Naval Missiles And Missile Launch Systems Market Report

Published Date: 03 February 2026 | Report Code: naval-missiles-and-missile-launch-systems

Naval Missiles And Missile Launch Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Naval Missiles and Missile Launch Systems market from 2023 to 2033, focusing on market trends, technologies, regional dynamics, and key players that shape the industry landscape.

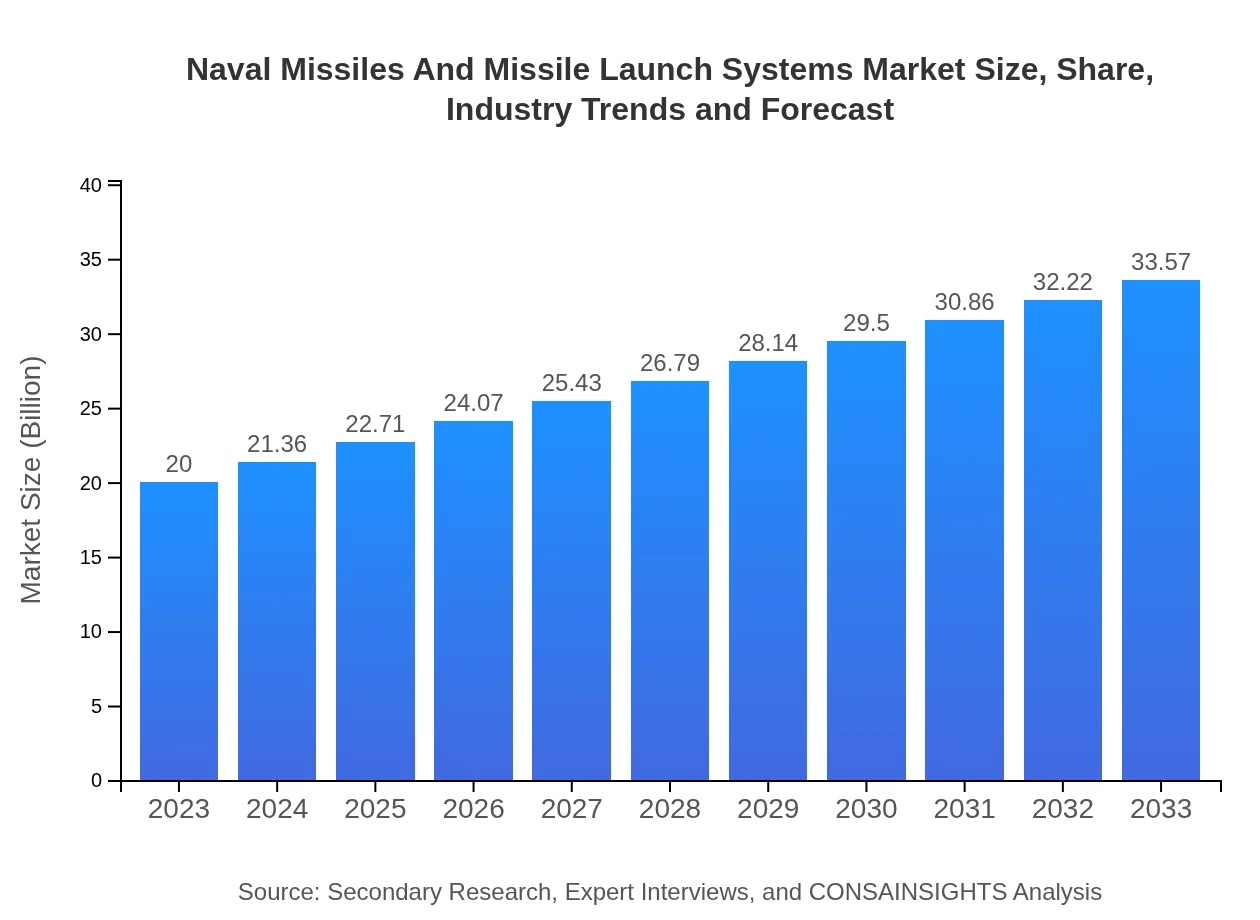

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $33.57 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Northrop Grumman, MBDA |

| Last Modified Date | 03 February 2026 |

Naval Missiles And Missile Launch Systems Market Overview

Customize Naval Missiles And Missile Launch Systems Market Report market research report

- ✔ Get in-depth analysis of Naval Missiles And Missile Launch Systems market size, growth, and forecasts.

