Nanosatellite And Microsatellite Market Report

Published Date: 31 January 2026 | Report Code: nanosatellite-and-microsatellite

Nanosatellite And Microsatellite Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Nanosatellite and Microsatellite market, including industry trends, size, segmentation, and regional insights. It forecasts the market growth from 2023 to 2033, equipping stakeholders with critical data for strategic decision-making.

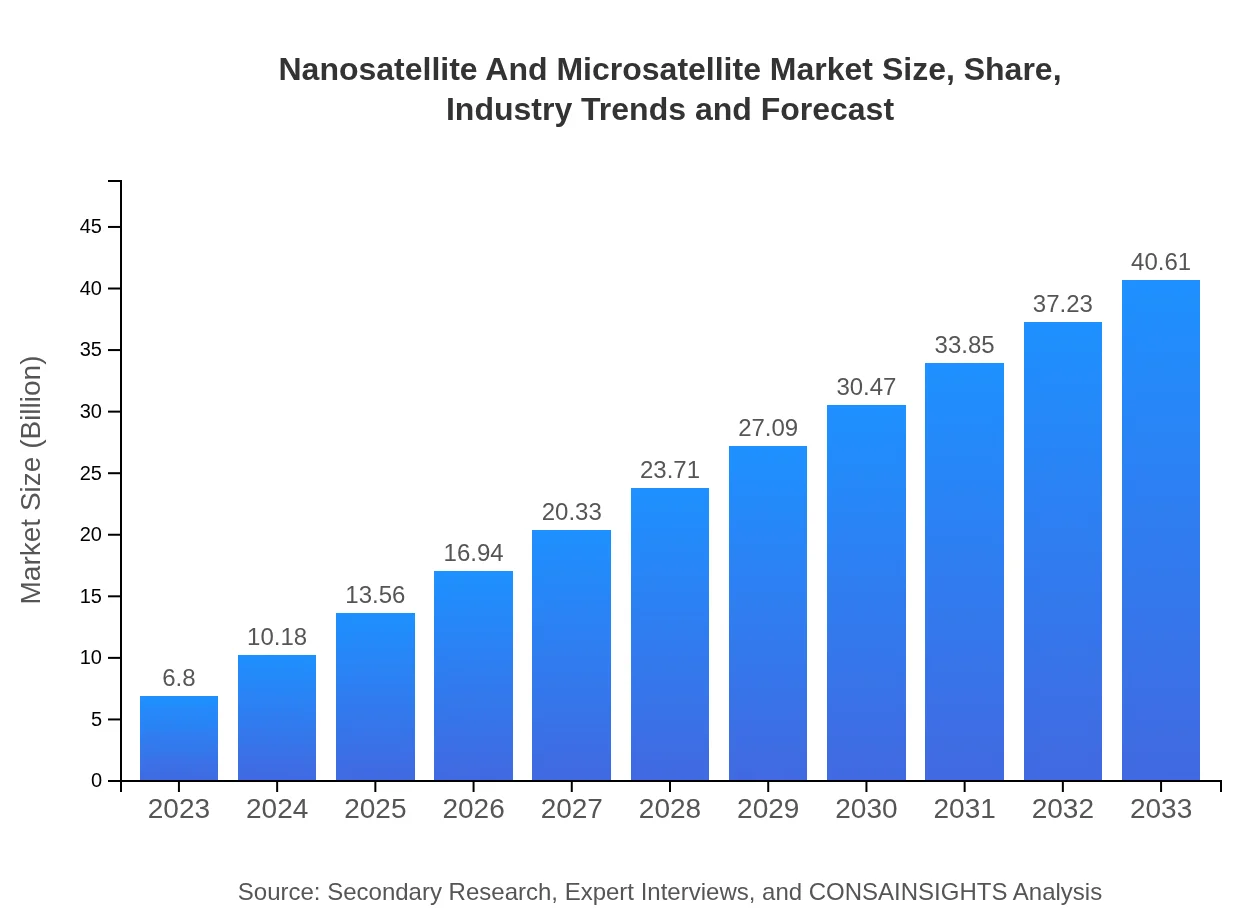

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 18.5% |

| 2033 Market Size | $40.61 Billion |

| Top Companies | Planet Labs Inc., Spire Global, Skybox Imaging (acquired by Google), Blue Canyon Technologies |

| Last Modified Date | 31 January 2026 |

Nanosatellite And Microsatellite Market Overview

Customize Nanosatellite And Microsatellite Market Report market research report

- ✔ Get in-depth analysis of Nanosatellite And Microsatellite market size, growth, and forecasts.

