Naval Smart Weapons Market Report

Published Date: 03 February 2026 | Report Code: naval-smart-weapons

Naval Smart Weapons Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Naval Smart Weapons market, including market size, growth trends, segmentation, regional insights, and key players from 2023 to 2033.

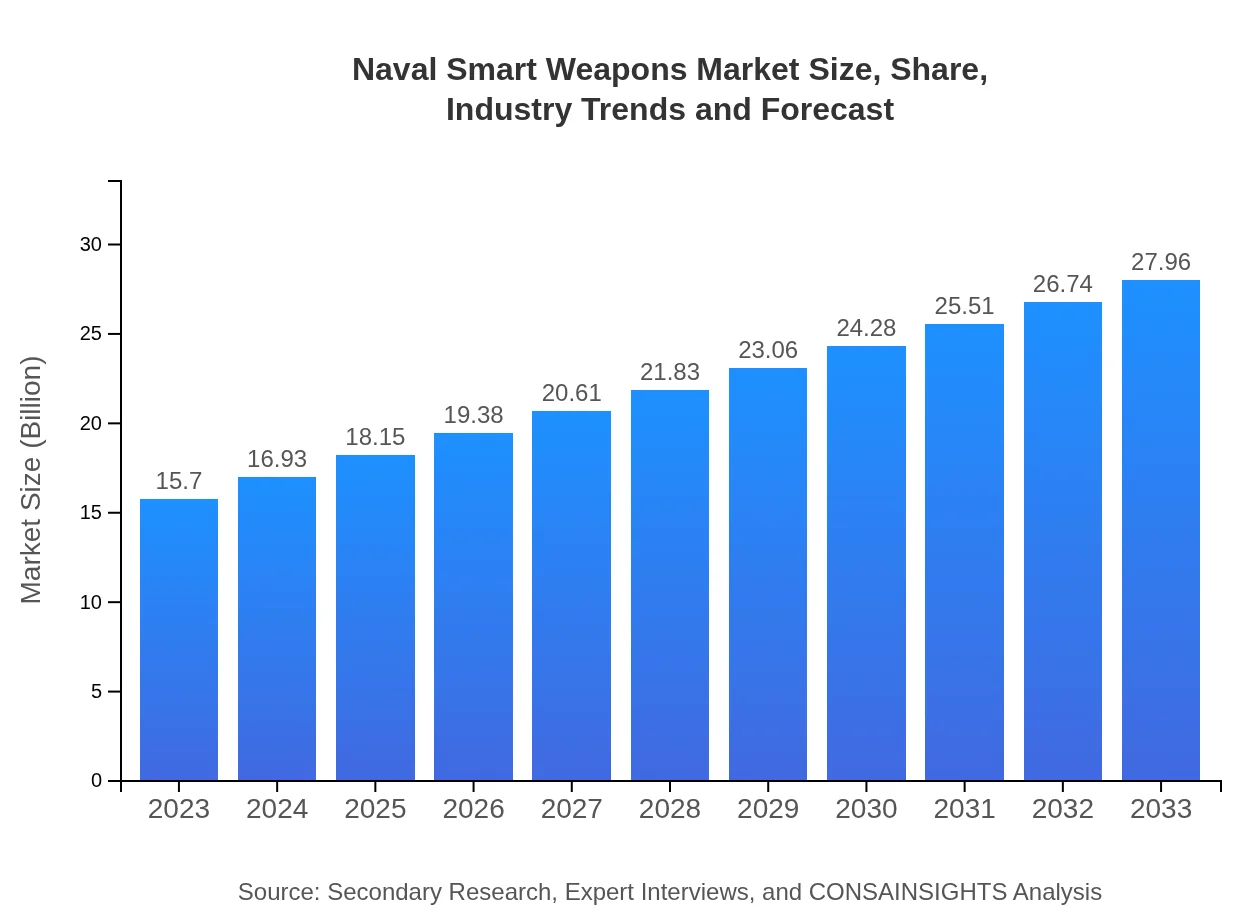

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $27.96 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, BAE Systems, Northrop Grumman |

| Last Modified Date | 03 February 2026 |

Naval Smart Weapons Market Overview

Customize Naval Smart Weapons Market Report market research report

- ✔ Get in-depth analysis of Naval Smart Weapons market size, growth, and forecasts.

