Music Publishing Market Report

Published Date: 31 January 2026 | Report Code: music-publishing

Music Publishing Market Size, Share, Industry Trends and Forecast to 2033

This report explores the current landscape and future outlook of the Music Publishing industry from 2023 to 2033, providing insights into market size, growth trends, and segmentation analysis.

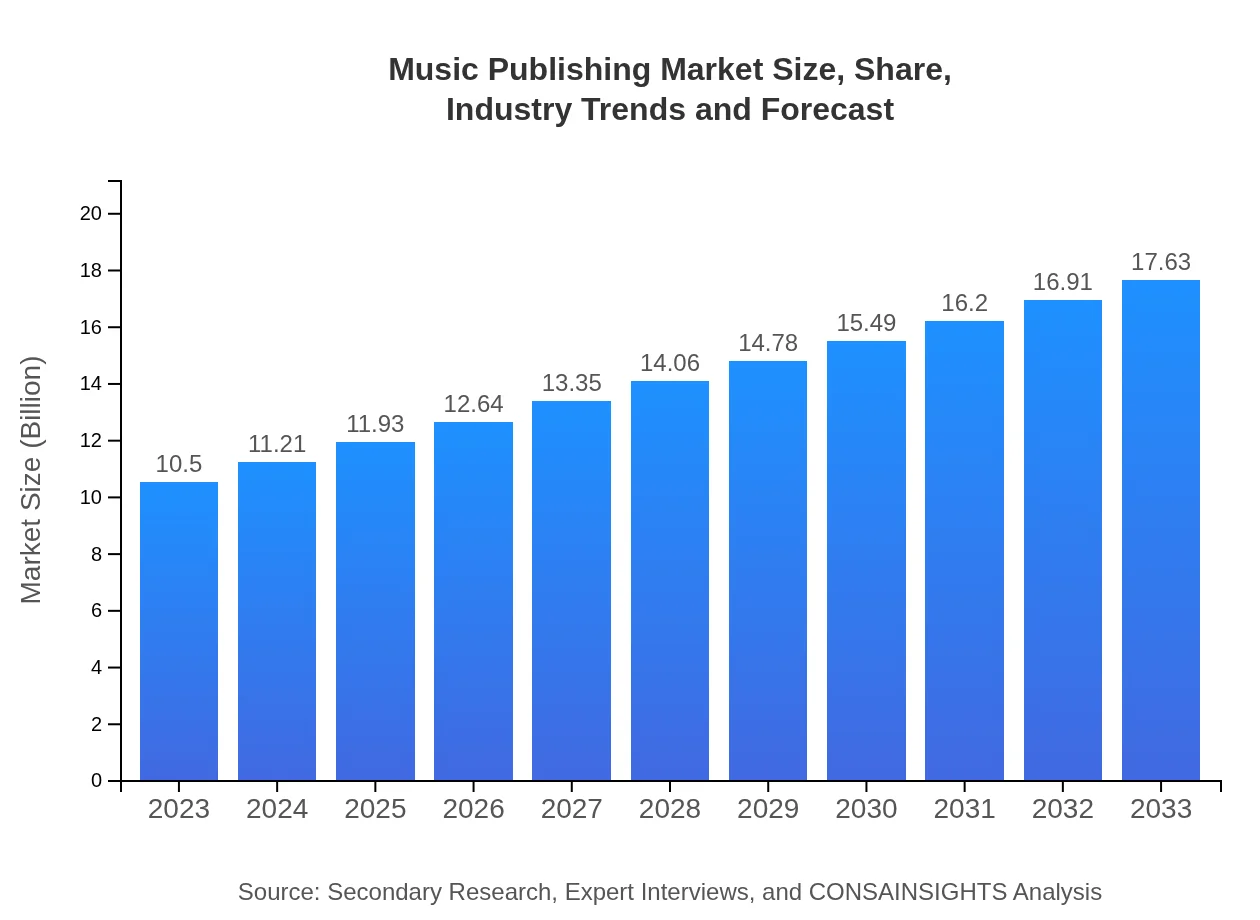

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.63 Billion |

| Top Companies | Universal Music Publishing Group, Sony Music Publishing, Warner Music Group, Kobalt Music Group |

| Last Modified Date | 31 January 2026 |

Music Publishing Market Overview

Customize Music Publishing Market Report market research report

- ✔ Get in-depth analysis of Music Publishing market size, growth, and forecasts.

