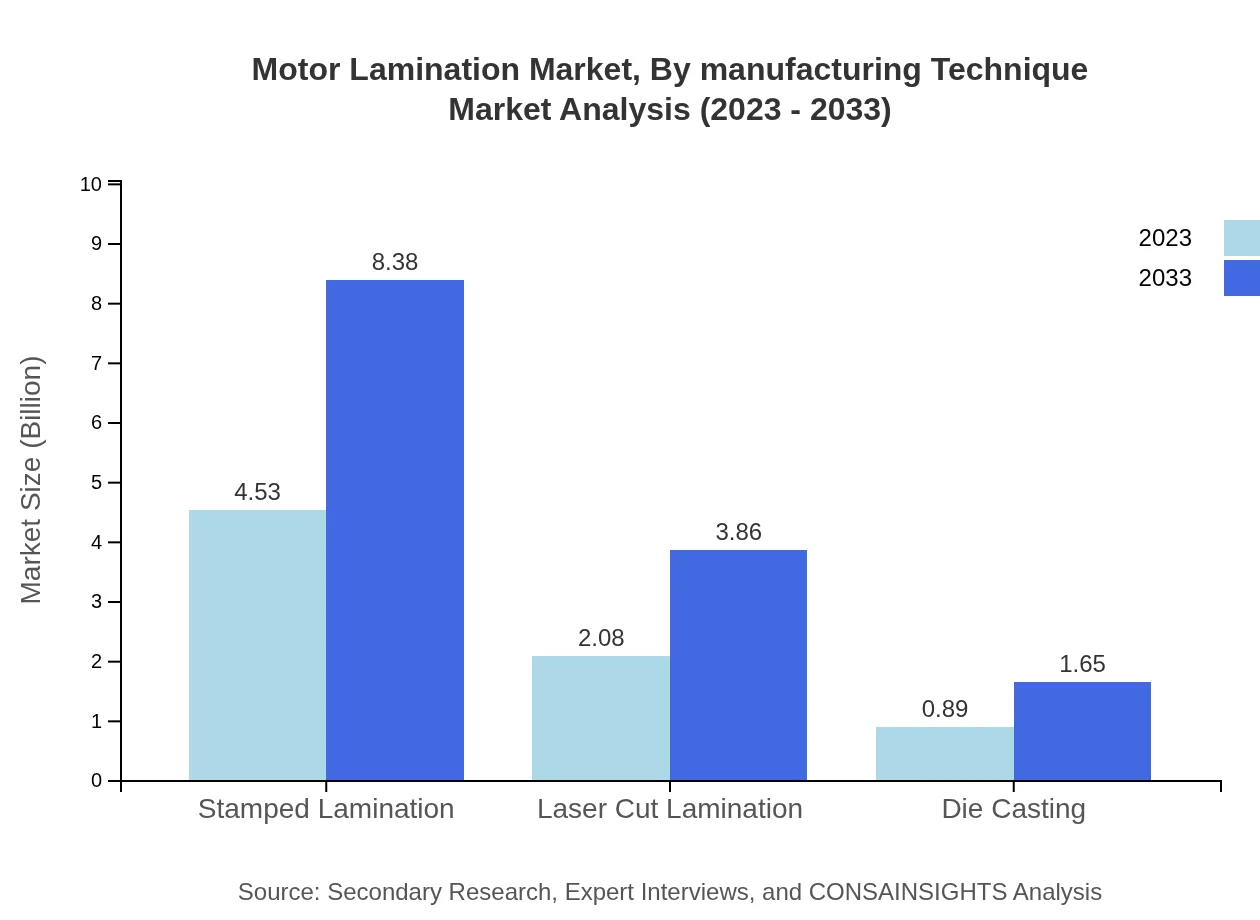

Motor Lamination Market Analysis By Manufacturing Technique

Stamped lamination continues to hold a major share, with market size growing from $4.53 billion in 2023 to $8.38 billion by 2033, due to its cost efficiency. Laser-cut lamination is also emerging, showing growth from $2.08 billion to $3.86 billion as manufacturers seek precision and flexibility in production.