- ✔ Understand Naval Missiles And Missile Launch Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Naval Missiles And Missile Launch Systems

What is the Market Size & CAGR of Naval Missiles And Missile Launch Systems market in 2023?

Naval Missiles And Missile Launch Systems Industry Analysis

Naval Missiles And Missile Launch Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Naval Missiles And Missile Launch Systems Market Analysis Report by Region

Europe Naval Missiles And Missile Launch Systems Market Report:

The European market is estimated to grow from $5.25 billion in 2023 to $8.81 billion in 2033. The heightened focus on defense readiness due to geopolitical tensions in Eastern Europe and the significance of NATO in collective defense initiatives drive this growth.Asia Pacific Naval Missiles And Missile Launch Systems Market Report:

The Asia-Pacific region is projected to exhibit the strongest growth in the Naval Missiles And Missile Launch Systems market, with a market size of approximately $4.01 billion in 2023, expected to rise to $6.74 billion by 2033. The increase is driven by military expansion in response to regional tensions, particularly involving major powers such as China and India, focusing on enhancing their naval capabilities.North America Naval Missiles And Missile Launch Systems Market Report:

North America remains a significant player within the Naval Missiles And Missile Launch Systems market, starting at $7.65 billion in 2023 and anticipated to reach $12.84 billion by 2033. The United States leads the market with substantial investments in naval defense technology, particularly amid evolving military strategies and potential threats.South America Naval Missiles And Missile Launch Systems Market Report:

In South America, the market size is projected to grow from $1.78 billion in 2023 to $2.99 billion by 2033. Factors contributing to this growth include rising defense budgets as regional threats emerge, alongside collaborations with other nations to enhance naval capabilities and procurement plans.Middle East & Africa Naval Missiles And Missile Launch Systems Market Report:

In the Middle East and Africa, the market is expected to expand from $1.31 billion in 2023 to $2.20 billion by 2033. Regions facing geopolitical instability and military conflicts are investing in enhancing their naval capabilities, contributing to the growth of missile and launch systems.Tell us your focus area and get a customized research report.