- ✔ Understand Music Publishing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Music Publishing

What is the Market Size & CAGR of the Music Publishing market in 2023?

Music Publishing Industry Analysis

Music Publishing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Music Publishing Market Analysis Report by Region

Europe Music Publishing Market Report:

Europe remains a substantial market, currently valued at $3.17 billion and expected to reach $5.33 billion by 2033. The diversity of music cultures and robust legal frameworks supporting music rights play a pivotal role in this region.Asia Pacific Music Publishing Market Report:

The Asia Pacific region is set to experience considerable growth, with the market size expected to increase from $1.90 billion in 2023 to $3.20 billion by 2033. This growth is driven by rising smartphone penetration and increased access to streaming services.North America Music Publishing Market Report:

North America leads the global market with an estimated size of $3.91 billion in 2023, growing to $6.57 billion by 2033. This growth is underpinned by established streaming services and a strong music industry infrastructure.South America Music Publishing Market Report:

In South America, the Music Publishing market is projected to grow from $0.63 billion in 2023 to $1.05 billion by 2033. The youth demographic and the growing adoption of digital platforms contribute to this upward trend.Middle East & Africa Music Publishing Market Report:

The Middle East and Africa market is forecasted to increase from $0.88 billion in 2023 to $1.48 billion by 2033. This growth is facilitated by increasing internet access and mobile device usage.Tell us your focus area and get a customized research report.

