Naval Vessels Market Report

Published Date: 03 February 2026 | Report Code: naval-vessels

Naval Vessels Market Size, Share, Industry Trends and Forecast to 2033

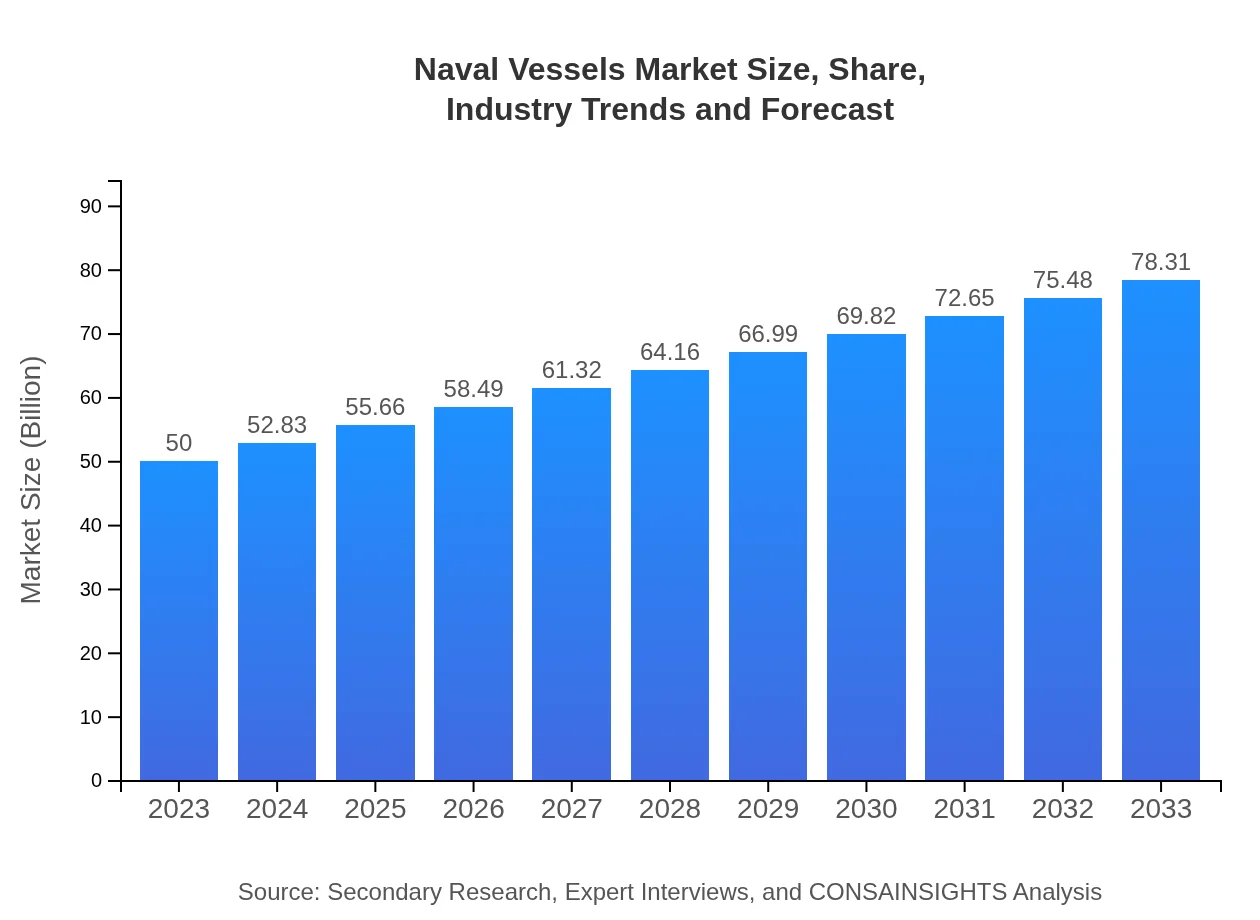

This detailed market report analyzes the Naval Vessels market from 2023 to 2033, providing insights into market size, growth forecasts, regional analyses, industry trends, and key players shaping the industry, along with technological advancements and market segmentation.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $78.31 Billion |

| Top Companies | Lockheed Martin, Thyssenkrupp Marine Systems, General Dynamics, BAE Systems |

| Last Modified Date | 03 February 2026 |

Naval Vessels Market Overview

Customize Naval Vessels Market Report market research report

- ✔ Get in-depth analysis of Naval Vessels market size, growth, and forecasts.

