Narcotics Scanner Market Report

Published Date: 31 January 2026 | Report Code: narcotics-scanner

Narcotics Scanner Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Narcotics Scanner market for the forecast period of 2023-2033, covering critical insights into market size, trends, technology advancements, regional performance, and competitive landscape, ultimately providing valuable guidance for stakeholders.

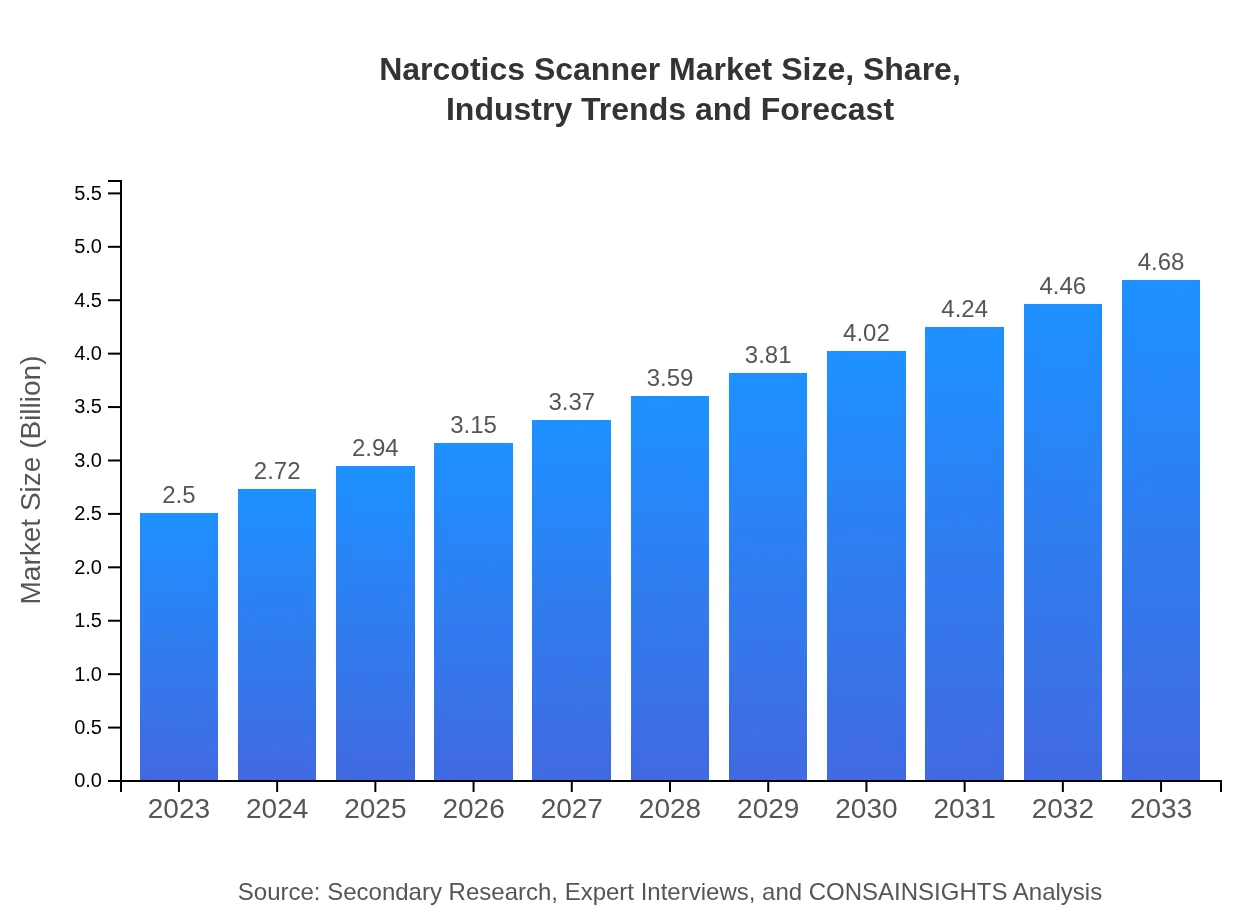

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $4.68 Billion |

| Top Companies | Smiths Detection, L3Harris Technologies, Bae Systems, Rohde & Schwarz, Teledyne FLIR |

| Last Modified Date | 31 January 2026 |

Narcotics Scanner Market Overview

Customize Narcotics Scanner Market Report market research report

- ✔ Get in-depth analysis of Narcotics Scanner market size, growth, and forecasts.