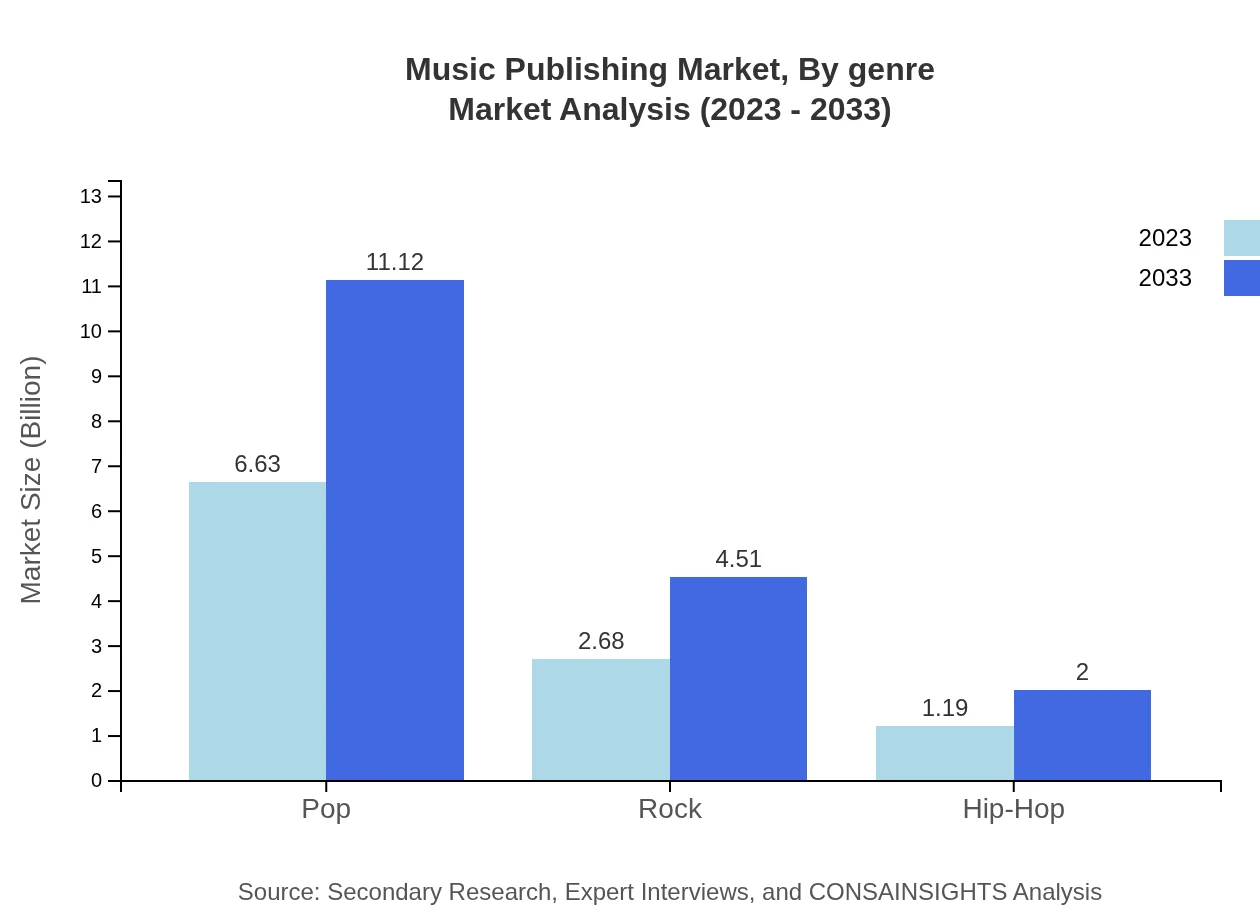

Music Publishing Market Analysis By Genre

The genre distribution highlights Pop music leading the market with $6.63 billion in 2023, projected to reach $11.12 billion by 2033. Rock holds a sizeable share at $2.68 billion, growing to $4.51 billion, while Hip-Hop shows potential with a rise from $1.19 billion to $2.00 billion within the same timeframe.

