Naval Navigation And Communication Systems Market Report

Published Date: 03 February 2026 | Report Code: naval-navigation-and-communication-systems

Naval Navigation And Communication Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Naval Navigation and Communication Systems market, including market size, growth forecasts from 2023 to 2033, industry trends, and competitive landscape insights.

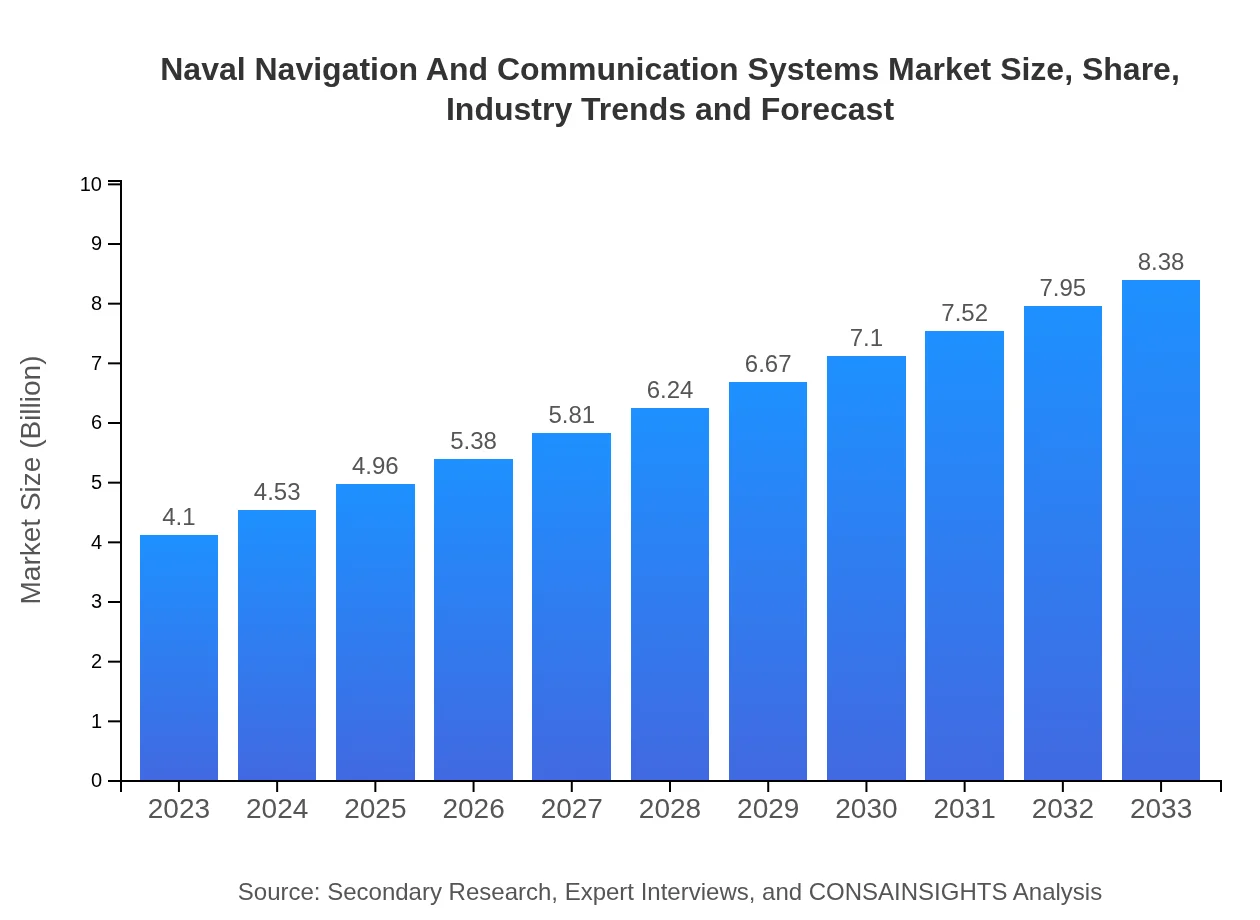

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.10 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $8.38 Billion |

| Top Companies | Raytheon Technologies, Northrop Grumman, Thales Group, Lockheed Martin, BAE Systems |

| Last Modified Date | 03 February 2026 |

Naval Navigation And Communication Systems Market Overview

Customize Naval Navigation And Communication Systems Market Report market research report

- ✔ Get in-depth analysis of Naval Navigation And Communication Systems market size, growth, and forecasts.