- ✔ Understand Narcotics Scanner's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Narcotics Scanner

What is the Market Size & CAGR of Narcotics Scanner market in 2023?

Narcotics Scanner Industry Analysis

Narcotics Scanner Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Narcotics Scanner Market Analysis Report by Region

Europe Narcotics Scanner Market Report:

The European market will move from $0.74 billion in 2023 to $1.38 billion by 2033, fueled by rigorous border control measures and an increasing focus on public safety amid rising drug-related issues in various countries.Asia Pacific Narcotics Scanner Market Report:

The Asia Pacific region is expected to develop significantly, with the market growing from $0.47 billion in 2023 to $0.89 billion by 2033. Increased governmental focus on drug trafficking prevention and an upsurge in airport security demand drive this growth. Countries like China and India are investing heavily in modern security systems.North America Narcotics Scanner Market Report:

North America, a leading region, shows a robust market progression, expanding from $0.95 billion in 2023 to $1.78 billion in 2033. The United States is at the forefront, with constant advancements in technology and stringent regulations driving the adoption of narcotics scanners.South America Narcotics Scanner Market Report:

In South America, the narcotics scanner market is poised to increase from $0.10 billion in 2023 to $0.19 billion in 2033. The growing drug trafficking challenges and law enforcement efforts in countries like Brazil and Colombia will enhance the demand for advanced scanning technologies.Middle East & Africa Narcotics Scanner Market Report:

In the Middle East and Africa, the market is anticipated to grow from $0.23 billion in 2023 to $0.44 billion by 2033. The region's investment in modern border security systems and increased political stability contribute to the demand for narcotics scanners.Tell us your focus area and get a customized research report.

