Mro Software Market Report

Published Date: 31 January 2026 | Report Code: mro-software

Mro Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the MRO Software market, covering insights and data for the forecast period 2023 to 2033, including market size, industry trends, regional insights, and growth opportunities.

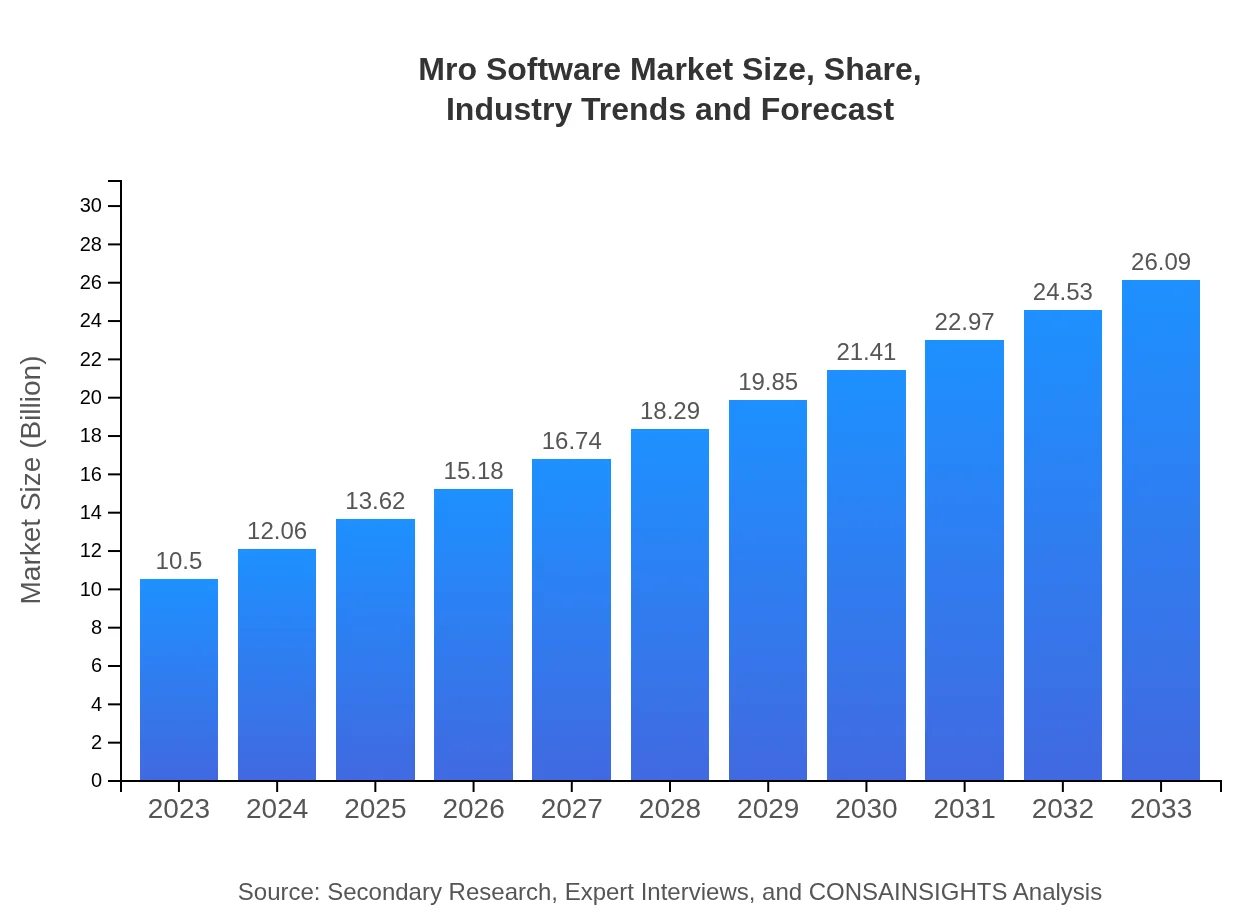

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | SAP, IBM, Oracle, Infor |

| Last Modified Date | 31 January 2026 |

MRO Software Market Overview

Customize Mro Software Market Report market research report

- ✔ Get in-depth analysis of Mro Software market size, growth, and forecasts.