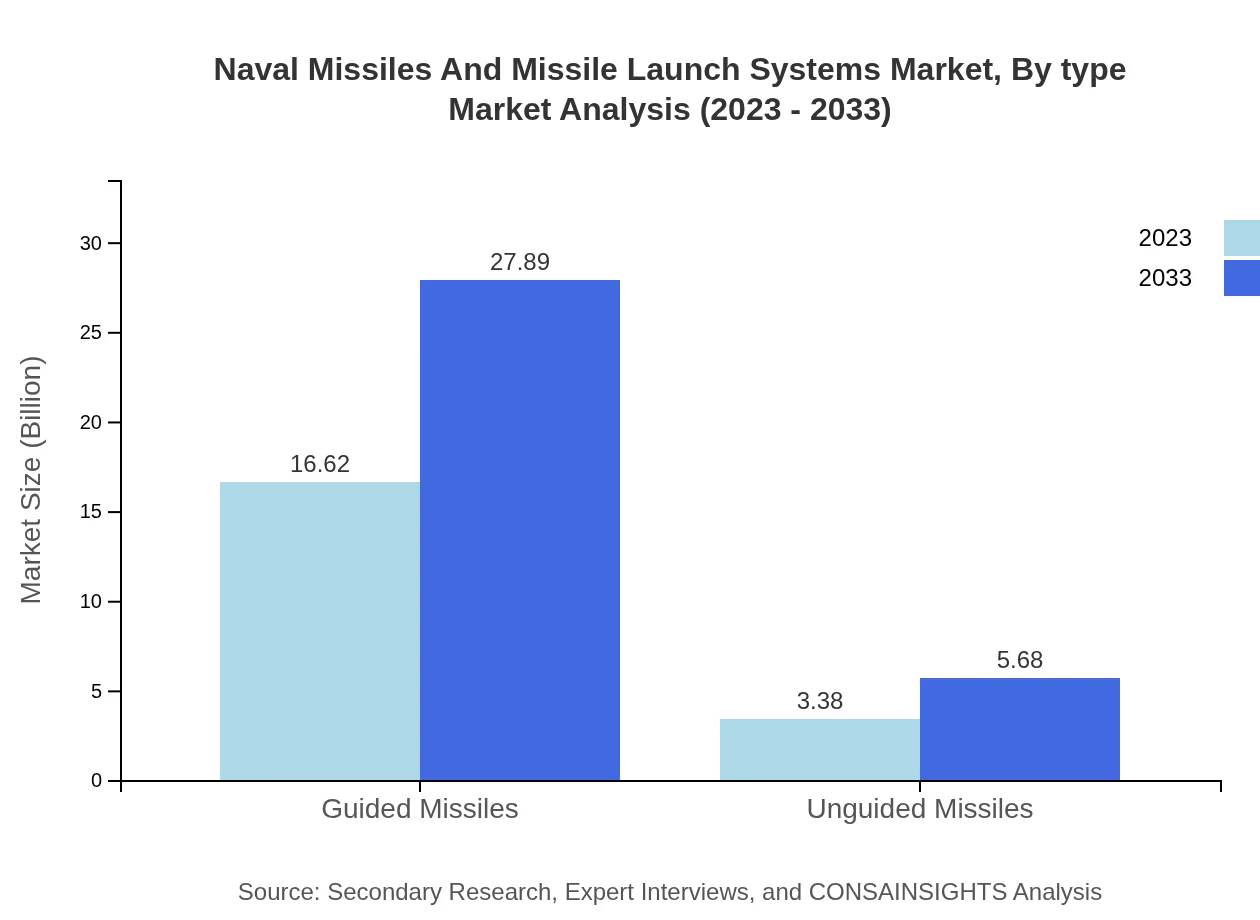

Naval Missiles And Missile Launch Systems Market Analysis By Type

The segment of guided missiles will dominate the market, increasing from $16.62 billion in 2023 to $27.89 billion by 2033, holding an 83.08% share throughout the period. Unguided missiles also show growth, increasing from $3.38 billion in 2023 to $5.68 billion by 2033, yet maintaining a smaller market share of 16.92%.