- ✔ Understand Naval Vessels's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Naval Vessels

What is the Market Size & CAGR of Naval Vessels market in 2023?

Naval Vessels Industry Analysis

Naval Vessels Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Naval Vessels Market Analysis Report by Region

Europe Naval Vessels Market Report:

The European market is expected to expand from $12.46 billion in 2023 to $19.52 billion by 2033, influenced by collaborative defense initiatives within NATO and increased defense budgets aimed at enhancing marine capabilities in light of evolving security threats.Asia Pacific Naval Vessels Market Report:

In 2023, the Asia-Pacific market size for Naval Vessels is approximately $9.79 billion, anticipated to grow to $15.33 billion by 2033. This region's growth is driven by increasing maritime disputes and a shift in naval strategy among major nations like China, India, and Japan, who are investing significantly in modern next-generation naval vessels to enhance their operational readiness.North America Naval Vessels Market Report:

North America represents a significant portion of the Naval Vessels market, with a size of $18.77 billion in 2023 projected to reach $29.41 billion by 2033. The U.S. Navy's modernization plans, including investments in new vessels and technologies, are key drivers of demand in this region.South America Naval Vessels Market Report:

The South American market is projected to grow from $3.49 billion in 2023 to $5.47 billion by 2033. This growth is underpinned by regional governments' efforts to strengthen their naval capabilities in response to emerging security threats and the need for enhanced maritime protection.Middle East & Africa Naval Vessels Market Report:

The Middle East and Africa market for Naval Vessels is forecasted to grow from $5.49 billion in 2023 to $8.60 billion by 2033. Increased military spending due to regional conflicts and investments in naval modernization by countries such as Saudi Arabia and UAE are key factors contributing to this growth.Tell us your focus area and get a customized research report.