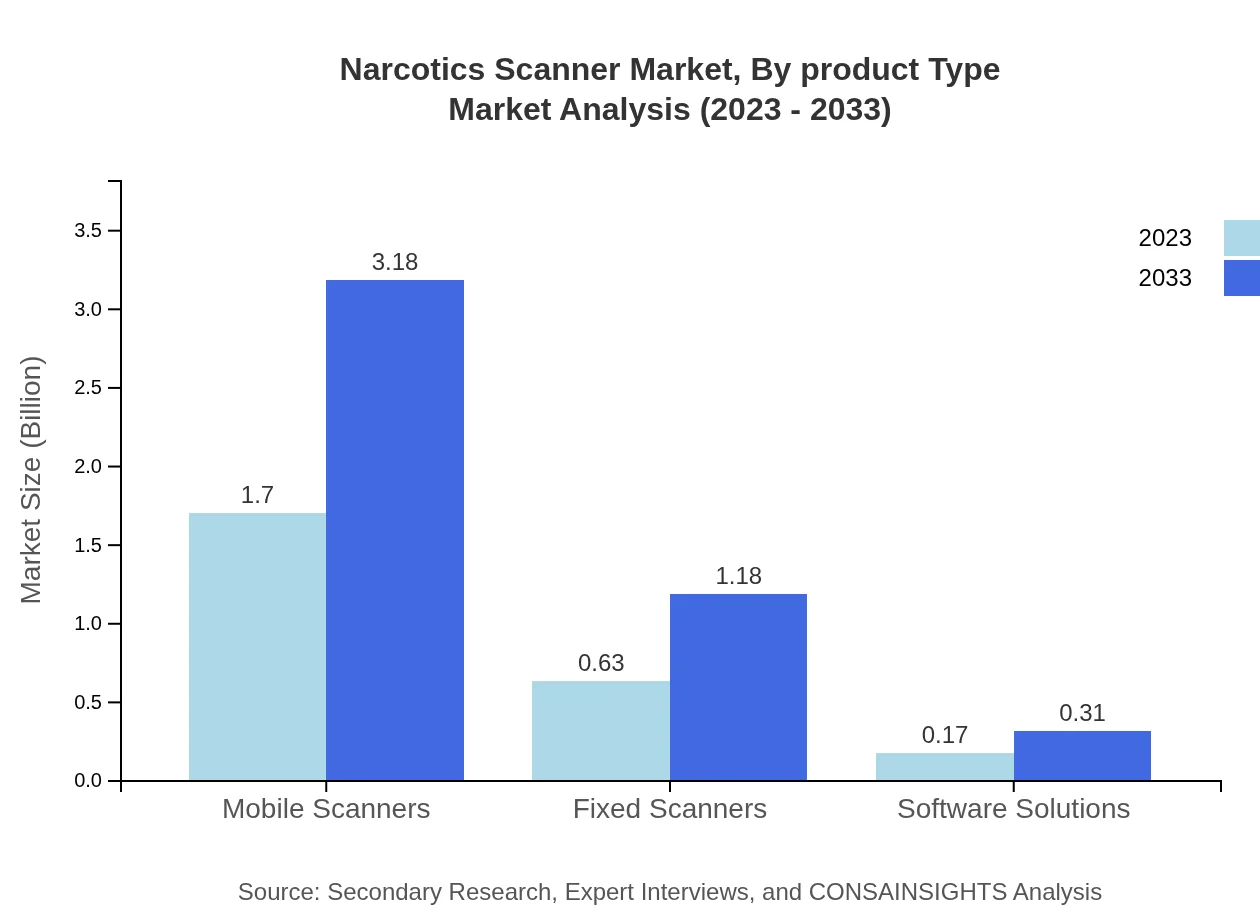

Narcotics Scanner Market Analysis By Product Type

The Narcotics Scanner market by product type includes mobile and fixed scanners. The mobile scanners segment dominates the market, valued at $1.70 billion in 2023, and expected to grow to $3.18 billion by 2033, capturing 68.05% market share. Fixed scanners follow, growing from $0.63 billion to $1.18 billion, holding a 25.31% market share. The increasing portability and ease of use of mobile scanners shape their prominence.