- ✔ Understand Naval Navigation And Communication Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Naval Navigation And Communication Systems

What is the Market Size & CAGR of Naval Navigation And Communication Systems market in 2023?

Naval Navigation And Communication Systems Industry Analysis

Naval Navigation And Communication Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Naval Navigation And Communication Systems Market Analysis Report by Region

Europe Naval Navigation And Communication Systems Market Report:

The European market is expected to see impressive growth from $1.31 billion in 2023 to $2.67 billion by 2033. Investments in defense from key players like the UK and France alongside NATO's maritime strategies are bolstering demand for advanced naval systems.Asia Pacific Naval Navigation And Communication Systems Market Report:

The Asia-Pacific region is expected to grow from approximately $0.77 billion in 2023 to $1.58 billion by 2033, driven by increasing naval activities and the strengthening of maritime security policies among countries like India, Japan, and China. The government initiatives focused on enhancing naval capabilities and emerging threats in the South China Sea are further elevating demand for these systems.North America Naval Navigation And Communication Systems Market Report:

North America, particularly the United States, is a leader in this market, projected to grow from $1.42 billion in 2023 to $2.89 billion by 2033. The United States Navy's ongoing modernization programs, along with increasing tensions in international waters, are significant factors driving this growth.South America Naval Navigation And Communication Systems Market Report:

In South America, the market is projected to grow from $0.17 billion in 2023 to $0.36 billion by 2033. Efforts to modernize naval forces and improve maritime safety amid territorial disputes have prompted investments in navigation and communication technologies. Countries like Brazil are particularly focused on expanding their capabilities.Middle East & Africa Naval Navigation And Communication Systems Market Report:

The naval navigation and communication systems market in the Middle East and Africa is projected to grow from $0.43 billion in 2023 to $0.88 billion by 2033. Geopolitical tensions and the need to ensure maritime security continue to drive significant investments in both military and commercial naval capabilities.Tell us your focus area and get a customized research report.