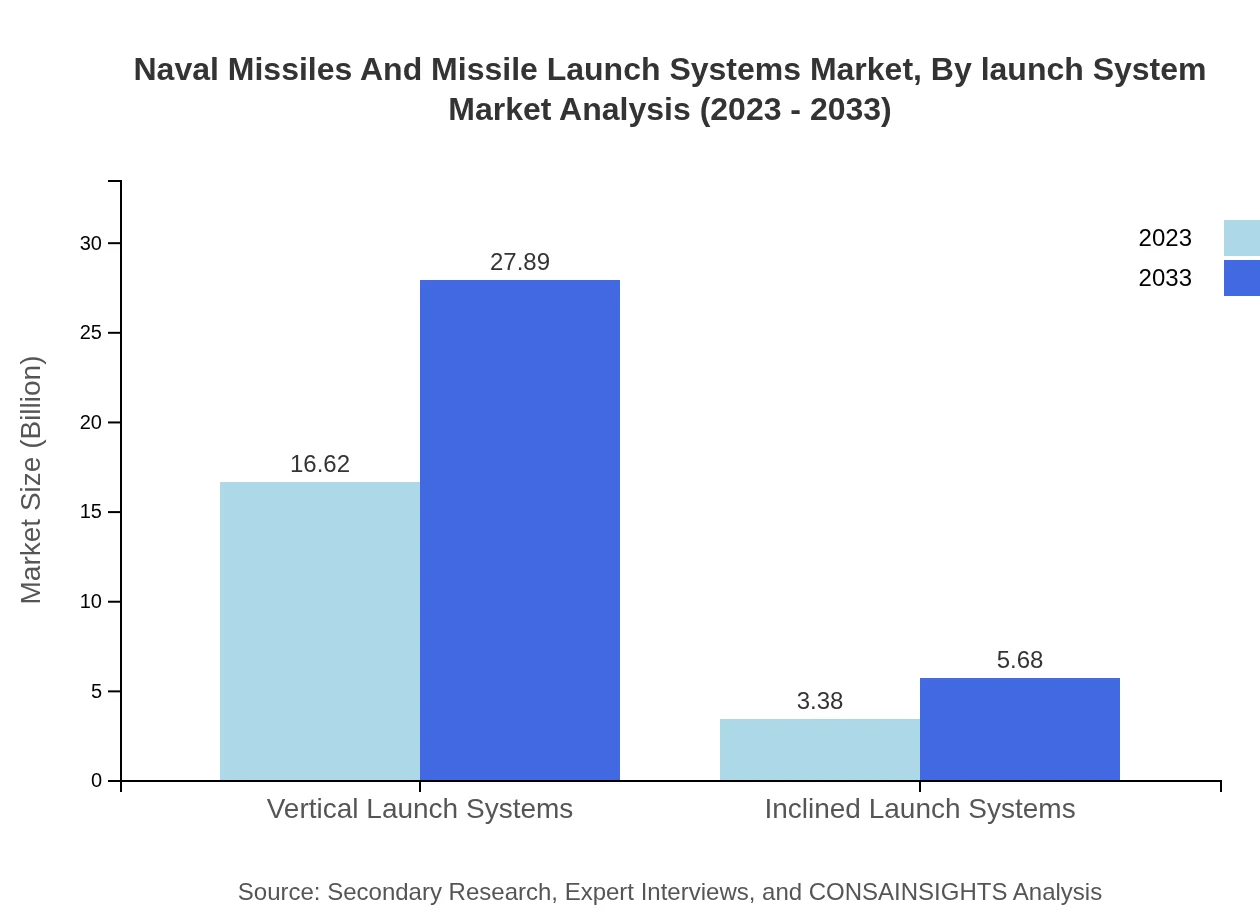

Naval Missiles And Missile Launch Systems Market Analysis By Launch System

Vertical Launch Systems (VLS) are expected to continue their dominance in market share at 83.08% as they grow from $16.62 billion in 2023 to $27.89 billion by 2033. Inclined launch systems will also witness growth, albeit slower, from $3.38 billion to $5.68 billion, retaining a 16.92% market share.