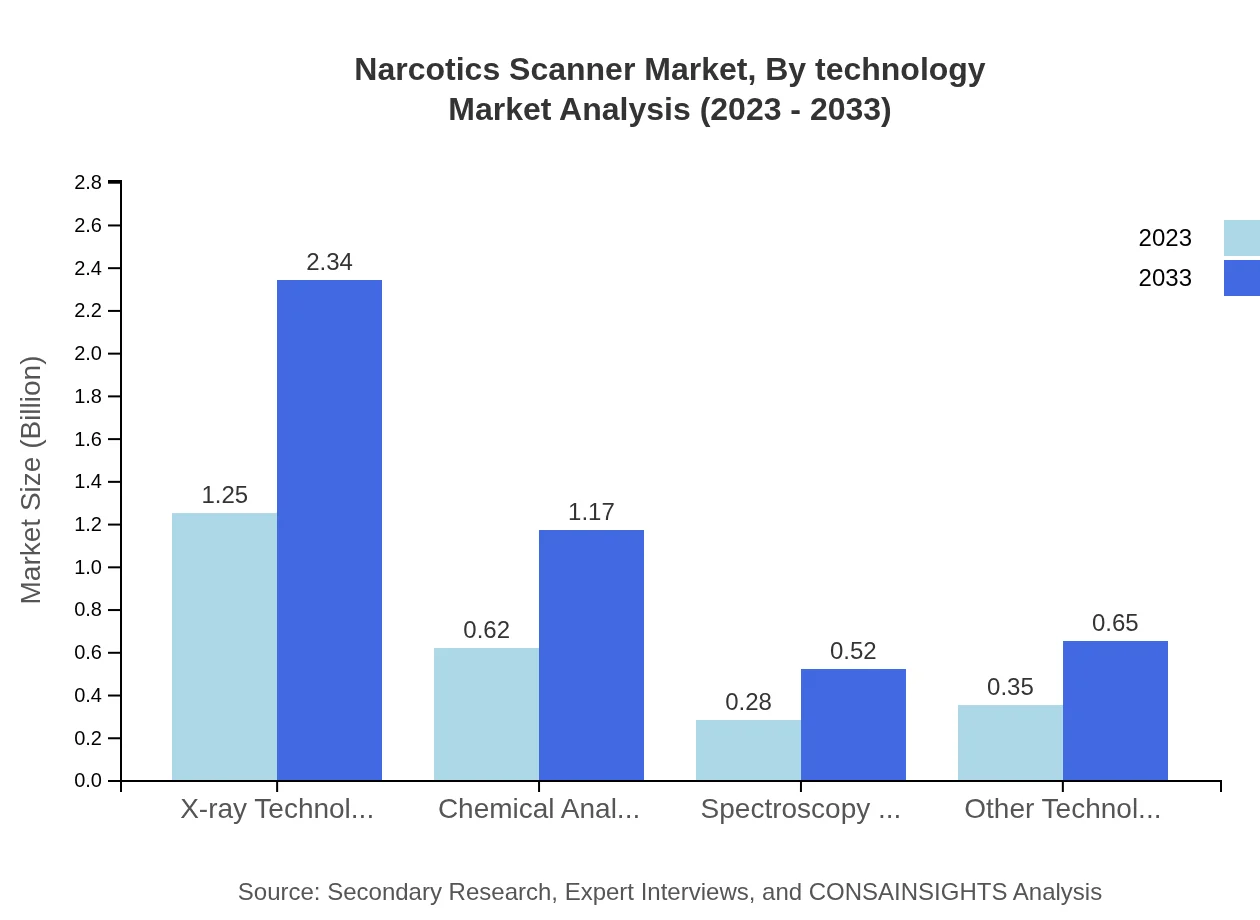

Narcotics Scanner Market Analysis By Technology

The market is significantly influenced by technology types such as x-ray, chemical analysis, and spectroscopy. X-ray technology currently leads the market, generating a size of $1.25 billion in 2023 with a 50.11% share, projected to reach $2.34 billion in 2033. Chemical analysis technology generates about $0.62 billion in 2023 and will rise to $1.17 billion by 2033, holding 24.91% of the market share. As demand for precise detection enhances, innovations within these technologies are vital.