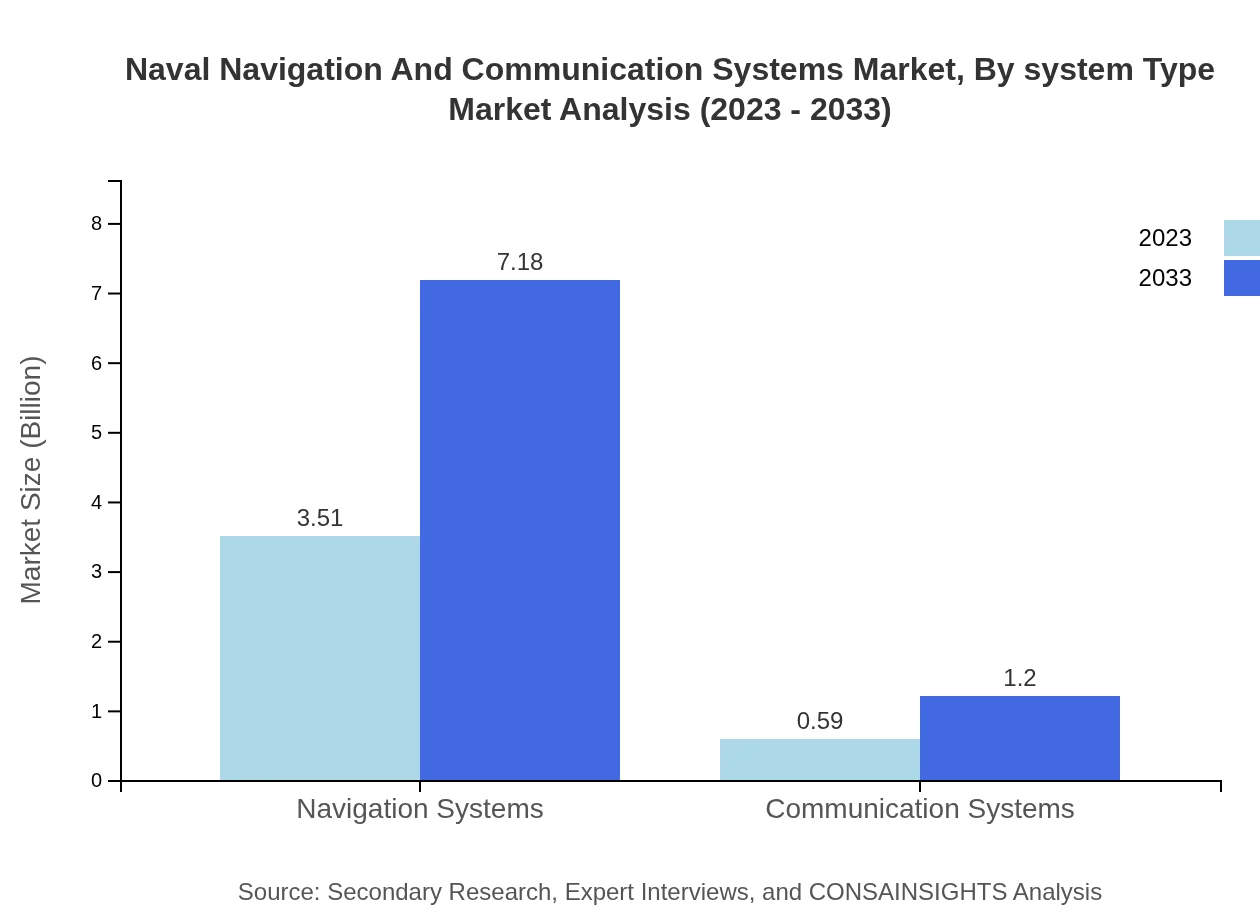

Naval Navigation And Communication Systems Market Analysis By System Type

Navigation systems dominate the market, expected to grow from $3.51 billion in 2023 to $7.18 billion by 2033, maintaining a significant share of 85.67%. Communication systems, while smaller, are steadily expanding, projecting a rise from $0.59 billion to $1.20 billion during the same period, constituting 14.33% of the market share.