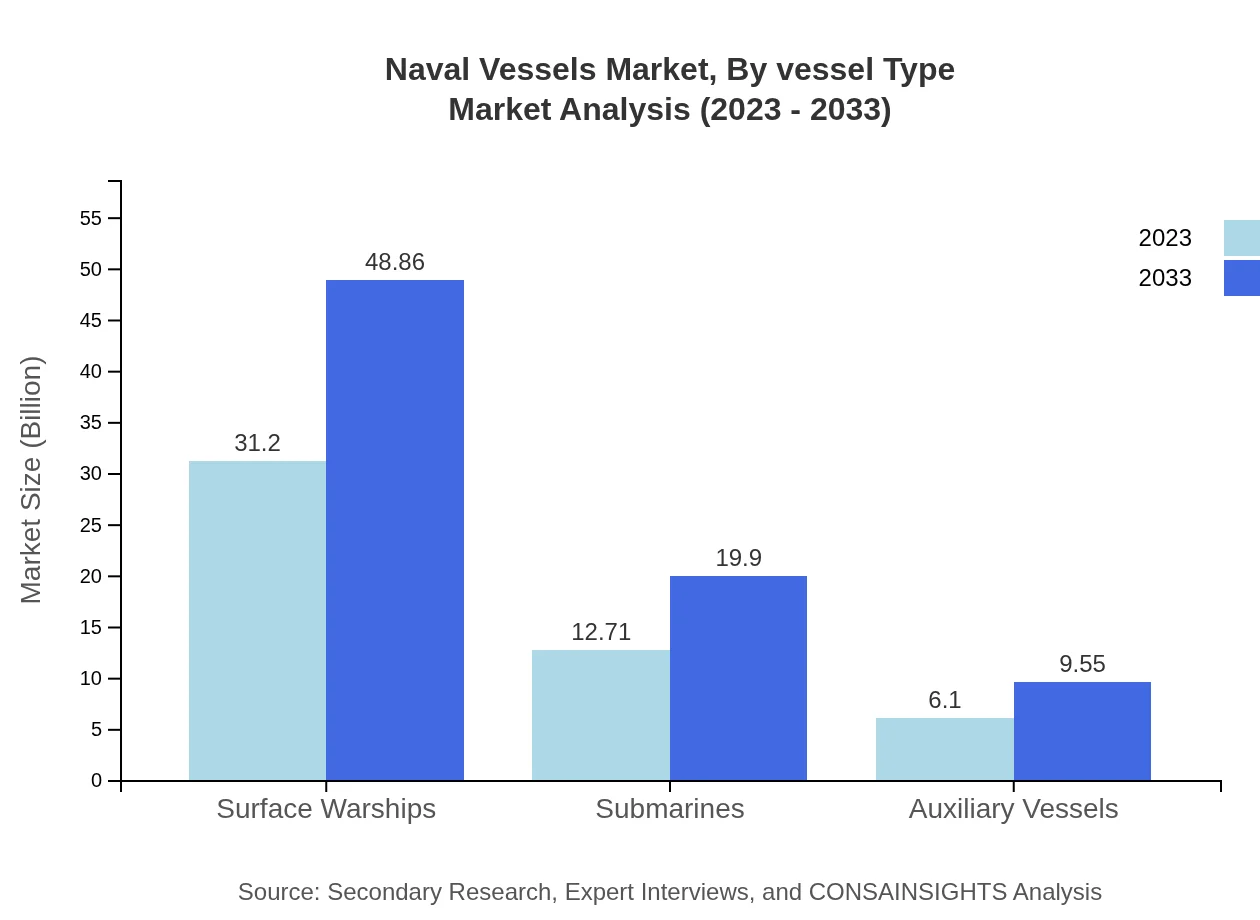

Naval Vessels Market Analysis By Vessel Type

The Naval Vessels market by vessel type indicates surface warships leading with a market value of approximately $31.20 billion in 2023, expected to grow to $48.86 billion by 2033. Submarines follow at $12.71 billion and are projected to reach $19.90 billion due to heightened focus on stealth and defense capabilities. Auxiliary vessels also play a crucial role, growing from $6.10 billion to $9.55 billion, supporting operational readiness.