- ✔ Understand Naval Smart Weapons's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Naval Smart Weapons

What is the Market Size & CAGR of Naval Smart Weapons market in 2023?

Naval Smart Weapons Industry Analysis

Naval Smart Weapons Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Naval Smart Weapons Market Analysis Report by Region

Europe Naval Smart Weapons Market Report:

In Europe, the market is forecasted to increase from $4.47 billion in 2023 to $7.96 billion by 2033. Increased defense spending in NATO countries reflects the rising geopolitical tensions and the need for advanced naval capabilities.Asia Pacific Naval Smart Weapons Market Report:

In 2023, the Asia Pacific region's Naval Smart Weapons market is estimated at $2.92 billion, projected to grow to $5.20 billion by 2033. Countries like China, India, and Japan are significantly enhancing their naval capacities due to regional security concerns.North America Naval Smart Weapons Market Report:

North America's market size is approximately $5.97 billion in 2023, with forecasts indicating growth to $10.63 billion by 2033. The United States remains the largest contributor due to its expansive naval modernization efforts amid evolving maritime threats.South America Naval Smart Weapons Market Report:

The South American Naval Smart Weapons market is valued at $0.80 billion in 2023 and is expected to reach $1.42 billion by 2033. Countries such as Brazil are investing in maritime defense upgrades to safeguard their vast oceanic resources.Middle East & Africa Naval Smart Weapons Market Report:

The Middle East and Africa's market is estimated at $1.54 billion in 2023, set to rise to $2.75 billion by 2033. Countries like Saudi Arabia and the UAE are investing heavily in smart weapons to counter regional instability.Tell us your focus area and get a customized research report.