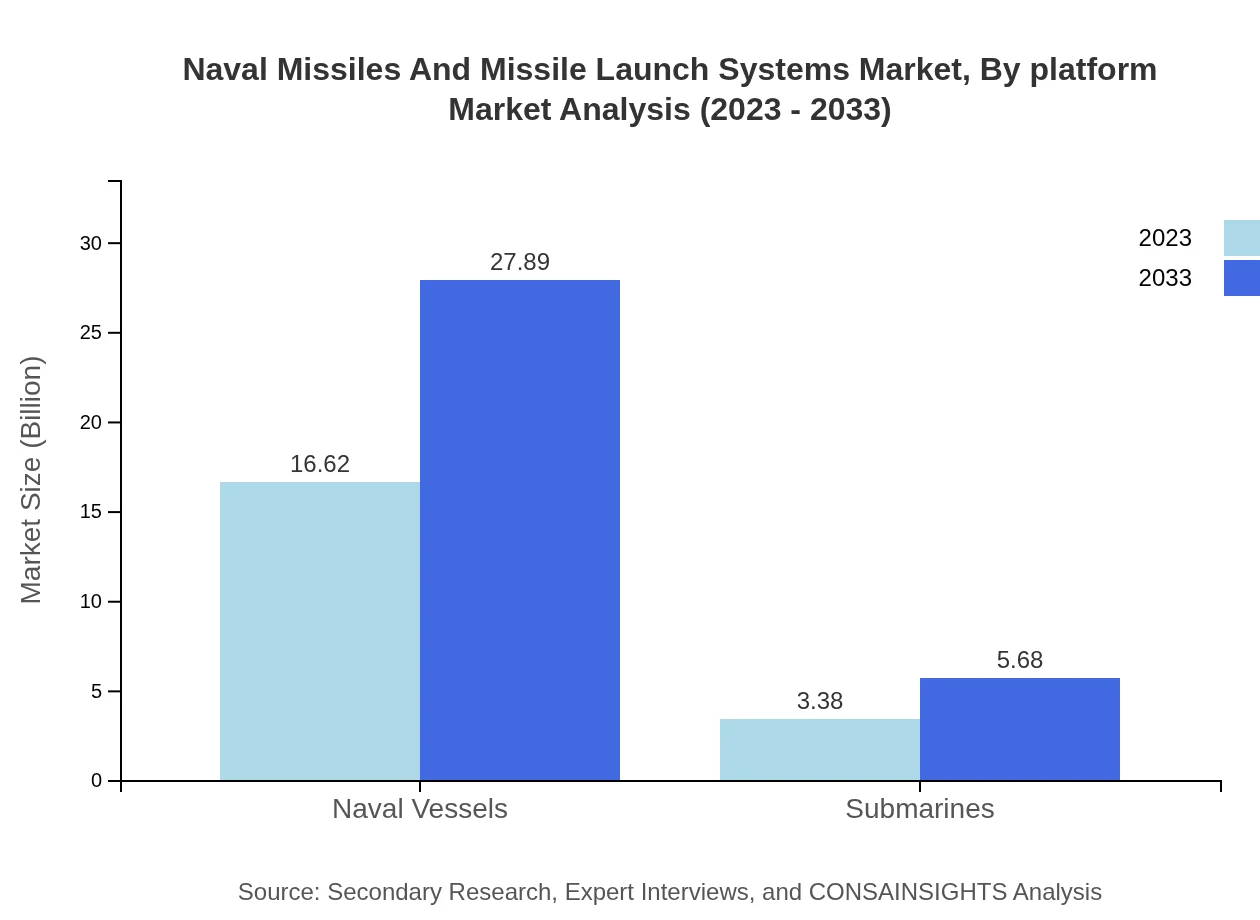

Naval Missiles And Missile Launch Systems Market Analysis By Platform

Within platforms, naval vessels will lead with sales increasing from $16.62 billion in 2023 to $27.89 billion by 2033. Submarines are also a crucial segment, projected to grow from $3.38 billion to $5.68 billion, maintaining a consistent share in the market.

