Natural Rubber Market Report

Published Date: 02 February 2026 | Report Code: natural-rubber

Natural Rubber Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Natural Rubber market, detailing market trends, size, segmentation, and regional insights for the forecast period of 2023 to 2033. It also covers significant industry players and future market projections.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

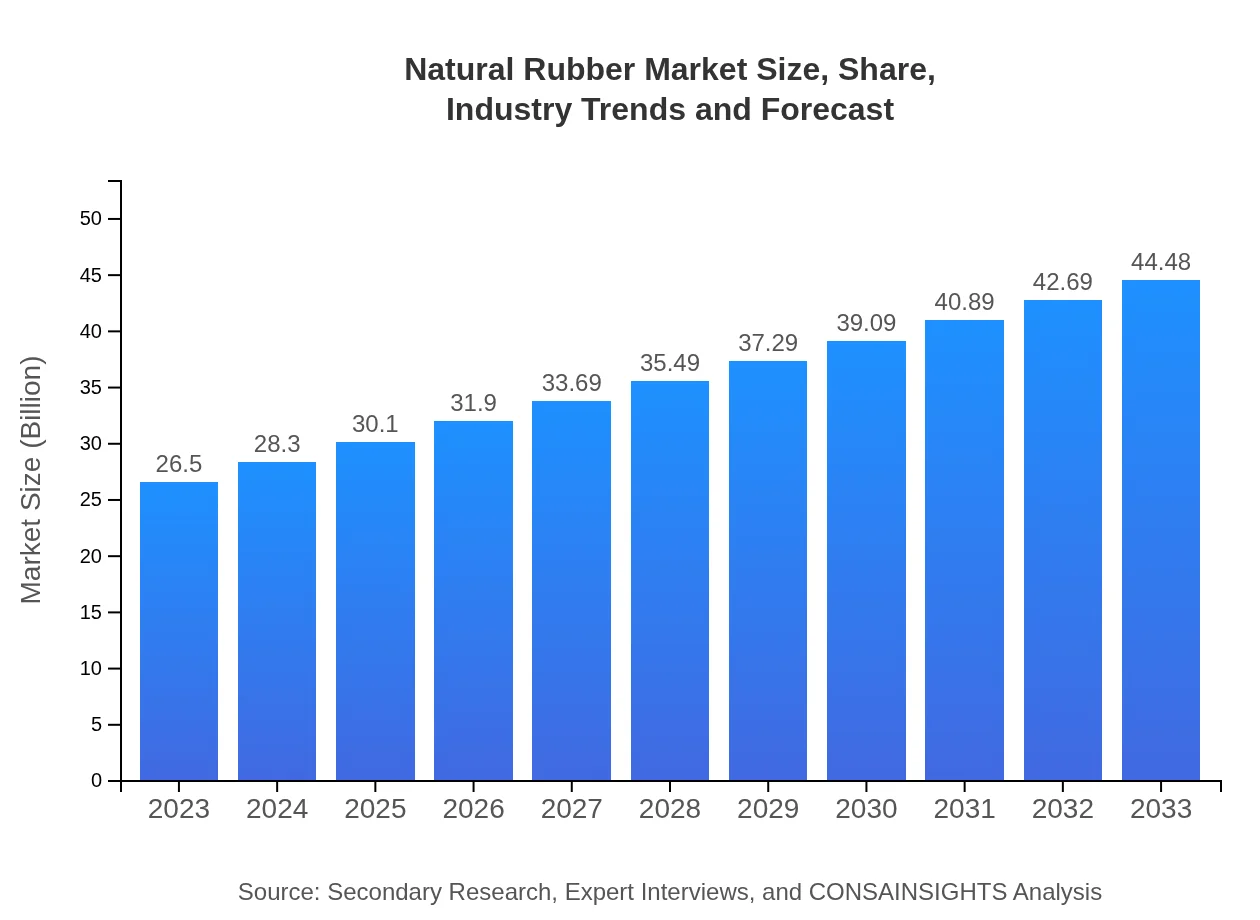

| 2023 Market Size | $26.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $44.48 Billion |

| Top Companies | Hevea Brasiliensis Co., Sri Trang Agro-Industry Public Company Limited, Kraton Corporation, Thai Rubber Latex Corporation |

| Last Modified Date | 02 February 2026 |

Natural Rubber Market Overview

Customize Natural Rubber Market Report market research report

- ✔ Get in-depth analysis of Natural Rubber market size, growth, and forecasts.