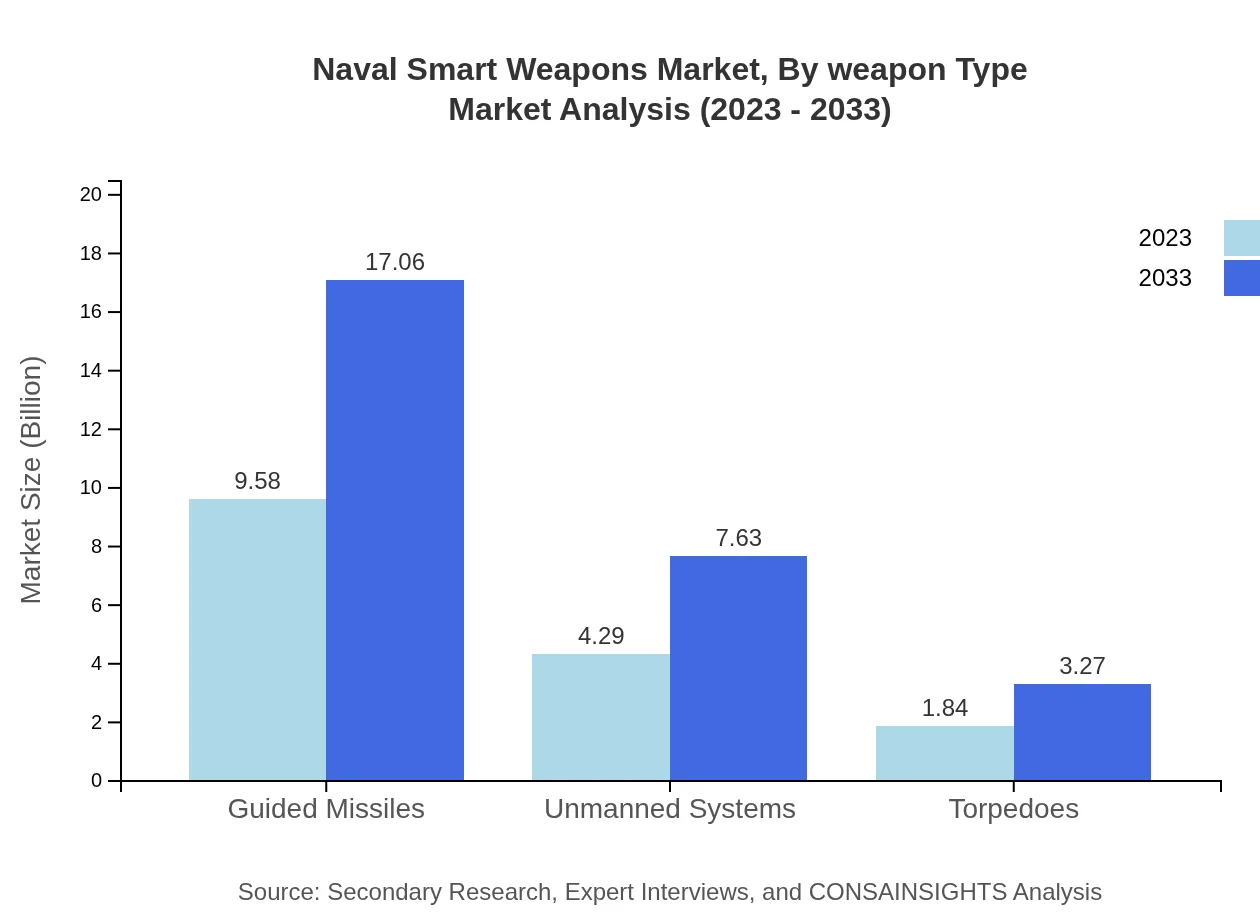

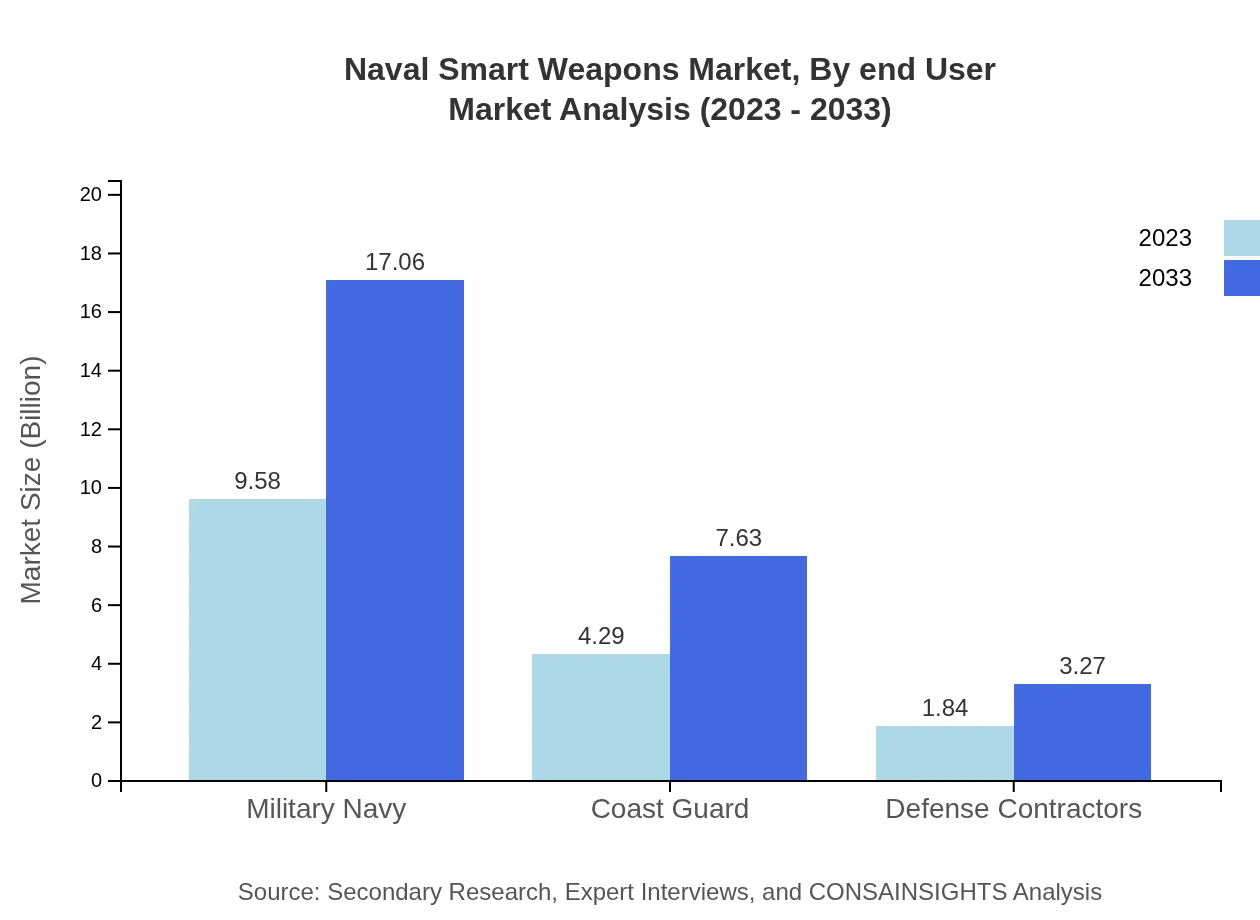

Naval Smart Weapons Market Analysis By Weapon Type

The weapon type segment consists of guided technologies, autonomous systems, and traditional munitions. Guided technology accounts for the majority share, valued at $9.58 billion in 2023 and expected to reach $17.06 billion in 2033. This demonstrates the importance of precision weapons in modern naval operations.