- ✔ Understand Mro Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Mro Software

What is the Market Size & CAGR of MRO Software market in 2023 and 2033?

MRO Software Industry Analysis

MRO Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

MRO Software Market Analysis Report by Region

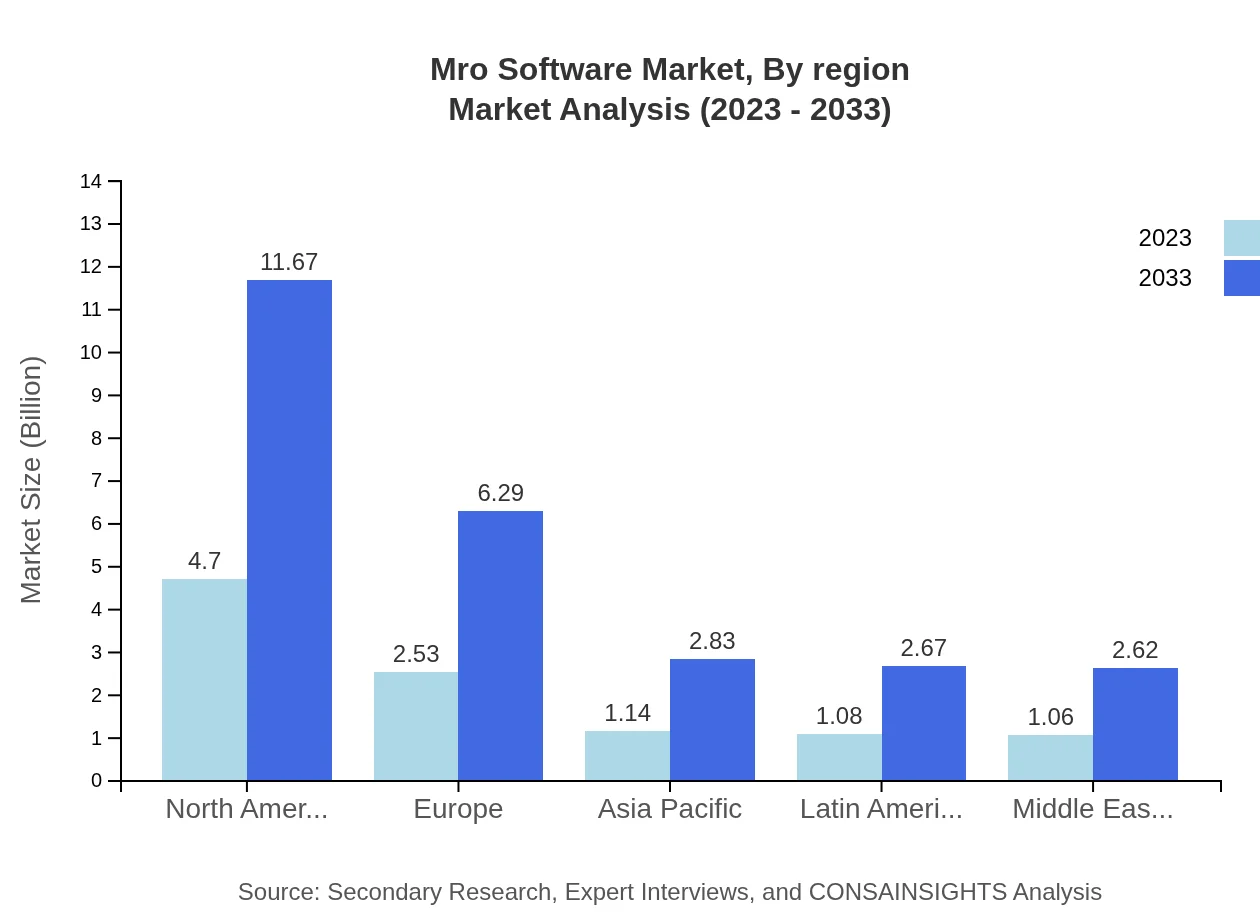

Europe Mro Software Market Report:

