Myocardial Infarction Drugs Market Report

Published Date: 31 January 2026 | Report Code: myocardial-infarction-drugs

Myocardial Infarction Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Myocardial Infarction Drugs market, projecting insights from 2023 to 2033. It includes market size and growth forecasts, regional insights, industry analysis, and detailed information on segment performances.

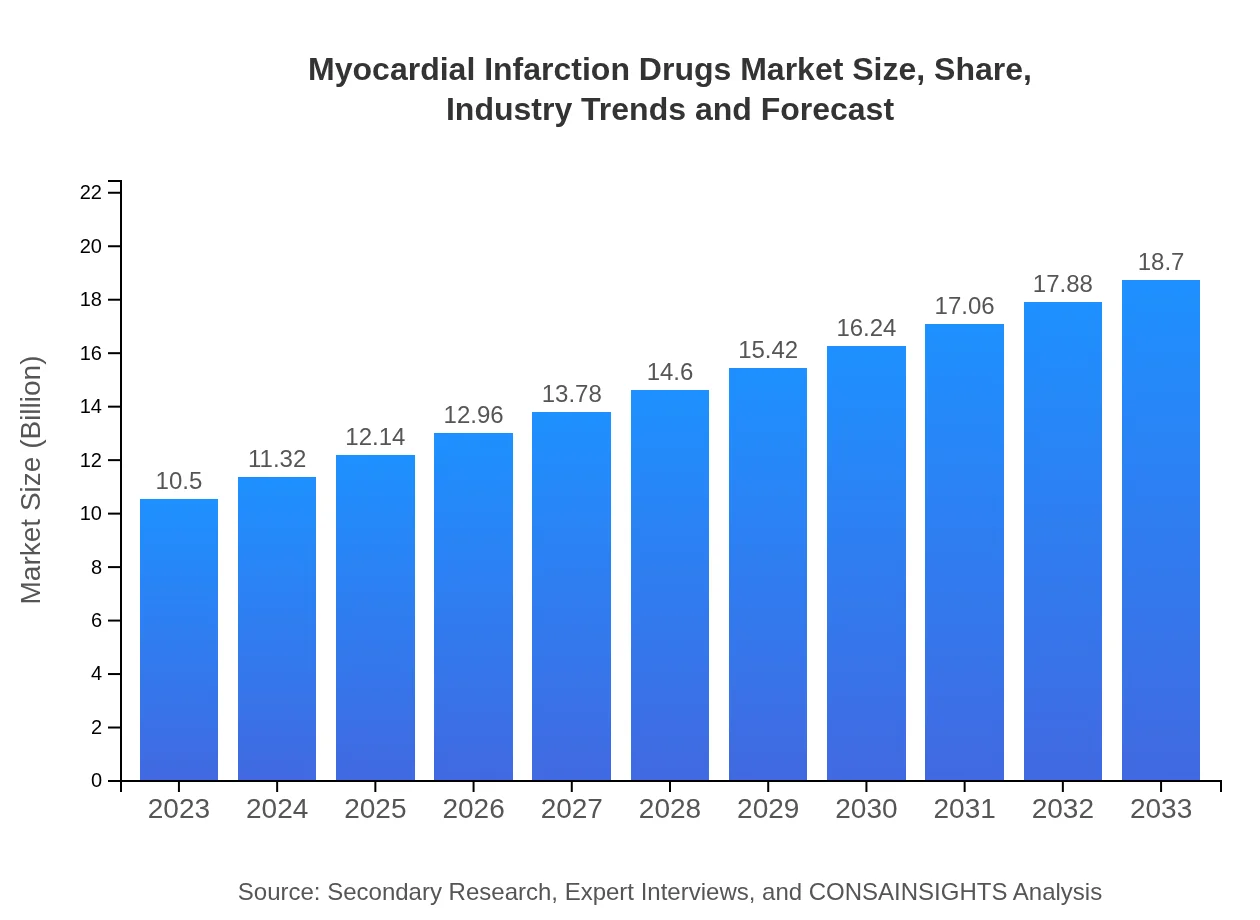

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Pfizer Inc., Novartis AG, Bristol-Myers Squibb, AstraZeneca, Sanofi |

| Last Modified Date | 31 January 2026 |

Myocardial Infarction Drugs Market Overview

Customize Myocardial Infarction Drugs Market Report market research report

- ✔ Get in-depth analysis of Myocardial Infarction Drugs market size, growth, and forecasts.