- ✔ Understand Nanosatellite And Microsatellite's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Nanosatellite And Microsatellite

What is the Market Size & CAGR of Nanosatellite And Microsatellite market in 2023?

Nanosatellite And Microsatellite Industry Analysis

Nanosatellite And Microsatellite Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Nanosatellite And Microsatellite Market Analysis Report by Region

Europe Nanosatellite And Microsatellite Market Report:

Europe's Nanosatellite and Microsatellite market is projected to expand from $2.05 billion in 2023 to $12.25 billion by 2033. The European Space Agency's initiatives and collaborations between nations are enhancing satellite capabilities and integration within commercial sectors, contributing to market growth.Asia Pacific Nanosatellite And Microsatellite Market Report:

The Asia Pacific region is emerging as a key player in the Nanosatellite and Microsatellite market, projected to grow from $1.35 billion in 2023 to $8.09 billion in 2033. Countries like India and China are significantly investing in their satellite technology programs, increasing the demand for small satellites for applications ranging from telecommunications to environmental monitoring.North America Nanosatellite And Microsatellite Market Report:

North America is expected to remain the largest market, with a forecasted growth from $2.34 billion in 2023 to $14 billion in 2033. The region benefits from established aerospace industries, significant government funding, and a robust ecosystem of startups focusing on satellite technology, driving innovation and service deployment.South America Nanosatellite And Microsatellite Market Report:

In South America, the market for Nanosatellites and Microsatellites is expected to increase from $0.34 billion in 2023 to $2.04 billion by 2033. The rise can be attributed to the developing space programs in countries like Brazil and Argentina, focusing on Earth observation and agricultural monitoring projects.Middle East & Africa Nanosatellite And Microsatellite Market Report:

In the Middle East and Africa, the market is anticipated to grow from $0.71 billion in 2023 to $4.23 billion in 2033. Development programs initiated by countries in the region aim to bolster space capabilities primarily for regional security, resource management, and infrastructure monitoring.Tell us your focus area and get a customized research report.