- ✔ Understand Natural Rubber's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Natural Rubber

What is the Market Size & CAGR of Natural Rubber market in 2023 and 2033?

Natural Rubber Industry Analysis

Natural Rubber Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Natural Rubber Market Analysis Report by Region

Europe Natural Rubber Market Report:

Europe's Natural Rubber market was valued at USD 6.55 billion in 2023, with projections indicating a rise to USD 10.99 billion by 2033. Increased emphasis on sustainability and environmental regulations is driving manufacturers to seek natural alternatives to synthetic options.Asia Pacific Natural Rubber Market Report:

The Asia Pacific region holds the largest share of the Natural Rubber market, valued at USD 5.48 billion in 2023, projected to reach USD 9.19 billion by 2033. The growth is mainly supported by major producing countries like Thailand, Indonesia, and Malaysia, leveraging their agricultural capacity and increasing sustainability practices.North America Natural Rubber Market Report:

North America shows a market value of USD 9.32 billion in 2023, anticipated to escalate to USD 15.65 billion by 2033. The region benefits from robust automotive and consumer goods sectors that heavily rely on natural rubber for product innovation.South America Natural Rubber Market Report:

In South America, the Natural Rubber market is valued at USD 2.16 billion in 2023, expected to grow to USD 3.63 billion by 2033. Brazil is a key player in this region, focusing on expanding cultivation areas and improving extraction methodologies to enhance production efficiency.Middle East & Africa Natural Rubber Market Report:

In the Middle East and Africa, the market is anticipated to grow from USD 2.99 billion in 2023 to USD 5.02 billion by 2033. The emerging market dynamics, coupled with rising industrial activities, are contributing to an increased demand for natural rubber in various applications.Tell us your focus area and get a customized research report.