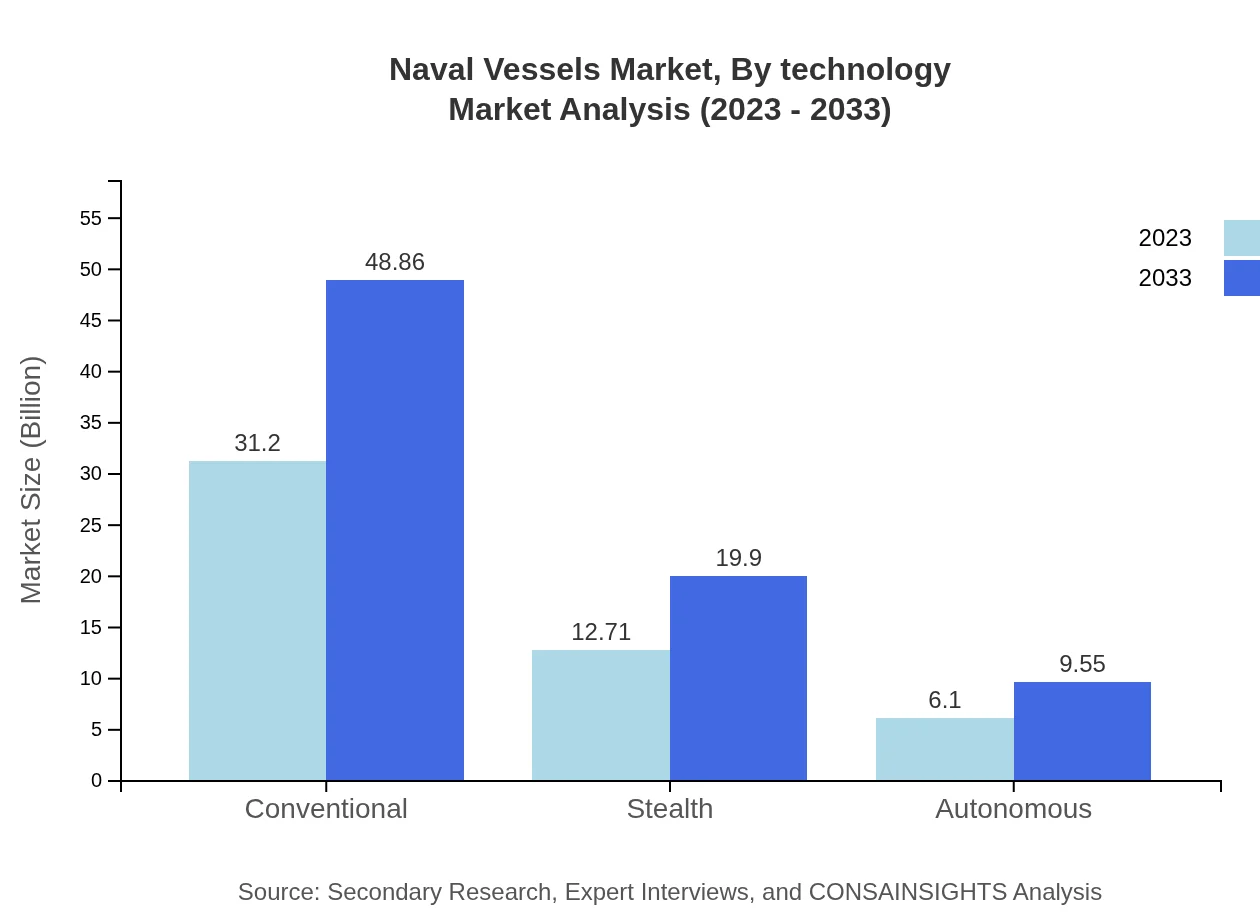

Naval Vessels Market Analysis By Technology

Technological advancements heavily influence the Naval Vessels market, with conventional vessels dominating at $31.20 billion in 2023. However, stealth technology is projected to expand from $12.71 billion to $19.90 billion, as nations seek to upgrade their vessels for enhanced survivability. Additionally, autonomous vessels are emerging as critical assets for new operational paradigms, expanding from $6.10 billion to $9.55 billion.