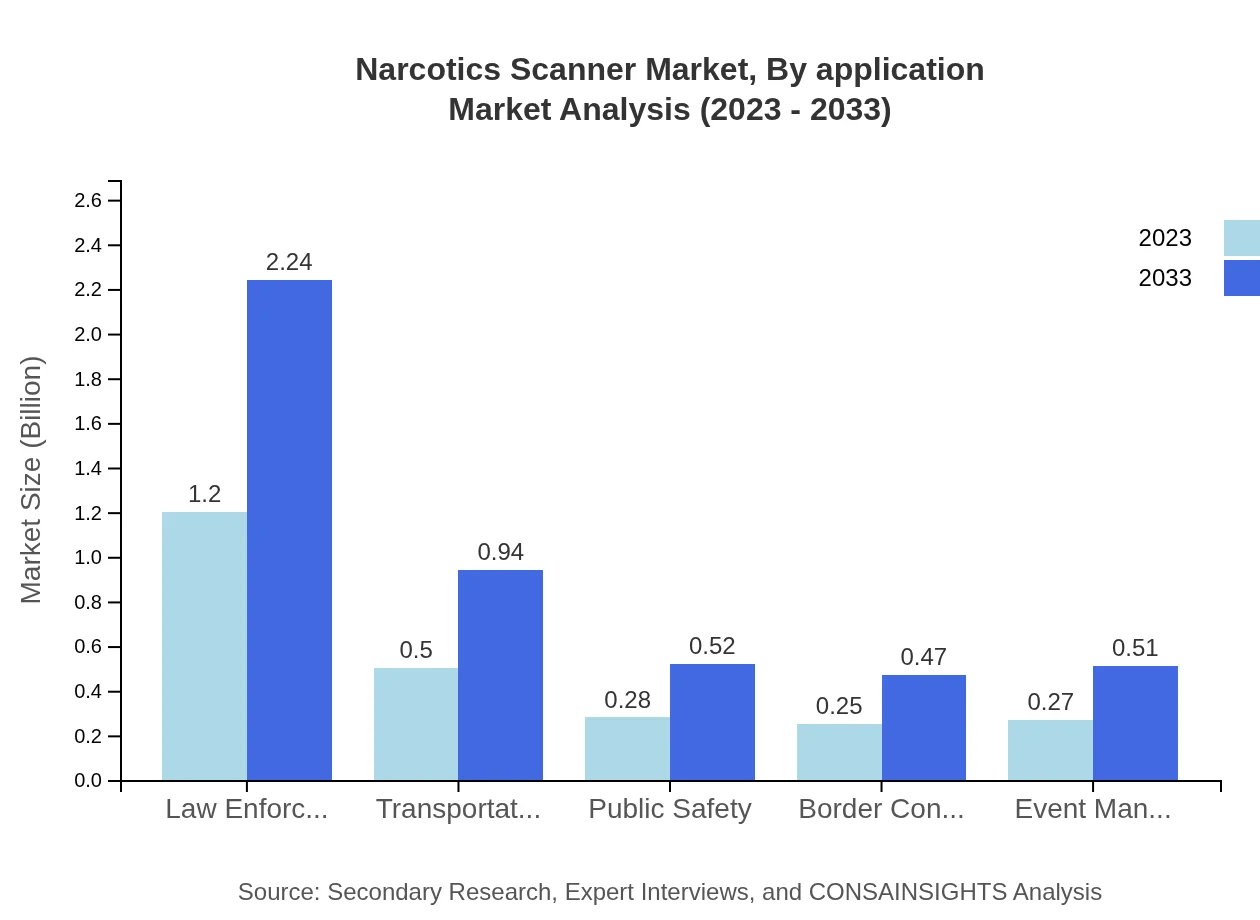

Narcotics Scanner Market Analysis By Application

Key applications of narcotics scanners span law enforcement, transportation security, customs, and airport security. Law enforcement leads the market with a value of $1.20 billion in 2023, expected to reach $2.24 billion by 2033, accounting for 47.87% market share. Transportation security follows, growing from $0.50 billion to $0.94 billion, maintaining a 20.13% share. The increasing integration of narcotics scanners into these applications underscores their critical importance in enhancing public safety.