Europe's MRO Software market size is forecasted to increase from $3.24 billion in 2023 to $8.06 billion by 2033. The region’s stringent regulations regarding asset management and maintenance contribute to the strong demand for sophisticated MRO solutions.Asia Pacific Mro Software Market Report:

In the Asia Pacific region, the MRO Software market is expected to grow from an estimated $1.90 billion in 2023 to $4.73 billion by 2033. This growth is supported by increasing industrial activity, especially in countries like China and India, where rapid infrastructure development is necessitating advanced maintenance solutions.North America Mro Software Market Report:

North America is anticipated to maintain its leadership in the MRO Software market with expected growth from $3.86 billion in 2023 to $9.59 billion by 2033. The high adoption of technology and the focus on increasing operational efficiency make North America a significant market.South America Mro Software Market Report:

The Latin American MRO Software market is projected to grow from $0.63 billion in 2023 to $1.57 billion by 2033. This growth will be driven by investments in the oil and gas, as well as manufacturing sectors, which increasingly require efficient maintenance management.Middle East & Africa Mro Software Market Report:

The Middle East and Africa MRO Software market is poised for growth from $0.86 billion in 2023 to $2.14 billion by 2033. Investments in energy and utilities sectors, especially in renewable energy projects, are pushing the adoption of MRO solutions in these industries.Tell us your focus area and get a customized research report.