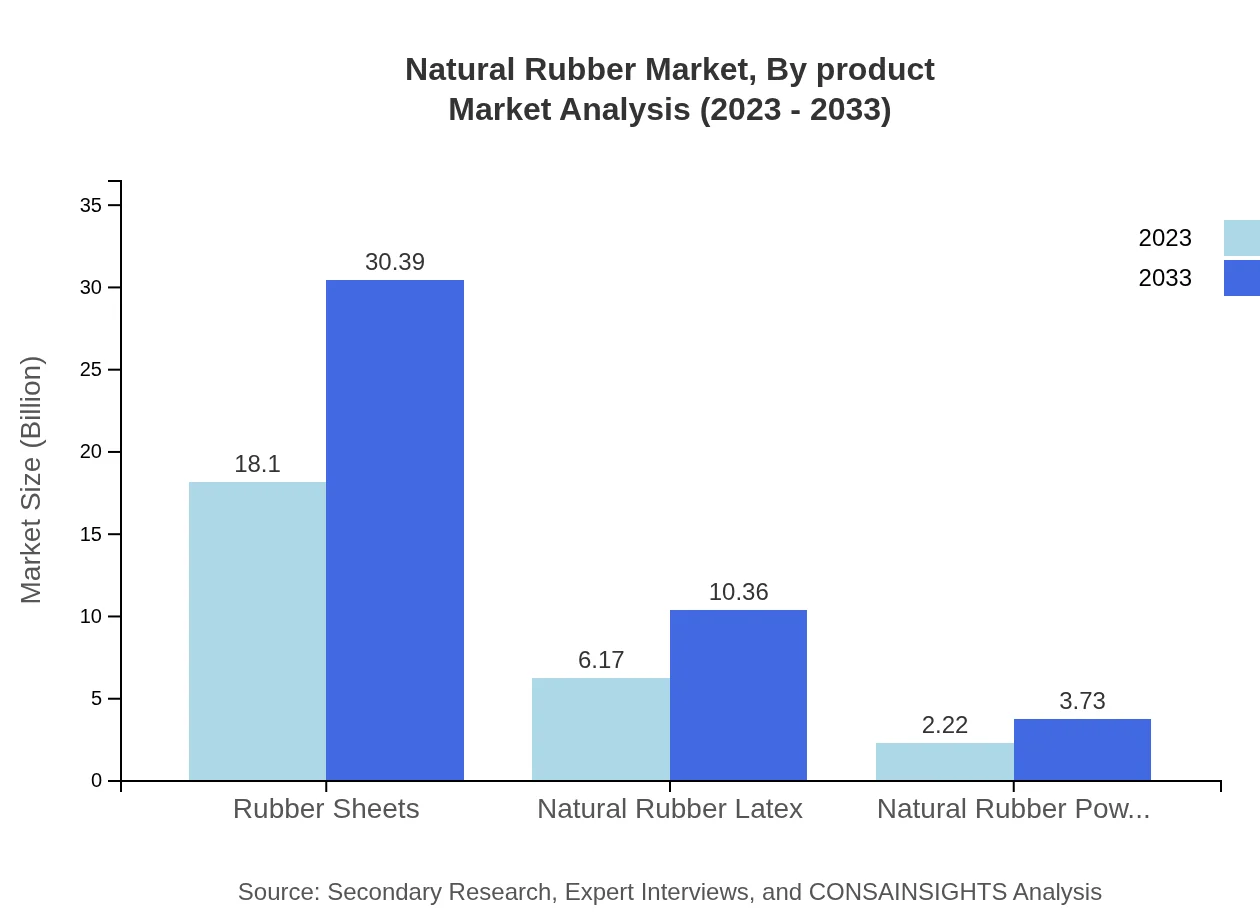

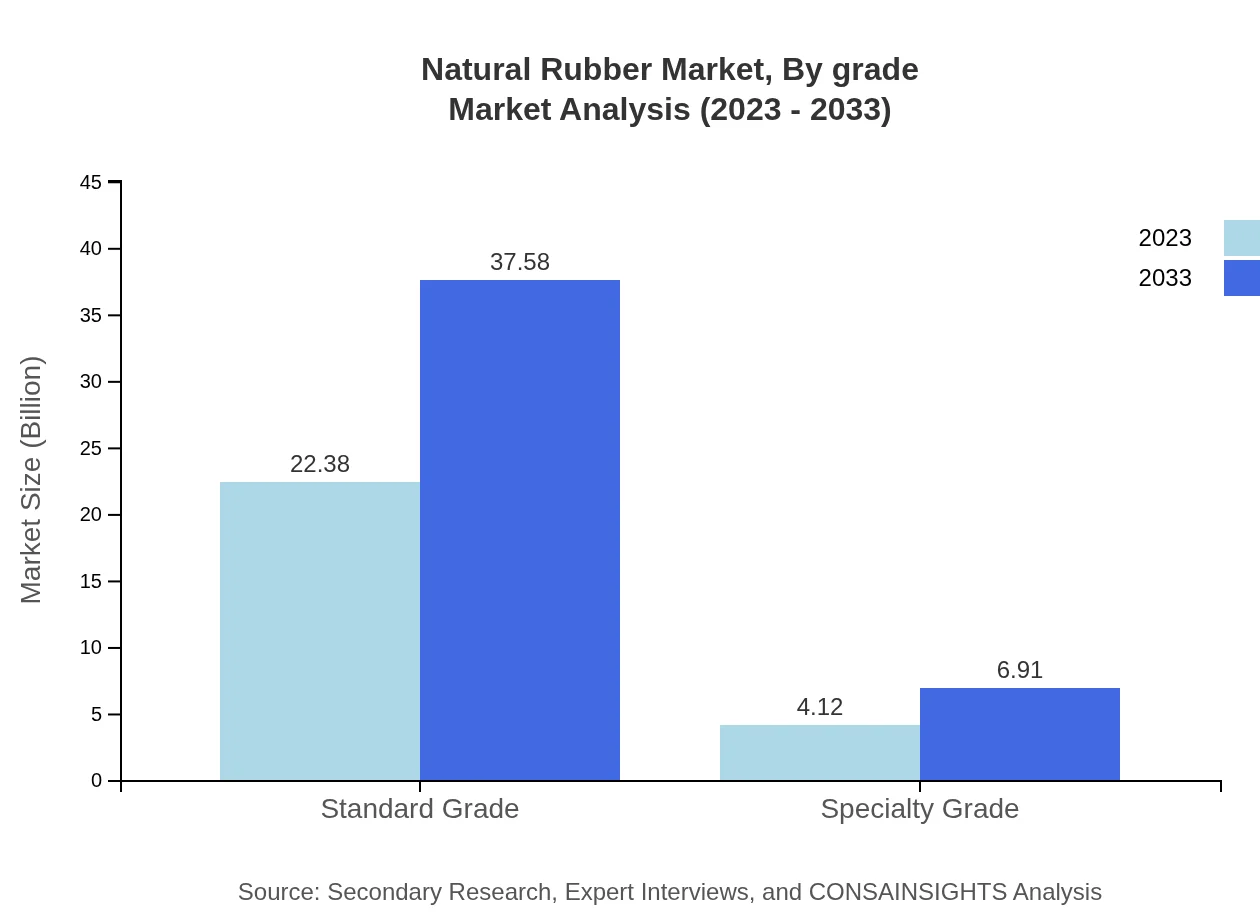

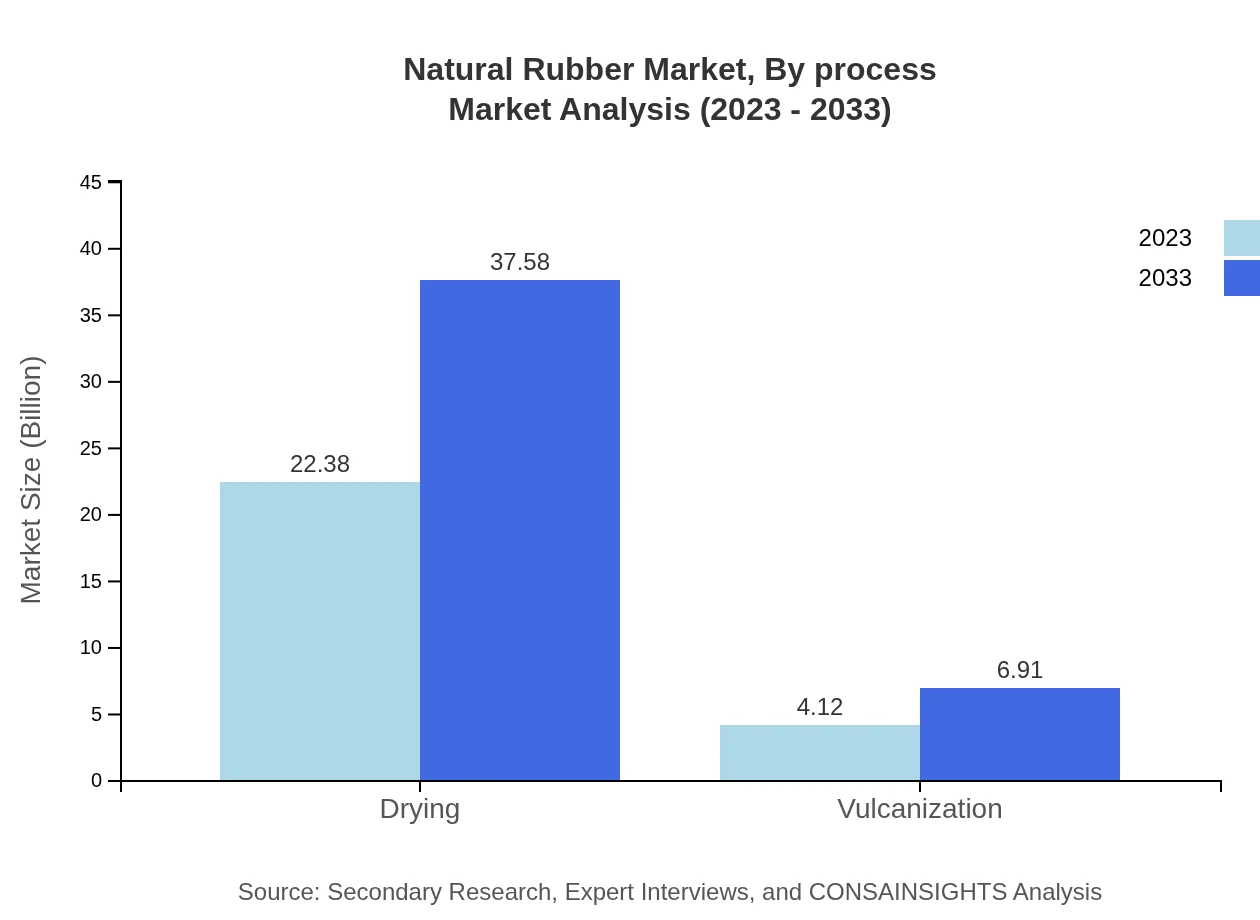

Natural Rubber Market Analysis By Product

The Natural Rubber market reveals distinctive performance patterns across its various product segments in 2023. Standard Grade dominates with a size of USD 22.38 billion and is expected to expand to USD 37.58 billion by 2033, maintaining a share of 84.47%. Specialty Grade follows, starting at USD 4.12 billion and anticipated to grow to USD 6.91 billion, ensuring a steady share of 15.53%. This segmentation signifies the importance of standard grades in industrial applications while highlighting the growth potential of specialty grades.