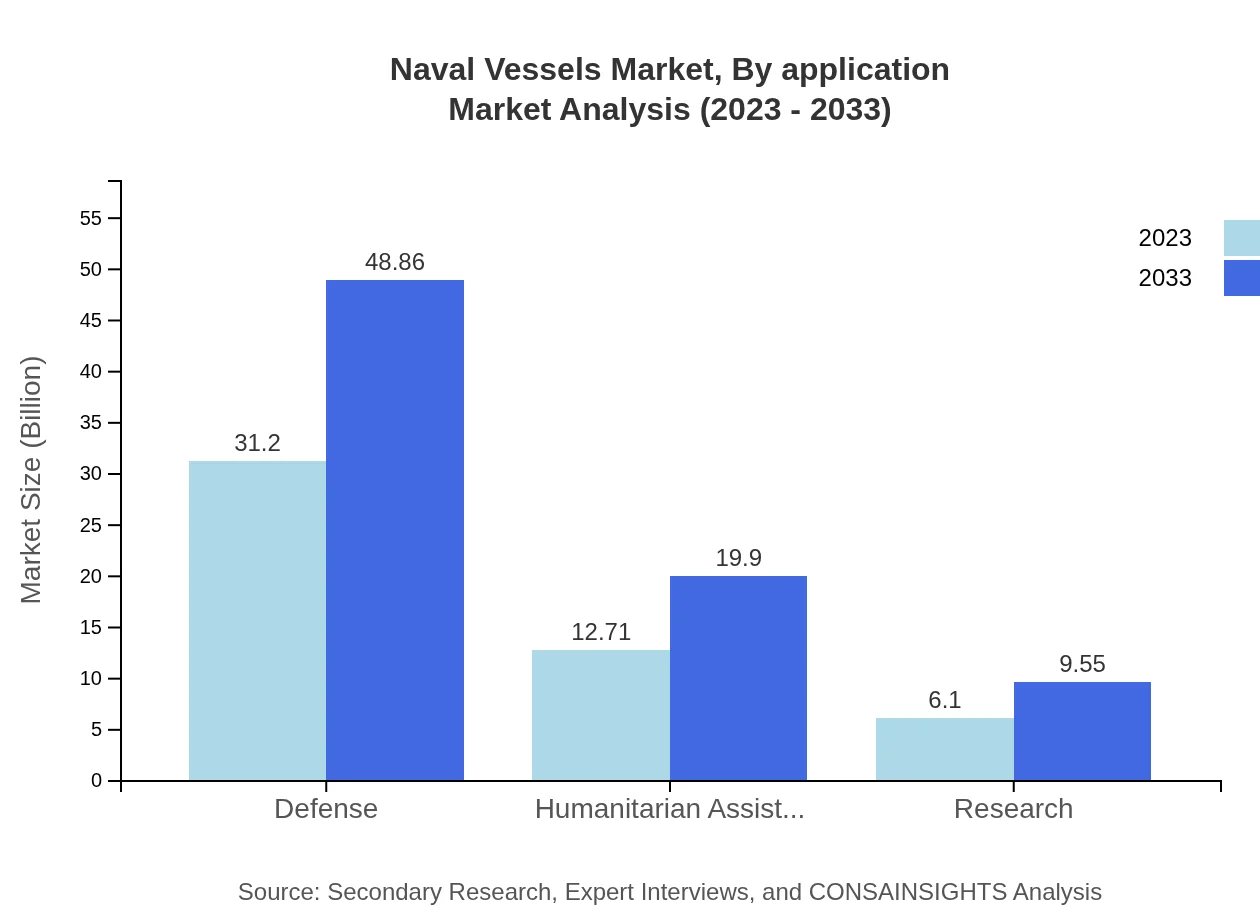

Naval Vessels Market Analysis By Application

The application segment is predominated by defense, valued at $31.20 billion in 2023, and is also expected to reach $48.86 billion by 2033. Humanitarian assistance applications are significant, representing $12.71 billion and projected to grow contingent on the increasing frequency of maritime rescue operations worldwide.