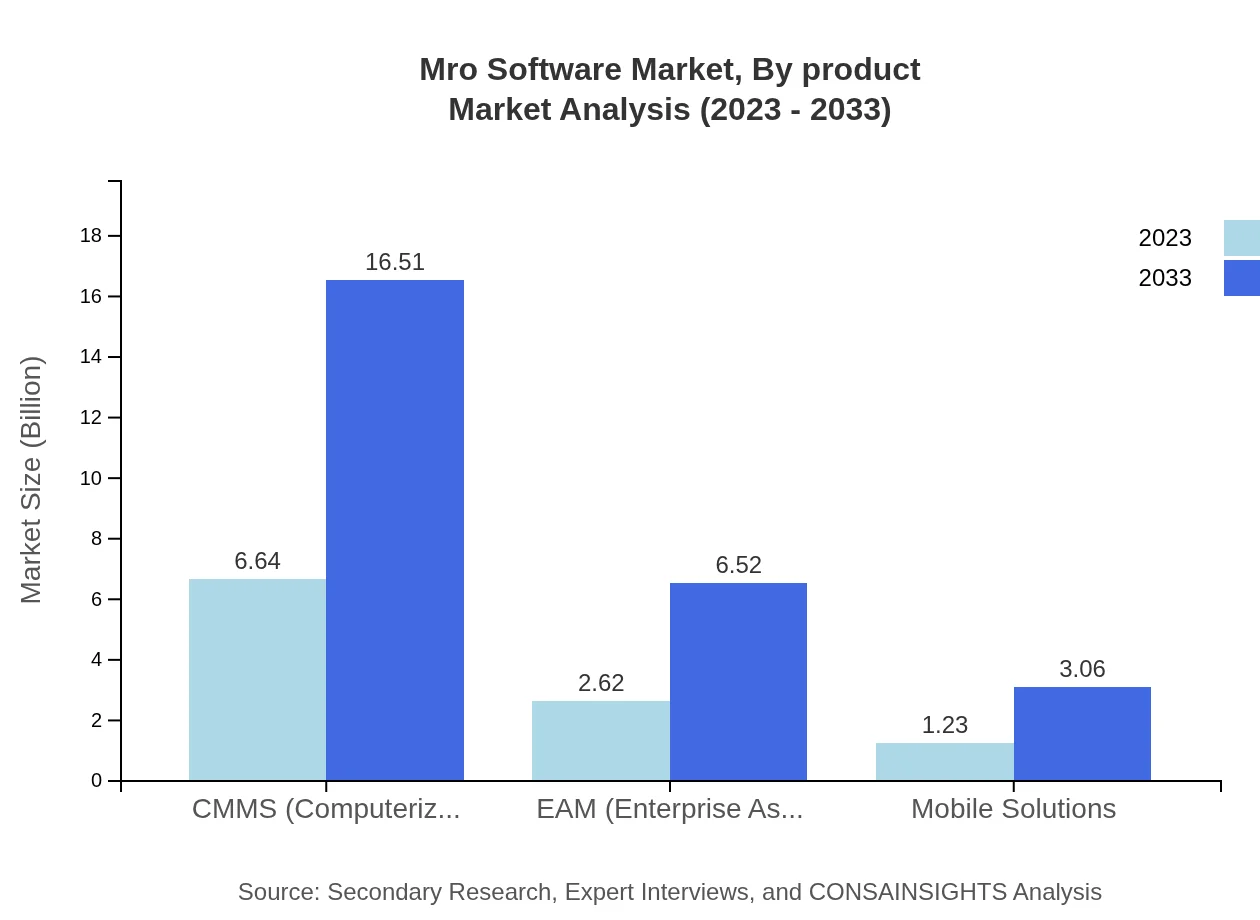

Mro Software Market Analysis By Product

The MRO Software market, segmented by product, prominently features CMMS and EAM solutions, with CMMS occupying the largest market share due to its widespread application in various sectors. By 2033, CMMS is expected to account for approximately 63% of the market share, reflecting its critical role in maintenance operations.