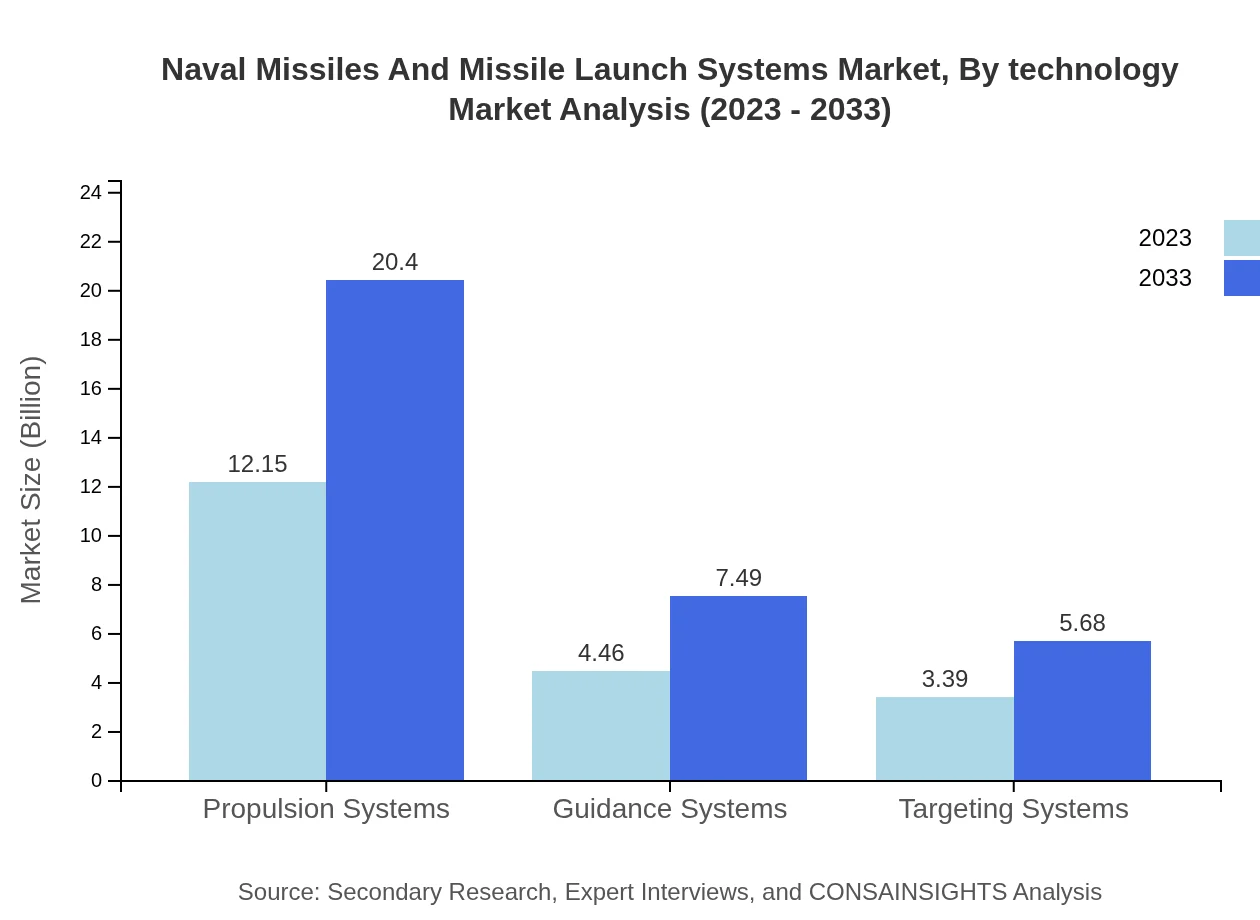

Naval Missiles And Missile Launch Systems Market Analysis By Technology

Guidance systems are expected to see significant advancements, growing from $4.46 billion to $7.49 billion by 2033, reflecting 22.31% of the market. Propulsion systems will also experience growth from $12.15 billion in 2023 to $20.40 billion, maintaining a substantial share of 60.76%.

