Naval Vessel Maintenance Repair And Overhaul Mro Market Report

Published Date: 03 February 2026 | Report Code: naval-vessel-maintenance-repair-and-overhaul-mro

Naval Vessel Maintenance Repair And Overhaul Mro Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Naval Vessel Maintenance Repair and Overhaul (MRO) market, providing insights into growth trends, segment performance, and regional dynamics from 2023 to 2033.

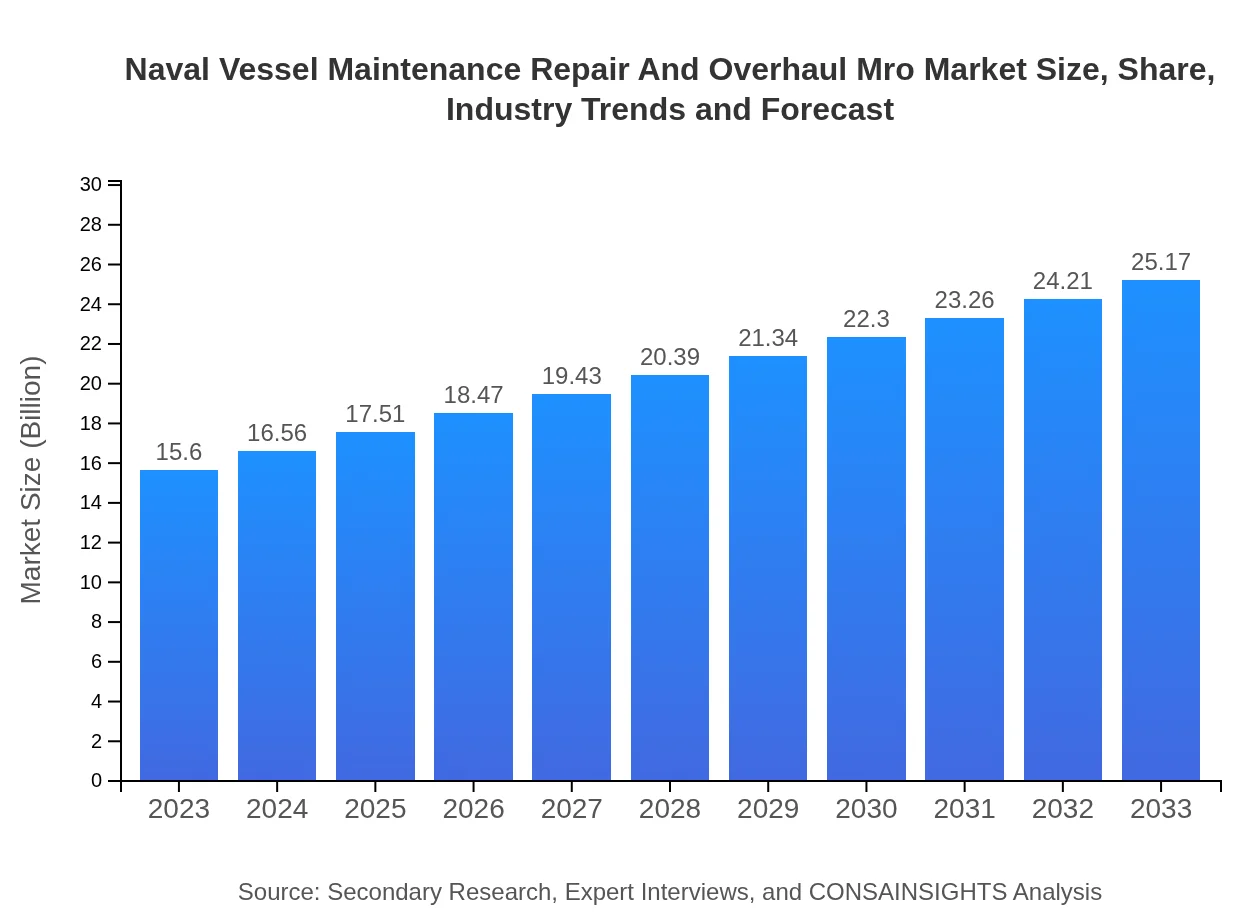

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $25.17 Billion |

| Top Companies | General Dynamics, BAE Systems, Huntington Ingalls Industries, Thales Group, Leonardo S.p.A. |

| Last Modified Date | 03 February 2026 |

Naval Vessel Maintenance Repair And Overhaul Mro Market Overview

Customize Naval Vessel Maintenance Repair And Overhaul Mro Market Report market research report

- ✔ Get in-depth analysis of Naval Vessel Maintenance Repair And Overhaul Mro market size, growth, and forecasts.