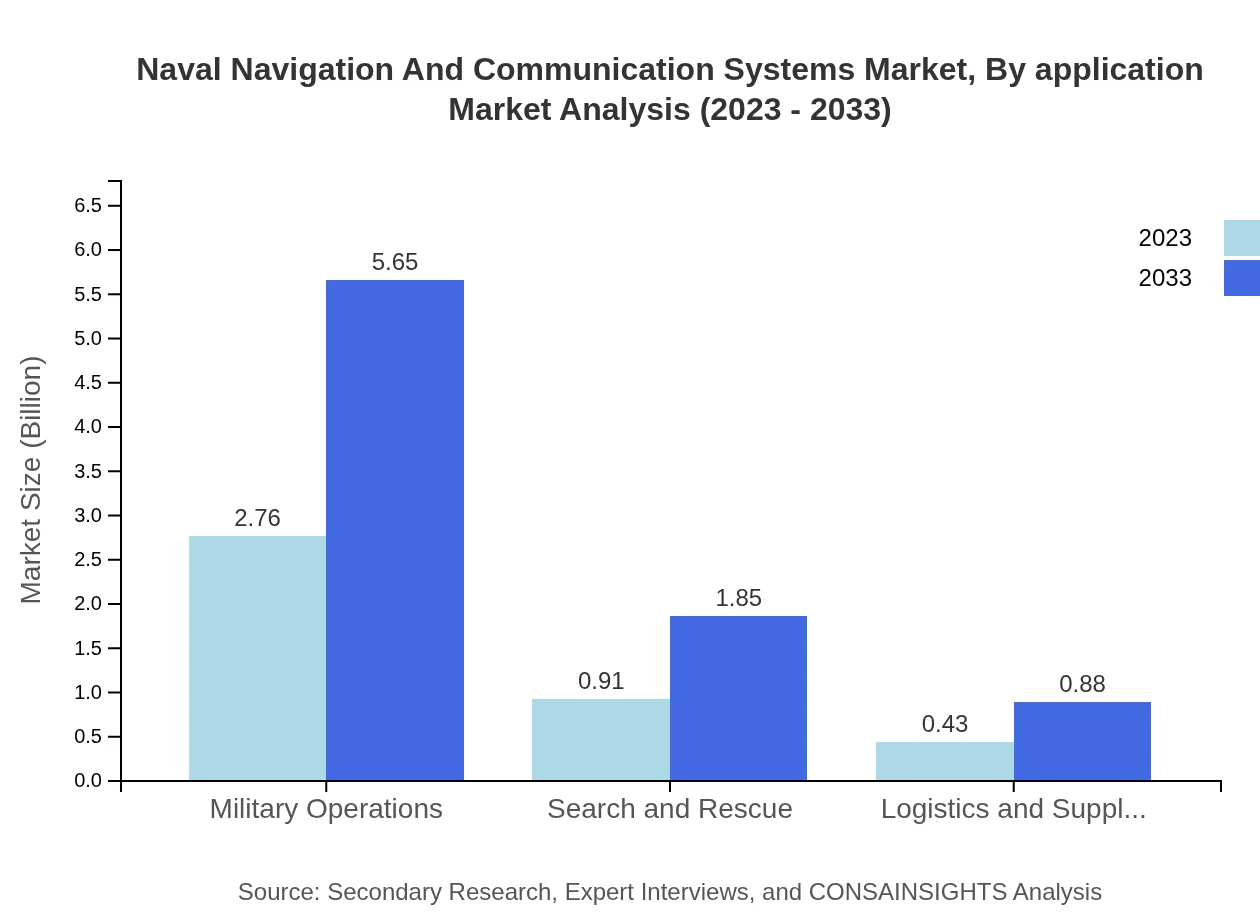

Naval Navigation And Communication Systems Market Analysis By Application

Military operations form the largest application area, growing from $2.76 billion in 2023 to $5.65 billion by 2033, holding a 67.43% market share. Search and rescue operations are also crucial, expected to expand from $0.91 billion to $1.85 billion, maintaining 22.09% of the market. Logistics and supply chain management will experience growth, with a rise from $0.43 billion to $0.88 billion, constituting 10.48% of the market.