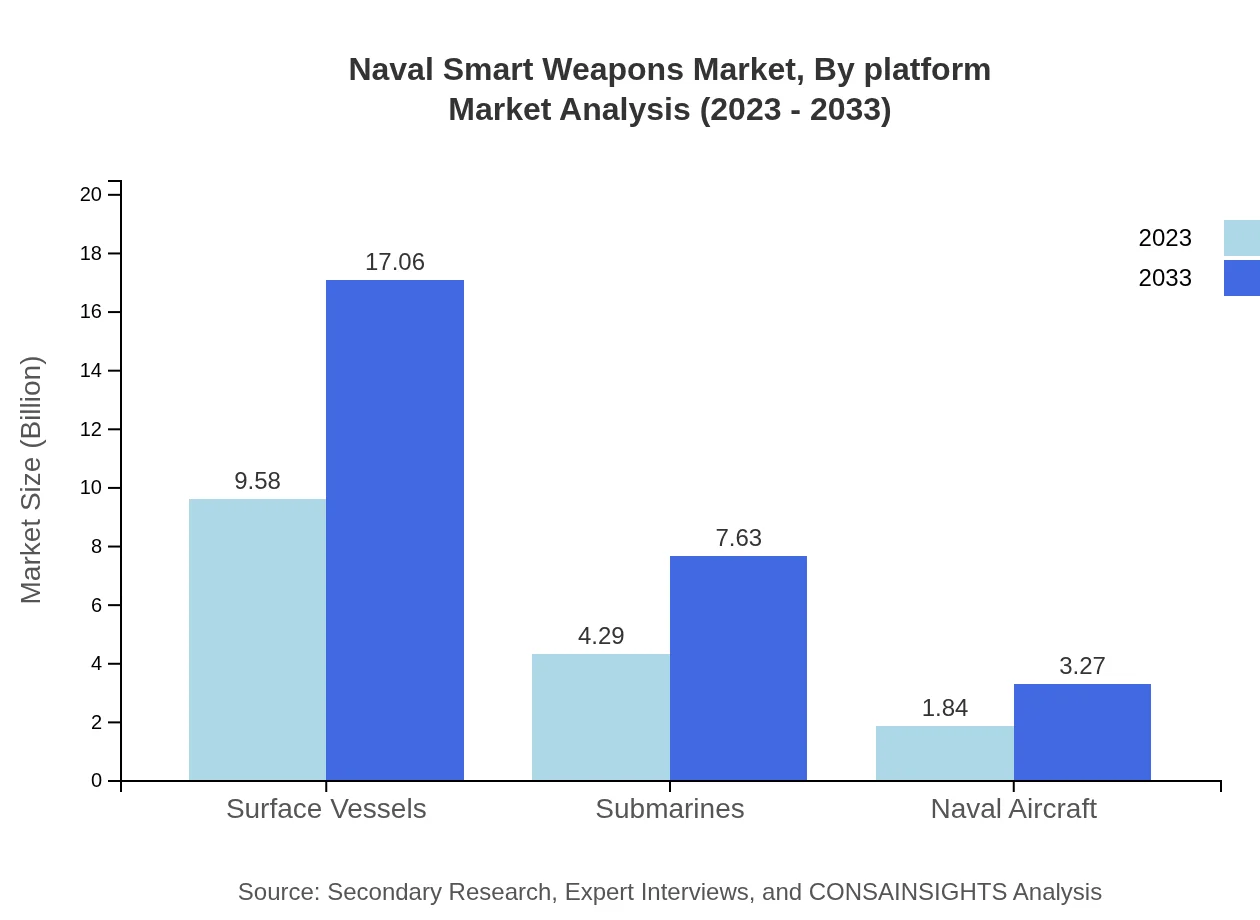

Naval Smart Weapons Market Analysis By Platform

The platform segment includes military navy ships, coast guard vessels, and submarines. Military navy ships dominate this segment, with a market size of $9.58 billion in 2023 expected to grow to $17.06 billion by 2033, showcasing the critical role of surface combatants in naval strategy.