- ✔ Understand Naval Vessel Maintenance Repair And Overhaul Mro's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Naval Vessel Maintenance Repair And Overhaul Mro

What is the Market Size & CAGR of Naval Vessel Maintenance Repair And Overhaul Mro market in 2023?

Naval Vessel Maintenance Repair And Overhaul Mro Industry Analysis

Naval Vessel Maintenance Repair And Overhaul Mro Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Naval Vessel Maintenance Repair And Overhaul Mro Market Analysis Report by Region

Europe Naval Vessel Maintenance Repair And Overhaul Mro Market Report:

Europe’s MRO market is also significant, estimated at $5.25 billion in 2023 and anticipated to grow to $8.48 billion by 2033. This growth is supported by NATO's increased focus on collective defense, prompting member nations to enhance naval capabilities and associated maintenance protocols.Asia Pacific Naval Vessel Maintenance Repair And Overhaul Mro Market Report:

The Asia Pacific region is expected to grow significantly, with the market size projected to increase from $2.96 billion in 2023 to $4.77 billion by 2033. The rise in maritime tensions and increasing naval capabilities among countries like China and India drive this growth, leading to expanded budgets for MRO services across the region.North America Naval Vessel Maintenance Repair And Overhaul Mro Market Report:

North America maintains a robust position in the MRO market, starting at $5.19 billion in 2023 and growing to $8.37 billion by 2033. The United States Navy's substantial modernization programs and investment in new technologies are pivotal to this growth trajectory.South America Naval Vessel Maintenance Repair And Overhaul Mro Market Report:

In South America, the MRO market is relatively smaller, with a projected size of $0.80 billion in 2023, expected to reach $1.29 billion by 2033. The focus on coastal defense and international naval collaborations supports modest growth in MRO investments.Middle East & Africa Naval Vessel Maintenance Repair And Overhaul Mro Market Report:

The Middle East and Africa region is expected to see growth from $1.40 billion in 2023 to $2.26 billion by 2033. Regional conflicts and maritime threats lead to increased spending on naval defense and MRO services, fostering an environment for growth.Tell us your focus area and get a customized research report.