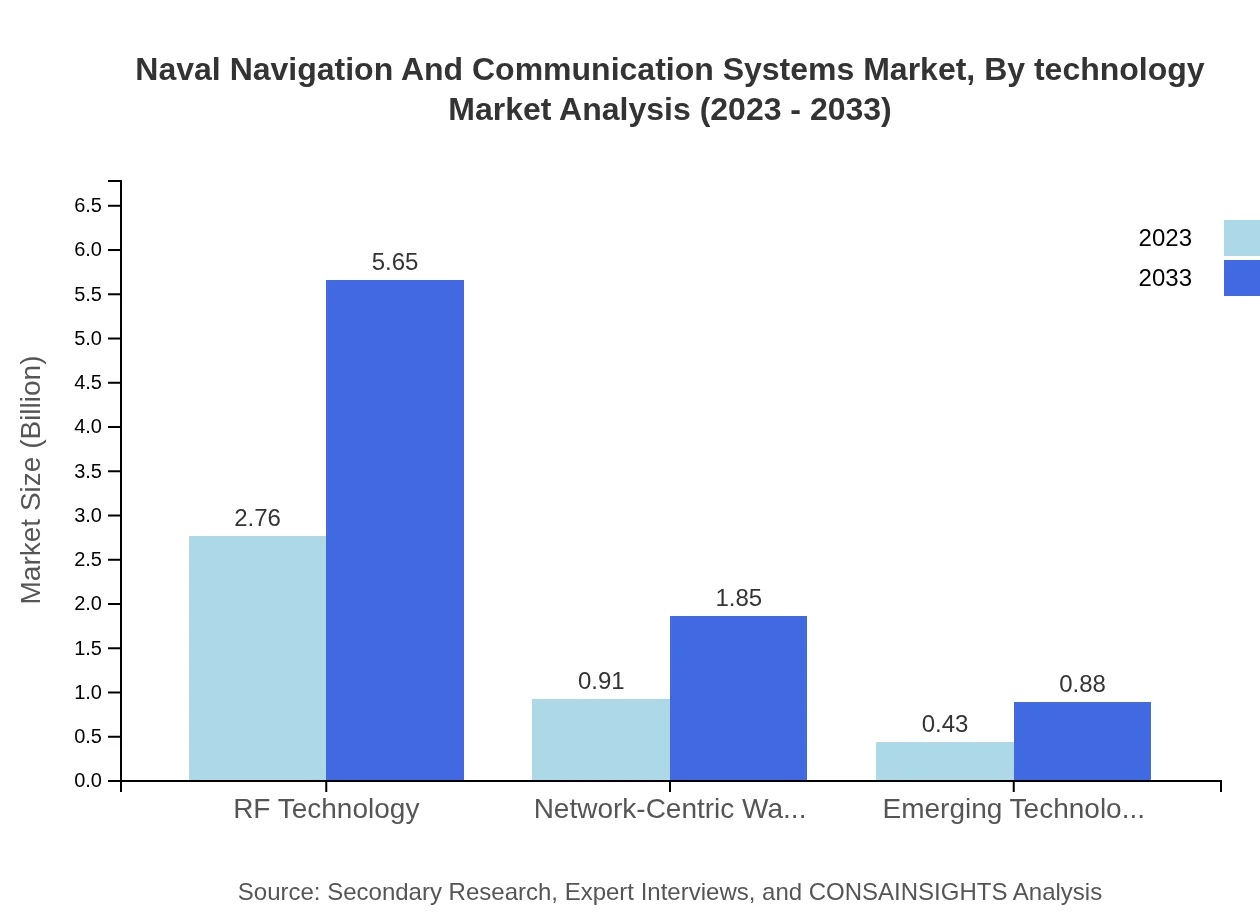

Naval Navigation And Communication Systems Market Analysis By Technology

RF technology holds the largest share with an increase from $2.76 billion in 2023 to $5.65 billion by 2033, covering 67.43%. Network-centric warfare technologies are also seeing growth, expected to rise from $0.91 billion to $1.85 billion, representing 22.09%. Emerging technologies, including advanced sensors, will grow from $0.43 billion to $0.88 billion, making up 10.48% of the share.