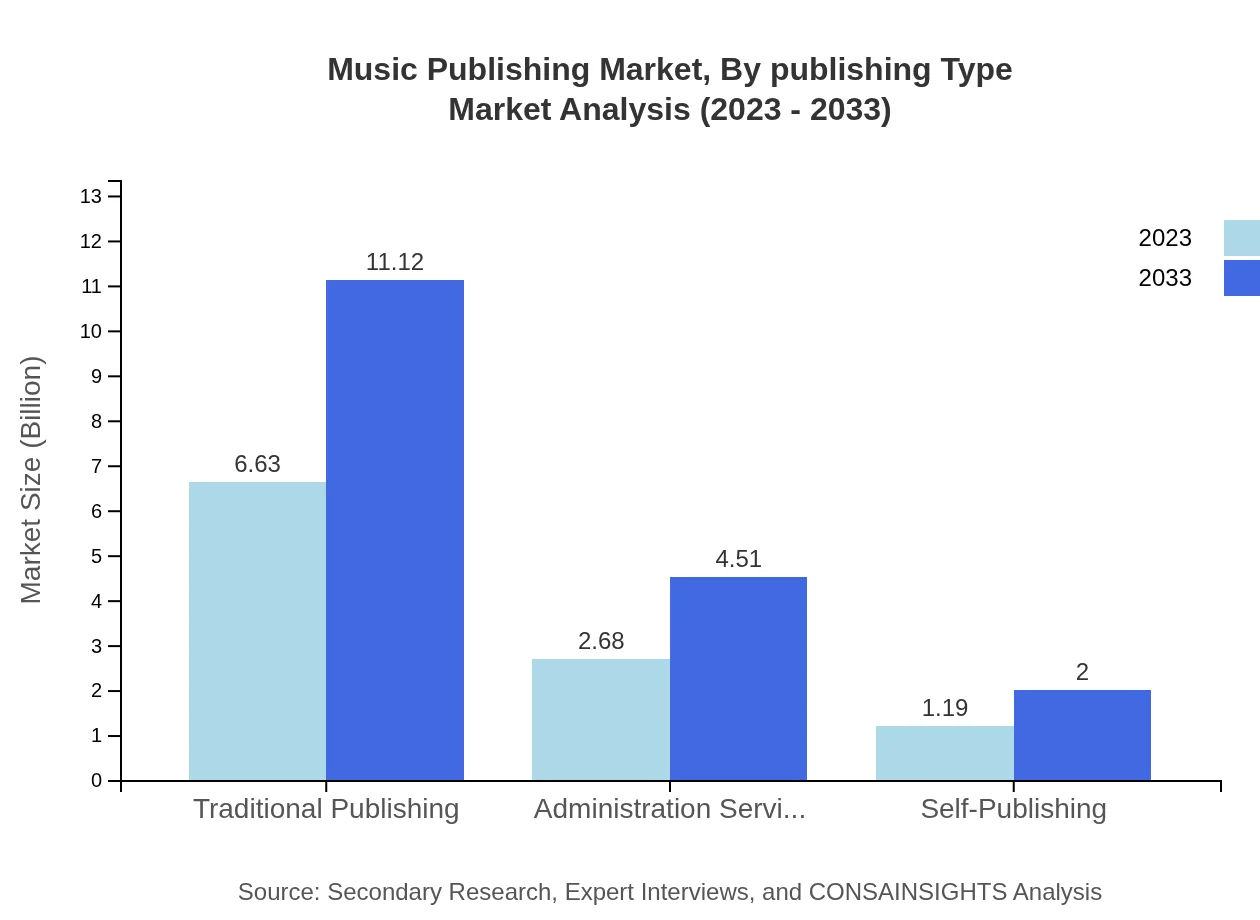

Music Publishing Market Analysis By Publishing Type

Traditional Publishing comprises $6.63 billion in 2023, maintaining a steady share through 2033. In contrast, Self-Publishing is on the rise, with growth from $1.19 billion to $2.00 billion, reflecting the shift towards independent artist autonomy.