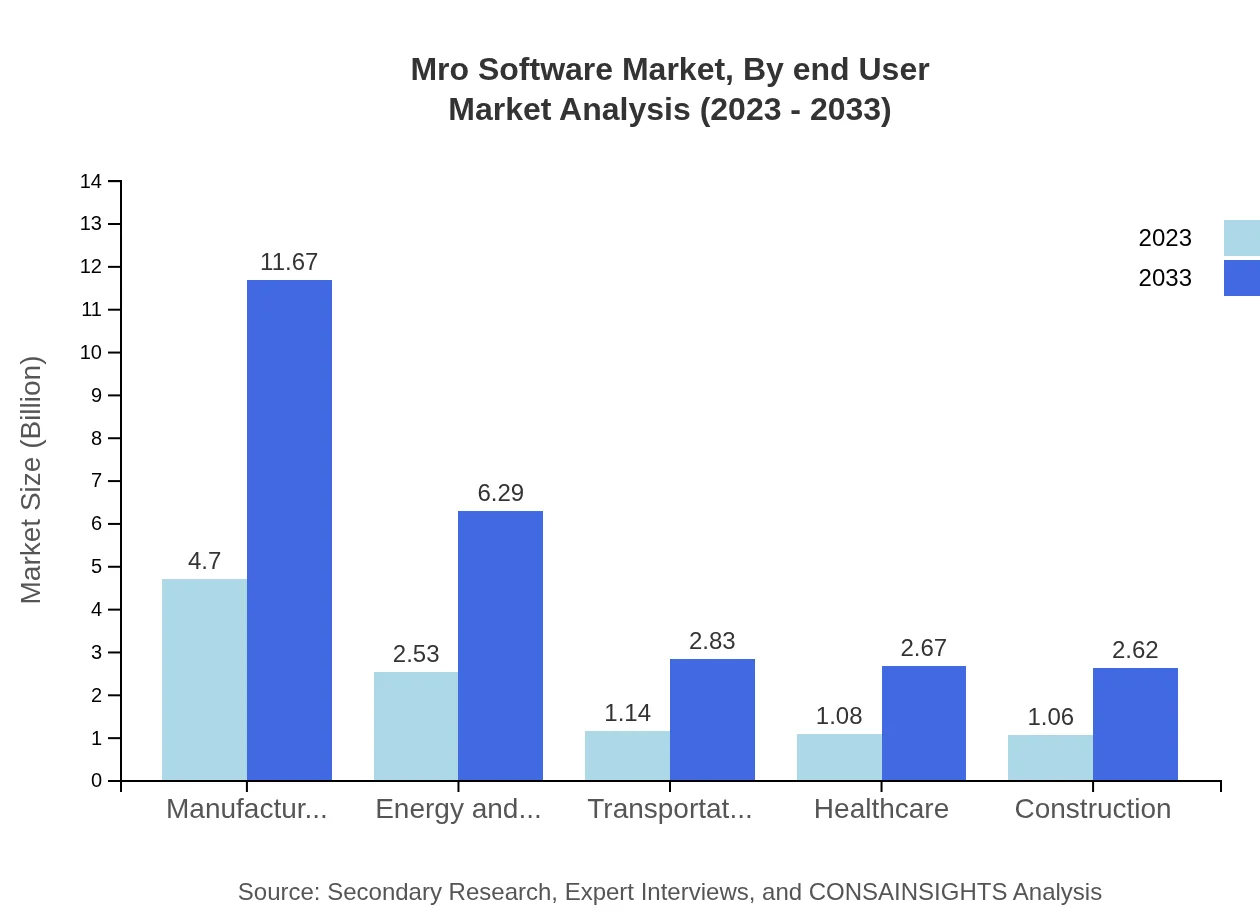

Mro Software Market Analysis By End User

The manufacturing sector holds the highest share in the MRO Software market, reflecting its large-scale operations and need for rigorous maintenance protocols. By 2033, this sector is projected to maintain a notable market share of about 44.72%, emphasizing the importance of MRO solutions in operational efficiency.