- ✔ Understand Myocardial Infarction Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Myocardial Infarction Drugs

What is the Market Size & CAGR of Myocardial Infarction Drugs market in 2023?

Myocardial Infarction Drugs Industry Analysis

Myocardial Infarction Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Myocardial Infarction Drugs Market Analysis Report by Region

Europe Myocardial Infarction Drugs Market Report:

In Europe, the market size is anticipated to increase from $2.63 billion in 2023 to $4.69 billion by 2033. This growth will be supported by advanced healthcare systems and the increasing prevalence of heart diseases.Asia Pacific Myocardial Infarction Drugs Market Report:

The Asia Pacific region is projected to see market growth from $2.04 billion in 2023 to $3.64 billion by 2033, driven by increasing urbanization, lifestyle-related diseases, and advancements in healthcare infrastructure.North America Myocardial Infarction Drugs Market Report:

North America holds a substantial market share, projected to grow from $3.40 billion in 2023 to $6.05 billion by 2033. Factors like high healthcare expenditure, and a growing number of myocardial infarction cases, significantly contribute to this growth.South America Myocardial Infarction Drugs Market Report:

In South America, the market is expected to rise from $1.03 billion in 2023 to $1.83 billion by 2033. The growth is primarily due to improved healthcare policies and rising awareness of cardiovascular diseases.Middle East & Africa Myocardial Infarction Drugs Market Report:

The Middle East and Africa region is forecasted to expand from $1.40 billion in 2023 to $2.49 billion by 2033, aided by rising investments in healthcare facilities and increasing patient awareness.Tell us your focus area and get a customized research report.