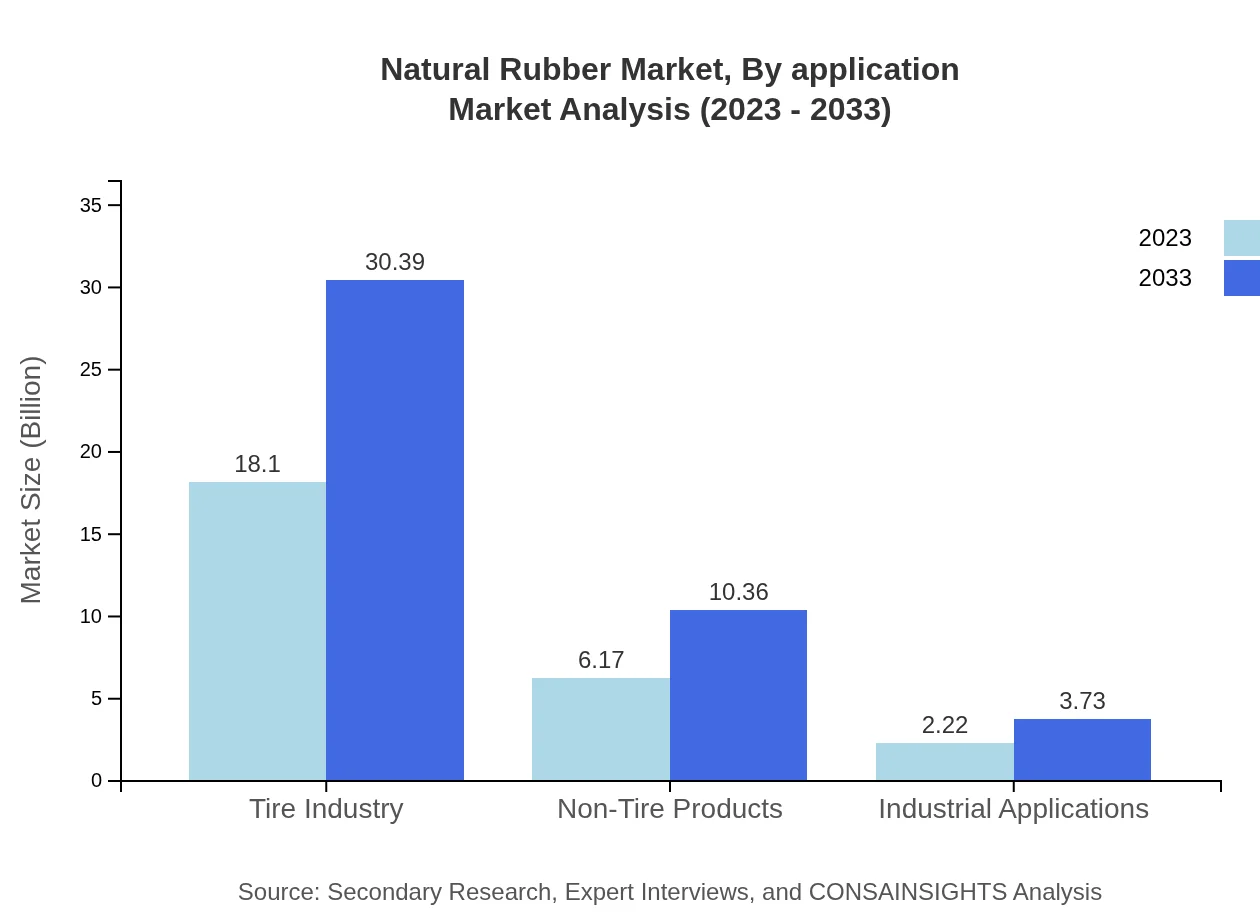

Natural Rubber Market Analysis By Application

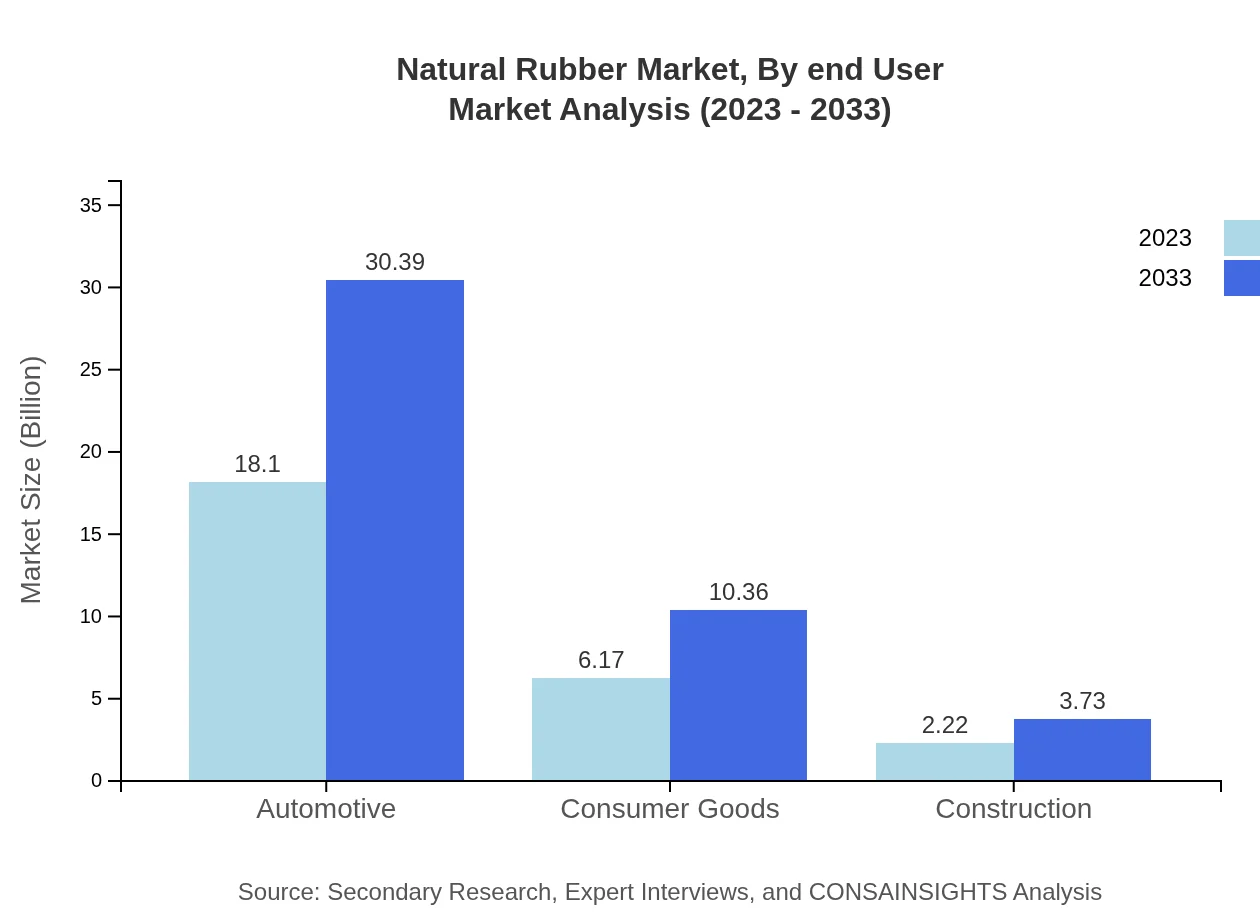

The Natural Rubber market is primarily driven by its extensive use in the Tire industry, which accounted for USD 18.10 billion in 2023 and is expected to grow to USD 30.39 billion by 2033, representing a significant market share of 68.32%. Other applications include Consumer Goods, valued at USD 6.17 billion currently and rising to USD 10.36 billion, and Industrial Applications, projected to grow from USD 2.22 billion to USD 3.73 billion. This highlights the tire industry's dominance while emphasizing growing applications in consumer sectors.

Natural Rubber Market Analysis By Grade

The market segmentation by grade reveals the Standard Grade's substantial position, where it constitutes a major portion of the market. In 2023, Standard Grade rubber's size reached USD 22.38 billion, expected to expand significantly as the automotive sector demands high-performance materials. Specialty Grade rubber also shows promise, indicating increasing utilization across diverse applications, confirming its anticipated rise from USD 4.12 billion to USD 6.91 billion.

Natural Rubber Market Analysis By End User

The Tire industry remains the top end-user of natural rubber, holding a prominent share at USD 18.10 billion in 2023 with prospects of reaching USD 30.39 billion by 2033. Conversely, industries such as Consumer Goods and Non-Tire Products indicate considerable growth potential, reflecting the increasing diversification of natural rubber applications across various sectors.

Natural Rubber Market Analysis By Process

Processing methods play a crucial role in determining the quality and applicability of natural rubber. Traditional methods, including tapping and collection from rubber trees, dominate the market. However, newer processes like vulcanization and drying are gaining traction for enhancing resilience and longevity. In 2023, vulcanization’s market size stood at approximately USD 4.12 billion, whilst processes like drying achieved substantial growth, reiterating their importance in rubber manufacturing.

Natural Rubber Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Natural Rubber Industry

Hevea Brasiliensis Co.:

A leading producer of natural rubber, focusing on sustainable practices and innovative agricultural methodologies to enhance production efficiency.Sri Trang Agro-Industry Public Company Limited:

One of the largest rubber producers globally, known for its extensive supply chain and commitment to quality management in rubber production.Kraton Corporation:

Specializes in advanced materials derived from natural rubber, focusing on sustainable practices and meeting industry demands for performance.Thai Rubber Latex Corporation:

A key player in the latex sector, offering a wide range of high-quality latex products derived from natural rubber.We're grateful to work with incredible clients.

FAQs

What is the market size of natural rubber?

The natural rubber market is projected to reach a size of $26.5 billion by 2033, growing at a CAGR of 5.2%. This growth highlights its significance across various industries, including automotive and consumer goods.

What are the key market players or companies in the natural rubber industry?

Key players in the natural rubber market include large companies involved in rubber cultivation, processing, and distribution. Prominent firms play significant roles in sourcing and delivering quality natural rubber products globally.

What are the primary factors driving the growth in the natural rubber industry?

Growth in the natural rubber industry is driven by increased demand in automotive and industrial applications, sustainability trends favoring natural over synthetic alternatives, and technological advancements in rubber processing methods.

Which region is the fastest Growing in the natural rubber market?

Asia Pacific is the fastest-growing region in the natural rubber market, with market size projected to grow from $5.48 billion in 2023 to $9.19 billion by 2033, reflecting a robust demand trajectory.

Does ConsaInsights provide customized market report data for the natural rubber industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications within the natural rubber industry, delivering insights that cater to specific market needs and trends.

What deliverables can I expect from this natural rubber market research project?

Deliverables from this market research project include comprehensive reports, detailed analysis of market segments, competitive landscape assessments, and forecasts detailing market trends and size up to 2033.

What are the market trends of natural rubber?

Market trends indicate a shift towards sustainable sourcing of natural rubber, increased integration of technology in production, and rising applications in eco-friendly products, enhancing the overall growth of the market.