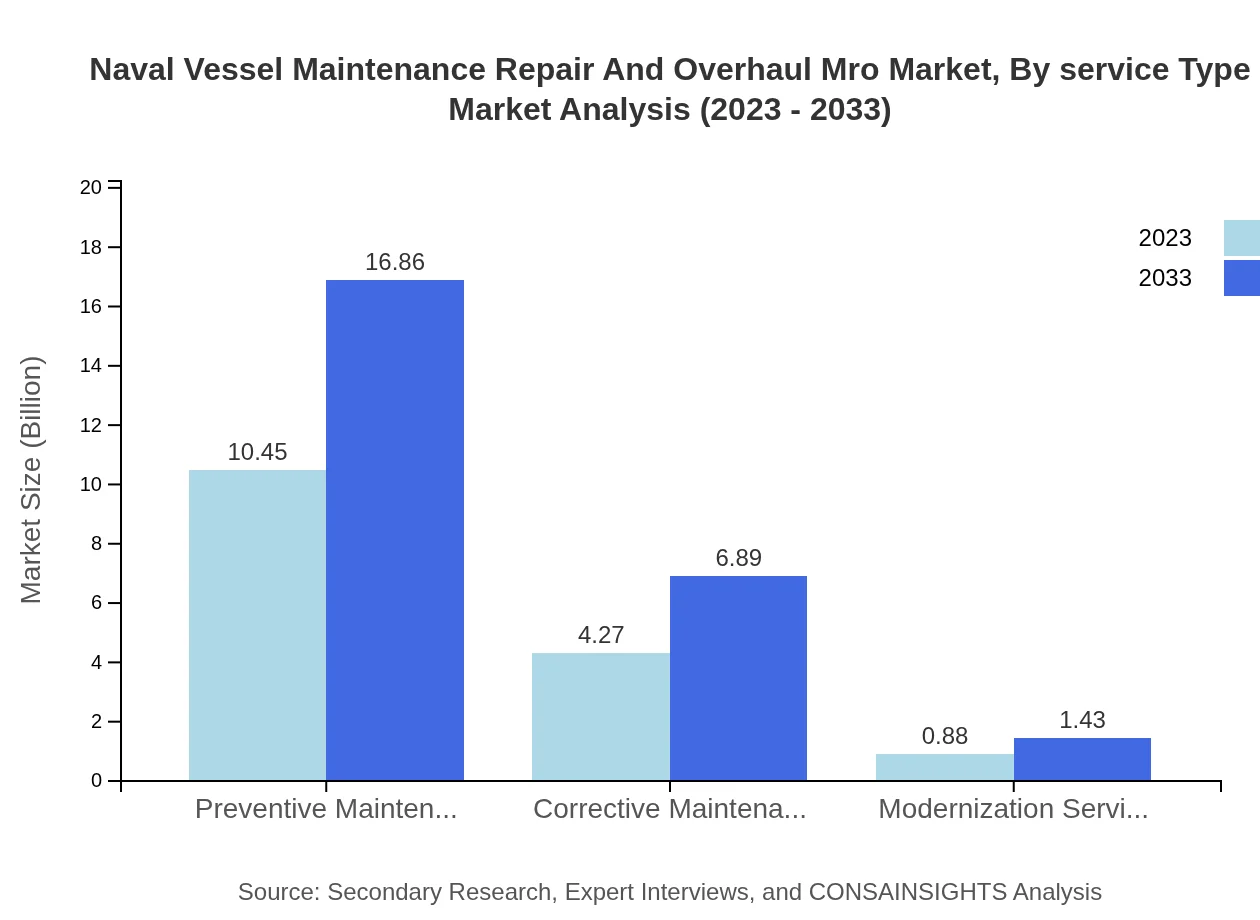

Naval Vessel Maintenance Repair And Overhaul Mro Market Analysis By Service Type

The market is divided into key service types: Preventive Maintenance and Corrective Maintenance. In 2023, Preventive Maintenance accounts for $10.45 billion, representing 66.97% market share, while Corrective Maintenance holds $4.27 billion, or 27.36%. By 2033, these figures will rise to $16.86 billion and $6.89 billion, respectively, emphasizing the importance of routine maintenance practices.