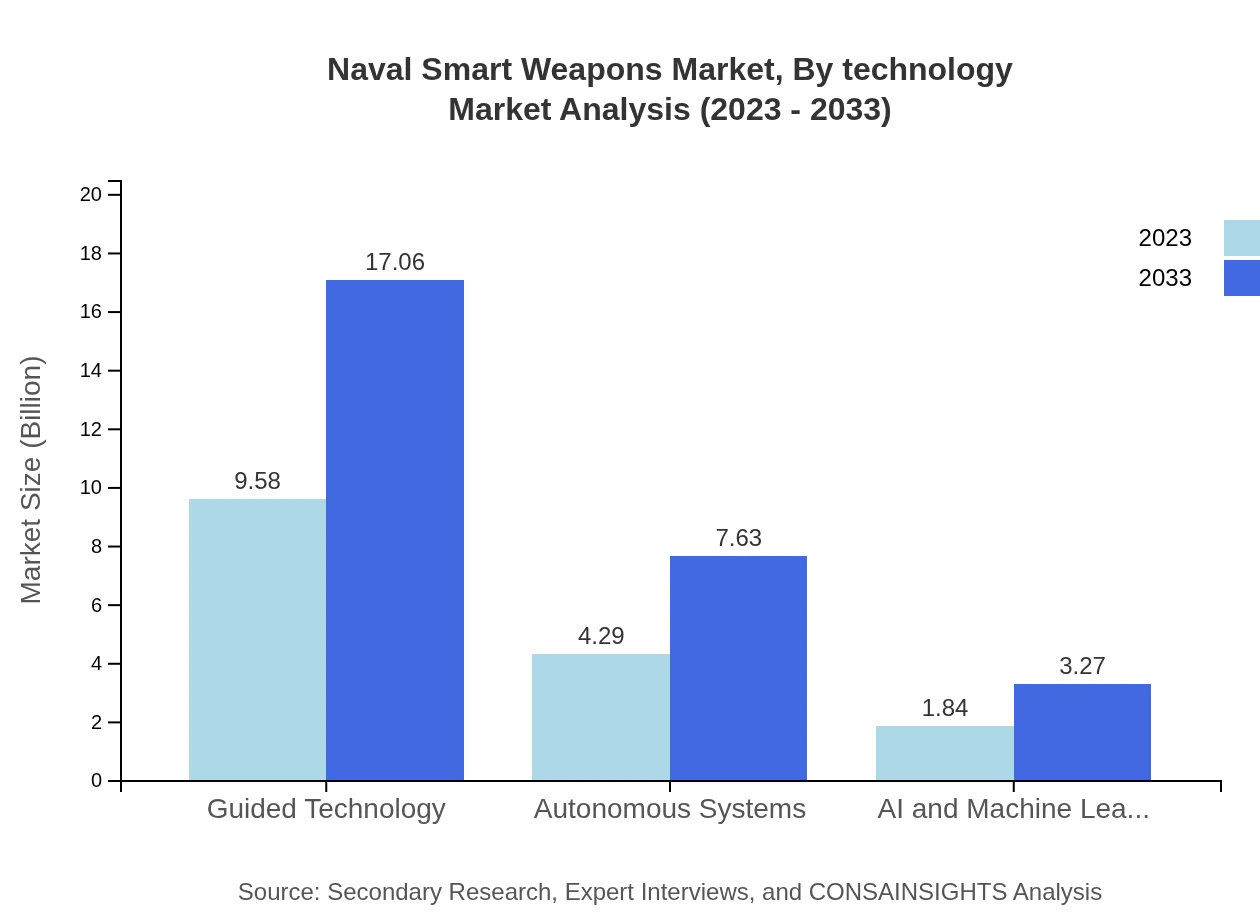

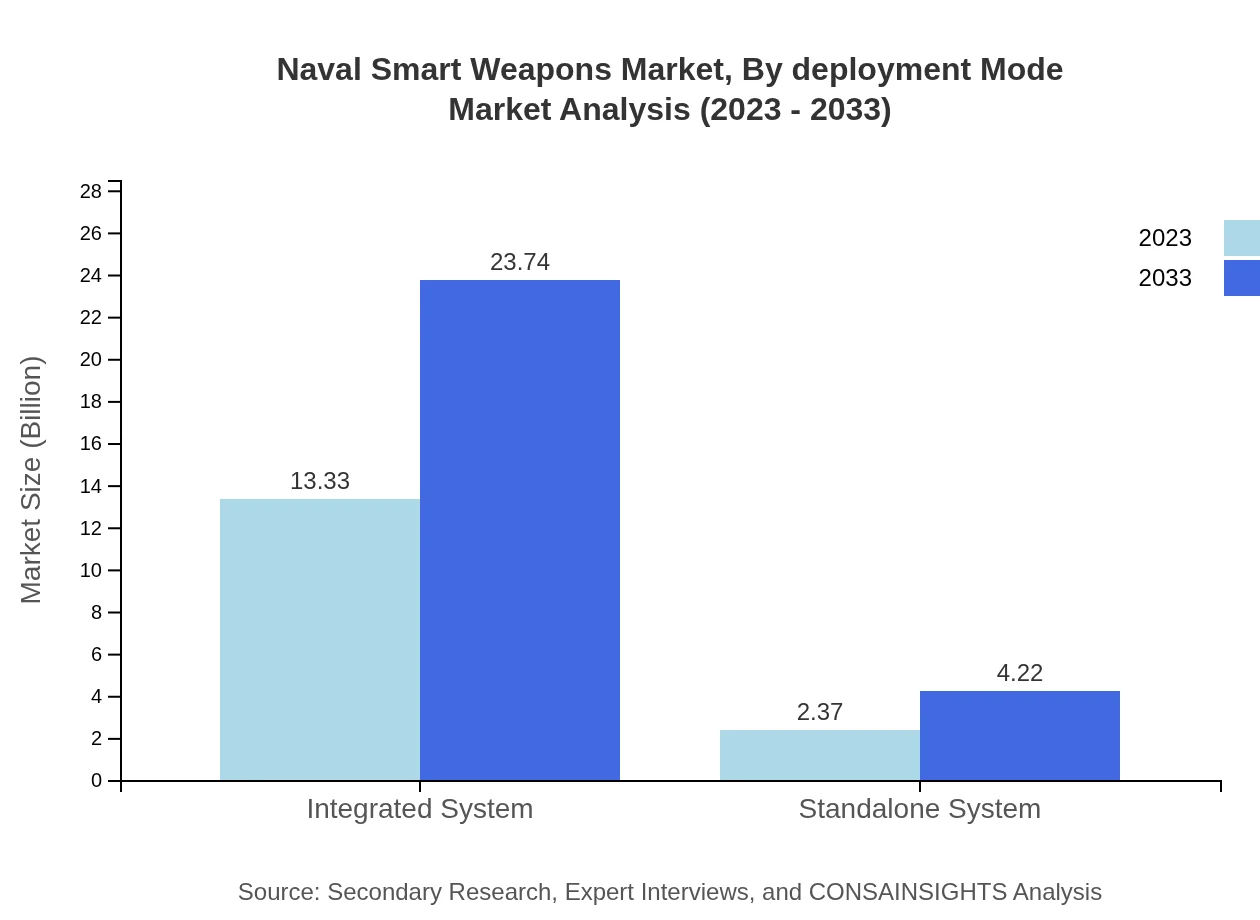

Naval Smart Weapons Market Analysis By Technology

The technology segment encompasses advanced systems such as AI, machine learning, and integrated systems, which are gaining relevance. Integrated systems take up a substantial market share, generating $13.33 billion in 2023, projected to rise to $23.74 billion by 2033.

Naval Smart Weapons Market Analysis By Deployment Mode

The deployment mode segment evaluates the effectiveness of various launch platforms, including land-based and naval-based systems. This segment is crucial for assessing the flexibility and strategic advantages provided by different deployment modes in combat scenarios.

Naval Smart Weapons Market Analysis By End User

The end-user segment includes military forces, government agencies, and defense contractors. Military end-users represent a significant share due to increasing defense expenditures aimed at enhancing naval capabilities.

Naval Smart Weapons Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Naval Smart Weapons Industry

Lockheed Martin:

A premier global aerospace and defense company involved extensively in naval technologies, including missile systems and integrated weapon platforms.Raytheon Technologies:

Known for its advanced defense systems, Raytheon is pivotal in developing naval smart weapons with state-of-the-art guidance systems and naval radars.BAE Systems:

A leading defense contractor specializing in naval systems, offering innovative solutions for next-generation naval warfare and smart weaponry.Northrop Grumman:

An aerospace and defense technology company focused on unmanned systems and related technology in the naval smart weapons market.We're grateful to work with incredible clients.

FAQs

What is the market size of naval smart weapons?

The naval smart weapons market is projected to reach approximately $15.7 billion by 2033, growing at a CAGR of 5.8%. This growth reflects the increasing investment in advanced defense technologies and modernization efforts across naval forces globally.