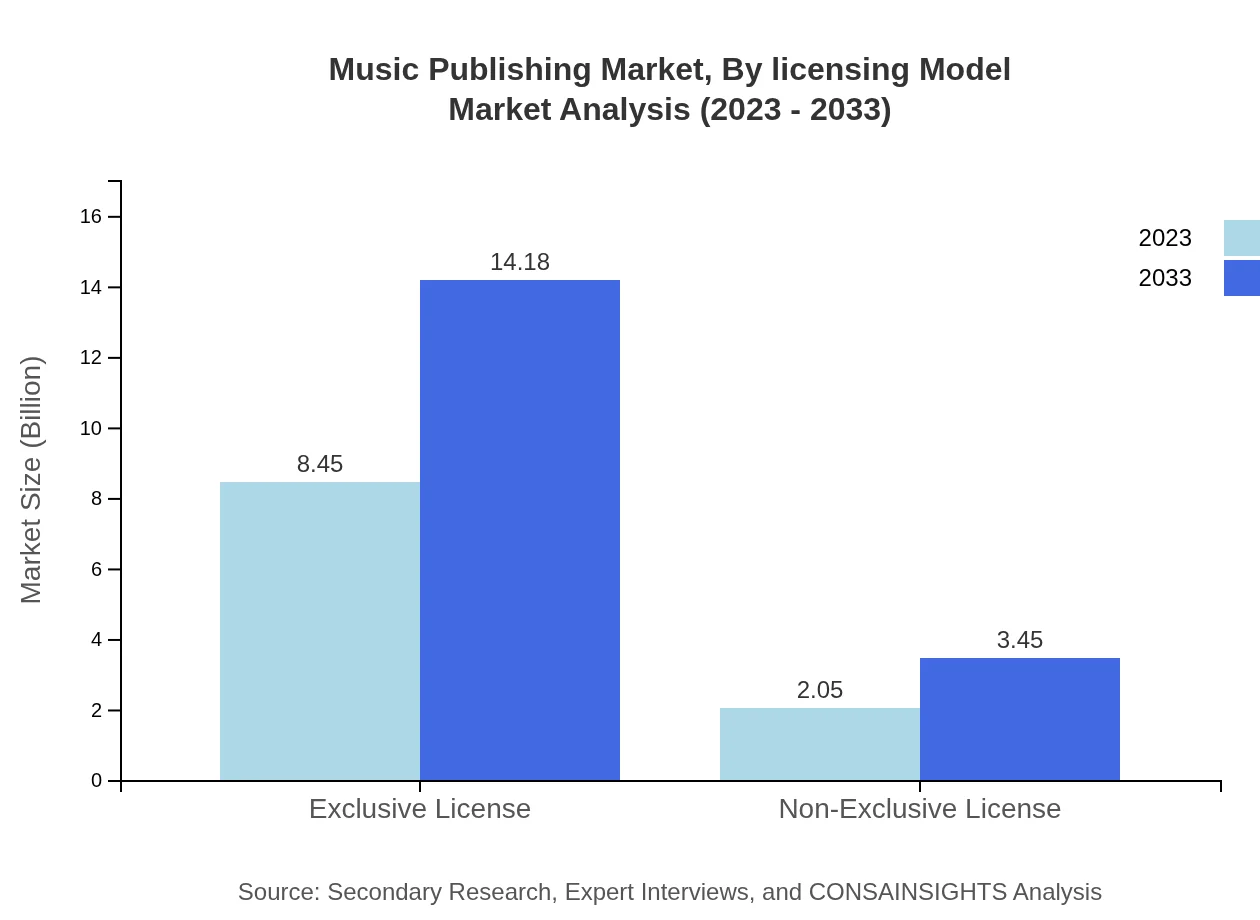

Music Publishing Market Analysis By Licensing Model

Exclusive Licensing dominates the market at $8.45 billion in 2023 and is set to expand to $14.18 billion, reflecting its essential role in revenue generation. Non-Exclusive Licensing, while smaller, shows growth potential from $2.05 billion to $3.45 billion.