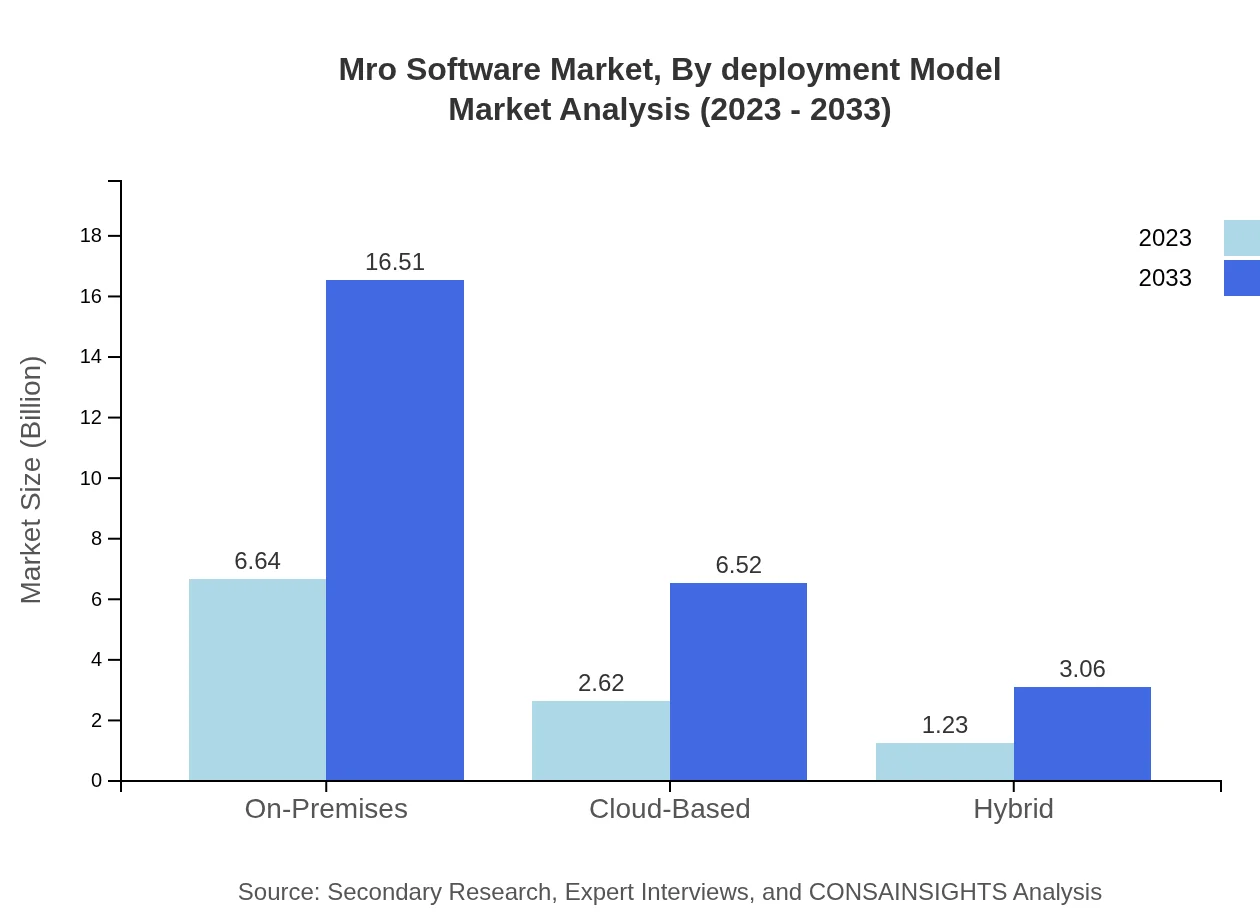

Mro Software Market Analysis By Deployment Model

On-premises solutions continue to dominate the deployment model segment, accounting for about 63.28% of market share in 2023. However, cloud-based solutions are rapidly gaining traction, with growth driven by their flexibility and cost-effective nature, expected to grow to a 24.99% share by 2033.