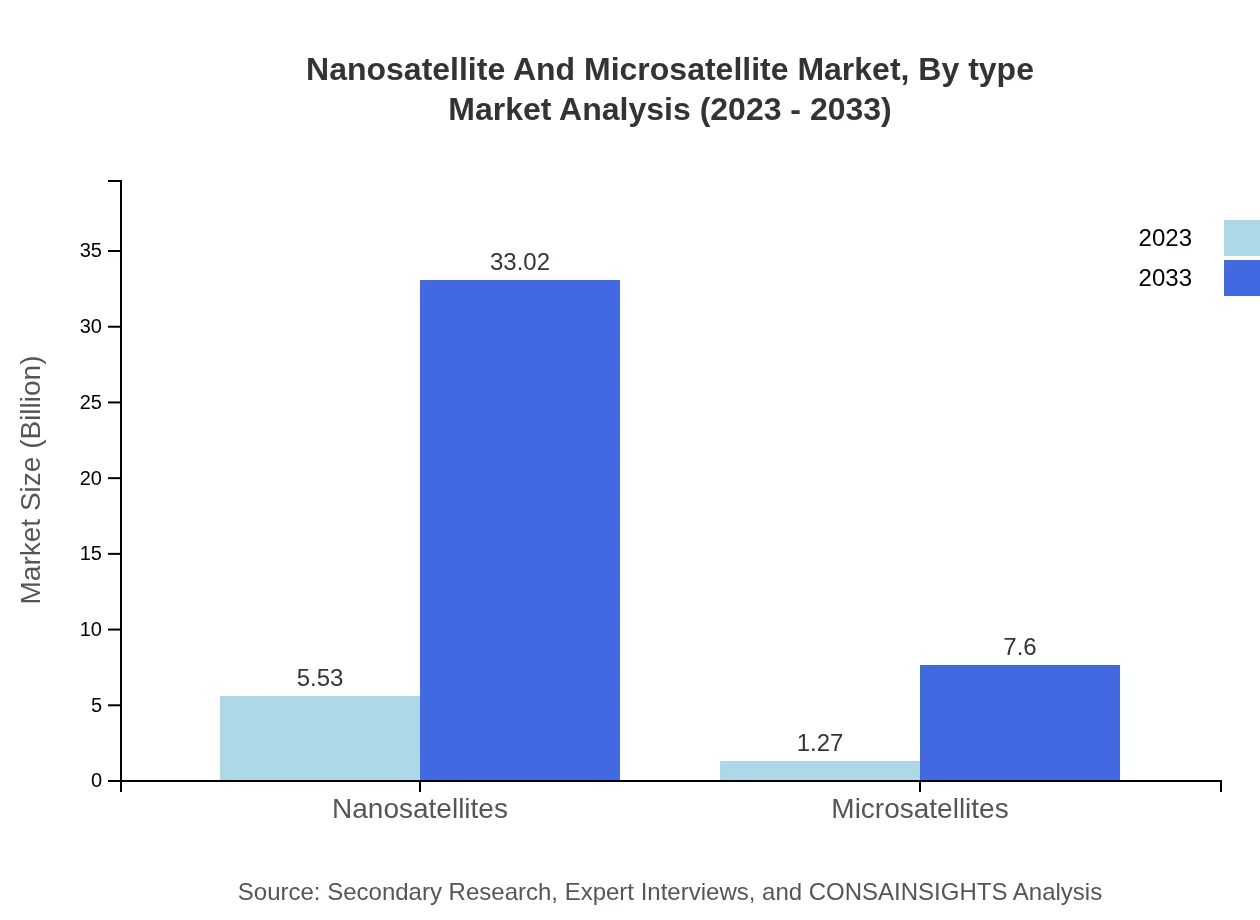

Nanosatellite And Microsatellite Market Analysis By Type

In 2023, the Nanosatellite segment dominates the market size at $5.53 billion, representing 81.29% of the total market. It is projected to grow to $33.02 billion by 2033, maintaining its market share. Meanwhile, the Microsatellite segment, valued at $1.27 billion in 2023, is expected to increase to $7.60 billion, holding a 18.71% share.