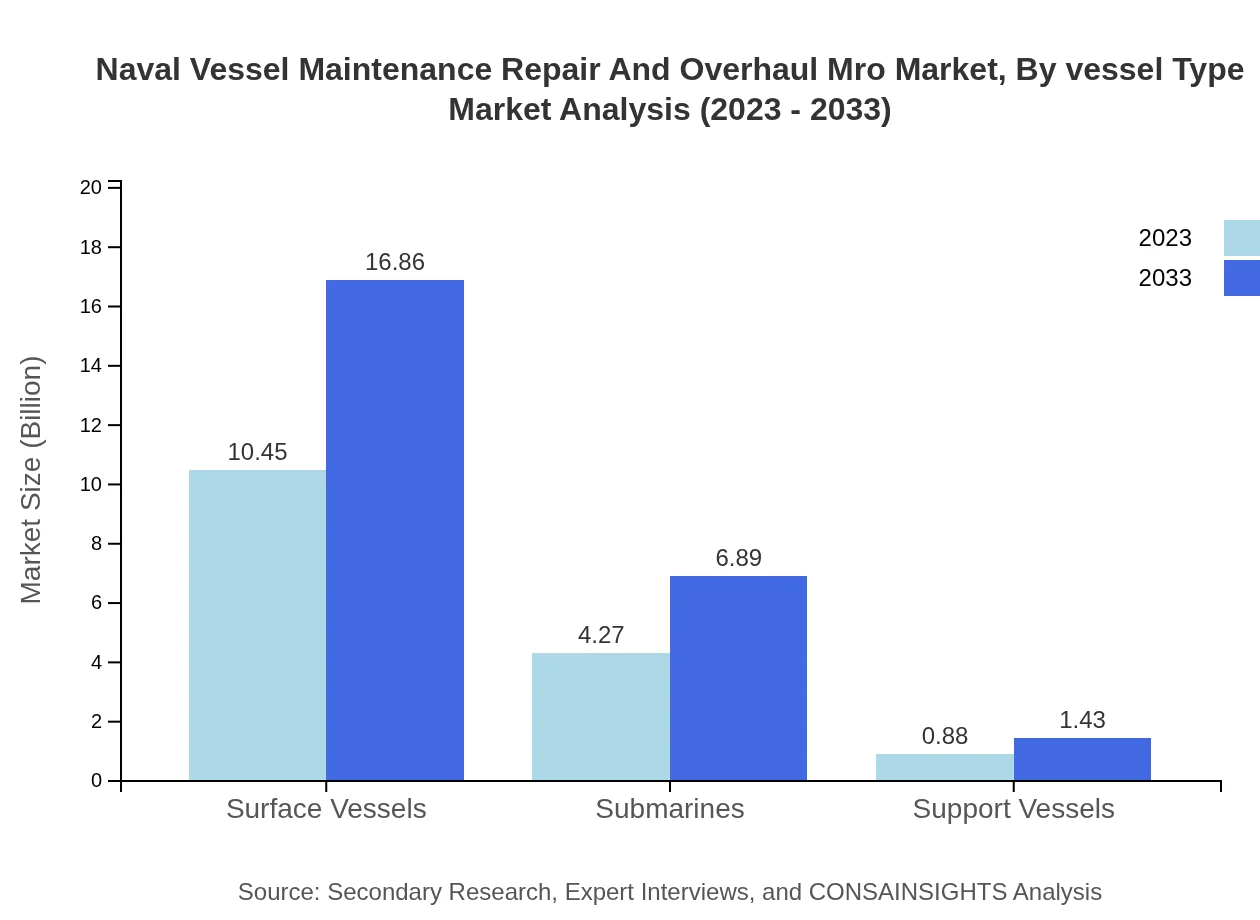

Naval Vessel Maintenance Repair And Overhaul Mro Market Analysis By Vessel Type

The vessel type analysis reveals that Surface Vessels dominate the segment, valued at $10.45 billion in 2023 (66.97% share), escalating to $16.86 billion by 2033. Submarines and Support Ships trail behind, with $4.27 billion (27.36%) and $0.88 billion (5.67%), expected to reach $6.89 billion and $1.43 billion by 2033, respectively.