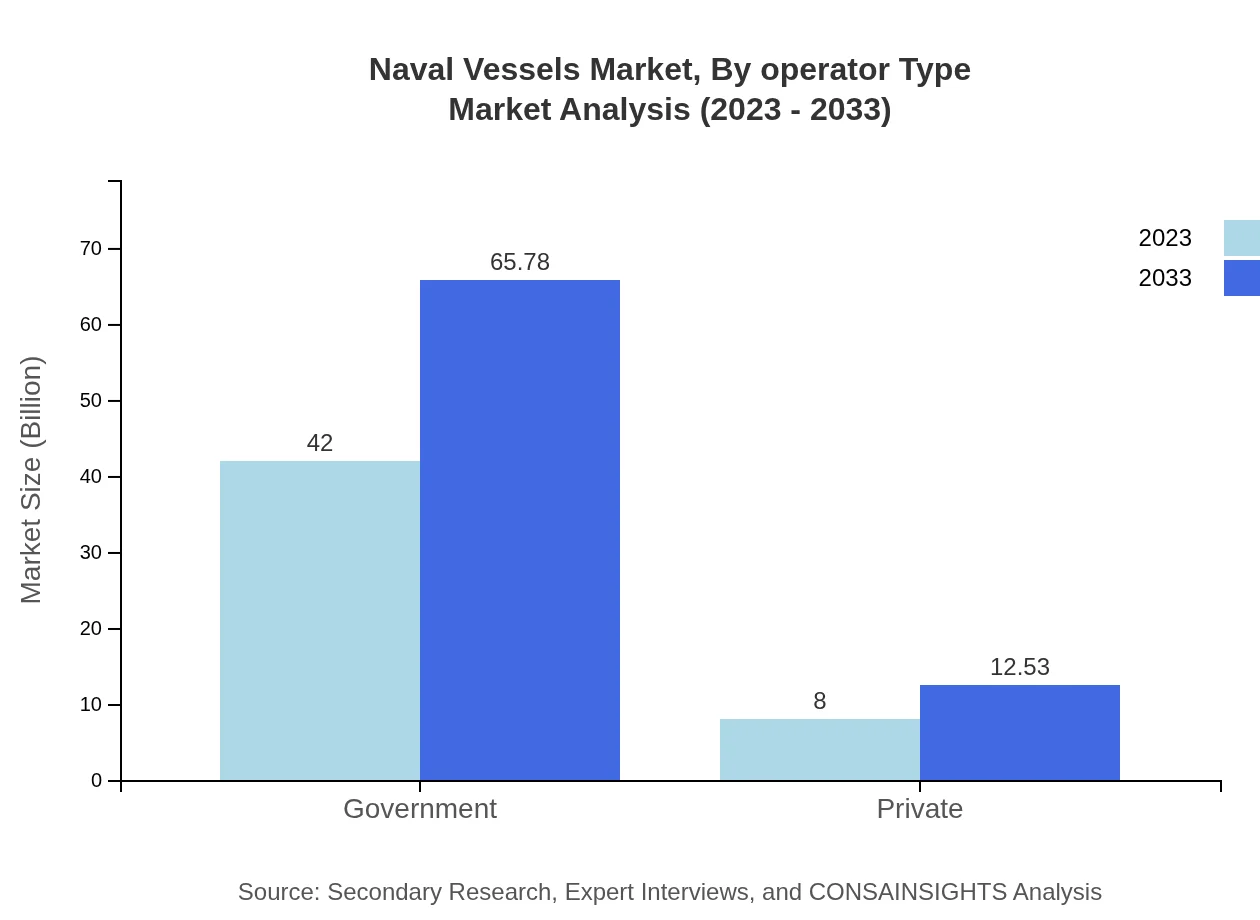

Naval Vessels Market Analysis By Operator Type

The market is primarily driven by government operators, expected to grow from $42.00 billion in 2023 to $65.78 billion by 2033. This increase is due to strengthening military capabilities and enhanced maritime patrol needs amid rising global tensions. Private operators, albeit smaller, are projected to grow from $8.00 billion to $12.53 billion, primarily focusing on commercial marine applications.

Naval Vessels Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Naval Vessels Industry

Lockheed Martin:

A leading global security and aerospace company involved in the design and production of naval vessels, particularly known for the Aegis Combat System.Thyssenkrupp Marine Systems:

Specializes in submarine technology and naval defense systems, providing advanced underwater capabilities to military forces around the globe.General Dynamics:

A prominent defense contractor recognized for shipbuilding and advanced vessel design, including littoral combat ships and submarines.BAE Systems:

Engaged in the development of surface ships and submarines as well as the integration of state-of-the-art naval technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of naval vessels?

The naval vessels market is expected to reach $50 billion by 2033, growing at a CAGR of 4.5% from 2023. The market will expand from a substantial base, reflecting increasing investments in naval capabilities globally.

What are the key market players or companies in the naval vessels industry?

Key players in the naval vessels industry include major defense contractors and shipbuilders. Notable names include General Dynamics, BAE Systems, Lockheed Martin, and Thales Group, which are pivotal in supplying advanced naval solutions.

What are the primary factors driving the growth in the naval vessels industry?

Growth in the naval vessels industry is driven by rising defense budgets, geopolitical tensions, and modernization programs. Additionally, increased demand for naval assets for security operations contributes significantly to the industry's expansion.

Which region is the fastest Growing in the naval vessels market?

The fastest-growing region in the naval vessels market is North America, with a projected market size increase from $18.77 billion in 2023 to $29.41 billion in 2033, driven by substantial government defense investments.

Does ConsaInsights provide customized market report data for the naval vessels industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the naval vessels industry, providing detailed insights and data relevant to various stakeholders and market dynamics.

What deliverables can I expect from this naval vessels market research project?

Deliverables from the naval vessels market research project include comprehensive market analysis reports, segmentation data, trend forecasts, competitive analysis, and tailored insights that assist strategic decision-making.

What are the market trends of naval vessels?

Key market trends in the naval vessels industry include a shift towards stealth technology, increasing emphasis on autonomous vessels, and growing investments in surface warships and submarines to enhance naval capabilities.