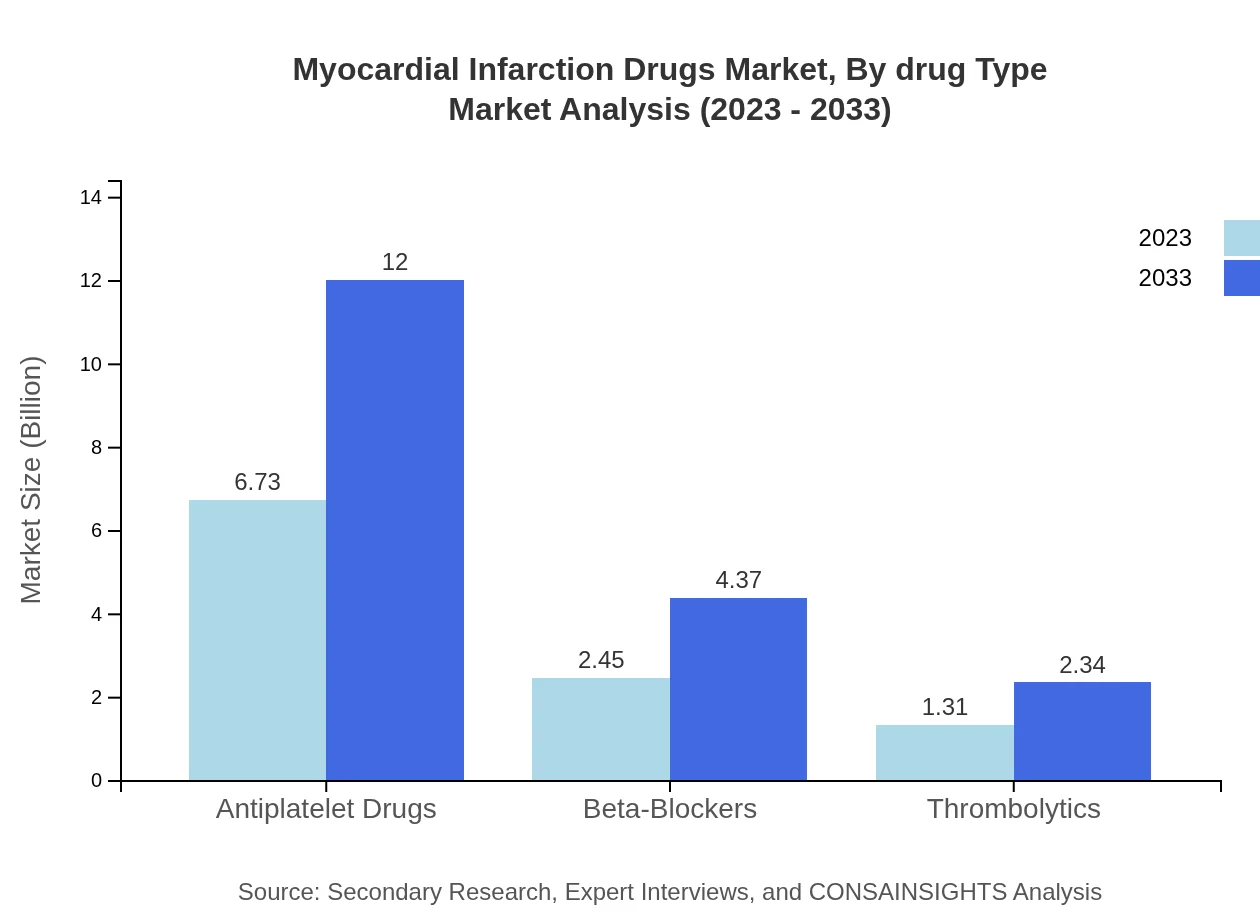

Myocardial Infarction Drugs Market Analysis By Drug Type

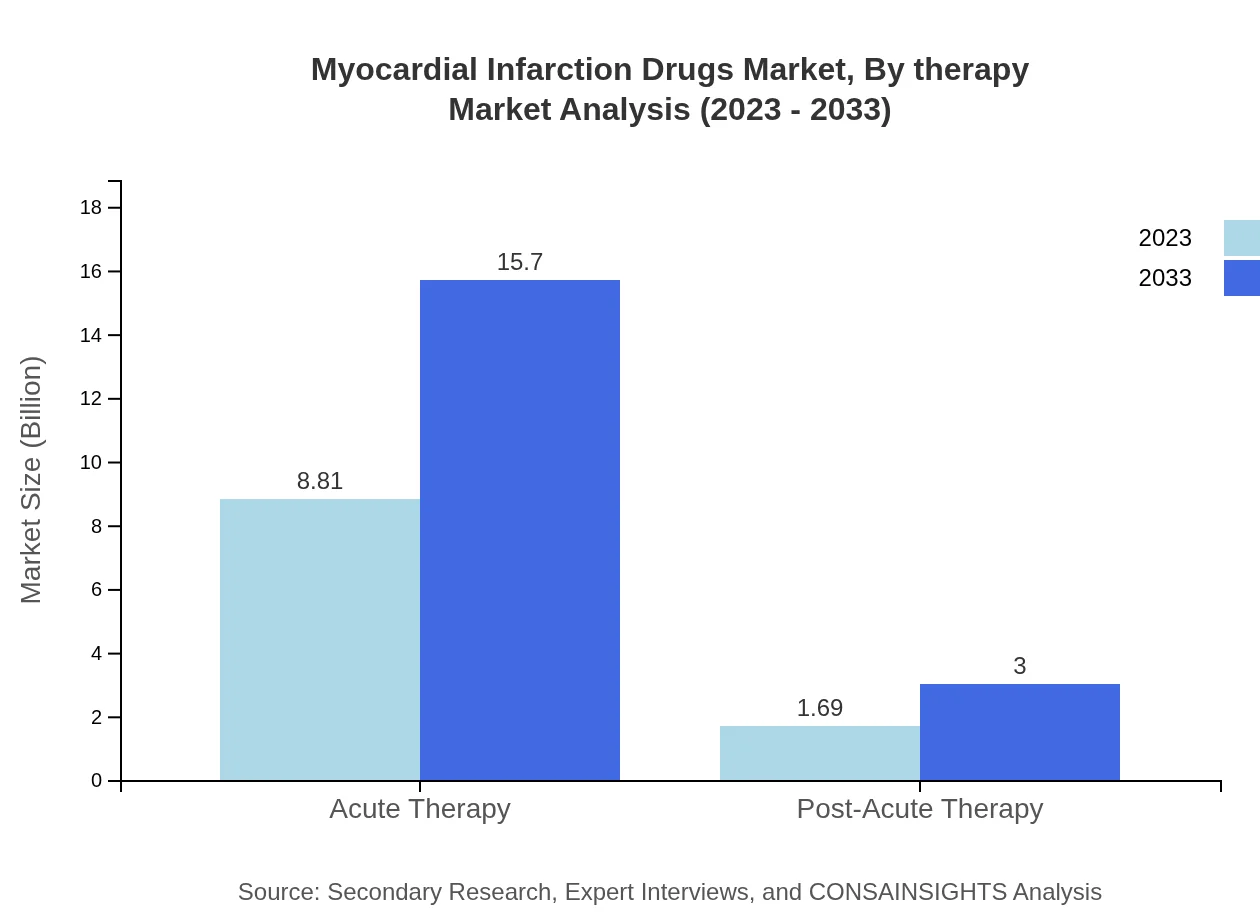

The market for Myocardial Infarction Drugs is predominantly driven by Acute Therapy, which is projected to grow from $8.81 billion in 2023 to $15.70 billion by 2033, retaining an 83.94% market share. Apart from this, Antiplatelet Drugs are also significant, expected to increase from $6.73 billion to $12.00 billion, capturing a 64.14% share by 2033.