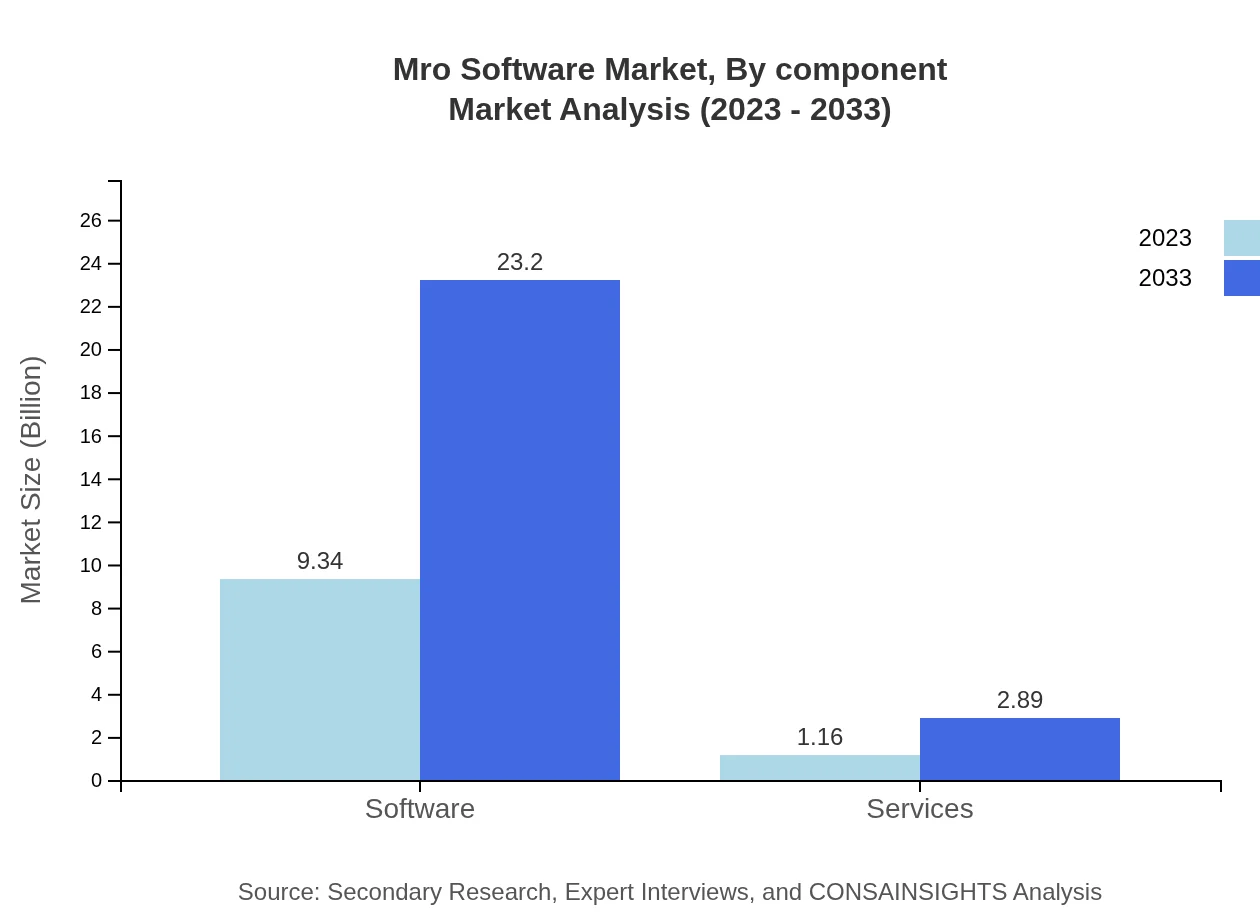

Mro Software Market Analysis By Component

The component segmentation of MRO Software indicates software systems leading with a market share of around 89%, showcasing the critical role of software in MRO functionalities, while services represent about 11%. This demonstrates the reliance on technology for maintenance operations.

Mro Software Market Analysis By Region

Each region's growth trajectory in the MRO Software market shows diverse patterns, with North America leading in innovation and adoption, followed by robust growth across Asia Pacific and Europe, driven by industrial demands for reliable maintenance solutions.

MRO Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in MRO Software Industry

SAP:

SAP offers an integrated suite of enterprise solutions, including advanced MRO capabilities tailored for various industries focused on streamlining operations and enhancing asset management.IBM:

IBM provides sophisticated enterprise asset management solutions leveraging AI and analytics, allowing organizations to predict maintenance needs and improve operational efficiency.Oracle:

Oracle's cloud-based solutions offer robust MRO functionalities that cater to extensive industries, emphasizing scalability and compliance.Infor:

Infor specializes in cloud-based MRO solutions tailored for manufacturing, energy, and utilities, focusing on service management and asset performance optimization.We're grateful to work with incredible clients.

FAQs

What is the market size of mro Software?

The MRO Software market was valued at $10.5 billion in 2023 and is projected to grow at a CAGR of 9.2%, expecting to reach a significant valuation by 2033, driven by increasing automation and efficiency needs across industries.

What are the key market players or companies in this mro Software industry?

Key players in the MRO Software industry encompass leading companies such as IBM, SAP, and Oracle, which dominate with comprehensive solutions, alongside emerging firms offering niche innovations aimed at optimizing asset management and maintenance strategies.

What are the primary factors driving the growth in the mro Software industry?

Growth in the MRO Software industry is driven by factors including technological advancements, increasing demand for asset reliability, regulatory compliance needs, and the rising shift towards predictive maintenance methodologies from reactive maintenance.

Which region is the fastest Growing in the mro Software?

The Asia Pacific region is experiencing the fastest growth in the MRO Software market. With a projected increase from $1.90 billion in 2023 to $4.73 billion by 2033, it highlights the rapid industrialization and technology adoption in this area.

Does ConsaInsights provide customized market report data for the mro Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the MRO Software industry. This ensures businesses receive unique insights and analyses that cater directly to their market or competitive landscape.

What deliverables can I expect from this mro Software market research project?

From the MRO Software market research project, you can expect detailed reports including market size forecasts, competitive landscape analysis, regional growth trends, and actionable insights that support strategic business decisions.

What are the market trends of mro Software?

Key market trends in MRO Software include the rise of AI-driven maintenance solutions, cloud-based service implementations, and increasing integration of IoT technologies for real-time data analytics and enhanced operational efficiency.