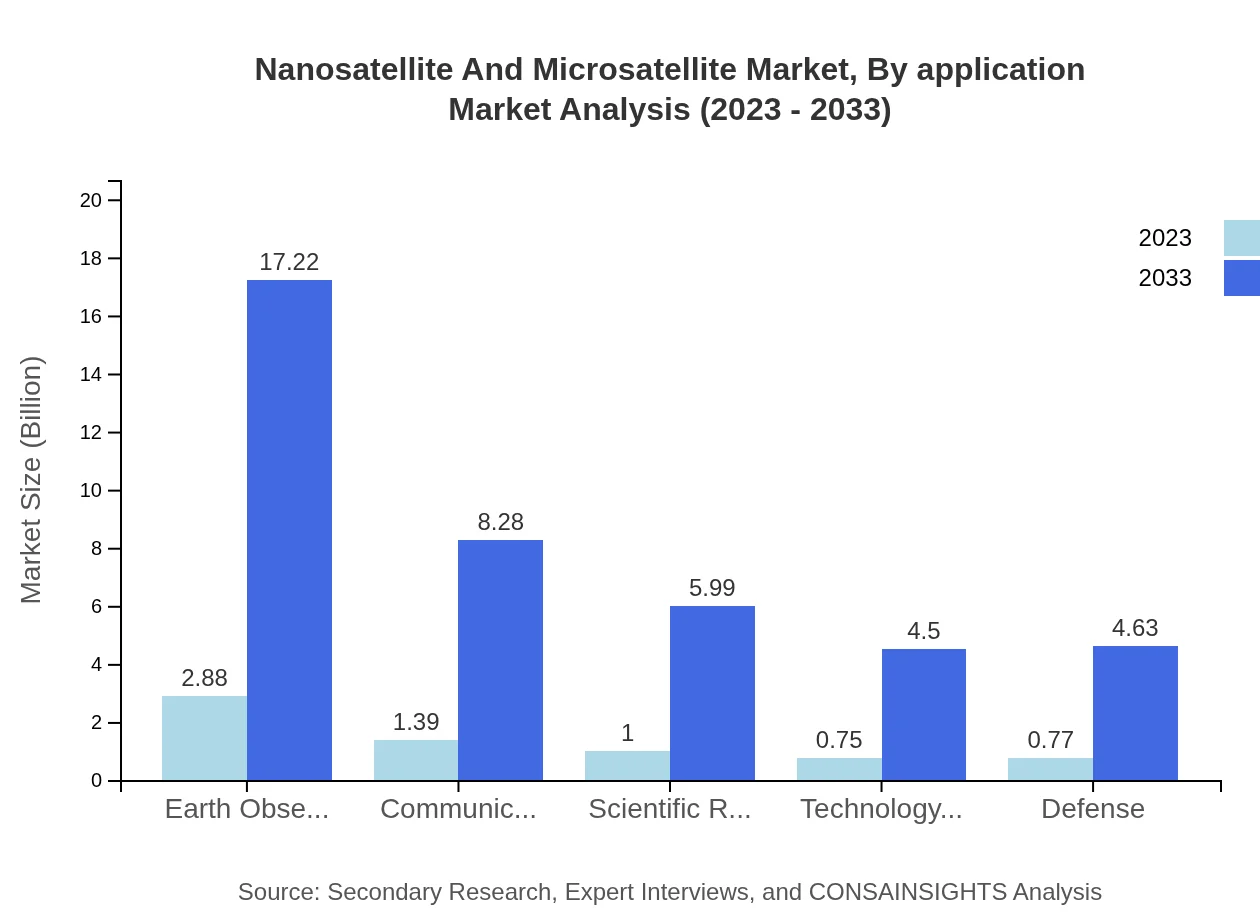

Nanosatellite And Microsatellite Market Analysis By Application

Earth Observation is the leading application segment for Nanosatellites and Microsatellites, expected to grow from $2.88 billion in 2023 to $17.22 billion in 2033. Other key applications include Communication, Scientific Research, while Defense and Technology Demonstration are also growing fields, showing significant market potential.