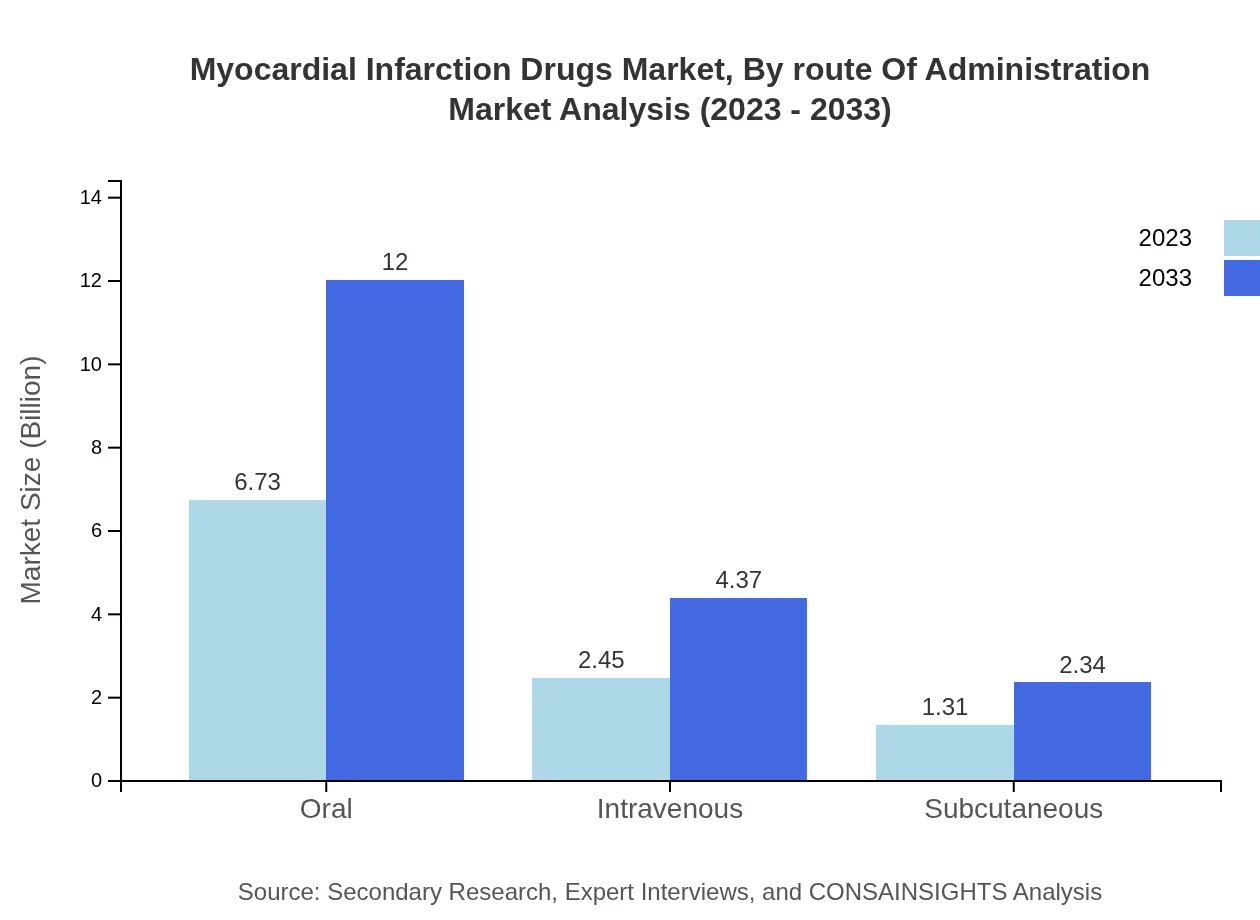

Myocardial Infarction Drugs Market Analysis By Route Of Administration

Oral administration is the most prevalent route in this market, with growth projected from $6.73 billion in 2023 to $12.00 billion by 2033. Intravenous and subcutaneous routes, though lower in volume, are also experiencing growth, indicating a diversified approach to treatment methods.

Myocardial Infarction Drugs Market Analysis By Therapy

The division between Acute Therapy and Post-Acute Therapy reveals a robust growth in Acute Therapy, while Post-Acute Therapy is also expected to see an increase from $1.69 billion to $3.00 billion, representing a growing focus on post-discharge care.