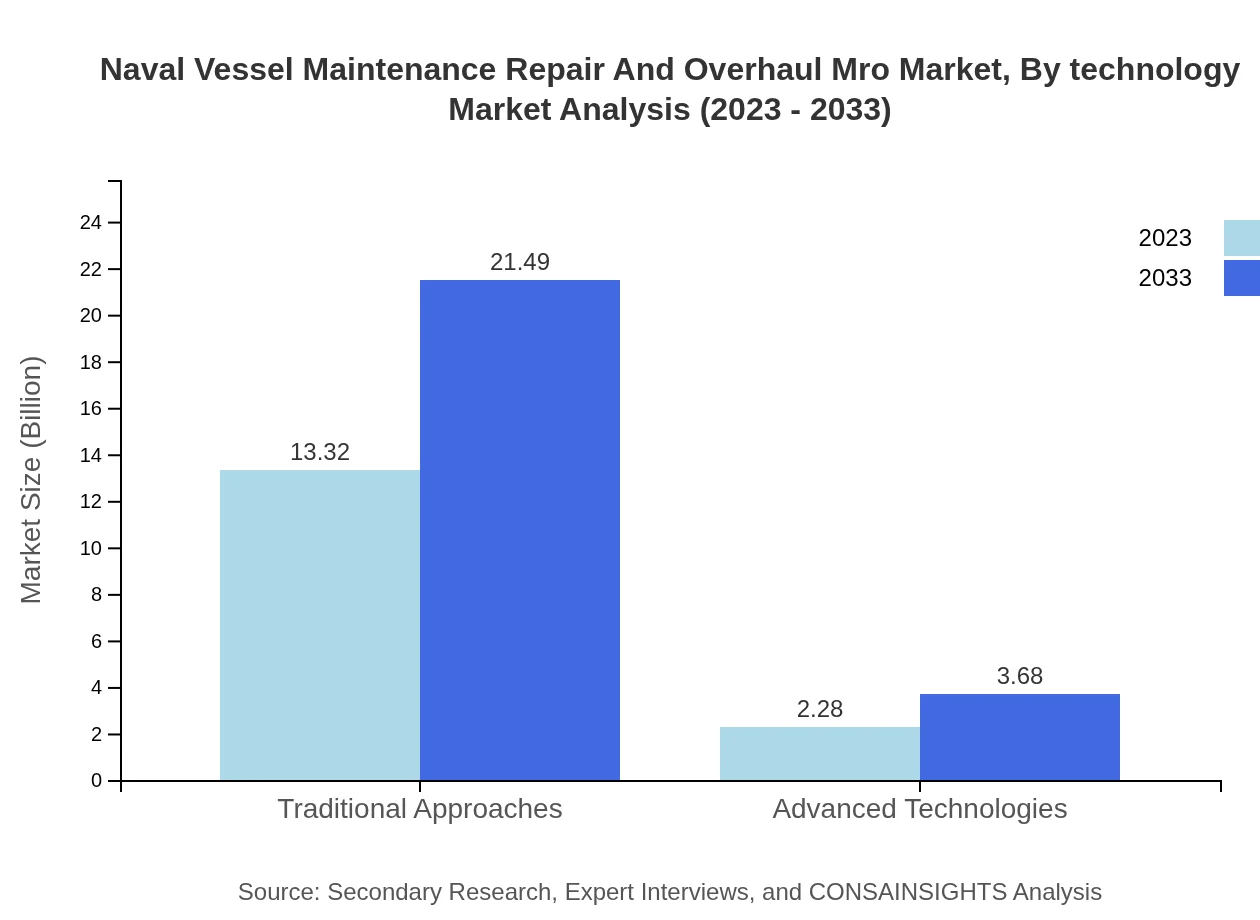

Naval Vessel Maintenance Repair And Overhaul Mro Market Analysis By Technology

Advanced technologies in MRO are gaining traction, with a market size of $2.28 billion in 2023, projected to grow to $3.68 billion by 2033, accounting for 14.64% share. The integration of IoT, AI, and other digital solutions enhances efficiency and reduces operational risks.

Naval Vessel Maintenance Repair And Overhaul Mro Market Analysis By Contract Type