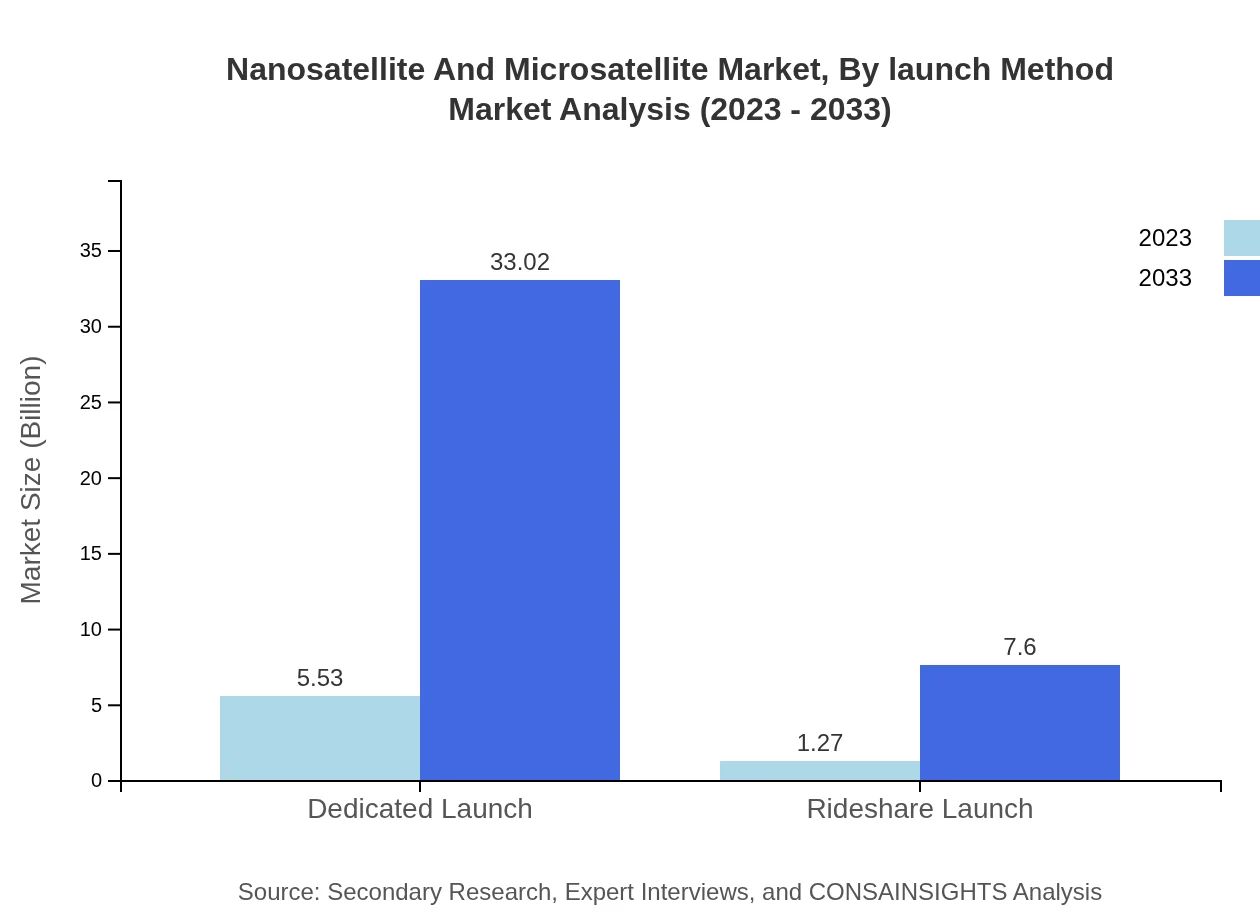

Nanosatellite And Microsatellite Market Analysis By Launch Method

Dedicated launches dominate the launch method segment with a market size of $5.53 billion in 2023, anticipated to reach $33.02 billion in 2033. Rideshare launches, while smaller at $1.27 billion, are also projected to grow to $7.60 billion, indicating increasing adoption for cost-effective launch solutions.