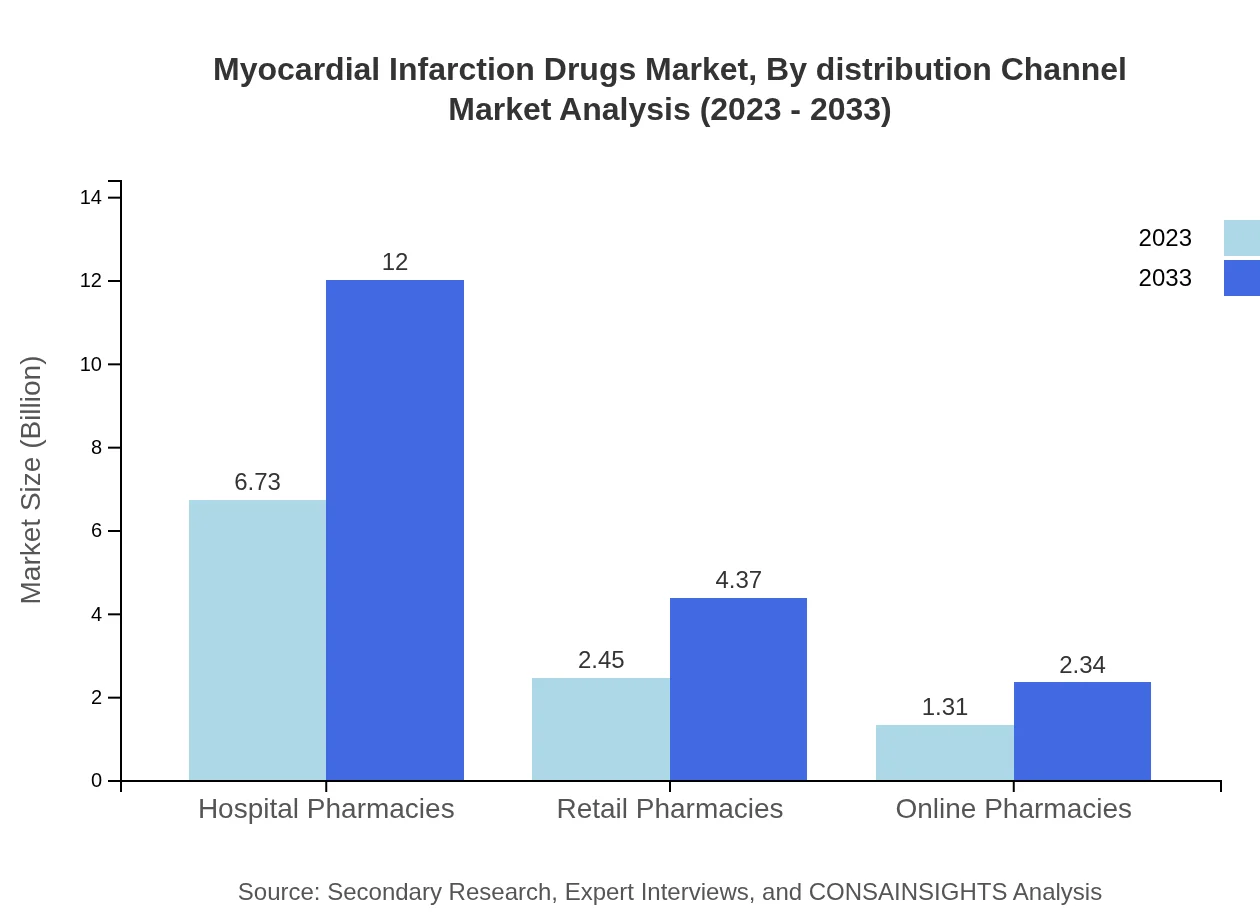

Myocardial Infarction Drugs Market Analysis By Distribution Channel

Hospital Pharmacies dominate the distribution channel, with a share of 64.14% increasing from $6.73 billion to $12.00 billion by 2033. Online and retail pharmacies, although smaller in share, are growing as patients seek convenience.