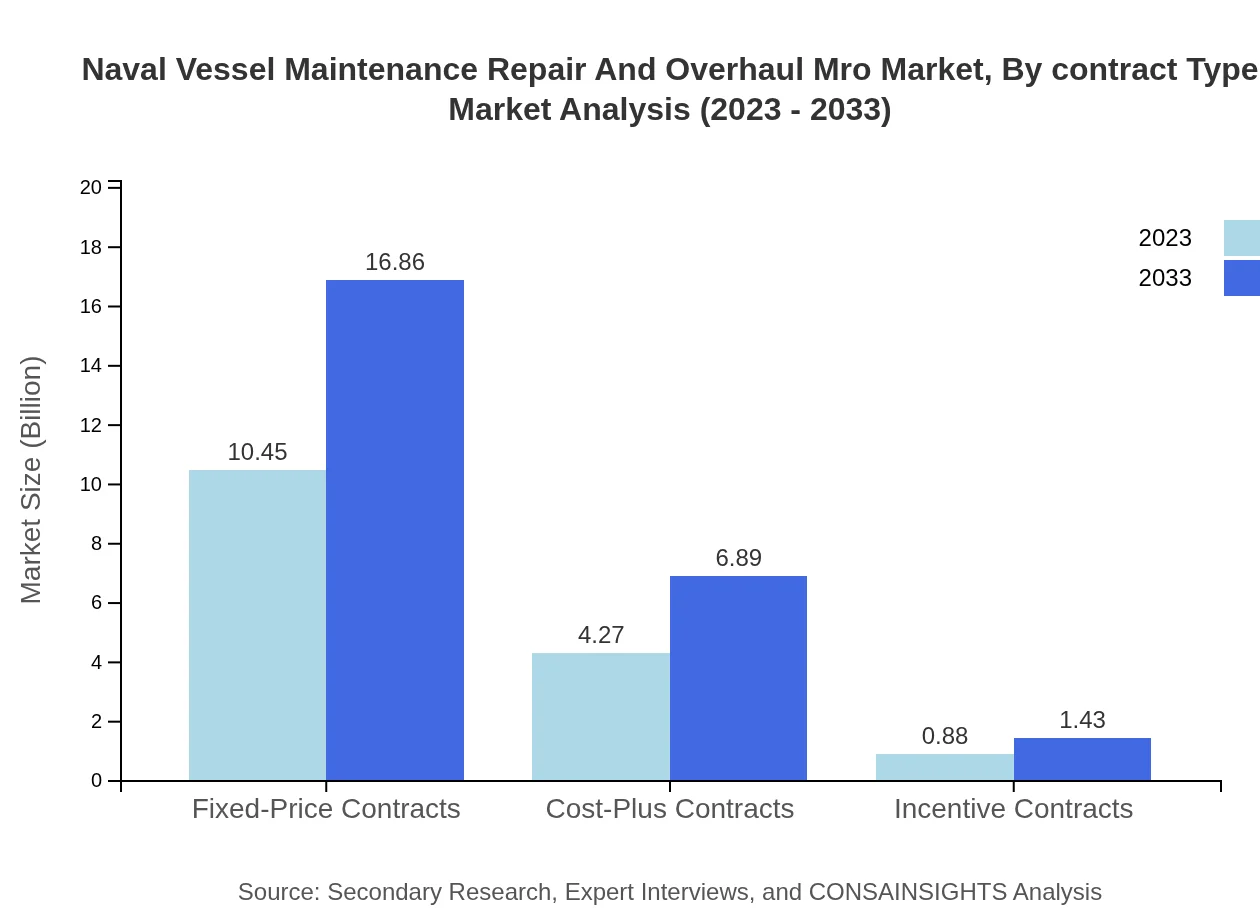

Contracts are categorized as Fixed-Price Contracts, Cost-Plus Contracts, and Incentive Contracts. Fixed-Price Contracts dominate with $10.45 billion (66.97%) in 2023, growing to $16.86 billion by 2033. Cost-Plus holds $4.27 billion (27.36%), while Incentive Contracts stand at $0.88 billion (5.67%), both expanding incrementally by 2033.

Naval Vessel Maintenance Repair And Overhaul Mro Market Analysis By Ownership Type