What are the key market players or companies in this naval smart weapons industry?

Key players in the naval smart weapons market include major defense contractors such as Lockheed Martin, Northrop Grumman, Raytheon Technologies, BAE Systems, and General Dynamics. These companies are pivotal in driving technological advancements and competition within this sector.

What are the primary factors driving the growth in the naval smart weapons industry?

The growth in the naval smart weapons industry is primarily driven by modernization of naval fleets, rising geopolitical tensions, increased defense budgets, advancements in technology, and the demand for autonomous systems and guided technologies for enhanced operational effectiveness.

Which region is the fastest Growing in the naval smart weapons market?

North America is the fastest-growing region in the naval smart weapons market, projected to reach $10.63 billion by 2033, driven by robust defense budgets and active modernization programs in the United States and Canada.

Does ConsaInsights provide customized market report data for the naval smart weapons industry?

Yes, ConsaInsights offers customized market report data tailored to client requirements within the naval smart weapons industry. This service ensures insight is aligned with specific strategic goals and market conditions.

What deliverables can I expect from this naval smart weapons market research project?

In this naval smart weapons market research project, clients can expect comprehensive deliverables including market analysis reports, trend evaluations, competitive landscape insights, segmentation data, and custom insights relevant to their strategic needs.

What are the market trends of naval smart weapons?

Current trends in the naval smart weapons market include a shift towards integrated and autonomous systems, increasing use of AI technologies, investment in cyber defense capabilities, and greater emphasis on missile defense systems to counter emerging threats.