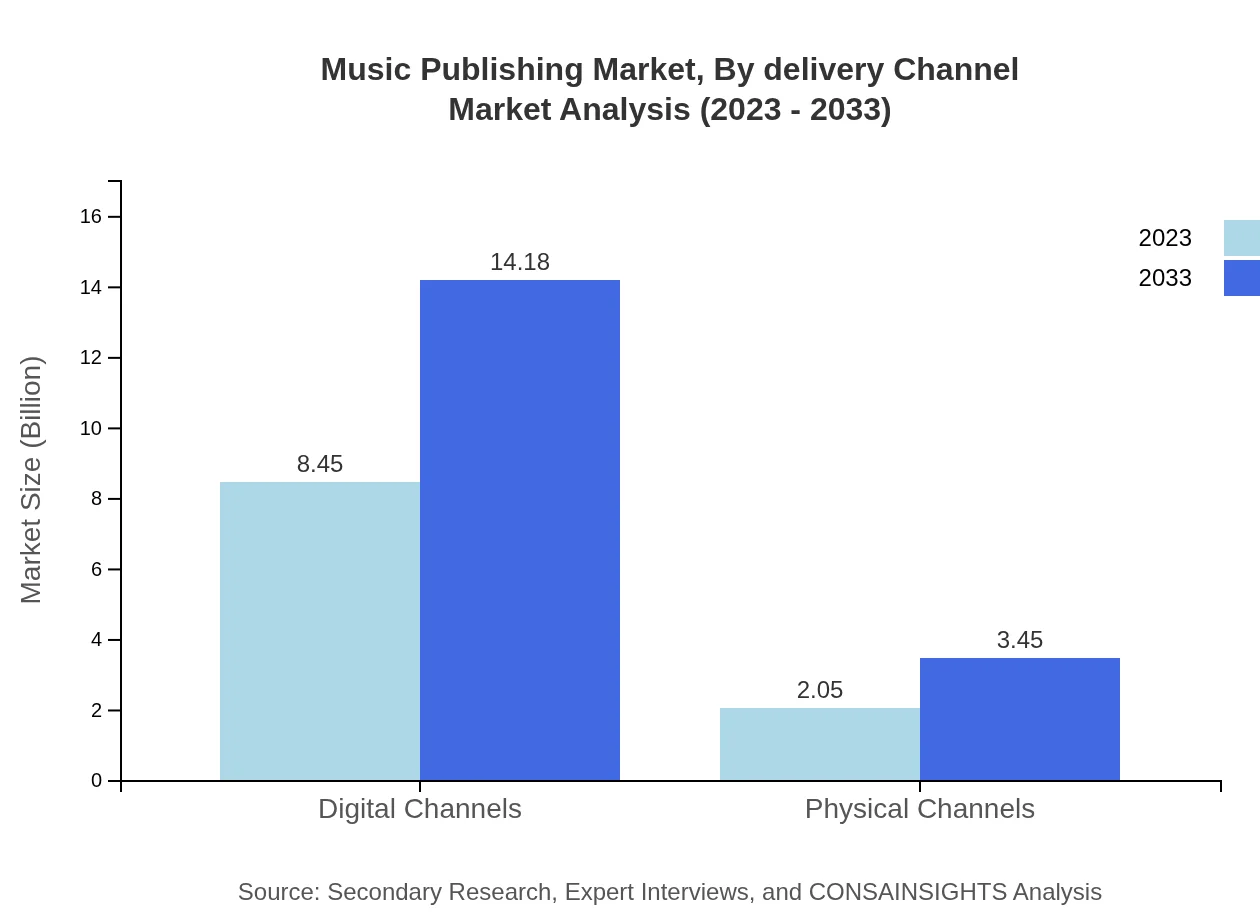

Music Publishing Market Analysis By Delivery Channel

Digital Channels lead the way with $8.45 billion in 2023, projected to rise to $14.18 billion by 2033, indicating a shift away from physical formats which stand at $2.05 billion and are growing less rapidly.