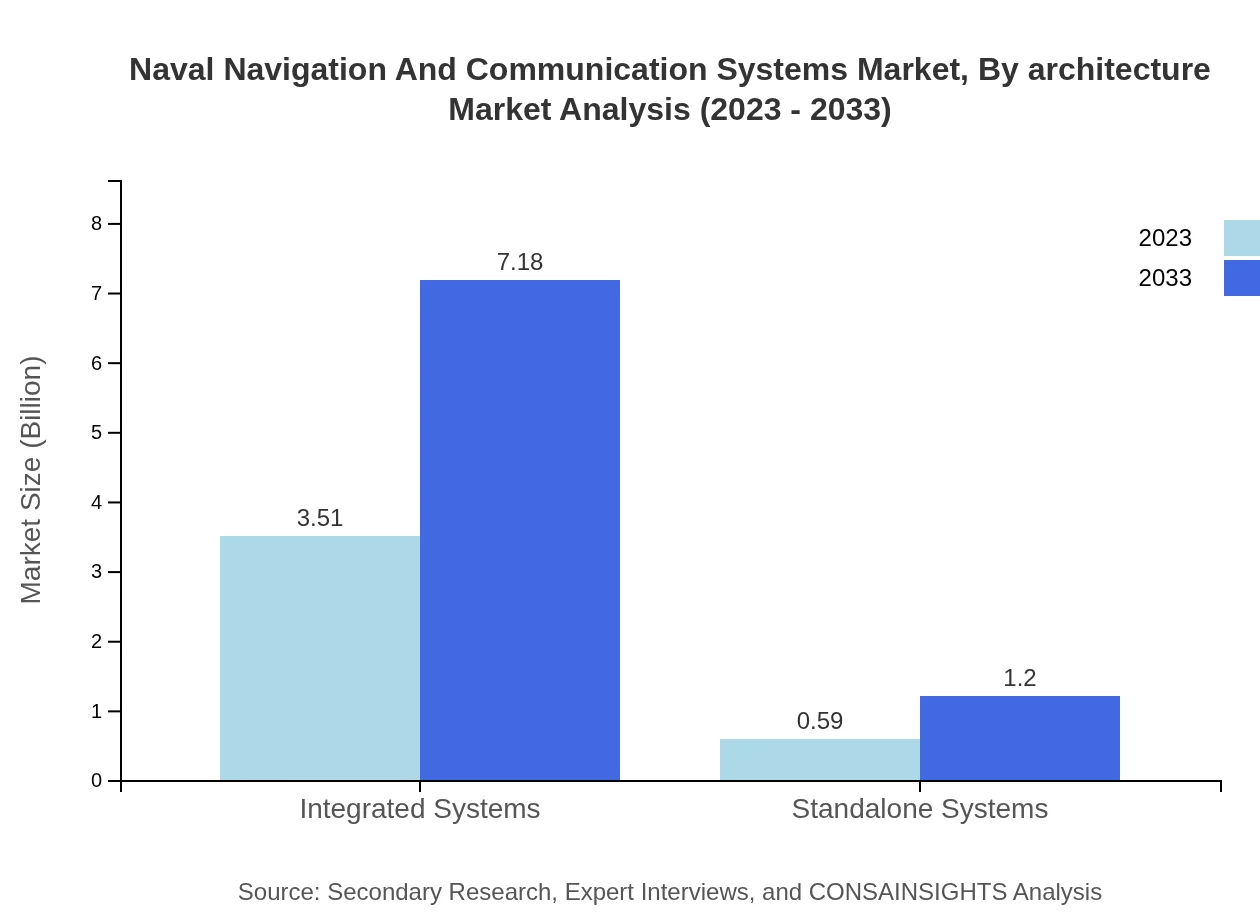

Naval Navigation And Communication Systems Market Analysis By Architecture

Integrated systems dominate with a growth projection from $3.51 billion to $7.18 billion, holding 85.67% of the market share. Standalone systems show smaller growth, expected to rise from $0.59 billion to $1.20 billion, making up 14.33% of the market.

Naval Navigation And Communication Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Naval Navigation And Communication Systems Industry

Raytheon Technologies:

A leading defense contractor known for advanced navigation technologies and communication systems, critical for modern naval operations.Northrop Grumman:

Specializes in navigation and surveillance systems, providing essential solutions for military applications worldwide.Thales Group:

A global leader in marine and naval navigation, offering integrated systems for both military and civilian operations.Lockheed Martin:

A key player in defense technologies, recognized for its comprehensive naval navigation and communication solutions.BAE Systems:

Offers advanced navigation and communication systems, focusing on naval capabilities and maritime security.We're grateful to work with incredible clients.

FAQs

What is the market size of naval Navigation And Communication Systems?

The market size of naval navigation and communication systems is projected to be $4.1 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 7.2% from 2023 to 2033. This growth reflects the increasing demand for advanced maritime technologies.

What are the key market players or companies in this naval Navigation And Communication Systems industry?

Key players in the naval navigation and communication systems industry include major defense contractors and technology firms specializing in communication networks and navigation systems. These companies play a vital role in supplying innovative solutions for military and commercial maritime applications.

What are the primary factors driving the growth in the naval Navigation And Communication Systems industry?

Growth in the naval navigation and communication systems industry is driven by advancements in navigation technology, increased defense spending globally, and growing maritime trade. Additionally, the expanding demand for integrated systems and military operations enhances market opportunities.

Which region is the fastest Growing in the naval Navigation And Communication Systems?

The Asia Pacific region is identified as the fastest-growing market for naval navigation and communication systems, with market growth projected from $0.77 billion in 2023 to $1.58 billion by 2033, reflecting a robust regional demand for naval technologies.

Does ConsaInsights provide customized market report data for the naval Navigation And Communication Systems industry?

Yes, ConsaInsights specializes in providing customized market report data tailored to specific needs in the naval navigation and communication systems industry, ensuring businesses have access to relevant insights and analyses for informed decision-making.

What deliverables can I expect from this naval Navigation And Communication Systems market research project?

From this market research project, deliverables typically include comprehensive reports on market size, growth projections, segment analysis, competitive landscape, and key trends, providing strategic insights and guidance for stakeholders in the naval navigation and communication sector.

What are the market trends of naval Navigation And Communication Systems?

Market trends in naval navigation and communication systems include increased adoption of RF technology, a focus on integrated systems for military operations and search and rescue, and the growing importance of cybersecurity in communication networks.