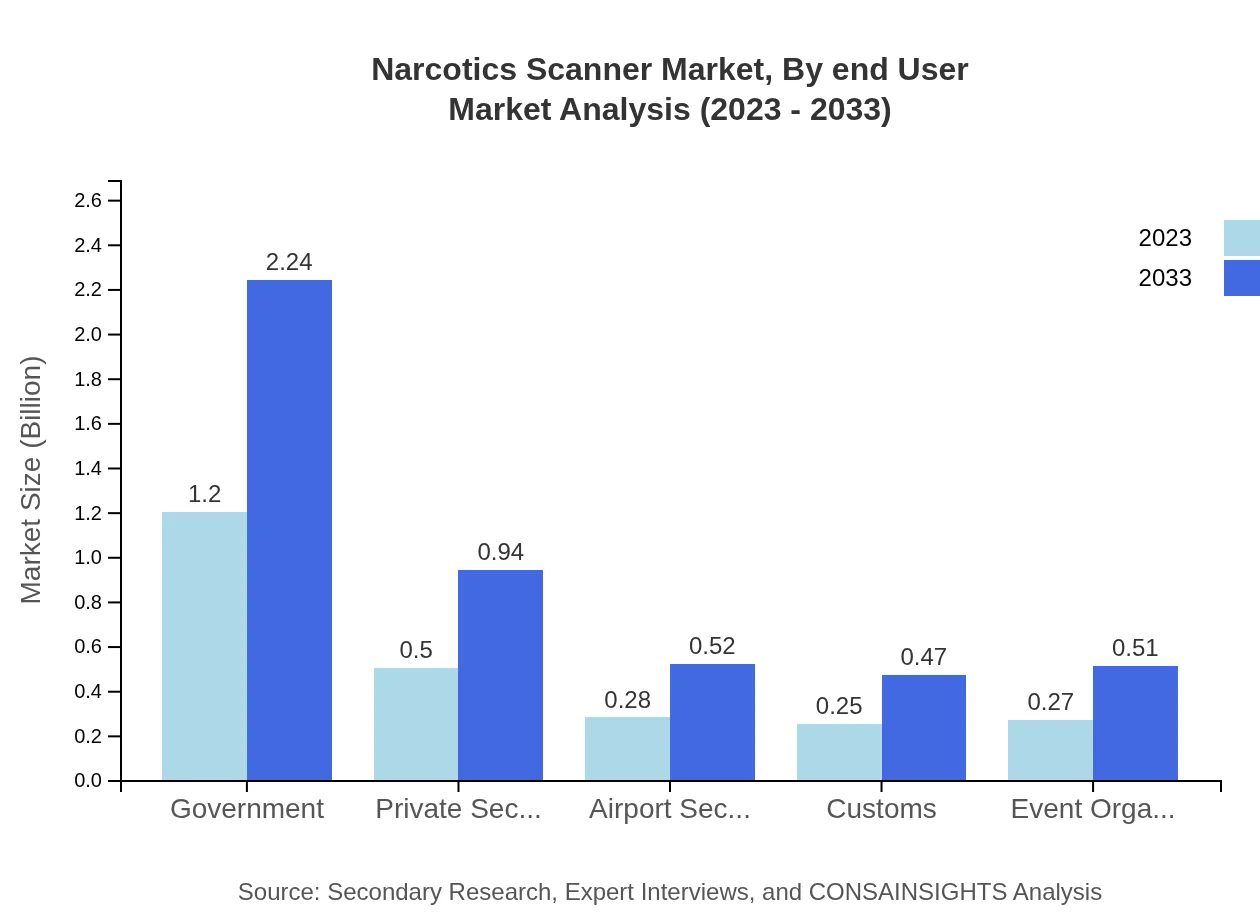

Narcotics Scanner Market Analysis By End User

The end-users for narcotics scanners include governmental agencies and private sectors. The government sector holds a substantial share, valued at $1.20 billion in 2023 and projected to grow to $2.24 billion by 2033, accounting for nearly 47.87% of the market. The private sector, encompassing security companies and transport service providers, is also gaining traction, valued at $0.50 billion in 2023 and expected to grow to $0.94 billion by 2033, indicating a promising market shift towards enhanced security solutions.