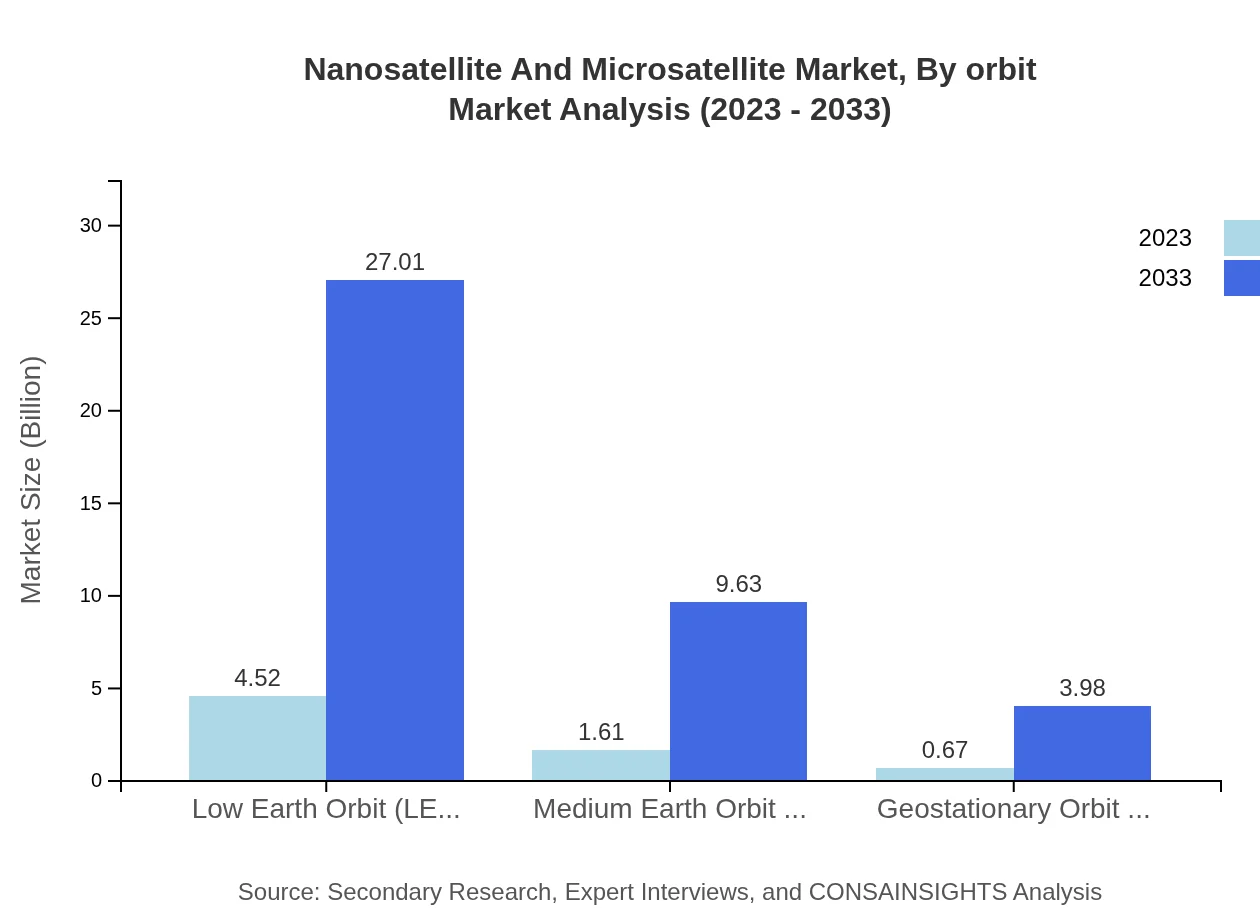

Nanosatellite And Microsatellite Market Analysis By Orbit

Low Earth Orbit (LEO) retains the largest share at $4.52 billion in 2023, projected to reach $27.01 billion by 2033. Medium Earth Orbit (MEO) and Geostationary Orbit (GEO) are also noteworthy segments, with MEO expected to grow from $1.61 billion to $9.63 billion, while GEO rises from $0.67 billion to $3.98 billion.