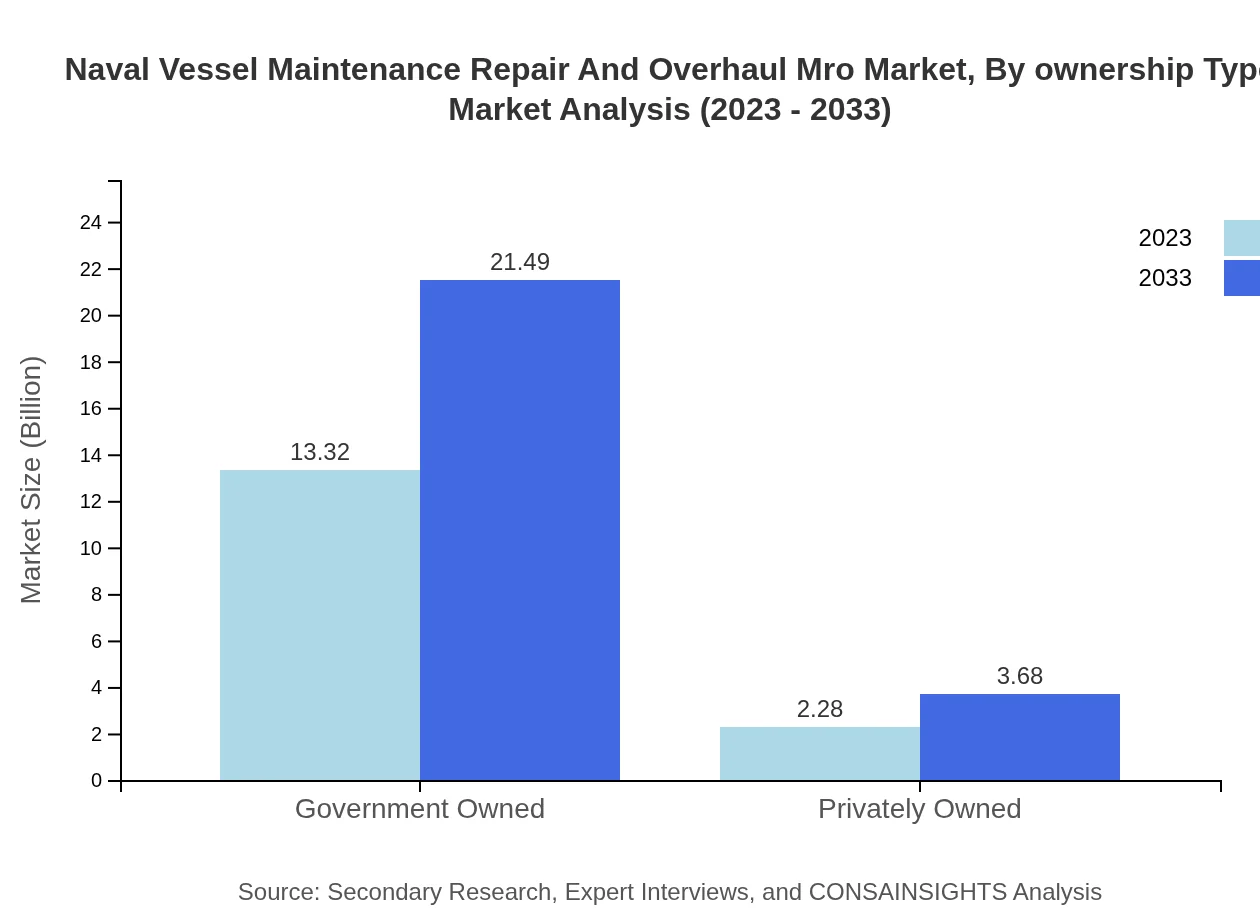

This market analysis segments ownership into Government Owned and Privately Owned vessels. Government Owned vessels lead with $13.32 billion (85.36%) in 2023, projected to rise to $21.49 billion by 2033. Privately Owned vessels, however, contribute $2.28 billion (14.64%), also expected to increase to $3.68 billion by 2033.

Naval Vessel Maintenance Repair And Overhaul Mro Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Naval Vessel Maintenance Repair And Overhaul Mro Industry

General Dynamics:

A leader in defense technology, General Dynamics provides comprehensive MRO services for naval vessels, contributing to advanced system integrations and maintenance solutions.BAE Systems:

BAE Systems is a prominent defense contractor specializing in naval systems and services, known for its innovative approaches to vessel maintenance and overhaul.Huntington Ingalls Industries:

This major American shipbuilding company also offers extensive MRO services, ensuring the operational readiness of the U.S. Navy's fleet.Thales Group:

Thales Group leverages cutting-edge technology to provide maritime solutions, focusing on integrated maintenance solutions for naval vessels.Leonardo S.p.A.:

Leonardo specializes in aerospace, defense, and security, offering naval MRO solutions that enhance fleet management and operational effectiveness.We're grateful to work with incredible clients.

FAQs

What is the market size of naval vessel maintenance, repair and overhaul (MRO)?

The global naval vessel maintenance, repair, and overhaul (MRO) market is valued at approximately $15.6 billion in 2023, with a projected growth rate (CAGR) of 4.8%, reaching around $24 billion by 2033.

What are the key market players or companies in the naval vessel maintenance, repair, and overhaul (MRO) industry?

Key players in the naval vessel MRO industry include major defense contractors, shipbuilding firms and specialized MRO service providers. Notable companies are Lockheed Martin, General Dynamics, BAE Systems, and ThyssenKrupp Marine Systems.

What are the primary factors driving the growth in the naval vessel maintenance, repair and overhaul (MRO) industry?

Growth in the naval vessel MRO industry is driven by increasing naval activities, the need to modernize aging fleets, investment in advanced technologies, and regulatory requirements for maintenance ensuring operational readiness and efficiency.

Which region is the fastest Growing in the naval vessel maintenance, repair and overhaul (MRO)?

The fastest-growing region in the naval vessel MRO market is Europe, projected to grow from $5.25 billion in 2023 to $8.48 billion by 2033, reflecting strong military expenditures and modernization programs.

Does ConsaInsights provide customized market report data for the naval vessel maintenance, repair and overhaul (MRO) industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the naval vessel MRO industry, enabling clients to gain insights that are relevant to their strategic business objectives.

What deliverables can I expect from this naval vessel maintenance, repair and overhaul (MRO) market research project?

Deliverables from the naval vessel MRO market research project typically include detailed market analysis, trend forecasting, competitive landscape assessments, and recommendations for market entry or expansion strategies.

What are the market trends of naval vessel maintenance, repair and overhaul (MRO)?

Key trends in the naval vessel MRO market include a shift towards advanced technological solutions, increased emphasis on preventive maintenance, and rising demand for sustainable practices amidst environmental regulations.