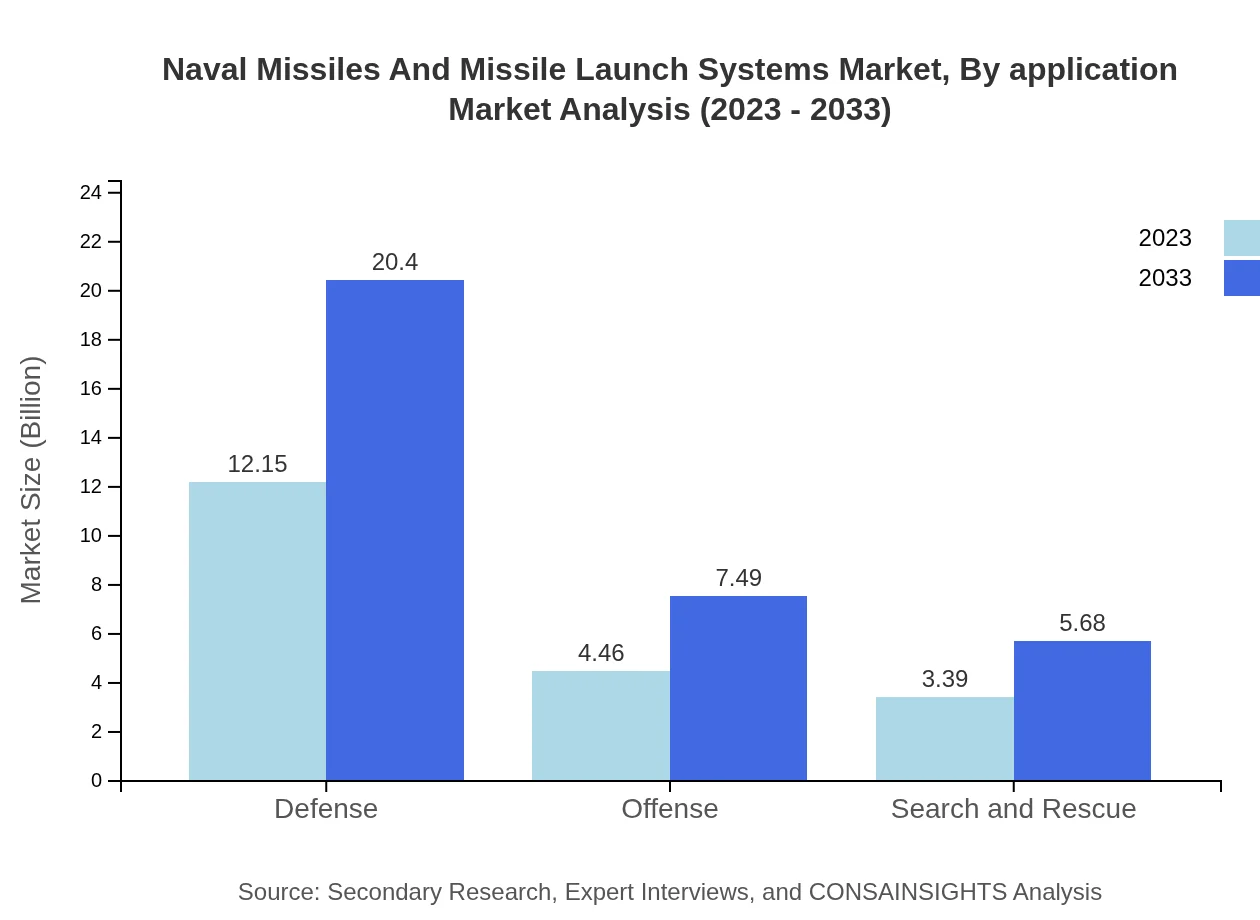

Naval Missiles And Missile Launch Systems Market Analysis By Application

The market segments by application can be grouped into defense and offense systems, with defense systems projected to dominate, increasing from $12.15 billion to $20.40 billion, while offense systems are also growing from $4.46 billion to $7.49 billion, each maintaining their respective shares.

Naval Missiles And Missile Launch Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Naval Missiles And Missile Launch Systems Industry

Lockheed Martin:

A leading aerospace and defense company specializing in missile and launch systems, known for advanced technologies in naval warfare.Raytheon Technologies:

An American multinational with expertise in defense and aerospace, significant contributions to missile systems and military contracts.Northrop Grumman:

A global security company focused on technology and defense systems, including missile technology and naval launch systems.MBDA:

A European defense company specializing in missile systems, known for innovative solutions in naval missile technology across multiple platforms.We're grateful to work with incredible clients.

FAQs

What is the market size of naval Missiles And Missile Launch Systems?

The naval missiles and missile launch systems market is valued at approximately $20 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.2% forecasted through 2033.

What are the key market players or companies in this naval Missiles And Missile Launch Systems industry?

Key players in the naval missiles and missile launch systems industry include major defense contractors such as Raytheon Technologies, Lockheed Martin, Northrop Grumman, BAE Systems, and Thales Group, all contributing to technological advancements and competitive strategies.

What are the primary factors driving the growth in the naval Missiles And Missile Launch Systems industry?

The growth in this industry is primarily driven by increasing geopolitical tensions, advancements in missile technology, enhanced naval warfare capabilities, and rising defense budgets across various nations aiming to strengthen maritime security.

Which region is the fastest Growing in the naval Missiles And Missile Launch Systems?

North America is the fastest-growing region for naval missiles and missile launch systems, projected to grow from $7.65 billion in 2023 to approximately $12.84 billion by 2033, reflecting significant investment in military capabilities.

Does ConsaInsights provide customized market report data for the naval Missiles And Missile Launch Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific requests within the naval missiles and missile launch systems industry, ensuring clients receive pertinent insights relevant to their strategic needs.

What deliverables can I expect from this naval Missiles And Missile Launch Systems market research project?

Expect deliverables such as comprehensive market analysis reports, competitive landscape evaluations, regional market insights, trend identification, and forecasts to support strategic decisions in the naval missiles and missile launch systems sector.

What are the market trends of naval Missiles And Missile Launch Systems?

Market trends include increasing R&D investments in guided and unguided missile technologies, growth in propulsion and targeting systems, heightening demand for vertical launch systems, and a shift towards modular and integrated naval systems.