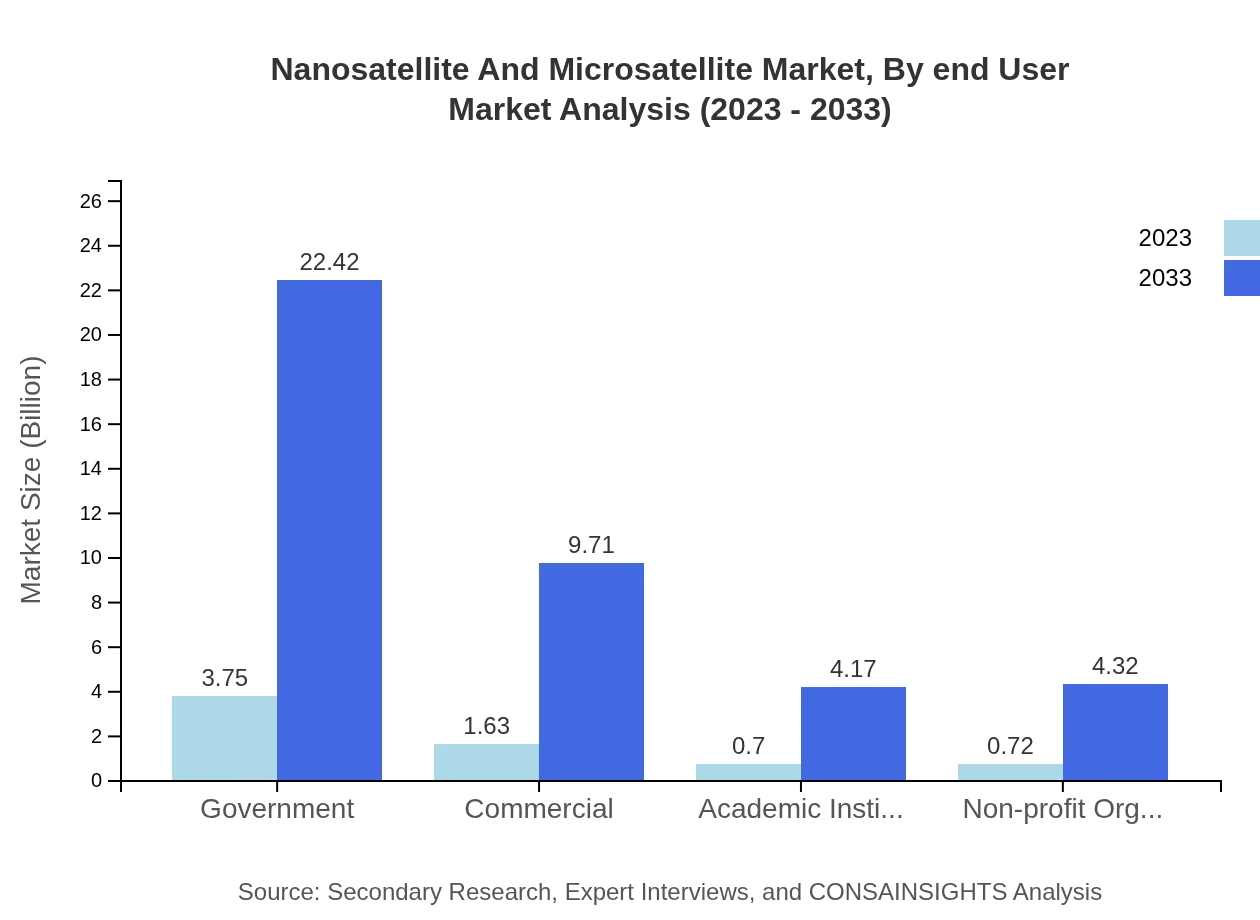

Nanosatellite And Microsatellite Market Analysis By End User

Government usage leads the segment at $3.75 billion in 2023, growing to $22.42 billion in 2033. This is closely followed by Commercial organizations, expected to increase from $1.63 billion to $9.71 billion, showcasing the growing interest and investments from private sectors.

Nanosatellite And Microsatellite Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Nanosatellite And Microsatellite Industry

Planet Labs Inc.:

Planet Labs specializes in Earth imaging satellites, providing vast amounts of data from its fleet of small satellites. The company has established a foothold in the microsatellite market with innovative imaging capabilities.Spire Global:

Spire is known for its CubeSats that gather data for weather, maritime, and aviation industries. The company’s focus on cost-effective satellite solutions has made it a prominent player in the small satellite market.Skybox Imaging (acquired by Google):

Skybox pioneered high-resolution imaging and has evolved into a data analytics provider. The transition into Google has enhanced its technological capabilities within the microsatellite sector.Blue Canyon Technologies:

Blue Canyon provides innovative nanosatellite solutions, contributing to missions spanning Earth observation and scientific research, reinforcing its position as a market leader.We're grateful to work with incredible clients.

FAQs

What is the market size of nanosatellite And Microsatellite?

The nanosatellite and microsatellite market is projected to reach a market size of $6.8 billion by 2033, with a remarkable CAGR of 18.5% from 2023 to 2033, indicating significant growth opportunities for stakeholders in this industry.

What are the key market players or companies in this nanosatellite And Microsatellite industry?

Key players in the nanosatellite and microsatellite market include established aerospace companies and emerging startups focusing on satellite technology, services, and launch capabilities, contributing to market innovation and increased competition.

What are the primary factors driving the growth in the nanosatellite And Microsatellite industry?

Growth in the nanosatellite and microsatellite industry is driven by advancements in space technology, increasing demand for Earth observation data, cost reduction in satellite manufacturing, and the rise of commercial space missions across various sectors.

Which region is the fastest Growing in the nanosatellite And Microsatellite?

Asia Pacific is the fastest-growing region in the nanosatellite and microsatellite market, with market growth projected from $1.35 billion in 2023 to $8.09 billion by 2033, indicating robust investment in space technology and satellite applications.

Does ConsaInsights provide customized market report data for the nanosatellite And Microsatellite industry?

Yes, ConsaInsights offers customized market report data tailored to individual client needs, ensuring comprehensive insights that align with specific business objectives within the nanosatellite and microsatellite industry.

What deliverables can I expect from this nanosatellite And Microsatellite market research project?

Deliverables from the nanosatellite and microsatellite market research project typically include detailed market analysis reports, segment-wise insights, competitive landscape assessment, trends identification, and tailored recommendations for strategic planning.

What are the market trends of nanosatellite And Microsatellite?

Current market trends in the nanosatellite and microsatellite industry include increased collaboration between governments and private entities, expansion of LEO satellite deployments, and heightened interest in sustainable and small satellite technology solutions.