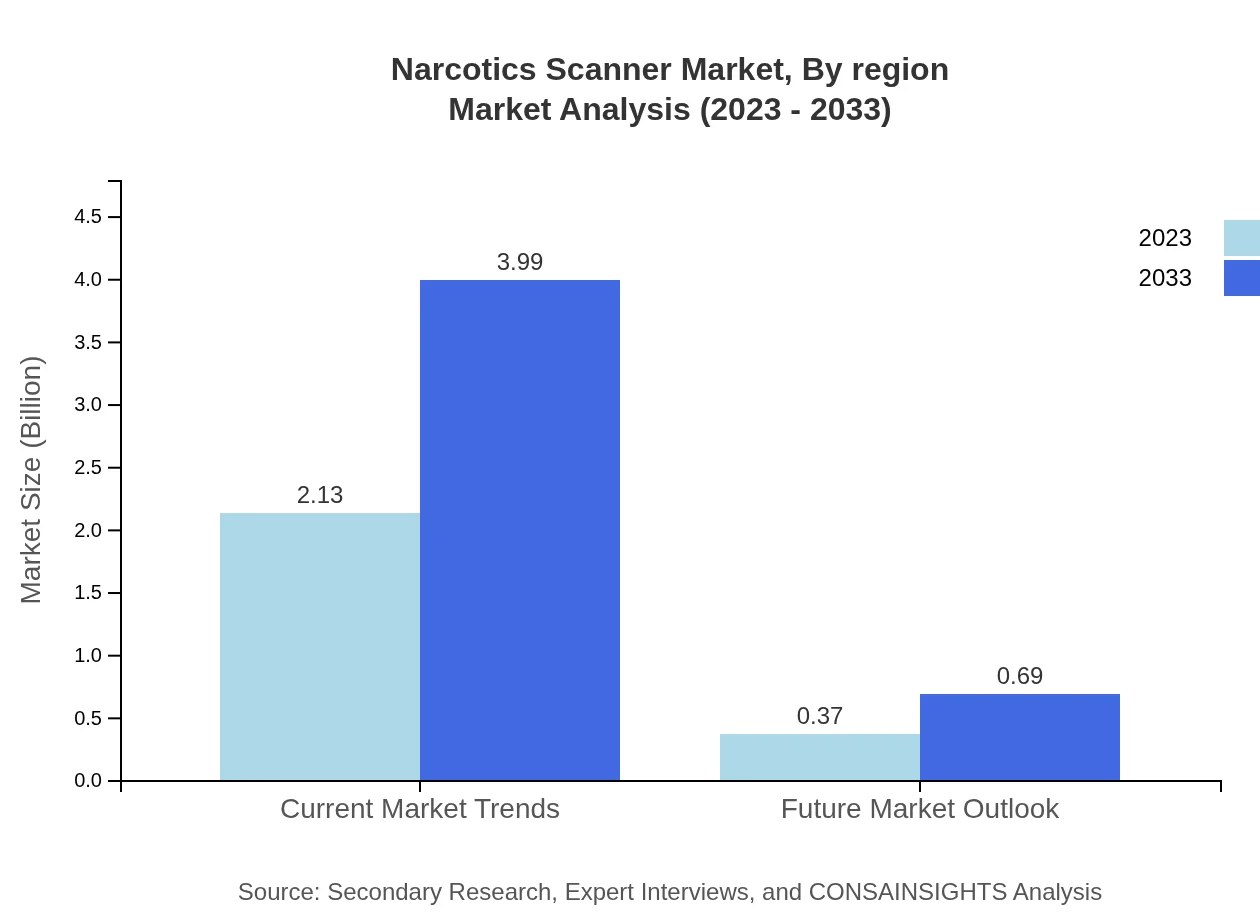

Narcotics Scanner Market Analysis By Region

Current trends indicate a robust emphasis on developing advanced narcotics scanners especially in law enforcement and public safety sectors. The future outlook suggests a steady demand will persist as emerging threats from drug trafficking continue to rise globally. Innovations in scanning technology will be pivotal in addressing these challenges, ensuring detection methods remain efficient while adhering to privacy regulations.

Narcotics Scanner Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Narcotics Scanner Industry

Smiths Detection:

A global leader in threat detection and screening technologies, Smiths Detection focuses on developing advanced scanner systems to enhance security for public safety.L3Harris Technologies:

Specializing in communication and electronic systems, L3Harris Technologies provides innovative narcotics scanners and solutions for various law enforcement and transportation applications.Bae Systems:

Bae Systems is known for its comprehensive security offerings, including narcotics scanner solutions designed for military and civil applications, focusing on advanced detection capabilities.Rohde & Schwarz:

With expertise in electronic testing and measuring technologies, Rohde & Schwarz delivers cutting-edge narcotics scanners with accurate detection and analysis capabilities.Teledyne FLIR:

Teledyne FLIR specializes in thermography and advanced sensing solutions, contributing to the development of mobile narcotics scanners for wider applications in security.We're grateful to work with incredible clients.

FAQs

What is the market size of Narcotics Scanner?

The global market size for narcotics scanners is projected at $2.5 billion in 2023, with a significant Compound Annual Growth Rate (CAGR) of 6.3% anticipated over the next decade, suggesting robust growth in demand and capabilities within this technology.

What are the key market players or companies in the Narcotics Scanner industry?

Key players in the narcotics scanner industry include major companies specializing in security technologies. These companies lead in innovation and provide advanced solutions for narcotics detection, contributing significantly to market growth and competition.

What are the primary factors driving the growth in the Narcotics Scanner industry?

The growth in the narcotics scanner industry is driven by increasing drug trafficking, stringent regulations for safety, advancements in detection technologies, heightened security concerns globally, and the expansion of law enforcement agencies requiring effective scanning solutions.

Which region is the fastest Growing in the Narcotics Scanner market?

North America is the fastest-growing region in the narcotics scanner market, with a market size projected to rise from $0.95 billion in 2023 to $1.78 billion by 2033, fueled by a high emphasis on security measures and technological advancements.

Does ConsaInsights provide customized market report data for the Narcotics Scanner industry?

Yes, ConsaInsights offers customized market report data for the narcotics scanner industry. This service ensures that clients receive tailored insights and analytics based on specific requirements, enabling informed decisions and strategic planning.

What deliverables can I expect from this Narcotics Scanner market research project?

From the narcotics scanner market research project, clients can expect comprehensive reports detailing market size, growth projections, regional analyses, competitive landscape, and insights into key trends, delivering a thorough understanding of the marketplace.

What are the market trends of Narcotics Scanner?

Current market trends include an increasing share for mobile scanners, which accounted for 68.05% in 2023, alongside technological advancements in X-ray and chemical analysis technologies, indicating a shift towards more reliable and versatile scanning solutions.