Myocardial Infarction Drugs Market Analysis By Patient Type

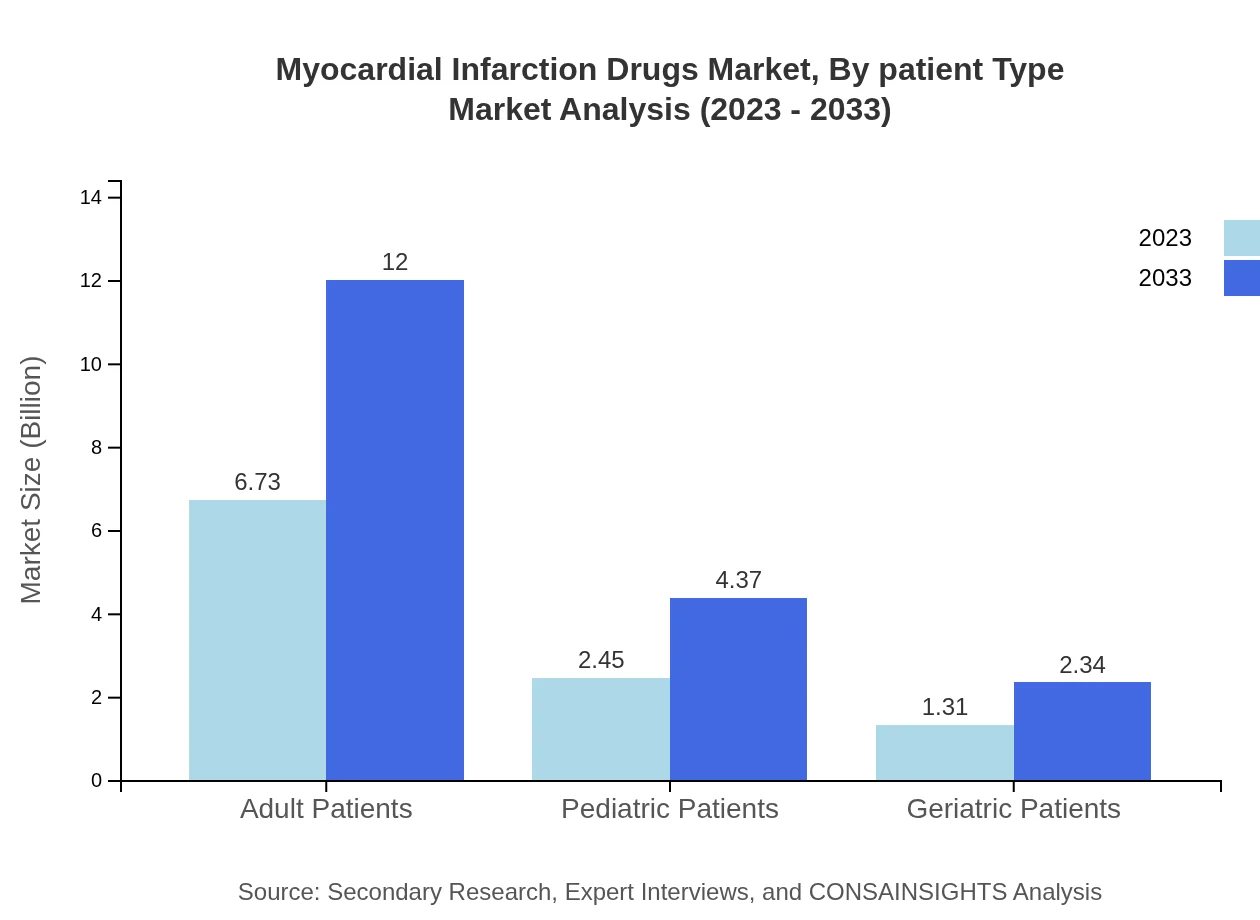

The market for Adult Patients leads, constituting 64.14% of share in 2023, expected to rise to $12.00 billion, while Pediatric and Geriatric Patients also show significant growth trends.

Myocardial Infarction Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Myocardial Infarction Drugs Industry

Pfizer Inc.:

Pfizer is a leading player in the pharmaceuticals industry, actively involved in developing innovative treatments for myocardial infarction, with a strong focus on patient-centric therapies.Novartis AG:

Novartis is well known for its advanced cardiovascular therapies, committing significant resources toward research and development to improve heart health outcomes.Bristol-Myers Squibb:

Bristol-Myers Squibb is renowned for its innovative research in anti-platelet therapies, addressing critical needs in myocardial infarction management.AstraZeneca:

AstraZeneca is recognized for its comprehensive cardiovascular portfolio and is heavily invested in solutions aimed at reducing the incidence of myocardial infarction.Sanofi:

Sanofi offers a variety of cardiac medications, focusing on strengthening treatments related to myocardial infarction and enhancing patient accessibility.We're grateful to work with incredible clients.

FAQs

What is the market size of myocardial Infarction Drugs?

The global market size for myocardial infarction drugs is estimated at $10.5 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 5.8% expected over the next decade, reaching significant growth by 2033.

What are the key market players or companies in this myocardial Infarction Drugs industry?

Key market players in the myocardial infarction drugs industry include major pharmaceutical companies such as Pfizer, Bayer, Johnson & Johnson, and Bristol-Myers Squibb. These companies are recognized for their extensive product portfolios and strong market presence.

What are the primary factors driving the growth in the myocardial Infarction Drugs industry?

The primary factors driving growth include an aging population, increasing prevalence of cardiovascular diseases, advancements in drug formulations, and heightened awareness about heart health, all contributing to rising demand for myocardial infarction therapies.

Which region is the fastest Growing in the myocardial Infarction Drugs?

The Asia-Pacific region is the fastest-growing market for myocardial infarction drugs, expected to grow from $2.04 billion in 2023 to $3.64 billion by 2033, due to increasing healthcare spending and rising patient populations.

Does ConsaInsights provide customized market report data for the myocardial Infarction Drugs industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the myocardial infarction drugs industry, allowing clients to access in-depth analytics, trends, and forecasts tailored to their market interests.

What deliverables can I expect from this myocardial Infarction Drugs market research project?

Deliverables from the myocardial infarction drugs market research project include comprehensive market analysis reports, growth forecasts, competitive landscape evaluations, and actionable insights tailored to client objectives.

What are the market trends of myocardial Infarction Drugs?

Current market trends include a shift towards personalized medicine, increased adoption of combination therapies, growth in online pharmacy sales, and expanding indications for existing myocardial infarction drugs.