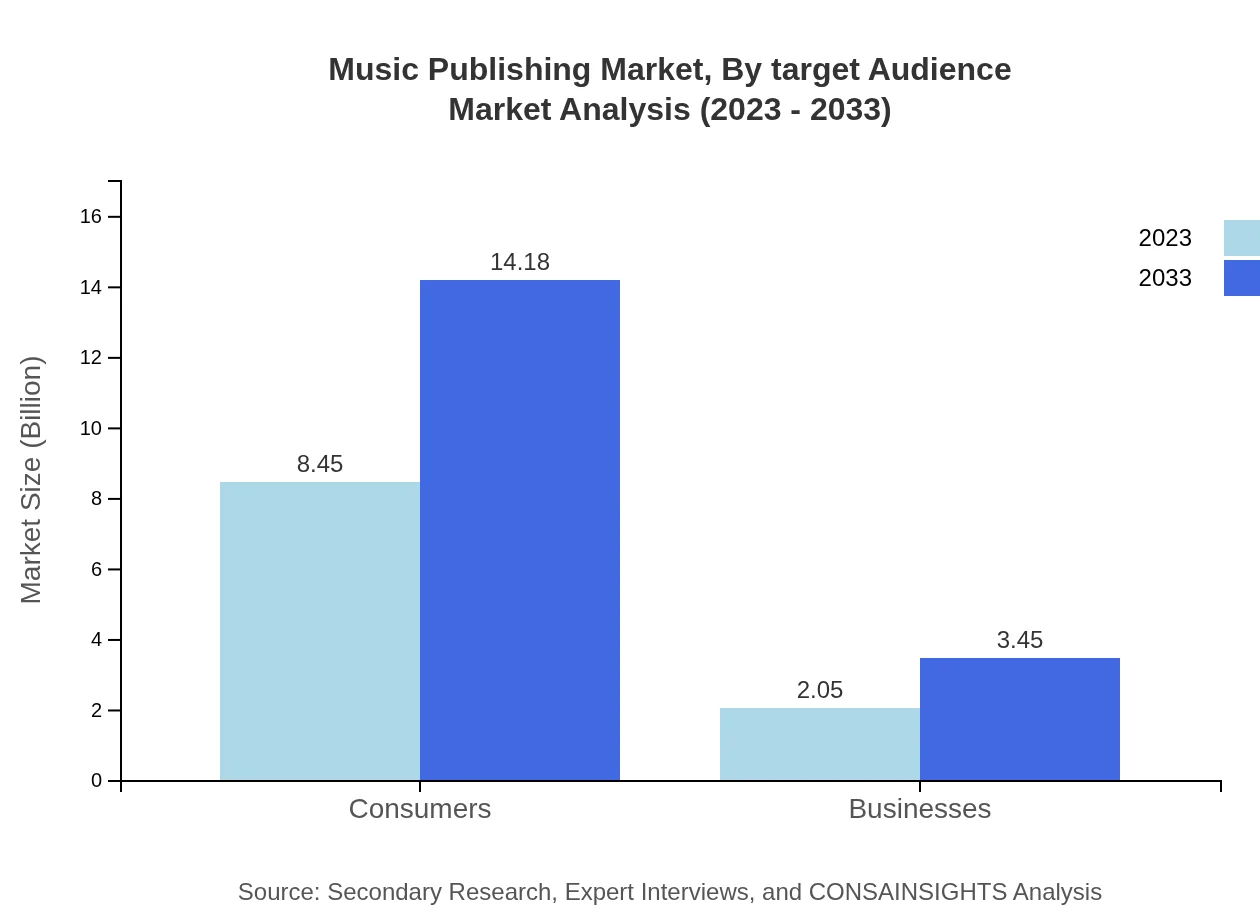

Music Publishing Market Analysis By Target Audience

The consumer segment dominates with $8.45 billion in 2023, expected to maintain this lead towards $14.18 billion. Meanwhile, the business segment grows from $2.05 billion to $3.45 billion, indicating emerging market potentials.

Music Publishing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Music Publishing Industry

Universal Music Publishing Group:

One of the largest music publishing companies globally, managing rights for numerous top artists and labels while providing a comprehensive range of services.Sony Music Publishing:

A leading provider of music publishing services, with a vast catalog and a strong presence in key global markets, enhancing the visibility of its artists.Warner Music Group:

A major player in music publishing, offering innovative solutions for rights management and revenue generation for songwriters and composers.Kobalt Music Group:

Renowned for its transparency and artist-friendly model, Kobalt has revolutionized traditional publishing practices, providing better returns to its contributors.We're grateful to work with incredible clients.

FAQs

What is the market size of music Publishing?

The global music publishing market is projected to grow from $10.5 billion in 2023 to an anticipated size of $17.21 billion by 2033, marking a compound annual growth rate (CAGR) of 5.2% during this period.

What are the key market players or companies in this music Publishing industry?

Key players in the music publishing industry include major companies like Universal Music Publishing Group, Sony Music Publishing, Warner Chappell Music, BMG Rights Management, and Kobalt Music Group, each commanding significant market share and offering diverse artistic works.

What are the primary factors driving the growth in the music publishing industry?

Factors driving growth include the rise of digital streaming services, increasing music consumption worldwide, growth in licensing opportunities, demand for original content across media, and advancements in technology that facilitate easier distribution.

Which region is the fastest Growing in the music publishing?

The fastest-growing region in the music publishing market is North America, projected to grow from $3.91 billion in 2023 to $6.57 billion by 2033, followed closely by Europe and Asia Pacific in terms of growth rate.

Does ConsaInsights provide customized market report data for the music publishing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the music publishing sector, enabling detailed analysis of niche areas or specific market segments based on client requirements.

What deliverables can I expect from this music publishing market research project?

Deliverables include comprehensive market reports, segmented analysis, consumer insights, trend forecasts, competitive landscapes, and actionable recommendations to help stakeholders strategically position themselves within the market.

What are the market trends of music publishing?

Current trends include a shift towards digital distribution, the importance of sync licensing for media use, growth in self-publishing among artists, and increasing consumer access to music via emerging platforms and technologies.