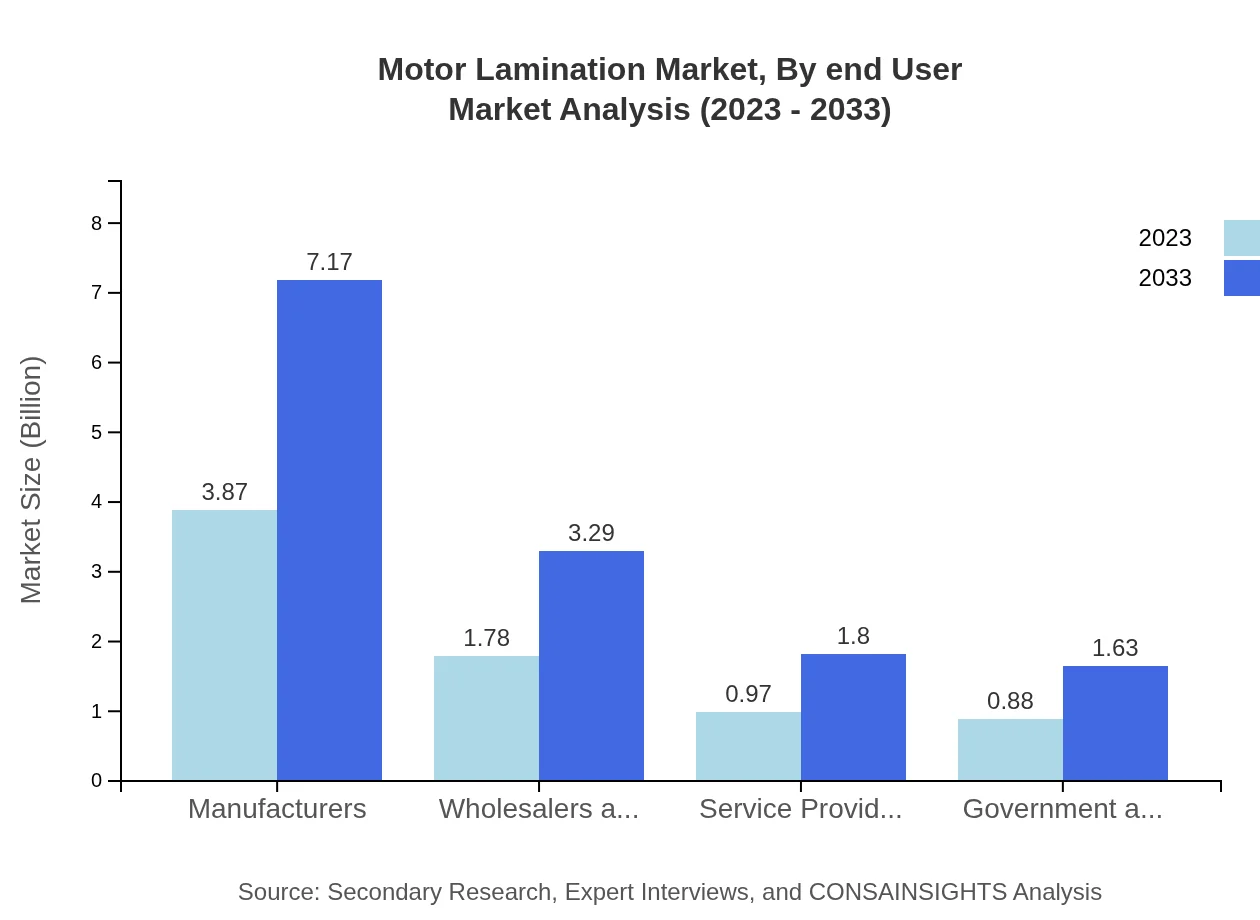

Motor Lamination Market Analysis By End User

End-user segments show diverse growth, particularly in industrial automation and automotive end-users. The automotive segment is expected to see growth from $1.78 billion to $3.29 billion while consumer electronics holds steady with a growth from $0.97 billion to $1.80 billion.

Motor Lamination Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Motor Lamination Industry

Nippon Steel Corporation:

A leading manufacturer of electrical steel sheets, Nippon Steel focuses on high-performance motor laminations used in various industries, particularly in automotive applications.Thyssenkrupp:

Thyssenkrupp is known for producing premium quality electrical steel, enabling manufacturers to create more energy-efficient and high-performing electric motors.JFE Steel:

As one of Japan's foremost steel producers, JFE Steel offers advanced electrical steel solutions that cater to multiple sectors, driving innovations in the motor lamination space.AK Steel:

Part of Cleveland-Cliffs Inc., AK Steel specializes in silicon-based steel products, applying sophisticated production techniques to enhance motor efficiency.POSCO:

A South Korean steel producer recognized for its focus on high-quality electrical steel laminations that meet international standards for energy efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of motor Lamination?

The motor-lamination market is valued at approximately $7.5 billion in 2023, with an expected growth at a CAGR of 6.2%. By 2033, the market is projected to expand significantly, reflecting its increasing importance in various applications.

What are the key market players or companies in this motor Lamination industry?

Key players in the motor-lamination industry include major manufacturers and distributors that collectively shape the market landscape. Their innovations and competitive strategies drive advancements in efficiency and technology in motor lamination, contributing to robust growth.

What are the primary factors driving the growth in the motor Lamination industry?

Key growth drivers in the motor-lamination industry include rising demand for electric vehicles, advancements in industrial automation, and increasing energy efficiency requirements in motor design, fostering a surge in innovation and market expansion.

Which region is the fastest Growing in the motor Lamination?

The fastest-growing region in the motor-lamination market is projected to be Europe, expanding from $2.44 billion in 2023 to $4.52 billion by 2033, driven by strong automotive and industrial sector growth in this area.

Does ConsaInsights provide customized market report data for the motor Lamination industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the motor-lamination industry. This flexibility ensures that clients receive tailored insights that align with their strategic objectives.

What deliverables can I expect from this motor Lamination market research project?

Clients can expect comprehensive deliverables from the motor-lamination market research project, including detailed market reports, analysis of segments, competitive landscape insights, and actionable recommendations for market strategies.

What are the market trends of motor Lamination?

Current market trends in motor-lamination indicate a shift towards higher efficiency materials, greater integration of smart technology in motors, and increased focus on sustainability, shaping the future landscape of this vital industry.